Executive summary:

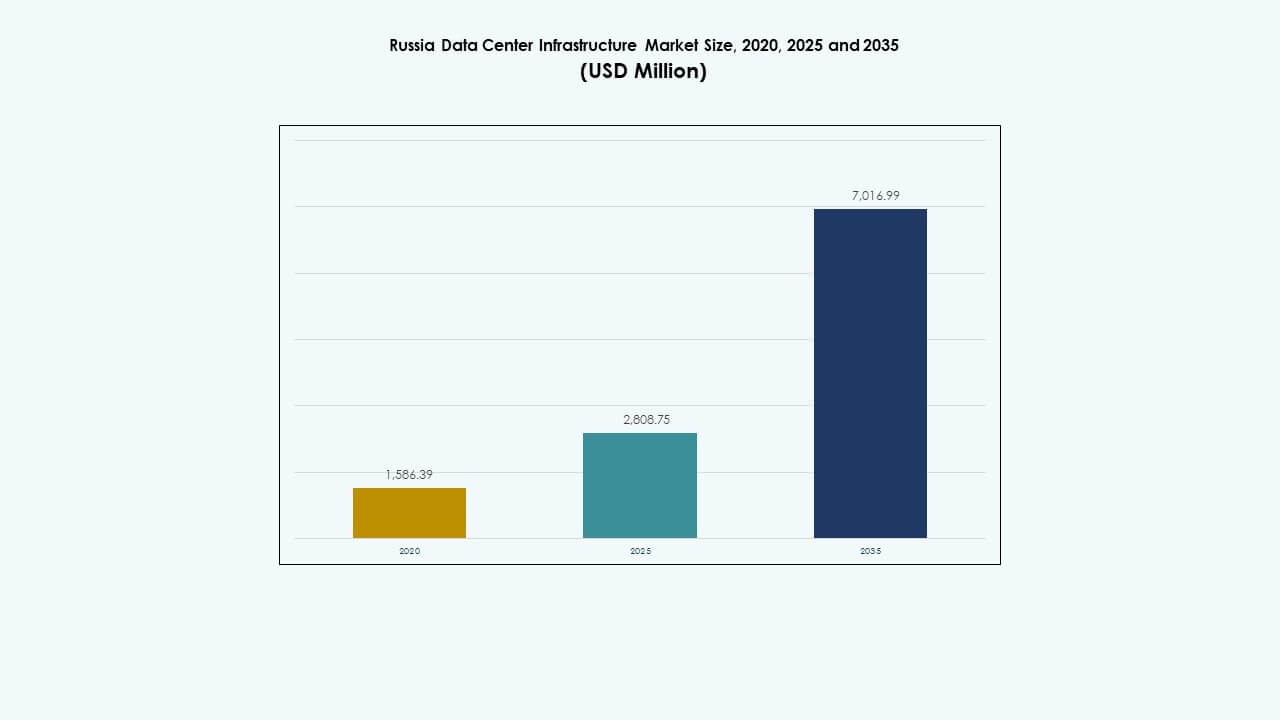

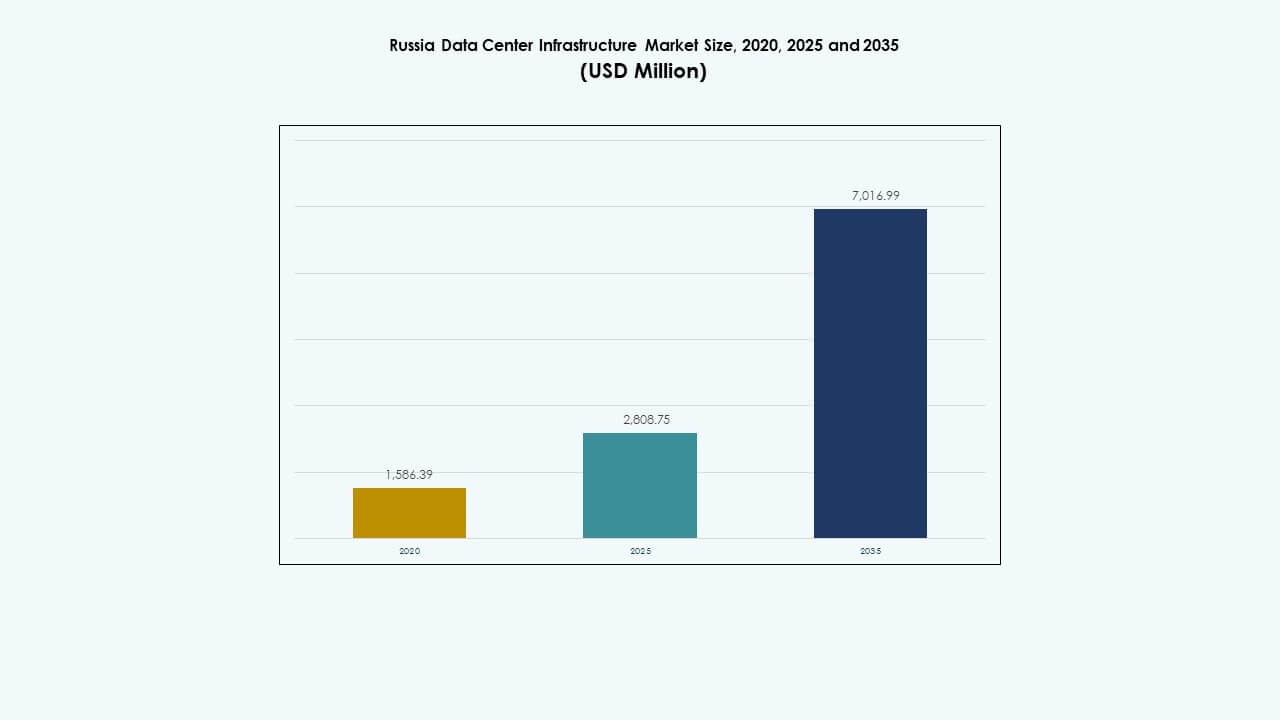

The Russia Data Center Infrastructure Market size was valued at USD 1,586.39 million in 2020, reached USD 2,808.75 million in 2025, and is anticipated to reach USD 7,016.99 million by 2035, growing at a CAGR of 9.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Russia Data Center Infrastructure Market Size 2025 |

USD 2,808.75 Million |

| Russia Data Center Infrastructure Market, CAGR |

9.52% |

| Russia Data Center Infrastructure Market Size 2035 |

USD 7,016.99 Million |

Rapid digitalization, cloud expansion, and the adoption of artificial intelligence technologies drive strong infrastructure demand. Enterprises modernize systems to support data localization and advanced analytics. It strengthens investor confidence through stable policy frameworks and high digital growth. Businesses emphasize modular construction, energy efficiency, and automation to reduce costs and downtime. Growing investments by telecoms and hyperscalers reflect strategic interest in sustainable, scalable facilities across major cities.

Moscow and Saint Petersburg lead the market with advanced connectivity, strong enterprise presence, and developed power infrastructure. Emerging regions like Siberia and the Far East attract interest due to cooler climates suitable for efficient data center cooling. Central Russia benefits from strategic proximity to telecom hubs and government institutions. Regional diversification supports national data sovereignty goals and enhances overall network resilience.

Market Drivers

Market Drivers

Growing Digital Transformation and Cloud Adoption Across Enterprises

The Russia Data Center Infrastructure Market benefits from rapid enterprise digitization and expansion of cloud-based workloads. Businesses migrate mission-critical systems to local cloud regions to meet data sovereignty needs. It experiences strong traction from e-commerce, financial services, and telecommunications. Companies invest in scalable data platforms to handle higher consumer traffic. Government policies promote domestic data hosting and cybersecurity resilience. Cloud service providers expand availability zones to improve latency and compliance. Continuous migration from legacy IT creates sustained infrastructure demand. Investors find growth opportunities in colocation and edge facilities. The digital shift strengthens national competitiveness across industries.

