Executive summary:

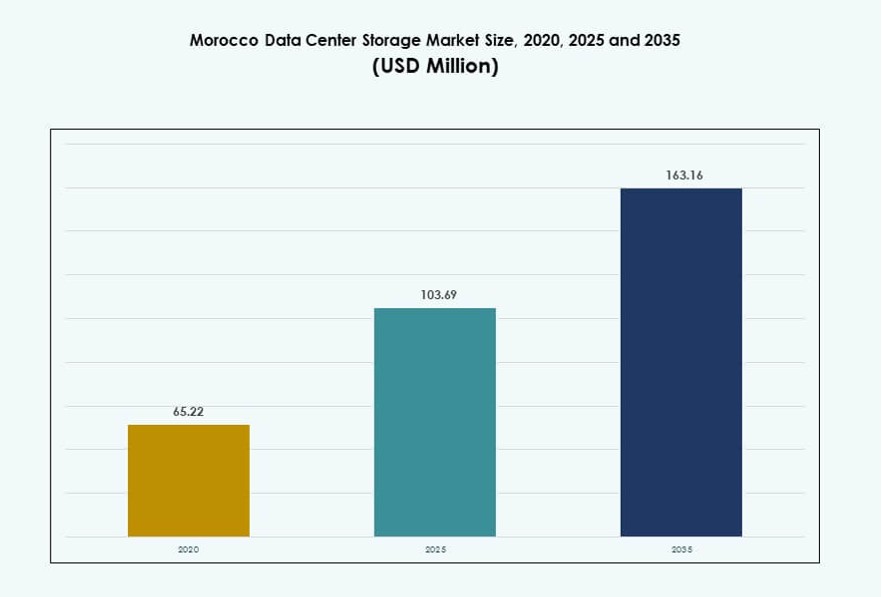

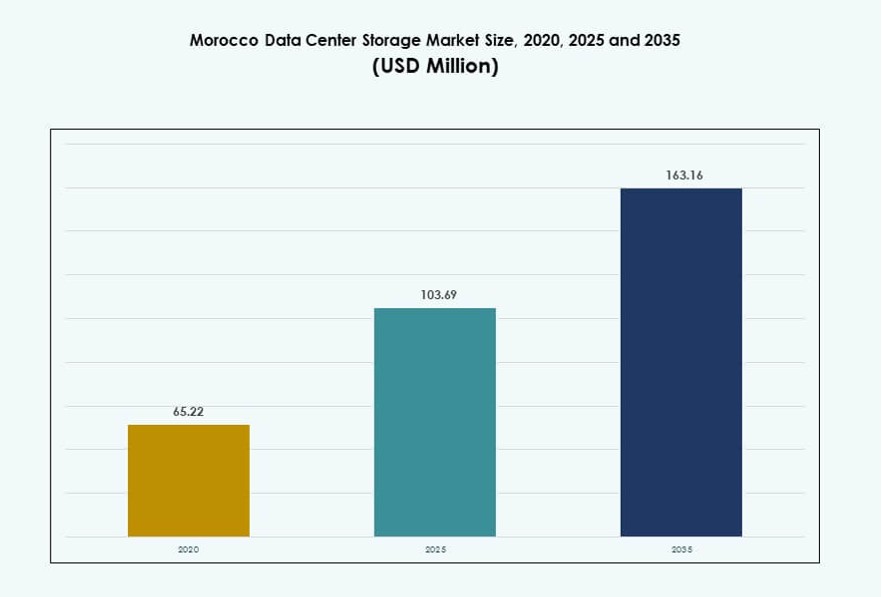

The Morocco Data Center Storage Market size was valued at USD 65.22 million in 2020 to USD 103.69 million in 2025 and is anticipated to reach USD 163.16 million by 2035, at a CAGR of 4.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Morocco Data Center Storage Market Size 2025 |

USD 103.69 Million |

| Morocco Data Center Storage Market, CAGR |

4.62% |

| Morocco Data Center Storage Market Size 2035 |

USD 163.16 Million |

Enterprises across Morocco are modernizing their IT infrastructure to support cloud applications, AI, and digital services. The surge in demand for low-latency, high-availability storage systems is driving investments in all-flash arrays and hybrid cloud models. Government digitization programs and public service platforms are creating long-term storage needs. Companies are migrating from legacy systems to scalable storage architectures. This shift offers investors an opportunity to enter a steadily growing and innovation-led market with strong digital ambitions.

