Executive summary:

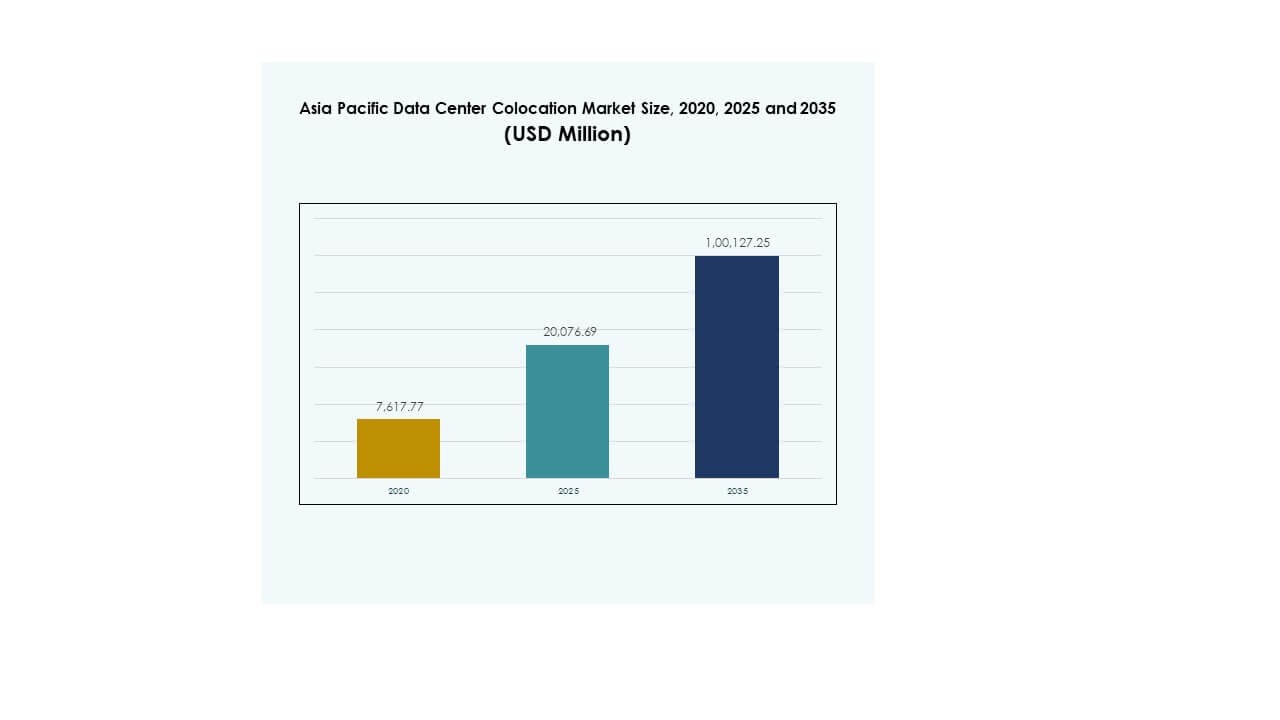

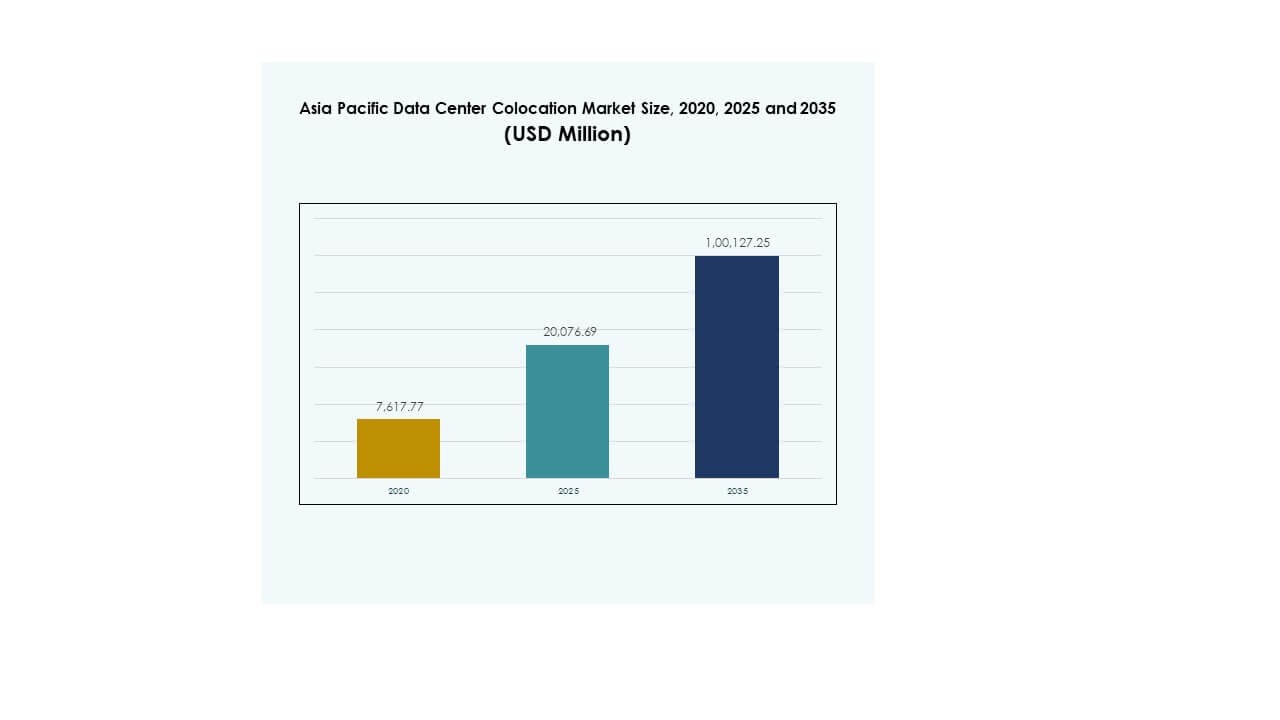

The Asia Pacific Data Center Colocation Market size was valued at USD 7,617.77 million in 2020 to USD 20,076.69 million in 2025 and is anticipated to reach USD 100,127.25 million by 2035, at a CAGR of 17.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Asia Pacific Data Center Colocation Market Size 2025 |

USD 20,076.69 Million |

| Asia Pacific Data Center Colocation Market, CAGR |

17.33% |

| Asia Pacific Data Center Colocation Market Size 2035 |

USD 100,127.25 Million |

Strong demand for colocation services is driven by rapid cloud adoption, edge infrastructure expansion, and growing investments in sustainable data centers. Enterprises are migrating workloads to modern facilities to improve security, reduce costs, and enable scalable growth. Innovation in hyperscale architecture, green energy use, and regulatory support enhances the sector’s appeal. This makes the market strategically significant for businesses and investors seeking long-term digital infrastructure opportunities.

