Executive summary:

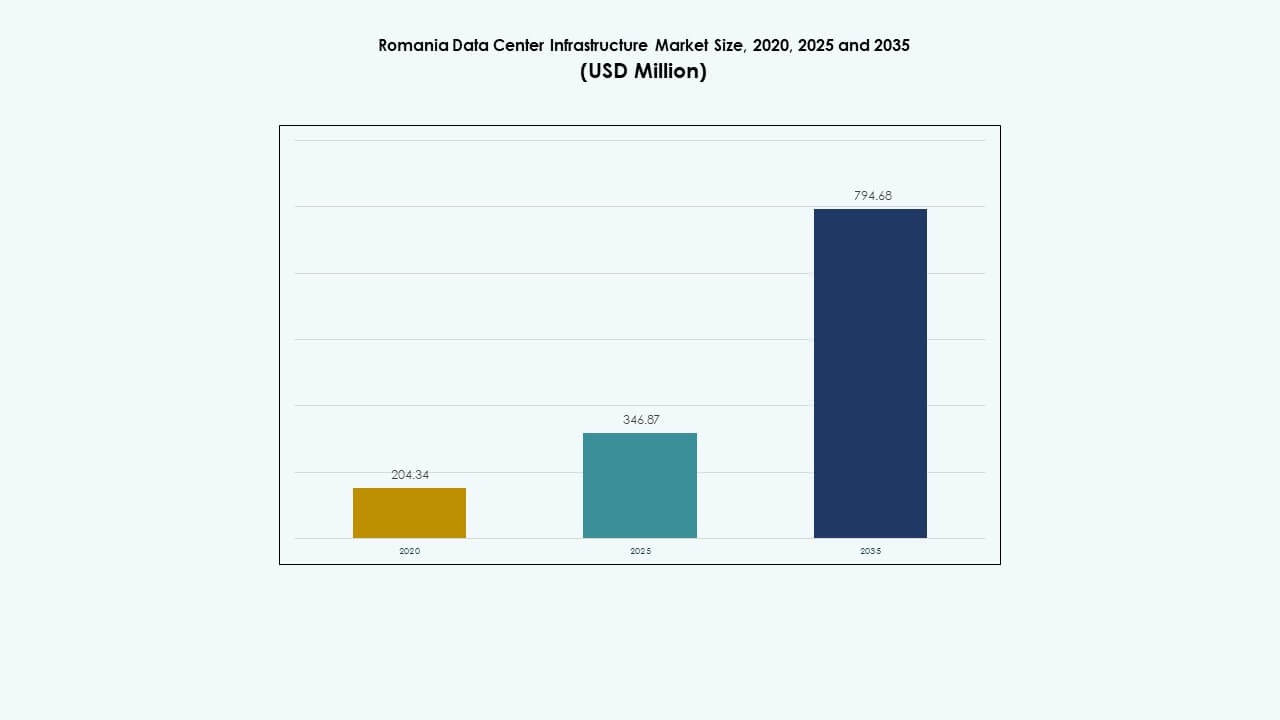

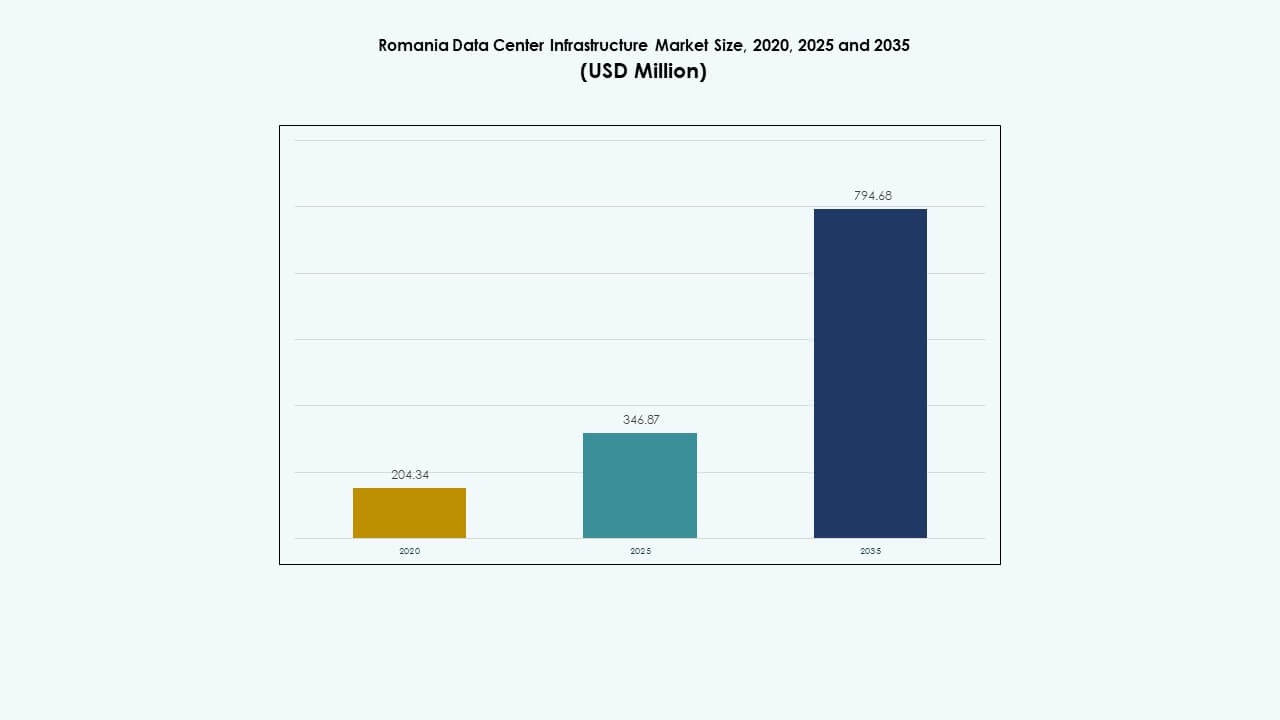

The Romania Data Center Infrastructure Market size was valued at USD 204.34 million in 2020, reached USD 346.87 million in 2025, and is anticipated to reach USD 794.68 million by 2035, at a CAGR of 8.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Romania Data Center Infrastructure Market Size 2025 |

USD 346.87 Million |

| Romania Data Center Infrastructure Market, CAGR |

8.57% |

| Romania Data Center Infrastructure Market Size 2035 |

USD 794.68 Million |

Strong digital transformation initiatives, rising data consumption, and expanding cloud adoption drive market growth. Enterprises invest in scalable power, cooling, and IT systems to enhance operational reliability. The demand for energy-efficient and modular data center solutions grows as businesses modernize legacy facilities. Innovation in AI, automation, and network technologies strengthens the strategic appeal of this market for investors and global service providers.

Bucharest leads the Romanian data center landscape due to superior connectivity and enterprise concentration. Western regions such as Cluj-Napoca and Timișoara emerge as new technology hubs driven by industrial and IT expansion. Eastern Romania gains traction with renewable energy integration and coastal connectivity advantages. This regional diversification supports national infrastructure growth and broader digital access.

Market Drivers

Growing Cloud Computing and Digitalization Across Enterprises

Rapid adoption of cloud platforms, SaaS applications, and virtualization drives higher infrastructure demand. The Romania Data Center Infrastructure Market benefits from the surge in online services, e-commerce, and digital governance. Enterprises modernize IT systems to reduce latency and enhance data protection. Local firms expand colocation spaces to host scalable computing workloads. It strengthens digital competitiveness among businesses seeking improved service delivery. Rising digital infrastructure investments by telecom and IT service providers support strong growth momentum. Government-backed digitization initiatives further accelerate data center deployment. These shifts enhance Romania’s role in regional digital ecosystems.

- For example, ClusterPower launched Romania’s first hyperscale data center campus near Craiova on a 25,400 sqm site, designed for up to 4,500 racks and 200 MW capacity by 2025, supporting scalable cloud workloads for enterprises.

