Executive summary:

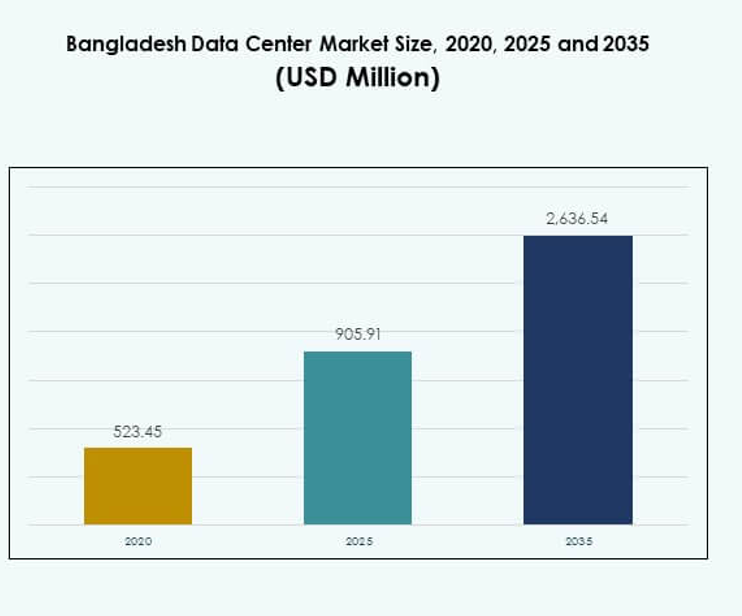

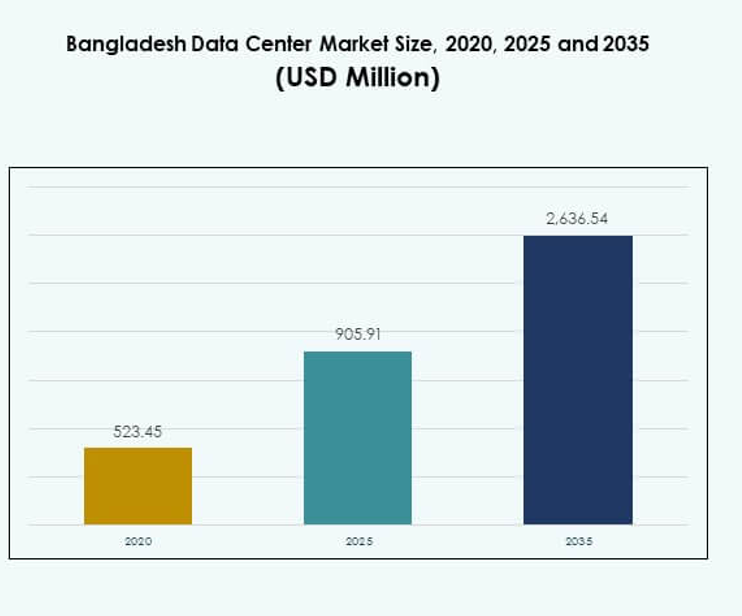

The Bangladesh Data Center Market size was valued at USD 523.45 million in 2020 to USD 905.91 million in 2025 and is anticipated to reach USD 2,636.54 million by 2035, at a CAGR of 11.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Bangladesh Data Center Market Size 2025 |

USD 905.91 Million |

| Bangladesh Data Center Market, CAGR |

11.20% |

| Bangladesh Data Center Market Size 2035 |

USD 2,636.54 Million |

Growth in the market is driven by rapid cloud adoption, rising demand for digital services, and the government’s focus on ICT development. Enterprises are investing in scalable, energy-efficient infrastructure to support fintech, telecom, and e-commerce expansion. It reflects a shift toward localized hosting, improved cybersecurity frameworks, and sustainable operations. For investors and businesses, the market holds strategic importance as digital transformation accelerates across industries.

Regionally, South Asia is led by India due to its established hyperscale infrastructure and advanced cloud ecosystem, while Bangladesh is emerging as a fast-growing hub. It benefits from regulatory support, submarine cable expansions, and rising digital service penetration. Neighboring countries like Nepal and Sri Lanka are also advancing, but at a slower pace, making Bangladesh a critical player in shaping the regional data center ecosystem.

