Executive summary:

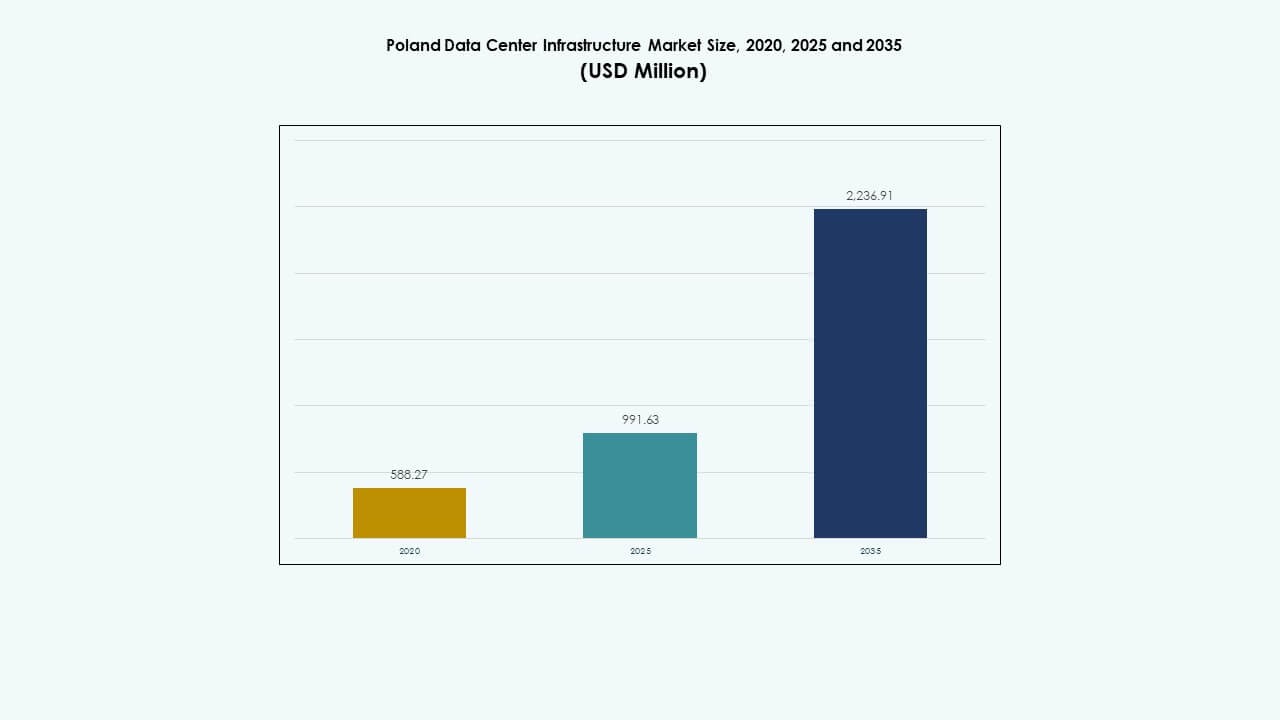

The Poland Data Center Infrastructure Market size was valued at USD 588.27 million in 2020, increased to USD 991.63 million in 2025, and is anticipated to reach USD 2,236.91 million by 2035, at a CAGR of 8.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Poland Data Center Infrastructure Market Size 2025 |

USD 991.63 Million |

| Poland Data Center Infrastructure Market, CAGR |

8.40% |

| Poland Data Center Infrastructure Market Size 2035 |

USD 2,236.91 Million |

Strong adoption of cloud computing, AI integration, and digital transformation across industries drives the market’s growth. Enterprises and government agencies expand investments in data sovereignty, renewable-powered operations, and modular infrastructure. It gains strategic importance as investors target Poland for its stable economy, skilled workforce, and connectivity advantage in Central Europe, fostering a robust digital ecosystem.

Central Poland, particularly Warsaw, leads the market with dense hyperscale and colocation developments supported by advanced fiber and energy infrastructure. Southern and western regions such as Kraków and Wrocław are emerging due to industrial digitization and edge deployment. Northern regions attract interest through renewable energy access and proximity to Baltic data routes.