Expansion of AI, IoT, and High-Performance Computing Technologies

AI and IoT adoption drive data-intensive operations across industries. Firms invest in next-generation servers and cooling solutions to handle complex workloads. It increases demand for low-latency networks and advanced cabling infrastructure. The Romania Data Center Infrastructure Market grows through integration of automation and energy-efficient systems. Machine learning and analytics workloads encourage deployment of GPU-optimized racks. Vendors offer modular and prefabricated setups to ensure scalability. The demand for resilient power backup systems rises among enterprise users. Technology-driven infrastructure expansion builds long-term value for operators.

Rising Energy Efficiency and Green Data Center Initiatives

Operators focus on reducing carbon footprints through efficient cooling and renewable power integration. Energy-efficient UPS, PDUs, and BESS systems enhance performance reliability. The Romania Data Center Infrastructure Market aligns with EU sustainability mandates encouraging green facilities. Advanced cooling systems, including liquid and free-air cooling, cut operational costs. Firms adopt DCIM software to monitor real-time energy metrics. Renewable energy sourcing improves resilience and brand positioning. It helps firms attract global clients prioritizing sustainability compliance. Energy innovation drives competitive differentiation within Romania’s data center landscape.

- For instance, a Romanian Company’s Tier III/IV modular data center in North-East Romania integrating dual liquid-air cooling with heat recovery and hydrogen hybrid generators. Firms adopt DCIM software to monitor real-time energy metrics.

Strategic Investments and Strengthening Connectivity Hubs

Foreign investments from hyperscale and colocation operators boost infrastructure capacity. Romania’s geographic position enables data exchange between Western Europe and the Balkans. The Romania Data Center Infrastructure Market gains strength from expanding fiber networks and new subsea links. Telecom carriers and ISPs enhance interconnection density across major cities. It positions Bucharest and Cluj-Napoca as emerging data transit hubs. Businesses invest in redundant facilities for uptime assurance. Enhanced regional connectivity attracts cloud service providers to co-locate assets. Growing investor confidence supports long-term infrastructure financing.

Market Trends

Market Trends

Shift Toward Modular and Prefabricated Data Center Designs

Operators adopt modular facilities to reduce construction timelines and deployment costs. Prefabricated modules allow rapid scaling of IT capacity. The Romania Data Center Infrastructure Market embraces containerized systems for flexibility in expansion. Modular construction supports efficient site management in constrained areas. It ensures quick adaptability to client-specific requirements. Vendors introduce plug-and-play systems to meet growing colocation demand. Prefabrication enhances thermal performance and power efficiency. Rising enterprise outsourcing trends further drive modular adoption.

Growing Focus on Edge Computing and Distributed Infrastructure

Edge data centers emerge to reduce latency for critical applications. It supports 5G networks, smart manufacturing, and autonomous systems. The Romania Data Center Infrastructure Market evolves with demand for micro data centers near users. Telecom and cloud providers deploy edge nodes to improve service proximity. Businesses use distributed setups for analytics and content delivery. Edge expansion complements hyperscale facilities for balanced capacity management. This trend improves reliability and resilience of digital services.

Integration of Automation, AI, and DCIM Software Platforms

Automation improves operational visibility and reduces maintenance risks. AI-enabled DCIM tools support predictive fault detection and load balancing. The Romania Data Center Infrastructure Market integrates software-defined infrastructure for seamless management. Operators leverage AI analytics to optimize cooling and energy use. Smart control systems help maintain consistent uptime standards. Automated monitoring ensures faster response to equipment irregularities. It reduces downtime while improving cost efficiency across facilities. The trend promotes intelligent infrastructure development.

Increasing Role of Renewable Energy and Sustainability Metrics

Green power sourcing becomes essential for compliance with EU energy goals. The Romania Data Center Infrastructure Market witnesses growing solar and hydro power integration. Operators implement PUE targets below 1.4 for efficiency certification. Heat reuse systems gain traction for urban energy recycling. It helps lower carbon emissions and operational costs. Vendors promote renewable-powered colocation packages for eco-conscious clients. Sustainable design practices attract enterprise and hyperscale customers. Sustainability-linked financing encourages wider project execution.

