Executive summary:

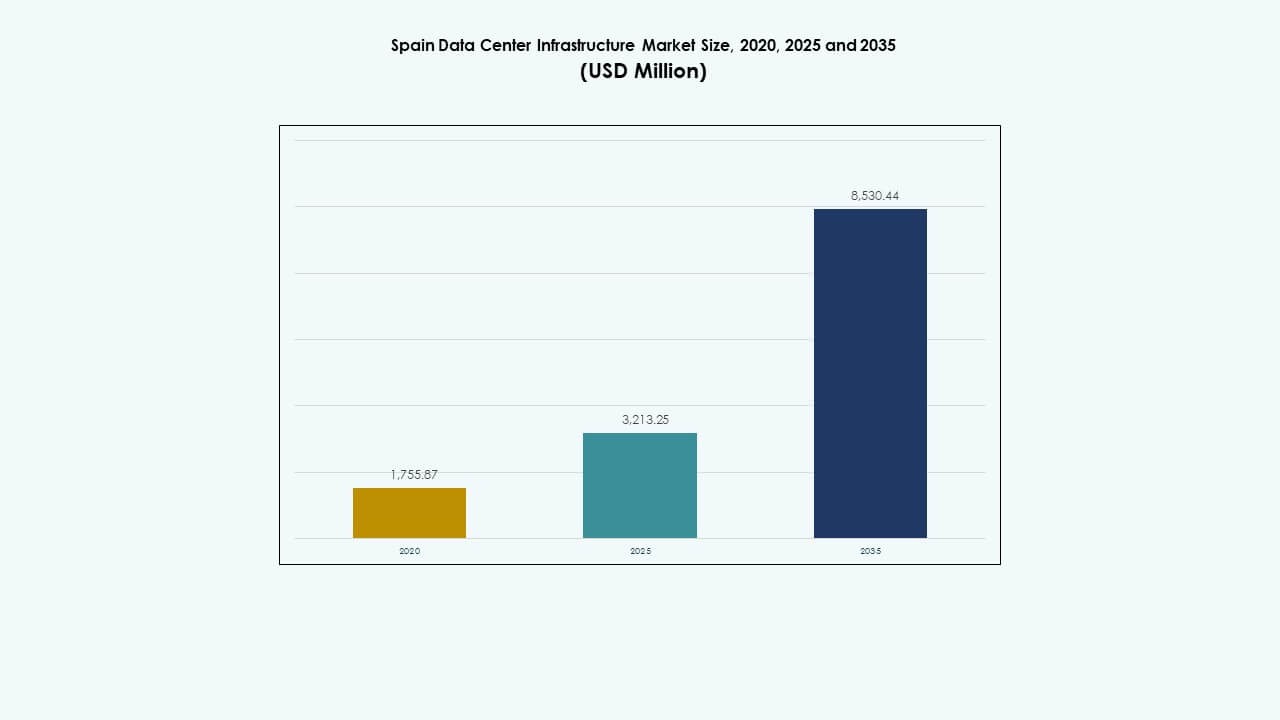

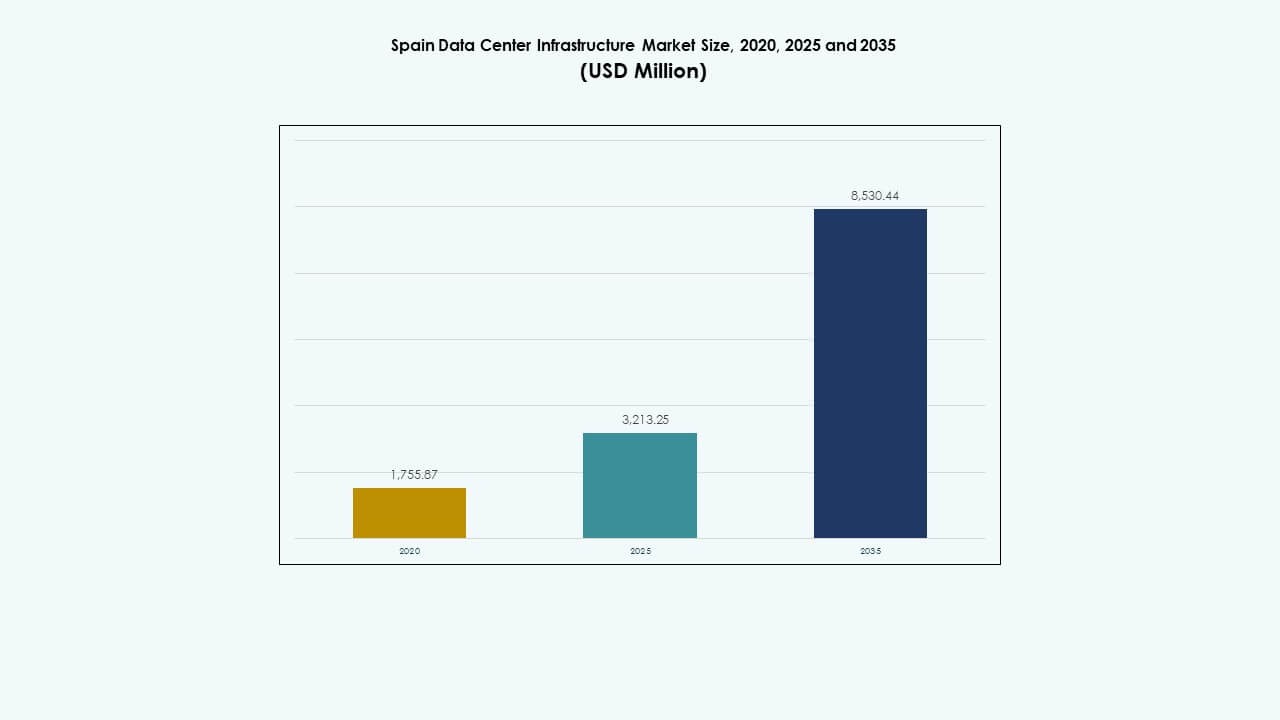

The Spain Data Center Infrastructure Market size was valued at USD 1,755.87 million in 2020, increased to USD 3,213.25 million in 2025, and is anticipated to reach USD 8,530.44 million by 2035, at a CAGR of 10.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Spain Data Center Infrastructure Market Size 2025 |

USD 3,213.25 Million |

| Spain Data Center Infrastructure Market, CAGR |

10.19% |

| Spain Data Center Infrastructure Market Size 2035 |

USD 8,530.44 Million |

Growing adoption of cloud computing, AI, and 5G networks drives infrastructure upgrades and new construction across Spain. Companies prioritize scalable, energy-efficient facilities to handle higher data volumes. Continuous innovation in cooling, power, and automation improves efficiency and uptime. The Spain Data Center Infrastructure Market plays a strategic role for investors and operators seeking to strengthen regional digital connectivity and expand sustainable technology ecosystems.

Madrid leads the market due to its strong connectivity, stable power grid, and strategic location for intercontinental data exchange. Barcelona and Valencia emerge as secondary hubs supported by renewable energy initiatives and growing colocation demand. Southern and northern regions, including Andalusia and the Basque Country, witness expansion due to lower land costs and availability of green power. This regional balance supports nationwide infrastructure growth.

Market Drivers

Market Drivers

Accelerating Digital Transformation and Cloud Migration

The Spain Data Center Infrastructure Market grows rapidly with surging digital adoption across enterprises. Organizations expand cloud-native workloads and hybrid systems to achieve faster service delivery. Major tech players strengthen presence through large-scale hyperscale deployments. It benefits from Spain’s strong network backbone and rising demand for low-latency connectivity. Local firms embrace cloud-based collaboration and automation tools to enhance productivity. Government programs promoting digital competitiveness further lift data traffic growth. Telecom carriers upgrade infrastructure to support next-generation workloads. Businesses adopt virtualized platforms for flexible operations. This structural digital shift secures Spain’s role as a vital European data hub.

