Executive summary:

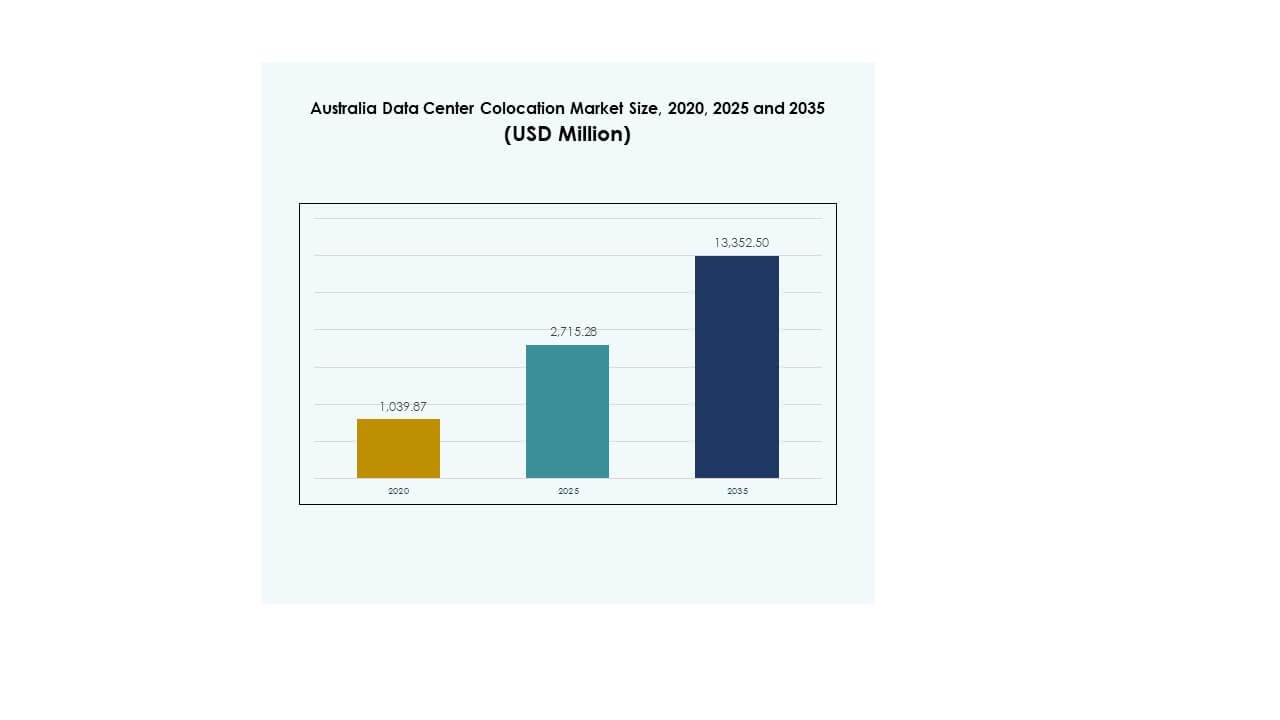

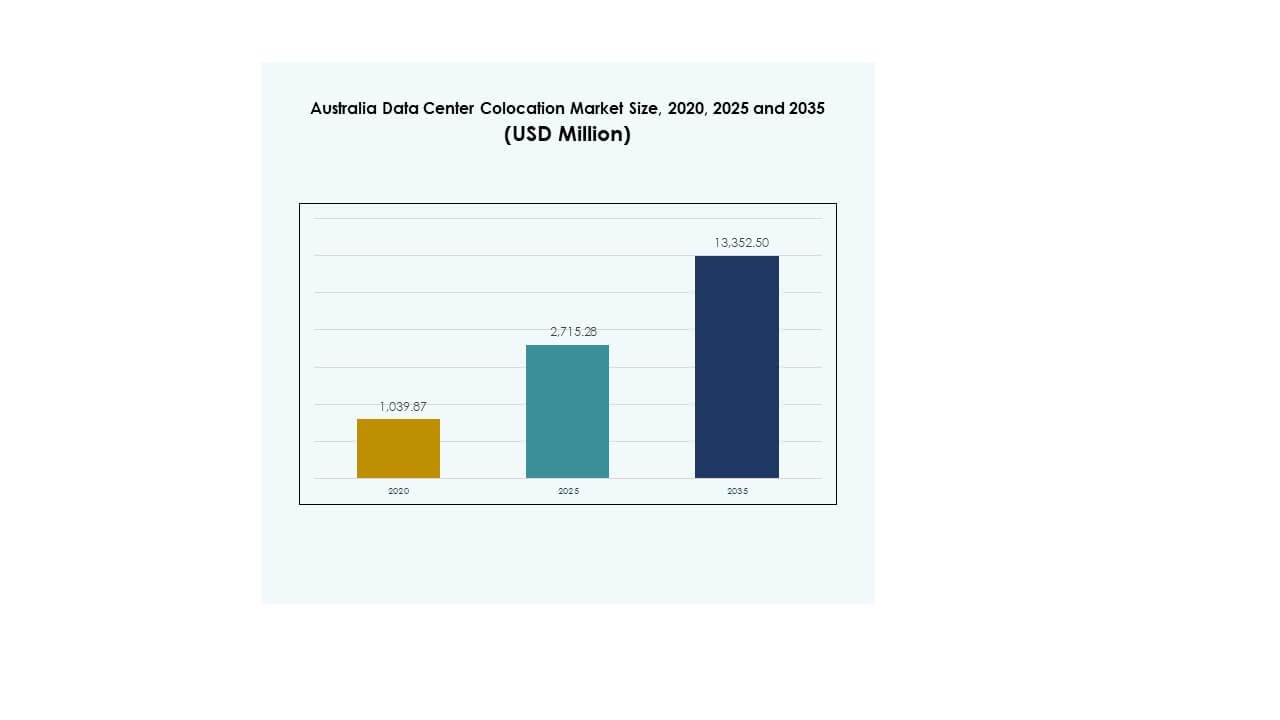

The Australia Data Center Colocation Market size was valued at USD 1,039.87 million in 2020 to USD 2,715.28 million in 2025 and is anticipated to reach USD 13,352.50 million by 2035, at a CAGR of 17.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Australia Data Center Colocation Market Size 2025 |

USD 2,715.28 Million |

| Australia Data Center Colocation Market, CAGR |

17.17% |

| Australia Data Center Colocation Market Size 2035 |

USD 13,352.50 Million |

The market is driven by growing digital infrastructure investments, rising cloud adoption, and advanced interconnection demand. Technology adoption in AI-ready, high-density facilities is accelerating hyperscale deployments. Strategic innovations in liquid cooling, energy-efficient systems, and hybrid cloud models are shaping enterprise IT strategies. It plays a vital role in strengthening network resilience and supporting critical national and enterprise operations, making it a key investment focus for both domestic and global players.

New South Wales leads the regional landscape with its strong connectivity and hyperscale campuses. Victoria follows as a fast-growing hub with rising green infrastructure investments. Queensland and Western Australia are emerging corridors due to renewable energy availability and strategic proximity to Asia. This geographic distribution supports balanced capacity growth and enhances Australia’s position as a regional digital infrastructure hub.

Market Drivers

Strong Expansion of Digital Infrastructure and Rising Enterprise Demand

The Australia Data Center Colocation Market is growing rapidly due to increasing digital transformation across multiple industries. Enterprises require scalable, secure, and high-performance infrastructure to support advanced workloads and cloud adoption. It benefits from expanding government digitalization initiatives that promote resilient IT ecosystems. Edge computing and 5G deployments drive the need for localized, low-latency data centers. Advanced interconnection services and hybrid cloud environments make colocation an attractive choice for businesses. Investors see the sector as a strategic gateway to Asia-Pacific’s digital economy. Hyperscale and enterprise customers are pushing operators to increase capacity. These combined factors strengthen the market’s position in global infrastructure growth.

