Executive summary:

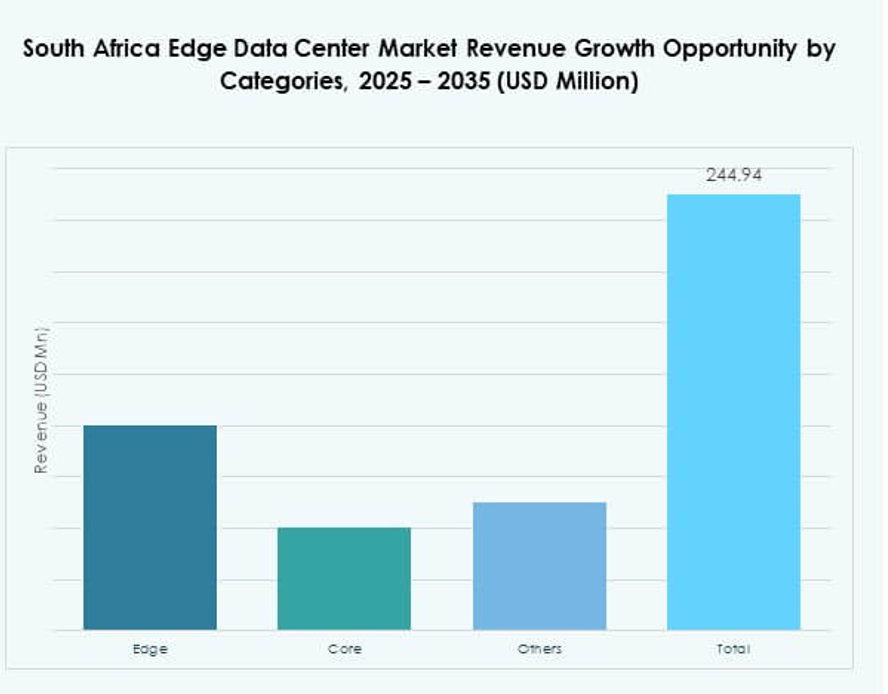

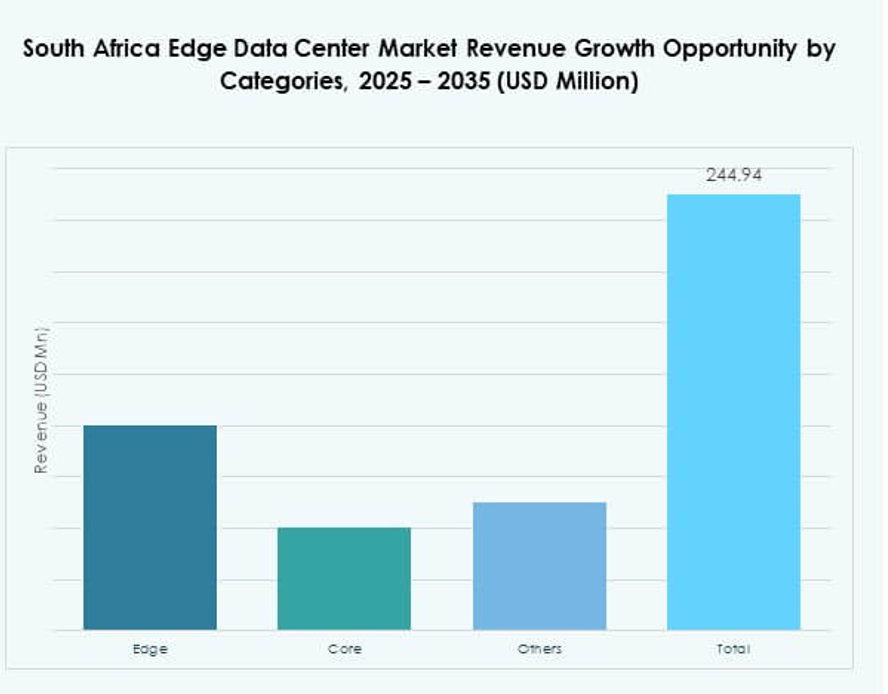

The South Africa Edge Data Center Market size was valued at USD 36.51 million in 2020 to USD 82.97 million in 2025 and is anticipated to reach USD 327.91 million by 2035, at a CAGR of 14.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| South Africa Edge Data Center Market Size 2025 |