- For instance, Microsoft is investing €6.69 billion ($7.16 billion) over 10 years in three hyperscale data center campuses spanning over 283 hectares in Aragon, including La Muela and Villamayor de Gállego near Zaragoza, supporting its Spain Central cloud region launched in Madrid in 2024.

Adoption of Advanced Cooling and Energy-Efficient Systems

Sustainability drives major investment in Spain’s data center ecosystem. Operators deploy liquid cooling, free-air cooling, and renewable-powered systems to cut carbon footprint. The industry aligns with EU energy directives promoting efficiency and green construction. Data centers implement real-time monitoring to control heat output and power use. It supports long-term operational savings and improves equipment life. Energy-efficient systems reduce power usage effectiveness (PUE) metrics below 1.4 in top facilities. The integration of smart cooling enhances temperature regulation and load management. Providers combine AI-driven automation for predictive maintenance. These innovations strengthen cost efficiency and environmental credibility.

Rising Demand for Edge and AI-Driven Infrastructure

Growing adoption of AI, IoT, and 5G networks fuels edge infrastructure expansion. The Spain Data Center Infrastructure Market benefits from increased data generation at distributed nodes. Enterprises seek decentralized models for faster data processing and minimal latency. Edge data centers serve real-time applications across logistics, retail, and manufacturing. AI workloads drive demand for higher GPU density and advanced rack designs. It supports the integration of scalable architectures to process unstructured data efficiently. Telecom operators form partnerships with cloud providers to deploy micro data centers. This strategy enhances regional coverage and business agility. Spain’s AI and automation ecosystem attracts heavy enterprise investments.

Strategic Importance for Investors and Global Operators

Spain emerges as a strategic gateway linking European, African, and Latin American digital networks. Its geographic advantage and submarine cable connectivity attract hyperscale investment. The Spain Data Center Infrastructure Market anchors strategic projects supporting digital trade and cross-border data exchange. Investors target Madrid and Barcelona for their established technology clusters. It offers stable policy frameworks and renewable power integration potential. International firms view Spain as an alternative hub to traditional Western Europe markets. Increasing foreign direct investment boosts construction and engineering contracts. Local infrastructure providers gain from rising colocation leasing activity. This market’s expansion enhances Spain’s global digital competitiveness.

- For instance, Meta acquired 2 million square meters of industrial land in Talavera de la Reina for €20.6 million as part of its €1 billion data center campus on 191 hectares, connecting to Spain’s submarine cable networks like MAREA.

Market Trends

Market Trends

Expansion of Hyperscale and Modular Data Center Facilities

The Spain Data Center Infrastructure Market experiences fast growth in hyperscale and modular deployment models. Major providers like Equinix and Digital Realty expand facilities near Madrid for cloud-heavy clients. Modular systems deliver faster setup and scalable performance under tight timelines. Operators adopt prefabricated components to meet sustainability and cost targets. It improves build speed and shortens commissioning cycles. Construction partners invest in modular integration for high-capacity zones. Hyperscale campuses strengthen Spain’s data capacity leadership in Southern Europe. Flexible architecture supports future-ready applications and AI clusters. This trend positions Spain among Europe’s fastest-developing data ecosystems.

Rising Integration of Renewable Energy in Data Operations

Green energy integration reshapes operational design across new Spanish facilities. Operators shift to solar, hydro, and wind-based sources for cleaner operations. It aligns with the EU’s Green Deal and national decarbonization objectives. Renewable power purchase agreements ensure long-term cost stability. Cooling and backup systems also adopt eco-efficient configurations. Companies measure carbon output transparently to meet ESG commitments. Sustainability drives customer preference and government support. Regional players enhance brand reputation by achieving near-zero emission goals. This transformation reinforces Spain’s leadership in sustainable data center development.

Deployment of Smart Automation and AI-Powered Infrastructure Management

Automation transforms data center operations through AI-based monitoring and predictive analytics. The Spain Data Center Infrastructure Market sees wider adoption of intelligent systems for workload optimization. Machine learning tools analyze environmental variables to improve uptime. Operators reduce human error and downtime using smart control interfaces. It enhances operational efficiency by enabling proactive fault detection. AI software adjusts cooling loads based on real-time data insights. Data-driven management supports continuous performance improvement. Smart infrastructure ensures consistent service delivery across critical systems. This adoption elevates Spain’s position in next-gen data automation.

