Executive summary:

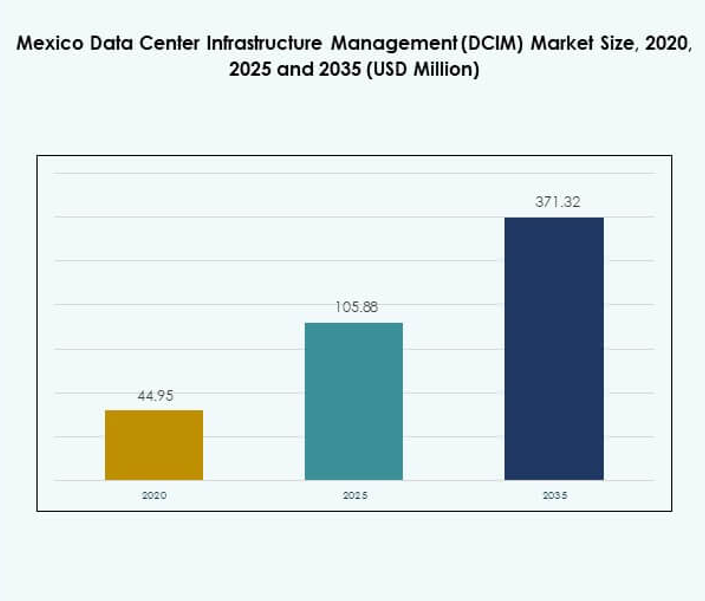

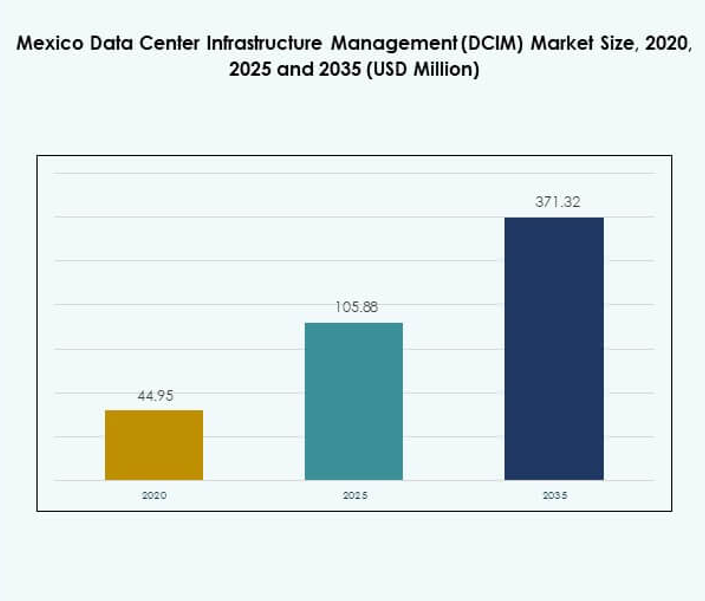

The Mexico Data Center Infrastructure Management (DCIM) Market size was valued at USD 44.95 million in 2020 to USD 105.88 million in 2025 and is anticipated to reach USD 371.32 million by 2035, at a CAGR of 15.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Mexico Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 105.88 Million |

| Mexico Data Center Infrastructure Management (DCIM) Market, CAGR |

371.32% |

| Mexico Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 15.14Million |

The market is driven by the rapid adoption of cloud computing, artificial intelligence, and edge data centers. Enterprises are shifting toward hybrid and scalable infrastructure models that require advanced DCIM platforms for seamless monitoring and predictive management. Innovation in automation, sustainability-focused features, and real-time analytics makes these solutions strategically important. Businesses and investors recognize DCIM as essential for optimizing performance, ensuring cost efficiency, and supporting digital transformation across industries.

Regionally, Northern Mexico leads due to strong cross-border connectivity and hyperscale developments. Central Mexico, anchored by Mexico City and Querétaro, is emerging as a hub for enterprise and colocation growth. Southern Mexico is gaining traction with renewable energy projects and new infrastructure investments. Together, these regions highlight a balanced landscape where established hubs dominate but emerging areas offer significant potential for future expansion.