Market Challenges

High Power Costs and Limited Grid Modernization

Romania faces constraints in energy infrastructure modernization. Power distribution inefficiencies raise operational costs for large facilities. The Romania Data Center Infrastructure Market struggles with high electricity tariffs affecting profitability. Dependence on fossil-based energy limits renewable adoption rates. Unstable supply networks challenge uptime and redundancy planning. It forces operators to deploy costly backup systems and batteries. Rural regions face grid reliability issues hindering data center expansion. Addressing these limitations requires stronger collaboration between utilities and developers.

Complex Permitting and Land Availability Constraints

Delays in construction permits and limited industrial-zoned land restrict project timelines. The Romania Data Center Infrastructure Market experiences longer approval cycles for large-scale builds. Land scarcity near fiber routes elevates setup costs. Developers face challenges in balancing environmental regulations and commercial needs. It slows investment inflow for hyperscale projects. Bureaucratic inefficiencies delay foreign direct investment execution. Upgrading administrative frameworks can accelerate infrastructure delivery. Simplified zoning laws could unlock broader data center construction across regions.

Market Opportunities

Market Opportunities

Rising Hyperscale and Cloud Expansion in Eastern Europe

Romania’s connectivity and cost advantage attract hyperscale operators seeking regional hubs. The Romania Data Center Infrastructure Market benefits from EU-backed digital transformation funds. Cloud service providers expand availability zones to serve Balkan and Central European users. It stimulates demand for high-density power infrastructure and scalable networking. Local IT service providers partner with global firms for joint investments. Growth in SaaS, AI, and storage workloads creates consistent expansion prospects. Romania’s role as a regional node continues to strengthen.

Growth in Sustainable Infrastructure and Smart Energy Integration

Renewable energy adoption opens opportunities for low-carbon facilities. The Romania Data Center Infrastructure Market evolves through integration of battery energy storage and smart grids. Investors focus on green-certified projects for long-term cost savings. Operators adopt hybrid power models combining solar and grid sources. It enhances operational sustainability while reducing long-term energy dependency. Partnerships with energy utilities support innovation in eco-friendly designs. The opportunity aligns Romania with EU sustainability goals.

Market Segmentation

By Infrastructure Type

Electrical infrastructure dominates due to the rising need for reliable power continuity. The Romania Data Center Infrastructure Market benefits from large-scale UPS and PDUs adoption. Mechanical and IT infrastructure segments also grow rapidly with automation and scalable cooling solutions. Civil and architectural components gain relevance in modular facility designs. Electrical infrastructure maintains the highest share through consistent upgrades in grid connection reliability and energy storage innovation.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) and Battery Energy Storage Systems (BESS) lead this segment. The Romania Data Center Infrastructure Market witnesses rapid modernization of PDUs and switchgear. Grid connection improvements enhance energy resilience across new sites. UPS adoption ensures business continuity for hyperscale and colocation facilities. BESS integration supports grid balancing and sustainability targets. Transfer switches deliver flexible load management during outages. Investment in advanced power technology drives higher market penetration.

By Mechanical Infrastructure

Cooling systems represent the backbone of operational efficiency. The Romania Data Center Infrastructure Market prioritizes CRAC, CRAH, and air-cooled chillers for temperature stability. Containment and airflow management systems gain traction for optimized cooling performance. Pumps and piping networks improve fluid transfer reliability. Firms explore liquid cooling for AI and HPC workloads. Mechanical infrastructure upgrades reduce power usage while maintaining uptime. Cooling innovation ensures strong cost efficiency and environmental compliance.

By Civil / Structural & Architectural

This segment involves foundation works, modular frameworks, and sustainable building materials. The Romania Data Center Infrastructure Market invests in prefabricated and steel-based superstructures for durability. Modern building envelopes reduce heat ingress and energy use. Raised floors and suspended ceilings improve airflow efficiency. Modular building techniques shorten project completion timelines. Developers focus on seismic-resistant and eco-certified designs. Civil and structural innovation improves construction scalability.

By IT & Network Infrastructure

Servers, networking gear, and storage units form the digital core of data centers. The Romania Data Center Infrastructure Market observes strong growth in high-density servers and fiber cabling. Racks and enclosures support better space optimization and airflow. Networking upgrades enhance data transmission speeds across regions. The segment remains critical for digital transformation and AI adoption. Demand for robust IT hardware reinforces Romania’s status as an emerging data hub.