Evolving Focus on Cybersecurity and Digital Resilience

With higher digitalization, cybersecurity becomes a top design priority. Data centers strengthen physical and digital defense frameworks to prevent disruptions. The Spain Data Center Infrastructure Market incorporates layered monitoring, encryption, and biometric access control. It supports compliance with the EU’s NIS2 Directive and GDPR standards. Security vendors deploy real-time threat analytics and adaptive access systems. Facilities include redundant pathways and disaster recovery zones to boost resilience. Operators coordinate with telecom networks for fast breach detection. These measures protect mission-critical data and service continuity. Strong cyber hygiene enhances Spain’s infrastructure reliability reputation.

Market Challenges

Market Challenges

High Energy Consumption and Sustainability Compliance Costs

Rising energy demand challenges Spain’s ability to maintain efficient operations. The Spain Data Center Infrastructure Market faces higher costs from grid dependency and sustainability compliance. Power constraints limit capacity expansion in dense urban areas. Operators must integrate renewable sources to meet regulatory standards. It increases capital investment and operational complexity. Cooling systems require advanced upgrades to meet strict energy ratings. Continuous monitoring and certification add administrative burden. Balancing sustainability with economic viability remains difficult. This pressure slows smaller players from scaling infrastructure competitively.

Talent Shortages and Construction Delays in Large-Scale Projects

Skilled labor gaps and lengthy permit cycles constrain project delivery timelines. Spain’s construction sector faces tight schedules due to supply chain volatility. The Spain Data Center Infrastructure Market depends on highly skilled technicians for electrical and network systems. Shortages lead to recruitment competition across engineering firms. It drives wage inflation and longer commissioning phases. Material sourcing delays from global suppliers worsen construction costs. Complex land acquisition rules slow hyperscale investments in major cities. Ensuring consistent workforce availability becomes vital for long-term scalability. This issue tests investor confidence and market momentum.

Market Opportunities

Growing Role of AI, 5G, and Edge Data Infrastructure

Rapid adoption of AI, machine learning, and 5G fuels new opportunities across Spain. The Spain Data Center Infrastructure Market supports low-latency processing through distributed edge sites. Enterprises seek intelligent infrastructure to enhance analytics and automation. Telecom carriers expand small footprint facilities for real-time workloads. It improves connectivity and supports high-bandwidth services. Demand for localized data centers grows in logistics, healthcare, and retail sectors. This evolution offers strong growth prospects for developers and investors.

Rising Public and Private Investments in Green Infrastructure

Spain’s energy transition programs attract funding for renewable-powered data centers. National and EU initiatives support carbon-neutral operations and grid modernization. The Spain Data Center Infrastructure Market benefits from tax incentives and green financing options. Operators deploy photovoltaic and hybrid cooling solutions to meet zero-emission goals. It enhances investor confidence and sustainability leadership. The market’s strong policy support encourages long-term expansion. These initiatives make Spain a regional benchmark for eco-efficient infrastructure projects.