Market Drivers

Market Drivers

Rising Cloud Migration and Digital Transformation Accelerating Infrastructure Expansion

The Poland Data Center Infrastructure Market gains strong momentum from the ongoing digital shift among enterprises and public institutions. Cloud migration projects by banks, telecoms, and government agencies push demand for scalable and secure hosting environments. Local and international providers invest in new hyperscale facilities to meet compliance and latency needs. The market benefits from nationwide 5G rollout and expanding fiber optic backbone. Energy-efficient infrastructure supports sustainability goals and cost optimization. It strengthens Poland’s role as a strategic digital hub in Central Europe. Businesses leverage improved data sovereignty and security frameworks.

- For instance, Atman has begun developing its WAW-3 data center campus near Warsaw, planned to deliver 43 MW of IT capacity across three buildings. This expansion reinforces Poland’s growing position in the Central European data infrastructure landscape and aligns with increasing hyperscale and colocation demand across the region.

Growing Investment in Renewable Power Integration and Green Data Centers

Renewable power integration is becoming a vital growth driver for the Poland Data Center Infrastructure Market. Operators deploy data centers near wind and solar generation clusters to lower emissions and energy costs. Large corporations adopt Power Usage Effectiveness (PUE) targets below 1.3 to meet ESG standards. Green design certifications and advanced liquid cooling systems gain traction. The focus on carbon neutrality enhances foreign investment confidence. Poland’s renewable grid modernization encourages energy-efficient equipment adoption. It strengthens the appeal for technology firms seeking sustainable expansion within the region.

Rapid Edge Deployment and Connectivity Enhancement for Industry 4.0 Applications

Edge computing growth drives investments across industrial and telecom segments. The Poland Data Center Infrastructure Market benefits from the proliferation of IoT, AI, and smart manufacturing operations. Edge sites improve latency and data processing efficiency near production facilities. Telecom operators deploy distributed nodes supporting Industry 4.0, logistics, and e-mobility ecosystems. High-speed fiber and 5G networks complement regional cloud adoption. These factors create consistent growth in regional data infrastructure. It positions Poland as a regional data convergence point connecting Western and Eastern Europe.

Strong Public and Private Partnership Models Supporting Data Sovereignty Goals

Strategic collaborations between government agencies and private investors strengthen digital resilience. The Poland Data Center Infrastructure Market witnesses initiatives encouraging localized data storage and cybersecurity frameworks. National projects support critical infrastructure hosting under strict compliance laws. Local firms partner with hyperscalers to co-develop hybrid architectures combining private and public clouds. This shift supports growing e-government and defense-related workloads. It ensures sustainable investment inflows and long-term digital autonomy. The policy-driven environment nurtures confidence among global investors entering the Polish market.

- For instance, Microsoft announced a PLN 2.8 billion investment in February 2025 to expand its cloud and AI infrastructure in Poland, strengthening computing capacity and supporting data sovereignty and cybersecurity in the region.

Market Trends

Market Trends

Expansion of Hyperscale Campuses by Global Cloud Providers and Colocation Firms

The Poland Data Center Infrastructure Market observes a surge in hyperscale campus developments across Warsaw, Poznań, and Kraków. Global cloud players like Google and Microsoft expand regional zones to handle large-scale workloads. Colocation operators follow with multi-megawatt buildouts supporting hybrid and AI-driven workloads. The country’s location enables low-latency access across Central and Eastern Europe. Investors capitalize on favorable land prices and renewable energy incentives. It reflects the growing transition toward large-capacity data ecosystems serving continental connectivity.

Adoption of Liquid Cooling and AI-Driven Thermal Optimization

Rising rack densities accelerate the adoption of advanced cooling technologies. The Poland Data Center Infrastructure Market experiences a shift from traditional air-based to liquid and immersion cooling. Operators deploy AI-driven thermal management systems to reduce energy waste. These technologies extend server lifespans while meeting sustainability targets. Facilities target PUE levels under 1.2 through continuous monitoring. Energy-efficient design improves operational economics. It enhances competitiveness for high-performance computing and AI data center use cases.

Integration of Modular and Prefabricated Data Center Designs for Speed and Scalability

Prefabricated modules redefine construction strategies for fast and scalable deployment. The Poland Data Center Infrastructure Market benefits from modular systems offering flexibility in capacity planning. Builders employ standardized components to reduce project timeframes and costs. These designs support remote edge and rural connectivity needs. Rapid assembly ensures better resilience and maintenance simplicity. The trend drives adoption among telecom and enterprise users. It aligns with evolving demand for localized and distributed processing sites.