Market Drivers

Rising Technology Adoption Driving Demand For Intelligent Infrastructure Management

The Mexico Data Center Infrastructure Management (DCIM) Market is driven by strong adoption of cloud, AI, and IoT across industries. Companies require platforms that support real-time visibility, efficient capacity planning, and advanced energy management. The rise of 5G networks and connected devices adds complexity, increasing the need for centralized monitoring. Businesses are shifting from legacy systems to automated and AI-enabled DCIM platforms. This shift reduces downtime and operational risks. Investors see high growth potential in technology-driven infrastructure optimization. The demand for data-intensive applications is strengthening long-term market prospects.

- For instance, in July 2024, Schneider Electric and ASOL Digital launched the Easy Modular All-in-One Data Center solution for Mexico, which integrates EcoStruxure IT Expert for DCIM, supports up to 14 racks and 100 kW, and uses ultra-efficient InRow DX cooling systems for better energy performance.

Innovation In Predictive Maintenance And Energy Optimization Enhancing Operational Efficiency

Innovation in predictive analytics and energy monitoring tools is shaping infrastructure strategies. Organizations use DCIM solutions to predict component failures and reduce maintenance costs. Energy-efficient operations remain a priority, and smart sensors integrated with DCIM platforms deliver real-time power usage insights. Enterprises adopt solutions that align with sustainability goals while maintaining performance reliability. Vendors focus on automation and AI features that improve asset utilization. The Mexico Data Center Infrastructure Management (DCIM) Market reflects a shift toward intelligent platforms supporting proactive decision-making. Investors recognize operational efficiency as a critical value driver.

Strategic Business Shifts Toward Cloud-First And Hybrid Models Increasing Market Relevance

Enterprises in Mexico are prioritizing hybrid models that balance cloud scalability and on-premise control. Organizations deploy DCIM solutions to streamline workflows across mixed environments. This flexibility enables better workload distribution and compliance with regional requirements. Service providers invest in hybrid-compatible features to capture enterprise demand. The Mexico Data Center Infrastructure Management (DCIM) Market benefits from this transition by offering adaptable solutions. Investors target this segment for its strong alignment with digital transformation strategies. Technology adoption ensures continuity of operations and reduces infrastructure costs. Cloud-first policies are reinforcing the market’s strategic importance.

- For instance, Vertiv’s Trellis platform is used by managed service providers in Latin America including Mexico to provide unified monitoring and improved uptime, supporting both traditional data centers and hybrid cloud environments by reducing response times to operational issues and enabling integration with ERP and IT management systems.

Growing Importance Of Strategic Infrastructure Investments Among Enterprises And Investors

Enterprises recognize the importance of DCIM in achieving digital resilience and competitiveness. Investors channel funds toward infrastructure providers with robust management platforms. The Mexico Data Center Infrastructure Management (DCIM) Market demonstrates strong potential through rising partnerships and innovation-led projects. Enterprises seek secure, scalable, and transparent management systems that deliver cost and energy savings. IT teams leverage DCIM tools to align infrastructure performance with business growth goals. The focus on efficiency strengthens long-term adoption. Stakeholders emphasize regional readiness for digital expansion. Strategic investments underline the critical role of DCIM in national competitiveness.

Market Trends

Integration Of Artificial Intelligence And Automation In Management Platforms

The Mexico Data Center Infrastructure Management (DCIM) Market shows clear progress with AI-driven automation. Enterprises deploy AI tools for capacity prediction, performance monitoring, and energy optimization. Automation enables managers to address faults before service disruptions occur. Businesses gain improved decision-making through real-time data visualization. Smart algorithms enhance operational accuracy across hybrid and edge data centers. It strengthens resilience against unplanned outages. This trend supports efficiency-focused strategies for enterprises. The growing reliance on AI enhances long-term scalability and security in infrastructure management.