Rising Adoption of Hybrid and Multi-Cloud Strategies Across Enterprises

The strong shift toward hybrid and multi-cloud strategies is reshaping enterprise IT infrastructure. It offers greater flexibility and cost optimization compared to traditional models. Enterprises seek colocation facilities to manage workloads that require security, control, and compliance. This demand is driving innovation in interconnection and cloud on-ramp solutions. Strategic partnerships between colocation providers and global cloud platforms enhance service delivery. The trend aligns with businesses prioritizing scalability and operational resilience. It creates opportunities for new investment models in the Australian colocation ecosystem. The strategic positioning strengthens the country’s role as a regional connectivity hub.

Integration of Energy-Efficient and Advanced Cooling Technologies

Growing pressure to reduce carbon footprints is driving adoption of energy-efficient cooling technologies. Liquid and direct-to-chip cooling enable higher power densities while cutting energy use. It helps operators meet corporate sustainability targets and comply with environmental standards. Data center operators invest in renewable energy integration to align with net-zero goals. The innovation enhances operational performance while reducing operating costs. Government incentives support infrastructure modernization projects focused on green technologies. The shift toward efficient cooling strengthens competitive positioning. This alignment of technology and policy accelerates sustainable infrastructure investments.

- For instance, in July 2024, AirTrunk deployed direct-to-chip liquid cooling at its Johor Bahru data center after five years of R&D. The technology reduces energy consumption by up to 23% and supports high-density, AI-ready compute environments.

Government Initiatives and Strategic Positioning in APAC Connectivity

Federal and state governments are promoting large-scale infrastructure investments to boost digital competitiveness. National connectivity programs encourage hyperscale players to expand operations in key metro hubs. It supports enhanced submarine cable networks and sustainable power integration. Strategic geographic positioning near Southeast Asia improves Australia’s role in global data routing. Businesses view this ecosystem as critical for expanding digital service delivery. Strong regulatory frameworks enhance investor confidence in infrastructure projects. This collaboration between government and private sectors accelerates long-term capacity growth. It positions Australia as a leading digital infrastructure hub in the region.

- For instance, SUBCO’s SMAP submarine cable spans around 5,000 km with 16 fiber pairs and a total capacity of 400 Tbps. Equinix was selected to host the cable’s landing points in its IBX data centers in Perth and Sydney.

Market Trends

Accelerating Demand for Hyperscale and AI-Ready Colocation Facilities

The market is witnessing strong growth in hyperscale and AI-optimized infrastructure deployments. It reflects a growing need for high-density racks, advanced interconnectivity, and low-latency performance. AI and ML workloads are driving demand for facilities with specialized power and cooling. Hyperscale operators continue expanding capacity to support global and domestic cloud ecosystems. The trend is reshaping design standards for colocation facilities. Investors focus on long-term returns from hyperscale expansions across urban hubs. Advanced GPU infrastructure deployment is increasing across strategic data center clusters. This shift drives significant structural transformation in facility design and operation.

Rise of Edge Colocation Nodes and Distributed Computing Networks

A strong shift toward edge computing is shaping next-generation colocation strategies. It is enabling data processing closer to end-users, supporting applications like IoT, AR/VR, and autonomous systems. Distributed edge nodes reduce latency and enhance service delivery in critical industries. The expansion of 5G networks supports this evolution across key metropolitan and regional zones. Colocation operators are partnering with telecom providers to build distributed infrastructure. Edge nodes support mission-critical operations for industries such as healthcare, logistics, and financial services. Their strategic placement creates opportunities for network resilience. This trend is transforming the infrastructure landscape across Australia.

Focus on Interconnection Ecosystems and Carrier-Neutral Facilities

Carrier-neutral data centers are becoming more attractive for enterprises seeking operational flexibility. It offers direct access to multiple network providers and cloud platforms within a single facility. High interconnection density supports business continuity and efficient traffic routing. It also strengthens ecosystem development across digital infrastructure hubs. Major cloud providers prefer carrier-neutral colocation sites to enhance network reach. Growing adoption of hybrid models supports this trend in metro regions. Strategic expansion of such facilities aligns with enterprise connectivity goals. This evolution reinforces Australia’s role in global data flows.

