Executive summary:

The Vietnam Data Center Market size was valued at USD 1,201.81 million in 2020 to USD 2,086.65 million in 2025 and is anticipated to reach USD 6,260.00 million by 2035, at a CAGR of 11.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Vietnam Data Center Market Size 2025 |

USD 2,086.65 Million |

| Vietnam Data Center Market, CAGR |

11.54% |

| Vietnam Data Center Market Size 2035 |

USD 6,260.00 Million |

The market growth is driven by rapid digital transformation, increasing cloud adoption, and demand for scalable IT infrastructure. Enterprises are modernizing operations with AI, IoT, and big data integration. Government-backed digital economy policies and 5G expansion strengthen the environment for investors. It is becoming a strategic destination for both local and global players seeking competitive opportunities in Southeast Asia.

Regionally, Northern Vietnam leads due to Hanoi’s strong infrastructure, connectivity, and concentration of enterprises. Southern Vietnam follows, anchored by Ho Chi Minh City’s economic base and commercial activity. Central Vietnam is emerging as an important hub, supported by industrial growth and smart city projects. This regional balance strengthens the country’s role as a rising data center market.

Market Drivers

Rapid Digital Transformation Across Core Industries Driving Strong Demand For Data Infrastructure

The Vietnam Data Center Market is experiencing rapid expansion due to digital transformation across industries such as BFSI, telecom, and e-commerce. Enterprises are moving operations to digital platforms, creating high demand for scalable IT infrastructure. Cloud adoption and hybrid solutions are becoming essential for supporting business continuity. Vietnam’s strong internet penetration accelerates the shift toward online services and digital payments. Multinational corporations are investing in modernized data operations to remain competitive. Local firms are adopting new technologies to improve efficiency and security. The strong push for digitization makes the market a strategic hub for investors.

Increasing Cloud Adoption And Hyperscale Deployments Boosting Competitive Position In The Region

Cloud adoption is a major driver as businesses rely on agile, scalable services for critical workloads. Hyperscale deployments provide cost advantages and high computing power, positioning Vietnam as a regional competitor. Enterprises require advanced solutions for managing large datasets and AI-driven workloads. Colocation providers are expanding capacity to meet demand from both domestic and international firms. Investors are supporting projects that integrate renewable energy for sustainable operations. Enterprises benefit from enhanced latency reduction through localized data storage. The market offers significant opportunities for scaling services across Southeast Asia.

- For instance, in April 2025, Viettel broke ground on Vietnam’s first hyperscale data center in Tan Phu Trung Industrial Park, Ho Chi Minh City, with a planned capacity of up to 140 MW across 10,000 racks and an average rack density of 10 kW more than double the national average. Selected racks will support up to 60 kW for AI workloads, marking the largest facility of its kind and a benchmark PUE below 1.4 for energy efficiency.

Strong Government Support And Digital Economy Policies Encouraging Infrastructure Investment

Government initiatives and national digital economy strategies play a key role in fostering market growth. Authorities are prioritizing cybersecurity, cloud-first policies, and 5G rollout to modernize infrastructure. Tax incentives and favorable regulations encourage international players to expand facilities. Enterprises benefit from enhanced compliance measures that safeguard data sovereignty. Public-private partnerships create opportunities for building new facilities across key regions. The focus on innovation improves Vietnam’s position as a reliable digital hub. The Vietnam Data Center Market gains credibility as a result of transparent regulatory practices.

- For instance, CMC Telecom’s Tan Thuan Data Center in Ho Chi Minh City was officially certified as Vietnam’s first facility to meet Level 4 Information System Security Standards under government regulations in June 2024, ensuring 24/7 continuous operations and compliance for critical Finance, Banking, and E-commerce sector clients.

Adoption Of Advanced Technologies Transforming The Competitive Landscape Of Data Centers

Enterprises are integrating artificial intelligence, IoT, and blockchain applications that require powerful data processing capabilities. Automation in facility management increases operational efficiency while reducing downtime. Advanced cooling technologies help optimize energy use in high-density setups. Providers invest in security infrastructure to counter rising cyber threats. Businesses demand low-latency connectivity for handling mission-critical applications. The adoption of edge computing supports localized data processing in fast-growing cities. Vietnam’s innovation-focused environment makes it attractive for international partnerships. The market is evolving as a key player in regional technology advancement.