USD 82.97 Million |

| South Africa Edge Data Center Market, CAGR |

14.57% |

| South Africa Edge Data Center Market Size 2035 |

USD 327.91 Million |

Rapid enterprise digitalization, AI integration, and 5G adoption are driving strong edge infrastructure demand. Companies are shifting toward modular and scalable facilities to support low-latency applications and real-time data processing. Innovation in power and cooling systems improves energy efficiency, while strategic collaborations between telecom operators, cloud providers, and equipment vendors strengthen the ecosystem. The South Africa Edge Data Center Market plays a critical role in enabling advanced digital services and attracting long-term investment.

Gauteng leads the South Africa Edge Data Center Market due to strong fiber connectivity, enterprise activity, and high data consumption. Western Cape is emerging as a major hub supported by strategic location and growing technology clusters. KwaZulu-Natal is gaining traction with investments in logistics and industrial infrastructure. These regional dynamics reflect expanding infrastructure coverage and strong market potential across key provinces.

Market Drivers

Rising Enterprise Digitalization and Increasing Need for Localized Data Processing Capabilities

The rapid digital transformation across industries drives strong demand for low-latency and scalable computing infrastructure. Enterprises require high-speed connectivity to support applications like AI, IoT, 5G, and real-time analytics. Traditional centralized data centers face latency and bandwidth challenges. Edge data centers enable faster processing and efficient traffic distribution, improving operational performance. Localized infrastructure supports faster decision-making and better customer experiences. Government and private sector investments strengthen network infrastructure. The South Africa Edge Data Center Market benefits from rapid enterprise IT modernization and growing business digitalization. It creates an ecosystem that accelerates technology adoption and enhances competitiveness.

Accelerated Adoption of IoT and 5G Networks Driving Low-Latency Edge Infrastructure Deployment

IoT device usage continues to expand across industries including manufacturing, logistics, and healthcare. 5G network expansion improves data transmission speeds and lowers latency, supporting advanced applications. Edge facilities enable faster local data processing, avoiding network congestion and delays. Enterprises integrate IoT platforms with edge infrastructure to enhance operational accuracy and system resilience. Telecom providers invest in fiber backhaul and high-capacity connectivity to support dense network nodes. This creates strong demand for distributed, modular, and scalable edge facilities. The South Africa Edge Data Center Market benefits from this network evolution. It helps operators deliver faster, more reliable digital services.

- For instance, MTN South Africa and Huawei launched the first 5G-Advanced (5.5G) network trial in Africa in November 2024, validating SingleRAN and hybrid beamforming technology on spectrum in millimeter wave and C-band to demonstrate ultra-low latency and flexible network slicing capabilities critical for advanced IoT and edge applications.

Growing Investments in Digital Infrastructure Supporting Economic Modernization and Data Sovereignty

The government and private operators are increasing infrastructure spending to boost connectivity and digital resilience. Investments target fiber networks, renewable energy integration, and high-density modular systems. Enterprises rely on these facilities to meet data localization rules and cybersecurity standards. Stronger regulatory frameworks support localized data hosting and processing. Energy-efficient technologies improve operational reliability and sustainability. Global cloud providers are expanding regional footprints through partnerships with local players. The South Africa Edge Data Center Market is becoming a strategic pillar of digital economic growth. It creates opportunities for advanced connectivity solutions and high-value IT services.

Expansion of AI-Driven and Real-Time Applications Across Industries Creating Demand for Edge Infrastructure

AI, ML, AR/VR, and advanced analytics adoption in industries drives new infrastructure demand. Edge computing provides immediate data processing, enabling faster response times. This supports industrial automation, predictive maintenance, telemedicine, and smart retail solutions. Businesses require scalable, secure, and energy-efficient architectures for sensitive workloads. Edge sites help reduce network costs and improve user experience in latency-sensitive use cases. Telecom operators, cloud hyperscalers, and colocation providers lead in deploying new edge nodes. The South Africa Edge Data Center Market aligns with these technological shifts. It helps businesses gain operational agility and better service delivery.