Market Segmentation

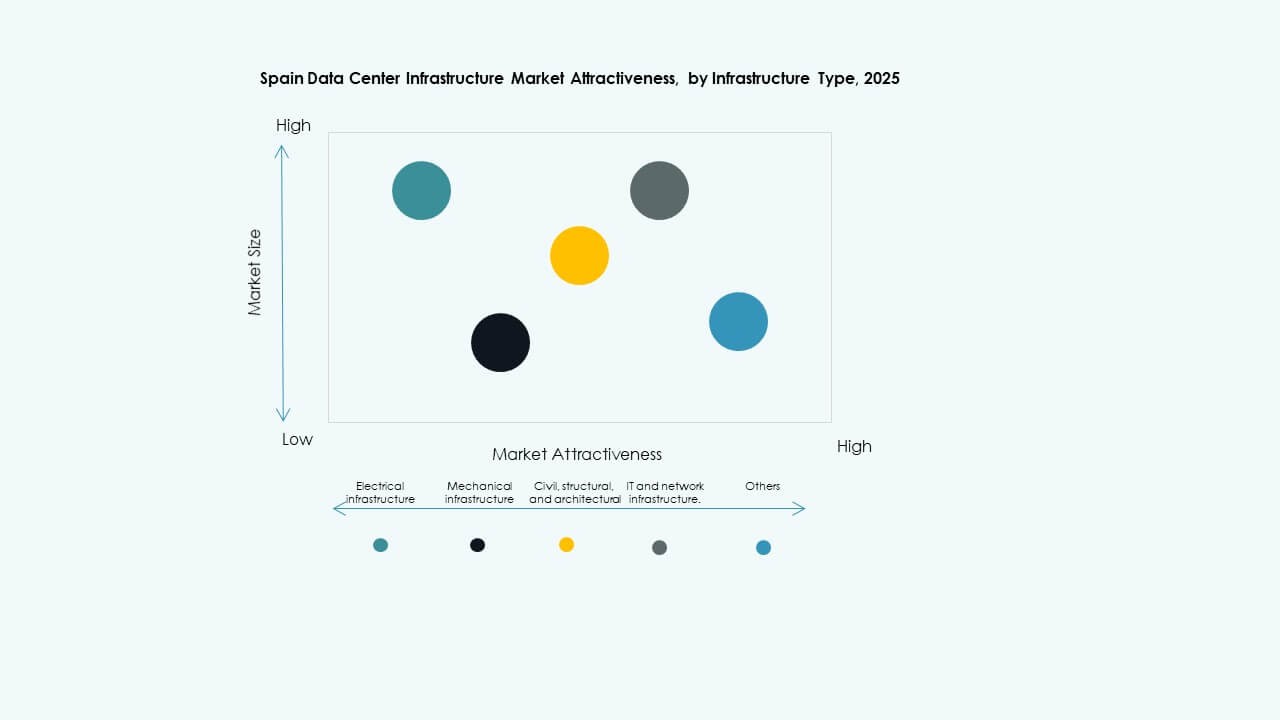

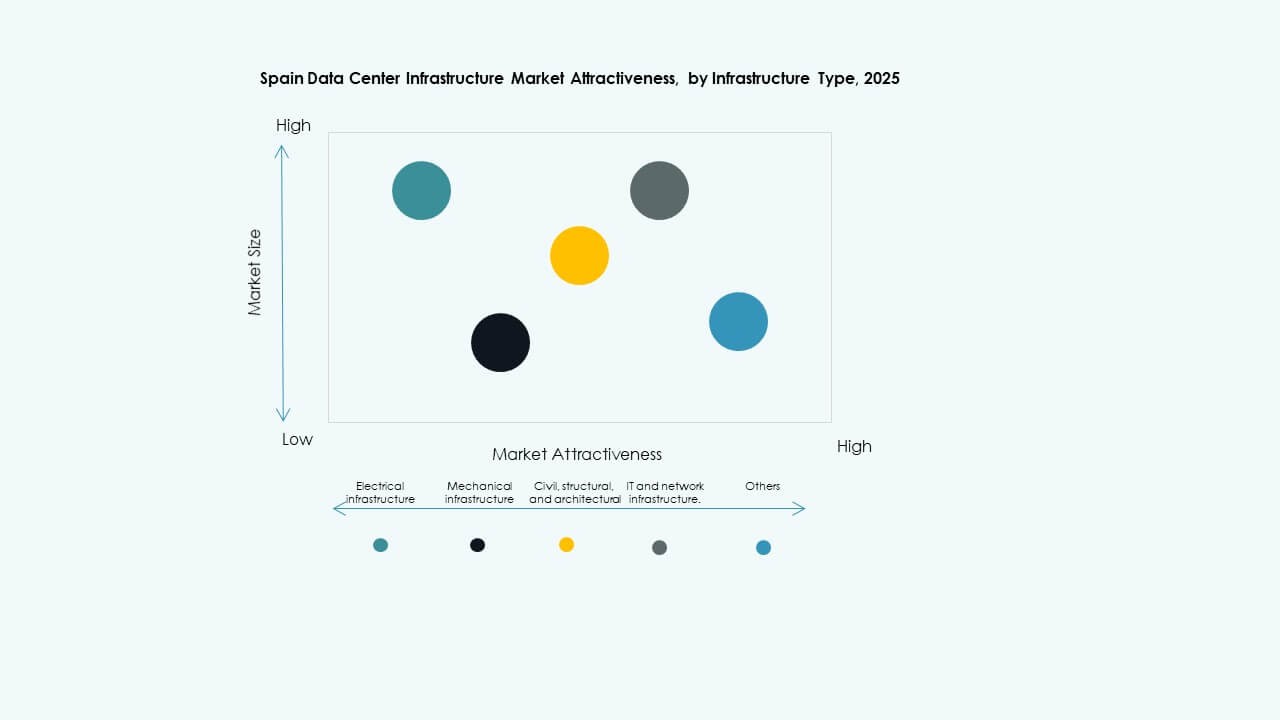

By Infrastructure Type

Electrical infrastructure leads the Spain Data Center Infrastructure Market with strong dominance in overall cost share. Reliable power systems form the foundation of continuous operations. Demand grows for high-capacity UPS and redundant grid connections supporting uptime guarantees. Mechanical and IT infrastructure segments follow closely, driven by advanced cooling and server density. Civil and structural works expand due to increased hyperscale campus construction. Investment in modular systems continues to gain traction for faster deployment and scalability.

By Electrical Infrastructure

The uninterruptible power supply (UPS) segment holds major share due to its critical role in ensuring resilience. The Spain Data Center Infrastructure Market emphasizes high-efficiency UPS systems with lithium-ion backup. Battery energy storage systems (BESS) emerge as a secondary powerhouse for grid support and renewable balancing. PDUs and transfer switches grow as automation enhances load distribution. Utility service integration improves power reliability. Operators prefer modular switchgear units for compact setups. Sustainability drives innovation in eco-efficient electrical hardware.

By Mechanical Infrastructure

Cooling units and chillers dominate the mechanical segment due to Spain’s warm climate. The Spain Data Center Infrastructure Market adopts air and water-cooled chiller systems for efficient thermal control. Containment and free-air solutions improve PUE ratings. Energy-saving pumps and piping optimize water management. Advanced airflow containment ensures balanced temperature distribution across racks. AI-controlled systems monitor heat loads in real time. Operators prioritize hybrid solutions combining liquid and air systems. Sustainable cooling remains central to operational optimization.