Sustainability as a Core Design Priority for Next-Generation Facilities

Sustainability is shaping investment decisions and operational strategies. It aligns with global corporate commitments to carbon neutrality and energy efficiency. Operators deploy renewable power sources, advanced cooling, and efficient power management systems. Government policies and green certification standards drive further adoption of sustainable practices. Major industry players integrate ESG goals into facility design and operations. It strengthens brand reputation and regulatory compliance across the sector. Growing investor focus on ESG-driven projects is accelerating infrastructure financing. This shift highlights how environmental responsibility and competitiveness are aligning.

Market Challenges

Infrastructure Bottlenecks and Power Supply Constraints Affecting Scalability

The Australia Data Center Colocation Market faces significant infrastructure and power-related constraints. Grid capacity limitations in some regions slow hyperscale expansion plans. It impacts project timelines and operational readiness for large facilities. Upgrading power infrastructure requires long approval cycles and high capital investment. Demand for renewable energy adds further complexity to power procurement strategies. Land availability in key metro zones is tightening, increasing development costs. These factors challenge operators seeking rapid capacity scaling. Addressing these constraints requires coordinated planning between utilities, regulators, and operators. Power availability remains a critical determinant of future growth.

Regulatory Complexity and Rising Costs of Compliance and Operations

Regulatory compliance creates operational complexity for colocation operators. Strict data protection, environmental, and construction standards drive up costs. It requires significant investments in certifications, audits, and monitoring systems. Variations in regional regulations add complexity to project execution. Skilled labor shortages in technical fields also increase operational expenses. Rising construction and energy costs impact profitability margins. These factors make project planning more challenging for small and mid-sized operators. Companies must align investment strategies with evolving policy frameworks to maintain competitiveness. Effective regulatory navigation remains essential for sustainable growth.

Market Opportunities

Rising Enterprise Digitalization and Cloud Service Expansion

The Australia Data Center Colocation Market offers strong opportunities from enterprise digitalization. Expanding hybrid cloud adoption across BFSI, healthcare, and media industries is creating new demand. It allows colocation providers to offer tailored infrastructure solutions for specific workloads. Strategic partnerships with cloud hyperscalers strengthen revenue potential. This convergence positions colocation as a core component of enterprise IT modernization.

Growth in Renewable Energy Integration and Green Infrastructure Development

Growing focus on sustainability is opening investment avenues in green data centers. Operators can leverage abundant renewable energy sources to enhance competitiveness. It aligns with corporate ESG goals and investor priorities. This transition creates opportunities for long-term, low-carbon infrastructure investments. It supports the development of modern, energy-efficient colocation facilities across strategic locations.

