Executive summary:

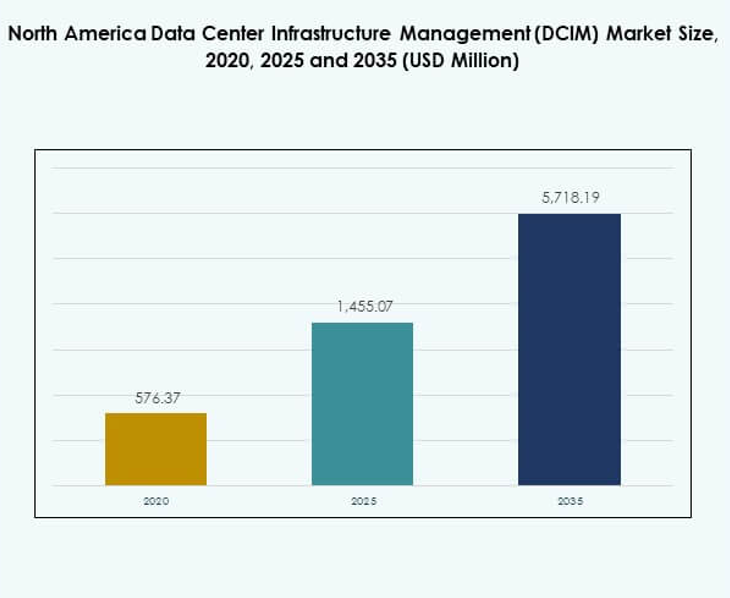

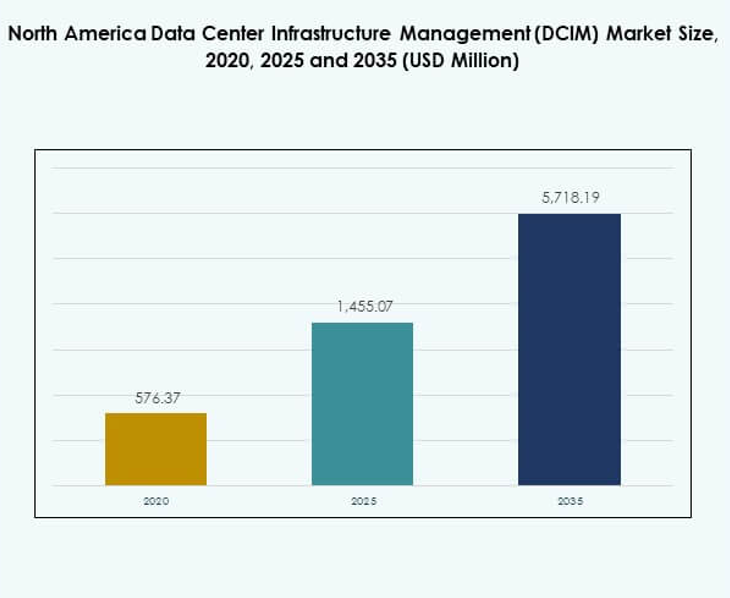

The North America Data Center Infrastructure Management (DCIM) Market size was valued at USD 576.37 million in 2020 to USD 1,455.07 million in 2025 and is anticipated to reach USD 5,718.19 million by 2035, at a CAGR of 16.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| North America Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 1,455.07 Million |

| North America Data Center Infrastructure Management (DCIM) Market, CAGR |

16.45% |

| North America Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 5,718.19 Million |

The market is driven by rapid adoption of automation, artificial intelligence, and advanced analytics to improve operational visibility and efficiency. Organizations prioritize energy optimization, predictive maintenance, and stronger compliance frameworks. It is strategically important for businesses seeking resilience, cost control, and scalability in managing diverse workloads. Investors view DCIM solutions as critical enablers of digital transformation, making the sector an attractive focus for long-term growth and innovation.