Market Trends

Expansion Of Edge Data Centers To Support Smart Cities And IoT Applications

The Vietnam Data Center Market is witnessing a surge in edge data center deployments to support smart city initiatives and IoT growth. Enterprises demand localized computing to process data closer to end-users, reducing latency. Edge facilities enable real-time applications in healthcare, logistics, and financial services. Urban development projects drive higher data demand across provinces. Edge models enhance performance for AI-powered services like video analytics and smart traffic systems. Investors see edge infrastructure as essential for meeting next-generation needs. It creates new opportunities for expansion beyond major urban hubs.

Growing Role Of Sustainability And Renewable Energy Integration In Data Center Operations

Sustainability is becoming a defining trend with operators adopting renewable energy sources for long-term efficiency. The Vietnam Data Center Market is aligning with global green commitments by adopting solar and wind-powered infrastructure. Enterprises prefer providers with certified energy-efficient systems. Cooling innovation reduces water consumption and energy waste in large facilities. International firms prioritize Vietnam due to its renewable potential and competitive costs. Investors recognize sustainable data centers as a driver of long-term value creation. Green operations are becoming a differentiator for market players.

Rising Investments In Artificial Intelligence And Automation To Enhance Operational Efficiency

Automation and AI adoption are shaping the future of facility operations. Data centers use AI-driven tools for predictive maintenance and workload optimization. The Vietnam Data Center Market is attracting investments in robotic process automation for monitoring power usage. Machine learning enhances energy management in high-density deployments. Enterprises seek automated solutions to reduce downtime and improve capacity planning. Operators deploy AI-powered cybersecurity systems to strengthen resilience. The trend is reshaping the competitive environment and driving next-generation infrastructure adoption.

Expansion Of Cross-Border Connectivity And Subsea Cable Integration To Strengthen Global Links

Vietnam’s position as a regional connectivity hub is being enhanced by subsea cable projects and international network links. The Vietnam Data Center Market benefits from strong cross-border connectivity to key Asian and global markets. Subsea infrastructure reduces latency for international traffic and supports cloud expansion. Enterprises use enhanced connectivity to provide services across Southeast Asia. Global providers partner with local firms to ensure robust interconnection. The trend strengthens Vietnam’s role in global digital trade and data routing. International demand for seamless connectivity accelerates further investment.

Market Challenges

Infrastructure Gaps And High Energy Demand Straining Expansion Capabilities Of Data Centers

The Vietnam Data Center Market faces challenges linked to energy supply and infrastructure limitations. Growing demand for hyperscale facilities strains the national power grid. Rising electricity costs increase operational expenses for providers. Availability of skilled labor remains limited for managing advanced systems. Urban centers face space constraints for new large-scale facilities. Cooling systems consume significant resources, raising sustainability concerns. These challenges create barriers for investors evaluating large deployments. It requires major infrastructure upgrades to keep pace with demand.

Cybersecurity Risks And Regulatory Complexities Creating Obstacles For Market Growth

The rapid expansion of digital services exposes providers to higher cybersecurity risks. Enterprises demand stronger compliance with international data security standards. The Vietnam Data Center Market faces complexities in harmonizing regulations with global requirements. Providers must address growing cyber threats and ensure data sovereignty. Delays in regulatory approvals create hurdles for international partnerships. Complex taxation frameworks may discourage some foreign investments. Market participants must invest heavily in advanced security systems. These challenges underscore the importance of coordinated regulatory and industry strategies.

Market Opportunities

Rising Demand For Cloud Services And Colocation Facilities Creating Attractive Growth Prospects

Cloud adoption and demand for colocation create opportunities for both local and global providers. The Vietnam Data Center Market benefits from enterprises shifting to flexible, scalable IT models. SMEs increasingly rely on colocation services to avoid high infrastructure costs. Hyperscale providers are expanding footprints to address the cloud-first policies of government and businesses. Data sovereignty regulations enhance demand for domestic storage solutions. Investors find opportunities in developing new hybrid cloud services. The rising number of digital-first companies further accelerates this growth.

