Executive summary:

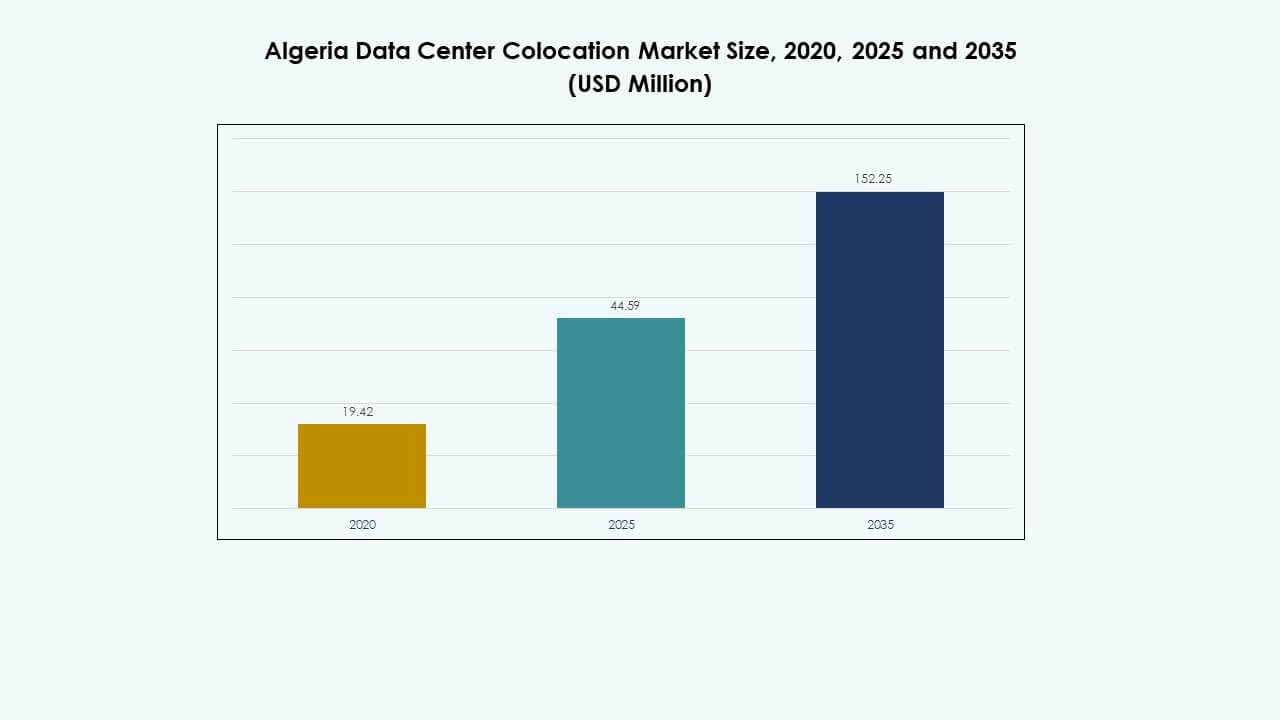

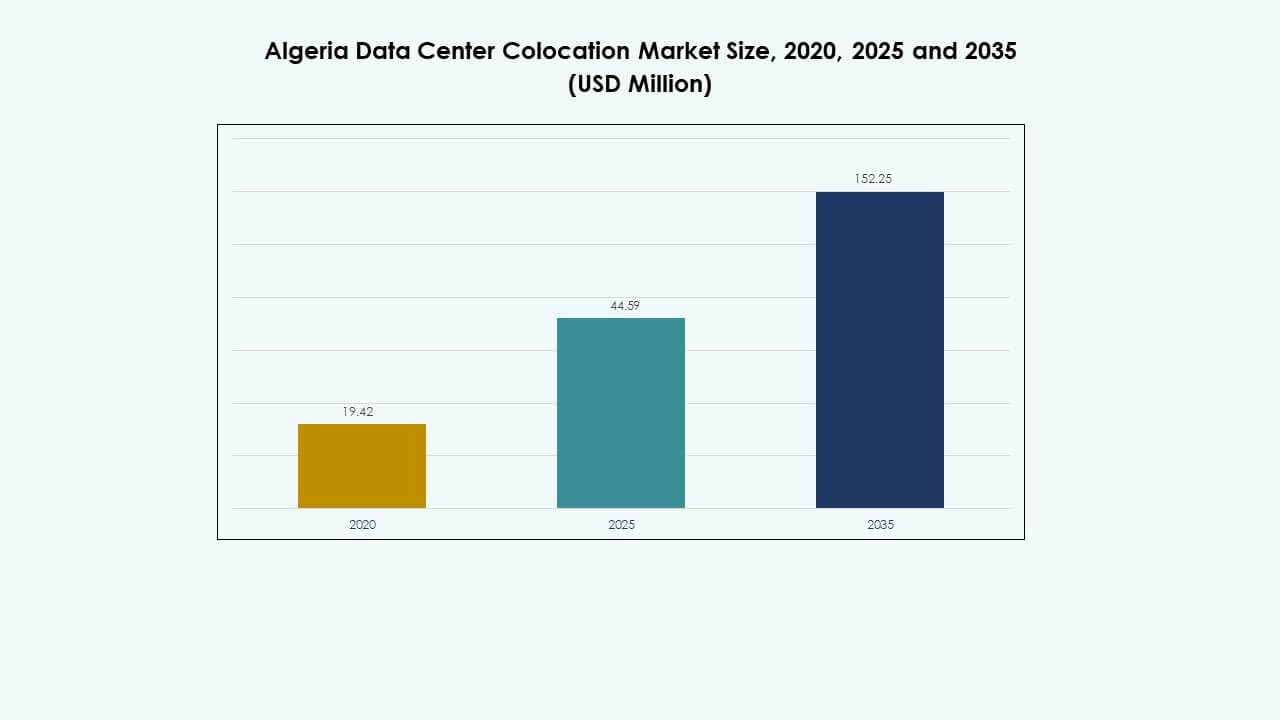

The Algeria Data Center Colocation Market size was valued at USD 19.42 million in 2020 to USD 44.59 million in 2025 and is anticipated to reach USD 152.25 million by 2035, at a CAGR of 12.98% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Algeria Data Center Colocation Market Size 2025 |

USD 44.59 Million |

| Algeria Data Center Colocation Market, CAGR |

12.98% |

| Algeria Data Center Colocation Market Size 2035 |

USD 152.25 Million |

Rising cloud adoption, expanding fiber networks, and growing enterprise digital transformation are driving strong market momentum. Rapid integration of AI, edge computing, and sustainable energy infrastructure is shaping demand for colocation facilities. It enables businesses to deploy scalable solutions while maintaining operational agility and compliance. Investors view the market as strategically important due to increasing connectivity, technological advancements, and favorable expansion potential.

North Africa leads the regional landscape due to its growing digital infrastructure and strategic location. Algeria is emerging as a key market because of its network expansion and regulatory support. Neighboring countries like Egypt and Morocco are also scaling their colocation capacity, creating a competitive and interconnected regional ecosystem that attracts global players and enterprises seeking lower latency and reliable connectivity.

Market Drivers

Rising Cloud Adoption and Enterprise Digital Transformation Driving Infrastructure Demand

The growing adoption of cloud computing and digital transformation is accelerating infrastructure investments. Businesses seek scalable, secure, and cost-efficient colocation facilities to reduce capital expenditure. It enables faster deployment of enterprise workloads while improving operational flexibility. The rise of AI, IoT, and big data creates demand for reliable and low-latency connectivity. Companies rely on colocation services to integrate cloud strategies with legacy systems. This shift strengthens Algeria’s position in the digital economy. Investors view this transformation as a strong foundation for steady returns. The Algeria Data Center Colocation Market benefits from these technology-driven shifts.