Market Drivers

Rising Demand for Digital Transformation and Scalable IT Infrastructure

The Bangladesh Data Center Market is expanding due to strong demand for digital services across industries. Businesses are shifting operations to cloud-based platforms, driving a surge in infrastructure investments. It reflects the growing need for secure data storage, efficient processing, and reliable connectivity. E-commerce, fintech, and telecom providers are among the largest contributors. Government digitalization programs accelerate private sector adoption. Enterprises view local data centers as vital to ensure data sovereignty. The market gains strategic importance for both investors and businesses. It continues to align with the broader digital economy goals.

- For example, CoLoCity Limited operates Bangladesh’s first Tier-III standard data center, certified under ISO 9001:2015 and IEC 27001:2013. It provides secure colocation and data hosting services to a wide range of domestic and international organizations, including banks and financial institutions.

Innovation in Cloud-Based Services and Managed Hosting Solutions

Cloud computing adoption drives new opportunities within the Bangladesh Data Center Market. Enterprises are leveraging managed hosting and hybrid cloud models to reduce operating costs. It creates demand for sophisticated automation tools and advanced orchestration software. Local providers are upgrading facilities to deliver global-standard services. Multinational players are forming partnerships with local firms to enhance competitiveness. Innovation enables businesses to achieve agility and scalability. Data-driven operations encourage deeper reliance on professional IT services. The market remains strategically positioned for sustainable growth.

Government Policies Supporting Connectivity and Data Localization Requirements

Policy initiatives shape the direction of the Bangladesh Data Center Market. National ICT strategies prioritize data sovereignty and cybersecurity frameworks. It compels organizations to adopt local hosting facilities rather than relying on foreign servers. Connectivity improvements, including submarine cable expansions, enhance reliability and performance. Stronger compliance regulations drive enterprises toward certified data centers. The government’s focus on smart infrastructure stimulates private investments. Businesses see value in adopting services that align with policy frameworks. Investors benefit from regulatory clarity and long-term certainty. These factors continue to strengthen the domestic ecosystem.

Technological Shifts Driving Efficiency, Security, and Competitive Differentiation

Advanced technologies reshape the Bangladesh Data Center Market through automation, virtualization, and AI-based monitoring. Providers focus on energy-efficient cooling and modular power systems. It supports sustainable operations while lowering costs for enterprises. Cybersecurity solutions enhance resilience against increasing threats. Adoption of green standards aligns with global sustainability goals. Intelligent systems improve predictive maintenance and uptime assurance. Competition now centers on delivering reliability and efficiency rather than capacity alone. The market positions itself as an essential enabler for digital-first enterprises. This shift underscores the strategic role of local providers.

- For instance, the Bangladesh Data Center Company Limited operates a Tier IV-certified data center in Kaliakoir Hi-Tech City, Gazipur, equipped with advanced cooling, redundancy, biometric access and 2N power backup, providing a 99.995% uptime guarantee to mission-critical applications for both public and private sector clients as documented in October 2024.

Market Trends

Expansion of Edge and Modular Data Centers to Enhance Local Connectivity

Edge and modular solutions are redefining the Bangladesh Data Center Market. Rising demand for low-latency services fuels their deployment across urban hubs. It enables seamless support for IoT devices, 5G applications, and digital media platforms. Enterprises use modular centers for faster deployment and reduced costs. Providers emphasize flexibility by integrating scalable infrastructure modules. This approach ensures adaptability to changing workload requirements. Edge centers improve data traffic management by reducing dependency on distant servers. The market continues to diversify its offerings through these emerging models.

Integration of Renewable Energy Sources into Data Center Infrastructure

Sustainability remains a leading trend shaping the Bangladesh Data Center Market. Providers adopt renewable energy solutions to address high power consumption. It supports regulatory compliance and long-term operational savings. Solar and hybrid systems increasingly power facilities in both urban and semi-urban regions. Green certifications become a key differentiator for competitive players. Investors prefer facilities that meet environmental and efficiency benchmarks. Enterprises align with sustainability goals to improve their corporate image. Demand for eco-friendly infrastructure is expected to grow further.

Adoption of Artificial Intelligence and Machine Learning in Operations

Artificial intelligence is transforming the Bangladesh Data Center Market by improving efficiency. It automates cooling, workload distribution, and fault detection processes. Machine learning enhances predictive maintenance, reducing downtime risks. It improves overall operational reliability for enterprises depending on data-intensive processes. Providers integrate AI-driven monitoring systems to track performance metrics. Businesses value advanced analytics for optimizing storage and processing. Cybersecurity applications of AI also gain prominence. These shifts highlight the market’s transition toward intelligent operations.