Edge Data Center Expansion Supporting New Use Cases And Regional Connectivity

Edge adoption accelerates demand for DCIM platforms that enable decentralized infrastructure control. The Mexico Data Center Infrastructure Management (DCIM) Market gains relevance with rising 5G coverage. Organizations deploy DCIM systems to maintain energy efficiency across distributed sites. Edge facilities require precise environmental monitoring and capacity planning. Vendors integrate mobile-friendly dashboards to support remote control. This trend improves regional service delivery for digital applications. It ensures continuous availability for latency-sensitive workloads. Growth in edge capacity strengthens infrastructure investments across Mexico and nearby regions.

Growing Role Of Sustainability And Green Infrastructure In Data Center Planning

Environmental goals shape new infrastructure requirements for enterprises and investors. The Mexico Data Center Infrastructure Management (DCIM) Market reflects stronger adoption of tools that track energy use and carbon impact. Organizations implement renewable power integration through DCIM platforms. Efficiency-focused operations reduce long-term costs and meet regulatory standards. Vendors market green DCIM features as competitive advantages. Sustainability remains central for global investors evaluating regional opportunities. It supports Mexico’s position as an emerging digital hub. Market trends highlight the alignment of infrastructure with climate-conscious strategies.

Increasing Focus On Cybersecurity And Compliance Within DCIM Deployments

Cybersecurity risks increase with the expansion of cloud and hybrid models. Enterprises use DCIM systems that incorporate advanced access controls and monitoring safeguards. The Mexico Data Center Infrastructure Management (DCIM) Market reflects demand for solutions aligned with compliance standards. Organizations prioritize platforms with real-time security analytics and risk alerts. Vendors add compliance management modules to expand market reach. It improves trust among regulated industries such as BFSI and healthcare. Security integration ensures resilience against evolving threats. This trend strengthens enterprise adoption across sensitive sectors.

Market Challenges

High Cost Of Deployment And Integration Limiting Adoption Among SMEs

The Mexico Data Center Infrastructure Management (DCIM) Market faces challenges due to expensive deployments. Small and medium enterprises hesitate to adopt platforms requiring significant upfront costs. Integration with legacy IT systems remains complex and resource-intensive. Vendors must provide scalable solutions that balance affordability with advanced features. It creates barriers for smaller firms seeking digital growth. Adoption requires specialized staff training, adding financial burden. Investors view this as a constraint impacting long-term scalability. Cost sensitivity delays broader adoption across diverse enterprise segments.

Complexity Of Multi-Vendor And Hybrid Environments Creating Operational Constraints

Enterprises often manage mixed infrastructure from multiple vendors, making integration difficult. The Mexico Data Center Infrastructure Management (DCIM) Market must address this complexity through interoperable platforms. Hybrid deployments require seamless control across cloud, edge, and on-premises models. Lack of standardization leads to fragmented oversight and rising operational risks. IT teams face difficulty maintaining real-time monitoring across distributed facilities. It reduces efficiency gains expected from digital transformation. Vendors must prioritize open architectures to overcome integration issues. Market growth depends on addressing this technical barrier effectively.

Market Opportunities

Growing Investments In Edge And Hybrid Infrastructure Creating Expansion Potential

The Mexico Data Center Infrastructure Management (DCIM) Market offers strong opportunities through rising investment in edge and hybrid models. Enterprises focus on deploying flexible management platforms that ensure efficient operation of distributed assets. Vendors with hybrid-ready solutions capture demand from industries modernizing infrastructure. It supports Mexico’s role as a hub for cross-border data services. Investors highlight long-term scalability and performance gains. Opportunities exist for providers offering simplified integration models. The shift toward next-generation workloads supports further expansion.

Demand For Sustainable And AI-Enhanced Solutions Driving Vendor Differentiation

Green operations and AI-enabled management tools position Mexico as a competitive digital economy. The Mexico Data Center Infrastructure Management (DCIM) Market benefits from global sustainability trends. Vendors developing AI-based predictive analytics gain an edge with measurable energy savings. It enhances resilience and operational transparency. Enterprises align with climate-focused regulatory requirements. Opportunities emerge for players offering compliance-ready DCIM solutions. Investors focus on innovation that combines efficiency and sustainability. This strengthens regional competitiveness across the Latin American market.