By Civil / Structural & Architectural

Superstructure and modular building systems lead Spain’s construction category. The Spain Data Center Infrastructure Market invests in prefabricated frames and high-strength concrete for durability. Raised floors and insulated roofing enhance cooling efficiency. Site preparation costs decline with modular assembly. Steel-clad envelopes improve heat insulation and reduce power usage. Urban facilities leverage vertical construction for land efficiency. The segment benefits from rising retrofit and urban redevelopment projects.

By IT & Network Infrastructure

Servers and storage equipment dominate this segment due to rising cloud and AI applications. The Spain Data Center Infrastructure Market demands high-density racks to support GPU-driven computation. Networking equipment upgrades ensure faster interconnection. Optical fiber cabling improves signal integrity. Advanced rack systems enhance airflow and cable management. The integration of storage clusters supports data-heavy analytics. Scalability and energy efficiency remain design priorities.

By Data Center Type

Hyperscale data centers lead the landscape due to cloud providers’ large deployments. The Spain Data Center Infrastructure Market expands through colocation and edge facilities supporting enterprises. Enterprise data centers maintain relevance for localized workloads. Edge centers gain traction near telecom hubs for latency-sensitive tasks. Developers explore hybrid models combining hyperscale and modular designs. These configurations enhance regional coverage and agility.

