Executive summary:

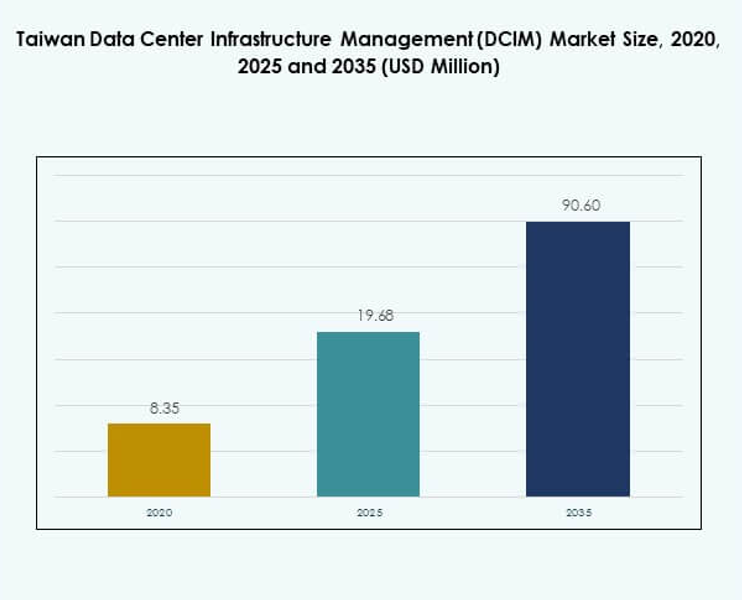

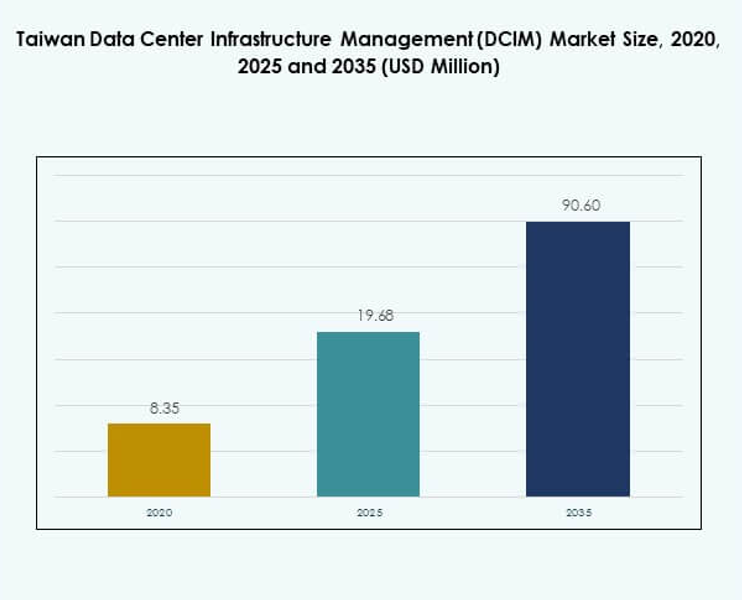

The Taiwan Data Center Infrastructure Management (DCIM) Market size was valued at USD 8.35 million in 2020 to USD 19.68 million in 2025 and is anticipated to reach USD 90.60 million by 2035, at a CAGR of 18.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Taiwan Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 19.68 Million |

| Taiwan Data Center Infrastructure Management (DCIM) Market, CAGR |

18.27% |

| Taiwan Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 90.60 Million |

The market is driven by rapid adoption of AI, IoT, and automation, transforming how enterprises manage data centers. Innovation in modular infrastructure, scalable platforms, and AI-based monitoring enhances efficiency and sustainability. Shifts in business strategies, including hybrid deployment and compliance with green standards, underline the market’s importance. For businesses and investors, it creates opportunities to improve resilience, reduce costs, and achieve long-term digital competitiveness.

Regionally, Taiwan benefits from strong positioning within Asia’s digital hub, supported by its semiconductor leadership and ICT ecosystem. Northern Taiwan leads due to hyperscale facilities and telecom investments, while central regions grow through industrial adoption. Southern Taiwan emerges with edge deployments linked to 5G and IoT expansion. Together, these regions create a balanced growth path, strengthening Taiwan’s role in regional digital transformation.