Casablanca leads the market due to its dense business clusters, telecom hubs, and colocation facilities. Rabat is emerging with public sector-led digital expansion, while cities like Tangier and Agadir are gaining momentum through logistics and smart zone projects. These regions benefit from improved connectivity and growing data consumption, positioning Morocco as a rising regional data hub in North Africa.

Market Dynamics:

Market Drivers

Digital Transformation Across Industries is Pushing Demand for Scalable and Resilient Storage Solutions

The Morocco Data Center Storage Market is benefiting from rapid digital transformation across sectors including finance, healthcare, telecom, and government. Enterprises are investing in secure and scalable storage systems to support their digital infrastructure. Cloud-native workloads, mobile-first services, and automation require low-latency, high-availability storage. Regulatory compliance around data sovereignty also compels businesses to localize data storage. The government’s Morocco Digital 2025 plan is accelerating digital infrastructure adoption. IT modernization in both public and private sectors is creating consistent demand for next-gen storage systems. Enterprises are moving from legacy infrastructure to modular, software-defined storage. This shift supports workload agility, disaster recovery, and faster deployment cycles. The market’s evolution makes it essential for investors seeking resilient, growth-ready assets.

- For instance, in July 2025, Maroc Telecom advanced a strategic partnership with Google Cloud to develop a regional data storage hub in Morocco. The initiative focuses on enhancing local cloud infrastructure and improving data sovereignty across North Africa.

Adoption of Cloud and Hybrid Models is Driving Storage Deployment at Scale

Widespread acceptance of cloud computing has fueled demand for data center storage that integrates on-premises and cloud capabilities. Enterprises in Morocco are leveraging hybrid cloud setups to maintain control while scaling storage across workloads. This transition supports flexibility, cost efficiency, and business continuity. Storage-as-a-Service models are becoming popular with SMBs and mid-sized enterprises. Global cloud vendors and local data center operators are building edge-ready, scalable storage platforms. Migration to cloud is driven by ERP, CRM, and analytics workloads that demand real-time data access. The Morocco Data Center Storage Market is benefiting from organizations seeking centralized and unified data storage systems. Data lifecycle management and backup storage continue to see spending. Cloud-native tools and API-driven architectures are shaping enterprise strategies.

Tech-Enabled Public Services and Smart Infrastructure Are Stimulating Storage Needs

Government initiatives such as smart cities, e-governance, and e-health platforms are pushing storage investments. Smart infrastructure depends on uninterrupted data capture, storage, and access from connected sensors and systems. Morocco’s growing smart city pilot projects, such as in Casablanca and Rabat, generate large volumes of video surveillance, traffic, and utility data. This data must be processed and archived securely in local facilities. Real-time processing requires storage nodes with high throughput and scalable design. The Morocco Data Center Storage Market is positioned to support these workloads with modern SAN, NAS, and hybrid systems. State-funded tech infrastructure and digital education programs also require long-term data preservation. Secure, high-capacity storage becomes essential for public-sector digitization.

- For example, in January 2025, Morocco inaugurated its first sovereign data centre at Mohammed VI Polytechnic University, offering secure cloud hosting and storage services to public and private sectors. This facility strengthens the nation’s digital infrastructure and supports e‑governance and data sovereignty objectives.

Rise of Fintech, AI, and Data Analytics is Reshaping Storage Infrastructure Demand

Emerging sectors such as fintech, AI, and big data analytics are transforming how storage infrastructure is procured and utilized. Banks, digital payment firms, and analytics startups require high-speed, fault-tolerant systems for continuous data access. AI workloads depend on GPU-accelerated environments, driving the need for NVMe-based flash storage. Data-driven innovation needs storage architectures that support structured and unstructured datasets. Morocco’s tech ecosystem is evolving, and startups seek storage solutions with built-in scalability and performance. The Morocco Data Center Storage Market is evolving toward intelligent storage platforms with real-time data processing capabilities. Growth in edge computing and IoT also requires storage nodes closer to end-users. These changes push traditional data centers to adopt agile and software-defined architectures.