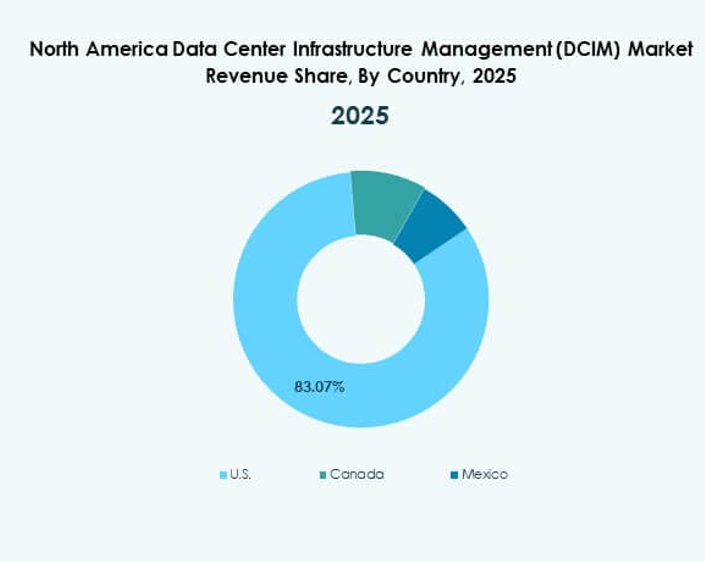

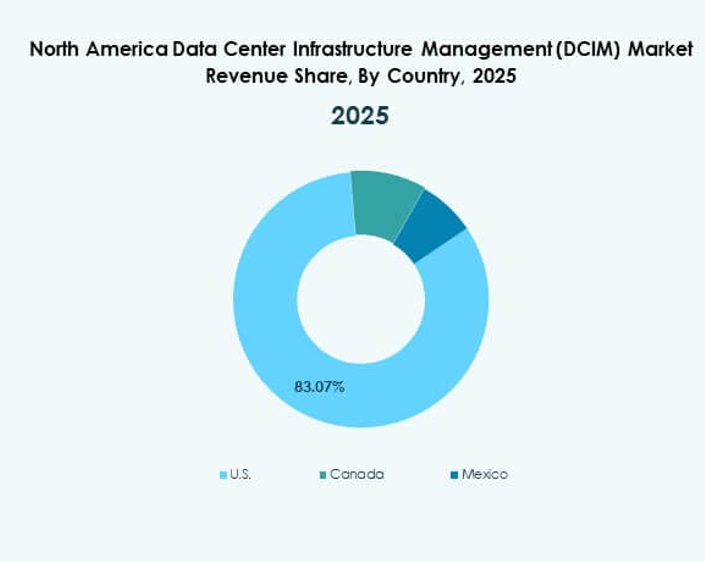

The United States leads the market with its concentration of hyperscale and colocation facilities supported by major cloud service providers. Canada is emerging as a fast-growing hub with strong sustainability initiatives and government-backed digital transformation strategies. Mexico is gaining traction with expanding colocation and cloud adoption to meet regional demand. Together, these subregions highlight a balanced mix of maturity, innovation, and growth opportunities across North America.

Market Drivers

Rising Adoption of AI-Driven Automation Across Data Center Operations

The North America Data Center Infrastructure Management (DCIM) Market is witnessing strong growth due to rapid adoption of artificial intelligence and automation. Operators use predictive analytics to reduce downtime and optimize resource utilization. AI-driven DCIM platforms enhance real-time monitoring of assets and improve decision-making for operators. Automated workflows lower manual intervention and increase operational efficiency across hyperscale and enterprise facilities. This driver is significant for enterprises aiming to cut costs and improve agility. Investors see long-term value in platforms that align with smart infrastructure strategies. It is shaping the competitive edge of data center businesses.

- For instance, in March 2024, Schneider Electric launched an automated sustainability reporting feature in its EcoStruxure IT DCIM platform, which enabled its Lexington, Kentucky, facility to reduce energy consumption by 30% in just six months through automated insight into asset usage and predictive analytics workflows.

Growing Emphasis on Energy Efficiency and Sustainable Infrastructure

Energy efficiency is a core driver across the North America Data Center Infrastructure Management (DCIM) Market as sustainability regulations become stricter. Operators integrate renewable-powered cooling systems and optimize energy usage with intelligent DCIM software. Advanced power monitoring tools allow operators to reduce energy waste and ensure compliance with green standards. Governments and enterprises prioritize reducing carbon footprints, creating demand for next-generation energy-efficient DCIM. It provides both regulatory compliance and cost savings for operators. Businesses adopting sustainability standards gain better brand value and customer trust. This driver strengthens investor confidence in clean technology adoption.