Market Drivers

Rising Adoption of AI, IoT, and Automation in Critical Infrastructure

The Taiwan Data Center Infrastructure Management (DCIM) Market is being shaped by strong adoption of AI, IoT, and automation technologies. Enterprises are using advanced DCIM platforms to improve monitoring, streamline operations, and reduce downtime. Automated workflows supported by AI-based analytics are helping operators optimize asset utilization and energy performance. The growing shift toward hybrid and multi-cloud environments is increasing demand for real-time visibility. IoT-enabled sensors are strengthening predictive maintenance strategies in critical infrastructure. These advancements reduce operational risk and extend equipment life cycles. For businesses and investors, it provides long-term value and operational stability. The ecosystem is moving toward more intelligent, software-driven infrastructure models.

Growing Innovation in Modular and Scalable Data Center Infrastructure

Innovation in modular and scalable systems is a major driver supporting the Taiwan DCIM market. Modular frameworks enable operators to scale capacity without large upfront investment, meeting rising digital workloads efficiently. DCIM platforms tailored to modular setups allow faster deployment and easier integration with existing systems. This flexibility is crucial for cloud providers and colocation operators. The focus on modularity also improves energy efficiency and reduces infrastructure redundancy. Investors see strong opportunities in modular DCIM because of its adaptability. It ensures enterprises can match operational costs with actual usage patterns. The emphasis on scalable architecture aligns with Taiwan’s digital economy expansion. It has become a core strategy for both established players and new entrants.

- For instance, Chunghwa Telecom earned Frost & Sullivan’s 2025 Taiwan Competitive Strategy Leadership Award for data center services, tied to its planned Taoyuan hyperscale facility with a 12 MW IT load.

Strategic Importance of Energy Efficiency and Sustainability

Energy efficiency remains a critical factor driving market adoption in Taiwan. DCIM solutions now include AI-based power monitoring and renewable integration to meet sustainability goals. Operators are under pressure to comply with green data center standards, making energy visibility a core requirement. Enterprises are integrating advanced cooling optimization and environmental monitoring. This trend has increased the role of DCIM in reducing power usage effectiveness. For investors, sustainability initiatives offer strong return potential through compliance-driven investments. Enterprises benefit from both cost reduction and improved brand reputation. The Taiwan Data Center Infrastructure Management (DCIM) Market is strategically positioned as a sustainability enabler. It strengthens operational performance while aligning with global ESG commitments.

- For example, Microsoft announced in October 2020 it would establish its first cloud region in Taiwan and commit to using 100 % renewable energy for its datacenters by 2025, while planning to skill over 200,000 people in Taiwan by 2024.

Shifts in Industry Structure and Strategic Business Investments

The market is witnessing a shift in how enterprises, telecoms, and hyperscalers invest in data center infrastructure. Telecom providers are aligning DCIM strategies with 5G rollouts, requiring better edge data center management. Financial institutions are also investing in DCIM to ensure compliance and operational resilience. Global hyperscalers see Taiwan as a critical hub due to its semiconductor ecosystem. This convergence is reshaping how digital infrastructure is financed and managed. For investors, the structural shift creates long-term opportunities in both managed and colocation services. Enterprises gain stronger control over capacity and compliance. The Taiwan Data Center Infrastructure Management (DCIM) Market holds strategic significance for regional digital growth. It is central to technology innovation and investment planning.

Market Trends

Growing Integration of Cloud-Native DCIM Platforms with Edge Deployments

A key trend shaping the Taiwan Data Center Infrastructure Management (DCIM) Market is the integration of cloud-native DCIM platforms with edge deployments. Edge data centers demand real-time monitoring and control at scale. Cloud-native models offer flexible deployment with lower upfront investment and faster updates. Enterprises prefer cloud-linked DCIM for integration across hybrid networks. The trend also improves resilience by enabling remote management. This has become vital for telecom and IoT ecosystems. Businesses adopt these solutions to enhance speed and agility. It highlights the growing role of cloud-native infrastructure in regional expansion strategies.