Strengthening Cross-Border Connectivity and Submarine Cable Linkages

Cross-border data connectivity shapes new growth corridors for the region. The Poland Data Center Infrastructure Market gains from new terrestrial and submarine fiber links connecting to Germany and Scandinavia. These upgrades lower latency and expand cloud region coverage. Warsaw emerges as a connectivity hub supporting intercontinental data flow. Investors focus on building carrier-neutral hubs and Internet Exchange Points (IXPs). The initiative increases Poland’s role in European digital infrastructure networks. It reinforces long-term regional competitiveness in data routing efficiency.

Market Challenges

Market Challenges

High Energy Consumption and Limited Grid Modernization Affecting Operational Efficiency

The Poland Data Center Infrastructure Market faces challenges due to rising power needs across hyperscale projects. Many facilities depend on aging grid infrastructure that struggles to meet large-scale demand. Delays in renewable grid expansion affect power cost predictability. The market contends with increasing electricity tariffs and carbon taxes. Energy reliability issues raise operational expenses and limit sustainable growth. It requires coordinated upgrades to secure long-term capacity planning. The issue restricts smaller firms from entering large-scale operations competitively.

Skilled Workforce Gaps and Regulatory Complexity Slowing Project Development

Talent shortages in mechanical, electrical, and IT infrastructure roles create project execution delays. The Poland Data Center Infrastructure Market must address skill development through targeted education programs. Complex permitting and environmental assessment procedures extend construction timelines. Investors face compliance challenges in sustainability reporting and local zoning laws. These regulatory factors limit market agility and scalability. It highlights the need for streamlined policies to sustain investor confidence. Stronger collaboration between industry bodies and government agencies could help accelerate approvals.

Market Opportunities

Rising Role of Artificial Intelligence, Cloud, and 5G Integration

The Poland Data Center Infrastructure Market offers strong potential through AI and 5G convergence. Edge-based AI workloads demand new micro data centers near industrial zones. Telecom operators build next-generation infrastructure supporting connected vehicles and IoT networks. Local cloud providers expand hybrid offerings targeting small and mid-sized enterprises. It creates favorable ground for technology integration across sectors. Investors view these innovations as gateways to high-value, future-proof deployments.

Expansion of Sustainable Energy and Data Localization Initiatives

Growing renewable projects open opportunities for green data center investments. The Poland Data Center Infrastructure Market aligns with national energy transition goals. Solar, wind, and hydro integration enable long-term power cost stability. Data localization regulations increase demand for regional storage capacity. International developers partner with utilities to deploy low-carbon campuses. It supports Poland’s goal of becoming a net data exporter in Europe.