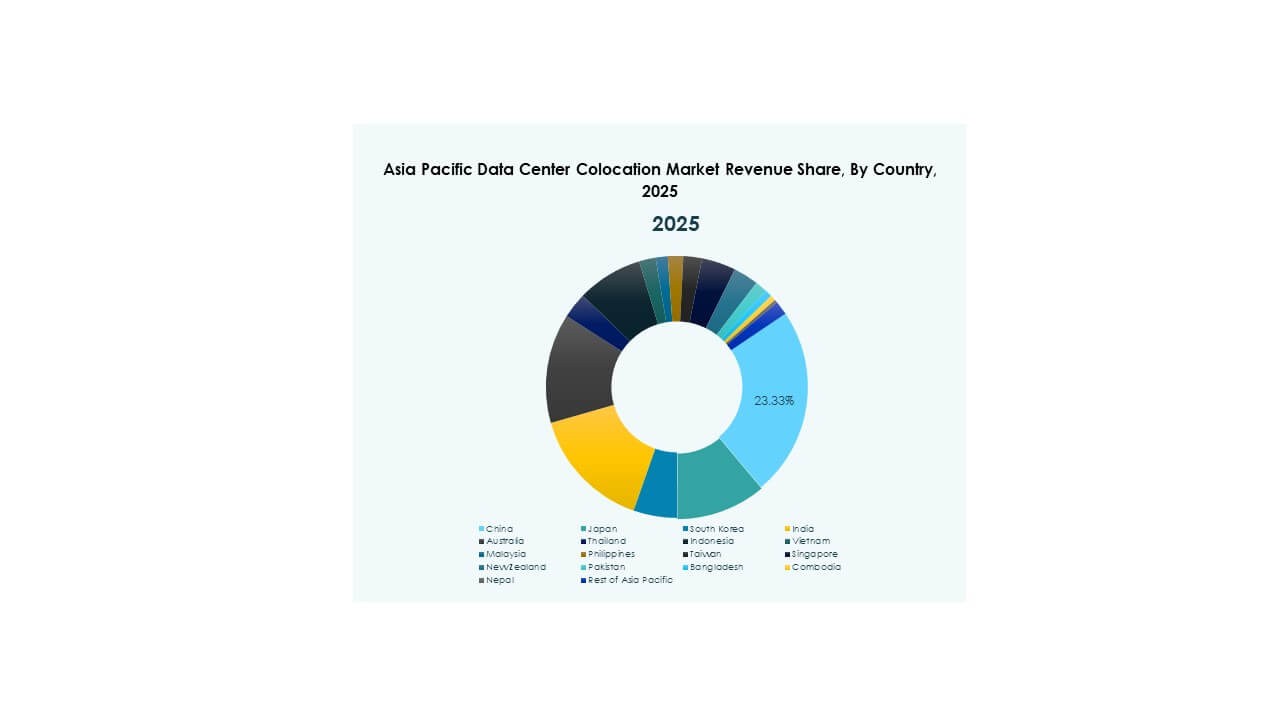

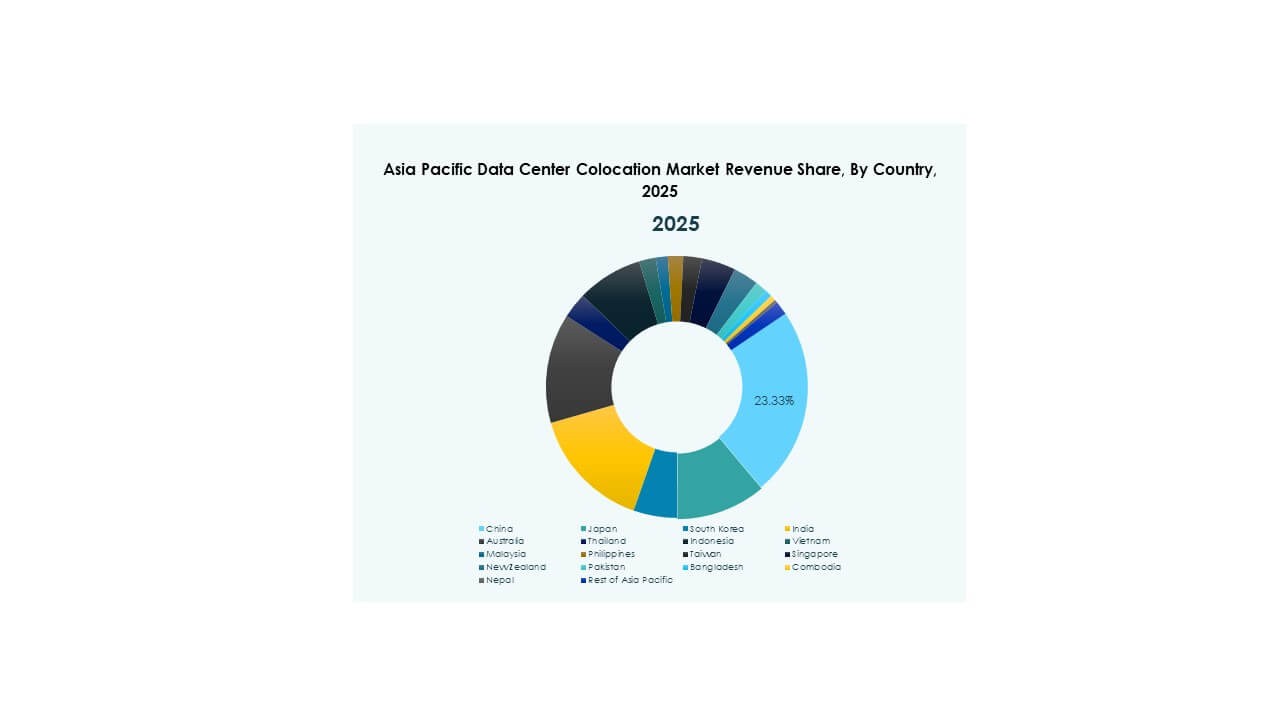

East Asia leads the market with strong hyperscale activity and mature connectivity, driven by China, Japan, and South Korea. Southeast Asia is emerging as the fastest-growing subregion, supported by digital investments in Singapore, Indonesia, Vietnam, and the Philippines. South Asia and Oceania contribute to steady growth, with India, Australia, and New Zealand expanding their capacity through large-scale infrastructure development.

Market Drivers

Rising Cloud Adoption and Digital Transformation Across Industries

Rapid enterprise cloud adoption is driving strong demand for colocation capacity across Asia Pacific. The Asia Pacific Data Center Colocation Market is benefiting from large-scale digital transformation programs in BFSI, retail, manufacturing, and public sector enterprises. Organizations are shifting critical workloads from legacy infrastructure to scalable colocation models to achieve operational agility and cost efficiency. Multi-cloud strategies are creating higher bandwidth and security needs, fueling hyperscale and retail colocation demand. Governments are launching smart city initiatives that further accelerate digitalization. High data traffic growth is pushing companies to expand IT infrastructure through colocation. Investors view the sector as a stable asset class backed by recurring revenue streams. This strategic importance is encouraging both domestic and international operators to strengthen their regional footprint.

Technological Advancements and Edge Infrastructure Expansion

Edge computing and AI adoption are accelerating new data center builds across the region. The Asia Pacific Data Center Colocation Market is evolving with growing deployment of edge facilities to support low-latency applications and next-generation connectivity. Enterprises are embracing AI-driven automation to optimize power, cooling, and network efficiency. Telecom