Increasing Complexity of Multi-Cloud and Hybrid Environments

The adoption of multi-cloud and hybrid models is driving investment in advanced DCIM platforms. The North America Data Center Infrastructure Management (DCIM) Market benefits from software that can track, manage, and optimize resources across diverse infrastructures. Enterprises require centralized visibility for workloads spread across on-premises, cloud, and edge sites. It enables IT managers to streamline operations while avoiding resource bottlenecks. Hybrid environments demand stronger integration between hardware, applications, and network layers. Investors consider this a key factor for long-term scalability and resilience. This driver enhances agility and reduces risks in evolving digital ecosystems.

Rising Importance of Data Security, Compliance, and Regulatory Demands

Cybersecurity and compliance requirements are increasingly shaping the North America Data Center Infrastructure Management (DCIM) Market. Operators use DCIM platforms with integrated security monitoring to protect mission-critical workloads. Regulations on financial data, healthcare records, and government operations enforce stricter control on infrastructure. It positions DCIM as a strategic layer to safeguard data integrity and compliance. Enterprises investing in DCIM gain stronger audit readiness and improved risk management capabilities. This driver provides investors with confidence in data protection frameworks. It is vital for sustaining trust among regulators and customers in a highly competitive environment.

- For instance, a large U.S. healthcare organization managing over 5,000 cabinets and 300 IDF sites deployed Sunbird DCIM to centralize asset management, which resulted in reduced risk of outage, improved audit readiness, and significant cost savings, as documented in Sunbird’s published case study for the healthcare sector.

Market Trends

Expansion of Edge Data Centers Supporting Emerging Workloads

The North America Data Center Infrastructure Management (DCIM) Market is experiencing a strong trend in edge deployment. Edge facilities support low-latency applications in healthcare, retail, and telecom. It enables seamless real-time processing for AI, IoT, and 5G-powered services. DCIM platforms are evolving to manage distributed sites with high reliability. Operators are deploying scalable solutions to monitor power, capacity, and performance at the edge. This trend creates new opportunities for providers and investors. It reflects how digital transformation reshapes infrastructure management strategies.

Integration of Digital Twins for Real-Time Simulation and Planning

A notable trend in the North America Data Center Infrastructure Management (DCIM) Market is the adoption of digital twins. Operators use these technologies to simulate energy usage, cooling efficiency, and asset lifecycle in real time. It helps enterprises reduce risks before making infrastructure changes. Digital twins also support predictive maintenance by analyzing system behaviors under different scenarios. This trend accelerates innovation in DCIM solutions across hyperscale operators. Investors recognize its value in reducing downtime and ensuring capacity planning accuracy. It is redefining operational strategies in modernized facilities.

Growing Popularity of AI-Enabled Sustainability Dashboards

Operators increasingly deploy AI-enabled sustainability dashboards in the North America Data Center Infrastructure Management (DCIM) Market. These dashboards measure water usage, carbon intensity, and renewable energy integration. It empowers operators to comply with ESG reporting standards. Businesses benefit from transparent monitoring of sustainability goals, which strengthens investor trust. Dashboards also provide actionable insights that reduce energy waste. This trend highlights the importance of integrating environmental responsibility with profitability. It reinforces the market’s shift toward next-generation green infrastructure.

Rising Demand for Remote Infrastructure Visibility and Control

The North America Data Center Infrastructure Management (DCIM) Market is shifting toward solutions that provide remote monitoring. Cloud-based DCIM platforms offer operators control over multiple facilities from centralized dashboards. It enhances visibility into capacity, power usage, and asset performance. Remote visibility has become critical due to distributed workloads and global operations. Operators rely on real-time alerts and automation to maintain uptime. This trend ensures scalability while lowering on-site dependency. It highlights the market’s responsiveness to changing business continuity needs.