- For instance, Cassava Technologies partnered with NVIDIA to launch Africa’s first AI factory in South Africa, deploying supercomputing infrastructure powered by NVIDIA GPUs. The project plans to install 3,000 GPUs initially, with future expansion to 12,000 units across the continent. This initiative aims to boost AI capabilities and support advanced digital transformation in key industries.

Market Trends

Rapid Growth of Modular and Prefabricated Edge Data Center Deployments Across Urban and Remote Zones

Modular edge facilities are gaining traction due to faster deployment and flexible scalability. Prefabricated units reduce construction time, lower initial costs, and enhance energy efficiency. Enterprises prefer this model to support unpredictable traffic and localized applications. Modular systems integrate power, cooling, and IT infrastructure in compact units. This supports quick deployment near users and critical industries. Operators target both metro areas and remote zones to improve service coverage. The South Africa Edge Data Center Market benefits from this deployment shift. It enables scalable expansion strategies for operators and enterprises.

Integration of Renewable Energy Sources and Advanced Cooling Technologies for Sustainable Edge Operations

Sustainability drives innovation in power and cooling systems. Operators adopt solar and wind energy to reduce operational costs and carbon footprints. Advanced cooling solutions like liquid cooling and free-air systems improve energy efficiency. Renewable integration ensures more stable power supply in high-demand zones. Sustainability targets align with ESG reporting standards and corporate commitments. This trend lowers PUE levels and improves long-term operating margins. The South Africa Edge Data Center Market aligns with green data infrastructure objectives. It strengthens its competitive position through energy-efficient operations.

Rising Partnerships Between Cloud Hyperscalers, Telecom Operators, and Colocation Providers for Service Expansion

Strategic collaborations support faster network buildouts and shared infrastructure investments. Cloud hyperscalers partner with telecom providers to deploy edge nodes closer to end-users. Colocation providers benefit from shared cost models and expanded client ecosystems. These alliances support 5G rollout, AI workloads, and IoT platform hosting. Multi-tenant infrastructure drives flexible service delivery for enterprises. Shared investment models reduce CAPEX barriers and improve market penetration speed. The South Africa Edge Data Center Market experiences rapid ecosystem expansion. It positions operators to deliver high-performance, low-latency services.

Rising Focus on AI Orchestration, Automation, and Software-Defined Infrastructure in Edge Facilities

Automation plays a critical role in improving operational reliability and reducing downtime. AI-driven orchestration tools enhance workload distribution and energy optimization. Software-defined infrastructure supports flexible scaling and advanced resource control. Automated systems reduce manual intervention and increase service uptime. Real-time monitoring improves predictive maintenance and incident response. Enterprises leverage these technologies to strengthen digital service delivery. The South Africa Edge Data Center Market aligns with this automation shift. It creates a foundation for intelligent, efficient infrastructure management.

Market Challenges

Power Supply Constraints, Infrastructure Gaps, and Grid Reliability Issues Affecting Edge Site Deployments

Power availability remains a major barrier for sustainable expansion. Load shedding and inconsistent grid supply increase operational risk for edge operators. Backup systems require significant investment, raising overall project costs. Rural and semi-urban zones face slower rollout timelines due to weak grid infrastructure. Regulatory delays complicate the integration of renewable power solutions. Site developers must navigate complex permitting and infrastructure coordination processes. These issues limit deployment flexibility and increase cost structures. The South Africa Edge Data Center Market faces risks tied to power and infrastructure reliability. It requires stronger grid investments to support stable growth.

Limited Availability of Skilled Workforce and Rising Complexity of Edge Infrastructure Deployment

Edge facilities need specialized expertise in networking, cybersecurity, and power systems. Shortages in trained professionals increase operational risk and slow project execution. Complex hybrid environments require advanced design, integration, and maintenance capabilities. Workforce gaps lead to higher dependency on international vendors and consultants. This raises operational expenses and complicates service scaling. Security and compliance management also require advanced skills to meet global standards. These challenges impact service reliability and operational efficiency. The South Africa Edge Data Center Market must address workforce development needs to support future capacity expansion.