Expanding Network Connectivity and Fiber Infrastructure Boosting Data Center Efficiency

Strong network connectivity is essential to meet the growing data traffic from enterprises and consumers. Expanding fiber backbone infrastructure improves resilience and uptime for mission-critical operations. It allows service providers to deliver lower latency and higher bandwidth to customers. Government and private partnerships drive faster fiber deployment across strategic cities. This creates better connectivity between business hubs and global networks. Colocation operators leverage this development to offer high-performance hosting environments. Improved interconnection attracts hyperscale and cloud players to the country. The Algeria Data Center Colocation Market gains momentum from this infrastructure upgrade.

- For instance, in February 2025, Algérie Télécom partnered with Huawei to deploy a 400G wavelength-division multiplexing (WDM) national backbone—boosting nationwide speed and network capacity while supporting 2.5 million fiber subscribers by September 2025, covering 27 percent of Algerian households.

Growing Investments in Renewable Energy and Sustainable Data Center Operations

Sustainability is becoming a critical factor for investors and operators. The deployment of renewable energy solutions such as solar power lowers operational costs and aligns with ESG goals. It supports energy-efficient data center designs while ensuring stable long-term power supply. Enterprises prefer sustainable infrastructure to meet regulatory and customer expectations. Operators use efficient cooling and power systems to enhance performance. Government policies encourage renewable energy integration in digital infrastructure. This supports green colocation development and reduces environmental impact. The Algeria Data Center Colocation Market positions itself as a sustainable infrastructure hub.

- For instance, in April 2025, the Algerian Ministry of Energy launched a 3.2 GW national solar program spanning 15 provinces including key digital zones like Ghardaïa and Ouargla to power industrial and data hub clusters with renewable energy under the 2035 national transition plan.

Strategic Importance of Edge Computing and Localized Infrastructure for Enterprises

Edge computing is reshaping how enterprises deploy digital infrastructure. It brings computation closer to the user, enhancing latency-sensitive applications. Colocation facilities provide enterprises with reliable, secure, and geographically strategic environments. It helps businesses manage data locally and comply with regulations. Growing adoption of 5G and AI increases the demand for edge-ready facilities. Telecom operators and IT service providers collaborate with data center operators to meet enterprise needs. This development strengthens Algeria’s role in regional connectivity. The Algeria Data Center Colocation Market becomes vital for supporting next-generation digital services.

Market Trends

Rising Adoption of AI-Driven Data Center Automation and Intelligent Infrastructure

Automation is transforming how colocation facilities are designed and operated. AI-driven monitoring tools optimize energy usage, reduce downtime, and predict maintenance needs. It enhances operational transparency and boosts service reliability for customers. Predictive analytics helps operators allocate resources efficiently. Automated systems support faster provisioning and scaling of IT workloads. Enterprises benefit from higher performance and better cost efficiency. This trend accelerates the adoption of smart colocation models. The Algeria Data Center Colocation Market embraces automation as a core operational strategy.

Integration of Hyperscale Requirements with Modular and Scalable Facility Designs

The rapid expansion of hyperscale deployments is driving a shift toward modular colocation infrastructure. Modular designs enable faster construction and flexible capacity expansion. It helps operators meet unpredictable enterprise demand with lower upfront costs. Hyperscale tenants prefer modular builds for speed and adaptability. This approach enhances operational agility and supports multiple deployment models. Operators focus on optimizing power density and cooling efficiency. Modular development aligns with growing cloud workloads and edge expansion. The Algeria Data Center Colocation Market sees increasing investments in scalable infrastructure.

Shifting Focus Toward Cybersecurity and Data Sovereignty Compliance Measures

Cybersecurity concerns shape how colocation facilities are developed and operated. Strong data protection frameworks ensure trust among enterprises and government agencies. It enables operators to attract regulated industries such as BFSI and healthcare. Data sovereignty drives localized infrastructure strategies and compliance-driven investments. Operators implement advanced security measures, including biometric access and encryption. Regulatory clarity boosts investor confidence and market credibility. Secure colocation solutions become a priority for digital transformation strategies. The Algeria Data Center Colocation Market evolves with a strong security focus.