Market Challenges

High Implementation Costs and Integration Complexities Across Diverse Infrastructures

The North America Data Center Infrastructure Management (DCIM) Market faces challenges related to high upfront investment and integration barriers. Enterprises struggle with the cost of licensing, customization, and training required for DCIM systems. It becomes complex when integrating with legacy systems, hybrid models, and multi-vendor equipment. Small and medium enterprises face stronger budget limitations compared to large corporations. Interoperability remains a hurdle when aligning hardware and software components. Vendors are under pressure to offer modular pricing and simplified deployment. These challenges slow adoption rates in certain sectors.

Shortage of Skilled Workforce to Operate Advanced DCIM Platforms

Another challenge for the North America Data Center Infrastructure Management (DCIM) Market is the lack of skilled professionals. Operating AI-driven, hybrid-ready DCIM systems requires advanced IT, cybersecurity, and analytics expertise. It is difficult for enterprises to recruit and retain staff with such capabilities. This shortage impacts implementation speed and long-term ROI. Training costs rise as organizations attempt to build in-house capabilities. The gap is more evident in smaller regions with limited technical resources. These challenges influence investor caution in funding large-scale rollouts. Vendors must bridge the skills gap with automation and managed services.

Market Opportunities

Expanding Role of AI and Machine Learning in Predictive Operations

The North America Data Center Infrastructure Management (DCIM) Market has strong opportunities in AI-powered predictive operations. AI helps identify anomalies, forecast equipment failures, and optimize workload distribution. It strengthens resilience for hyperscale operators managing mission-critical workloads. Enterprises can reduce downtime and maintenance costs while improving agility. It is an area where investors anticipate long-term returns due to the need for intelligence-driven infrastructure. This opportunity supports both mature and emerging operators across the region.

Rising Demand for Cloud-Native DCIM Solutions Among Enterprises

Cloud-native DCIM platforms present a significant growth opportunity in the North America Data Center Infrastructure Management (DCIM) Market. Enterprises seek scalable, subscription-based models that align with hybrid and multi-cloud strategies. It reduces upfront investments and offers remote management capabilities. Vendors offering SaaS-based DCIM attract businesses shifting from traditional systems. Investors see recurring revenue potential in these platforms. This opportunity will expand with increasing digitalization across industries. It is shaping the competitive direction of solution providers in the region.