operators are expanding 5G infrastructure, increasing demand for distributed colocation sites near consumption hubs. Edge facilities are supporting applications like autonomous mobility, smart manufacturing, and telemedicine. This expansion reduces network congestion and improves data processing speed. Investors see strong returns in distributed architectures that enable flexible and resilient digital ecosystems. It reflects a clear shift from centralized systems toward highly connected edge environments.

- For instance, in February 2024, PlanckDot secured USD 1.6 million in funding to deploy edge data centers at telecom tower sites in India. This initiative highlights the growing role of edge infrastructure in supporting 5G-driven enterprise connectivity in the region.

Growing Emphasis on Sustainable Infrastructure Development

Sustainability has become a core priority for operators building new colocation facilities. The Asia Pacific Data Center Colocation Market is witnessing rising investments in green buildings and energy-efficient technologies. Operators are adopting renewable power sources, advanced cooling systems, and modular designs to meet environmental goals. Regulatory frameworks are tightening across major economies, pushing facilities to lower carbon footprints. Enterprises are prioritizing green colocation providers to meet their ESG targets. This trend is reshaping investment strategies and driving technology upgrades. Data center operators are focusing on LEED and ISO certifications to strengthen their competitive position. Investors prefer sustainable assets that align with global climate commitments and long-term energy security goals.

- For instance, PwC projects that electricity demand from data centers in Mainland China, Japan, Australia, India, Singapore, and Korea could reach nearly 800 TWh by 2030. The report highlights a widening gap between total power demand and renewable energy supply in these key Asia Pacific markets.