Market Trends

Shift Toward All-Flash Storage Systems for High-Speed and Performance-Intensive Workloads

Organizations are rapidly adopting all-flash storage arrays for mission-critical applications and analytics platforms. Flash systems offer low latency, high IOPS, and reduced energy consumption. Enterprises are modernizing their storage to support virtualization, AI models, and big data frameworks. The Morocco Data Center Storage Market is witnessing this shift across telecom and finance sectors. Flash storage is replacing mechanical drives in many high-performance applications. Vendors are offering tiered storage solutions that balance cost and performance. NVMe technology is gaining traction for AI training, inference, and real-time processing. Flash-based systems also help reduce operational costs over time. This trend strengthens the move toward agile and future-ready infrastructure.

Growing Integration of AI-Driven Storage Management and Predictive Analytics

Intelligent storage solutions that leverage AI for data tiering, capacity forecasting, and self-healing are becoming common. Predictive analytics helps optimize storage efficiency and reduce downtime. Storage platforms with machine learning capabilities are reducing manual administration and increasing automation. AI-integrated systems can detect anomalies and balance workloads across storage tiers. The Morocco Data Center Storage Market is slowly adopting these smart solutions to meet service-level agreements. Companies are investing in platforms that adapt to business demands dynamically. Data lakes and warehouse systems now rely on AI to classify and manage massive datasets. AI-enabled storage orchestration supports performance consistency. This shift is reshaping how storage operations are planned and executed.

Edge-Centric Storage Deployment is Rising Due to Latency-Sensitive Applications

Edge computing adoption is increasing demand for decentralized storage closer to users and devices. Workloads such as video surveillance, autonomous systems, and IoT platforms require near-instant data access. Local data centers and micro-data centers are deploying storage at the edge for real-time operations. The Morocco Data Center Storage Market is adjusting to this decentralization with compact, rugged storage deployments. Remote industrial and retail sites are deploying on-site storage systems to process and retain critical data. Edge storage also enhances compliance in sectors requiring local data residency. High-throughput SSDs and compact SAN units are supporting edge applications. This trend ensures business continuity and faster decision-making at distributed nodes.

Containerized and Software-Defined Storage Solutions Are Gaining Traction

Container adoption through platforms like Kubernetes is changing storage procurement. Traditional hardware-bound storage is less compatible with cloud-native applications. Software-defined storage (SDS) offers flexibility and hardware independence. Organizations are embracing SDS to support scalable microservices-based environments. The Morocco Data Center Storage Market is seeing demand from developers and SaaS providers for container-integrated storage. SDS allows provisioning and expansion without physical intervention. APIs and orchestration tools simplify deployment and monitoring. With digital agility becoming a priority, container-ready storage enables faster application delivery. These systems also support multi-tenant environments with logical storage segregation.

Market Challenges

Limited Local Manufacturing and Heavy Dependence on Imported Storage Hardware

The Morocco Data Center Storage Market is largely dependent on imported hardware for its infrastructure development. This reliance on foreign vendors creates cost vulnerabilities linked to currency fluctuations and tariffs. Shipping delays and global supply chain disruptions affect project timelines and procurement cycles. Limited local assembly or production also impacts price competitiveness and service availability. Organizations may face longer wait times for replacements or upgrades. Local distribution lacks deep inventories, especially for high-end or niche storage configurations. This dependence reduces the bargaining power of domestic integrators. It also affects the pace of customization for sector-specific use cases.

Skills Shortage and Lack of Advanced Training for Data-Centric Infrastructure Management

Skilled professionals with experience in advanced storage systems, cloud integration, and data lifecycle management remain scarce in the region. Organizations often struggle to maintain or scale infrastructure without relying on foreign consultants or remote support. Complex storage technologies like SDS, NVMe clusters, and AI-integrated systems require certified expertise. The Morocco Data Center Storage Market faces implementation delays and configuration inefficiencies due to this gap. IT teams require continual upskilling to manage hybrid or container-native environments. Talent scarcity increases costs and leads to operational risks. Without sufficient local expertise, system misconfiguration and performance issues become more likely.

Market Opportunities

Rising Government Investments in Digital Infrastructure and Smart City Projects

Government-backed smart city and digital governance projects are creating demand for resilient storage solutions. High-volume data from surveillance, utilities, traffic systems, and citizen portals needs fast and secure storage. The Morocco Data Center Storage Market can benefit from public-private partnerships driving edge and centralized storage deployment. These efforts create long-term opportunities for OEMs, integrators, and software vendors. Storage requirements will continue to expand as public digital services scale.