Market Segmentation

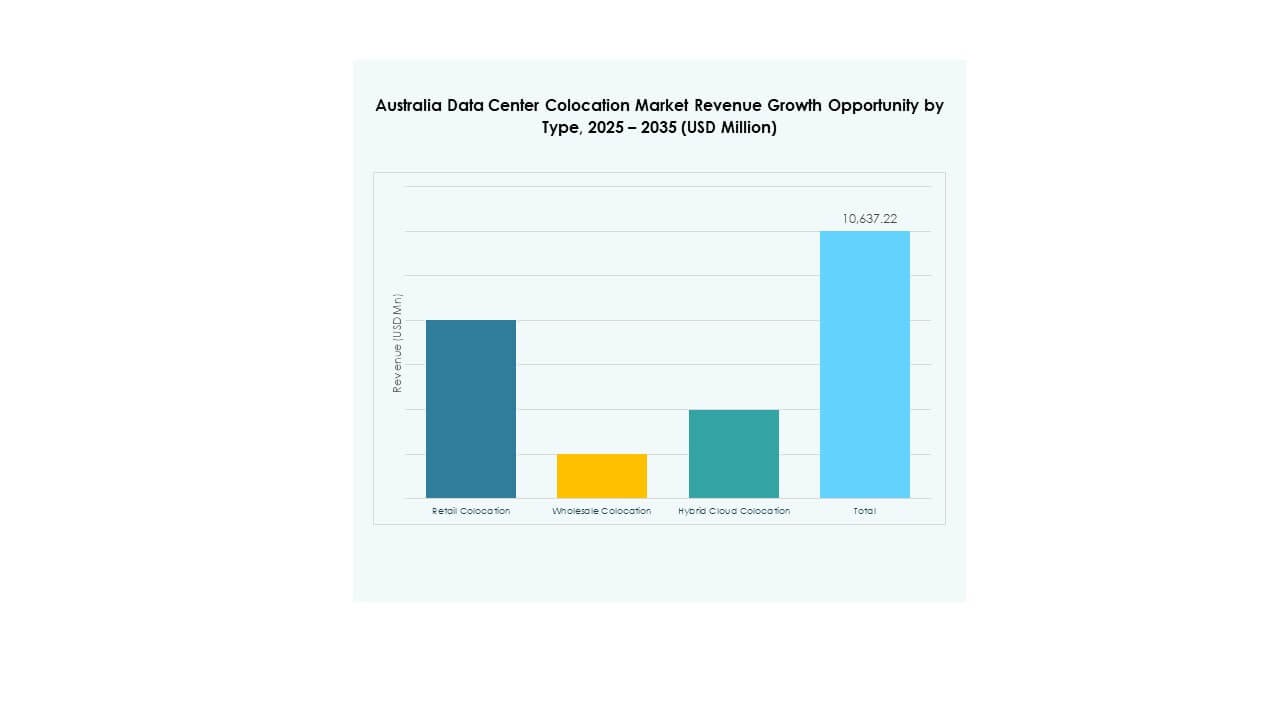

By Type

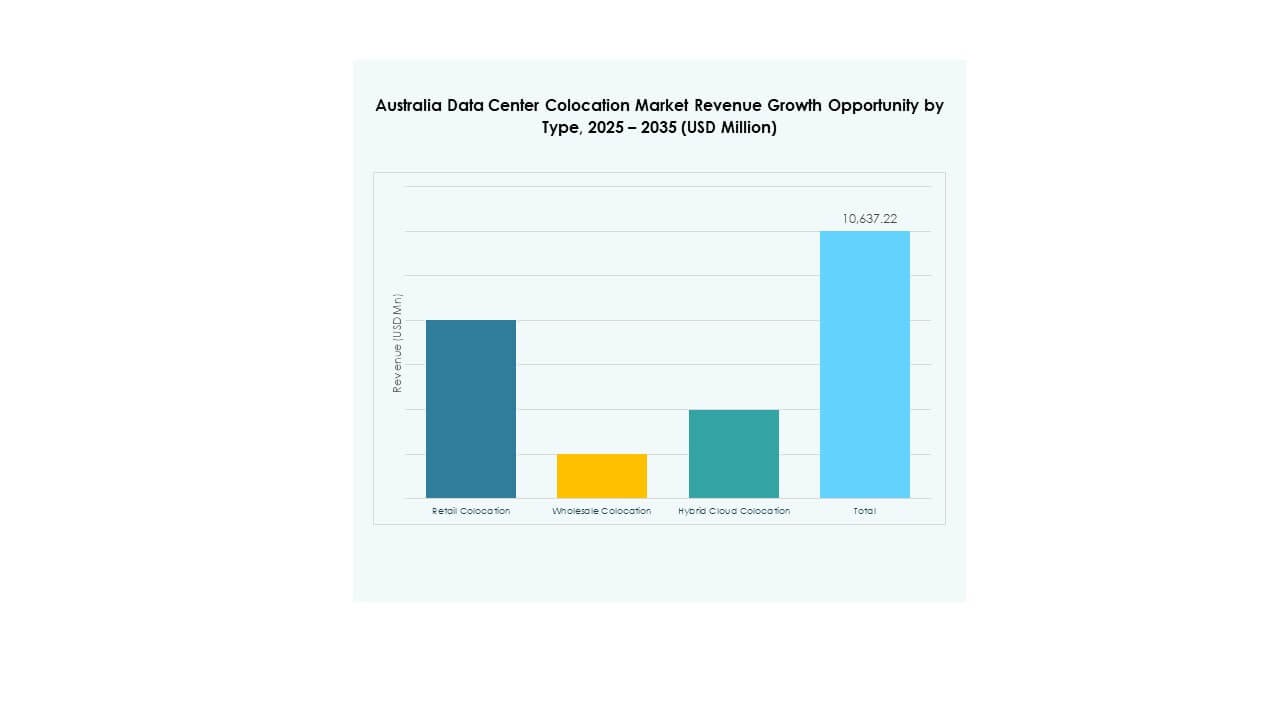

Retail colocation holds the largest market share in the Australia Data Center Colocation Market due to its flexible pricing models and scalability. It serves SMEs and enterprises seeking reliable infrastructure without high upfront investment. Wholesale colocation is expanding rapidly, supported by hyperscale demand and strategic campus builds. Hybrid cloud colocation is growing with the adoption of integrated architectures that combine private and public clouds. Its adaptability to changing workloads makes it attractive for modern enterprise IT ecosystems.

