Executive summary:

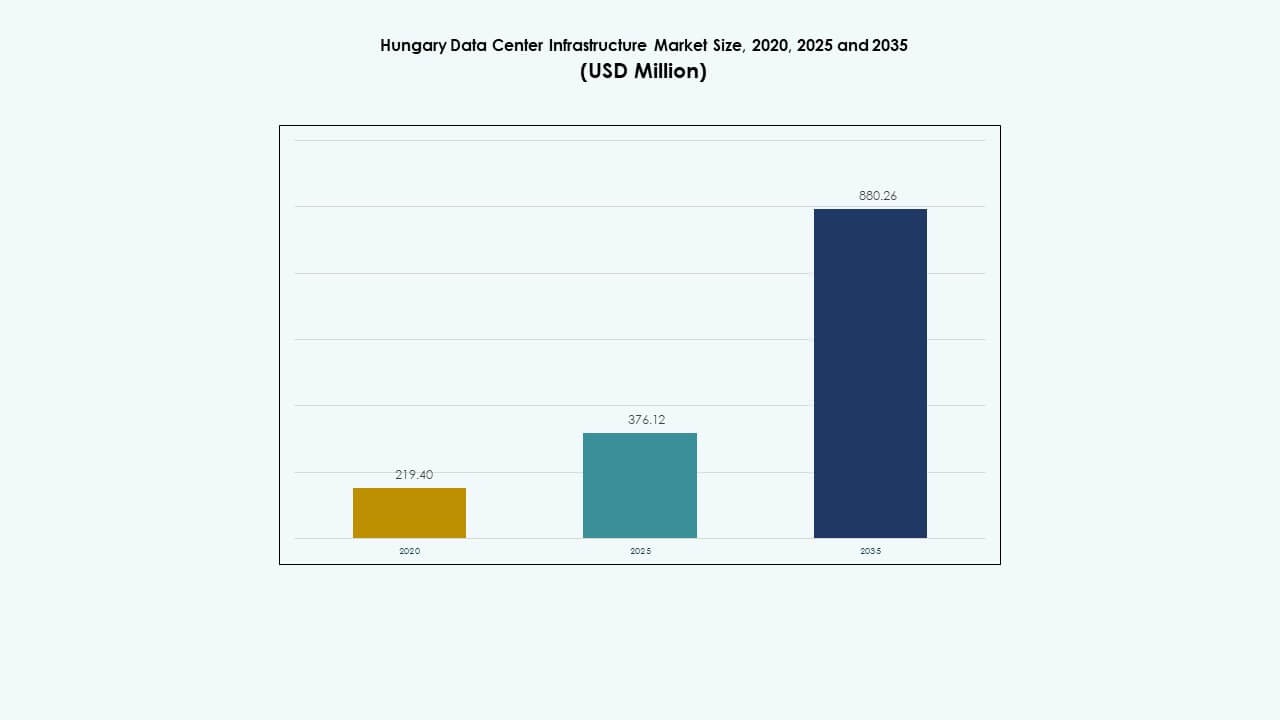

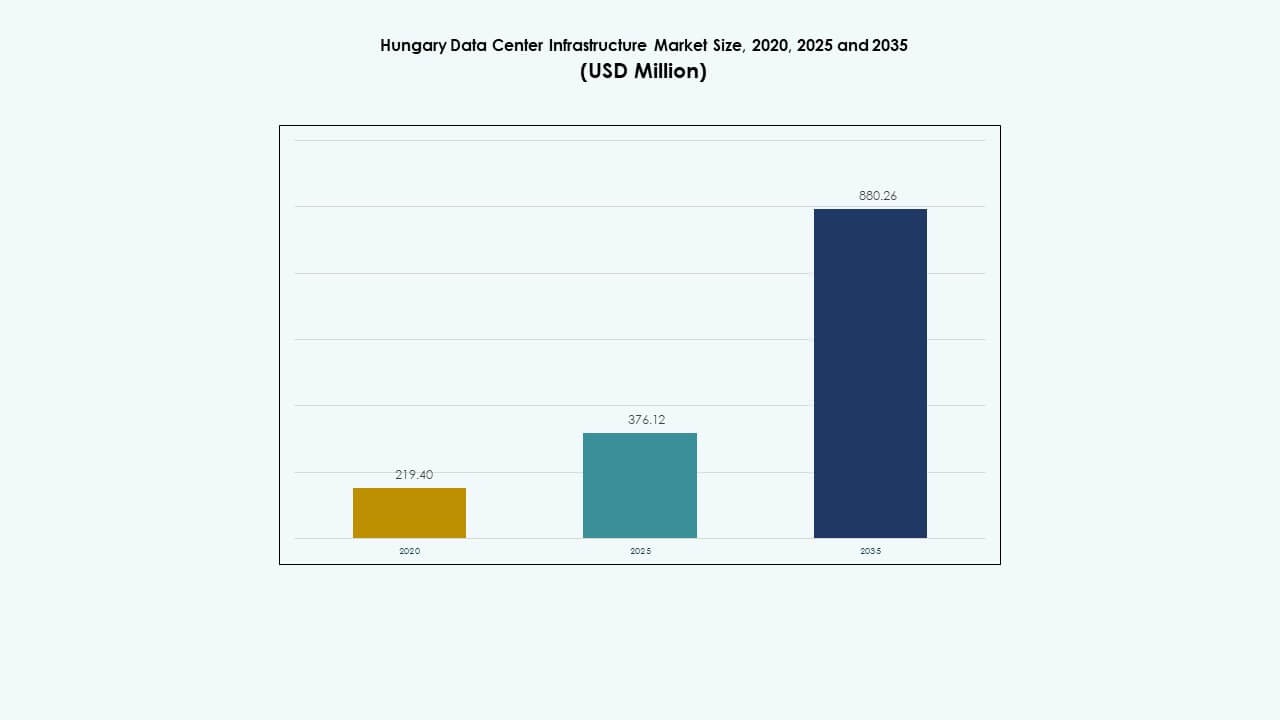

The Hungary Data Center Infrastructure Market size was valued at USD 219.40 million in 2020 to USD 376.12 million in 2025 and is anticipated to reach USD 880.26 million by 2035, at a CAGR of 8.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Hungary Data Center Infrastructure Market Size 2025 |

USD 376.12 Million |

| Hungary Data Center Infrastructure Market, CAGR |

8.80% |

| Hungary Data Center Infrastructure Market Size 2035 |

USD 880.26 Million |

The growth is driven by rapid adoption of cloud services, rising digital demand, and shifts toward virtualization and automation. As enterprises invest in scalable, energy-efficient infrastructure, Hungary becomes strategically important for businesses needing secure, compliant data hosting and for investors seeking stable returns. Innovation in cooling, power efficiency, and modular design fuels infrastructure expansion.

Regionally, central and eastern European markets lead growth in data centre infrastructure demand, with countries like Hungary and neighbouring markets emerging rapidly. Western European hubs remain established but growth is moderate; emerging markets benefit from lower power costs, favourable regulations and rising digital adoption, making the region increasingly attractive for new data centre investments.

Market Drivers

Market Drivers

Accelerating Digital Transformation and Cloud Adoption

The Hungary Data Center Infrastructure Market expands with enterprises modernizing IT systems to match global digital trends. Businesses migrate core applications to the cloud, lifting demand for secure and scalable facilities. It supports banking, manufacturing, and telecom firms that rely on hybrid and multi-cloud architectures. Strong digital transformation policies promote private investments. Government-backed programs enhance fiber connectivity across Budapest and industrial corridors. Companies seek data resiliency to manage growing workloads. Hyperscalers invest in automation and intelligent monitoring tools. The trend strengthens infrastructure modernization for sustained enterprise growth.

- For instance, EuroHPC Joint Undertaking approved the EUR 42 million LEVENTE supercomputer in Budapest in July 2025, elevating Hungary into the global top-50 high-performance computing nations.