By Data Center Type

Colocation and enterprise facilities lead, while hyperscale sites expand rapidly. The Romania Data Center Infrastructure Market shows rising enterprise adoption for hybrid IT setups. Edge centers emerge to improve latency for regional applications. Hyperscale operators target large energy-efficient campuses. Colocation providers attract SMEs through flexible pricing and service integration. Edge deployment supports remote connectivity and 5G services.

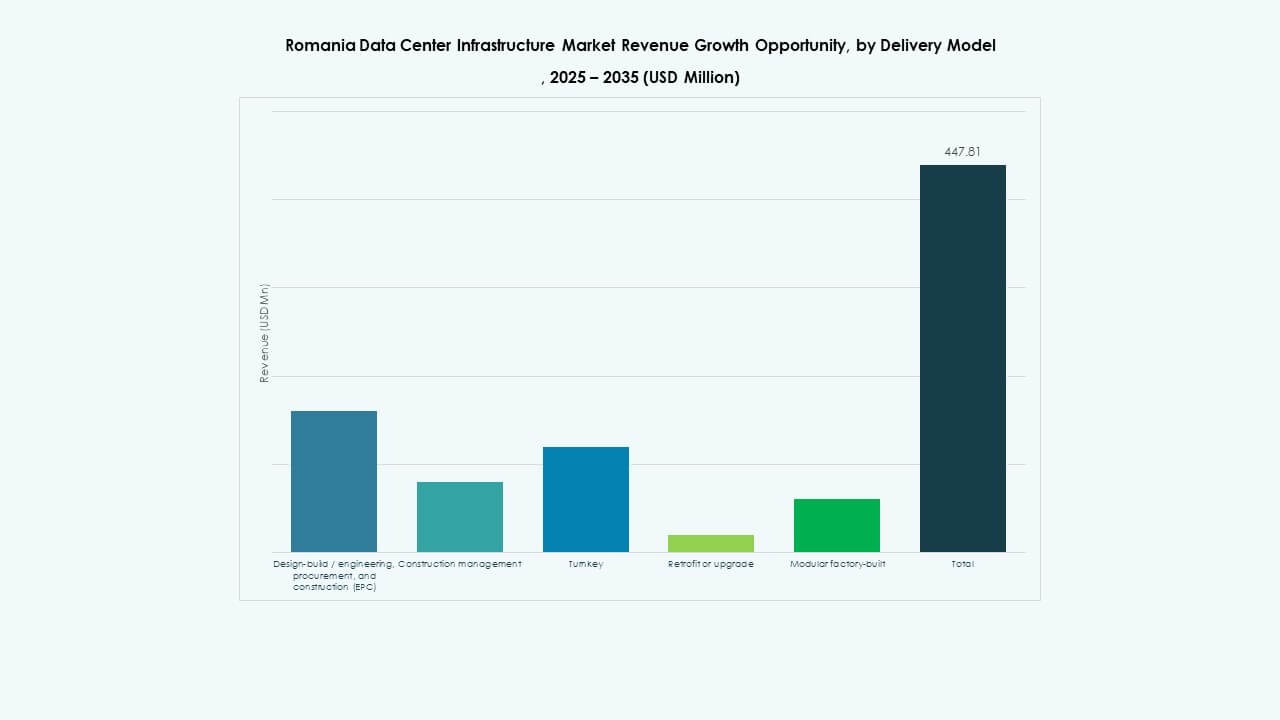