Evolving Partnerships Between Telecom Operators and Data Center Providers

Telecom operators are emerging as strategic partners in colocation development. Their networks enhance interconnection options for enterprise clients. It supports the delivery of hybrid and multi-cloud solutions with reliable performance. These partnerships expand market coverage and improve capacity utilization. Telecom providers enable new business models by integrating connectivity with hosting services. Strong collaboration accelerates infrastructure expansion into underserved regions. This strategic alignment supports long-term growth and resilience. The Algeria Data Center Colocation Market benefits from these operator-led alliances.

Market Challenges

Power Supply Limitations and Infrastructure Reliability Constraints Impacting Growth

Limited power availability remains a key barrier for large-scale colocation deployments. Dependence on traditional grids raises concerns about reliability and uptime. It forces operators to invest heavily in backup systems and power redundancy. High capital expenditure affects pricing strategies and slows infrastructure rollout. Power instability limits the ability to attract hyperscale customers with strict SLAs. Integrating renewable energy helps but requires strong regulatory and financial support. These challenges increase operational costs for operators and investors. The Algeria Data Center Colocation Market must address these infrastructure gaps to scale effectively.

Regulatory Complexity and Talent Shortages Affecting Market Expansion

Complex regulations can delay data center projects and increase compliance burdens. Unclear policies on data sovereignty and energy use affect investor confidence. It creates uncertainty for operators planning long-term infrastructure investments. Talent shortages in specialized roles such as network engineering and cooling management intensify operational pressure. Limited availability of skilled labor raises costs and slows deployments. Enterprises face hurdles in maintaining advanced IT infrastructure locally. Addressing these gaps is critical for building a competitive ecosystem. The Algeria Data Center Colocation Market needs regulatory clarity and workforce development to grow sustainably.

Market Opportunities

Rising Foreign Investments and Strategic Expansion of Colocation Ecosystem

Growing investor interest creates a favorable environment for market expansion. Global operators explore joint ventures and strategic alliances to enter new regions. It helps accelerate infrastructure development and bring advanced technologies into the market. Strong connectivity and low-latency opportunities attract hyperscale cloud players. Government incentives support large-scale digital infrastructure projects. Foreign partnerships enhance Algeria’s role as a digital hub. The Algeria Data Center Colocation Market benefits from these strategic investment inflows.

Expanding Edge Infrastructure and Digital Services Ecosystem Across Key Cities

Edge infrastructure development opens opportunities for colocation operators to capture new demand. Enterprises need localized capacity to support low-latency services. It encourages the deployment of smaller, distributed data centers. Telecom integration and 5G adoption drive this growth further. Urban centers become focal points for edge rollouts. This creates new revenue streams and enhances service diversity. The Algeria Data Center Colocation Market positions itself to lead in localized digital infrastructure.

Market Segmentation

By Type

Retail colocation dominates the market due to strong demand from SMEs and enterprises requiring scalable IT environments. It offers cost-effective solutions, faster deployments, and flexible resource allocation. Wholesale colocation grows steadily as large enterprises seek dedicated capacity. Hybrid cloud colocation attracts companies integrating private and public infrastructure. Rising demand for connectivity and edge computing drives the retail segment’s leadership. The Algeria Data Center Colocation Market benefits from this shift toward flexible colocation models.