Expanding 5G And AI Ecosystems Driving Opportunities For Advanced Data Processing Services

The rollout of 5G networks and rapid adoption of AI-driven services create strong opportunities for advanced processing. The Vietnam Data Center Market supports low-latency services required for fintech, telemedicine, and logistics applications. Enterprises demand high-performance facilities to handle increasing workloads. Edge and modular data centers provide tailored solutions for specific industries. International players are exploring partnerships to strengthen innovation ecosystems. Opportunities are emerging in integrating blockchain and IoT solutions. Providers that adapt to these shifts gain a competitive advantage.

Market Segmentation

By Component

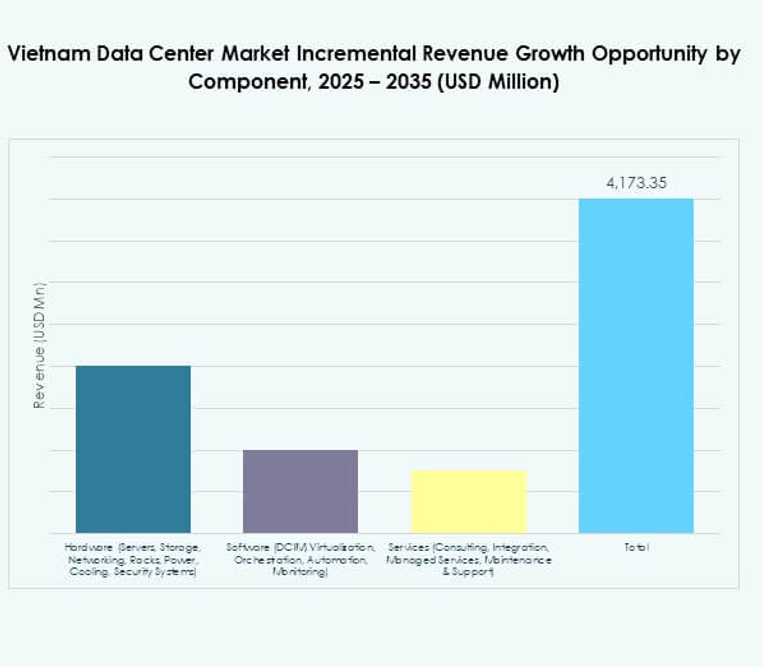

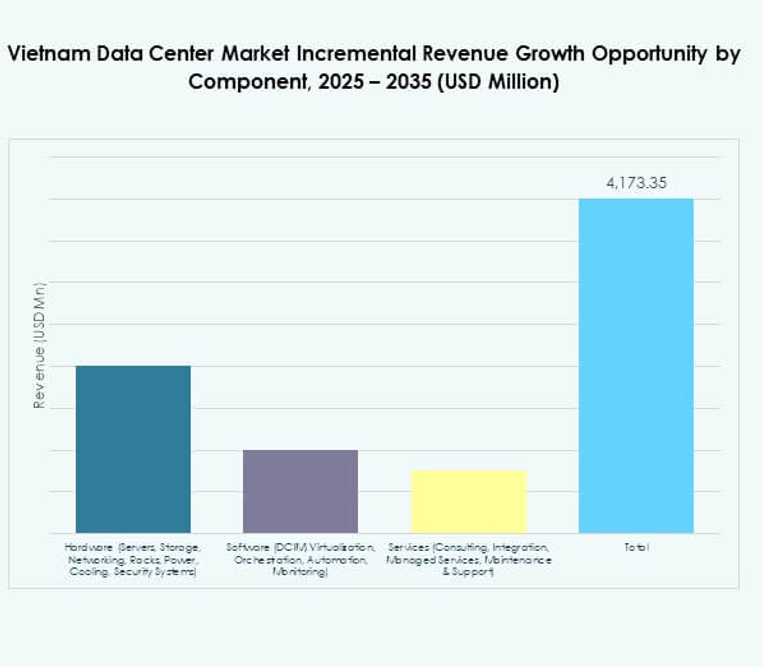

Hardware dominates the Vietnam Data Center Market, accounting for the largest share due to the growing demand for servers, storage, power, and cooling systems. Enterprises invest heavily in networking and security infrastructure to ensure high availability. Software solutions such as DCIM and virtualization are gaining traction but remain secondary. Services including consulting and managed support grow steadily with cloud adoption. Hardware continues to drive revenue growth by supporting hyperscale and colocation facilities.