Regulatory Support and Strategic Investments in Digital Infrastructure

Government-backed initiatives are enabling rapid expansion of data center infrastructure across multiple Asia Pacific economies. The Asia Pacific Data Center Colocation Market is growing stronger due to national policies promoting digitalization, cybersecurity, and cross-border data exchange. Several governments are creating tax incentives and special economic zones to attract global colocation providers. This supportive environment encourages large-scale foreign direct investments in hyperscale and enterprise-grade facilities. Regulatory clarity is helping operators streamline licensing and operational processes. Countries are focusing on sovereign data security and localization frameworks that further increase colocation demand. Strategic partnerships between telecom, cloud, and infrastructure firms are boosting market maturity. This collaboration strengthens the ecosystem and accelerates infrastructure modernization.

Market Trends

Rising Adoption of Hyperscale Models to Support Next-Generation Applications

The shift toward hyperscale colocation facilities is reshaping industry structure across the region. The Asia Pacific Data Center Colocation Market is moving toward large, energy-efficient campuses supporting massive workloads. Hyperscale models enable operators to serve AI, IoT, and 5G networks more efficiently. Enterprises are consolidating fragmented infrastructure into fewer, more advanced sites. This trend supports better energy management and network scalability. Cloud service providers are leading this build-out, supported by strategic capital inflows. Colocation providers are integrating advanced automation and real-time monitoring technologies to meet high-performance needs. This evolution is positioning the region as a major global hyperscale hub.

Integration of Renewable Energy and Sustainable Design Practices

Colocation operators are prioritizing renewable energy integration to lower operational costs and carbon intensity. The Asia Pacific Data Center Colocation Market is adopting modular, energy-optimized designs that reduce environmental impact. Operators are investing in power purchase agreements and onsite renewable generation. This focus aligns with national decarbonization goals and growing enterprise demand for low-carbon infrastructure. Cooling systems are shifting to advanced liquid and free-air solutions that improve efficiency. Energy reporting and transparency are becoming central to customer decisions. Green data center certifications are emerging as competitive differentiators. This trend reflects the sector’s alignment with global sustainability objectives.

Increased Investments in Interconnection and Carrier-Neutral Ecosystems

Strong growth in cloud and content delivery is increasing demand for interconnection hubs. The Asia Pacific Data Center Colocation Market is seeing expansion of carrier-neutral facilities that support diverse network ecosystems. Enterprises prefer neutral colocation to access multiple ISPs and cloud platforms from a single location. This reduces costs and improves latency performance. Content delivery networks are expanding edge nodes to bring data closer to users. Interconnection-rich facilities are attracting hyperscalers and SaaS providers looking for flexible connectivity. This trend enhances market competitiveness and fosters stronger cross-industry partnerships.

Growing Focus on Automation and AI-Powered Operations

Automation is transforming operational efficiency and resilience in modern colocation facilities. The Asia Pacific Data Center Colocation Market is adopting AI tools to optimize capacity planning, security, and energy management. Predictive analytics is enabling real-time decision-making for asset utilization. AI-driven maintenance is reducing downtime and improving power usage effectiveness. Automation reduces manual errors and accelerates response time for dynamic workloads. Operators are investing in intelligent control systems to handle complex multi-tenant environments. This technology-driven shift increases operational reliability and supports scalable growth strategies.

Market Challenges

Rising Power and Land Constraints in Key Urban Hubs

Power availability and land scarcity are creating significant barriers for new deployments in dense urban zones. The Asia Pacific Data Center Colocation Market faces mounting pressure to secure reliable, affordable energy sources for high-capacity facilities. Growing energy demand is outpacing grid modernization in several economies. Urban centers such as Tokyo, Singapore, and Hong Kong are struggling with site limitations. Strict zoning regulations make expansion complex and time-intensive. This slows project timelines and raises construction costs. Operators are turning toward secondary cities for capacity expansion, which increases logistical complexity. Power pricing volatility is also impacting profitability and investment planning. This constraint requires advanced planning and strategic partnerships with utilities and regulators.

Regulatory Fragmentation and Complex Compliance Landscape

Varying national regulations are creating operational challenges for global operators across the region. The Asia Pacific Data Center Colocation Market is impacted by inconsistent data sovereignty rules, cybersecurity frameworks, and compliance standards. Differing policies increase costs and operational risks for multi-country deployments. Some countries enforce strict localization mandates that require separate infrastructure investments. This fragmentation complicates scaling strategies and slows cross-border service delivery. Operators must adapt to fast-changing laws that differ across markets. Limited regulatory harmonization is discouraging smaller providers from expanding regionally. Addressing this challenge demands closer collaboration between industry and policymakers to support balanced growth.

Market Opportunities

Market Opportunities

Expansion into Emerging Economies with High Digital Growth Potential

Rising digital adoption in Southeast Asian economies presents a significant growth window. The Asia Pacific Data Center Colocation Market is expanding in markets like Vietnam, Indonesia, and the Philippines due to favorable demographics and improving connectivity. Enterprises in these countries are accelerating their migration toward cloud and colocation solutions. Strategic investments in undersea cables and fiber networks are strengthening the digital ecosystem. Global players are entering these markets to secure early-mover advantages. This expansion creates strong revenue potential and regional diversification opportunities.