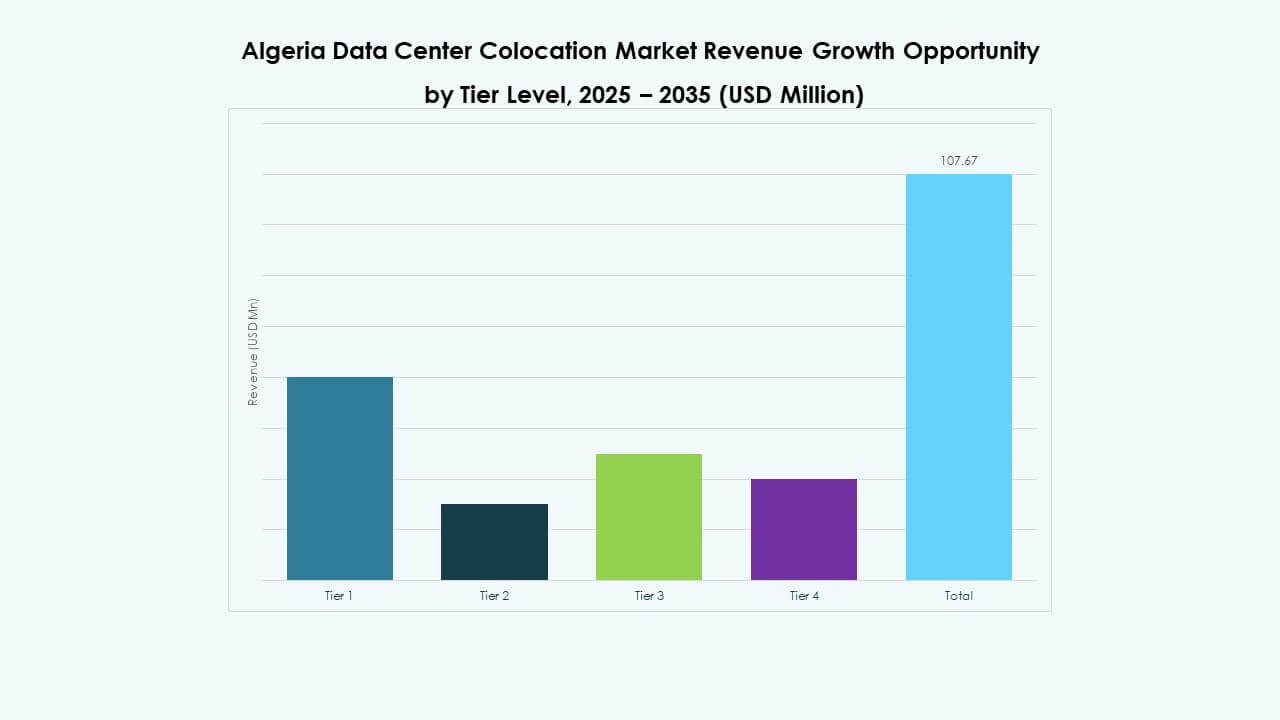

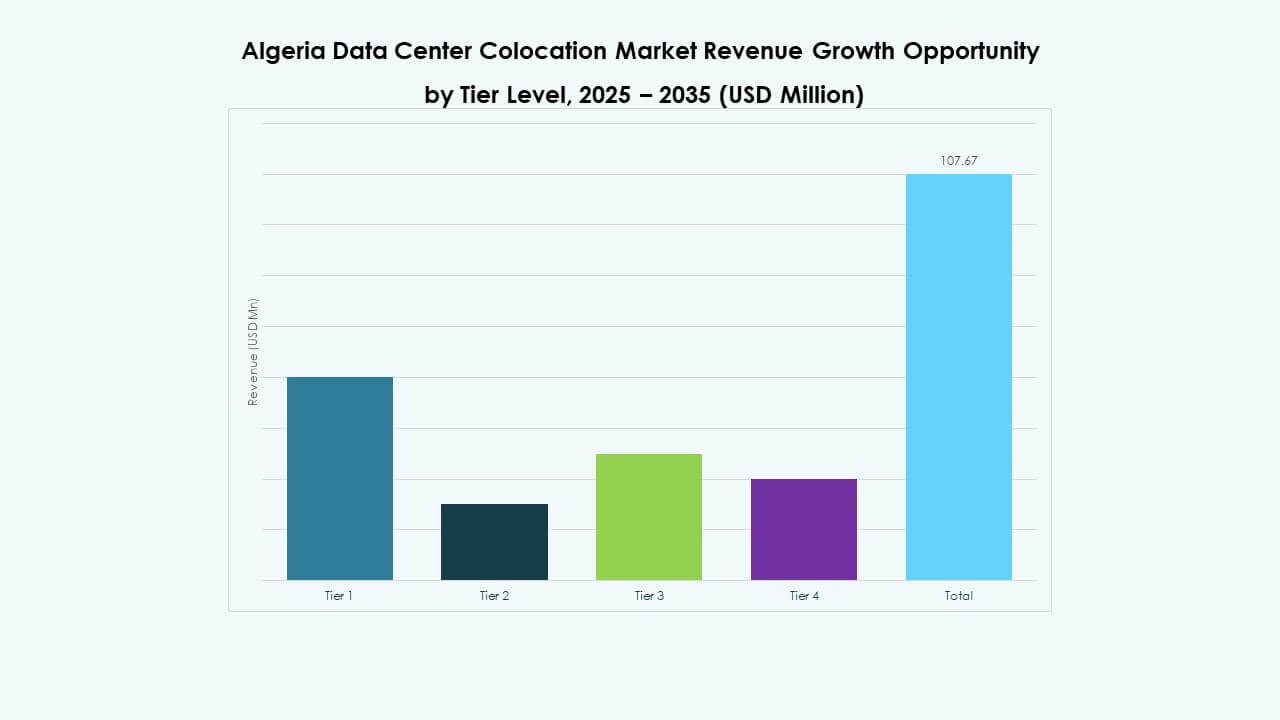

By Tier Level

Tier 3 facilities hold the largest share due to their strong uptime, redundancy, and cost efficiency. Tier 4 deployments gain traction for hyperscale projects requiring higher fault tolerance. Tier 1 and Tier 2 serve smaller workloads with lower operational complexity. Growing enterprise reliance on mission-critical applications supports advanced tier adoption. This tier structure reflects increasing demand for secure and reliable data environments. The Algeria Data Center Colocation Market aligns with global best practices in tiered infrastructure.

By Enterprise Size

Large enterprises lead the market, leveraging colocation for scalable, secure, and compliant infrastructure. Their investments support the adoption of advanced technologies and hybrid cloud strategies. SMEs show steady growth driven by digital transformation and cost savings. Flexible pricing models make colocation accessible to smaller businesses. Strong connectivity options and regional presence strengthen service adoption. The Algeria Data Center Colocation Market benefits from this enterprise mix.

