Executive summary:

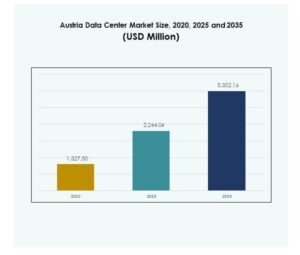

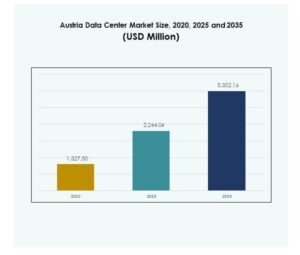

The Austria Data Center Market size was valued at USD 1,327.50 million in 2020 to USD 2,244.04 million in 2025 and is anticipated to reach USD 5,302.16 million by 2035, at a CAGR of 8.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Austria Data Center Market Size 2025 |

USD 2,244.04 Million |

| Austria Data Center Market, CAGR |

8.94% |

| Austria Data Center Market Size 2035 |

USD 5,302.16 Million |

Growth in the Austria Data Center Market is driven by strong adoption of cloud services, AI, and IoT technologies across industries. Enterprises are modernizing infrastructure to handle rising data volumes and ensure secure storage. Innovation in energy-efficient cooling, modular designs, and automation supports operational efficiency. The market plays a strategic role for investors and businesses by enabling digital transformation, compliance with EU regulations, and long-term competitiveness in a data-driven economy.

Regionally, Western Austria leads due to Vienna’s role as a financial and digital hub, supported by advanced connectivity and hyperscale investments. Central Austria shows growth momentum from manufacturing and logistics-driven demand for hybrid solutions. Eastern Austria emerges with public sector projects and localized applications in healthcare and education. Together, these regions strengthen the Austria Data Center Market by balancing mature infrastructure with new growth opportunities.

Market Drivers

Growing Demand for Advanced Digital Infrastructure and Data-Intensive Applications

The Austria Data Center Market is fueled by rising demand for digital infrastructure as industries scale digital operations. Businesses in finance, healthcare, retail, and telecom depend on secure data processing, storage, and real-time analytics. Growing adoption of AI and IoT increases workload demands on existing systems. It requires stronger network resilience and efficient data management. Enterprises prioritize uptime, reliability, and disaster recovery, driving investment. Cloud adoption accelerates the need for modern centers with higher scalability. Investors recognize the sector as a strategic digital backbone, ensuring long-term market relevance.

- For example, Interxion, a Digital Realty company, acquired a 22,000 m² land parcel in Vienna to develop up to 40 MW of additional IT capacity, expanding its existing campus that connects to over 120 carriers and provides direct access to seven global cloud platforms.

Rapid Adoption of Cloud Services and Virtualization Across Enterprises

The Austria Data Center Market benefits from growing adoption of cloud computing and virtualization technologies. Enterprises use hybrid and multi-cloud models to balance flexibility, performance, and cost efficiency. Virtualization reduces hardware dependency, enabling better resource utilization and faster deployment cycles. It enhances workload management, especially for high-demand applications. Cloud providers expand regional footprints, increasing competition and innovation. Demand for data sovereignty and compliance with EU regulations strengthens local investments. Investors view this as a high-growth area offering scalable solutions to enterprises. It continues to gain strategic importance in digital transformation initiatives.

- For instance, Microsoft inaugurated its Austria cloud region in August 2025, comprising three datacenters around Vienna, which enables Austrian businesses and public administration to leverage advanced AI and cloud services within national data residency requirements, as part of a long.

Innovation in Energy-Efficient Cooling and Sustainable Infrastructure Solutions

The Austria Data Center Market advances through innovation in energy-efficient designs and sustainability practices. Operators deploy advanced cooling methods, renewable energy integration, and green building certifications. Energy efficiency reduces operational costs while aligning with EU climate targets. It drives corporate responsibility, making centers attractive to global enterprises. Sustainable designs also attract government support and favorable policies. Businesses prefer providers with low carbon footprints to strengthen brand image. Investors prioritize sustainability as part of long-term return strategies. It strengthens Austria’s position as a sustainable hub for digital infrastructure.