Market Segmentation

By Component

Solutions dominate the Mexico Data Center Infrastructure Management (DCIM) Market due to high demand for software platforms that integrate asset, energy, and environmental monitoring. Services segment shows steady growth as enterprises seek consulting, managed support, and training for implementation. Vendors offering combined solutions and services strengthen adoption rates. Businesses invest in intelligent DCIM platforms that deliver actionable insights. Solutions account for a major share due to customization options. Services remain attractive for firms without in-house expertise.

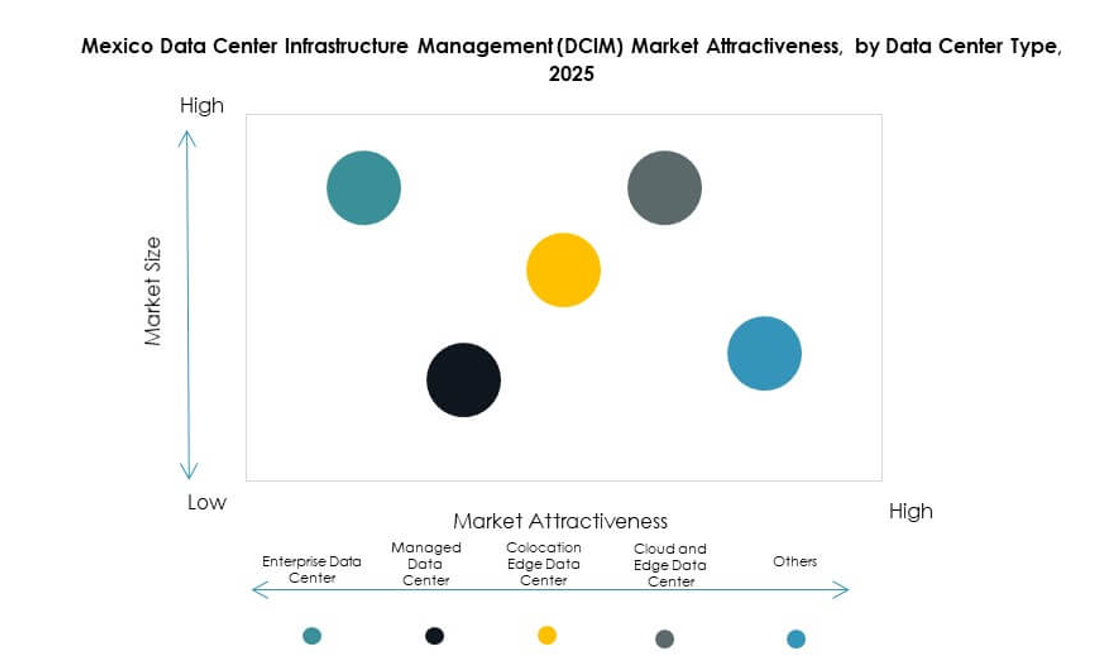

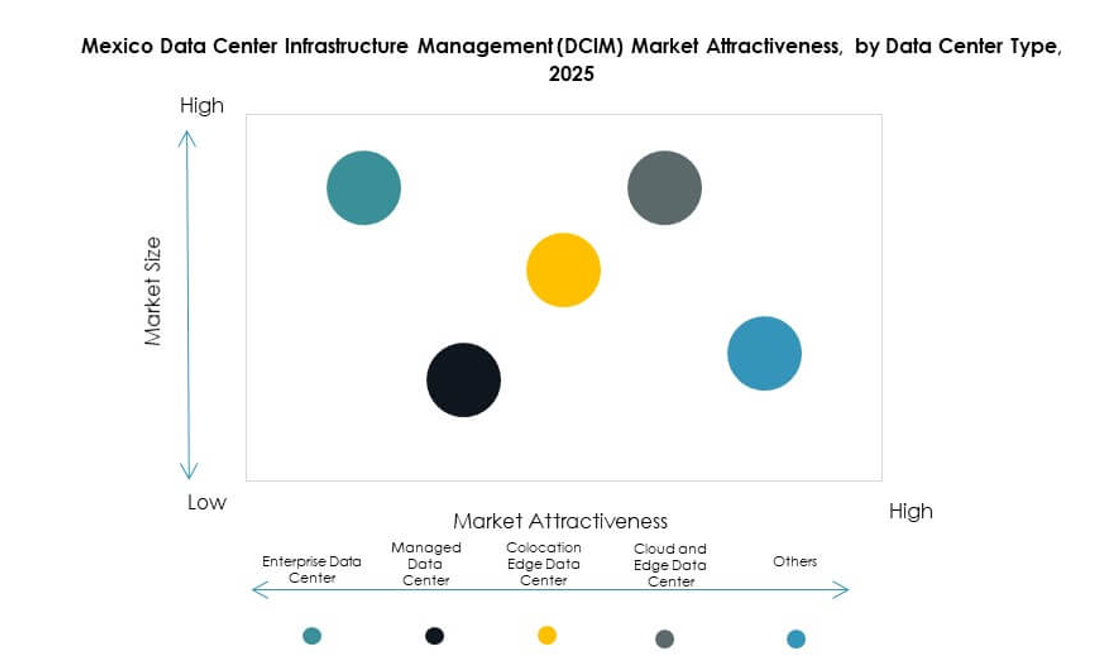

By Data Center Type

Cloud and edge data centers lead the Mexico Data Center Infrastructure Management (DCIM) Market with the largest share. Enterprises prefer these models to support latency-sensitive workloads and remote connectivity. Colocation centers remain vital for businesses outsourcing infrastructure management. Managed and enterprise data centers maintain presence but face slower growth compared to cloud-driven adoption. Vendors focus on providing DCIM features adaptable across all facility types. Edge adoption continues expanding with 5G rollout.