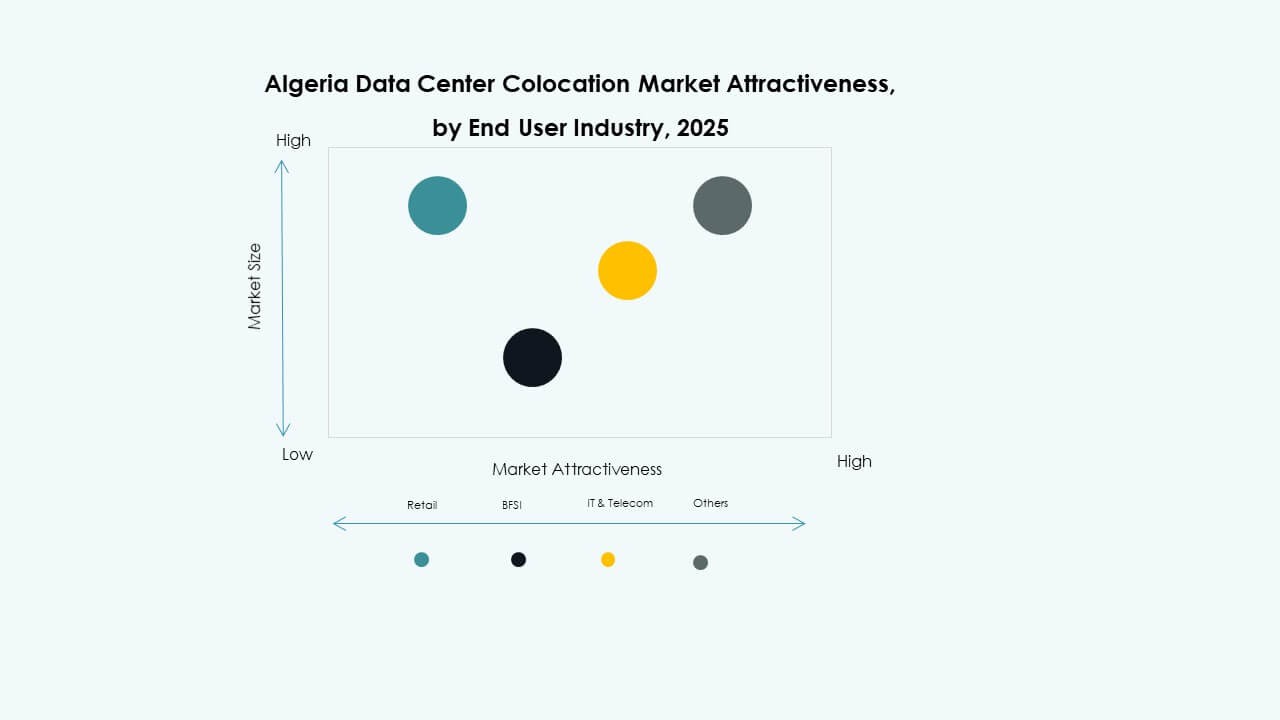

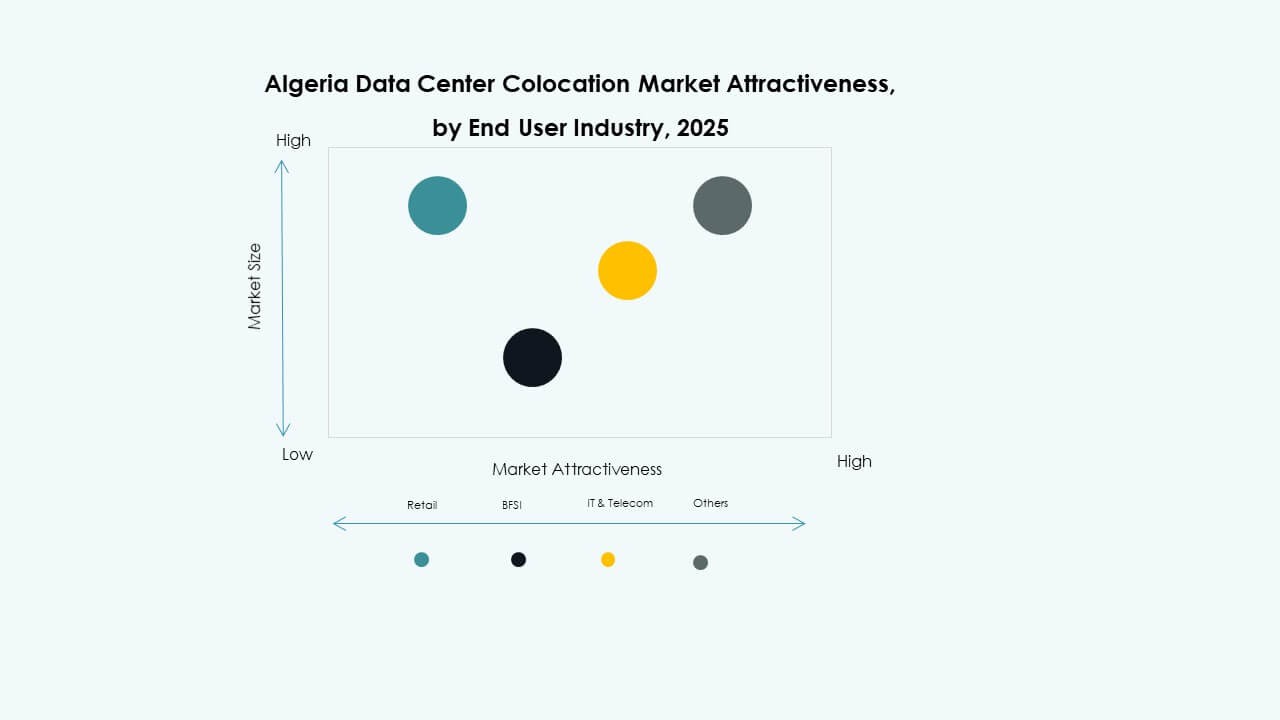

By End User Industry

IT & Telecom leads the market with high demand for connectivity and low-latency solutions. BFSI follows closely due to strict data security and regulatory needs. Healthcare and media sectors expand their footprints through edge and cloud integration. Retail businesses adopt colocation for omnichannel operations. The “Others” category includes manufacturing, education, and logistics with growing infrastructure needs. This diverse end-user base strengthens the Algeria Data Center Colocation Market ecosystem.