Growing Role of Colocation and Managed Service Providers

Colocation demand is rising within the Bangladesh Data Center Market as enterprises prioritize flexibility. Small and medium enterprises increasingly prefer shared infrastructure for cost efficiency. It reduces capital expenditure while ensuring reliable connectivity. Managed service providers expand their portfolios with security and automation offerings. Enterprises gain access to advanced IT capabilities without heavy investments. Providers emphasize value-added services to enhance client retention. Colocation centers strengthen business continuity planning for diverse industries. The market evolves to serve both large enterprises and SMEs through managed solutions.

Market Challenges

High Energy Consumption and Infrastructure Limitations in Data Center Operations

The Bangladesh Data Center Market faces challenges linked to power demand and infrastructure readiness. High energy costs place pressure on operational margins for providers. It creates uncertainty in scaling capacity across metropolitan hubs. Limitations in power grids restrict reliable uptime in certain regions. Cooling systems require modernization to handle increasing workloads. Infrastructure gaps delay rapid deployment of large-scale projects. These factors hinder global competitiveness compared to established markets. Providers continue to seek innovative solutions to balance cost and efficiency.

Shortage of Skilled Workforce and Concerns Over Cybersecurity Threats

Workforce shortages represent a significant challenge for the Bangladesh Data Center Market. Skilled professionals for cloud architecture, cybersecurity, and automation remain limited. It restricts innovation and slows adoption of new models. Rising cyber threats create vulnerability for both enterprises and providers. Lack of advanced local training programs hinders knowledge transfer. Organizations must rely on external expertise to address critical gaps. These issues raise concerns for long-term scalability. The market continues to face pressure to strengthen local talent pipelines and security resilience.

Market Opportunities

Rising Cloud Adoption and Enterprise Digitalization Initiatives Supporting Growth

Cloud adoption provides significant opportunities for the Bangladesh Data Center Market. Enterprises continue to shift workloads to hybrid and public cloud models. It creates demand for robust facilities with secure and compliant frameworks. SMEs drive adoption with low-cost digitalization strategies. Providers expand managed services to meet client-specific needs. Data localization laws further stimulate domestic demand. These factors highlight strong opportunities for both investors and local players.

Strategic Investments and Cross-Border Collaborations Enhancing Market Positioning

The Bangladesh Data Center Market benefits from growing foreign and local investments. Partnerships with global providers strengthen technical capabilities and infrastructure scale. It improves competitiveness and supports global-standard service delivery. Cross-border collaborations help providers adopt new technologies quickly. Enterprise clients gain access to advanced services without relocating data abroad. Strategic alliances create new revenue streams for market participants. Investors see attractive opportunities in this evolving ecosystem.