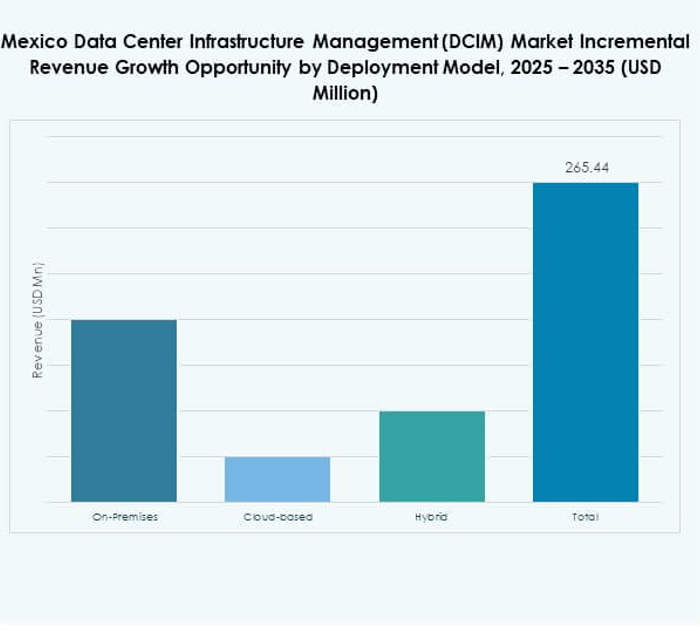

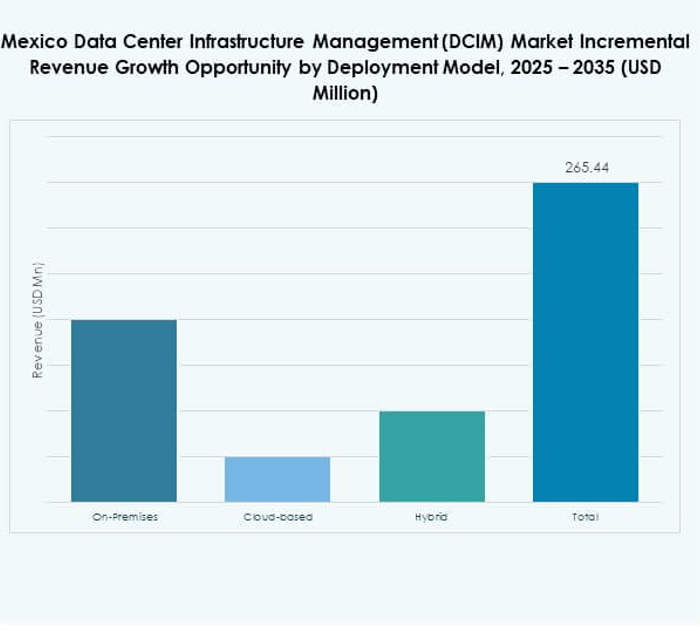

By Deployment Model

Cloud-based deployments dominate the Mexico Data Center Infrastructure Management (DCIM) Market, driven by flexibility and scalability benefits. Hybrid models grow rapidly as enterprises balance security needs with performance. On-premises deployments maintain demand in regulated industries requiring strict control. Vendors design modular DCIM platforms to serve diverse requirements. Enterprises prioritize cost-efficient cloud adoption for long-term operations. Hybrid adoption strengthens partnerships with hyperscale providers. Market growth reflects strong migration toward flexible and secure deployment models.

By Enterprise Size

Large enterprises dominate the Mexico Data Center Infrastructure Management (DCIM) Market, holding the majority share. These organizations invest in advanced DCIM solutions to manage complex operations. SMEs represent a growing segment due to digitalization initiatives. Vendors introduce affordable platforms tailored to SME budgets. It ensures adoption across broader industry verticals. Large enterprises drive early innovation adoption, setting benchmarks for efficiency. SMEs highlight demand for simplified and scalable platforms.

By Application / Use Case

Power monitoring and asset management lead the Mexico Data Center Infrastructure Management (DCIM) Market, reflecting critical demand for efficiency and uptime. Environmental monitoring gains traction with sustainability targets. Capacity management supports resource optimization in hybrid environments. BI and analytics provide real-time decision-making value. Enterprises invest in predictive tools for risk reduction. Vendors target multi-function platforms that integrate multiple use cases. Asset and power monitoring dominate due to direct impact on performance and costs.

By End User Industry