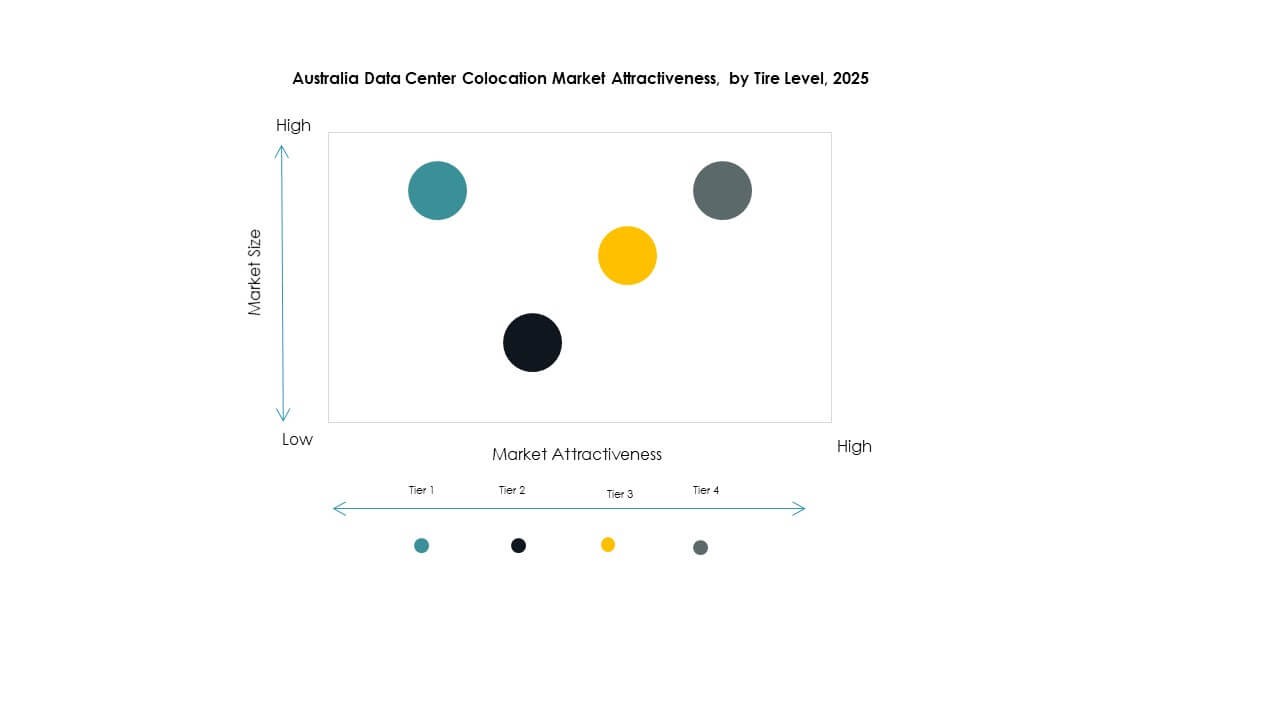

By Tier Level

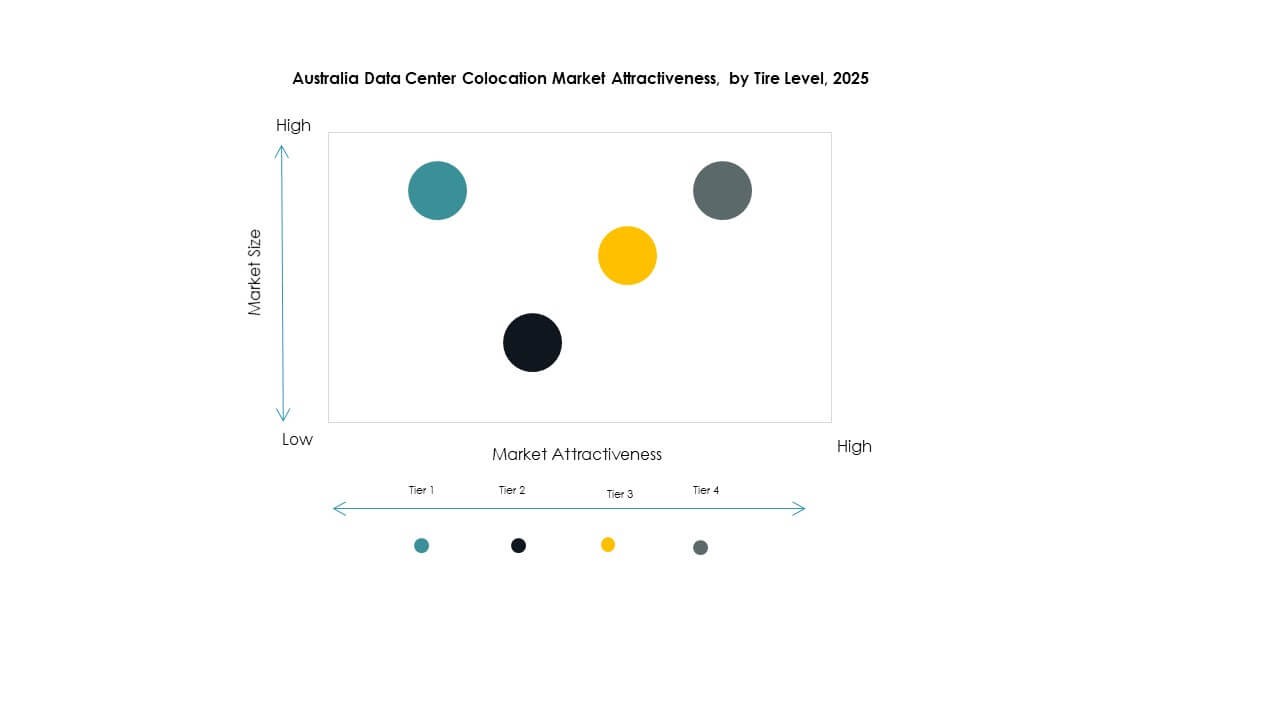

Tier 3 facilities dominate the market due to their balance between performance, redundancy, and cost. These data centers meet strict uptime requirements and attract major enterprises. Tier 4 facilities are growing with hyperscale expansions focusing on high resilience and availability. Tier 1 and Tier 2 facilities serve smaller enterprises and edge deployments. It reflects a structured market where higher-tier infrastructure aligns with critical workloads and service-level expectations.

By Enterprise Size

Large enterprises lead the market, leveraging colocation to support complex IT infrastructure. Their demand drives the need for high-capacity, secure, and interconnected facilities. SMEs are increasingly adopting colocation due to its cost efficiency and scalability. It supports business continuity and operational resilience without significant capital expenditure. Growing digital adoption among SMEs enhances the overall market expansion.

By End User Industry

The IT & Telecom sector dominates demand due to extensive data processing and connectivity needs. BFSI and healthcare industries follow, driven by strict regulatory compliance and security requirements. Media & entertainment relies on high-performance infrastructure for content delivery and streaming services. Retail is adopting colocation to support e-commerce growth and omnichannel operations. Other industries contribute through niche deployments that support operational agility.

Regional Insights

New South Wales – Leading Hyperscale and Connectivity Hub

New South Wales leads the Australia Data Center Colocation Market with 37% share. It hosts major hyperscale facilities, submarine cable landing points, and dense connectivity infrastructure. Sydney serves as the primary hub for global and domestic cloud traffic. Strategic location, strong grid capacity, and proximity to enterprises strengthen its dominance. Investments in sustainable infrastructure support its position as a leading colocation cluster. Government-backed digital infrastructure projects further enhance its capacity growth trajectory.