Rising Investments in Energy-Efficient and Sustainable Infrastructure

Operators emphasize low-power usage effectiveness (PUE) designs to meet green goals. Cooling and power systems now integrate advanced controls and renewable inputs. Firms deploy liquid cooling, free air systems, and AI-based power monitoring. It ensures energy optimization and cost savings across campuses. Hungary’s clean energy policies attract investors focusing on sustainability. Data center developers build high-efficiency zones near renewable clusters. Firms invest in on-site generation and heat recovery units. This approach strengthens long-term operational stability and investor appeal.

Growing Importance of Data Localization and Compliance Standards

Regulatory enforcement on data protection encourages local hosting across Hungary. Enterprises prefer in-country storage to meet EU GDPR and cybersecurity rules. It pushes hyperscalers to expand regional availability zones. Telecom firms enhance network edge capacity for faster local processing. Strong compliance improves customer trust and data integrity. Firms gain competitive advantage through certified facilities. Government digital strategies promote domestic server expansion. It positions Hungary as a safe hub for regional data hosting and regulated digital trade.

- For instance, the Government “Digital Success Program 2030” channels EUR 1.7 billion from the Recovery and Resilience Plan into cloud, cybersecurity, and network upgrades supporting data center growth.

Rapid Shift Toward Modular and Scalable Infrastructure Models

Operators adopt modular build strategies to enable quick deployment and capacity flexibility. Prefabricated systems cut construction time and improve site adaptability. It reduces upfront cost while allowing phased expansion. Local integrators develop factory-built modules for remote deployment. Enterprises deploy edge-ready modules to manage latency-sensitive workloads. Modular adoption aligns with smart manufacturing and automation goals. Scalable models reduce infrastructure risk during peak demand. The trend ensures faster ROI and resilient facility management across regions.

Market Trends

Market Trends

Adoption of Artificial Intelligence and Automation in Data Center Operations

The Hungary Data Center Infrastructure Market witnesses automation across monitoring, cooling, and fault detection. AI tools predict failures and optimize energy distribution. Smart analytics guide dynamic cooling adjustments for real-time efficiency. Automation reduces downtime and labor dependence. It enhances uptime consistency and asset utilization. Predictive maintenance tools enable precise resource allocation. AI-led management transforms operational transparency. This shift promotes advanced control environments and sustainability metrics for facility operations.

Growing Popularity of Edge and Colocation Facilities

Edge deployments gain attention with rising IoT, 5G, and content delivery requirements. Businesses choose localized centers for lower latency and better control. Colocation sites provide scalable racks for SMEs lacking capital-heavy setups. It supports cloud, fintech, and e-commerce ecosystems. Developers deploy edge micro-centers near industrial clusters for fast analytics. Global operators collaborate with local firms for multi-city expansion. This trend diversifies hosting models across Hungary. It strengthens nationwide digital readiness and regional data sovereignty.

Integration of Renewable Energy Sources in Facility Design

Operators integrate wind, solar, and geothermal power for long-term sustainability. Green energy contracts reduce reliance on fossil grids. It supports low-carbon operations across hyperscale and colocation sites. Power purchase agreements stabilize energy costs over decades. Companies pursue green certifications to enhance brand credibility. District heating integration optimizes waste energy reuse. This renewable alignment drives global investor interest. The movement reflects Hungary’s ambition to align digital growth with climate goals.

Expansion of High-Density Computing and Liquid Cooling Solutions

AI and HPC workloads accelerate demand for advanced cooling systems. Liquid immersion and direct-to-chip cooling gain rapid traction. It ensures higher rack density without compromising stability. Local providers upgrade capacity to support AI and rendering applications. Precision cooling reduces energy waste and increases reliability. Equipment vendors launch modular liquid systems for hyperscale use. Operators improve thermal efficiency through smart control platforms. The shift transforms traditional layouts into sustainable, high-performance zones.

Market Challenges

Market Challenges

Rising Energy Costs and Grid Dependency Risks

The Hungary Data Center Infrastructure Market faces strain from volatile energy prices. Operators depend heavily on the national grid, which raises operational exposure. Limited renewable access in some regions impacts sustainability goals. Firms struggle to secure stable power under strict capacity rules. Higher tariffs pressure colocation pricing models. It compels developers to explore on-site generation and microgrids. Infrastructure resilience requires smarter energy storage and load management. These issues slow project execution and reduce investor flexibility.