Regional Insights

North Africa Leading Regional Adoption Through Connectivity and Investment Strength

North Africa holds a 54.2% share, driven by strong fiber infrastructure and strategic investments. It benefits from favorable geographic positioning and cross-border network expansion. Telecom integration strengthens its interconnection ecosystem. Global players view the region as a key entry point to African digital infrastructure. It attracts both hyperscale and enterprise customers. The Algeria Data Center Colocation Market plays a vital role in this regional leadership.

Middle East Strengthening Ties Through Infrastructure Partnerships and Capacity Expansion

The Middle East holds a 27.4% share supported by strong investment partnerships. Regional carriers and hyperscale companies expand colocation capacity to meet growing enterprise demand. It enables better integration with global cloud networks. Strategic partnerships between governments and private operators accelerate deployments. Emerging hubs enhance service diversity and resilience. The Algeria Data Center Colocation Market gains from its proximity to these fast-growing ecosystems.

- For instance, du and Microsoft announced a US$544.5 million hyperscale data center deal in Dubai (April 2025), signed during Dubai AI Week, making Microsoft the anchor tenant to expand AI cloud capacity across the UAE.

Europe and Sub-Saharan Africa Emerging Through Edge and Network Expansion

Europe and Sub-Saharan Africa together hold an 18.4% share supported by rapid network expansion. Edge data centers and subsea cable landings drive growth in underserved markets. Partnerships strengthen regional interconnection and service capabilities. Enterprises target these regions for expansion due to lower competition and strong demand. Cross-border connectivity projects enhance ecosystem maturity. The Algeria Data Center Colocation Market benefits from this extended regional integration.

- For example, EXA Infrastructure raised €1.3 billion in October 2025 to finance new fiber backbone deployments in Central Europe and the first new North Sea subsea cable in 25 years, expanding connectivity across 37 countries with a 155,000 km network footprint.

Competitive Insights:

- Algeria Telecom

- Mobilis

- Djezzy

- Ooredoo Algeria

- Eriadatech

- Digital Realty Trust

- Amazon Web Services (AWS)

- Google Cloud

- CoreSite

- CyrusOne

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

The Algeria Data Center Colocation Market features a competitive mix of domestic telecom operators and global hyperscale players. It is shaped by expanding infrastructure investments, increasing edge deployments, and rising demand for cloud integration. Local firms focus on improving connectivity and compliance, while global operators bring advanced technology, scalability, and international reach. Strong partnerships strengthen market positioning and service differentiation. Competition centers on latency optimization, renewable energy integration, and service automation. Leading providers enhance their footprint through strategic alliances, capacity expansion, and hybrid solutions. Market leaders leverage technology leadership and ecosystem collaboration to attract hyperscale and enterprise clients. This strategic competition accelerates market maturity and drives long-term growth.

Recent Developments:

- In July 2025, Ooredoo Algeria announced a DZD 8.6 billion (approximately USD 64 million) investment directed toward strengthening its network infrastructure during the first half of the year. This investment represents a 32.4% increase over the previous year and reflects Ooredoo’s focus on enhancing its digital services and preparing for 5G deployment.

- In July 2025, Sparkle, a European global service provider, and Algérie Télécom signed a memorandum of understanding to build a new subsea cable system connecting Italy and Algeria. The project’s goal is to enhance Algeria’s international connectivity and support data center growth and colocation services by offering high-capacity, resilient bandwidth between North Africa and Europe.

- In April 2025, Mobilis, Algeria’s largest mobile network operator, announced the successful completion of 5G trials across several regions in the country. This milestone marks a major step toward the commercial rollout of 5G services expected by the end of 2025. The company’s move to 5G is expected to significantly improve connectivity, data speeds, and digital transformation in the Algerian market, particularly in underserved areas.

- In February 2025, Algérie Télécom partnered with Huawei to roll out a national 400G WDM all-optical network across Algeria. This large-scale infrastructure launch aims to provide ultra-fast transmission speeds that can support expanding colocation and data center operations.