Market Segmentation

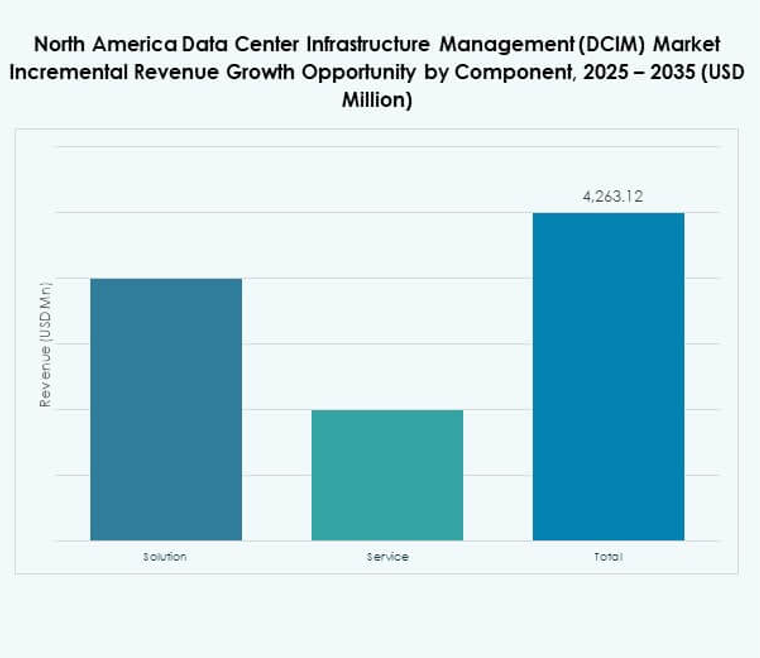

By Component

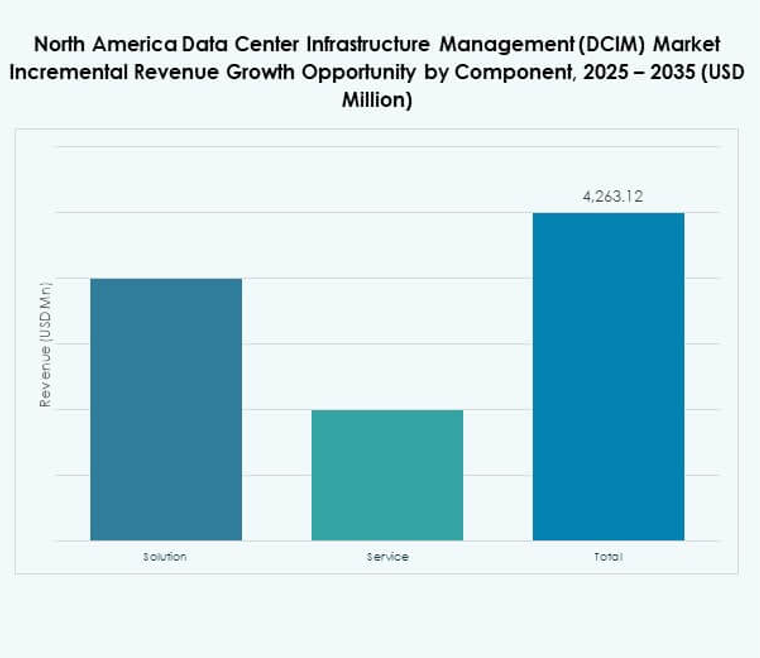

Solutions hold the dominant share in the North America Data Center Infrastructure Management (DCIM) Market, driven by demand for integrated monitoring and optimization tools. Services are also growing as enterprises seek managed support for complex infrastructure. Solutions provide scalability, centralized visibility, and better ROI for hyperscale operators.