Market Segmentation

Market Segmentation

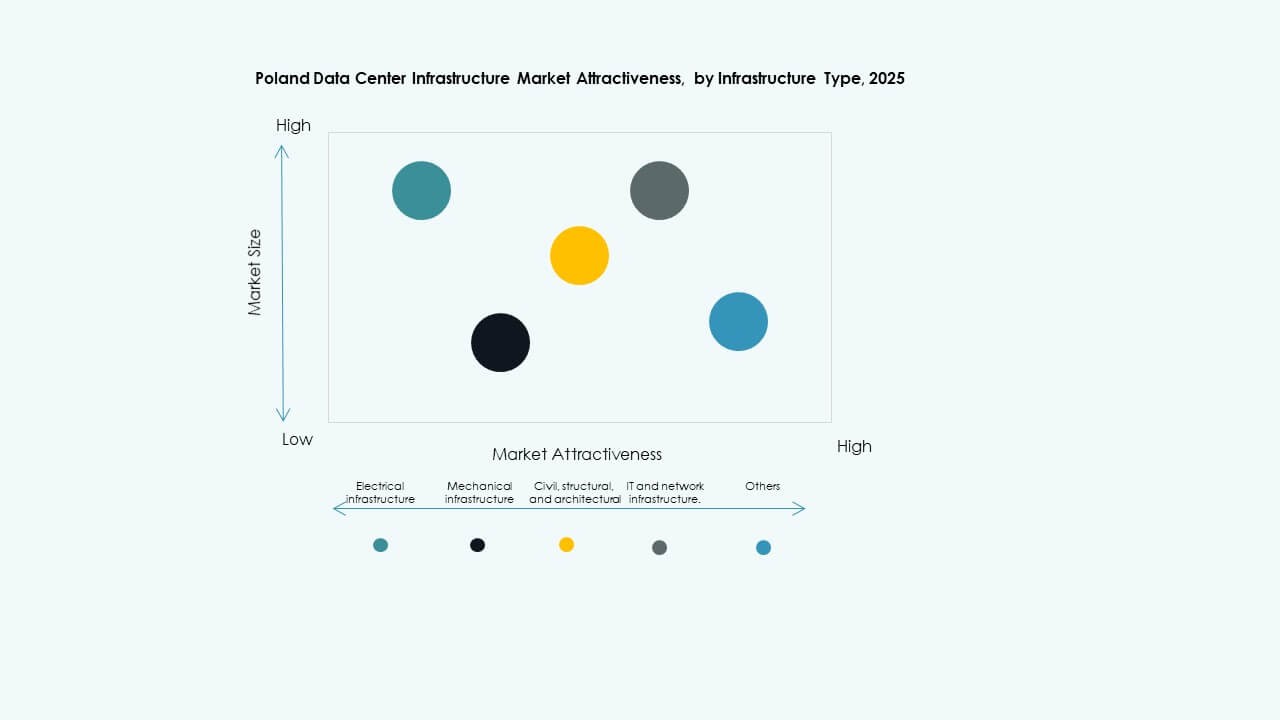

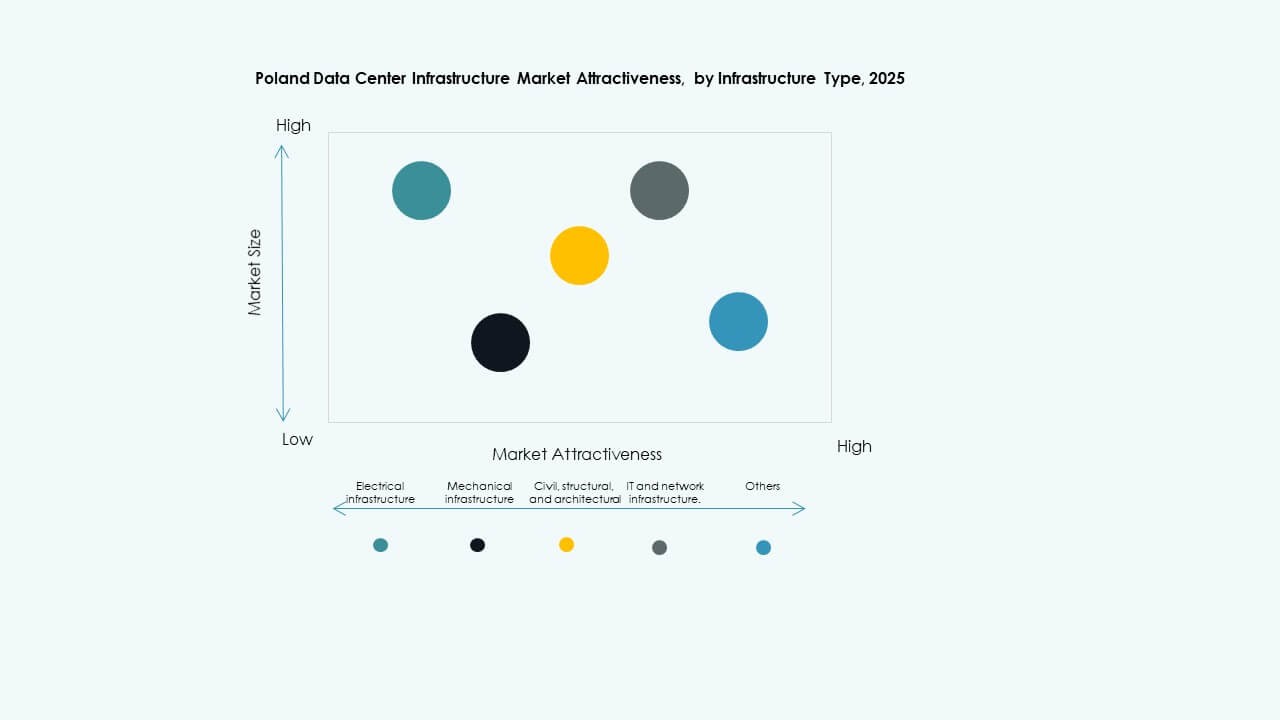

By Infrastructure Type

Electrical infrastructure holds the dominant share in the Poland Data Center Infrastructure Market. Reliable power backup and distribution systems remain critical to continuous operations. Mechanical infrastructure grows steadily due to the adoption of high-efficiency cooling systems. Civil and architectural works follow, supported by modular and prefabricated designs. IT and network infrastructure expand with increased adoption of AI-ready servers and fiber networks.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) systems represent a key segment driving reliability. The Poland Data Center Infrastructure Market depends on resilient UPS and switchgear systems to prevent downtime. Battery Energy Storage Systems (BESS) gain traction for peak-load balancing. Grid connection upgrades enhance redundancy for hyperscale sites. Smart PDUs and transfer switches improve load distribution efficiency. Electrical modernization strengthens energy resilience across colocation and enterprise facilities.

By Mechanical Infrastructure

Cooling units dominate the mechanical infrastructure segment in the Poland Data Center Infrastructure Market. The move toward liquid cooling and containment systems improves power efficiency. Chillers and heat recovery setups enhance thermal management. Pumping systems integrate smart sensors for temperature control. Energy optimization remains a key operational focus for operators. Mechanical advancements lower PUE values across multi-megawatt campuses.