Market Segmentation

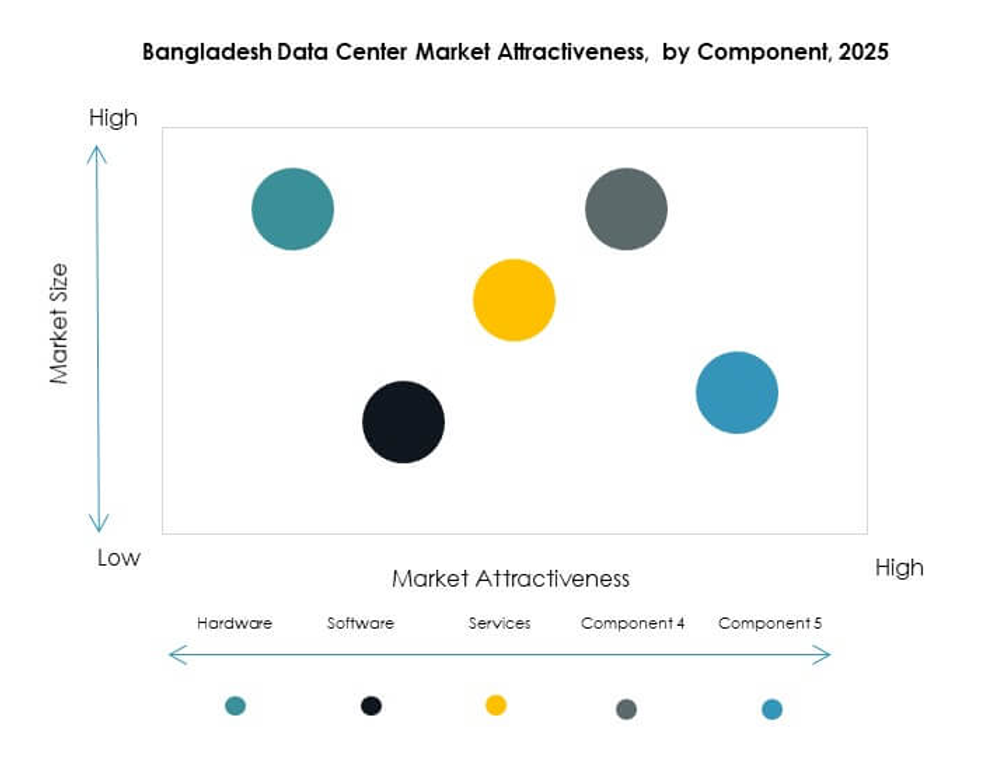

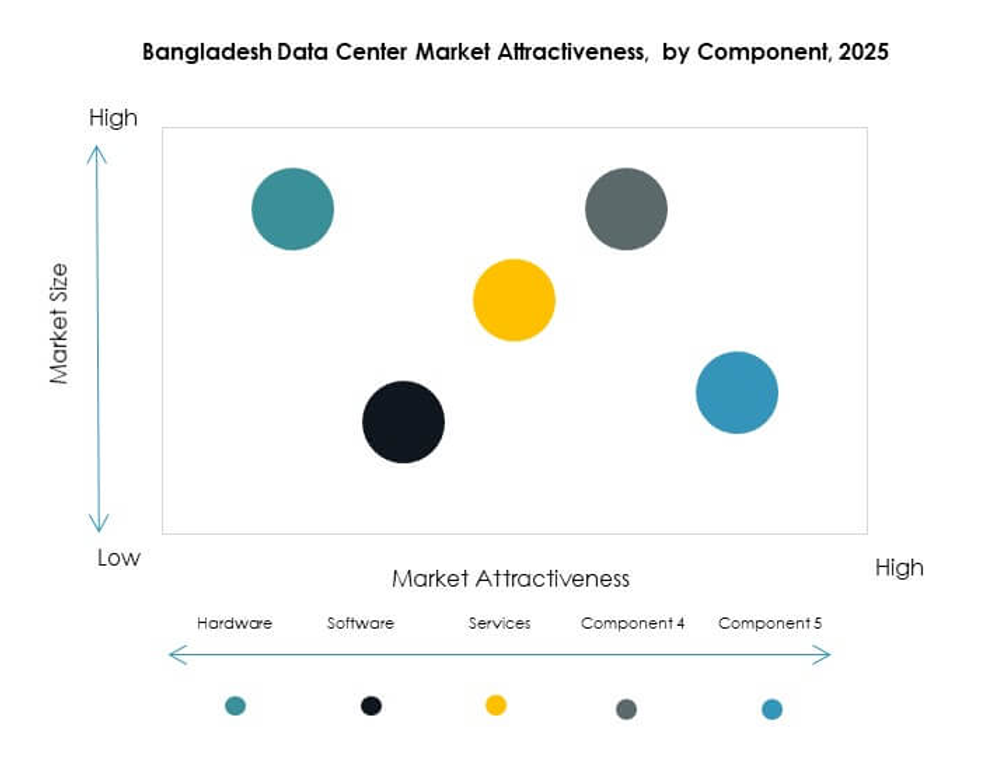

By Component

Hardware dominates the Bangladesh Data Center Market with the largest share due to high investments in servers, storage, and networking. It reflects enterprises’ priority to scale performance and ensure secure operations. Cooling and power infrastructure play vital roles in reducing downtime. Software demand is also rising, led by DCIM and virtualization. Services remain critical as enterprises depend on managed and consulting solutions. The ecosystem benefits from a balanced contribution across all three categories.

By Data Center Type

Hyperscale and colocation centers hold leading shares within the Bangladesh Data Center Market. Hyperscale facilities attract multinational cloud providers seeking scalable operations. Colocation services serve SMEs and enterprises looking for cost-effective hosting. Edge and modular centers are emerging with faster deployment and localized connectivity. Enterprise centers remain important but less dominant compared to shared facilities. Cloud or internet data centers enhance the market’s overall digital capacity. The diversity of types ensures long-term stability and competitive positioning.