Market Opportunities

Expansion of Edge Infrastructure Supporting AI, IoT, and Industry 4.0 Applications Across Multiple Verticals

Demand for real-time analytics and low-latency applications is growing rapidly. Edge infrastructure supports smart manufacturing, telehealth, logistics, and fintech use cases. Enterprises deploy localized facilities to optimize operational costs and enhance responsiveness. Industry 4.0 strategies rely on distributed architecture for efficiency and security. IoT expansion in utilities and mobility creates new demand clusters. This creates strong opportunities for service providers and hyperscalers. The South Africa Edge Data Center Market benefits from cross-sector infrastructure adoption. It enables diversified revenue streams and stronger market penetration.

Favorable Regulatory Push, Green Energy Integration, and Rising Investor Interest Creating Growth Momentum

Government policies support infrastructure modernization and data sovereignty objectives. ESG-focused investors are funding sustainable edge infrastructure projects. Tax incentives and renewable energy adoption reduce long-term operational costs. Investors prefer scalable models with strong return potential. Telecom and cloud providers can leverage regulatory frameworks to expand footprints faster. The South Africa Edge Data Center Market aligns with these regulatory and financial trends. It creates a favorable investment environment for global and local stakeholders.

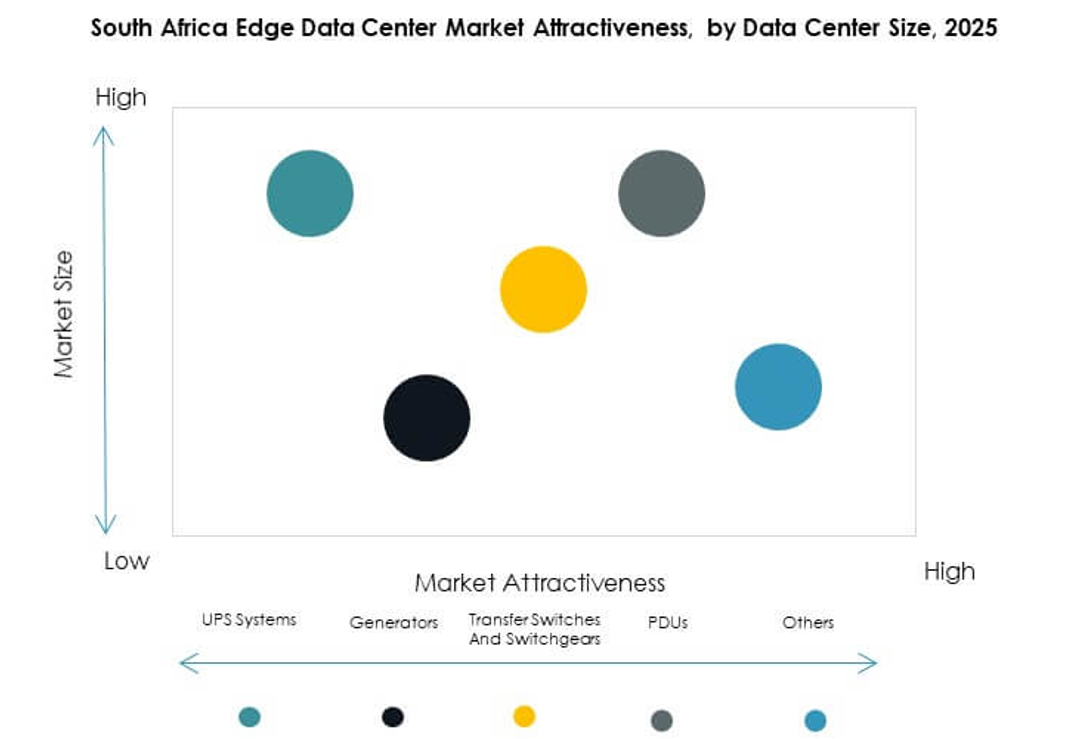

Market Segmentation

By Component

Solutions lead with a dominant market share due to strong demand for advanced power, cooling, and IT systems. Edge deployments rely on integrated solutions that offer efficiency, speed, and reliability. Hardware and software integration reduces downtime and improves operational control. Service demand grows but remains secondary to infrastructure investment. Managed service models gain traction as enterprises seek cost-effective options. Solution providers focus on modular and scalable systems to meet diverse needs. The South Africa Edge Data Center Market benefits from this hardware-led expansion. It strengthens market maturity and operational resilience.