Accelerating Development of AI and Edge Infrastructure Ecosystems

The deployment of AI and edge computing is opening new demand streams for colocation capacity. The Asia Pacific Data Center Colocation Market is well positioned to support distributed edge networks that power advanced applications. Enterprises require low-latency connectivity to enable AI-driven automation, autonomous systems, and immersive experiences. Colocation facilities near urban and industrial hubs offer strong strategic value. This opportunity supports new business models for operators and strengthens the region’s digital backbone.

Market Segmentation

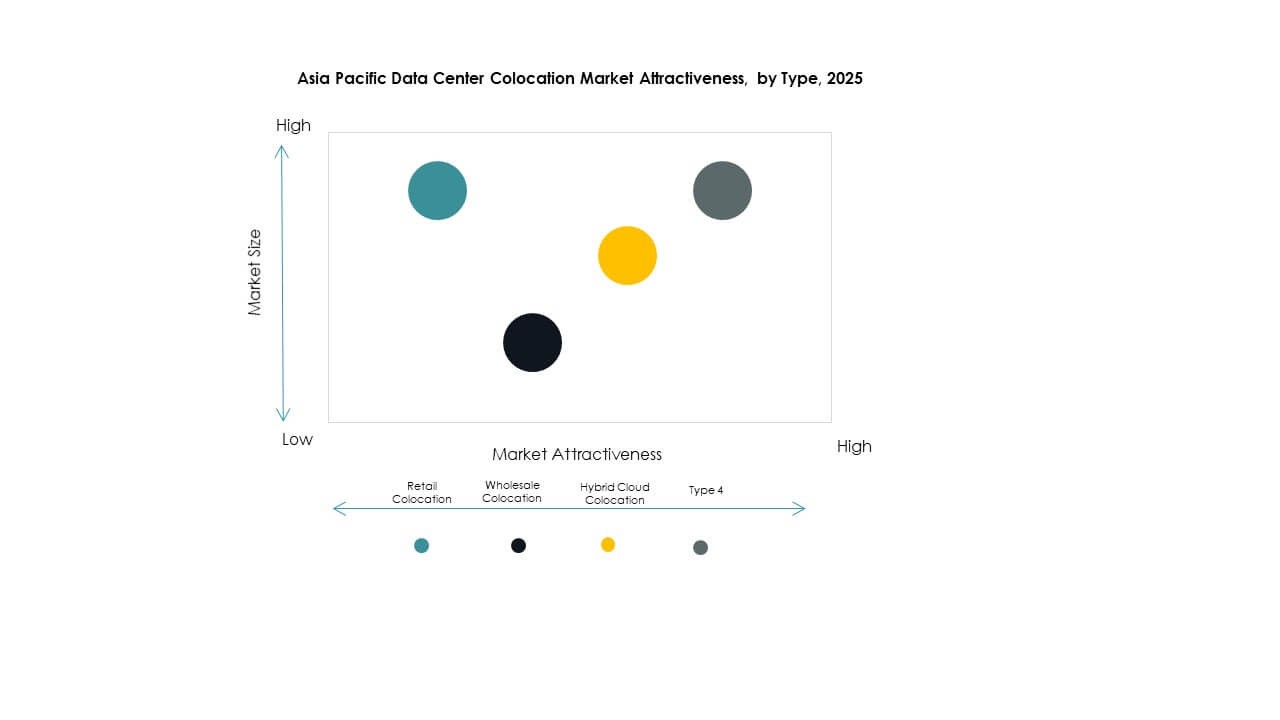

By Type

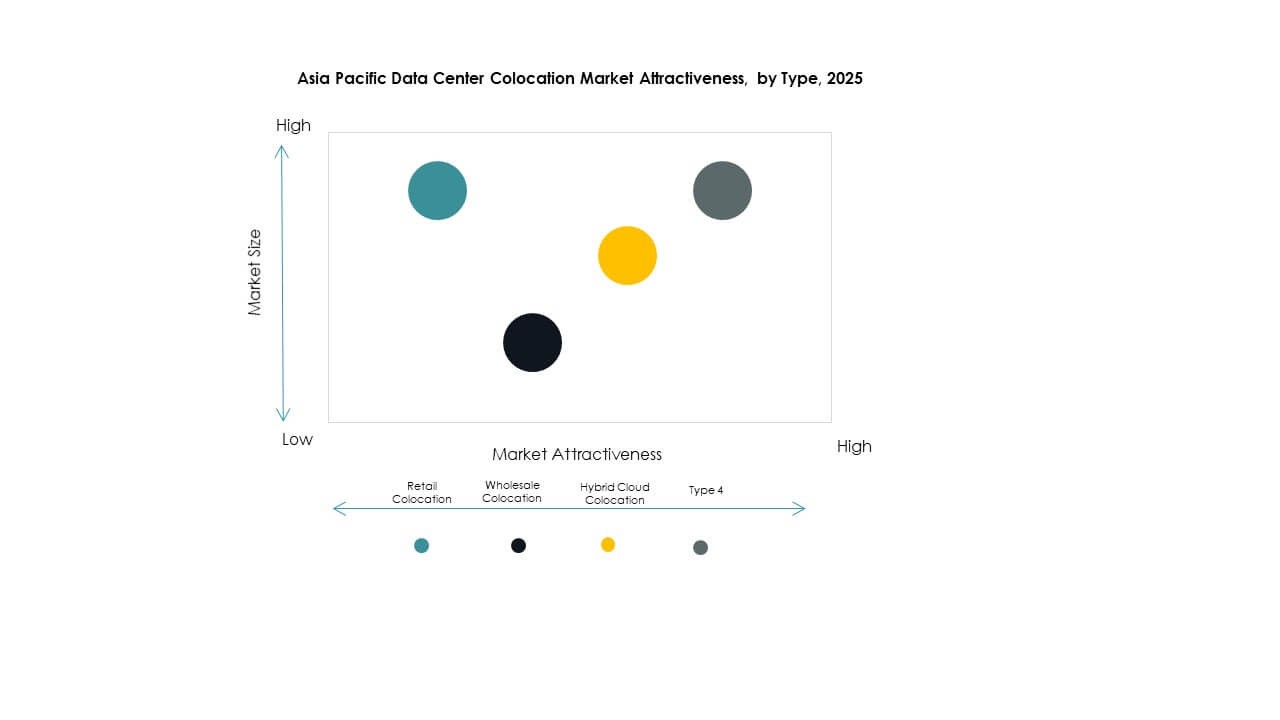

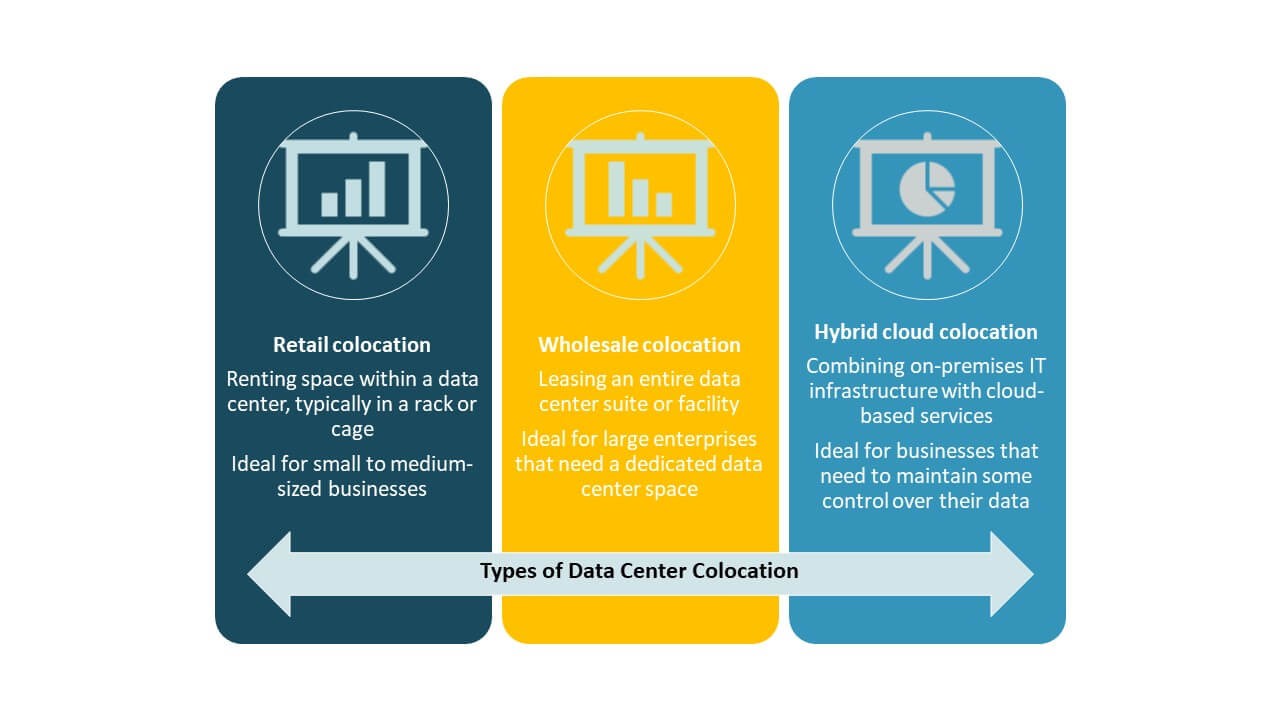

Retail colocation dominates the Asia Pacific Data Center Colocation Market with a strong share, driven by enterprises seeking flexible and scalable capacity. Retail models allow tenants to lease smaller spaces while maintaining control over hardware. This model supports growing demand from IT and telecom sectors. Wholesale colocation is expanding, fueled by hyperscale customers. Hybrid cloud colocation is gaining traction as businesses adopt multi-cloud strategies for operational agility.

By Tier Level

Tier 3 facilities lead the Asia Pacific Data Center Colocation Market with the largest market share due to their high uptime and cost-efficiency balance. Enterprises prefer Tier 3 for mission-critical workloads that demand strong redundancy without hyperscale cost structures. Tier 4 facilities are growing due to rising hyperscaler presence. Tier 1 and Tier 2 remain relevant for small businesses in emerging economies. Tier differentiation reflects the maturity and reliability of digital infrastructure across the region.