IT and telecommunications dominate the Mexico Data Center Infrastructure Management (DCIM) Market with the largest share. BFSI follows closely, requiring secure and compliant management. Healthcare shows strong growth with rising demand for digital patient records and connected devices. Retail and e-commerce adopt DCIM platforms for efficient scaling. Aerospace and defense prioritize security-focused management solutions. Energy and utilities embrace platforms for reliability and monitoring. Other sectors adopt at varied rates depending on digital readiness.

Regional Insights

Northern Mexico Driving Market Leadership With 42% Share

Northern Mexico leads the Mexico Data Center Infrastructure Management (DCIM) Market with 42% share. Proximity to the U.S. border supports strong cross-border connectivity. Investors focus on Monterrey and border cities for hyperscale and colocation facilities. The region benefits from reliable power availability and logistics infrastructure. Enterprises prefer this region for operational expansion. It attracts significant foreign investment. Northern Mexico remains central to cross-border data exchange and digital services.

- For instance, Equinix is developing its MO2 data center in Monterrey, located in Apodaca, Nuevo León. The facility is planned to open with two 1,200-square-meter data halls and has an expansion design for up to eight halls, positioning it as a major hub for cross-border digital connectivity.

Central Mexico Supporting Strong Growth With 35% Share

Central Mexico accounts for 35% of the Mexico Data Center Infrastructure Management (DCIM) Market. Mexico City and Querétaro emerge as core hubs for enterprise and colocation facilities. The area benefits from strong demand for cloud, AI, and fintech workloads. Investors expand capacity to meet rising digital service adoption. It gains relevance due to government and financial sector investments. Central Mexico strengthens national leadership in data services. Proximity to dense urban centers drives continuous growth.

- For instance, KIO Networks is expanding its Querétaro QRO2 facility to reach up to 12MW IT power capacity and 139,000 square feet of IT space by 2025, featuring robust connectivity via two diverse underground entry routes and more than 20 carrier providers to support high-demand workloads including AI and financial services.