Emergence of Digital Twin Technologies for Data Center Optimization

The adoption of digital twin technology is transforming how DCIM is applied. Operators build virtual replicas of facilities to simulate operations and identify inefficiencies. This approach enhances decision-making by predicting outcomes before physical changes occur. Digital twins reduce downtime risks by improving scenario testing. It also strengthens disaster recovery and capacity planning. The Taiwan Data Center Infrastructure Management (DCIM) Market is seeing rising interest in these tools for precision-driven operations. Enterprises gain visibility over environmental and power factors in real time. This trend aligns with global adoption of advanced predictive modeling. It is a major step toward autonomous data center operations.

Increased Demand for Security-Embedded DCIM Solutions

Cybersecurity integration has emerged as a trend within the Taiwan DCIM ecosystem. With growing connectivity, DCIM platforms are targeted as critical infrastructure. Security-embedded DCIM tools now include identity access control, compliance monitoring, and anomaly detection. Enterprises view these capabilities as vital for maintaining operational trust. The focus has expanded from physical monitoring to cyber resilience. For businesses, integrated cybersecurity provides competitive advantage. It also ensures compliance with international regulatory frameworks. The Taiwan Data Center Infrastructure Management (DCIM) Market is aligning with global security mandates. It highlights the evolution of DCIM into a security-driven operational layer.

Rising Importance of AI-Driven Analytics and Smart Automation

AI-driven analytics is becoming an essential trend in Taiwan’s DCIM landscape. Platforms are integrating machine learning to analyze performance patterns and optimize power allocation. Automated recommendations reduce costs while improving capacity planning. Businesses use these insights to predict equipment failure and schedule preventive maintenance. It supports efficiency and maximizes uptime. The Taiwan Data Center Infrastructure Management (DCIM) Market is leveraging AI-driven tools for smart automation. This ensures operational continuity in both enterprise and cloud environments. Investors recognize AI as a differentiator for market leaders. It reinforces the transformation of DCIM into an intelligence-centered infrastructure backbone.

Market Challenges

Complexity of Integration Across Hybrid and Legacy Environments

One of the main challenges facing the Taiwan Data Center Infrastructure Management (DCIM) Market is integration across hybrid and legacy systems. Many enterprises operate mixed infrastructures with both cloud-based and on-premises facilities. Integrating DCIM across these environments creates high technical complexity. Legacy systems lack compatibility with modern APIs and automation frameworks. This increases deployment cost and slows adoption. It also creates operational silos, reducing visibility across assets. Businesses often face downtime risks during integration. The challenge requires specialized expertise, which adds further cost pressure. It remains a major hurdle for enterprises transitioning to advanced DCIM systems.

High Cost of Deployment and Shortage of Skilled Professionals

Another challenge is the high cost of deployment coupled with a shortage of skilled professionals. Comprehensive DCIM platforms require significant investment in software, sensors, and integration tools. Many enterprises hesitate due to budget constraints. The shortage of trained professionals in DCIM adds to the challenge. Without skilled staff, adoption is often delayed or underutilized. Investors consider workforce training as a limiting factor for long-term expansion. Smaller enterprises are particularly constrained by financial and technical barriers. The Taiwan Data Center Infrastructure Management (DCIM) Market must overcome these hurdles for wider adoption. It underscores the importance of cost optimization and skill development.

Market Opportunities

Expansion of Edge Computing and 5G-Enabled DCIM Solutions

The expansion of edge computing and 5G networks is creating significant opportunities in the Taiwan Data Center Infrastructure Management (DCIM) Market. Edge facilities require lightweight, flexible DCIM platforms capable of real-time monitoring. Telecom providers and enterprises are investing in solutions to manage distributed networks. This trend enables service providers to scale faster with reliability. It creates openings for vendors offering edge-optimized DCIM systems. For investors, 5G-driven deployments present high-growth potential. The opportunity lies in providing scalable solutions for distributed workloads. It is a growth accelerator for Taiwan’s digital ecosystem.

Growth Potential in AI-Enhanced Predictive and Sustainable Operations

Another strong opportunity is in AI-driven sustainability and predictive management tools. Businesses are increasingly focusing on energy-efficient solutions to meet environmental goals. AI-based DCIM platforms help optimize cooling, reduce carbon footprints, and extend asset life. Predictive tools strengthen resilience against equipment failure. For enterprises, this creates measurable cost savings and compliance benefits. Investors benefit from the alignment with ESG-focused strategies. The Taiwan Data Center Infrastructure Management (DCIM) Market will see accelerated adoption of AI-driven sustainability solutions. It supports long-term competitiveness and environmental responsibility in the region.