Strategic Importance of Data Centers for National and Regional Competitiveness

The Austria Data Center Market holds strategic significance for both local and regional competitiveness. Austria’s central European location supports cross-border connectivity and digital trade. It positions the country as a gateway between Western and Eastern European markets. Reliable centers enable seamless cloud and data traffic integration across industries. Governments and enterprises depend on strong digital infrastructure for economic stability. Investors recognize the market’s long-term resilience amid digital acceleration. Technology-driven industries anchor their growth strategies around secure infrastructure. It emerges as a critical enabler of digital competitiveness for Austria and its partners.

Market Trends

Expansion of Hyperscale and Colocation Facilities to Support Cloud Ecosystems

The Austria Data Center Market is experiencing an expansion of hyperscale and colocation facilities. Global cloud providers and local operators focus on capacity upgrades to handle rising workloads. Hyperscale centers enhance scalability and performance for enterprises adopting AI and advanced analytics. Colocation services attract SMEs seeking cost-effective solutions with lower entry barriers. Demand for flexible contracts drives competition in service models. Facilities integrate automation and AI-based monitoring for operational efficiency. It supports digital ecosystems by fostering collaborations across industries. The trend aligns with Europe’s growing cloud-first strategies.

Integration of Edge Computing and Modular Infrastructure for Localized Needs

The Austria Data Center Market is shaped by integration of edge and modular infrastructure. Edge facilities support real-time data processing close to end-users, enhancing latency-sensitive applications. Modular centers deliver scalable, customizable solutions suited for rapid deployment. Industries such as manufacturing, retail, and telecom adopt edge for smart applications. Cloud players invest in distributed infrastructure to balance performance and cost. Localized facilities strengthen security and compliance with EU regulations. It boosts market adoption of hybrid and distributed computing. The trend enhances digital readiness across regional enterprises.

Adoption of Advanced Automation and AI-Driven Operations for Efficiency Gains

The Austria Data Center Market benefits from automation and AI deployment across facility operations. Intelligent systems predict energy usage, reduce downtime, and improve system resilience. AI-driven monitoring detects anomalies, enhancing cybersecurity readiness. Automated orchestration optimizes workloads across cloud and on-premise environments. Predictive analytics strengthens maintenance efficiency by reducing failures. Operators gain better control over resources while cutting operational costs. It ensures sustainable management of growing data volumes. This trend positions Austria as an innovator in digital infrastructure automation.

Focus on High-Density Computing for Artificial Intelligence and Cloud Workloads

The Austria Data Center Market is witnessing a rise in high-density computing solutions. AI, machine learning, and cloud-native applications require intensive computing power. Facilities upgrade rack densities and cooling systems to handle workload demands. Enterprises prefer providers offering GPU-optimized infrastructure for deep learning. High-performance storage systems support advanced simulations and big data analytics. The trend enhances Austria’s role in supporting research, fintech, and healthcare innovation. Investors see high-density infrastructure as a differentiator for growth. It signals stronger market maturity for advanced workloads.

Market Challenges

High Energy Costs and Strain on Power Supply for Large-Scale Facilities

The Austria Data Center Market faces significant challenges due to high energy costs and limited supply reliability. Large-scale facilities demand constant electricity, straining national grids. Operators invest heavily in renewable integration and efficiency technologies to offset expenses. Rising costs impact competitiveness compared to other European hubs. Enterprises hesitate to commit long-term without energy cost assurances. Policy-driven energy reforms further affect operating stability. It creates uncertainty for investors evaluating long-term returns. Managing power efficiency remains a priority to maintain sustainable growth.

Regulatory Compliance and Cybersecurity Concerns Impacting Industry Expansion

The Austria Data Center Market encounters complex compliance requirements tied to EU and local regulations. Operators face stringent data protection, sustainability, and reporting obligations. Failure to comply risks penalties and reputational damage. Cybersecurity remains another pressing challenge due to evolving threats. Enterprises demand stronger protections for sensitive workloads, creating higher costs for providers. Compliance audits and certifications increase operational overhead. Small operators face greater difficulty competing under such requirements. It highlights the sector’s dependence on regulatory adaptation and strong security practices.