By Enterprise Size

Large enterprises dominate the Asia Pacific Data Center Colocation Market with the largest revenue contribution. These organizations host massive data volumes and require advanced security, network reliability, and compliance. SMEs are steadily increasing their adoption due to cloud migration and digital service expansion. Colocation offers cost-effective infrastructure access without heavy capital expenditure. Growing SME participation expands the market’s demand base and geographic diversity.

By End User Industry

IT and telecom lead the Asia Pacific Data Center Colocation Market with the largest market share, supported by rapid cloud integration, content delivery, and 5G deployments. BFSI follows closely, driven by compliance-heavy data hosting needs. Retail, healthcare, and media sectors are accelerating adoption due to digitalization initiatives. Demand from other sectors is rising with Industry 4.0 transformation. Sector diversification strengthens market resilience and capacity growth.

Regional Insights

East Asia: Leading the Regional Market with Strong Hyperscale Presence (37%)

East Asia holds the largest share in the Asia Pacific Data Center Colocation Market at 37%. China, Japan, and South Korea drive demand through high cloud adoption, advanced connectivity, and strong regulatory support. These economies have mature digital ecosystems with dense hyperscale and interconnection hubs. Large domestic players and global hyperscalers are investing in sustainable, high-capacity facilities. Strategic urban locations and robust power grids strengthen the region’s leadership position.

- For instance, in April 2024, Microsoft announced an investment of USD 2.9 billion to expand its AI and cloud infrastructure in Japan. The plan includes building new data center facilities and enhancing national AI capabilities to strengthen the country’s digital infrastructure.

Southeast Asia: Fastest-Growing Market with Expanding Digital Infrastructure (31%)

Southeast Asia accounts for 31% of the Asia Pacific Data Center Colocation Market and represents the fastest-growing subregion. Countries like Singapore, Indonesia, Vietnam, and the Philippines are experiencing rapid cloud adoption and strong investor interest. Submarine cable projects and connectivity upgrades are enabling large-scale data center expansions. Favorable regulatory environments and strategic trade positions make the region a key digital gateway. The rise of domestic digital enterprises is also boosting local colocation demand.

South Asia and Oceania: Strategic Growth Zone for Emerging Markets (32%)

South Asia and Oceania collectively hold 32% of the Asia Pacific Data Center Colocation Market. India, Australia, and New Zealand are driving growth through expanding hyperscale footprints and rising enterprise demand. India’s digital ecosystem is maturing rapidly with strong government support and private investments. Australia and New Zealand are leveraging renewable energy resources to build sustainable data infrastructure. This subregion plays a strategic role in regional redundancy, resilience, and capacity expansion.

- For instance, NEXTDC’s S3 Sydney data center supports 80 MW of critical IT load and features sustainable infrastructure, including on-site solar and rainwater harvesting systems. This facility represents one of Australia’s largest colocation developments, reinforcing the country’s strong data center capacity in Oceania.

Competitive Insights:

- China Telecom

• NTT Communications

• KT Corporation

• Global Switch Holdings Limited

• Cologix

• Colt Technology Services Group Limited

• CoreSite

• CyrusOne

• Centersquare

• Digital Realty Trust

• Equinix, Inc.

• NTT Ltd. (NTT DATA)

• QTS Realty Trust, LLC

• Rackspace Technology

• Telehouse (KDDI Corporation)