Market Segmentation

By Component

Solutions dominate the Taiwan Data Center Infrastructure Management (DCIM) Market, accounting for a significant share due to demand for advanced monitoring and analytics platforms. Businesses prefer solutions offering real-time insights into power usage, asset tracking, and environmental control. Services, including consulting and managed support, are growing steadily as enterprises seek expert guidance for implementation and optimization. Vendors providing both software and professional services strengthen adoption rates. The growing complexity of data centers drives reliance on integrated solutions. Enterprises benefit from reduced downtime and optimized asset management. Services complement this trend by addressing skill gaps. Together, both components play a vital role in market expansion.

By Data Center Type

Enterprise data centers hold strong adoption in Taiwan due to large-scale IT operations and compliance needs. Managed and colocation centers are gaining prominence as businesses shift to shared infrastructure models. Colocation edge data centers support IoT and 5G applications, making them a fast-emerging category. Cloud and edge data centers are rapidly expanding with hyperscaler investments. Others, including specialized government and research facilities, contribute to niche demand. The Taiwan Data Center Infrastructure Management (DCIM) Market is increasingly shaped by colocation and cloud facilities. Enterprises leverage these types for scalability and cost control. The dominance of enterprise and colocation setups reflects evolving business strategies.

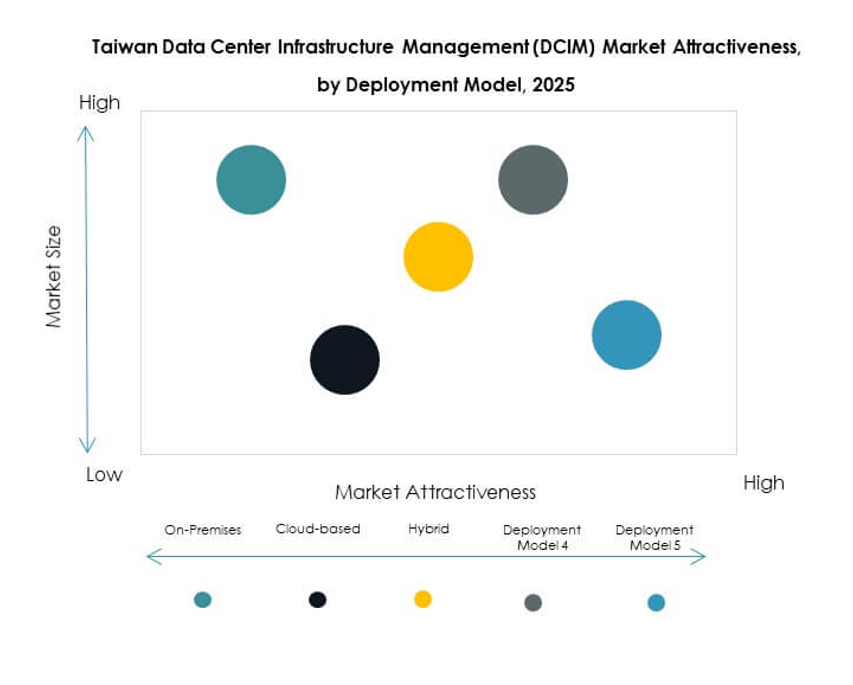

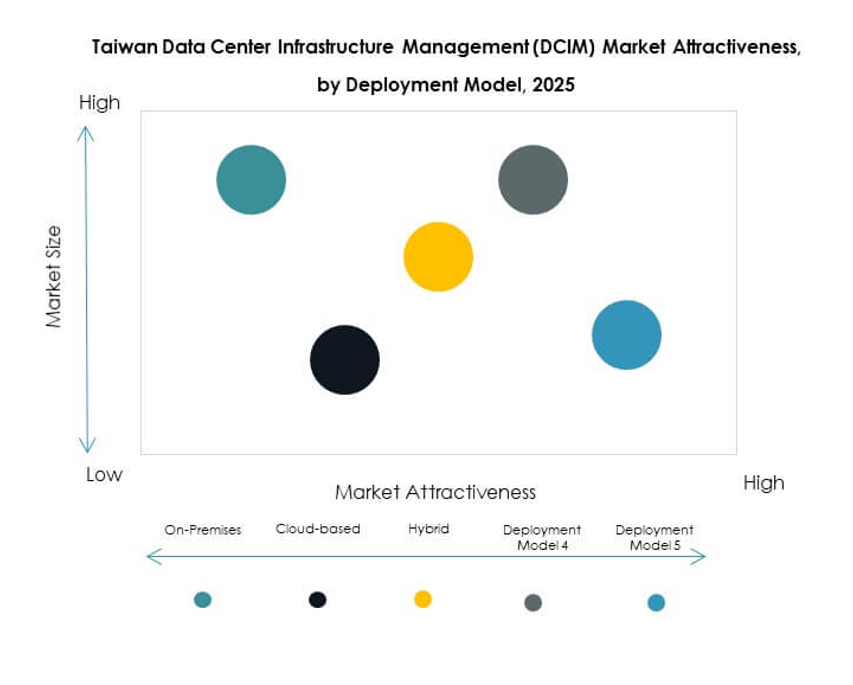

By Deployment Model

On-premises deployment continues to dominate the Taiwan DCIM landscape, particularly among large enterprises prioritizing control and security. Cloud-based DCIM models are gaining momentum due to flexibility and reduced upfront costs. Hybrid deployment is emerging as a preferred choice for enterprises balancing security with scalability. It allows integration across multi-cloud and legacy environments, offering comprehensive visibility. The market is evolving toward hybrid dominance as businesses diversify IT infrastructure. Enterprises see hybrid as the best compromise between operational flexibility and compliance. Investors recognize hybrid deployments as key to long-term adoption. The Taiwan Data Center Infrastructure Management (DCIM) Market reflects these deployment dynamics.

By Enterprise Size

Large enterprises dominate the Taiwan DCIM market due to higher IT infrastructure demand and compliance needs. They invest heavily in advanced platforms for predictive analytics, real-time monitoring, and automation. Small and Medium Enterprises (SMEs) are increasingly adopting cloud-based DCIM for cost efficiency. SMEs benefit from flexible pricing and easy scalability, making cloud solutions attractive. The market is seeing rising adoption among SMEs due to expanding digital operations. Large enterprises, however, maintain majority share because of complex workloads. Investors focus on SMEs for growth potential. The Taiwan Data Center Infrastructure Management (DCIM) Market benefits from a balanced adoption across both segments.

