Executive summary:

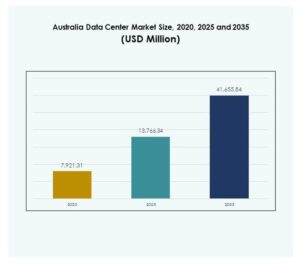

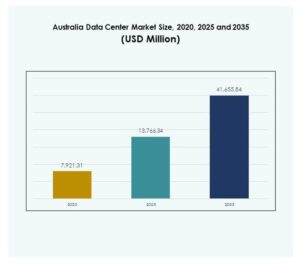

The Australia Data Center Market size was valued at USD 7,921.31 million in 2020 to USD 13,766.34 million in 2025 and is anticipated to reach USD 41,655.84 million by 2035, at a CAGR of 11.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Australia Data Center Market Size 2025 |

USD 13,766.34 Million |

| Australia Data Center Market, CAGR |

11.63% |

| Australia Data Center Market Size 2035 |

USD 41,655.84 Million |

Market expansion is supported by rising cloud adoption, enterprise digitalization, and demand for secure, scalable infrastructure. It reflects growing integration of AI, IoT, and advanced analytics, which require high-performance facilities. Businesses depend on efficient data centers to enhance customer experiences, improve operational resilience, and achieve sustainability goals. The Australia Data Center Market strengthens investor confidence by positioning itself as a critical enabler of long-term digital transformation.

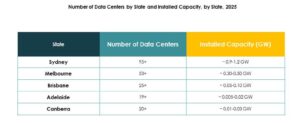

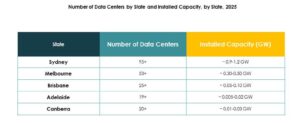

Sydney and Melbourne lead the market due to their strong connectivity, enterprise density, and hyperscale presence. It highlights Eastern Australia as the primary hub, while Perth emerges as a secondary growth region supported by subsea cable projects and industrial digitalization. Brisbane also gains traction from localized demand and strategic investments. These regions collectively drive the Australia Data Center Market by building a balanced and distributed infrastructure ecosystem.

Market Drivers

Rapid Growth of Cloud Computing and Scalable Digital Infrastructure

The Australia Data Center Market is witnessing significant growth due to rising adoption of cloud computing across industries. Enterprises are moving workloads to cloud environments to improve scalability, reduce costs, and enhance performance. It drives demand for hyperscale facilities with robust infrastructure. Cloud service providers expand capacity to support AI, IoT, and big data analytics. The market’s role in enabling secure storage and processing makes it vital for enterprise operations. Investors view this sector as a strategic pillar of digital transformation.

Integration of Advanced Technologies for Efficiency and Reliability

The adoption of automation, artificial intelligence, and advanced monitoring systems is reshaping operations. Organizations implement DCIM tools to optimize energy use and streamline facility management. It ensures improved reliability, reduced downtime, and operational transparency. Data-driven insights empower operators to manage critical assets effectively. Businesses prioritize efficiency to meet sustainability goals and reduce operating costs. The Australia Data Center Market reflects this shift through investments in innovative technologies. Investors benefit from facilities designed with efficiency and resilience as key performance drivers.

- For instance, NEXTDC’s M2 Melbourne data center is Tier IV certified and records a PUE of about 1.28 (annual average), backed by fault-tolerant infrastructure and SO Parallel Bus redundancy.

Rising Enterprise Digitalization and Demand for High-Performance Computing

Enterprises across industries are embracing digitalization strategies to remain competitive. Growing reliance on e-commerce, online banking, and digital services pushes organizations toward data-driven models. It creates the need for high-performance computing environments capable of handling complex workloads. Healthcare, finance, and retail sectors particularly demand secure and scalable infrastructure. The Australia Data Center Market plays a strategic role by enabling enterprises to expand digital offerings. Businesses view data centers as critical enablers of operational growth and customer engagement.