By Data Center Type

Colocation and hyperscale data centers dominate due to rising demand from enterprises and cloud providers. The Vietnam Data Center Market benefits from international investments in mega facilities to meet high-capacity workloads. Enterprise data centers still play a role for private organizations, while modular and edge centers emerge to serve regional cities. Internet Data Centers support rapid cloud adoption across industries. Growth remains strong in colocation as businesses seek cost-efficient scalability.

By Deployment Model

Cloud-based models lead the Vietnam Data Center Market as enterprises migrate to flexible infrastructures. Hybrid deployment grows rapidly by offering a balance between on-premises control and cloud scalability. On-premises data centers hold a smaller share but remain relevant for regulated industries. Organizations increasingly adopt hybrid strategies to manage critical workloads securely. This shift reflects the rising reliance on cloud-native services.

By Enterprise Size

Large enterprises dominate the Vietnam Data Center Market due to their scale of operations and capacity needs. SMEs represent a growing segment as they adopt colocation and cloud-based solutions. Cost efficiency and managed services attract SMEs to avoid infrastructure investments. Large enterprises continue to drive significant infrastructure spending, but SME adoption accelerates overall market growth. Both segments contribute to expanding demand across industries.

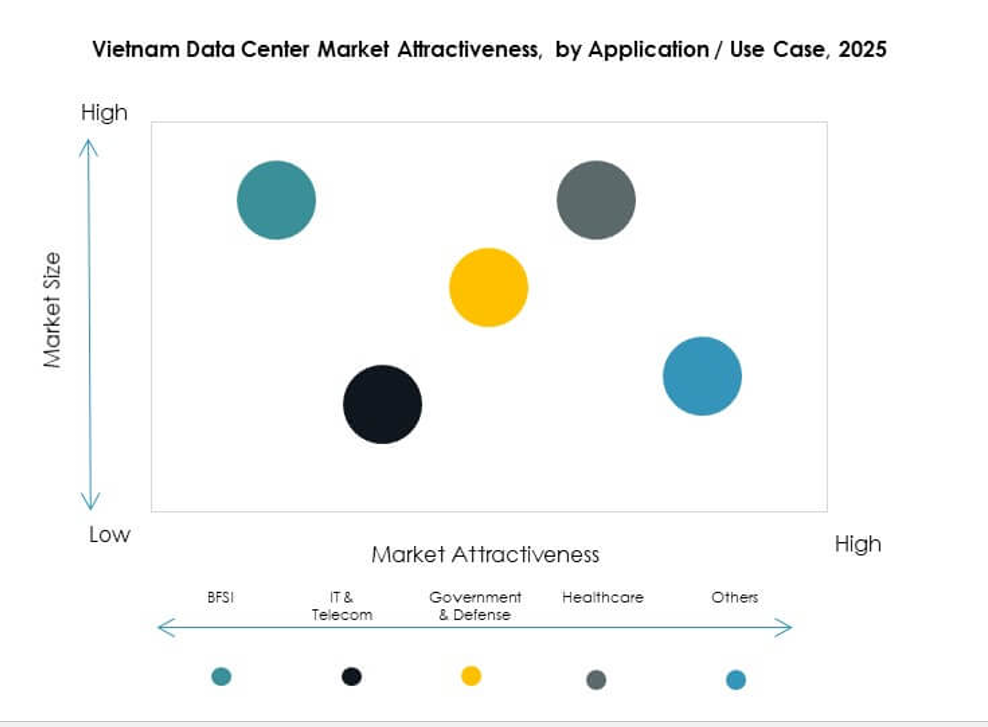

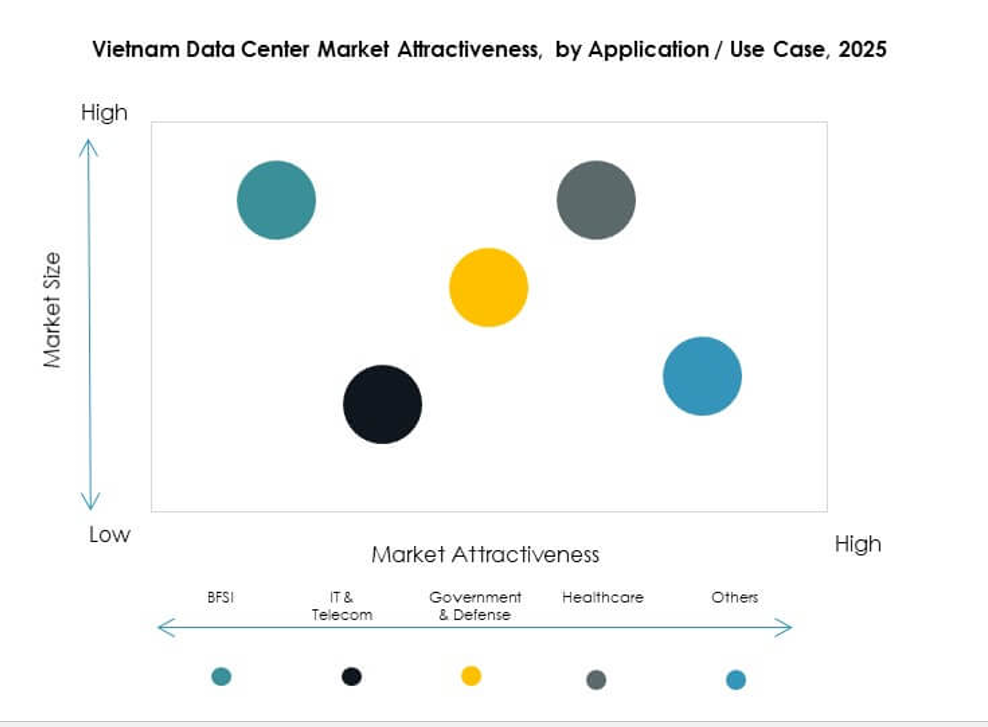

By Application / Use Case

IT and telecom lead the Vietnam Data Center Market due to high digital traffic and 5G expansion. BFSI follows with rising demand for secure storage and processing. Retail and e-commerce drive growth through digital platforms and online transactions. Healthcare and media require advanced solutions for data-intensive applications. Manufacturing and government also adopt modernized centers for operational efficiency. Other sectors like education and energy increasingly contribute to demand.

By End User Industry

Cloud service providers dominate the Vietnam Data Center Market, supporting enterprise workloads and digital services. Enterprises adopt both private and hybrid facilities to maintain flexibility. Colocation providers hold a strong share by offering scalable and cost-effective solutions. Government agencies invest in secure data infrastructure for public services. Other industries, including utilities, continue to adopt advanced systems for critical applications.