- For instance, IXcellerate’s Moscow North Campus MOS1 supports 1,835 racks across 6,000 m² with 13.7 MW power capacity for high-density colocation. It experiences strong traction from e-commerce, financial services, and telecommunications.

Expansion of AI, HPC, and Edge Computing Workloads

Rising use of artificial intelligence (AI), high-performance computing (HPC), and edge analytics drives major infrastructure upgrades. Enterprises and research institutes require high-density power systems and liquid cooling solutions. It encourages operators to deploy advanced network fabrics with low-latency connections. AI workloads demand GPU clusters and precision thermal management. Data-intensive industries like healthcare and oil & gas accelerate AI adoption. The move toward automation creates strong need for efficient server utilization. Edge computing supports smart manufacturing and autonomous systems. Companies design data centers closer to users to reduce delays. These technologies transform Russia’s digital and industrial ecosystems.

Infrastructure Modernization and Energy Efficiency Initiatives

Investments in new-generation data centers reflect growing awareness of energy optimization. Operators replace outdated facilities with modular and scalable designs. The Russia Data Center Infrastructure Market focuses on green power integration, emphasizing renewable and low-carbon solutions. Efficient UPS, liquid cooling, and smart monitoring reduce operational costs. Global standards like ISO 50001 shape sustainable facility management. Developers build Tier III and Tier IV sites with PUE below 1.4. Energy-efficient architecture attracts international cloud partners. Companies emphasize transparent reporting of energy metrics. Sustainability commitments enhance investor appeal and long-term project viability.

- For instance, Selectel operates facilities with 99.999% SLA uptime across multiple Tier III sites supporting scalable colocation. The Russia Data Center Infrastructure Market focuses on green power integration, emphasizing renewable and low-carbon solutions.