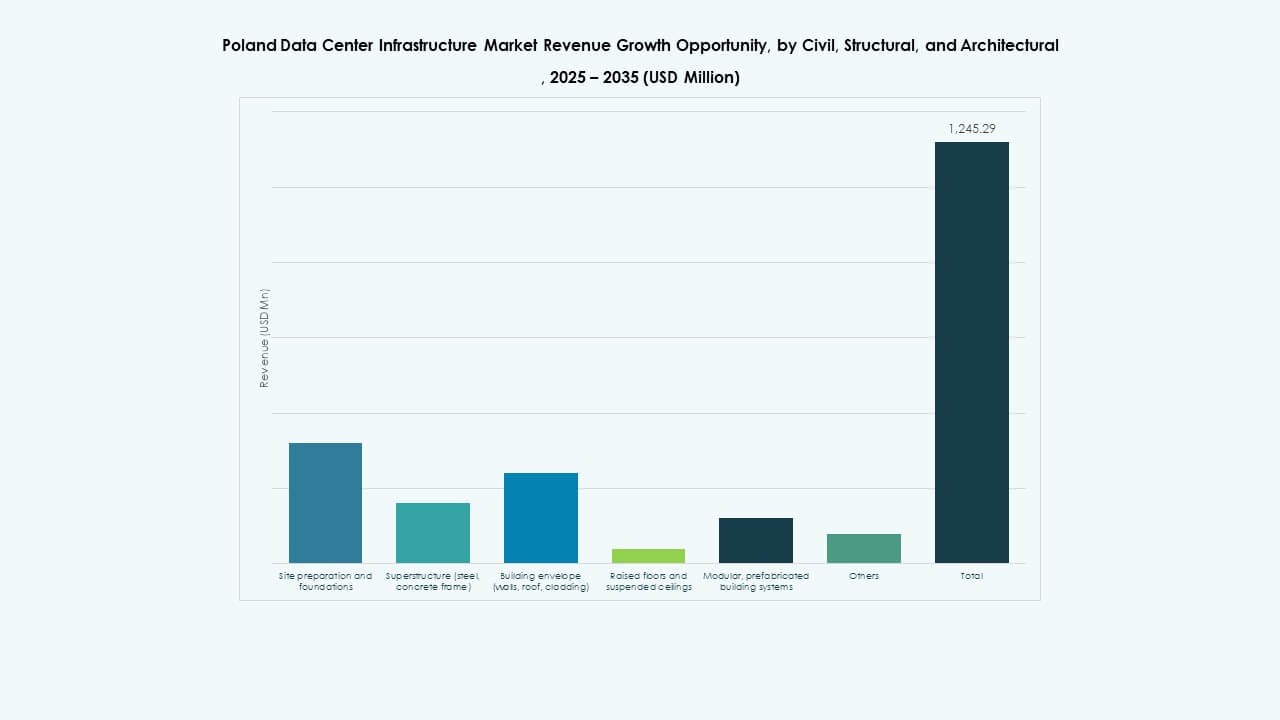

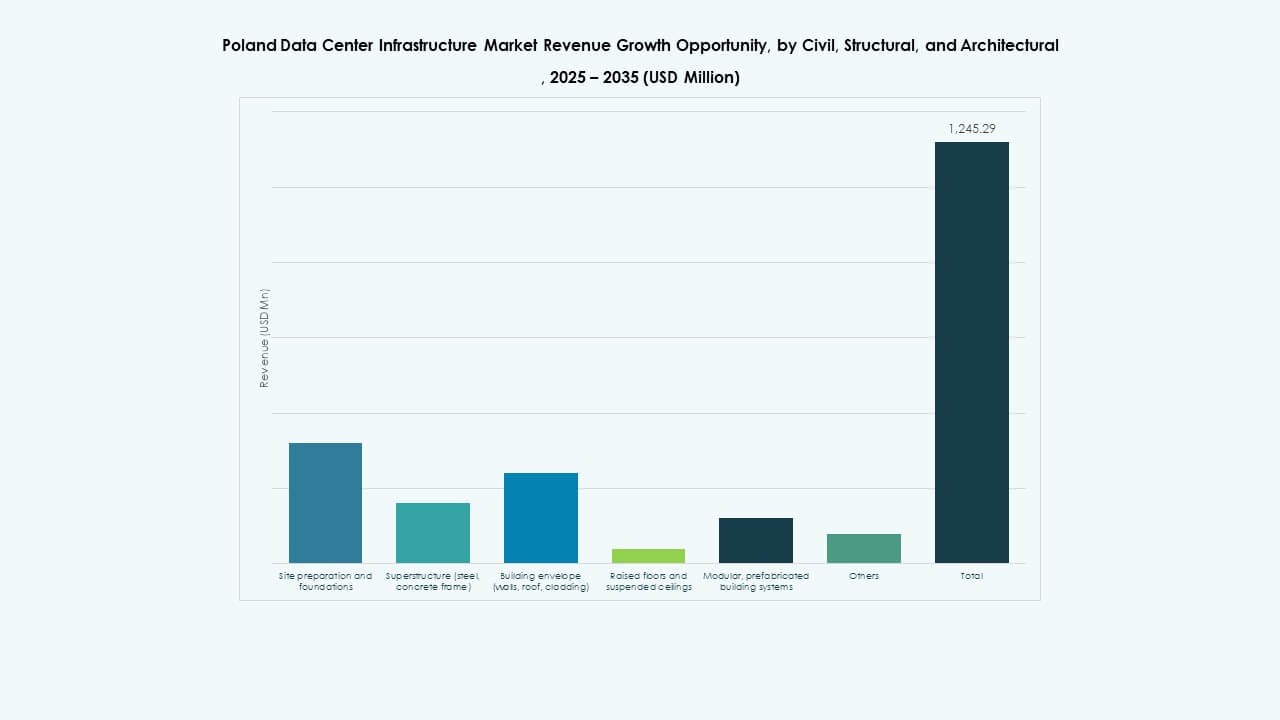

By Civil / Structural & Architectural

Superstructure and modular building systems dominate this segment. The Poland Data Center Infrastructure Market benefits from fast modular assembly for scalability. Steel and concrete frames ensure durability and structural safety. Raised flooring and suspended ceilings support airflow control and cabling integration. Prefabricated shells shorten construction lead times. These practices reduce costs and increase deployment flexibility.

By IT & Network Infrastructure

Server and storage systems hold the largest share in the Poland Data Center Infrastructure Market. High-performance computing and cloud workloads increase rack demand. Networking equipment supports AI-driven operations and low-latency performance. Optical fiber and cabling systems expand to handle rising data traffic. Racks and enclosures improve spatial efficiency within modular setups. The segment plays a key role in enabling smart and scalable computing architectures.

By Data Center Type

Hyperscale data centers dominate the Poland Data Center Infrastructure Market, driven by major cloud providers. Colocation facilities grow quickly to support hybrid and enterprise hosting. Edge centers emerge near industrial clusters and telecom hubs. Enterprise data centers remain relevant for regulated sectors like finance. The diversification of types ensures broad market coverage.