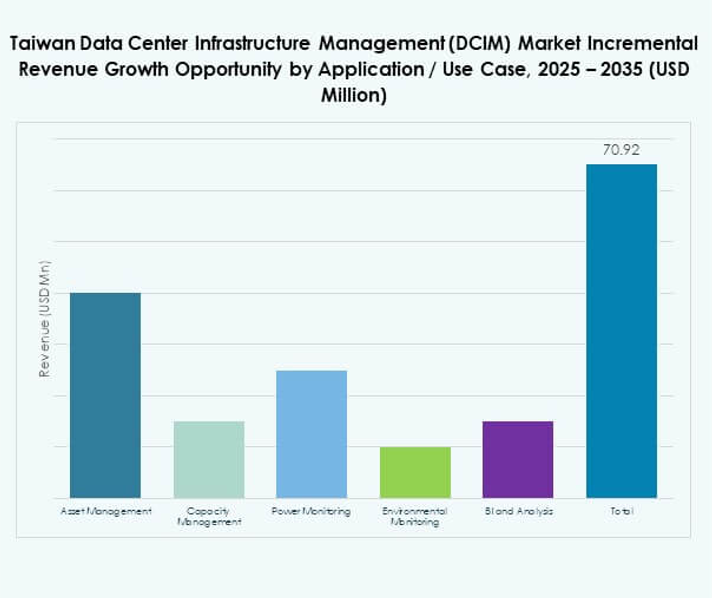

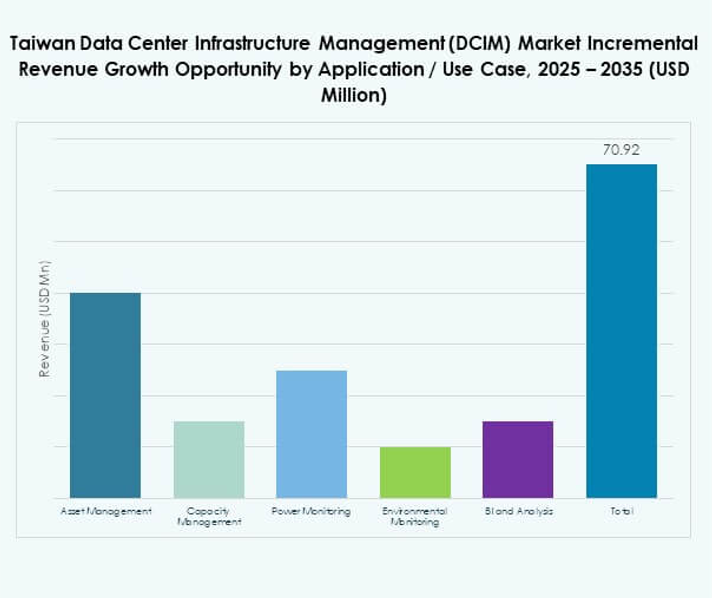

By Application / Use Case

Asset management leads in the Taiwan DCIM market due to demand for improved equipment tracking and lifecycle management. Capacity management is gaining share as enterprises focus on scalability and space optimization. Power monitoring and environmental monitoring remain critical for sustainability compliance. BI and analysis applications enhance decision-making with predictive insights. Each application supports efficiency in unique ways. Enterprises deploy multiple use cases simultaneously to maximize value. Asset and power management form the foundation of adoption. The Taiwan Data Center Infrastructure Management (DCIM) Market continues to evolve through specialized applications for operational excellence.

By End User Industry

IT and Telecommunications dominate end-user adoption in the Taiwan DCIM market, supported by cloud, 5G, and hyperscale requirements. BFSI follows, focusing on compliance, data integrity, and uptime reliability. Healthcare facilities are adopting DCIM for sensitive data handling and continuous operations. Retail and e-commerce players invest in DCIM for managing high transaction volumes. Aerospace and defense adopt it for mission-critical infrastructure resilience. Energy and utilities require DCIM for grid stability and monitoring. Other industries contribute niche demand for specialized applications. The Taiwan Data Center Infrastructure Management (DCIM) Market benefits from diverse vertical adoption. It strengthens demand across multiple growth-driven sectors.

Regional Insights

Northern Taiwan – Taipei and Hsinchu Technology Hub

Northern Taiwan dominates the Taiwan Data Center Infrastructure Management (DCIM) Market with over 52% share, led by Taipei and Hsinchu. The presence of semiconductor giants, ICT companies, and government-backed infrastructure projects strengthens the region’s leadership. Hyperscalers and telecom providers are heavily investing in DCIM platforms for large-scale operations. The high concentration of enterprise data centers enhances demand. It also benefits from international connectivity, making it a regional hub. For investors, Northern Taiwan represents the most attractive zone. The market’s leadership is anchored in innovation and strong capital inflow.

- For instance, NTT DATA reported achieving a 26% reduction in emissions and a 15% increase in renewable energy use across its global operations in 2025, reflecting its sustainability progress in data center management.

Central Taiwan – Industrial and Manufacturing Base

Central Taiwan holds around 28% market share, driven by industrial and manufacturing enterprises. The region benefits from demand for automation in production facilities and logistics hubs. DCIM platforms are being deployed to support operational efficiency and environmental monitoring. Growing SME participation strengthens adoption across supply chains. Managed service providers are also expanding in this region to address rising digital needs. The Taiwan Data Center Infrastructure Management (DCIM) Market is increasingly supported by manufacturing-led demand. It reflects the region’s role in balancing industrial output with digital transformation. Investors see it as a stable growth segment with consistent adoption.