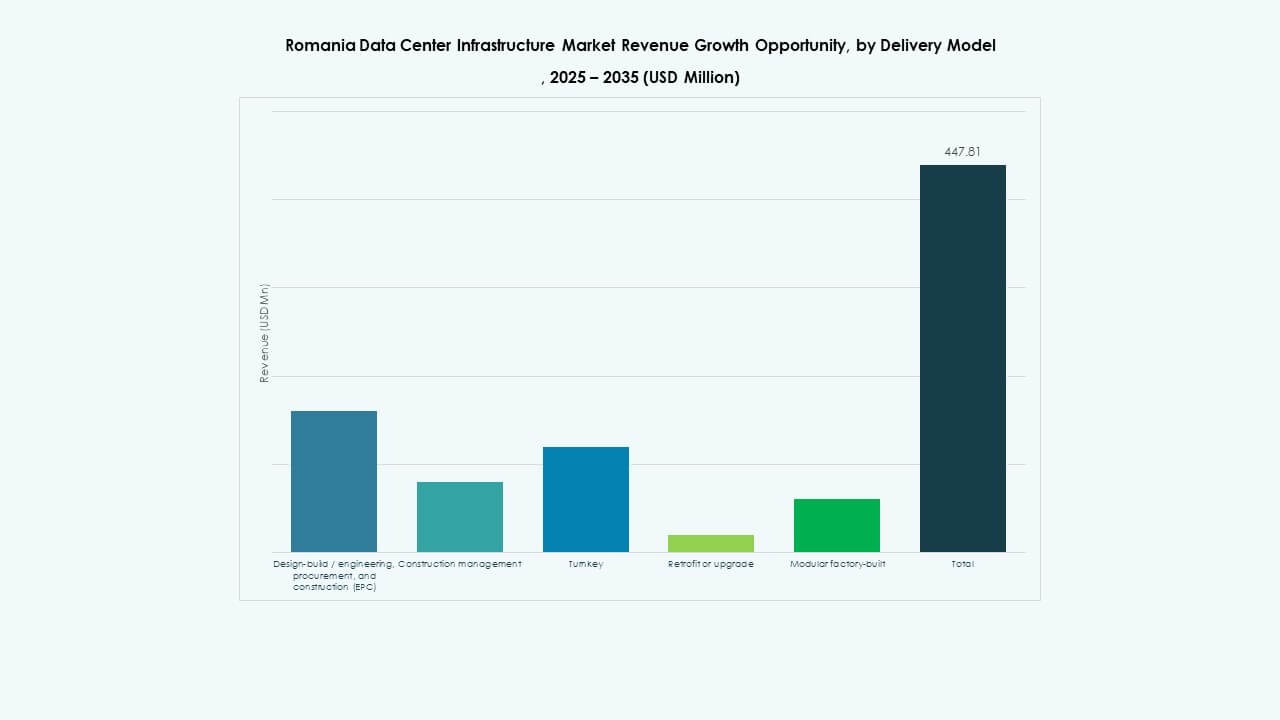

By Delivery Model

Turnkey and modular factory-built models dominate construction demand. The Romania Data Center Infrastructure Market emphasizes EPC and design-build contracts for fast project execution. Construction management supports large custom projects requiring flexibility. Retrofit and upgrade models ensure modernization of legacy systems. Modular setups enable cost control and scalability. The design-build approach improves coordination between engineering and deployment.