Southern Mexico Emerging With 23% Share And Rising Infrastructure Investments

Southern Mexico captures 23% of the Mexico Data Center Infrastructure Management (DCIM) Market. Regions such as Yucatán and Oaxaca witness gradual adoption of infrastructure solutions. Renewable energy projects create opportunities for sustainable data center operations. Investors expand to untapped regions seeking lower costs. It provides strong potential for decentralized infrastructure adoption. Southern markets emerge as attractive alternatives for scaling operations. Growth in this subregion strengthens Mexico’s position in Latin America’s digital landscape.

Competitive Insights:

- Kio Networks

- Alestra

- Megacable Data Center

- Triara

- ABB Ltd.

- Cisco Systems, Inc.

- Device42, Inc.

- Eaton Corporation

- FNT GmbH

- Huawei Technologies Co., Ltd.

- IBM

- Schneider Electric SE

- Siemens AG

- HPE (Hewlett Packard Enterprise)

- Sunbird Inc.

- Delta Electronics

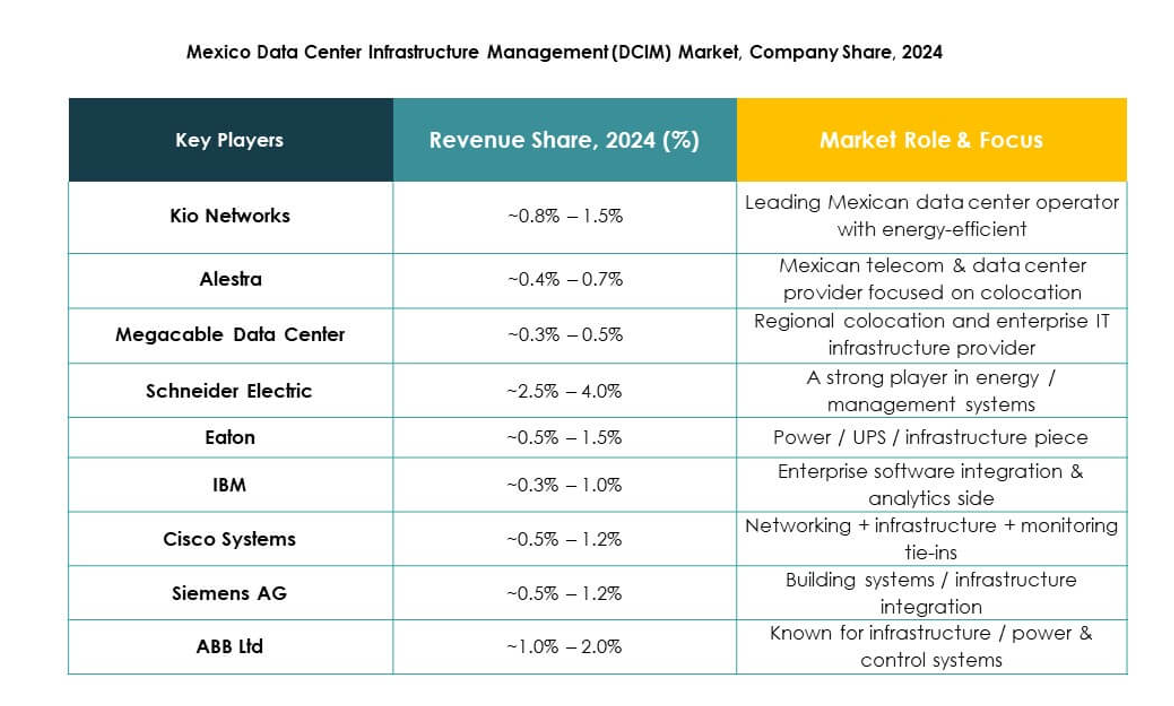

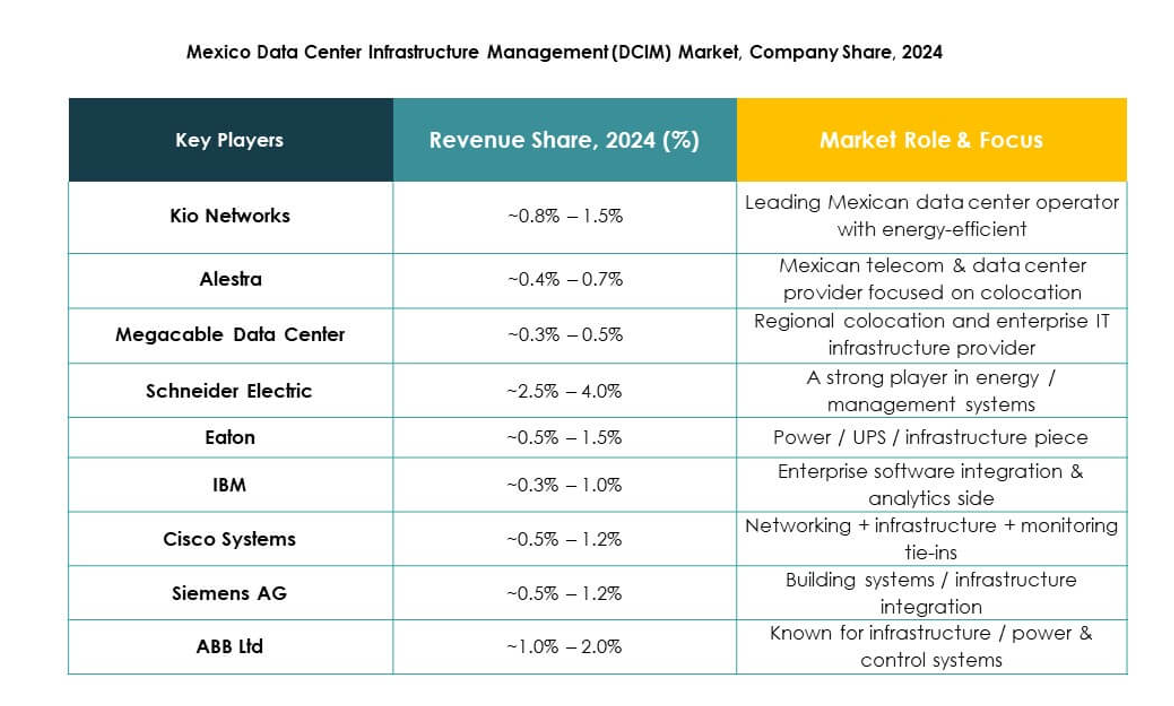

The competitive landscape of the Mexico Data Center Infrastructure Management (DCIM) Market is defined by a mix of global technology leaders and strong domestic providers. Local companies such as Kio Networks, Alestra, and Triara play a pivotal role by addressing regional compliance, connectivity, and customer-specific requirements. Global players including Schneider Electric, Huawei, IBM, Cisco, and HPE strengthen their positions through AI-driven platforms, predictive analytics, and hybrid-ready solutions. It reflects intense competition across software