By Deployment Model

Cloud-based models dominate the Bangladesh Data Center Market due to enterprise preference for flexibility and scalability. On-premises infrastructure remains relevant for government and defense sectors requiring control. Hybrid models grow as organizations balance control with cloud efficiency. This diversity allows providers to cater to different enterprise requirements. Cloud-based adoption continues to expand faster than other segments. Hybrid models highlight the transition stage of several organizations. The mix strengthens the market’s adaptability.

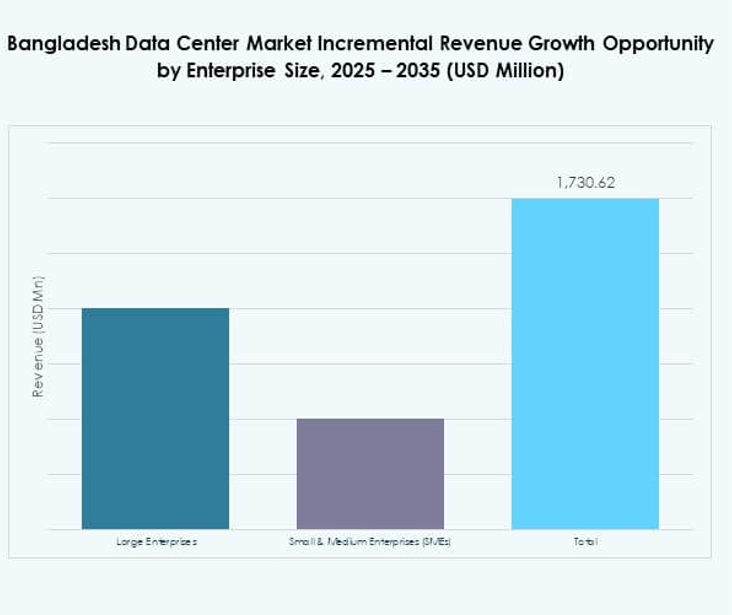

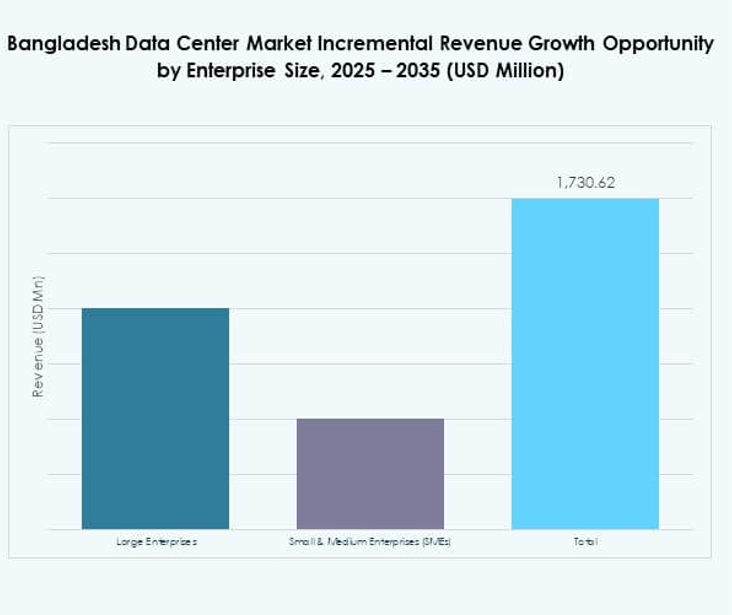

By Enterprise Size

Large enterprises dominate the Bangladesh Data Center Market due to their higher IT budgets and complex workloads. They invest in hyperscale facilities, advanced security, and automation. SMEs contribute growing demand for cloud-based and colocation services. It reflects their focus on affordability and scalability. Providers target SMEs with flexible packages and managed services. The mix between large enterprises and SMEs drives balanced growth. Both segments remain critical for future expansion.

By Application / Use Case

The IT & telecom segment holds the largest share of the Bangladesh Data Center Market due to expanding mobile and internet penetration. BFSI also contributes significantly with strict compliance and high transaction volumes. Retail and e-commerce rely heavily on digital infrastructure for customer engagement. Healthcare and government sectors are expanding adoption for secure data management. Media and entertainment grow with streaming demand. Manufacturing and education gradually increase usage. The market benefits from wide applications across industries.