Untapped Potential in SMB Digitalization and Regional Data Hosting Zones

Small and mid-sized businesses across retail, healthcare, and logistics are beginning their digital journey. These businesses require affordable, scalable, and secure storage to support ERP, CRM, and analytics. The Morocco Data Center Storage Market can capture this segment by offering managed services, cloud-native storage, and hybrid models. Regional hosting zones like Tangier and Agadir offer growth potential due to connectivity improvements and industrial expansion.

Market Segmentation

By Storage Type

Hybrid storage dominates due to its balance of speed, cost, and scalability, offering enterprises flexibility across workloads. Traditional storage still holds presence in legacy environments, but adoption is declining. All-flash storage is growing fast in performance-intensive sectors like BFSI and telecom. The Morocco Data Center Storage Market supports diverse workloads that drive demand for tailored configurations. Flash systems are expanding due to AI, while traditional HDDs remain in backup use cases.

By Storage Deployment

Storage Area Network (SAN) systems lead the deployment segment with high-performance support for mission-critical applications. SAN is favored by banks and telcos needing block-level access and consistent throughput. Network-attached Storage (NAS) is gaining traction in SMBs and government units for file-based workloads. Direct-attached Storage (DAS) caters to edge deployments and remote office setups. The Morocco Data Center Storage Market reflects demand across deployment types, aligned with user scale and complexity.

By Component

Hardware holds the largest share due to physical infrastructure needs for racks, drives, and arrays. Vendors are innovating with modular hardware supporting both legacy and modern systems. Software is growing rapidly through SDS platforms, AI integration, and data orchestration. Enterprises prioritize software to gain agility and cost control. The Morocco Data Center Storage Market benefits from software that enables flexible capacity and smarter data control.

By Medium

Hard Disk Drive (HDD) remains widely used for archival and bulk storage requirements. Solid-State Drives (SSD) are preferred for active workloads due to their speed and durability. SSD demand is driven by AI, analytics, and cloud-native environments. Tape storage still plays a role in long-term compliance and backup scenarios. The Morocco Data Center Storage Market is shifting toward SSD, but hybrid approaches ensure cost-efficiency and tiered storage strategy.