Rising Strategic Investments from Hyperscalers and Telecom Operators

Hyperscale and telecom-led expansion redefines Russia’s data infrastructure landscape. Major carriers diversify services by deploying regional cloud nodes. Hyperscalers establish large campuses in Moscow, Saint Petersburg, and emerging tech corridors. It helps create interconnection hubs for content delivery and enterprise solutions. Local partnerships accelerate regional infrastructure rollouts. Government incentives support strategic data localization and digital autonomy. Telecom providers enhance fiber and backbone connectivity. These developments reinforce national resilience in digital infrastructure. Strategic capital inflows stimulate competitive innovation across all data center segments.

Market Trends

Market Trends

Shift Toward Modular and Prefabricated Data Center Designs

Modular construction gains traction across new projects due to faster deployment and scalability. The Russia Data Center Infrastructure Market sees rising adoption of prefabricated systems that minimize site disruption. Developers prefer modular pods for regional and edge facilities. It reduces setup time and aligns with flexible capacity planning. Prefabrication enhances reliability in harsh climates and remote locations. Modular designs also simplify retrofits in aging buildings. Builders integrate factory-tested units to achieve consistent performance. Standardization helps meet Tier III and Tier IV requirements. This approach enables faster alignment with enterprise demand shifts.

Integration of Renewable Power and Smart Energy Systems

Operators focus on lowering carbon emissions by deploying renewable energy and advanced grid systems. Data centers integrate on-site solar or hydro-based energy where possible. It enhances sustainability and meets ESG goals. Battery energy storage systems stabilize power supply and reduce dependency on diesel generators. Smart grid controls allow dynamic load balancing. Developers explore renewable-backed power purchase agreements for long-term savings. Continuous PUE optimization remains a top operational metric. Facilities adopt AI-based energy analytics for predictive maintenance. The shift improves both economic and environmental efficiency.

Adoption of Advanced Cooling and Automation Technologies

Automation reshapes how Russian data centers manage thermal and operational environments. The Russia Data Center Infrastructure Market moves toward liquid cooling and intelligent air management systems. AI-based monitoring tools adjust fan speeds and water flows dynamically. This automation ensures stability in high-density workloads. Robotic systems perform regular inspections in restricted zones. IoT sensors gather real-time facility data for quick response. Predictive algorithms reduce unplanned downtime and optimize energy use. Automated management boosts reliability across hyperscale and enterprise sites. Efficiency becomes a defining trend for future-ready data centers.

Rising Focus on Security and Data Sovereignty Compliance

Heightened cybersecurity regulations influence infrastructure design and operational standards. Data centers deploy multi-layered physical and digital security frameworks. It reinforces compliance with Russian data sovereignty requirements. Local storage of sensitive data drives domestic facility investments. Security certification, encryption protocols, and biometric access are becoming standard. Companies partner with government-certified integrators for compliant solutions. Demand grows for integrated monitoring and access control systems. This security focus increases trust among enterprise clients and regulators. Strengthened compliance positions Russia as a reliable data hosting destination.

Market Challenges

Market Challenges

Geopolitical Constraints and Supply Chain Limitations

The Russia Data Center Infrastructure Market faces supply chain constraints due to import restrictions and logistical bottlenecks. Limited access to high-end equipment impacts project timelines. It challenges deployment of advanced servers, cooling units, and network hardware. Sanctions limit sourcing options for certain foreign technologies. Operators depend on domestic and Asian suppliers to fill component gaps. Longer procurement cycles affect project ROI. Developers adopt localization strategies to offset disruptions. These constraints raise costs and delay expansions. Balancing quality and availability remains a key operational challenge.

High Energy Demand and Infrastructure Maintenance Complexity

Power-intensive operations require robust and stable energy supply. Frequent fluctuations in regional grids increase operational risks. The Russia Data Center Infrastructure Market needs stronger energy efficiency frameworks. Operators struggle to manage heat loads in dense server environments. Cooling system upgrades demand higher capital expenditure. Maintaining 24/7 uptime in aging facilities adds complexity. Limited technical expertise slows modernization in smaller cities. Sustainability goals push companies to innovate under financial pressure. Managing performance and cost under strict environmental targets remains a long-term hurdle.

Market Opportunities

Expansion of Edge and Regional Data Centers Across Emerging Zones

Edge deployment offers strong growth opportunities across secondary cities and industrial zones. The Russia Data Center Infrastructure Market benefits from growing connectivity needs in manufacturing, energy, and retail. Regional hubs near Siberia and the Far East enhance network resilience. Edge infrastructure supports faster local data processing for IoT and AI. Investors prioritize low-latency capacity near consumption points. Scalable modular centers attract private and public projects. These distributed sites unlock access to underserved markets.

Rising Adoption of Domestic Cloud and AI Computing Platforms

Domestic cloud service providers expand aggressively to capture enterprise workloads. The Russia Data Center Infrastructure Market supports national AI and analytics initiatives. New facilities integrate GPU clusters for data-intensive research. Local players collaborate with telecoms to enhance hybrid cloud ecosystems. Growth in smart city programs and e-government services increases hosting demand. AI-enabled infrastructure improves national competitiveness. Expanding domestic platforms ensures data compliance and long-term digital independence.