Market Opportunities

Rising Investments in Cloud Expansion and Cross-Border Connectivity Solutions

The Austria Data Center Market holds opportunities in expanding cloud footprints and enhancing connectivity. Austria’s geographic position supports regional integration with Western and Eastern Europe. Enterprises seek hybrid models balancing compliance with flexibility, strengthening local demand. Cross-border digital trade accelerates investment in advanced interconnection facilities. Cloud providers expand service offerings, creating competitive opportunities for investors. It aligns Austria with Europe’s vision for a unified digital economy. Growth potential remains strong in regulated sectors requiring localized cloud storage.

Emerging Role of AI, Healthcare Digitization, and Smart Industry Applications

The Austria Data Center Market presents opportunities in supporting AI adoption, healthcare digitization, and smart industries. AI-driven analytics, electronic health records, and telemedicine rely on advanced infrastructure. Manufacturing and retail deploy smart solutions requiring real-time data processing. Government projects adopt digital-first models that increase demand for scalable facilities. Cloud-native innovation attracts international players to Austria’s growing digital ecosystem. It allows providers to develop specialized solutions for vertical industries. The opportunity strengthens Austria’s role as a regional innovation hub.

Market Segmentation

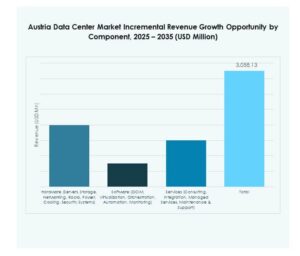

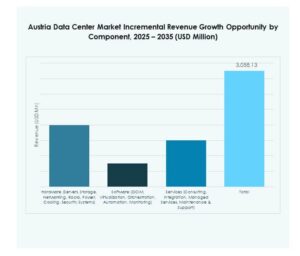

By Component

The Austria Data Center Market is dominated by the hardware segment, driven by servers, power, and cooling systems that account for a majority share. Software solutions such as DCIM and automation grow steadily as enterprises adopt intelligent management platforms. Services including consulting and managed offerings gain traction for enterprises with limited IT resources. Growth in hardware demand comes from rising workloads, while services ensure lifecycle optimization. Together, the component landscape highlights strong reliance on infrastructure investments and growing sophistication in management solutions.

By Data Center Type

The Austria Data Center Market is led by hyperscale facilities, reflecting strong demand from global cloud providers and enterprises handling large-scale workloads. Colocation centers expand rapidly, serving SMEs with flexible capacity needs. Edge and modular centers gain attention for latency-sensitive applications across telecom and retail. Enterprise and mega data centers maintain relevance with legacy system integration. Cloud/IDC models expand, linking Austria to Europe’s broader cloud-first strategies. This mix illustrates balanced growth across traditional and next-generation facilities, ensuring comprehensive market coverage.

By Deployment Model

The Austria Data Center Market shows dominance of hybrid models, allowing enterprises to balance on-premises control with cloud scalability. On-premises remains important for regulated industries requiring data sovereignty. Cloud-based deployment grows due to cost efficiency and agility benefits. Hybrid adoption reflects demand for compliance, security, and flexibility across industries. It ensures enterprises adapt digital strategies while mitigating risks. Growing hybrid integration highlights Austria’s progression toward global standards in data management.

By Enterprise Size

The Austria Data Center Market is dominated by large enterprises due to higher investments in digital transformation and AI-based workloads. SMEs increasingly adopt colocation and cloud-based services to reduce capital expenses. Large firms invest in dedicated infrastructure for compliance, scalability, and global competitiveness. SMEs rely on managed services for operational efficiency. Both segments highlight diverse demand patterns, ensuring providers cater to wide-ranging business needs. The balance strengthens the overall market structure.

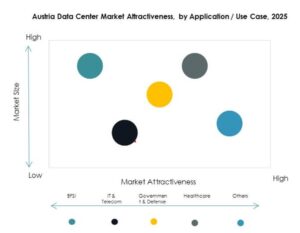

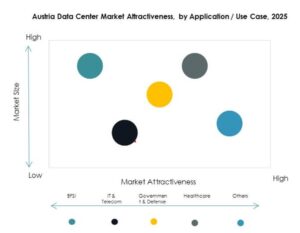

By Application / Use Case

The Austria Data Center Market is led by IT and telecom, driven by digital services, 5G, and cloud demand. BFSI and healthcare represent strong growth sectors requiring compliance-driven infrastructure. Retail and e-commerce expand data needs with online platforms. Media and entertainment adopt high-performance storage for streaming services. Manufacturing integrates smart industry solutions. Government and defense maintain stable demand for secure systems. Education and energy utilities add emerging use cases. This wide application base drives consistent market expansion.