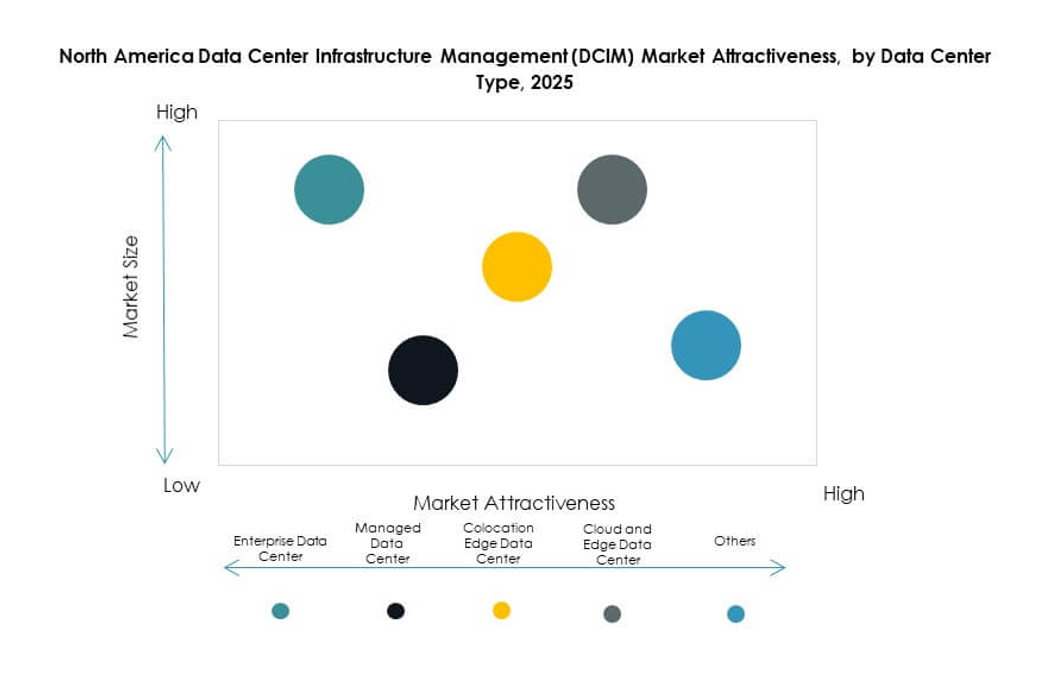

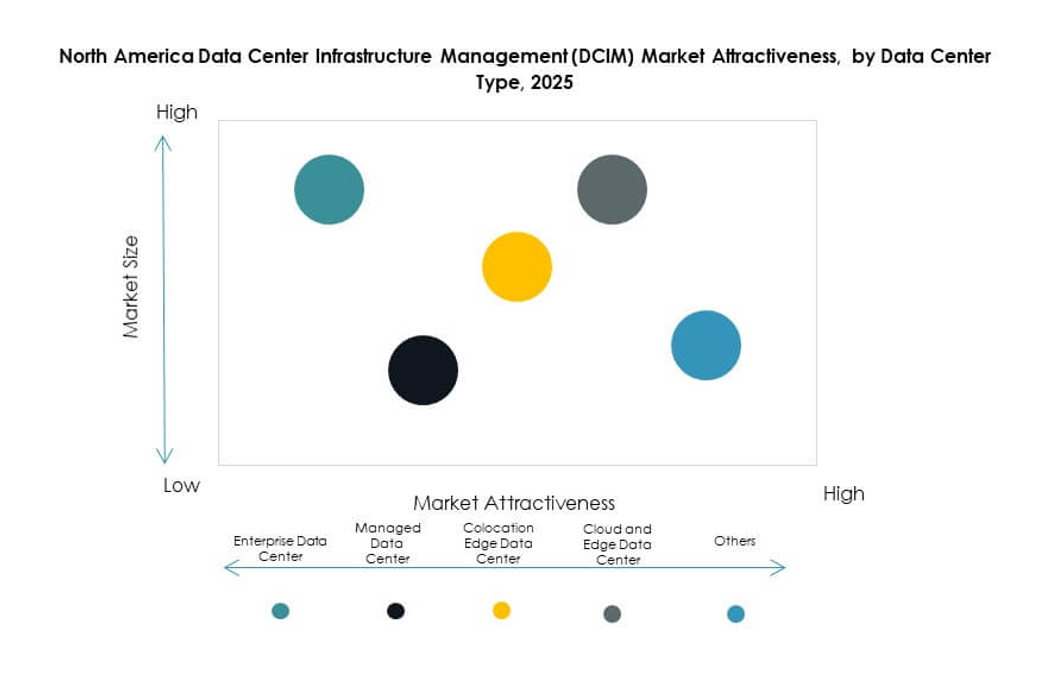

By Data Center Type

Cloud and edge data centers dominate the North America Data Center Infrastructure Management (DCIM) Market due to strong adoption by hyperscale providers and telecom operators. Managed and colocation facilities are also expanding with enterprise outsourcing. It strengthens the market’s hybrid and distributed model adoption.

By Deployment Model

Cloud-based deployment is emerging as the fastest-growing model in the North America Data Center Infrastructure Management (DCIM) Market. On-premises models remain critical for security-focused industries. Hybrid models provide flexibility, allowing enterprises to balance control with scalability.

By Enterprise Size

Large enterprises dominate the North America Data Center Infrastructure Management (DCIM) Market as they require advanced automation and integration tools. Small and medium enterprises are adopting cloud-based DCIM to lower costs and improve scalability. Vendors targeting SMEs with flexible pricing see growing traction.

By Application / Use Case

Power monitoring leads the North America Data Center Infrastructure Management (DCIM) Market as energy optimization becomes a top priority. Asset and capacity management are also critical, helping enterprises plan and extend infrastructure lifecycle. BI and analysis gain importance as decision-makers require data-driven insights.

By End User Industry

IT and telecommunications hold the largest share of the North America Data Center Infrastructure Management (DCIM) Market. BFSI and healthcare sectors are rapidly expanding adoption due to regulatory and operational needs. Retail, energy, and defense industries also contribute to market growth with digital expansion.

Regional Insights

United States Leading with Strongest Market Share

The United States accounts for nearly 72% share of the North America Data Center Infrastructure Management (DCIM) Market. It leads due to the concentration of hyperscale data centers, global cloud providers, and strong digital infrastructure. It is supported by heavy investment in AI, automation, and sustainability-driven initiatives. The U.S. remains the center for technological innovation and sets standards for the region.