By End User Industry

Cloud service providers dominate the Bangladesh Data Center Market with their large-scale infrastructure demands. Enterprises remain key users seeking tailored services. Colocation providers support SMEs with shared facilities. Government agencies focus on compliance-driven adoption. Other industries, including energy and utilities, contribute smaller but growing demand. The distribution of end users highlights the importance of a diverse ecosystem. Each category sustains growth by addressing specific requirements.

Regional Insights

South Asia Leadership with India as the Dominant Market

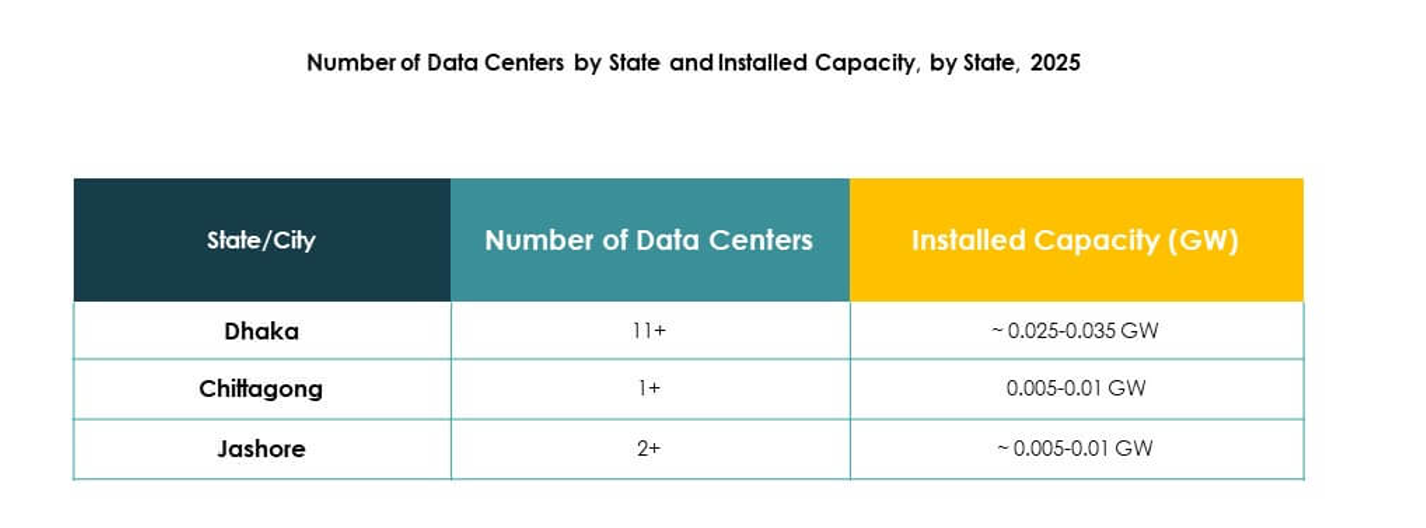

In the Bangladesh Data Center Market, South Asia is the leading subregion with India holding 52% share. India’s dominance is due to hyperscale data centers and strong cloud adoption. It benefits from robust infrastructure and global investments. Bangladesh captures 14% share, reflecting its emerging status within the subregion. It shows rapid adoption trends driven by digitalization. Neighboring countries contribute smaller portions but follow similar growth patterns. South Asia continues to dominate regional growth dynamics.