Market Segmentation

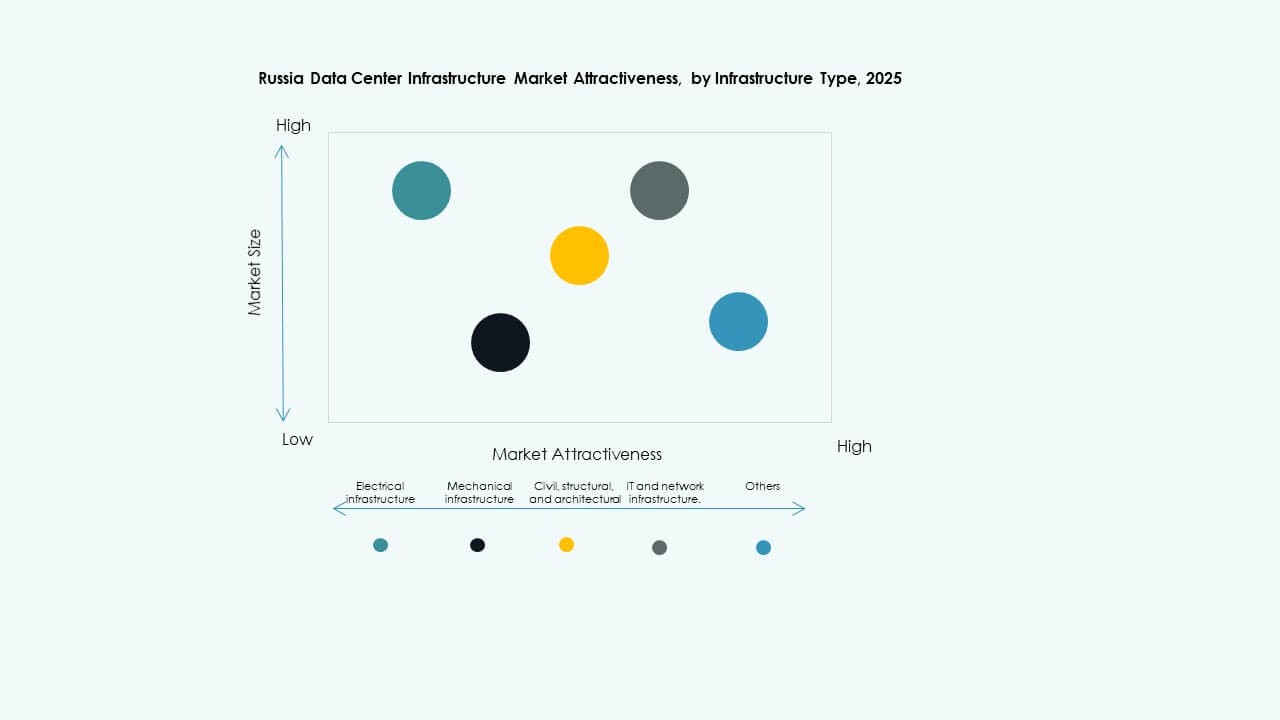

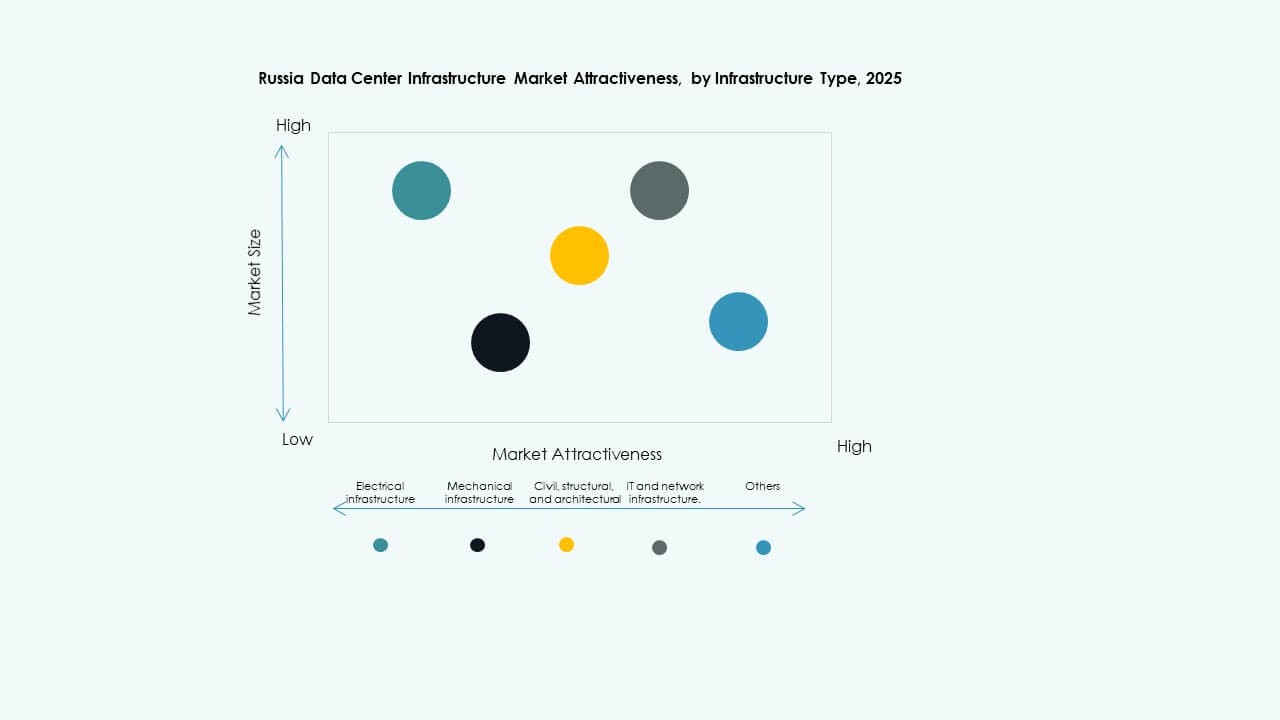

By Infrastructure Type

Electrical infrastructure dominates the Russia Data Center Infrastructure Market due to high reliability requirements and continuous operations. Mechanical systems and IT infrastructure also contribute significantly as operators modernize cooling and server environments. Civil and structural components focus on seismic safety and scalable layouts. Integration of digital monitoring tools enhances coordination between infrastructure layers. Rising demand for integrated solutions fuels market consolidation across segments.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) and PDUs hold strong shares due to their essential backup and power distribution roles. Battery energy storage systems (BESS) gain adoption for grid stability. Utility grid connections expand with rising hyperscale facilities. Transfer switches and switchgears support redundancy and safety. Smart monitoring improves energy utilization. The Russia Data Center Infrastructure Market continues to align power systems with renewable integration goals.

By Mechanical Infrastructure

Cooling units and chillers dominate mechanical investments. Hot and cold aisle containment systems enhance energy efficiency. Operators prefer water-cooled chillers in large campuses to maintain thermal stability. Pumps and piping systems enable precise circulation in high-density areas. The Russia Data Center Infrastructure Market adopts modular mechanical designs to reduce downtime. Efficient thermal management remains central to operational excellence.

By Civil / Structural & Architectural

Superstructures and modular buildings dominate due to rapid construction demand. Raised floors, insulated claddings, and suspended ceilings improve maintenance flexibility. Foundations focus on long-term structural stability in cold climates. Building envelopes integrate thermal-resistant materials for efficient temperature control. Modular factory-built systems gain adoption for remote deployments. The Russia Data Center Infrastructure Market favors prefabrication for project speed and quality.

By IT & Network Infrastructure

Servers and networking equipment lead due to growing compute and interconnection demand. Storage solutions follow closely with expansion of cloud and edge facilities. Racks, cabling, and optical fiber systems support scalability. The Russia Data Center Infrastructure Market integrates advanced hardware with software-defined systems. Strong demand for high-bandwidth connectivity underpins network modernization.

By Data Center Type

Hyperscale facilities dominate due to large enterprise and government workloads. Colocation centers attract small and mid-sized businesses seeking cost-efficient scalability. Enterprise and edge centers expand to enhance localized computing. The Russia Data Center Infrastructure Market balances urban and regional deployments for optimized coverage. Demand diversification supports resilient ecosystem development.