Focus on Sustainability and Renewable Energy Integration in Operations

Sustainability is now a central driver in data center operations across Australia. Operators prioritize renewable energy sources to reduce carbon footprints and align with government targets. It strengthens investor confidence and appeals to enterprises with ESG commitments. Energy-efficient cooling and advanced waste heat reuse are gaining adoption. The Australia Data Center Market positions itself as a leader in sustainable digital infrastructure. For investors, facilities aligned with green energy adoption signal long-term stability. This focus creates strategic opportunities to enhance competitiveness while meeting global sustainability standards.

- For instance, AirTrunk’s SYD2 facility in Sydney began a 70 MW expansion in 2023. It employs high-temperature air-cooled chillers, customized fan wall units, and is designed to achieve a PUE of 1.15, reducing cooling energy use by about 20 %.

Market Trends

Expansion of Hyperscale and Colocation Facilities Across Key Regions

The Australia Data Center Market is experiencing rapid expansion of hyperscale and colocation facilities. Hyperscale providers increase capacity to meet demand from global enterprises and digital platforms. It also attracts colocation growth as SMEs seek cost-effective and flexible hosting solutions. Providers design modular infrastructure to ensure scalability and faster deployments. The trend is reinforced by rising enterprise demand for shared facilities with strong connectivity. This dual growth positions Australia as a critical hub for regional and international data traffic.

Shift Toward Edge and Modular Data Centers to Enhance Latency Reduction

Edge and modular facilities are gaining momentum to improve latency and meet localized demand. Businesses require proximity-based solutions to support IoT, 5G, and AI-driven workloads. It pushes operators to expand edge capacity near urban and industrial centers. Modular designs reduce construction time and allow flexible scalability. Enterprises adopt edge models to enhance customer experience through faster service delivery. The Australia Data Center Market highlights this trend with strong investments in edge deployments. These facilities improve resilience while extending market reach across regional areas.

Growth of Hybrid Deployment Models Supporting Enterprise Flexibility

Hybrid models are emerging as a preferred choice for enterprises seeking balanced infrastructure. Organizations combine on-premises systems with cloud-based environments to ensure agility and compliance. It allows businesses to retain control over critical data while leveraging cloud scalability. Service providers expand hybrid offerings to address evolving customer needs. Hybrid adoption strengthens disaster recovery and multi-cloud integration capabilities. The Australia Data Center Market benefits from enterprises’ demand for flexible deployment. Investors see hybrid strategies as a key driver of long-term infrastructure commitments.

Increasing Emphasis on Cybersecurity and Compliance in Infrastructure Planning

Cybersecurity and regulatory compliance are rising as dominant trends within facility design. Enterprises face heightened risks due to data breaches and evolving cyber threats. It compels operators to adopt advanced security tools, monitoring systems, and regulatory frameworks. Australia enforces strict data protection standards that shape operational strategies. Businesses view secure facilities as essential to maintain customer trust. The Australia Data Center Market reflects this through widespread compliance investments. Strengthened cyber defenses and regulatory adherence enhance competitiveness and attract global investors.

Market Challenges

Rising Energy Consumption and Pressure to Balance Sustainability Goals

The Australia Data Center Market faces challenges linked to energy consumption growth. Facilities consume large amounts of electricity, creating strain on national grids. It raises concerns over sustainability and long-term cost efficiency. Operators must adopt advanced cooling, efficient servers, and renewable integration to address these concerns. Balancing demand growth with energy efficiency remains difficult for providers. The challenge intensifies as enterprises require more high-density computing. Investors seek assurance that facilities can manage rising power needs responsibly. This pressure creates long-term risks for sustainability-focused operations.

Intensifying Competition and High Infrastructure Investment Requirements

Competition in the Australia Data Center Market continues to increase with new entrants and expansions. Hyperscale and colocation providers compete aggressively for enterprise clients and cloud partners. It requires large-scale investments in infrastructure, land, and connectivity. Barriers to entry remain high due to capital requirements and strict compliance standards. Smaller players struggle to compete with multinational operators offering scale advantages. Rising competition compresses margins and pushes providers to innovate rapidly. For investors, sustaining profitability amid high capital intensity is a key concern.