By Data Center Type

Colocation edge data centers hold a strong market share due to their cost advantages and scalability. Enterprises prefer shared facilities to reduce CAPEX and access flexible capacity. Managed and enterprise facilities also record steady growth driven by strategic workloads. Cloud and edge hybrid architectures gain attention from digital-native firms. Colocation models support multi-tenant services, improving utilization rates. Operators offer high-density racks and low-latency connectivity to attract clients. The South Africa Edge Data Center Market grows through these hybrid colocation models. It supports a diverse customer base.

By Deployment Model

Cloud-based deployment leads the segment due to scalability and cost efficiency. Enterprises leverage public and private clouds to optimize workload distribution. Hybrid deployments are gaining importance for regulated industries. On-premises deployments continue for security-critical applications. Cloud models reduce CAPEX and enable flexible scaling. Strong cloud adoption accelerates AI and IoT workloads. The South Africa Edge Data Center Market reflects this deployment shift. It builds stronger cloud-edge integration ecosystems.

By Enterprise Size

Large enterprises dominate the segment due to higher capital budgets and infrastructure needs. These enterprises adopt edge computing to support complex, latency-sensitive workloads. SMEs show growing interest through managed services and shared facilities. Large firms prioritize advanced security, low downtime, and automation. SMEs rely on cost-effective and modular systems. Market expansion creates space for hybrid service models. The South Africa Edge Data Center Market is shaped by large enterprise adoption. It also gains momentum from SME participation.

By Application / Use Case

Power monitoring leads the segment, supported by operational efficiency requirements and energy cost management. Capacity management and asset monitoring record strong growth due to scalability needs. Environmental monitoring gains traction for compliance and green operations. BI and analytics use cases grow with real-time data applications. Industries prioritize energy and resource optimization in edge setups. These use cases enhance system reliability and cost control. The South Africa Edge Data Center Market benefits from this diversified application landscape. It supports intelligent infrastructure management.

By End User Industry

IT and telecommunications dominate due to 5G expansion, IoT growth, and AI applications. BFSI and retail follow with demand for secure, low-latency transactions. Healthcare invests in telemedicine and diagnostic analytics supported by edge computing. Energy and utilities deploy edge nodes for operational monitoring. Aerospace and defense focus on secure, localized processing capabilities. Multi-industry adoption diversifies market opportunities. The South Africa Edge Data Center Market gains resilience from its wide end-user base. It positions operators for stable long-term growth.

Regional Insights

Gauteng Region Driving Infrastructure Investments and Dominating Edge Deployments

Gauteng holds 42.5% market share supported by dense fiber networks and strong enterprise activity. It remains the economic hub for telecom, finance, and manufacturing industries. High data consumption levels increase demand for low-latency processing. The region attracts global cloud and colocation providers due to strong connectivity. Major cities such as Johannesburg and Pretoria host multiple modular and hyperscale edge deployments. Ongoing 5G rollouts and AI workload integration drive expansion. The South Africa Edge Data Center Market strengthens its base in Gauteng through continuous investment flows.

- For instance, Teraco completed a major expansion of its JB4 Bredell Campus in August 2025, adding 30 MW of critical IT power across six new data halls. The facility now delivers a total of 50 MW, making it the largest standalone data center in Africa. It features a zero-water closed loop cooling system and connects to 80 MW of utility power.

Western Cape Emerging as a Strategic Technology Hub for Cloud and Edge Infrastructure

Western Cape holds 34.7% market share supported by growing tech clusters and cloud activity. Cape Town’s strategic location supports submarine cable landings and international connectivity. Enterprises and hyperscalers invest in new edge nodes to serve global clients. Renewable energy integration improves cost competitiveness and ESG alignment. Local government support enhances infrastructure readiness. The Western Cape strengthens its role as a digital gateway for sub-Saharan Africa. The South Africa Edge Data Center Market expands its capacity in this region through strategic partnerships.