By Delivery Model

Design-build and turnkey models lead the market due to faster project execution. The Poland Data Center Infrastructure Market increasingly favors modular factory-built setups. Construction management remains critical for multi-phase expansions. Retrofit and upgrade projects rise as older sites modernize for higher density. The flexibility of models enables investment scalability and faster return on infrastructure.

By Tier Type

Tier 3 facilities dominate with strong reliability and cost balance. The Poland Data Center Infrastructure Market sees gradual Tier 4 adoption for mission-critical users. Tier 2 centers serve small enterprises, while Tier 1 sites remain limited. Growth focuses on certifications under Uptime Institute standards. The tier distribution reflects the country’s evolving enterprise and hyperscale ecosystem.

Regional Insights

Central Poland Leading with Warsaw as the Primary Hyperscale Hub (Market Share ~48%)

Central Poland leads the Poland Data Center Infrastructure Market with Warsaw as the strategic center. Major hyperscalers and colocation providers cluster around the capital due to strong fiber connectivity. The region benefits from government digital policies and expanding tech clusters. Reliable energy access and data demand from financial and enterprise sectors sustain growth. Central Poland remains the top destination for large-scale investments.

- For example, Microsoft confirmed a PLN 2.8 billion (approximately $700 million) investment announced in February 2025 to expand its hyperscale cloud and AI data center infrastructure near Warsaw, with the project expected to complete by mid-2026. This phase follows their initial $1 billion investment starting in 2020, supporting cybersecurity enhancement and AI development for the Polish market.

Southern and Western Poland Emerging as Industrial Data and Edge Clusters (Market Share ~32%)

Southern and Western regions witness strong expansion driven by industrial and manufacturing digitalization. Cities like Kraków, Wrocław, and Katowice host new edge data centers. The Poland Data Center Infrastructure Market benefits from logistics, AI, and automation industries. Access to renewable energy sources enhances cost competitiveness. Local authorities promote investment through tax incentives and industrial parks.

Northern and Eastern Poland Gaining Momentum with Renewable Integration (Market Share ~20%)

Northern Poland emerges with renewable-powered data center initiatives leveraging Baltic wind corridors. Eastern Poland develops smaller facilities serving public and educational networks. The Poland Data Center Infrastructure Market expands toward energy-efficient and sustainable infrastructure. These areas attract developers seeking proximity to Scandinavian data routes. It strengthens the country’s national connectivity and decentralization objectives.

- For instance, Poland’s national grid development plan allocates about 1,200 MW of capacity for future data center projects by 2034, reflecting national efforts to integrate renewable power and enhance grid readiness for digital infrastructure growth. PGE continues to expand offshore wind and renewable energy capacity, supporting the country’s broader sustainability and energy transition goals.

Competitive Insights:

- Digital Realty

• Equinix, Inc.

• Schneider Electric

• Vertiv Group Corp.

• Huawei Technologies Co., Ltd.

• Cisco Systems, Inc.

• Dell Inc.

• IBM Corporation

• ABB

• Fujitsu

The Poland Data Center Infrastructure Market features a mix of global hyperscale operators and specialized infrastructure vendors competing for capacity expansion and technology leadership. It focuses on integrating advanced cooling, energy-efficient designs, and AI-driven monitoring systems. Global players like Digital Realty and Equinix expand colocation and interconnection ecosystems, while Schneider Electric and Vertiv drive hardware and power management innovation. Cloud adoption and sustainability goals push vendors to localize operations and enhance service reliability. Competition centers on modular construction, renewable integration, and Tier III–IV certified facilities, positioning Poland as a rising European data hub.

Recent Developments:

- In November 2025, Digital Realty further advanced its AI infrastructure innovation supporting NVIDIA AI Factory research, focusing on next-generation design, efficiency, and scalability for AI computing infrastructure.

- In October 2025, Digital Realty announced a strategic collaboration with Dell Technologies and DXC to accelerate enterprise AI infrastructure adoption globally. This partnership aims to address enterprise AI challenges by bringing AI services directly to customers’ data environments with validated use cases, private AI solutions, and expert-led implementation and management.

- In February 2025, Microsoft announced a PLN 2.8 billion ($704 million) investment to expand its existing hyperscale cloud and AI data center campuses in Poland, enhancing Azure services to meet growing regional demand.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Market Segmentation

Market Segmentation