Regional Insights

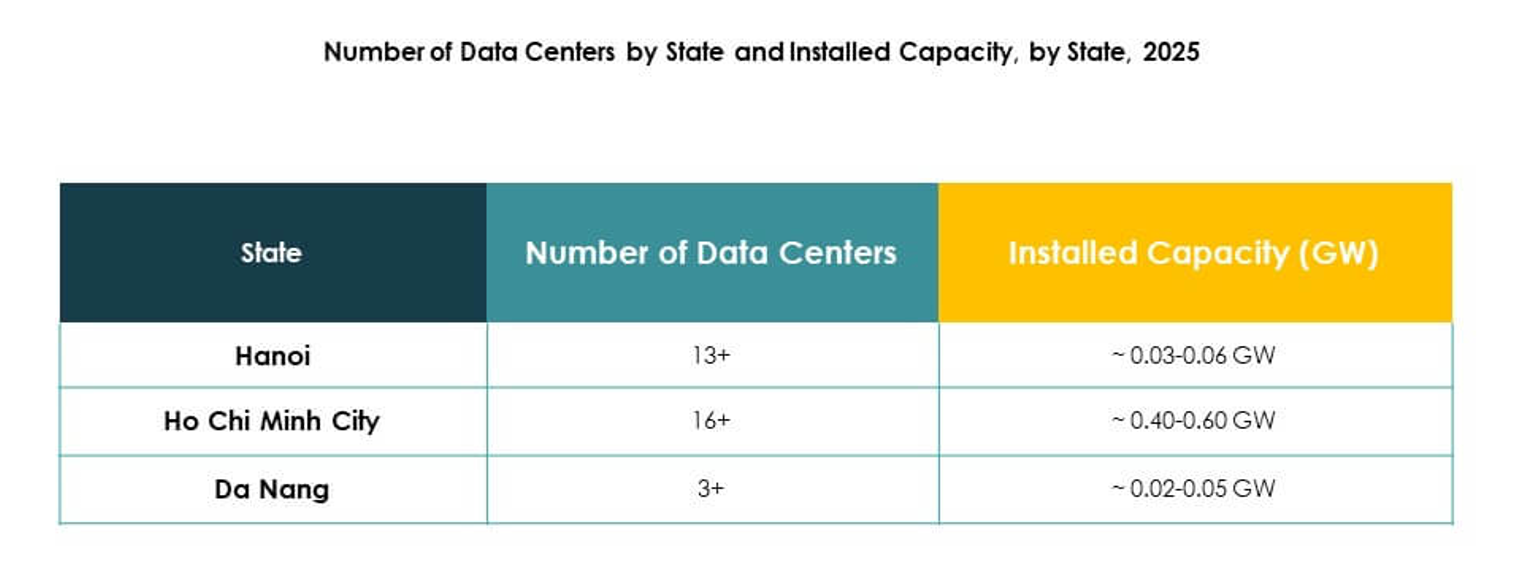

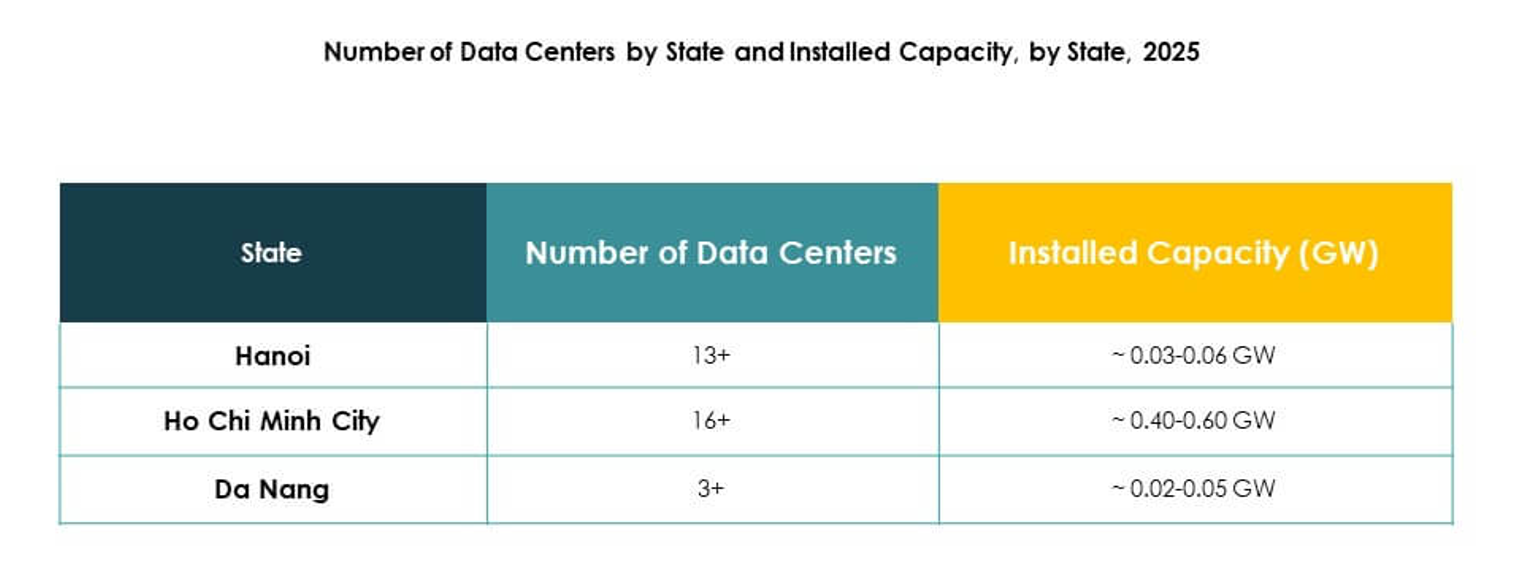

Northern Vietnam Leading With 42% Share Supported By Hanoi’s Strong Digital Infrastructure

Northern Vietnam dominates the Vietnam Data Center Market with 42% share, driven by Hanoi’s strong connectivity and government-backed initiatives. The region attracts investments due to its strategic location and large enterprise base. Demand for colocation and cloud services continues to rise in urban clusters. It benefits from major financial and telecom hubs operating in the capital. International players are expanding capacity to serve cross-border clients from the north.