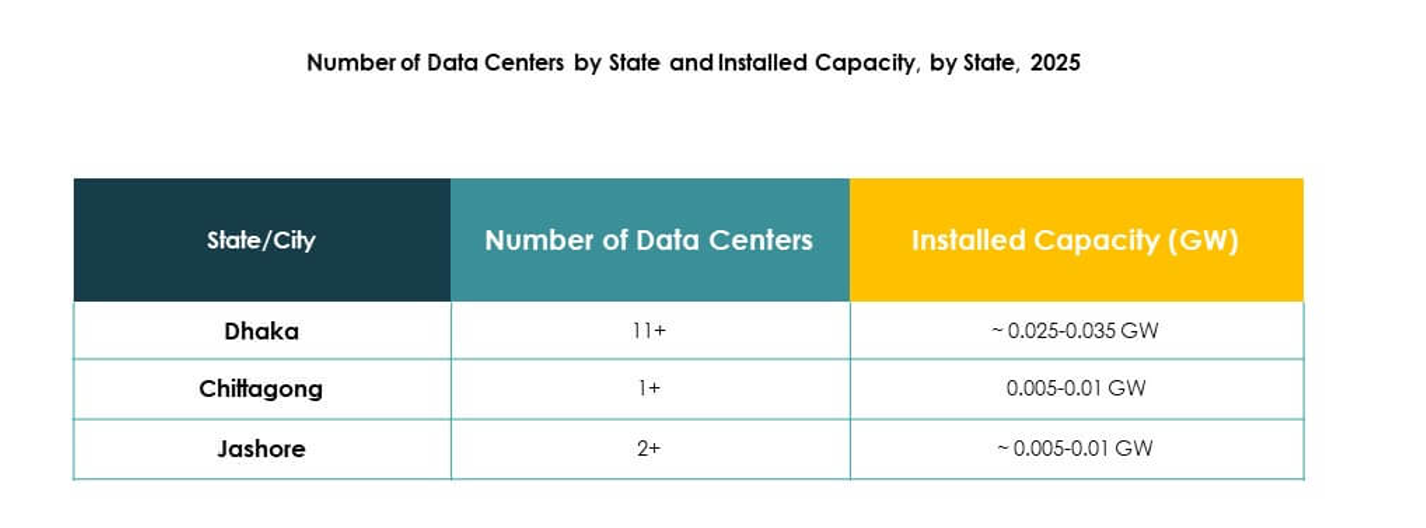

Bangladesh Emerging as a Fast-Growing Regional Hub

Bangladesh holds an increasingly strong position in the Bangladesh Data Center Market with 14% share. It attracts investments due to expanding digital services and supportive regulations. The market gains momentum from government-led ICT initiatives. Private sector innovation reinforces this progress with scalable solutions. It also benefits from improved submarine cable connectivity. These developments position Bangladesh as a significant growth hub in the subregion. Its rising role strengthens South Asia’s overall infrastructure.

- For example, in February 2024, Gennext Technologies and BDCCL launched Meghna Cloud, described as Bangladesh’s first cloud data center located in Bangabandhu Hi-Tech City in Kaliakoir, Gazipur. The data center spans about 200,000 sq ft and operates under a Tier IV standard.

Other South Asian Countries Contributing to Balanced Regional Growth

Nepal, Sri Lanka, and Pakistan together contribute 34% share in the Bangladesh Data Center Market. These countries adopt data center services to support fintech, telecom, and e-commerce. It represents a growing wave of regional adoption. Their progress remains slower compared to India and Bangladesh. Investments continue to improve infrastructure resilience in these emerging nations. Providers target opportunities in secondary hubs to expand networks. The balanced growth across countries enhances subregional stability.

- For instance, Grameenphone in Bangladesh launched its first Super Core data center in Sylhet in January 2024, with a capacity of 4 MW and built to Tier III standard, to enhance telecom and enterprise resilience.

Competitive Insights:

- DataEdge Bangladesh

- Microsoft Azure Bangladesh

- Grameenphone

- Amazon Web Services (AWS)

- AWS Operation Bangladesh

- Aamra Technologies

- Link3 Technologies

The Bangladesh Data Center Market features strong competition between global cloud leaders and established local providers. International firms such as AWS and Microsoft Azure leverage advanced infrastructure and global expertise to capture large enterprise clients. Local players including DataEdge Bangladesh, Aamra Technologies, and Link3 Technologies focus on scalable colocation, managed services, and connectivity solutions tailored to regional needs. Grameenphone strengthens its presence through telecom-driven data infrastructure, enabling broad customer access. It demonstrates a mix of multinational investment and domestic innovation, creating a balanced ecosystem. Providers differentiate through service reliability, compliance, and energy-efficient designs. Partnerships between local and global firms enhance competitiveness, while government support for digitalization strengthens long-term opportunities in the evolving data center landscape.

Recent Developments:

- In February 2024, Meghna Cloud became operational as Bangladesh’s first cloud data center in the Bangabandhu Hi-Tech City at Kaliakoir, Gazipur. Developed as a joint venture between Bangladesh Data Center Company Limited (BDCCL) and Gennext Technologies, this launch significantly advanced the nation’s cloud computing and data storage capabilities, catering to the growing digital demands of both public and private sectors.

- In January 2025, the Asian Development Bank, Bangladesh Telecommunications Company Limited (BTCL), and the Public-Private Partnership Authority (PPPA) entered a memorandum of understanding (MoU) to establish Bangladesh’s first green data center on a BTCL-owned site near Chattogram. This state-of-the-art facility will be built according to international standards, powered by renewable energy, and provide commercial colocation services as well as support BTCL’s internal storage needs.