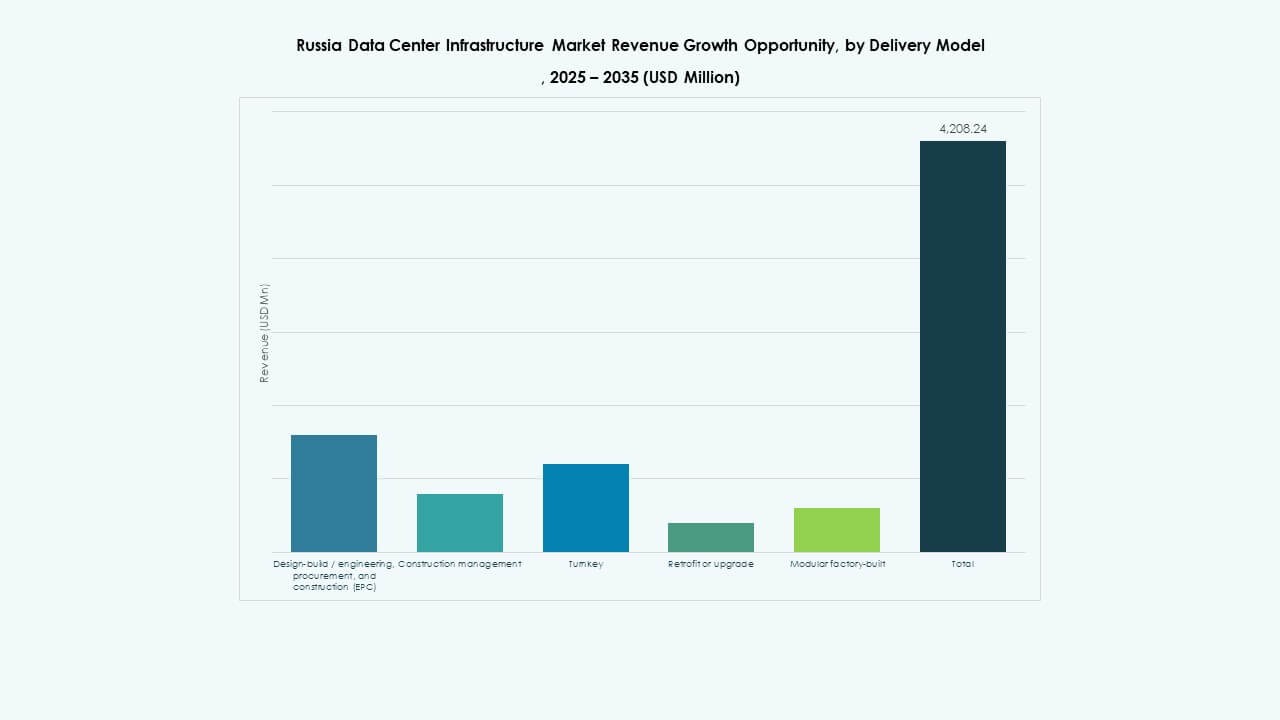

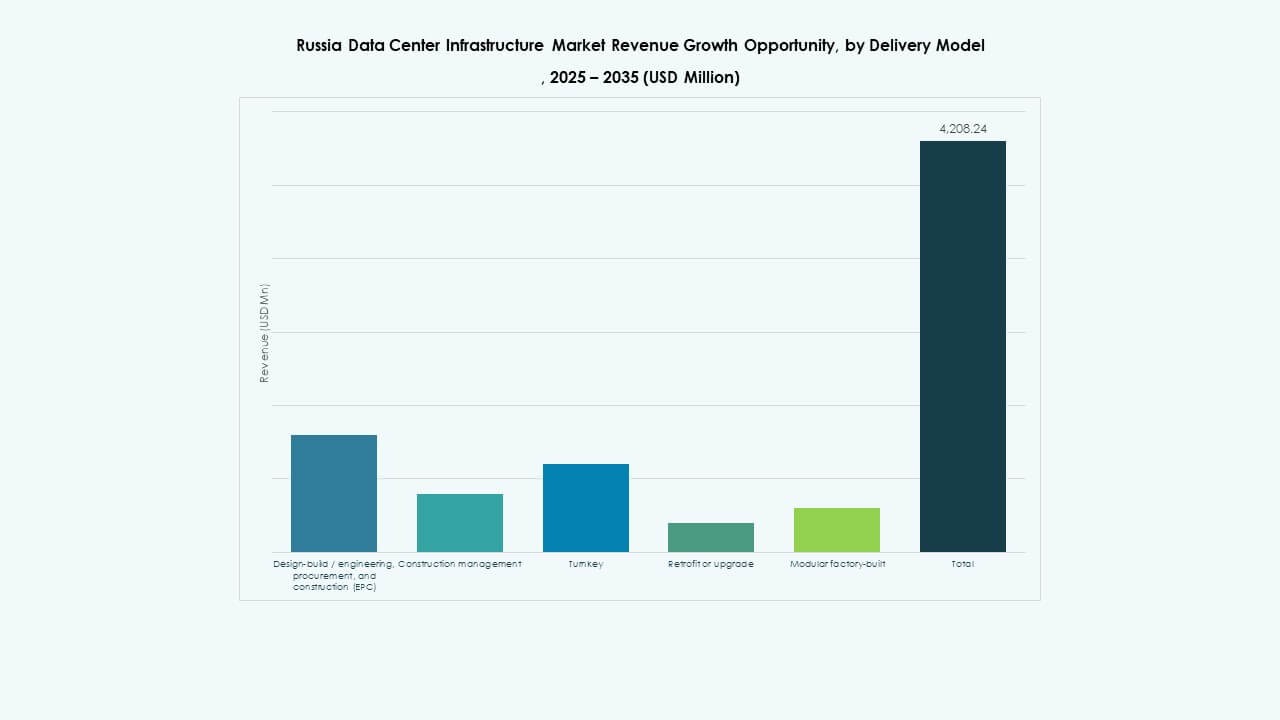

By Delivery Model

Design-build and turnkey models dominate due to end-to-end accountability and efficiency. Retrofit and modular factory-built projects expand for faster deployment. Construction management models gain popularity in multi-phase projects. The Russia Data Center Infrastructure Market embraces integrated delivery to ensure quality control and cost optimization.