innovation, energy efficiency, and service integration. Partnerships, acquisitions, and sustainability-driven projects expand market reach. Vendors differentiate through scalability, interoperability, and security-focused features, shaping a dynamic ecosystem where both global expertise and local specialization drive adoption across industries.

Recent Developments:

- In September 2025, CloudHQ, a U.S.-based technology company, revealed plans for a $4.8 billion investment to build six new data centers in Querétaro, Mexico. The project, announced in a press event attended by Mexico’s president and economic leaders, aims to bolster the country’s artificial intelligence and cloud computing capabilities.

- In August 2025, ODATA, part of Aligned Data Centers, announced the launch of its fourth hyperscale data center in Mexico, named QR04, located near San Miguel de Allende in Querétaro. This new facility is designed to address surging demand for cloud and AI services and strengthens ODATA’s leadership in the Mexican data center market, completing their network of four interconnected hyperscale sites.

- In August 2025, Mexico Telecom Partners (MTP) inaugurated the second phase of its edge data center in Mérida. This development underscores MTP’s ongoing commitment to expanding critical digital infrastructure and meeting the escalating demands of enterprise and edge computing in the region. MTP’s data center network now includes one major enterprise site and 60 edge locations across 19 cities, with a combined capacity of 13MW, enhancing the resilience and reach of Mexico’s digital ecosystem.