By End User Industry

The Austria Data Center Market is led by cloud service providers that drive innovation and capacity expansion. Enterprises maintain a significant share due to internal workload requirements. Colocation providers serve SMEs with cost-efficient access to infrastructure. Government agencies ensure stable demand by investing in public digital transformation. Other industries contribute niche demand through specialized applications. This distribution ensures balanced demand drivers across private and public stakeholders, reinforcing sector resilience.

Regional Insights

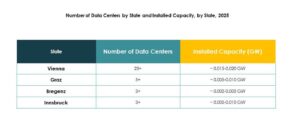

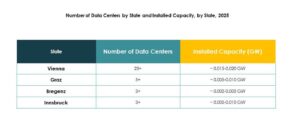

Western Austria Driving Growth with 41% Market Share

The Austria Data Center Market in Western Austria holds 41% share, driven by Vienna’s role as a financial and technology hub. The region benefits from strong enterprise adoption of cloud, AI, and digital services. Operators expand hyperscale and colocation facilities, supported by strong connectivity infrastructure. It remains attractive for global investors targeting European digital corridors. Western Austria leads in innovation and compliance readiness. The region sets benchmarks for capacity expansion and sustainability.

- For example, A1 Digital’s Vienna data center provides 2,550 m² of Tier III-compliant whitespace within an 8,000 m² facility, connected to a 2×6 MW load, designed for a PUE of 1.4 or lower, and offering uptime availability of 982%.

Central Austria Expanding with 34% Market Share

The Austria Data Center Market in Central Austria accounts for 34% share, with strong growth in manufacturing and logistics. Enterprises adopt hybrid solutions to support industrial applications and real-time monitoring. Regional cities attract cloud providers investing in distributed infrastructure. It benefits from improved energy efficiency initiatives and renewable adoption. Central Austria strengthens Austria’s role as a digital enabler for mid-sized enterprises. It continues to attract strategic investments in infrastructure.

Eastern Austria Emerging with 25% Market Share

The Austria Data Center Market in Eastern Austria captures 25% share, reflecting emerging opportunities in healthcare, education, and public administration. Smaller enterprises rely on colocation and modular infrastructure to scale operations. The region attracts government-led projects in digital transformation and public services. Renewable energy adoption enhances operational stability. It gains importance as a hub for specialized applications requiring localized support. Eastern Austria strengthens overall national market coverage by diversifying growth drivers.

- For instance, Google has advanced plans for its data center in Kronstorf, located in Upper Austria near Eastern corridors, which supports expansion of Austria’s data infrastructure and helps spill benefits into nearby Eastern provinces.

Competitive Insights:

- Interxion Austria

- NTT Austria

- A1 Telekom Austria

- eww ITandTel

- Anexia Data Center

- Digital Realty Austria

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Austria Data Center Market is characterized by strong competition among global hyperscale players and regional providers. Interxion Austria and Digital Realty dominate colocation services, offering scalable solutions for enterprises and cloud providers. NTT Austria and A1 Telekom Austria strengthen the sector with telecom-driven infrastructure and integrated IT services. Local firms like eww ITandTel and Anexia Data Center provide tailored offerings that address compliance, security, and regional connectivity needs. Global hyperscale leaders Microsoft, AWS, and Google drive cloud adoption, investing in high-capacity facilities that support AI, analytics, and enterprise digitization. It fosters a competitive environment where innovation in energy efficiency, modular designs, and hybrid solutions differentiates market leaders and ensures Austria remains a critical hub in Europe’s digital ecosystem.

Recent Developments:

- In August 2025, A1 Telekom Austria entered a multi-year partnership with Amdocs to modernize its monetization platforms, enabling rapid launch of new products and services for 5G, IoT, and cloud offerings. This upgrade boosts operational efficiency and security while driving future growth for the operator in Austria.

- In March 2025, Digital Realty Austria strengthened its strategic collaboration with Console Connect to enhance global connectivity and network-as-a-service (NaaS) solutions. This partnership gives Austrian clients improved access to worldwide data center interconnectivity, cloud, and AI-enabled services