- For instance, in September 2025, Microsoft announced a total of $7 billion investment in two AI-enabled hyperscale data centers in Wisconsin. The data centers will house hundreds of thousands of Nvidia chips for AI workloads and will be balanced by a new solar farm providing 250 MW of carbon-free energy. Over half of Microsoft’s announced $80 billion global data center investment for 2025 is earmarked for U.S. facilities, strengthening its leadership in hyperscale infrastructure.

Canada Emerging with Accelerated Growth

Canada holds a 19% share in the North America Data Center Infrastructure Management (DCIM) Market. It is driven by government-backed digital strategies, renewable-powered data centers, and increased enterprise adoption. Montreal and Toronto are major hubs with expanding colocation and hyperscale activity. Canada’s growth outlook remains strong as it strengthens its position as a sustainable data center destination.

- For instance, Cologix expanded its Canadian operations in September 2025, acquiring full ownership of the TOR4 and TOR5 hyperscale data centers in Toronto. This enhancement brought their Canadian portfolio to 22 data centers providing 1,057,000 square feet of space and 94 MW of power, alongside the largest public cloud onramps ecosystem in the country with more than 350 networks and 200+ cloud providers.

Mexico Gaining Momentum in Regional Expansion

Mexico represents 9% share of the North America Data Center Infrastructure Management (DCIM) Market. It benefits from multinational investments in colocation and cloud facilities to serve Latin American demand. Mexico City and Querétaro are emerging as regional hubs. It is becoming strategically important for enterprises seeking connectivity and lower operating costs in the region.

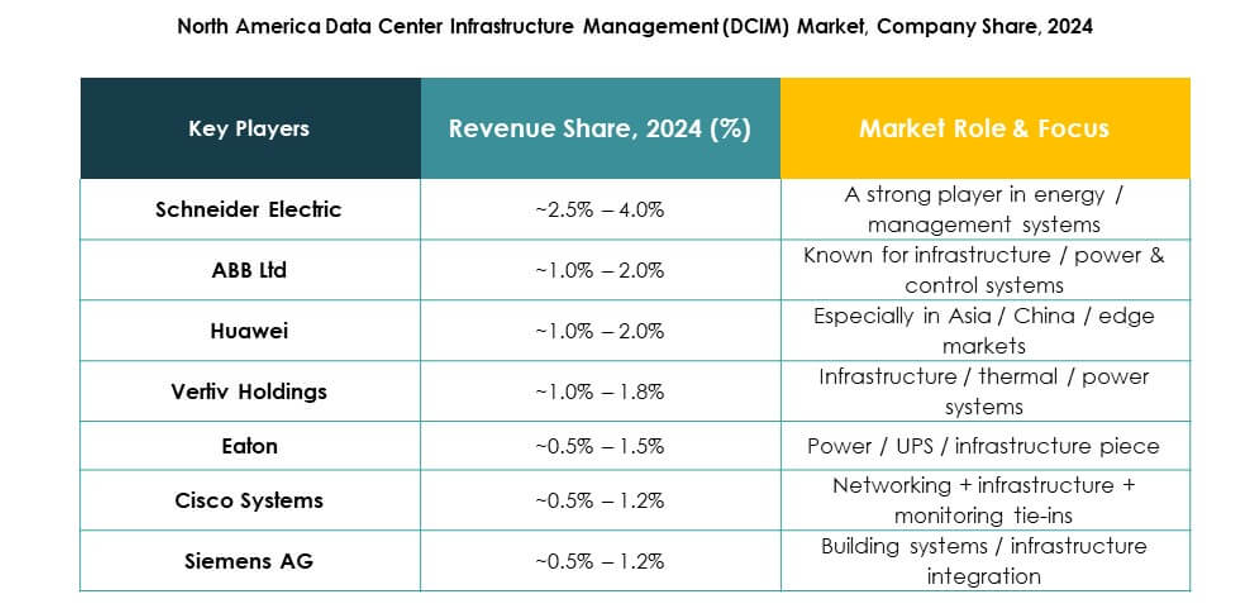

Competitive Insights:

- ABB Ltd.