By Tier Type

Tier III data centers remain most preferred for balancing uptime and cost. Tier IV facilities rise in hyperscale and government-led projects needing maximum redundancy. Tier I and II remain common in regional or smaller installations. The Russia Data Center Infrastructure Market adopts tiered design for flexibility across investment scales.

Regional Insights

Regional Insights

Central Russia (Moscow and Surrounding Regions)

Central Russia holds around 55% market share driven by concentration of hyperscale and telecom facilities. Moscow leads due to dense enterprise networks, regulatory proximity, and robust connectivity. The Russia Data Center Infrastructure Market finds strong investor appeal in the capital zone. Power grid stability and fiber backbones attract large-scale deployments. Proximity to cloud and financial sectors further strengthens its dominance. Continuous upgrades maintain its leadership in digital infrastructure growth.

- For instance, a major data center project currently in Moscow offers 24MW capacity with plans to expand to 100MW full buildout. This expansion will include the installation of 750 Nvidia H100 GPUs, recognized for their top-tier AI and HPC performance, confirming precise technological advancement and capacity scaling in the capital zone.

Northwest Region (Saint Petersburg and Neighboring Areas)

The Northwest accounts for nearly 25% of the national share with growing regional data centers. Saint Petersburg benefits from strong industrial clusters and logistics connectivity. It evolves into a redundancy hub for Moscow-based operations. Data centers here integrate renewable sources like hydropower for sustainability. The Russia Data Center Infrastructure Market benefits from government-backed industrial digitization. Cross-border connectivity with Europe and the Baltics improves data traffic routes.

Eastern and Southern Russia (Siberia, Far East, and Volga)

Emerging regions such as Siberia and the Far East contribute around 20% market share and are rapidly expanding. These areas gain attention due to cooler climates favorable for energy-efficient cooling. Local governments promote data sovereignty and IT cluster development. The Russia Data Center Infrastructure Market experiences steady interest from investors targeting new frontiers. Lower land and energy costs create strong appeal for future hyperscale campuses. Regional growth diversifies the national infrastructure base.

- For example, MegaFon’s data center in Novosibirsk currently has 5MW capacity with scalability plans, utilizing ambient cold temperatures to significantly reduce cooling power usage effectiveness (PUE), a well-known energy efficiency metric.

Competitive Insights:

- IXcellerate LLC

- Rostelecom

- Selectel Ltd

- DataPro

- MTS PJSC (MTS Group)

- Cloud LLC

- Equinix, Inc.

