Executive summary:

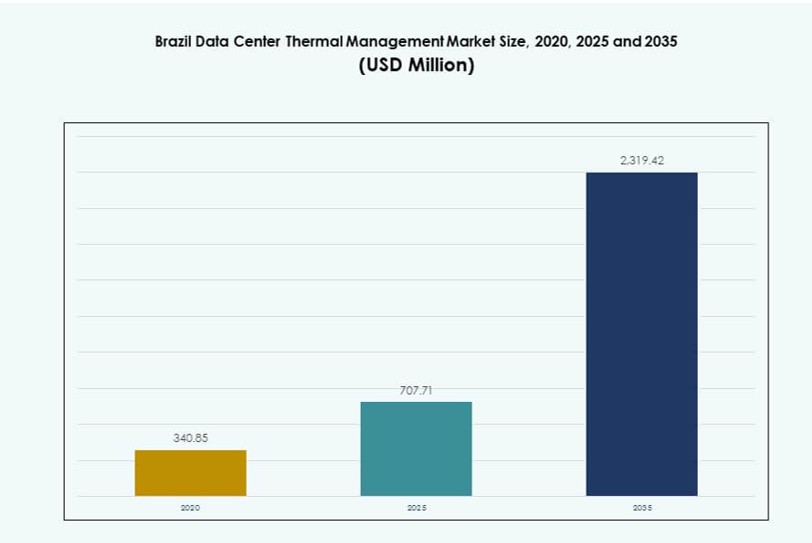

The Brazil Data Center Thermal Management Market size was valued at USD 340.85 million in 2020 to USD 707.71 million in 2025 and is anticipated to reach USD 2,319.42 million by 2035, at a CAGR of 12.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Brazil Data Center Thermal Management Market Size 2025 |

USD 707.71 Million |

| Brazil Data Center Thermal Management Market, CAGR |

12.53% |

| Brazil Data Center Thermal Management Market Size 2035 |

USD 2,319.42 Million |

The market is driven by rising deployment of high-density AI workloads, increased demand for hyperscale capacity, and growing sustainability pressures. Operators are shifting to advanced thermal solutions, including liquid cooling and AI-enabled airflow management. These systems help reduce energy use, improve uptime, and support dense compute environments. Businesses view thermal infrastructure as a key operational asset. Cloud and colocation players are adopting modular and scalable cooling strategies. It aligns with broader digital growth across banking, telecom, and e-commerce. The market’s strategic importance grows as power and thermal efficiency shape data center investment.

Southeast Brazil leads due to strong infrastructure and hyperscale presence, with São Paulo as the core hub for cloud and colocation activity. The South and Central-West regions are emerging, supported by public cloud adoption and government IT upgrades. Cities like Brasília and Curitiba attract demand for thermal retrofits and edge sites. The North and Northeast show potential through telecom-led edge expansion. Climate, fiber access, and energy costs shape regional cooling strategies.

Market Dynamics:

Market Drivers

Rising High-Density AI Workloads Are Forcing Liquid Cooling Adoption Across Core Data Centers

The growth of AI, HPC, and GPU-intensive workloads is driving thermal demand across Brazil’s hyperscale and colocation data centers. High-performance racks reaching 40–100kW are pushing the limits of traditional air cooling systems. Operators are shifting to liquid cooling technologies like direct-to-chip and immersion to ensure thermal stability. Vertiv, Schneider Electric, and Dell have demonstrated pilot deployments in Brazilian facilities. The Brazil Data Center Thermal Management Market benefits from this shift as investors prioritize scalable, high-efficiency cooling for futureproofing. It supports high compute density while reducing thermal inefficiencies. AI models require predictable thermal performance under heavy loads. Businesses and cloud providers see direct benefits in uptime and hardware longevity.

Energy Efficiency Pressures Are Increasing Demand For Sustainable Thermal Infrastructure Investments

Brazil’s tropical climate and high electricity costs increase the need for efficient thermal management. Government pressure for greener data center infrastructure is encouraging investment in free cooling, liquid loop systems, and renewable-integrated chillers. Energy performance metrics such as PUE are becoming a key evaluation factor in investment decisions. Many operators are targeting PUE levels below 1.3 through retrofits and new builds. The Brazil Data Center Thermal Management Market is strategically positioned as a driver of energy cost optimization. It aligns directly with ESG frameworks adopted by major global cloud and colocation players. Smart airflow control, low-latency DCIM, and thermal-aware workload placement support better operational efficiency. Sustainability-linked financing adds further incentive to modernize thermal systems.

- For instance, ODATA’s DC SP04 facility introduced the Delta³ (Delta Cube) cooling system in March 2025, featuring a patented high-efficiency design that supports adaptive rack densities for AI and cloud workloads.

Colocation And Cloud Providers Accelerate Thermal Upgrades To Support Regional Digital Infrastructure Growth

Brazil’s growing demand for digital infrastructure is fueled by fintech, e-commerce, cloud gaming, and government digitalization. Colocation and cloud providers are rapidly expanding data center footprints across urban and secondary cities. To support demand, operators are deploying more modular and scalable thermal architectures. Vertically integrated ecosystems like Scala and ODATA are optimizing cooling infrastructure at scale. The Brazil Data Center Thermal Management Market supports this ecosystem by enabling high uptime, workload efficiency, and SLA compliance. Liquid cooling and thermal zoning support faster deployment of AI racks and storage systems. Providers are upgrading thermal systems in tandem with compute upgrades. Regional players focus on differentiated cooling to stay competitive in the colocation space.

- For instance, Elea Data Centers integrated Vertiv’s liquid cooling systems as part of a US$300 million first-phase investment across multiple buildings in São Paulo, enabling AI-ready infrastructure. Vertically integrated ecosystems like Scala and ODATA are also optimizing cooling infrastructure at scale to support high-density deployments.

Edge And Micro Data Center Deployments Are Creating Niche Demand For Compact, High-Efficiency Cooling Systems

With the expansion of edge computing, localized data centers are emerging across Brazil’s logistics hubs, telecom towers, and metro zones. These deployments require high-efficiency, space-saving cooling systems that operate reliably in remote or harsh environments. Compact immersion and direct-to-chip liquid coolers are gaining traction. Energy-aware software like AI-based thermal tuning ensures reliability at low overhead. The Brazil Data Center Thermal Management Market is directly benefiting from this distributed edge strategy. These facilities often face power and space limitations, making thermal innovation critical. Startups and telecom vendors are forming thermal management partnerships to deliver edge reliability. This growth is reshaping cooling needs beyond large-scale hyperscale campuses.

Market Trends

Adoption Of Smart Thermal Software And AI-Based Optimization Tools Across Data Center Ecosystems

Thermal management in Brazil is increasingly software-defined, using AI and ML algorithms to balance cooling loads dynamically. Tools like CFD modeling, thermal zoning, and DCIM-integrated controls are gaining popularity among operators. Real-time temperature tracking, fan speed control, and predictive maintenance reduce energy consumption. Major players deploy AI software to minimize hot spots and optimize liquid and air flow systems. The Brazil Data Center Thermal Management Market is experiencing a strong trend toward software-enhanced efficiency. Integration with workload placement and real-time energy monitoring is also advancing. This convergence of thermal hardware and smart software is shaping next-generation thermal design standards. The trend enhances operational intelligence and infrastructure agility.

Growing Use Of Rear Door Heat Exchangers And In-Row Cooling Solutions For Space Optimization

Brazil’s urban data centers often face space constraints, especially in high-cost zones like São Paulo. To adapt, operators use rear door heat exchangers and in-row cooling to manage airflow at the rack level. These compact systems enable high-density deployments in existing buildings without major retrofits. Rear door units paired with liquid loops are now a preferred option for supporting 30kW+ racks. The Brazil Data Center Thermal Management Market reflects this shift toward localized, rack-level thermal solutions. Rack-based containment supports modular growth and zone-based cooling control. Urban operators favor flexible cooling hardware that reduces real estate pressure and improves thermal accuracy. This trend supports high efficiency in limited footprints.

Shift Toward Retrofit-Focused Thermal Upgrades Across Legacy Data Centers

Many enterprise and institutional data centers in Brazil operate outdated thermal systems with poor energy performance. Retrofit programs are accelerating as operators seek to meet newer efficiency standards without rebuilding entire facilities. Retrofit options include chilled water upgrades, EC fans, modular heat exchangers, and airflow containment enhancements. Operators also adopt hybrid cooling models by integrating air and liquid systems. The Brazil Data Center Thermal Management Market sees strong traction in the retrofit vertical due to ROI clarity and ESG alignment. Government subsidies and efficiency mandates also support modernization efforts. Retrofit-ready solutions allow operators to bridge the gap between current capacity and future cooling demands.

Emerging Interest In Alternative Cooling Technologies Like Phase-Change And Thermoelectric Modules

Advanced R&D is expanding into new thermal technologies like phase-change materials (PCMs), thermoelectric coolers, and nanofluid-based systems. While early in deployment, some pilot projects in Brazil are testing thermoelectric cooling for micro data centers and telco applications. These technologies offer advantages in passive cooling, localized heat absorption, and precision temperature control. The Brazil Data Center Thermal Management Market may see future disruptions from these innovations as scaling and costs improve. Venture-backed startups and research institutions are exploring compact cooling materials suitable for edge and embedded applications. This trend reflects long-term diversification in the cooling tech mix for AI and edge growth.

Market Challenges

High Electricity Prices And Regional Power Constraints Raise Operational Cost For Cooling Systems

Brazil’s electricity prices are among the highest in Latin America, with tariffs fluctuating across regions. Power grids in rural or underserved areas often lack the stability needed for modern cooling systems. Cooling equipment must run reliably under voltage fluctuations and backup scenarios. High ambient temperatures further raise energy demand for cooling loads. The Brazil Data Center Thermal Management Market faces pressure to deliver efficient cooling under these constraints. Operators must balance uptime with utility overheads, especially during peak load seasons. Many delay adoption of high-capex liquid cooling systems due to uncertain ROI and long payback periods. Energy availability and cost remain key bottlenecks for rapid market transformation.

Limited Local Manufacturing And Cooling Equipment Supply Chains Delay Project Execution

Brazil depends on imports for many advanced thermal systems, including chillers, liquid loops, sensors, and high-performance fans. Local manufacturing of precision cooling components remains underdeveloped. This affects lead times, project costs, and long-term maintenance cycles. Customs duties and logistics delays also slow deployment of upgrades. The Brazil Data Center Thermal Management Market must overcome these supply-side gaps to meet rising demand. Limited access to skilled thermal technicians further adds to integration challenges. Operators must rely on global vendors or invest in local partnerships to streamline supply chains. These issues slow market penetration in regions beyond major urban zones.

Market Opportunities

Greenfield Hyperscale Campuses Are Investing In Next-Gen Cooling Infrastructure Across Strategic Tech Hubs

Hyperscale data center investments in Brazil continue to expand in key zones like São Paulo, Campinas, and Fortaleza. New builds are integrating direct-to-chip liquid cooling, chilled water loops, and modular cooling towers from the design stage. This offers an opportunity for vendors to deploy next-gen thermal systems with optimized layouts. The Brazil Data Center Thermal Management Market benefits from greenfield designs that prioritize ESG goals and performance KPIs. Investors see thermal efficiency as a strategic asset in competitive digital infrastructure markets.

Government Incentives And Cloud Localization Norms Will Drive Thermal Modernization Across Mid-Tier Facilities

Brazil’s policy shifts around cloud sovereignty, data residency, and local infrastructure support are driving mid-tier operators to modernize. Public incentives and energy efficiency programs will encourage upgrades in federal and regional cloud facilities. The Brazil Data Center Thermal Management Market gains momentum from this institutional push, especially in education, healthcare, and telecom sectors. Vendors offering compliance-ready cooling systems and training services will capture new demand clusters.

Market Segmentation

By Data Center Size

Large data centers dominate the Brazil Data Center Thermal Management Market due to investments from hyperscale and colocation players. These facilities handle AI, cloud, and enterprise loads at massive scale. Medium-sized centers follow, driven by national enterprises and fintech firms. Small data centers, often at the edge, require compact and efficient cooling solutions. Demand across all sizes is rising, but large centers contribute the highest thermal load and capex in this segment.

By Cooling Technology

Air-based cooling leads with widespread deployment across legacy and modern centers. Hot/cold aisle and direct air systems remain standard. Liquid-based cooling is gaining fast traction in AI-heavy deployments, especially direct-to-chip and rear-door liquid loops. Hybrid cooling solutions are expanding as transitional models. Phase-change and thermoelectric technologies remain niche but promising. The market is seeing fast diversification driven by density and sustainability needs.

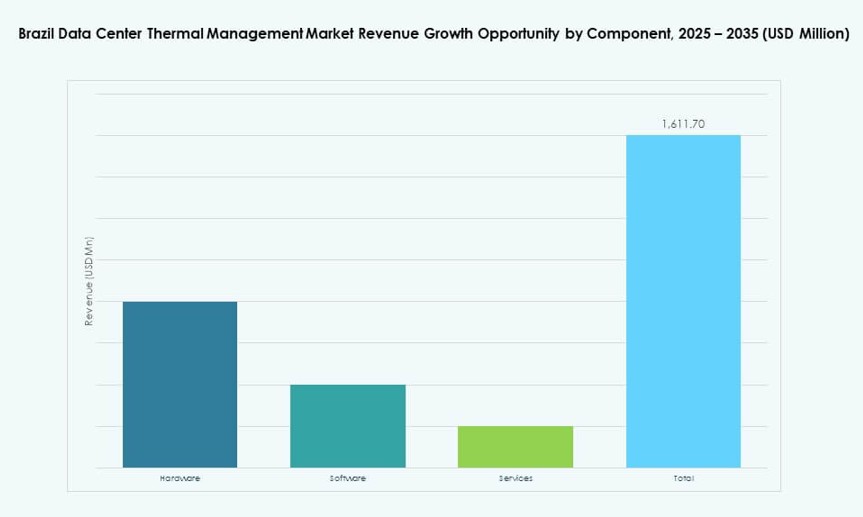

By Component

Hardware holds the largest share in the Brazil Data Center Thermal Management Market, driven by investments in chillers, piping, heat exchangers, and fans. Software is growing rapidly as AI, DCIM, and simulation tools enable performance optimization. Services such as retrofits, monitoring, and upgrades are essential for lifecycle management. All components contribute to efficient and scalable cooling systems across segments.

By Hardware

Cooling units and chillers account for the bulk of hardware investments. Piping and heat exchangers follow, supporting both liquid and hybrid systems. Fans and airflow components are key in air-based setups. Other niche components like valves, controllers, and smart ducts are gaining traction in advanced builds. The hardware segment benefits from continuous innovation in energy efficiency and materials.

By Software

DCIM dashboards and BMS modules are the most deployed software tools, enabling real-time monitoring and control. AI-based optimization is growing fast due to its ability to adapt to workload shifts. CFD simulation supports system design and predictive modeling. Software integration is becoming critical to extract full value from thermal hardware investments.

By Services

Preventive maintenance and monitoring services lead the segment due to uptime priorities. Retrofits and upgrades follow, especially in legacy sites. Installation services are vital in new builds, and remote diagnostics tools are expanding in managed service models. As cooling systems become more complex, lifecycle support services are in higher demand.

By Data Center Type

Hyperscale data centers dominate due to ongoing expansion by global and regional cloud firms. Colocation/cloud sites hold the second-largest share, driven by enterprise outsourcing. Edge/micro deployments are rising fast, supporting telecom, retail, and logistics needs. Enterprise sites show steady demand, particularly in finance and healthcare. Each type creates unique thermal challenges, shaping demand diversity.

By Structure

Room-based cooling still leads in legacy centers. Rack-based and row-based solutions are growing due to modularity, efficiency, and space optimization. Row-based cooling supports high-density racks and rapid deployment. Rack-level liquid cooling is expanding in AI-intensive zones. The structure mix is evolving in line with compute density and data center form factor shifts.

Regional Insights

Southeast Brazil Leads With Over 50% Share Due To Hyperscale Concentration In São Paulo

Southeast Brazil is the dominant subregion in the Brazil Data Center Thermal Management Market, accounting for more than 50% of the total market share. São Paulo, Campinas, and Rio de Janeiro house the largest clusters of hyperscale and colocation data centers. High power availability, fiber density, and cloud service hubs make the region a strategic location. The cooling infrastructure here is modern and often includes liquid systems, containment strategies, and software-driven airflow management. Multinational vendors prioritize this region for new deployments and partnerships. It remains the most active zone for greenfield and retrofit thermal investments.

- For instance, Scala Data Centers’ SGRUTB05 facility in São Paulo’s Tamboré campus operates with 6 MW of IT capacity, a 72,669 sq ft built area across five stories, supporting 400 racks, and uses waterless air-cooling to achieve a PUE of 1.4. Multinational vendors prioritize this region for new deployments and strategic partnerships.

South And Central-West Regions Are Emerging With Government, Education, And Cloud Initiatives

South and Central-West Brazil are emerging markets driven by regional government data centers, public cloud rollouts, and enterprise IT expansion. Cities like Curitiba, Goiânia, and Brasília are seeing demand from education, telecom, and financial institutions. Thermal solutions in these zones are often retrofit-focused, balancing energy performance with budget. The Brazil Data Center Thermal Management Market sees growing inquiries for hybrid cooling, remote monitoring, and modular units in these regions. While infrastructure maturity is lower than the Southeast, momentum is building with cloud adoption and local policy support. Vendors have a growing opportunity to tap into underserved metros.

North And Northeast Regions Hold Modest Share But Show Growth Potential In Edge Deployments

The North and Northeast regions contribute a smaller share but are important for distributed and edge computing. Climate conditions are more extreme, requiring durable cooling infrastructure with low energy overhead. Cities like Recife, Salvador, and Manaus are integrating micro data centers into telecom and logistics ecosystems. These locations need compact liquid and thermoelectric systems for harsh environments. The Brazil Data Center Thermal Management Market is slowly expanding here through telecom and smart city use cases. Infrastructure limitations and low digital density slow large-scale growth, but the long-term need for edge cooling will unlock regional demand.

- For instance, Scala Data Centers’ SFORPF01 facility in Fortaleza’s Praia do Futuro campus delivers 7.2 MW of IT capacity in a 206,613 sq ft structure, scheduled to go live in 2025, supporting edge computing growth in Brazil’s Northeast region.

Competitive Insights:

- Vertiv Group Corp.

- Schneider Electric

- Stulz GmbH

- Delta Electronics, Inc.

- Mitsubishi Electric Corporation

- Daikin Industries Ltd.

- Trane Technologies plc

- Airedale International Air Conditioning Ltd.

- Johnson Controls International plc

- Nortek Air Solutions, LLC

The Brazil Data Center Thermal Management Market features a competitive landscape led by global thermal solution providers and regional infrastructure operators. Vertiv and Schneider Electric hold significant market share through their advanced air and liquid cooling systems and strong local partnerships. Mitsubishi Electric, Daikin, and Trane bring HVAC expertise, while Stulz and Nortek offer precision cooling technologies tailored for high-density racks. Delta Electronics and Johnson Controls integrate smart automation and software optimization into their systems. It is seeing increasing competition in AI-driven thermal control and modular cooling solutions. Product innovation, regional presence, and integration capabilities remain the key competitive factors. Companies are expanding retrofit services and launching next-gen systems to serve hyperscale and edge deployments across major Brazilian cities.

Recent Developments:

- In October 2025, ODATA announced the launch of its new DC SP04 data center in São Paulo, Brazil. This facility introduces the Delta Cube (Delta³) cooling system for the first time in Brazil, enhancing efficiency and supporting high-density AI and cloud computing needs.

- In February 2025, Elea Data Centers partnered with Vertiv to deploy hundreds of cooling distribution units (CDUs) for liquid cooling infrastructure supporting AI and ML workloads across Brazil, marking the first such initiative in Latin America with a $300 million investment and first-phase delivery planned for 2025.

- In January 2025, Mitsubishi Electric signed a memorandum of understanding with AWS to collaborate on data center energy management. The partnership focuses on air conditioning control using thermal load prediction and AWS AI technologies to improve energy savings in data centers.

- In August 2024, Scala Data Centers inaugurated the second phase of its São Paulo campus, launching buildings SGRUTB08 and SGRUTB12 equipped with advanced thermal management solutions to handle substantial IT loads amid Brazil’s data center expansion.