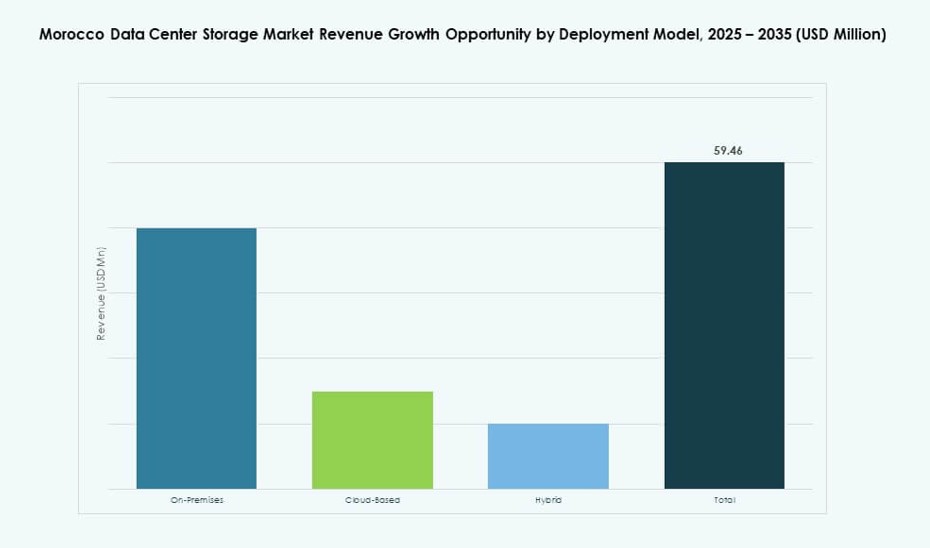

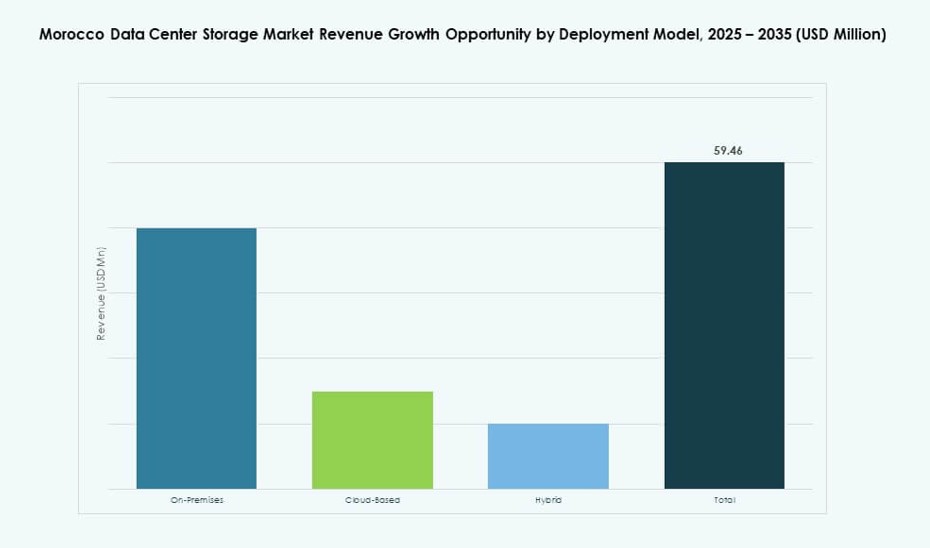

By Deployment Model

On-premises storage still leads due to control and regulatory needs, especially in finance and government. Cloud-based storage is growing steadily as enterprises seek flexibility and OPEX-based models. Hybrid deployments combine on-prem and cloud for best performance and redundancy. The Morocco Data Center Storage Market shows increasing hybrid model adoption. Organizations prefer hybrid systems to balance data sovereignty with scalability.