- Digital Realty

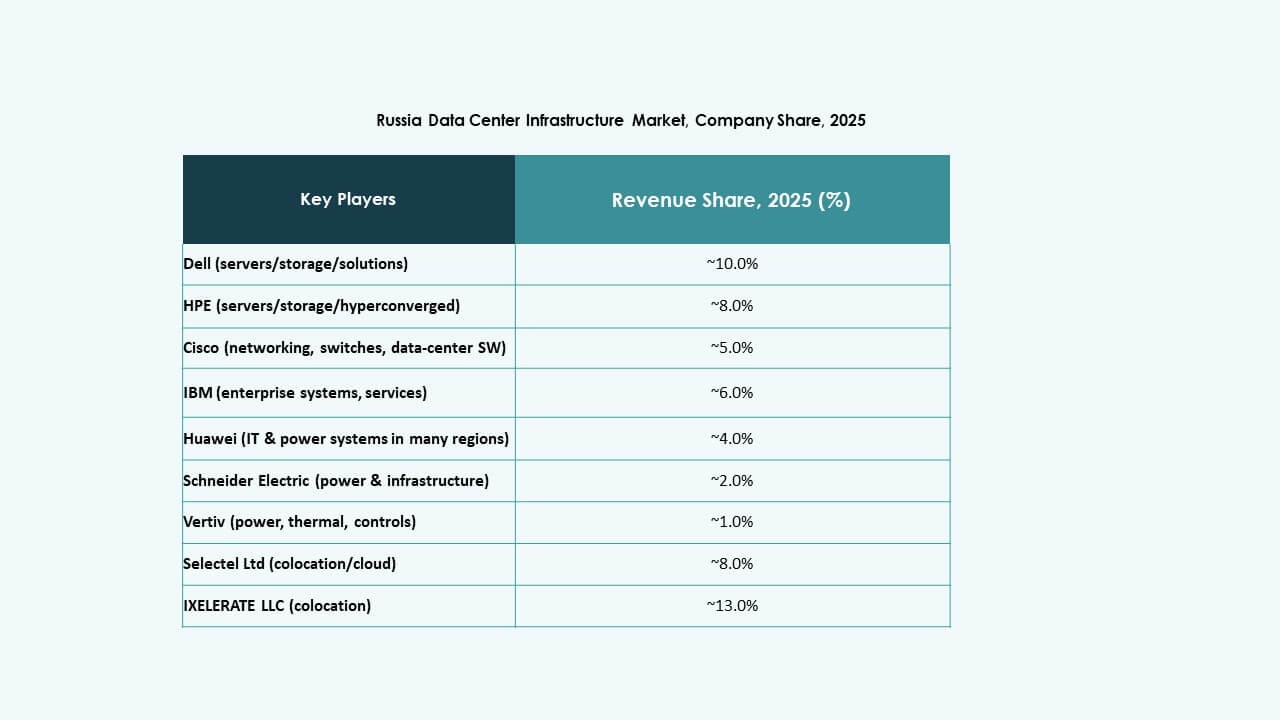

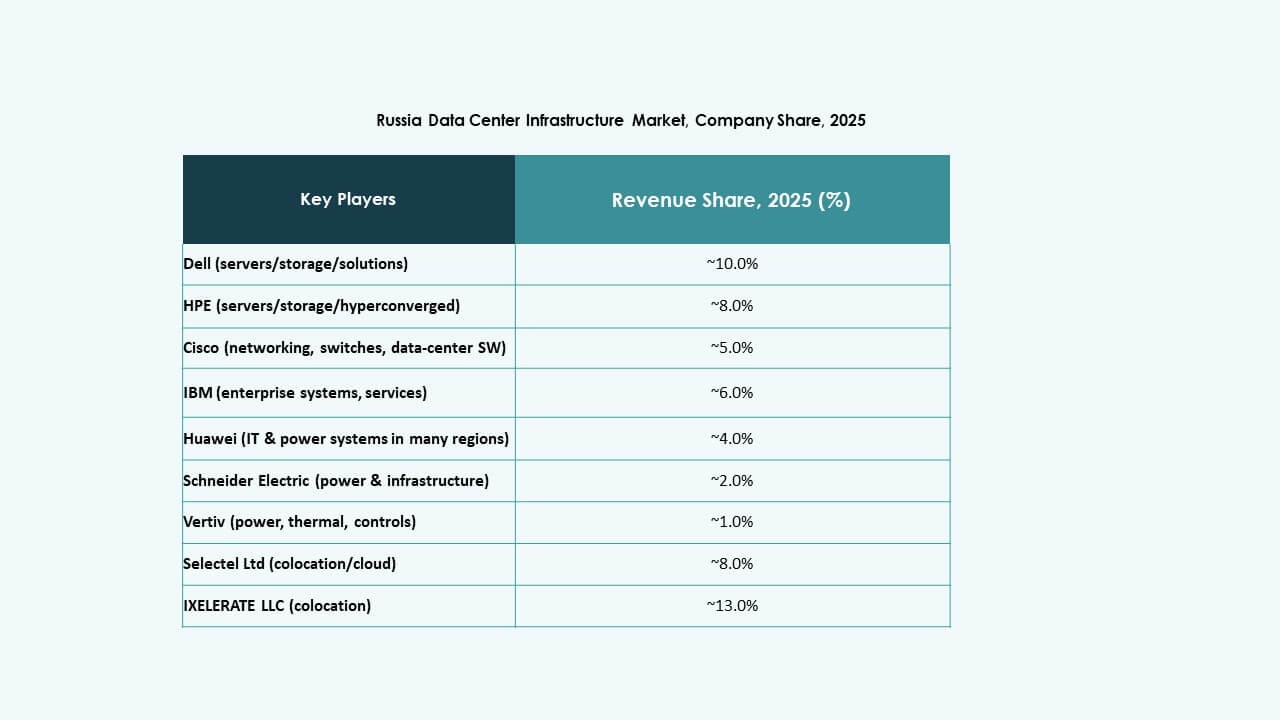

The Russia Data Center Infrastructure Market features a mix of strong domestic operators and global infrastructure firms competing for capacity, connectivity, and compliance advantage. IXcellerate invests heavily in carrier-neutral campuses with high rack density and robust power capacity, which attracts multinational clients. Rostelecom and Selectel leverage nationwide networks and colocation offerings to serve regional enterprises and public-sector demand. DataPro and MTS build redundancy and geographic spread to mitigate regional risks. Global players such as Equinix and Digital Realty bring international connectivity and hyperscale facility expertise, appealing to clients needing global reach. Competition centres on power reliability, low-latency connectivity, regulatory compliance, and flexible capacity. It remains intense and pushes infrastructure upgrades, service diversification, and strategic investments across the market.

Recent Developments:

- In November 2025, IXcellerate also completed the acquisition of a 5.5-hectare land plot to commence the development of its third campus, reinforcing its long-term strategy to build interconnected ecosystems for scalable digital infrastructure in the Moscow region.

- In October 2025, IXcellerate LLC announced the completion and launch of its MOS3 data center, expanding its total rack spaces to 10,329 across its campuses, making it the second-largest commercial data center operator in Russia by capacity.

- In July 2025, Megafon, a leading Russian telecom operator, launched new data centers in the cities of Yekaterinburg and Tver, each offering a capacity of 1MW. This expansion reflects the company’s strategy to enhance its data infrastructure across regional locations in Russia, supporting growing digital demand.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights