Executive summary:

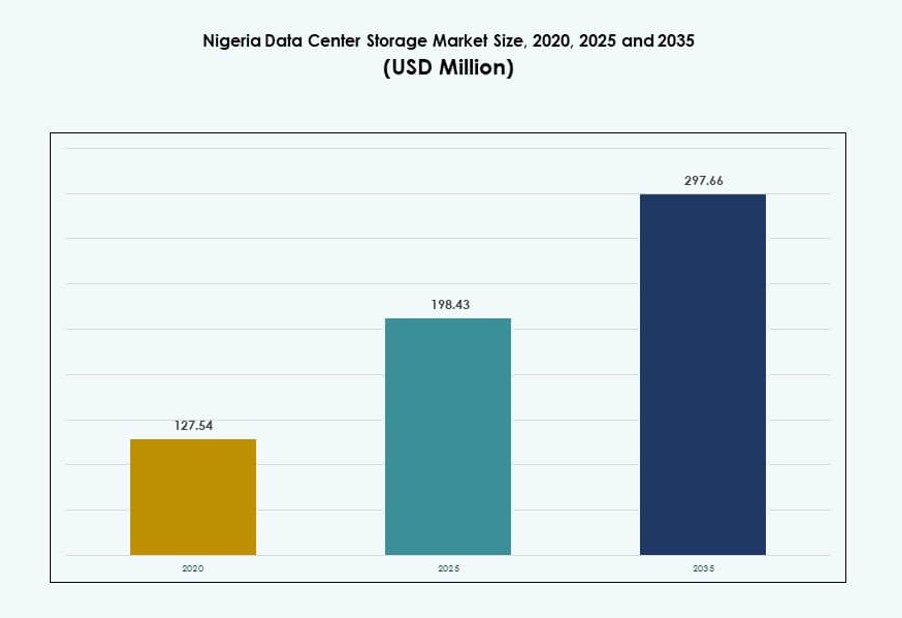

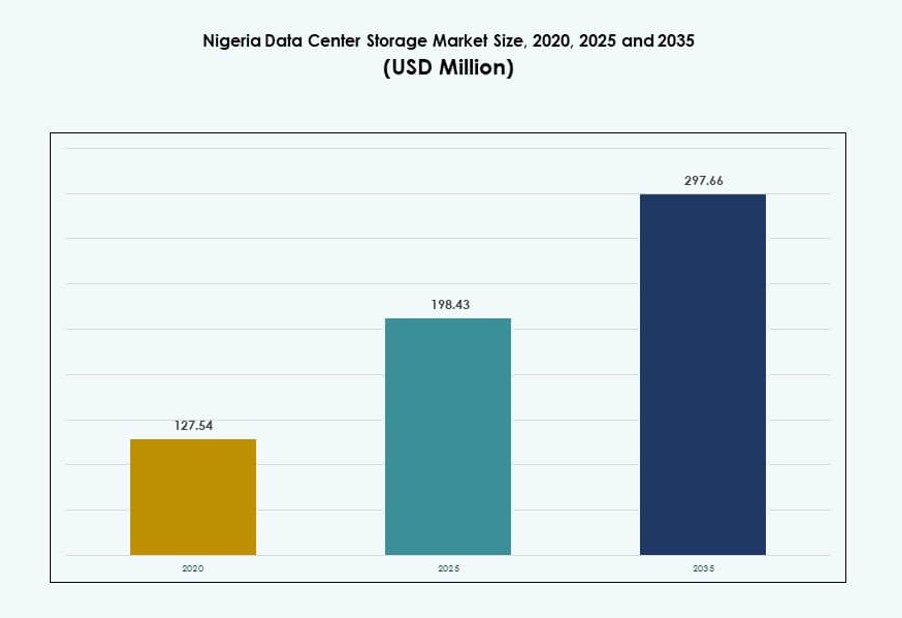

The Nigeria Data Center Storage Market size was valued at USD 127.54 million in 2020 to USD 198.43 million in 2025 and is anticipated to reach USD 297.66 million by 2035, at a CAGR of 4.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Nigeria Data Center Storage Market Size 2025 |

USD 198.43 Million |

| Nigeria Data Center Storage Market, CAGR |

4.16% |

| Nigeria Data Center Storage Market Size 2035 |

USD 297.66 Million |

Growth in digital transformation, rising enterprise cloud adoption, and data localization trends are driving demand for modern storage infrastructure. Businesses across banking, telecom, and public sectors are upgrading from legacy systems to all-flash and hybrid storage models. Technology vendors are integrating AI and automation to improve storage efficiency and reduce downtime. The expansion of hyperscale and Tier III facilities is strengthening the market’s base. Data security, latency reduction, and local data residency remain key priorities. The Nigeria Data Center Storage Market presents strategic value to investors focused on scalable and regulated infrastructure.

Lagos leads the market due to its dense enterprise ecosystem, advanced infrastructure, and access to submarine cables. Abuja follows as a key hub for public sector digital initiatives and data compliance needs. Port Harcourt, Kano, and Ibadan are emerging markets supported by growing telecom presence and SME digitization. The coastal regions offer strong connectivity, while inland areas are seeing increased investment in localized data hubs. Regional expansion is supported by national broadband and digital transformation programs. These developments are broadening the geographic footprint of the Nigeria Data Center Storage Market. Demand across subregions reflects a mix of centralized cloud and edge computing use cases.

Market Dynamics:

Growing Enterprise Digitalization and Data Proliferation Across Financial and Telecom Sectors

Enterprises across BFSI and telecom sectors in Nigeria are deploying digital tools that require scalable and secure storage infrastructure. These sectors generate large volumes of structured and unstructured data daily, demanding robust and efficient storage systems. The Nigeria Data Center Storage Market is benefiting from strong digitization efforts, particularly in Lagos, Abuja, and Port Harcourt. IT leaders are focusing on enhancing data accessibility and redundancy across business units. Cloud migration is accelerating, and hybrid deployment models are becoming standard across mid-to-large enterprises. Businesses are shifting from traditional file storage to object-based and all-flash architectures. This shift supports faster access speeds and real-time analytics. Investors are targeting service providers with scalable solutions to support long-term digital maturity. Government-backed tech incentives continue to create a favorable investment climate.

- For instance, MTN Nigeria partnered with Huawei to deploy FDD tri-band Massive MIMO, resulting in a 90% increase in LTE traffic volume and a 252% rise in peak-hour user-perceived rates. This upgrade supports high-performance applications and strengthens digital infrastructure linked to the Nigeria Data Center Storage Market.

Rising Cloud Adoption and the Surge in Localized Content Delivery Requirements

Nigeria’s growing user base for streaming, gaming, and e-commerce platforms has increased demand for low-latency and high-throughput storage. This has driven edge data centers and CDN providers to expand footprint near user clusters. The Nigeria Data Center Storage Market is adapting to this shift by supporting distributed cloud models and storage-as-a-service offerings. Businesses are investing in local cloud zones to reduce bandwidth costs and meet compliance. Cloud-native apps and microservices are creating new requirements for scalable storage arrays. The need for elastic, multi-tiered storage that adjusts with workload variation is pushing platform innovation. Storage vendors are integrating AI to auto-tier data between SSD and HDD systems. Strategic partnerships between telcos and hyperscalers are strengthening hybrid-cloud ecosystems. It improves storage reliability and data recovery.

Strategic Investments in Hyperscale and Modular Data Center Infrastructure

New projects led by local operators and international tech firms are boosting Nigeria’s data center capacity. The Nigeria Data Center Storage Market is expanding with modular facilities built to scale and adapt to client-specific needs. Developers are introducing Tier III and Tier IV data centers with advanced rack density and energy-efficient designs. These centers demand high-performance storage backbones such as SAN and NVMe systems. Enterprises now require high Input/Output Operations Per Second (IOPS) and low-latency storage. Public-private partnerships are enabling easier access to land, power, and fiber routes. Major players are integrating advanced cooling and backup systems for continuous operation. Storage is being bundled with data center co-location, increasing value proposition. These projects attract long-term institutional capital and technology transfer.

- For instance, Rack Centre’s LGS2 facility in Lagos, commissioned in April 2025, added 12 MW of capacity with 3,240 sqm of white space across six data halls, supporting high-density racks and next-gen storage infrastructure for hyperscale clients.

Growth in Digital Identity Programs and E-Governance Drives Demand for Secure Storage

The national e-governance rollout and digital identity schemes require secure, scalable data management infrastructure. Government portals and citizen databases generate high-volume transactional and personal data. The Nigeria Data Center Storage Market plays a critical role in storing and protecting these datasets. Data sovereignty laws and security concerns favor domestic storage facilities. This fosters demand for high-availability and encrypted storage solutions. Vendors are deploying storage with built-in compliance and role-based access control. Public cloud platforms are being evaluated for sensitive workloads but often supplemented with local hybrid infrastructure. High-growth in healthcare digitization and educational platforms adds pressure on public agencies. Security and uptime are now central criteria in storage procurement decisions.

Market Trends

Adoption of NVMe-Based Storage Arrays for Performance-Critical Enterprise Workloads

Organizations are transitioning to NVMe storage systems to enhance speed and handle latency-sensitive workloads. These arrays support fast retrieval of data for AI workloads, edge analytics, and real-time processing. The Nigeria Data Center Storage Market is seeing increased investment in NVMe-over-Fabrics (NVMe-oF) to improve bandwidth. Enterprises are phasing out legacy HDD arrays for flash-based systems that offer higher IOPS and durability. Vendors are integrating NVMe with automated storage tiering to reduce operational cost. Mission-critical sectors like BFSI and e-healthcare prefer NVMe for high throughput. IT departments are restructuring their architecture to support these formats across distributed environments. Adoption is highest among Tier III data centers in Lagos and Abuja. Migration to NVMe is seen as a long-term ROI-enhancing strategy.

Shift Toward Object Storage to Handle Large-Scale Unstructured Data Growth

Rapid growth in surveillance, social media, and multimedia content is leading to a shift toward object storage. Object storage provides scalability and metadata-rich environments suited for unstructured data workloads. The Nigeria Data Center Storage Market is deploying these systems across content-heavy sectors like media, education, and fintech. Enterprises prefer object-based formats for their cost efficiency and ease of retrieval across platforms. Storage vendors are offering S3-compatible APIs for cloud and hybrid deployments. Backup and disaster recovery services now rely on object storage for scalability and integrity. Demand is rising in areas processing satellite imagery, IoT data, and AI datasets. Object storage also simplifies compliance with data protection mandates. Its flexibility supports multiple storage use cases through a single architecture.

Demand for Software-Defined Storage (SDS) to Improve Infrastructure Flexibility and Cost Management

Enterprises are shifting to software-defined storage to increase operational efficiency and reduce dependency on hardware. SDS separates storage software from physical devices, enabling centralized management. The Nigeria Data Center Storage Market is witnessing demand for SDS to optimize resource utilization. Telecom and ISP operators use SDS for better scalability in multi-tenant environments. SDS also supports automation and reduces provisioning time for enterprise workloads. Many deployments are driven by open-source stacks like Ceph or commercial SDS platforms from VMware and Red Hat. This model appeals to mid-size businesses unable to invest in high-end appliances. SDS helps align storage capacity with variable demand from digital platforms. It supports hybrid cloud strategies and vendor-neutral deployment.

Integration of AI and Machine Learning for Predictive Storage Optimization

AI-powered storage solutions are improving how organizations manage and scale their data environments. These systems analyze usage patterns to forecast capacity requirements and optimize tiering. The Nigeria Data Center Storage Market is adopting AI-enabled platforms for smarter decision-making and self-healing storage. AI tools help detect anomalies, prevent failures, and enhance data lifecycle management. Enterprise IT teams use machine learning models to balance performance and cost. Cloud providers offer AI-integrated dashboards to streamline storage operations. Predictive analytics reduces downtime and ensures data availability. This improves resilience and supports high SLAs across sectors. AI-driven automation has become a competitive differentiator among storage vendors.

Market Challenges

Power Supply Instability and Energy Cost Burdens for Data Center Operators

Frequent power outages and inconsistent grid performance affect the operational stability of storage infrastructure. Backup systems like diesel generators increase cost and carbon footprint. The Nigeria Data Center Storage Market faces high energy expenses, which constrain ROI for smaller operators. Efficient power delivery and thermal management become essential to avoid data loss and system overheating. Rising electricity tariffs impact the viability of on-premise deployments. While solar adoption is growing, it remains inadequate for large-scale Tier III or IV setups. This limits the ability to deploy high-density storage solutions that require steady power. Investors view power reliability as a risk factor when funding infrastructure projects.

Limited Local Manufacturing and Heavy Import Dependence for Storage Hardware Components

Most storage hardware used in Nigeria is imported, leading to high costs and long lead times. Currency fluctuations and import duties make it harder for operators to scale infrastructure quickly. The Nigeria Data Center Storage Market relies on foreign vendors for core hardware like SSDs, enclosures, and control units. Lack of local assembly or manufacturing creates bottlenecks during periods of high demand. Maintenance cycles get delayed due to spare part shortages or shipment delays. Service level agreements with OEMs often include offshore support, adding to complexity. Limited domestic R&D slows product localization. This gap affects innovation and resilience in the storage ecosystem.

Market Opportunities

Rising Demand for Tier-2 and Edge Data Centers Unlocks Regional Storage Growth Potential

Secondary cities like Ibadan, Benin City, and Kano are emerging as key demand zones. The Nigeria Data Center Storage Market is poised to benefit from edge deployments supporting latency-sensitive services. Businesses require localized storage for faster processing, caching, and compliance. Startups and SMEs in these regions need cost-effective, modular storage setups. Growth in fintech, video content, and surveillance systems drives need for edge storage. These areas offer untapped opportunities for mid-size integrators. Partnerships with ISPs and local governments can accelerate deployments.

Policy Support for Data Localization and Digital Infrastructure Development Fosters Market Entry

New regulations encourage public institutions and enterprises to store citizen and transactional data within national borders. The Nigeria Data Center Storage Market stands to gain from policies that mandate local hosting of sensitive datasets. Government cloud initiatives and national digital strategy increase demand for compliant storage. Foreign investors find a favorable environment supported by reforms and digital roadmaps. Incentives for technology zones and infrastructure players make Nigeria a target for long-term investment.

Market Segmentation

By Storage Type

Traditional storage remains widely used but is gradually losing share to more advanced formats. All-flash storage is gaining traction in BFSI and telecom segments for its high speed and reliability. The Nigeria Data Center Storage Market shows strong growth in hybrid storage due to its flexibility in handling mixed workloads. Hybrid models balance performance and cost by combining flash and HDD systems. Niche deployments such as archival storage use tape or WORM-based systems.

By Storage Deployment

Storage Area Network (SAN) leads in high-performance environments requiring low-latency storage. Network-attached Storage (NAS) is dominant among mid-size enterprises needing shared access. The Nigeria Data Center Storage Market has growing deployments of Direct-attached Storage (DAS) in edge and on-prem setups. SAN provides better scalability for co-location facilities and hyperscalers. Emerging demand from AI and surveillance is reshaping preferences in deployment types.

By Component

Hardware leads the market due to demand for physical drives, enclosures, and connectivity modules. Software is growing fast with the rise of software-defined storage and storage management platforms. The Nigeria Data Center Storage Market reflects increasing use of automation software to manage multi-tiered storage environments. Vendors offer bundled packages of hardware and software to streamline procurement. Remote monitoring tools are now standard in enterprise-grade setups.

By Medium

Hard Disk Drive (HDD) still holds the majority share due to cost efficiency in large storage arrays. Solid-State Drives (SSD) are gaining preference for high-performance computing and transaction-heavy applications. The Nigeria Data Center Storage Market also uses tape storage in backup, cold storage, and compliance-focused use cases. SSD adoption is growing fastest in financial services and healthcare. Hybrid configurations involving SSD cache with HDD bulk storage are common.

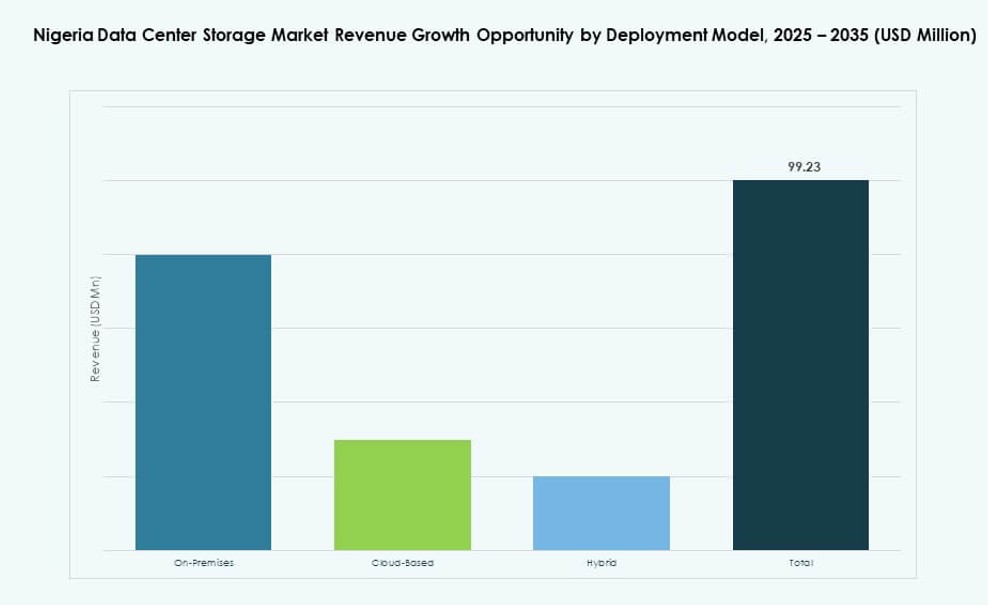

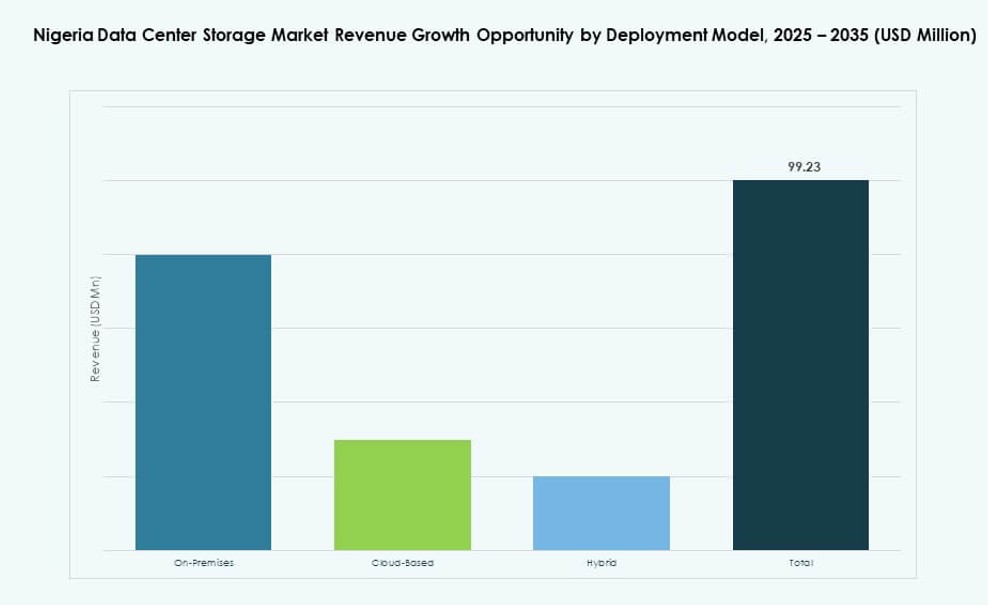

By Deployment Model

On-premises storage remains dominant in regulated sectors like government and banking. Cloud-based storage is expanding rapidly across startups and IT services. The Nigeria Data Center Storage Market is also seeing increased demand for hybrid models, combining private and public storage layers. Hybrid models support data residency and scalability needs. Many organizations are transitioning to cloud-native platforms but maintain on-prem backups for redundancy.

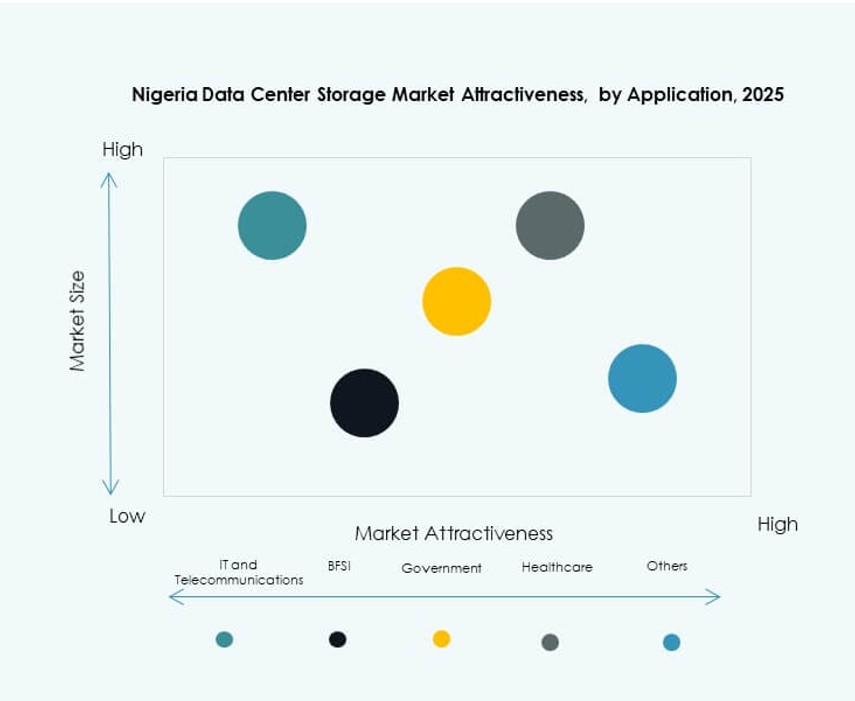

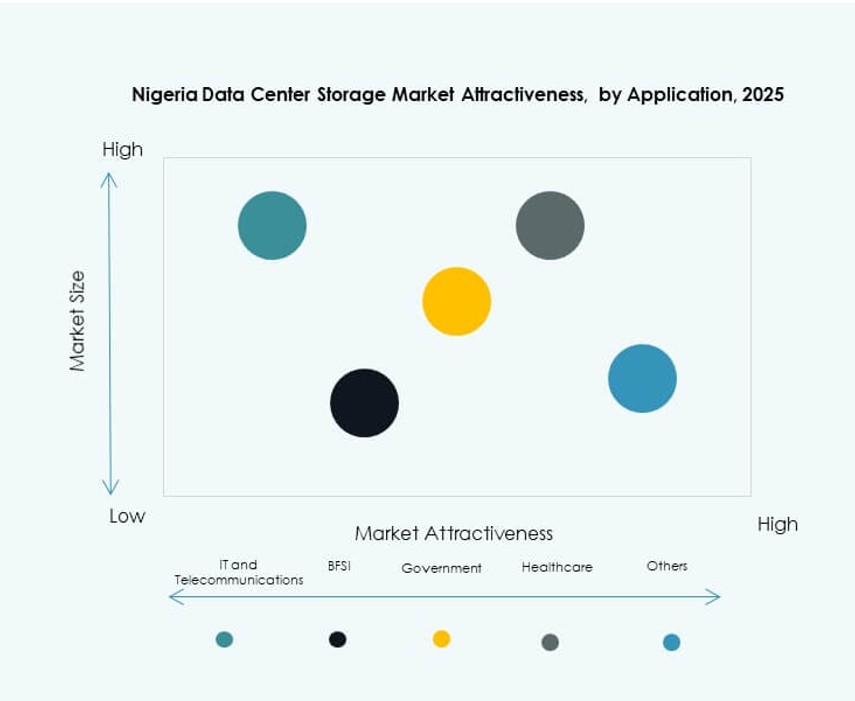

By Application

IT and telecommunications lead the demand, followed by BFSI due to heavy data volumes and low-latency needs. Government agencies use storage for digital ID systems, taxation, and public records. The Nigeria Data Center Storage Market also sees strong adoption in healthcare for imaging, diagnostics, and EHR platforms. Education and retail sectors are emerging as growth areas. Demand for AI-ready storage is rising across all sectors.

Regional Insights

Lagos Zone Leads the Market with Over 60% Share Due to Infrastructure Maturity and Dense Enterprise Base

Lagos remains the epicenter of Nigeria’s digital infrastructure, hosting hyperscale, co-location, and telecom data centers. The region accounts for more than 60% of the Nigeria Data Center Storage Market. It offers submarine cable landing stations, fiber rings, and reliable power access. Enterprises based in Lagos require high-performance storage for real-time analytics and cloud workloads. The financial sector contributes significantly to storage demand. Investment in smart buildings and digital services further drives adoption.

- For instance, Equinix commissioned its LG2.3 data center expansion in Lagos in April 2025, adding 6 MW of IT load and over 1,200 rack positions. This strengthened enterprise colocation and storage capabilities within the Nigeria Data Center Storage Market.

Abuja Emerges as a Key Government and Public Sector Storage Hub with 20% Market Share

Abuja hosts major government-run data centers supporting digital governance, identity management, and civil services. It holds around 20% share of the Nigeria Data Center Storage Market. Policy mandates for data localization and security create high demand for local storage. The city’s data centers often integrate secure storage modules and government cloud platforms. Healthcare and education departments are moving toward digital record systems. Abuja’s strategic role in national digital infrastructure continues to grow.

Port Harcourt and Other Emerging Cities Account for 20% Share with Growing Private Sector Activity

Port Harcourt, Kano, and Benin City are witnessing early-stage growth in regional data centers. These areas make up the remaining 20% of the Nigeria Data Center Storage Market. Local telecom operators and ISPs are deploying small-scale facilities. SME digitization and localized cloud hosting are driving demand for modular storage. Regional financial services and logistics firms require fast and resilient data access. Government incentives are encouraging investment in tech clusters outside major metros.

- For instance, Rack Centre operates Tier III–certified data centers in Lagos with modular, scalable designs that support enterprise and cloud workloads. The company’s facilities play a central role in Nigeria’s colocation and data storage ecosystem, serving financial institutions, telecom operators, and global cloud providers.

Competitive Insights:

- Rack Centre

- MainOne Data Centers

- MDXi

- Dell Technologies

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies Co., Ltd.

- NetApp

- Cisco Systems, Inc.

- Nutanix, Inc.

The Nigeria Data Center Storage Market features a mix of local colocation providers and global technology vendors competing on performance, scalability, and compliance. Rack Centre, MainOne, and MDXi lead on infrastructure availability, offering localized services aligned with Nigerian data regulations. Dell, IBM, and HPE dominate the enterprise segment through high-performance hardware and hybrid-ready platforms. Huawei and Cisco provide integrated solutions combining storage with networking and AI acceleration. NetApp and Nutanix serve cloud-native needs through software-defined and hyperconverged platforms. It remains fragmented but fast-growing, with vendors forging partnerships to gain access to financial services, telecom, and government sectors. Product innovation, latency optimization, and secure storage configurations shape competitive differentiation.

Recent Developments:

- In November 2025, Rack Centre entered a strategic partnership with EdgeNext to advance edge computing and storage capabilities across Nigeria.

- In April 2025, Rack Centre launched its second data center, LGS2, in Lagos, Nigeria. The 12MW facility includes six data halls and 3,240 sqm of white space, significantly enhancing colocation and storage capacity.