Southern Taiwan – Kaohsiung and Emerging Edge Deployments

Southern Taiwan contributes 20% market share, with Kaohsiung emerging as a key edge deployment zone. Telecom providers are establishing data center hubs closer to users, supporting 5G and IoT adoption. The focus is on modular facilities that integrate AI-driven DCIM for cost control. Emerging colocation services strengthen the regional market footprint. Southern Taiwan is expected to grow faster than other regions due to digital infrastructure expansion. The Taiwan Data Center Infrastructure Management (DCIM) Market sees strong momentum here from new investments. It is becoming a hotspot for edge and telecom-driven digital infrastructure growth.

- For instance, Chunghwa Telecom has been actively expanding 5G infrastructure in southern Taiwan, including Kaohsiung, as part of its smart city and network modernization initiatives announced in 2025.

Competitive Insights:

- Chunghwa Telecom

- Taiwan Mobile

- FarEasTone Telecommunications

- Vantage Data Centers

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

- Others

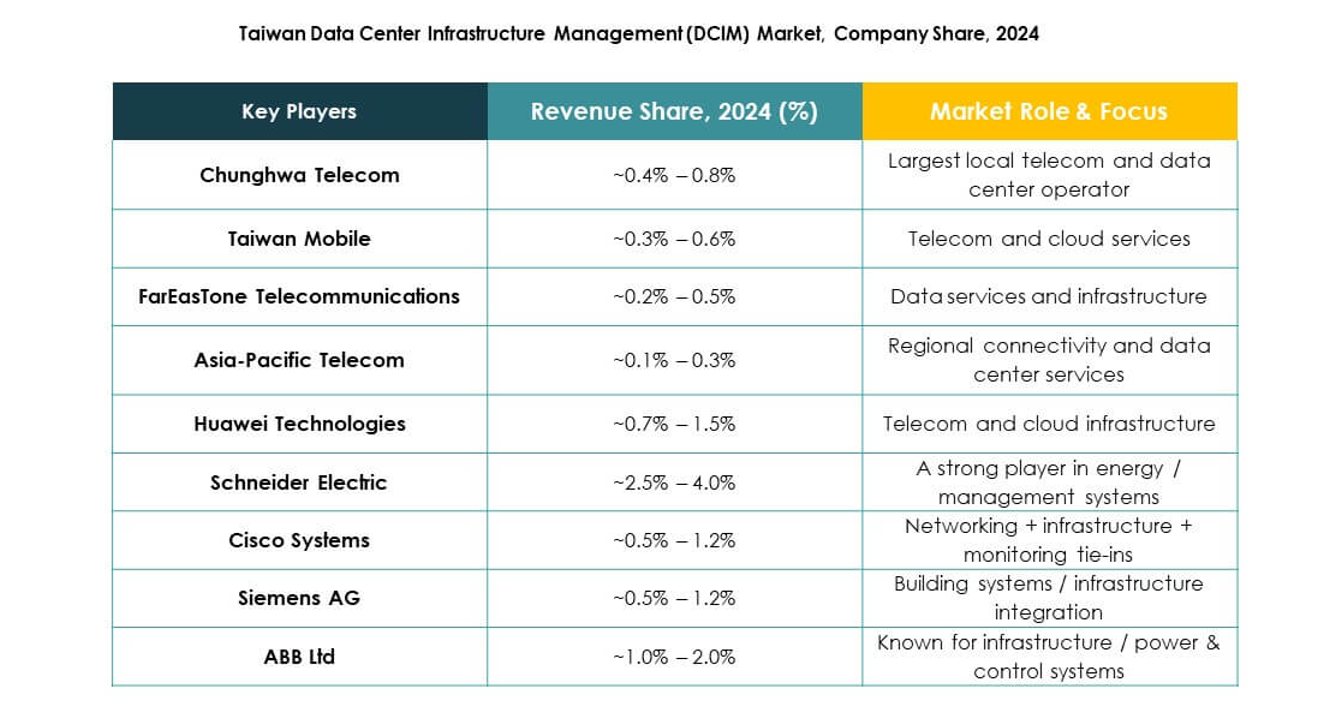

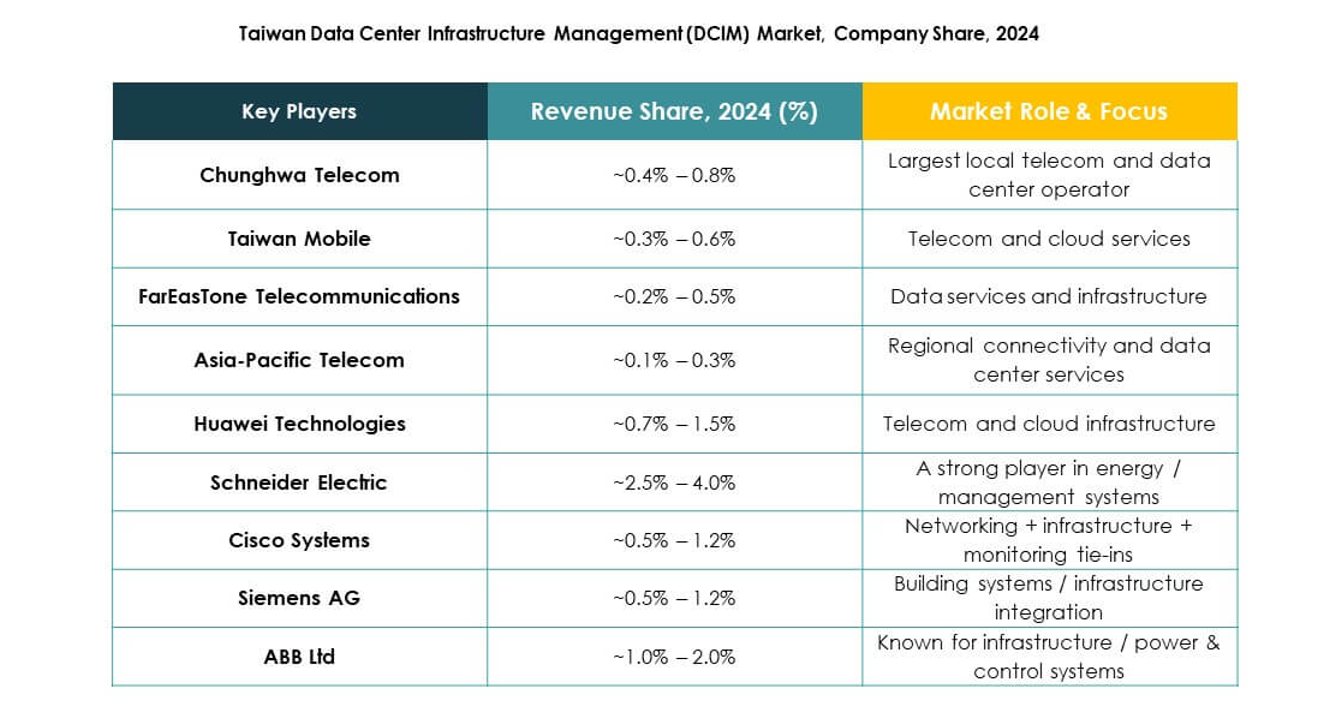