Market Opportunities

Expansion into Edge and AI-Driven Infrastructure to Support Next-Gen Workloads

The Australia Data Center Market presents opportunities through investments in edge and AI-ready infrastructure. Enterprises demand faster data processing closer to end-users. It encourages operators to deploy edge facilities integrated with AI-powered systems. AI workloads in healthcare, finance, and retail create demand for specialized infrastructure. Providers that enable advanced analytics and low-latency services gain strong positioning. This expansion supports enterprises’ digital transformation and investors’ pursuit of growth opportunities.

Growing Demand from Cloud Services and Government Digitalization Initiatives

Government initiatives for digital transformation create new growth opportunities for data centers. Cloud adoption continues to accelerate across SMEs and large enterprises. It strengthens demand for scalable colocation and hyperscale environments. Public sector digitalization drives reliance on secure and compliant infrastructure. The Australia Data Center Market benefits as cloud and government contracts fuel sustained expansion. Investors and businesses leverage these opportunities to build long-term market presence.

Market Segmentation

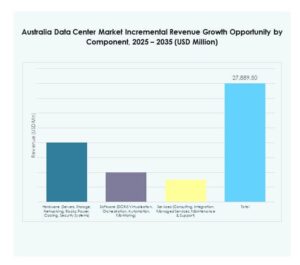

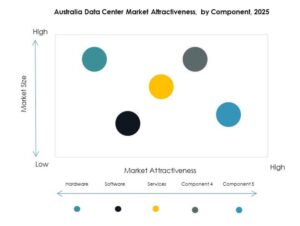

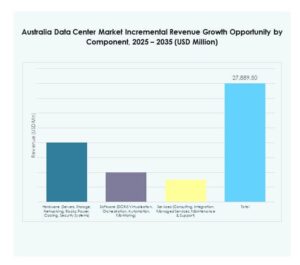

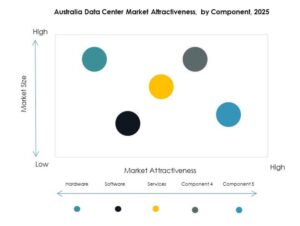

By Component

Hardware dominates the Australia Data Center Market due to demand for servers, storage, and cooling systems. Enterprises rely on hardware to support high-performance computing, AI, and cloud-based services. It drives strong adoption of efficient power and cooling technologies. Software solutions such as DCIM and virtualization gain traction for improving operational efficiency. Services like consulting and managed solutions expand as enterprises seek tailored support. Hardware maintains the largest share while software and services show steady growth.

By Data Center Type

Hyperscale facilities lead the Australia Data Center Market with rising demand from cloud providers. These large-scale facilities support AI, IoT, and big data. Colocation remains significant, offering cost-efficient solutions for SMEs and enterprises. Edge and modular centers expand to address latency-sensitive applications. Enterprise data centers retain relevance for critical workloads requiring control and compliance. Cloud and mega facilities also gain importance with increasing digital service adoption. Hyperscale dominates but edge and cloud models are emerging strongly.

By Deployment Model

Hybrid deployment models hold a strong share in the Australia Data Center Market. Enterprises combine on-premises systems with cloud environments for flexibility and compliance. Cloud-based adoption accelerates among SMEs seeking scalability. On-premises models persist for highly regulated sectors. Hybrid deployments attract investment due to resilience and agility. It supports disaster recovery strategies and enables multi-cloud integration. Hybrid remains the preferred choice, supported by enterprises balancing performance and control.

By Enterprise Size

Large enterprises dominate the Australia Data Center Market due to high demand for scalable infrastructure. They invest in hyperscale and hybrid models to support global operations. SMEs adopt colocation and cloud-based models to minimize costs and enhance scalability. It enables SMEs to access enterprise-grade infrastructure without large capital outlay. Both segments contribute to market expansion, but large enterprises lead adoption. The growing digitalization of SMEs further supports future growth opportunities.