Complex Regulatory Framework and Land Acquisition Barriers

Developers face lengthy permitting cycles and high land costs in urban zones. Regulatory approval delays affect construction timelines. Environmental compliance adds extra technical demands. It raises entry barriers for small-scale players. Skilled workforce shortage complicates system integration and maintenance. Complex approval structures discourage foreign entrants. Firms must align multiple standards for grid, environment, and data protection. These bureaucratic hurdles restrict expansion velocity and market scalability.

Market Opportunities

Government Support and Strategic Geographic Positioning

Hungary’s location between Western and Eastern Europe creates a strong logistics advantage. The Hungary Data Center Infrastructure Market benefits from EU-backed funding for digital infrastructure. Government tax benefits encourage private participation in data investments. Strategic placement near power and fiber routes supports large-scale builds. It attracts foreign hyperscalers seeking regional entry points. Infrastructure alliances with telcos strengthen deployment speed. The environment enables cross-border cloud traffic and regional interconnectivity.

Growth of AI, Cloud, and Edge-Driven Demand

AI and automation accelerate computing intensity across business sectors. Edge and hybrid cloud adoption push higher equipment demand. It supports new design-build partnerships and modular site adoption. Enterprises prioritize regional storage to improve compliance and latency. Domestic firms seek tailored colocation and connectivity packages. Smart city and IoT projects expand processing needs. The opportunity enhances Hungary’s role as a regional compute and analytics hub.

Market Segmentation

Market Segmentation

By Infrastructure Type

Electrical infrastructure dominates the Hungary Data Center Infrastructure Market due to high reliability needs and continuous uptime demand. Mechanical and IT infrastructure follow with strong adoption in energy optimization and server modernization. Civil and structural components gain traction through modular designs and seismic resilience. The segment expansion reflects an integrated approach toward high-efficiency, low-maintenance environments, supporting growth in hyperscale and colocation developments.

By Electrical Infrastructure

UPS systems and PDUs lead this segment, ensuring uninterrupted power across mission-critical zones. Firms invest in BESS for peak load management and renewable integration. Grid connection enhancements improve supply stability for hyperscale centers. Switchgear and transfer systems expand reliability levels across facilities. This segment’s performance shapes the operational backbone of the Hungary Data Center Infrastructure Market and influences scalability standards.

By Mechanical Infrastructure

Cooling systems, including CRAC and CRAH units, dominate due to heavy heat output from dense racks. Chillers and containment systems improve airflow management and lower PUE levels. Pumps and piping technologies enhance efficiency across multiple halls. Modular and water-based systems gain preference in large campuses. Continuous improvement in cooling design sustains stable environmental control and enhances cost savings across major operators.

By Civil / Structural & Architectural

Building envelopes, foundations, and modular construction remain key to expansion agility. Prefabricated frameworks cut project timelines and reduce capital intensity. Structural innovation enhances resilience against climate conditions. Raised floors and suspended ceilings ensure air distribution precision. This segment contributes to faster scalability of the Hungary Data Center Infrastructure Market and supports long-term durability in infrastructure planning.

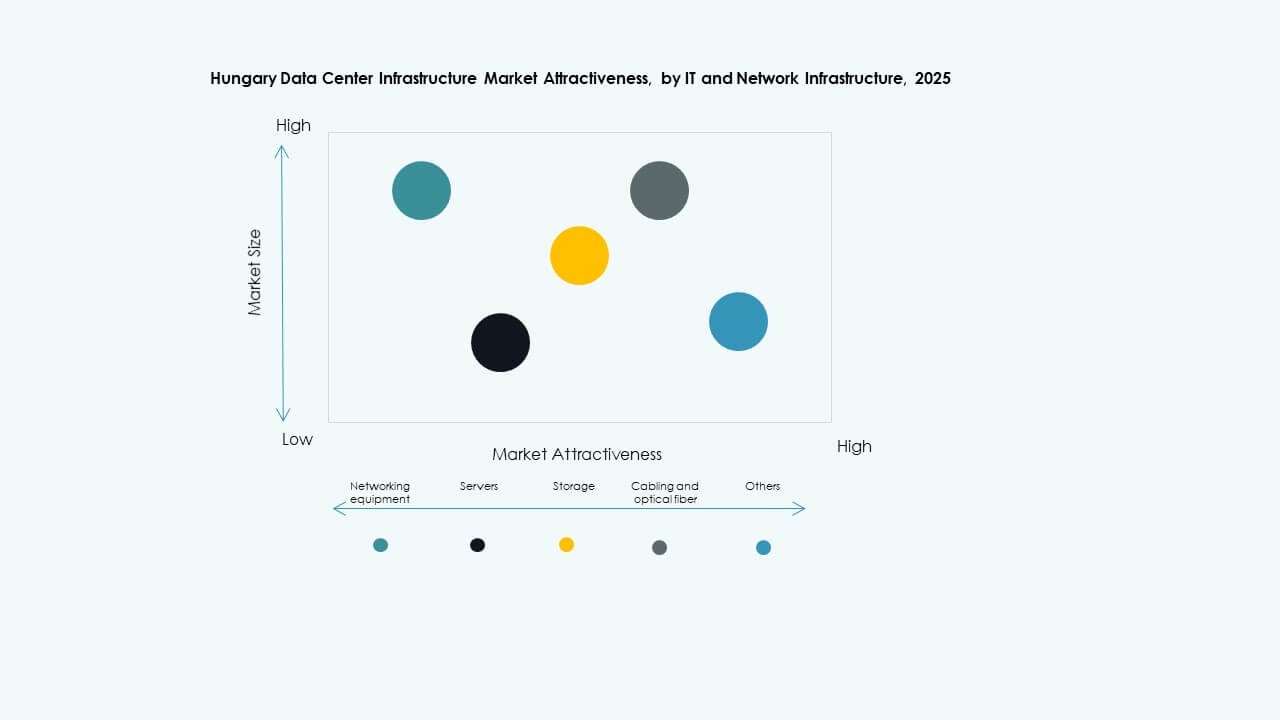

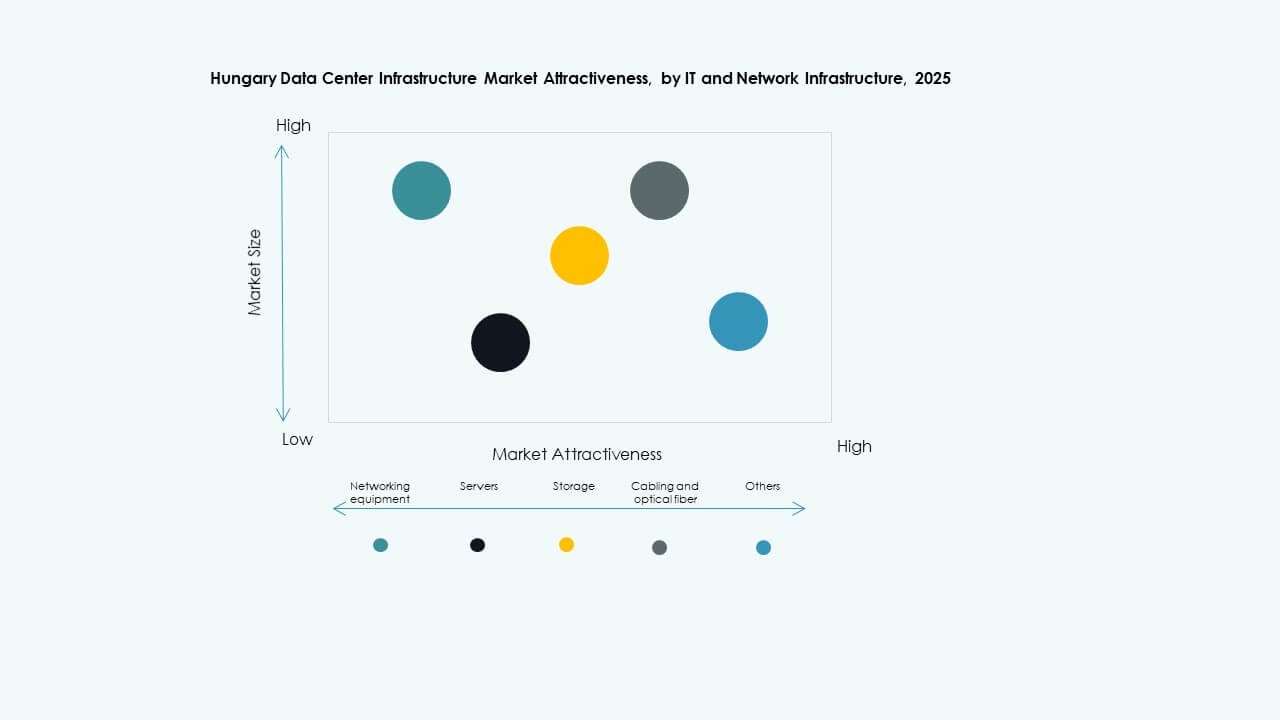

By IT & Network Infrastructure

Servers and storage systems lead deployments with advanced virtualization and redundancy support. Network cabling and fiber links ensure minimal latency across zones. Racks and enclosures evolve toward flexible configurations for dense computing. Vendors integrate intelligent monitoring for workload efficiency. This segment underpins digital transformation strategies across enterprises and supports sustainable IT modernization in Hungary.

By Data Center Type

Colocation centers hold the largest share due to enterprise outsourcing preference. Hyperscale projects expand quickly with global cloud providers entering the region. Enterprise and edge data centers gain traction for private workloads and localized processing. The Hungary Data Center Infrastructure Market benefits from mixed deployment strategies that combine flexibility, compliance, and cost efficiency under multi-tenant models.

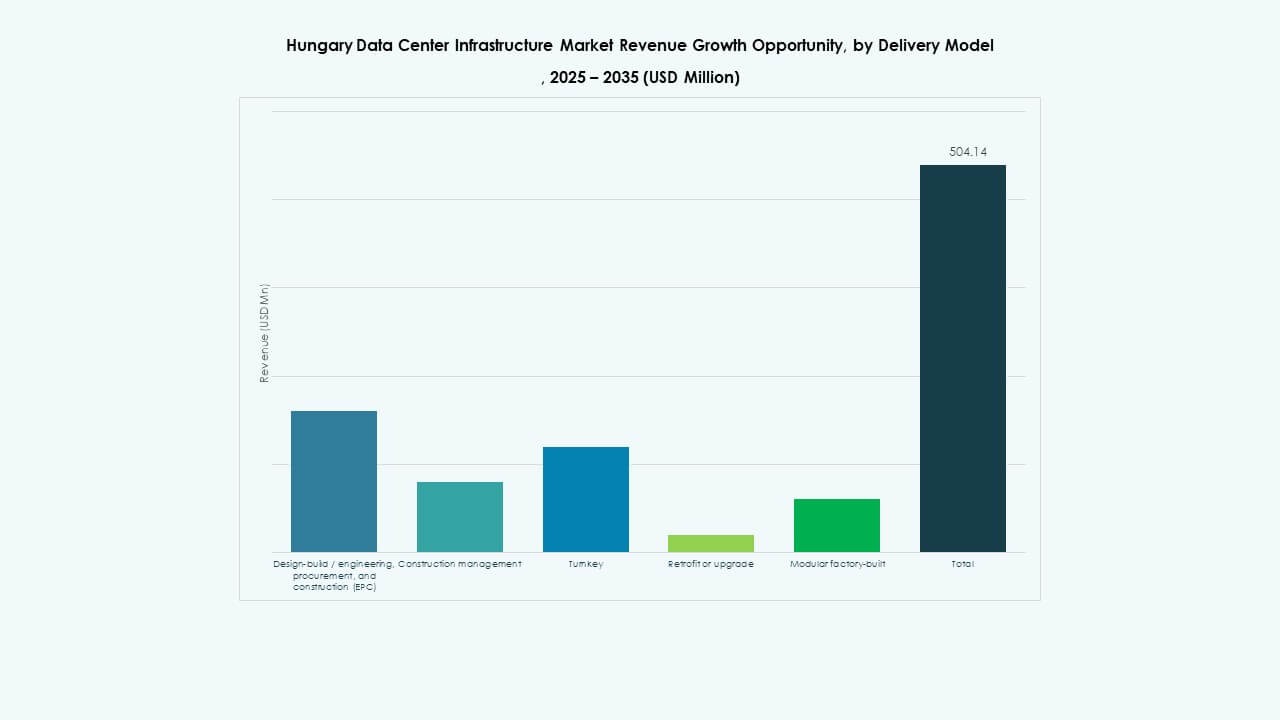

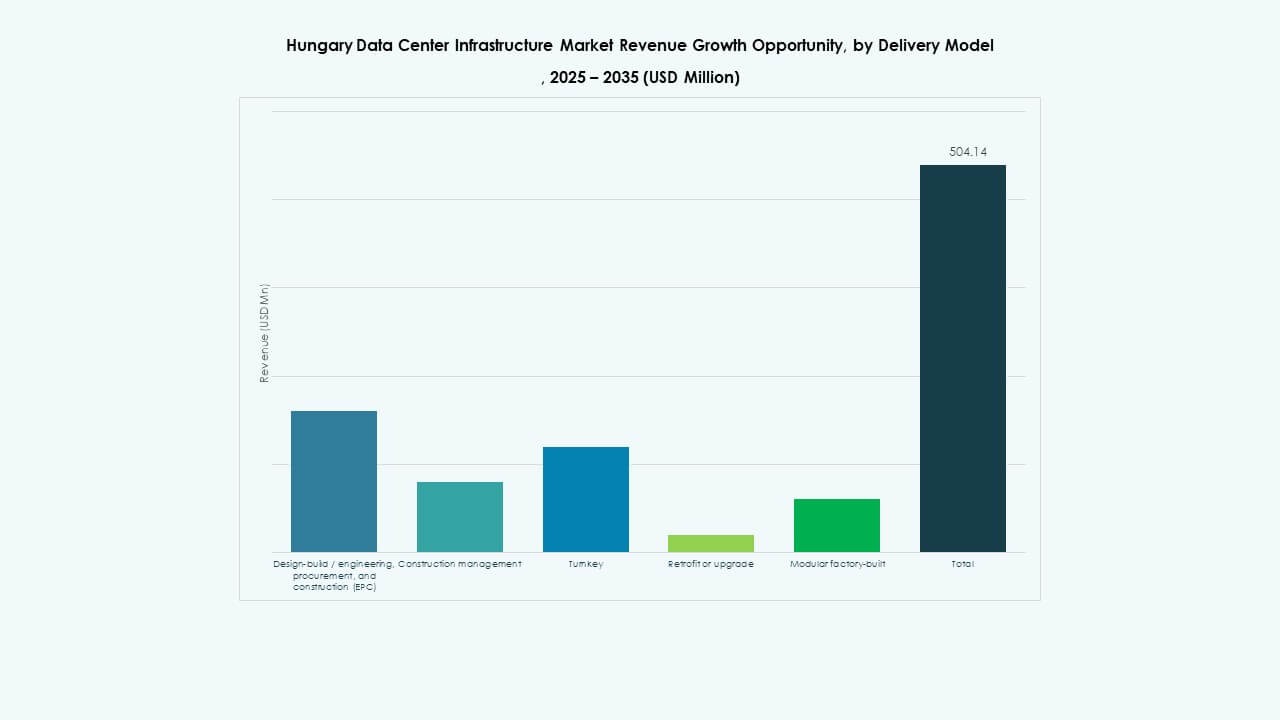

By Delivery Model

Design-build and turnkey models dominate due to their faster execution timelines. EPC contracts ensure integrated management and quality control. Retrofit projects rise as legacy facilities upgrade cooling and power systems. Modular factory-built solutions enable standardization and portability. The diversity of delivery models supports tailored solutions across various enterprise sizes and operational requirements.