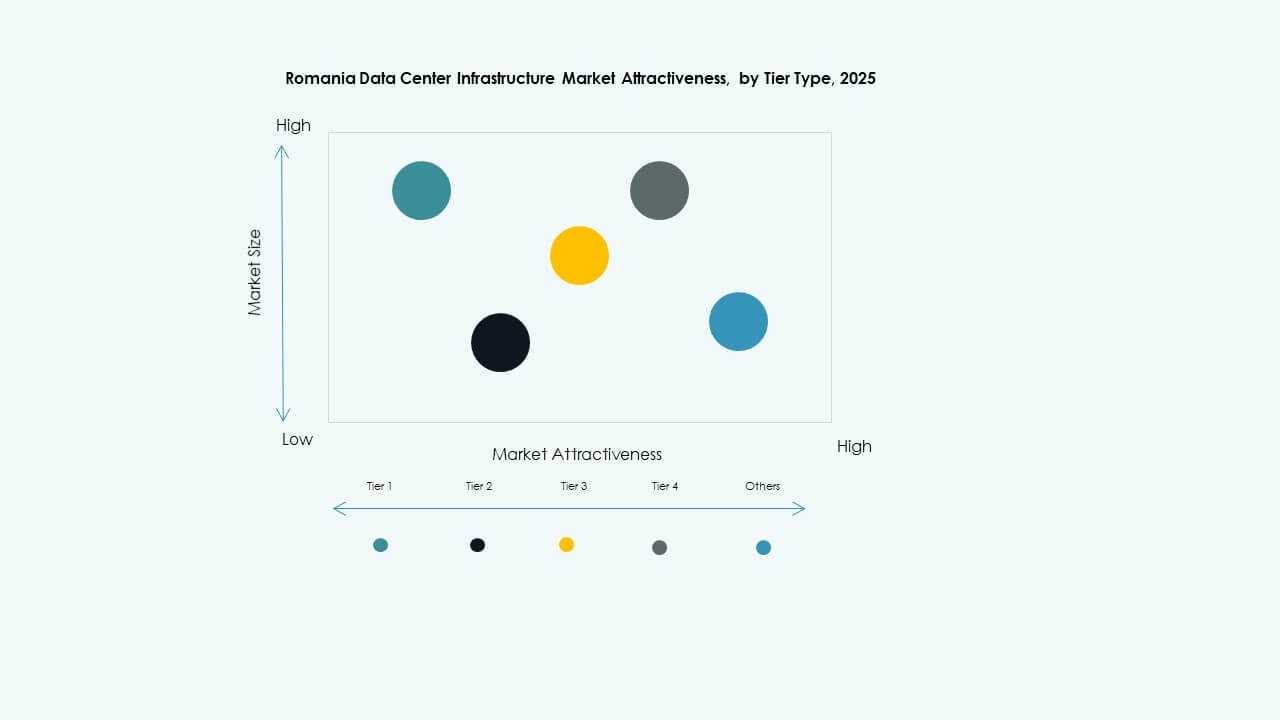

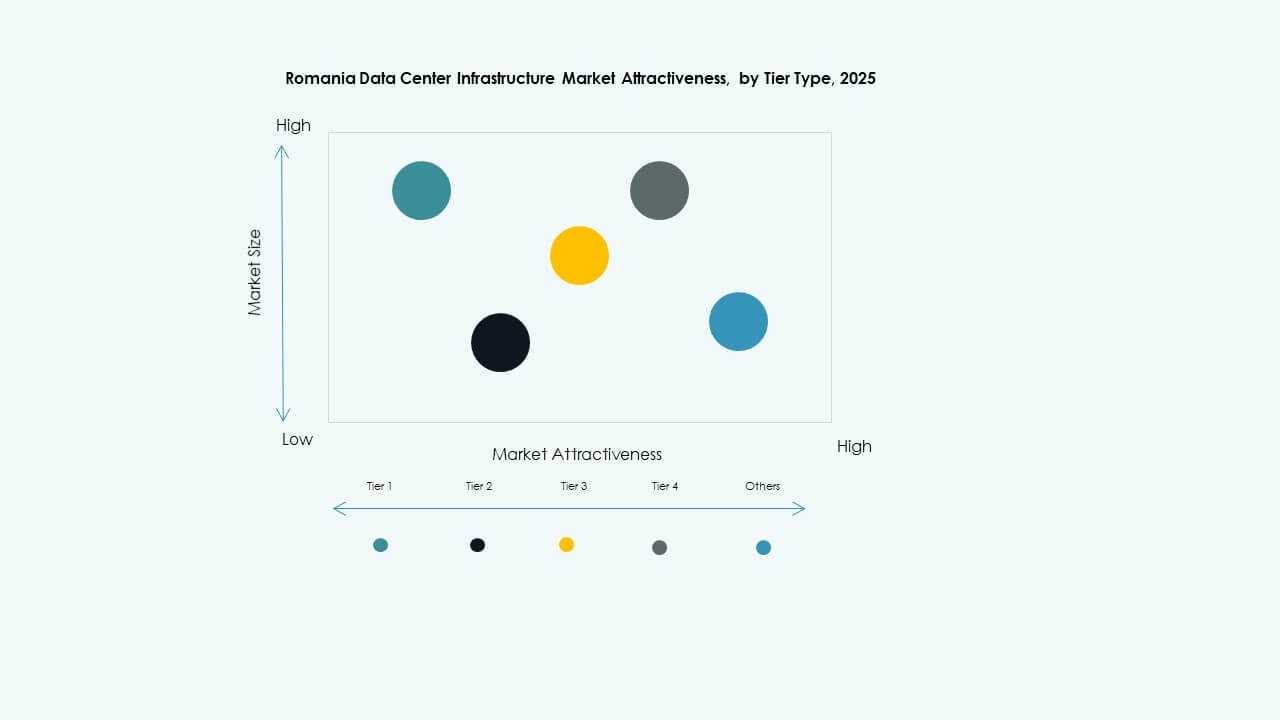

By Tier Type

Tier 3 facilities hold the largest share due to their balanced cost and redundancy. The Romania Data Center Infrastructure Market sees growing demand for Tier 4 facilities supporting hyperscale operations. Tier 1 and Tier 2 centers serve smaller enterprise workloads. Businesses prefer Tier 3 standards for optimal uptime and energy efficiency. Advancements in cooling and automation enhance resilience across facilities.

Regional Insights

Regional Insights

Western Romania – Industrial Growth and Strategic Hubs (Market Share: 40%)

Western Romania leads with robust industrial clusters and digital hubs. The Romania Data Center Infrastructure Market grows around cities like Cluj-Napoca and Timișoara. These areas benefit from advanced power infrastructure and skilled IT workforce. Cross-border connectivity with Hungary and Serbia improves network reliability. It attracts colocation providers seeking regional expansion. Government-backed tech zones support foreign data center investments. Western Romania remains a preferred location for scalability and resilience.

- For instance, Telekom Romania opened a data center in Cluj-Napoca in 2020 with capacity for 300 server racks connected to 600kW and 1,000kW power sources.

Central and Southern Romania – Core Data Center Corridor (Market Share: 45%)

Central and Southern regions, including Bucharest, dominate due to strong connectivity and enterprise demand. The Romania Data Center Infrastructure Market thrives on telecom concentration and business activity in these areas. Bucharest hosts the majority of colocation and hyperscale operations. Proximity to fiber routes and utility access boosts market concentration. Developers expand redundant facilities near industrial zones for continuity. It reinforces Bucharest’s role as Romania’s digital capital.

- For example, Bucharest hosts the majority of colocation and hyperscale operations, for instance, hosting 27 of Romania’s 59 data centers with 59% of national installed capacity.

Eastern Romania – Emerging Frontier for Expansion (Market Share: 15%)