The Taiwan Data Center Infrastructure Management (DCIM) Market is highly competitive, with both domestic telecom operators and global technology leaders driving growth. Chunghwa Telecom, Taiwan Mobile, and FarEasTone strengthen their presence through investments in large-scale data centers and managed services. Vantage Data Centers focuses on hyperscale and colocation facilities to support international enterprises. ABB, Eaton, and Schneider Electric provide advanced energy and power management solutions, enabling sustainable operations. Cisco and Huawei dominate network-driven DCIM solutions, while Siemens delivers automation and smart infrastructure technologies. Competition is defined by innovation in AI-driven monitoring, hybrid deployment support, and sustainability features. It remains a market where local operators leverage strong infrastructure presence, while global players introduce advanced solutions that enhance resilience, scalability, and regulatory compliance.

Recent Developments:

- In July 2025, Chunghwa Telecom was honored with the Frost & Sullivan Taiwan Data Center Services Competitive Strategy Leadership Award, recognizing its outstanding achievements in advancing Taiwan’s data center sector through technology-driven innovation and operational excellence in services and infrastructure management.

- In June 2025, ABB introduced the MegaFlex UL 415V, an AI-ready UPS for large-scale data centers, with features designed to enhance power resilience and efficiency for advanced manufacturing and DCIM environments in Taiwan and globally.