- Cisco Systems, Inc.

- Device42, Inc.

- Eaton Corporation

- FNT GmbH

- Huawei Technologies Co., Ltd.

- IBM

- Schneider Electric SE

- Siemens AG

- HPE (Hewlett Packard Enterprise)

- Sunbird Inc.

- Vertiv Holdings

- Delta Electronics

- Nlyte Software

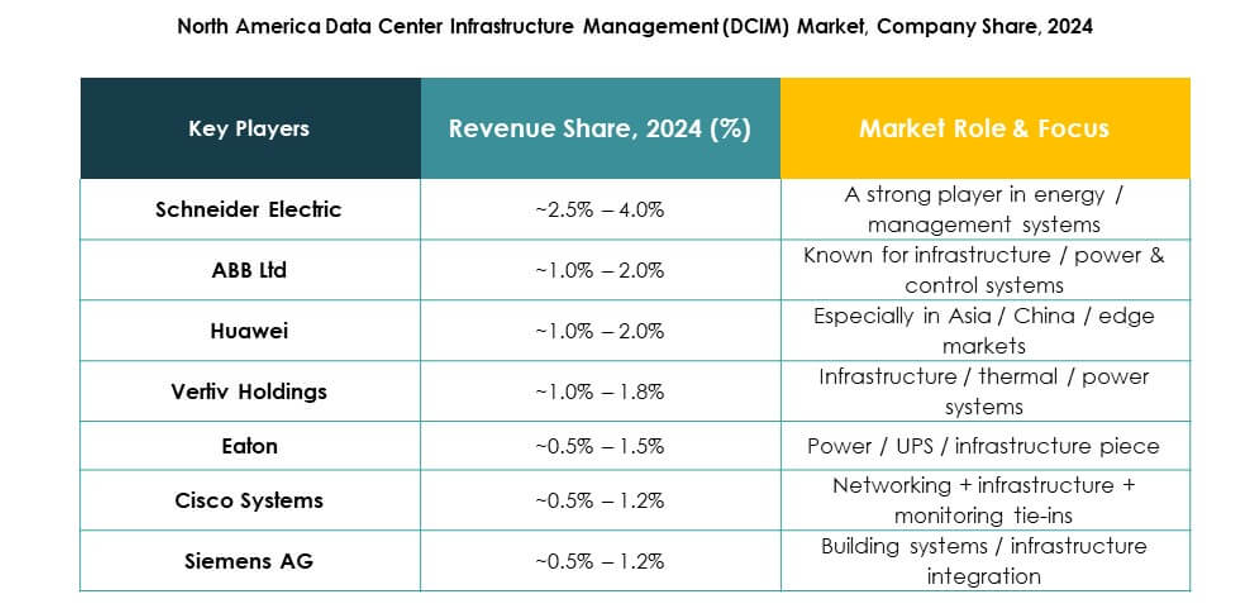

The competitive landscape of the North America Data Center Infrastructure Management (DCIM) Market is defined by a mix of global leaders, niche specialists, and regional innovators. Large corporations like Schneider Electric, Vertiv, and ABB dominate with end-to-end DCIM platforms integrated into critical power and cooling solutions. Cisco, IBM, and HPE strengthen their positions through advanced analytics, networking, and hybrid cloud capabilities. Sunbird, Nlyte, and Device42 focus on asset and capacity management, offering cost-efficient and scalable tools for enterprises. Eaton, Siemens, and Delta emphasize energy optimization and intelligent infrastructure design. It is shaped by continuous innovation, ESG alignment, and partnerships with hyperscale operators, which ensure vendors remain competitive in an evolving market ecosystem.

Recent Developments:

- In Dec 2025, Siemens acquired Danfoss Fire Safety to expand its data center infrastructure management capabilities in North America, integrating environmental controls and advanced sustainability features into its DCIM stack. This acquisition is expected to enhance Siemens’ offerings for managing complex data center operations including fire safety and environmental monitoring as demand for sustainable, robust solutions continues to rise across the North American market.