• Zayo Group, LLC

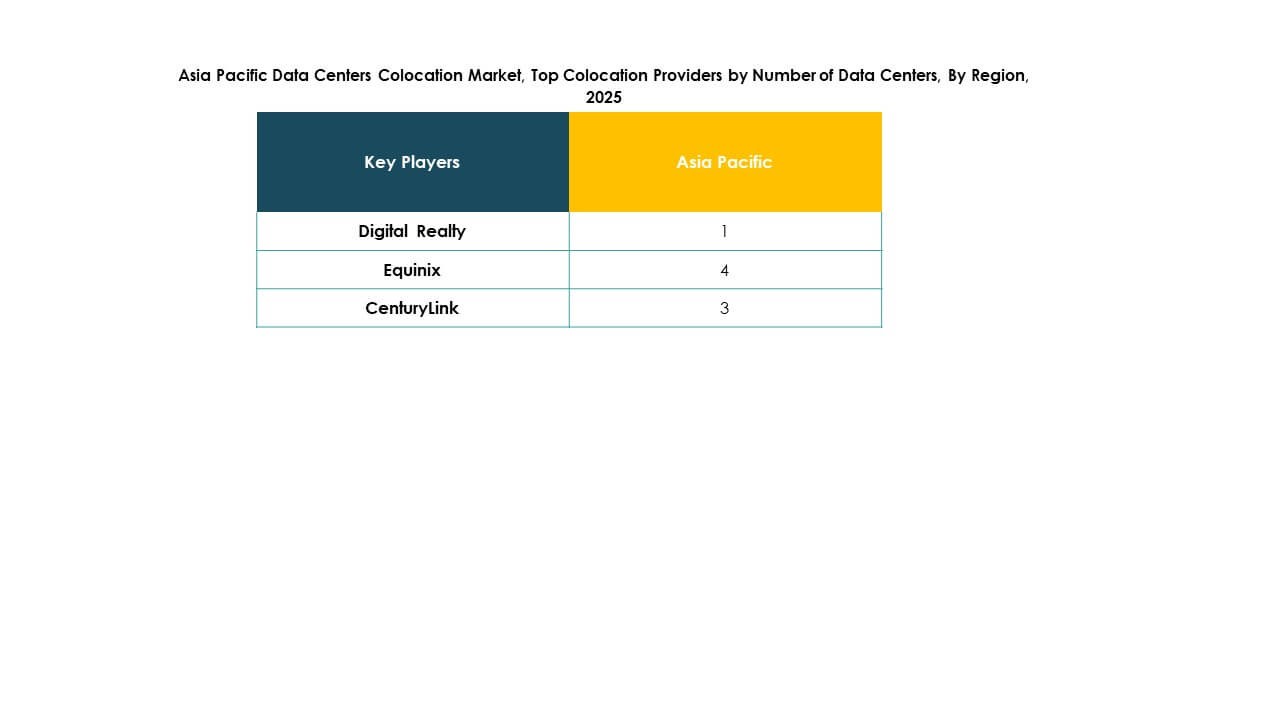

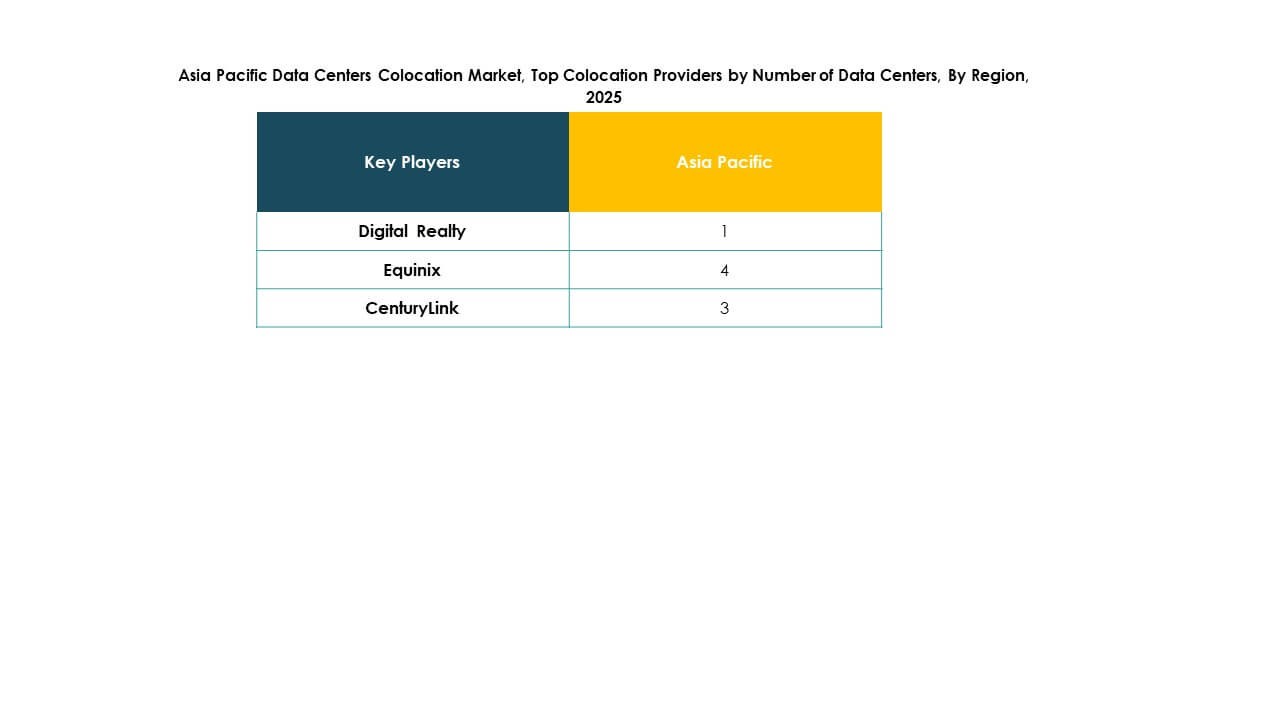

The competitive landscape of the Asia Pacific Data Center Colocation Market is shaped by a mix of telecom operators, global hyperscale providers, and carrier-neutral colocation firms. It is driven by strong infrastructure investments, hyperscale expansion, and sustainability goals. Companies are building advanced facilities near urban hubs to support cloud growth, AI workloads, and interconnection ecosystems. Global leaders are forming partnerships with local operators to strengthen coverage and compliance readiness. Firms are integrating automation, edge infrastructure, and renewable energy sourcing to gain competitive advantages. Strategic acquisitions are enhancing geographic reach and service depth. Intense competition is pushing providers to differentiate through uptime reliability, scalability, and low-latency network performance.

Recent Developments:

- In October 2025, EdgeConneX announced the acquisition of its second data center site located in the Greater Osaka and Yawata areas of Japan. This site offers an impressive 150 MW of capacity and marks a significant step for EdgeConneX’s expansion strategy in Asia Pacific colocation and hyperscale data center cluster development.

- In May 2025, Bridge Data Centres established a strategic partnership with EcoCeres, a Hong Kong-based biofuels firm, through a Memorandum of Understanding (MoU). This collaboration points to increased focus on green and sustainable data center operations within the Asia Pacific colocation industry, supporting both companies’ environmental objectives and market competitiveness.

Market Opportunities

Market Opportunities