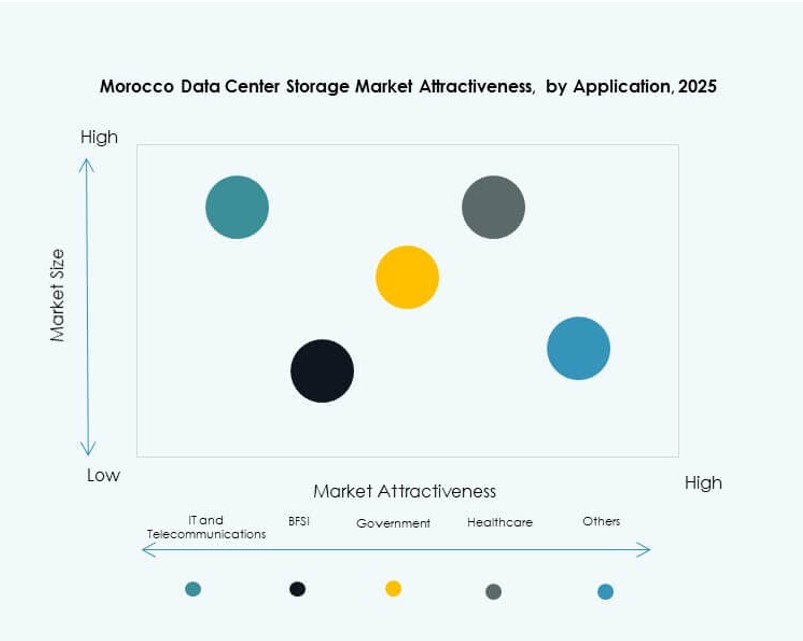

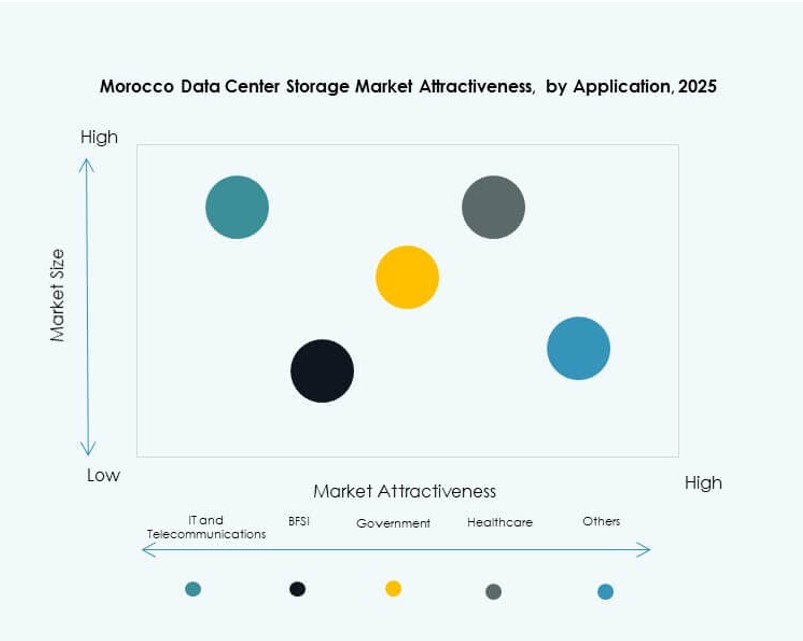

By Application

IT and Telecommunications lead application demand, with high throughput and availability needs. BFSI follows closely, driven by real-time transaction data, compliance, and secure backup. Government is investing in centralized platforms for e-services and surveillance, boosting storage requirements. Healthcare is expanding digital records and diagnostics, needing compliant storage systems. The Morocco Data Center Storage Market sees broad adoption across sectors, with IT, finance, and public services leading growth.

Regional Insights

Casablanca Region Holds the Largest Share Driven by Commercial Density and IT Concentration

Casablanca leads with nearly 38% share of the Morocco Data Center Storage Market. It serves as the country’s financial and business center, hosting major banks, telcos, and corporate HQs. The city has robust fiber connectivity, international cloud nodes, and strong enterprise demand. Data center clusters serve dense urban workloads and centralized platforms. Local hosting providers cater to regulated industries seeking localized infrastructure. The region continues to attract investment in Tier III and Tier IV facilities.

- For example, in November 2025, Orange Maroc opened its new “Orange Tech” data center in Casablanca with an initial 1.5 MW power capacity to expand local hosting and cloud storage services. The facility supports enterprise and public sector infrastructure and enhances Morocco’s digital storage ecosystem under the national digital strategy.

Rabat Region Emerges with Government-Backed Digitization and Academic Infrastructure

Rabat accounts for around 22% market share due to its role as the administrative capital. Government agencies, ministries, and public institutions drive significant data volumes. Digital governance initiatives and centralized e-services create consistent storage needs. Academic and healthcare institutions also contribute to structured and unstructured data growth. Rabat hosts secure, state-backed data platforms for national applications. The Morocco Data Center Storage Market in this region is supported by policy incentives and tech grants.

Northern and Southern Zones Are Emerging Hubs with Industrial Expansion and Hosting Needs

Tangier and Agadir collectively contribute over 17% to the Morocco Data Center Storage Market. These zones are industrial and logistics hubs linked to port activities and SEZs. Growing industrial automation, logistics tracking, and IoT deployment are fueling data generation. Improved connectivity and power availability are attracting regional data center projects. Local governments promote digital services and SME support platforms. These emerging zones offer long-term hosting potential and edge deployment opportunities.

- For example, in June 2025, Idox launched its first data centre in Morocco in partnership with N+ONE Datacenters, providing secure, locally hosted cloud infrastructure that improves access speed and compliance for engineering and large‑scale project data.

Competitive Insights:

- Maroc Telecom Data Centers

- N+ONE Datacenters Morocco

- inwi Business

- Dell Technologies

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- NetApp

- Nutanix, Inc.

The Morocco Data Center Storage Market features a mix of domestic telecom-backed data center providers and global technology vendors. Local firms like Maroc Telecom, N+ONE, and inwi Business dominate infrastructure ownership and regional colocation services. Global leaders including Dell, IBM, HPE, and Cisco support the market with enterprise storage systems, SDS platforms, and hybrid cloud integration. Huawei and NetApp are expanding their reach through partnerships and performance-optimized storage offerings. The market is becoming more competitive due to rising enterprise demand, infrastructure modernization, and digital policy initiatives. It offers significant opportunities for solution providers focused on flash storage, hybrid cloud models, and AI-optimized systems. Players are differentiating through energy efficiency, automation, and local support.

Recent Developments:

- In June 2025, Idox officially launched its first data centre in Morocco in partnership with N+ONE Datacenters, delivering secure, high‑performance infrastructure to support cloud‑based engineering document management services and local data storage for major infrastructure projects.

- In March 2025, Maroc Telecom and Inwi signed an expanded partnership to share fiber‑optic and mobile infrastructure across Morocco, aiming to accelerate network rollout and support the expanding digital ecosystem that underpins data centre and storage demand.