- For instance, NEXTDC’s S3 Sydney data center in Artarmon, opened in September 2022, offers 80 MW of IT capacity, 10,800 racks, and 20,000 m² of technical space. The facility is Uptime Institute Tier IV certified and interconnected with S1 and S2, forming a major Sydney interconnection hub.

Victoria – Rapid Growth Through Hyperscale and Green Energy Initiatives

Victoria holds 29% of the market, driven by hyperscale investments and sustainable energy availability. Melbourne is emerging as a major colocation and edge computing hub. It benefits from lower land costs and high renewable power integration. Its expanding network interconnectivity supports cloud, AI, and content delivery platforms. Strong enterprise presence enhances demand for hybrid and multi-cloud services. Policy support for green infrastructure further accelerates facility development in the region.

- For instance, Equinix’s ME2 data center in Melbourne provides around 4,070 m² of colocation space and supports high-density deployments for hybrid cloud workloads. Equinix has publicly committed to expanding renewable energy use across its Australian operations as part of its global sustainability strategy.

Queensland and Western Australia – Emerging Strategic Corridors

Queensland and Western Australia together account for 22% of the market. These regions benefit from abundant renewable resources and growing enterprise activity. Proximity to Asia strengthens Western Australia’s role as a strategic connectivity link. Queensland’s expanding digital economy supports edge and regional colocation deployments. Government incentives promote investments in data center infrastructure across both states. Their strategic importance continues to grow as new facilities balance national capacity distribution.

Competitive Insights:

- Equinix, Inc.

- Digital Realty Trust

- NTT Ltd. (NTT DATA)

- Iron Mountain

- Amazon Web Services (AWS)

- Google Cloud

- Australia Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Flexential

The Australia Data Center Colocation Market features strong competition among global hyperscale players and domestic telecom operators. It is shaped by strategic investments in hyperscale campuses, interconnection ecosystems, and green infrastructure. Equinix and Digital Realty lead the market with extensive capacity and multiple campuses in Sydney and Melbourne. AWS and Google Cloud expand their edge through integrated cloud on-ramps. NTT and Iron Mountain focus on hybrid infrastructure and energy-efficient operations. Domestic telecom operators strengthen their presence through carrier-neutral services. Strategic partnerships and acquisitions define competitive moves. Strong emphasis on energy efficiency, connectivity, and geographic reach creates a layered and dynamic market structure.

Recent Developments:

- In September 2025, Telstraentered a new five‑year partnership agreement with Imei, a managed mobility and communications provider, to deliver enterprise‑grade connectivity and digital solutions for Australian businesses. The collaboration leverages Telstra’s robust 5G network and Imei’s lifecycle‑management services to enhance secure data‑center interconnectivity and enterprise cloud deployments.

- In June 2025, Amazon Web Services committed AU $20 billion (US $13.3 billion)over five years to expand its Australian data‑center operations – marking the largest tech‑infrastructure investment in the country’s history. The investment includes upgrades to AWS regions in Sydney and Melbourne, alongside renewable‑energy‑powered data centers to meet the surging AI and cloud‑computing demand nationwide.

- In May 2025, NTT DATA revealed a global expansion plan involving $10 billion in investmentthrough 2027, including new land acquisitions across high‑growth Asia‑Pacific markets such as Japan and Australia. The company aims to add nearly 1 GW of additional data‑center capacity globally to support AI‑ready infrastructure for hyperscale and enterprise clients.

- In April 2025, Google Cloud expanded its multi‑cloud strategic partnershipwith Oracle, introducing the Oracle Database@Google Cloud solution in Australia’s Sydney and Melbourne regions. This collaboration allows enterprises to access Oracle database services directly within Google Cloud infrastructure, enhancing colocation efficiency and performance for data‑intensive workloads across Australia.

- In March 2025, Colt Technology Services announced a major network expansion in Sydney, directly connecting over 250 commercial buildings and 20 data centerswith 400 Gbps metro connectivity and up to 10 Gbps international links. This initiative supports AI, ML, and Big Data clients who require low‑latency colocation infrastructure for enterprise workloads in Australia.