By Application / Use Case

IT & Telecom leads the Australia Data Center Market due to strong connectivity and digital service demand. BFSI also accounts for significant share driven by secure and compliant infrastructure requirements. Healthcare and government adopt advanced facilities to enable digital transformation and secure data. Retail, e-commerce, and media sectors benefit from scalability for customer-facing services. Manufacturing industries adopt infrastructure to enable Industry 4.0 and automation. It reflects the broad adoption of data centers across diverse applications.

By End User Industry

Cloud service providers dominate the Australia Data Center Market by driving hyperscale expansion. Enterprises contribute with adoption of hybrid and colocation services. Colocation providers remain important in offering shared, cost-effective infrastructure. Government agencies drive demand through public sector digitalization. It highlights the diverse user base shaping the market landscape. Cloud service providers retain the largest share as digital platforms expand operations.

Regional Insights

Eastern Australia Leading With Highest Market Share

Eastern Australia accounts for 52% share of the Australia Data Center Market. Sydney and Melbourne dominate due to strong enterprise presence, global cloud investments, and superior connectivity. It serves as the core hub for hyperscale, colocation, and government-led projects. Renewable energy adoption and strategic coastal locations further boost competitiveness. Eastern Australia remains the central growth engine, attracting multinational investments and expanding regional digital capabilities.

- For instance, in FY25 NEXTDC commissioned 42.7 MW of new built capacity and had 121 MW under development, while its mainland state capital facilities maintain Uptime Institute Tier IV certification.

Western Australia Emerging as a Secondary Growth Hub

Western Australia holds 27% share of the Australia Data Center Market. Perth leads expansion due to mining sector digitalization, subsea cable connectivity, and edge adoption. It attracts investments from enterprises seeking localized infrastructure. Operators emphasize renewable integration and modular deployments to address rising demand. Western Australia emerges as a key regional hub supporting industrial and enterprise growth.

- For instance, in August 2025, CDC Data Centres announced plans for a 200 MW campus near Perth, with AUD 415 million allocated for the first stage, designed with closed-loop liquid cooling systems that achieve zero water consumption, and scheduled to be operational from 2026.

Northern and Southern Australia Developing With Smaller Market Shares

Northern and Southern Australia collectively account for 21% share of the Australia Data Center Market. These regions are developing with localized data needs, government projects, and SME adoption. It highlights opportunities for edge and modular deployments. Limited population density slows large-scale expansions but encourages tailored infrastructure investments. Growth in these subregions strengthens overall national coverage and supports distributed infrastructure strategies.

Competitive Insights:

- NEXTDC Ltd

- Equinix Australia

- Macquarie Telecom

- Fujitsu Australia

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Australia Data Center Market features intense competition among global hyperscale providers and domestic operators. NEXTDC and Macquarie Telecom strengthen their presence with colocation and enterprise-focused services, while Equinix and Digital Realty expand capacity for international connectivity. It benefits from strong investment strategies by global cloud leaders such as AWS, Microsoft, and Google, who continue to scale infrastructure for advanced workloads and hybrid deployments. NTT Communications and Fujitsu enhance competitiveness by offering managed services and regional expertise. It highlights a balanced mix of multinational providers and local specialists driving innovation, energy efficiency, and customer-centric solutions. The competitive environment pushes players to differentiate through green initiatives, modular expansion, and advanced digital infrastructure capabilities.

Recent Developments:

- In September 2025, construction began on a new Amazon data center located in western Sydney, highlighting Amazon’s ongoing commitment to expand infrastructure in Australia and cater to increasing demand for cloud and AI solutions in the region.

- In early September 2025, NextDC announced its search for a strategic partner for a major joint venture in Sydney, aiming to add 850MW of data center capacity over the next decade with a targeted investment of AU$15 billion, marking one of the largest industry expansion plans in Australia to date.

- In August 2025, DocuSign revealed plans to launch a local data center in Australia during the fourth quarter of the year, signifying a strategic initiative to improve regional data residency and support service reliability for its Australian clientele.

- In July 2025, Bloomreach expanded its operations by launching a new ANZ data center, enabling local brands to store customer data within Australia and bolster compliance with modern privacy standards while enhancing user experience through reduced latency.