Southern Vietnam Holding 38% Share Anchored By Ho Chi Minh City’s Economic Strength

Southern Vietnam accounts for 38% share of the Vietnam Data Center Market, fueled by Ho Chi Minh City’s role as the commercial center. The region attracts global investors seeking proximity to multinational companies. Strong demand arises from e-commerce and fintech sectors. Data center operators focus on expanding capacity with hyperscale and colocation facilities. Southern hubs provide high connectivity, making the region essential for regional expansion strategies.

- For instance, in July 2025, CMC Corporation received approval for the CMC Hyperscale Data Center project at Saigon Hi-Tech Park, Ho Chi Minh City, with an initial design power capacity of 30 MW, expandable to 120 MW, serving AI-as-a-service, cloud, and cybersecurity needs.

Central Vietnam Emerging With 20% Share Supported By Growing Industrial Clusters

Central Vietnam holds 20% share in the Vietnam Data Center Market, driven by industrial clusters and smart city projects. Demand rises from manufacturing and logistics hubs seeking advanced data services. Regional governments encourage infrastructure growth to support digital ecosystems. Edge and modular facilities gain traction in secondary cities. It strengthens overall national capacity by diversifying data infrastructure. Central Vietnam is gradually establishing itself as an emerging growth corridor.

- For instance, in August 2025, IPTP Networks launched the AIDC DeCenter at Da Nang Hi-Tech Park, featuring 1,000 racks and a minimum power supply of 10 MW, with total investment of USD 200 million and carrier-neutral, AI-ready infrastructure for global enterprise clients.

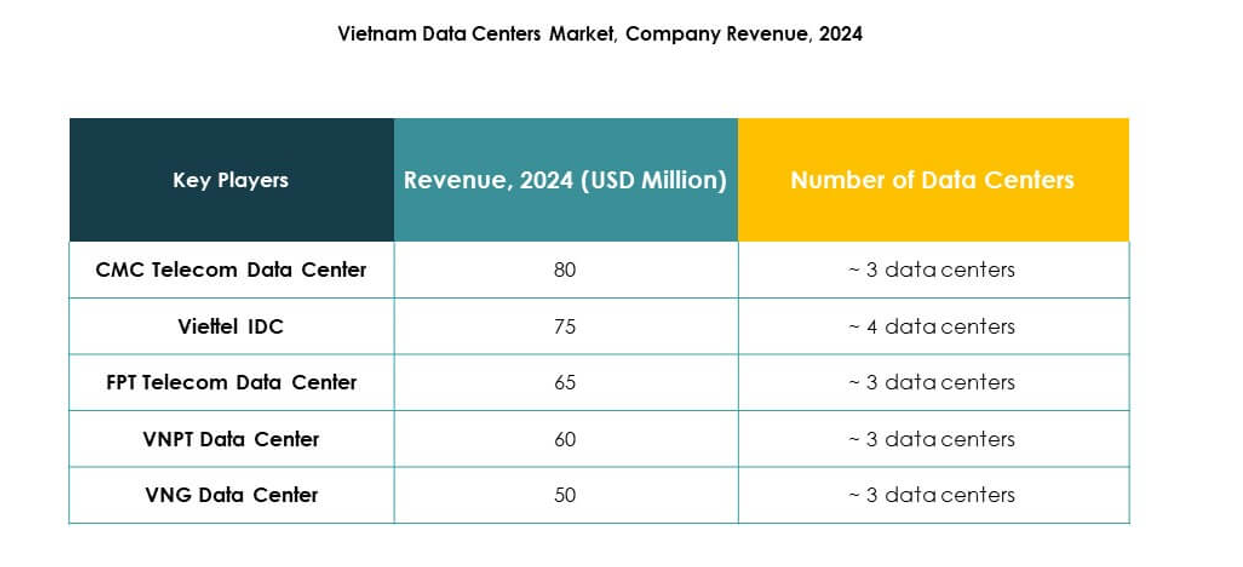

Competitive Insights:

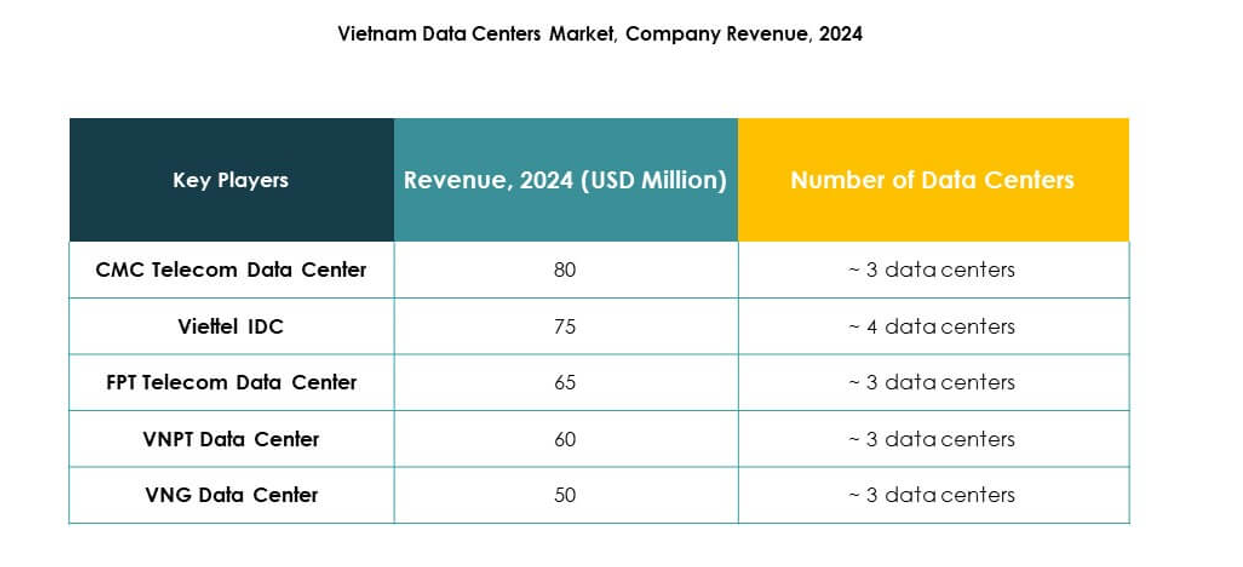

- CMC Telecom Data Center

- Viettel IDC

- FPT Telecom Data Center

- Indonet

- VNPT Data Center

- NTT Communications Corporation

- Digital Realty Trust, Inc.

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Vietnam Data Center Market features a competitive mix of domestic telecom-backed providers and global technology leaders. Local companies such as Viettel IDC, VNPT, FPT, and CMC Telecom dominate colocation and enterprise services, leveraging strong domestic networks and government partnerships. International players including Microsoft, AWS, Google, NTT, and Digital Realty are expanding hyperscale and cloud infrastructure to serve regional enterprises. It is characterized by rising foreign investment, cross-border connectivity, and sustainability-focused deployments. Competition is intensifying as firms integrate renewable energy, advanced cooling, and automation. Market participants pursue mergers, partnerships, and innovation-driven strategies to strengthen positioning. The diversity of players ensures customers benefit from scalable, secure, and cost-effective solutions.

Recent Developments:

- In September 2025, Boyd announced the expansion of its manufacturing capacity in Vietnam to accelerate the production of advanced liquid cooling solutions for AI data centers, marking a significant boost in local capabilities for next-generation infrastructure deployment.

- In August 2025, Samsung C&T and CMC signed a memorandum of understanding to collaborate and develop a $1 billion data center in Ho Chi Minh City, with the first operational phase set at $250 million and 30MW, and plans for further expansion.

- In May 2024, ST Telemedia Global Data Center announced its partnership with VNG Corporation to develop and operate a new 60MW data center, expected to be completed in 2026, expanding international presence in Vietnam’s market.

- In April 2024, Viettel launched Vietnam’s largest green data center, the Hoa Lac Data Center, with a total capacity of 30MW, 2,400 racks, and 60,000 servers, positioning itself as the leading local technology company supporting AI-driven data applications in Vietnam.