KwaZulu-Natal Supporting Regional Diversification and Edge Infrastructure Expansion

KwaZulu-Natal holds 22.8% market share supported by logistics and manufacturing industries. Durban’s port connectivity and industrial base attract digital infrastructure investments. Edge deployments support IoT applications and logistics optimization. Local networks improve operational efficiency for regional enterprises. New modular and prefabricated edge facilities reduce deployment timelines. This strengthens the digital backbone of the province. The South Africa Edge Data Center Market gains strategic regional coverage through KwaZulu-Natal development. It creates balanced capacity distribution across major economic zones.

- For instance, Open Access Data Centres (OADC) announced the rollout of over 100 open-access edge data centres across South Africa, each with 0.5 MW of capacity. This initiative aims to enhance network reach and reduce latency for IoT, 5G, and enterprise applications. It represents one of the largest coordinated edge infrastructure deployments in the region.

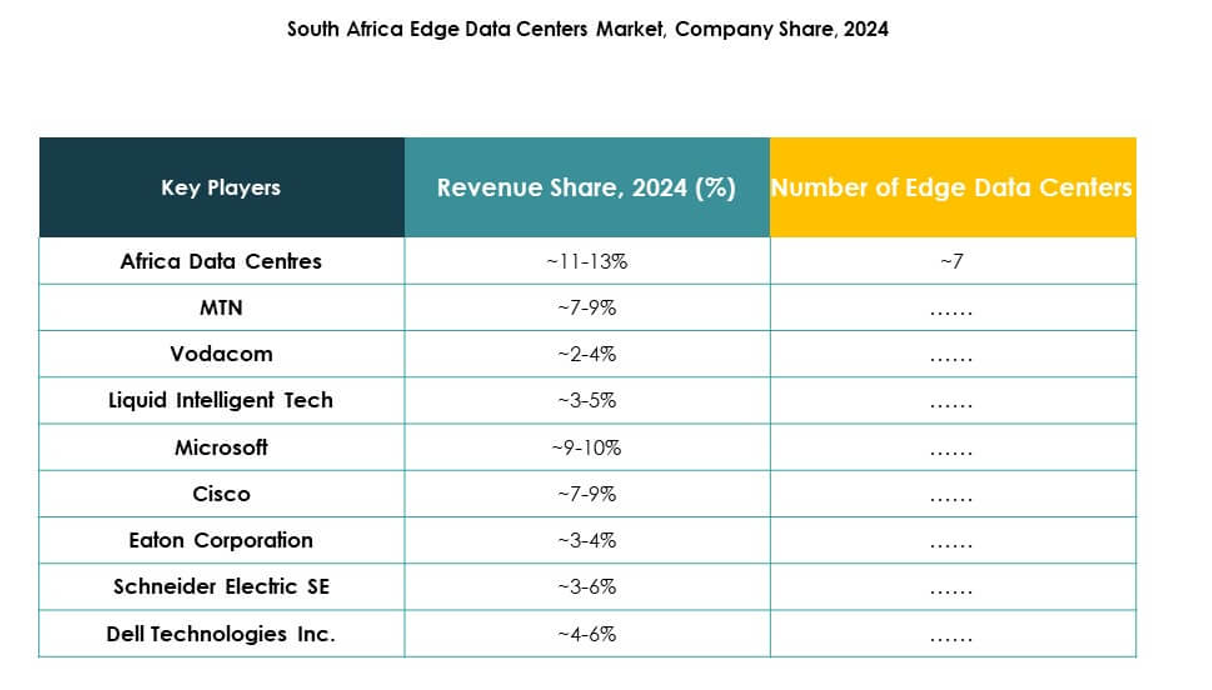

Competitive Insights:

- Teraco Data Environments

- Africa Data Centres

- Vodacom

- Liquid Intelligent Tech

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

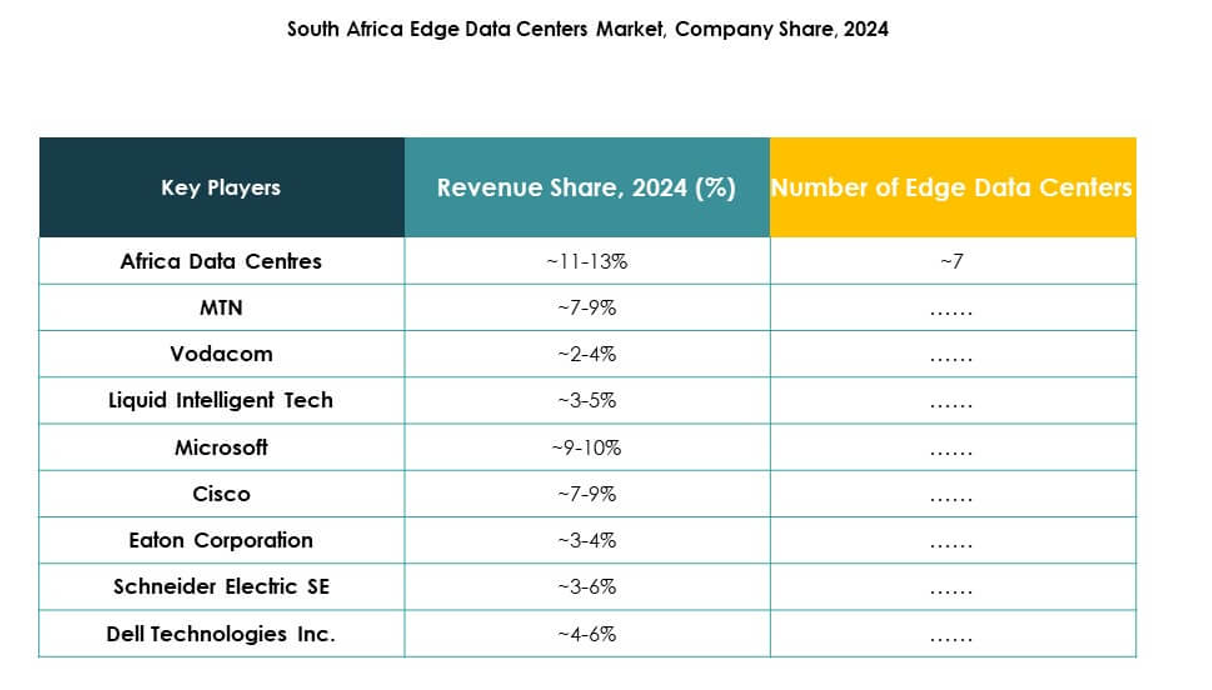

The competitive landscape of the South Africa Edge Data Center Market is shaped by infrastructure operators, technology providers, and cloud service companies. It is characterized by rapid expansion, strong investment flows, and a focus on edge innovation. Leading players like Teraco Data Environments and Africa Data Centres invest heavily in scalable facilities and energy-efficient systems. Global technology firms including Cisco, Dell Technologies Inc., and Fujitsu strengthen their market presence through strategic alliances and advanced edge solutions. Telecom providers like Vodacom and Liquid Intelligent Tech drive connectivity improvements, enabling low-latency infrastructure. Companies prioritize modular design, automation, and renewable integration to enhance competitiveness. Strategic partnerships, M&A activities, and capacity expansion define current market dynamics.

Recent Developments:

- In August 2025, Alibaba Cloud introduced its Edge Node Service in South Africa, deploying computing, storage, and networking capabilities inside ISP data centers closer to end users. This new platform supports local businesses in industries like e-commerce, gaming, finance, and manufacturing, providing faster performance, better user experience, and compliance-ready cloud innovation.

- In August 2025, Teraco Data Environments completed a major expansion of its JB4 hyperscale data center campus in Johannesburg, South Africa, adding substantial new capacity and sustainability features to support the region’s digital transformation and growing demand for hybrid cloud deployments.

- In July 2025, Visa launched a new data center in Johannesburg, South Africa, enhancing its local infrastructure to better support digital payment systems with improved latency and reliability. This move reflects Visa’s commitment to expanding its regional footprint and capacity in the South African edge data center market.

- In November 2024, Teraco started constructing a 120 MW solar photovoltaic power plant in Free State, South Africa, to power its data centers across the country. This initiative aligns with the broader regional trend of integrating renewable energy sources into data center operations to ensure sustainability and reduce reliance on unstable power grids.