By Tier Type

Tier 3 facilities lead deployments, balancing redundancy with affordability. Tier 4 sites expand gradually with hyperscale investments in ultra-reliable environments. Tier 1 and Tier 2 remain active for small enterprises and edge setups. The mix provides flexibility for multi-segment user needs. This diversity ensures efficient scaling of the Hungary Data Center Infrastructure Market toward global operational benchmarks.

Regional Insights

Central Hungary: The Core Growth Hub

Central Hungary, including Budapest, holds around 60% market share in data infrastructure investments. The region benefits from advanced fiber networks, skilled workforce, and proximity to enterprise clusters. It remains the focal point for hyperscale and colocation deployments. Government-backed innovation parks attract new facilities near existing IT zones. It sustains dominant growth through strong energy access and policy stability. Central Hungary remains the strategic base for regional expansion.

- For instance, Magyar Telekom increased capex excluding spectrum licenses by 7.8% year-on-year to HUF 113.3 billion in 2024, driven by accelerated fiber network rollout, reaching over 3.8 million gigabit-capable access points by year-end.

Western and Northern Hungary: Emerging Investment Corridors

Western and Northern Hungary witness growing activity in edge and modular facilities. Industrial corridors near Győr and Sopron offer land availability and renewable integration potential. The region contributes roughly 25% market share driven by logistics and manufacturing digitization. Cross-border connectivity with Austria enhances redundancy and export capacity. It attracts mid-scale developers exploring regional diversity and decentralized operations. These zones improve national distribution of computing resources.

- For instance, 4iG completed the acquisition of Vodafone Hungary on January 31, 2023, gaining a controlling 51% stake through Corvinus Zrt. The merger positioned 4iG as Hungary’s second-largest telecom operator, strengthening its fixed broadband, mobile, and television service portfolio nationwide.

Eastern and Southern Hungary: Expanding Digital Footprint

Eastern and Southern regions represent emerging potential with about 15% market contribution. Infrastructure growth depends on government-led fiber rollout and energy grid expansion. It attracts small and medium facilities focused on localized data processing. Strategic efforts target rural digital inclusion and regional resilience. It plays a growing role in balancing national capacity loads. Development projects strengthen Hungary’s complete digital ecosystem across all subregions.

Competitive Insights:

- Cisco Systems, Inc.

- Dell Inc.

- Equinix, Inc.

- ABB Ltd.

- Schneider Electric

- Vertiv Group Corp.

- Digital Realty

- IBM Corporation

- Fujitsu Ltd.

- Lenovo Group Ltd.

The Hungary Data Center Infrastructure Market features strong competition among global technology providers and infrastructure specialists. It is driven by high demand for energy-efficient, modular, and scalable data solutions. Established firms focus on expanding local partnerships to strengthen regional presence. Equipment providers invest in AI-enabled cooling, advanced power systems, and automation platforms. Data center operators compete through sustainable designs and reliable uptime performance. Mergers and acquisitions support technology integration and service diversification. Competitive advantage depends on network resilience, renewable energy integration, and security compliance. Strong innovation pipelines and localized service offerings help key vendors capture emerging enterprise demand.

Recent Developments:

- In November 2025, Vertiv announced the acquisition of HVAC services firm PurgeRite for approximately USD 1 billion. The acquisition aims to expand Vertiv’s liquid-cooling and thermal-management capabilities to meet rising demand from high-power, AI-driven data centers. This enhances Vertiv’s mechanical infrastructure offerings in cooling and HVAC services

- In November 2025, Schneider Electric secured roughly USD 2.3 billion in new U.S. data-center contracts. The deals include major supply agreements with a hyperscale operator and a leading colocation provider to supply power modules, cooling systems, UPS units and switchgear over 2025–2026.

- In September 2025, Schneider Electric launched its AI-ready liquid-cooled EcoStruxure solutions designed for high-density servers supporting NVIDIA GPU-based workloads, marking a significant product launch in data center infrastructure.

- In May 2025, NTT DATA announced the accelerated expansion of its Global Data Centers division with land acquisitions across North America, Europe, and Asia, supporting nearly a gigawatt of planned data center capacity as part of a $10 billion investment through 2027.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Market Segmentation

Market Segmentation