Eastern Romania shows early-stage development but holds strong long-term potential. The Romania Data Center Infrastructure Market expands near Iași and Constanța due to port access and renewable energy projects. Subsea cable connectivity strengthens links to global networks. Regional incentives attract investors for edge and modular centers. It benefits from cost-effective land availability and renewable energy supply. Eastern Romania’s gradual growth supports nationwide infrastructure balance.

Competitive Insights:

- Cisco Systems, Inc.

- Dell Inc.

- Equinix, Inc.

- Schneider Electric SE

- Vertiv Group Corp.

- Digital Realty

- ABB Ltd.

- IBM Corporation

- Lenovo Group Limited

- ClusterPower

The Romania Data Center Infrastructure Market features strong competition among global and regional operators. It reflects a mix of hardware vendors, colocation providers, and technology integrators investing in scalable solutions. Equinix and Digital Realty expand hyperscale capacity, while ClusterPower and NXDATA strengthen local hosting networks. Schneider Electric and Vertiv lead in power and cooling systems with efficient modular designs. Cisco and Dell drive server and networking innovation through automation and cloud integration. It continues to evolve as companies focus on low-latency infrastructure, renewable energy adoption, and edge deployments. Strategic alliances and mergers enhance service depth, shaping a dynamic competitive landscape focused on efficiency, sustainability, and reliability.

Recent Developments:

- In December 2025, Inter Computer Romania signed contracts worth €5 million to modernize IT infrastructures, integrating hybrid cloud solutions, immutable storage, Quantum-Safe cryptography, and AI-ready platforms amid rising digital compliance and cybersecurity needs.

- In July 2024, Google and the Romanian government signed a Memorandum of Understanding to collaborate on cloud technology, cybersecurity, and a potential $2 billion data center investment to boost digital infrastructure

Market Trends

Market Trends Market Opportunities

Market Opportunities Regional Insights

Regional Insights