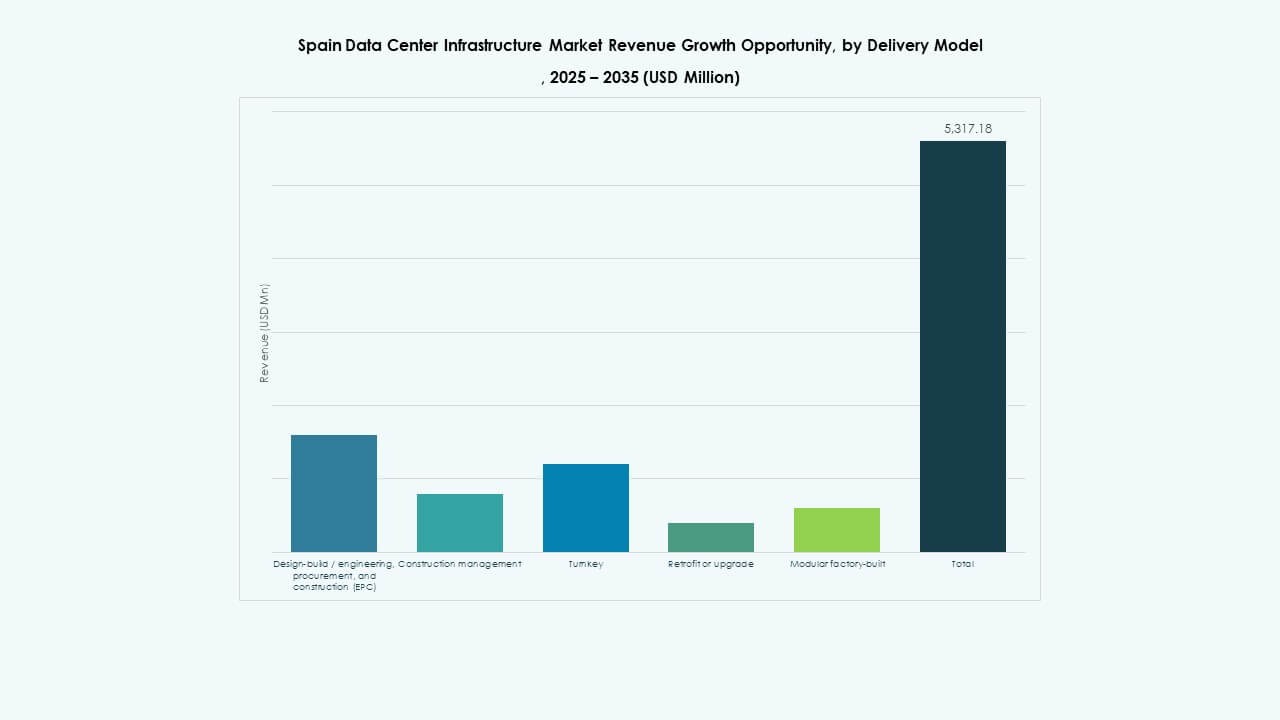

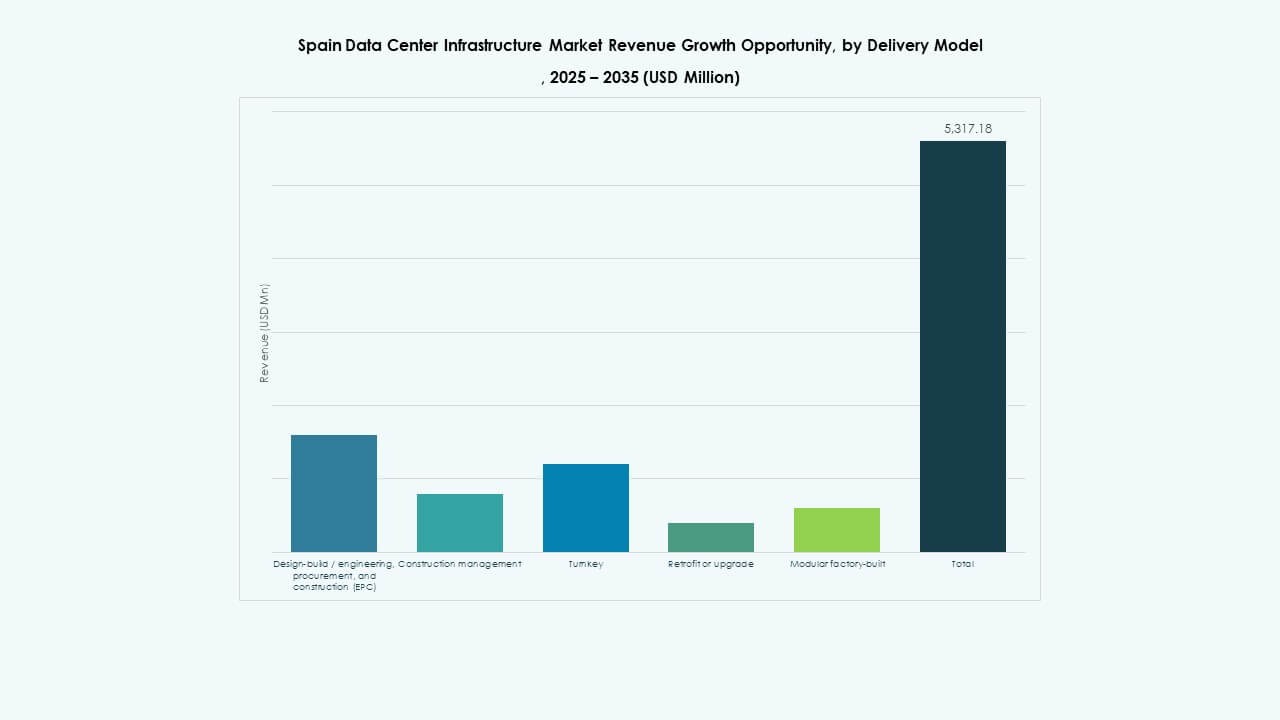

By Delivery Model

Design-Build/EPC models dominate as investors prefer integrated construction for faster completion. The Spain Data Center Infrastructure Market relies on turnkey projects for consistent quality. Retrofit and modular factory-built models gain share due to speed and flexibility. Construction management contracts serve complex multi-tenant projects. EPC vendors use digital twins for planning and risk control. This structure ensures predictable cost and performance metrics.

By Tier Type

Tier 3 facilities dominate with balanced redundancy and cost efficiency. The Spain Data Center Infrastructure Market records increasing Tier 4 development for mission-critical workloads. Tier 2 and Tier 1 centers serve smaller enterprises and edge environments. Tier 4 growth reflects higher enterprise resilience standards. Operators aim to achieve 99.999% uptime certifications. Compliance with global standards strengthens Spain’s reputation for reliability.

Regional Insights

Regional Insights

Central Spain: Madrid as the Core Growth Engine (40% Share)

Madrid remains the leading region for data center infrastructure investment. The Spain Data Center Infrastructure Market records over 40% share concentrated around Madrid’s tech corridor. Its strong grid network, fiber connectivity, and proximity to government agencies attract global operators. Hyperscale projects cluster in Alcobendas and Getafe zones. Cloud and telecom providers benefit from strategic central location advantages. High investment inflow continues to drive land acquisition and expansion planning. Madrid strengthens its role as Spain’s digital gateway.

- For instance, Digital Realty is developing its fifth data center, MAD5, in the MadBit technology district with a capacity of 20-24 MW via a €300 million investment.

Eastern and Northeastern Spain: Barcelona and Valencia (35% Share)

Catalonia and Valencia regions emerge as secondary growth hubs. The Spain Data Center Infrastructure Market benefits from port connectivity and cross-Mediterranean data exchange. Barcelona supports strong colocation demand from enterprise clients. Valencia grows through renewable-powered projects leveraging solar and offshore wind sources. The region’s logistics infrastructure enables efficient equipment transport. Data traffic between France and Spain flows through these nodes, boosting cross-border integration. Industrial parks encourage data innovation partnerships.

Southern and Northern Spain: Andalusia and Basque Regions (25% Share)

Emerging regions such as Andalusia and the Basque Country witness steady adoption. The Spain Data Center Infrastructure Market expands here due to availability of land and renewable power. Malaga and Bilbao attract mid-size data facilities serving local enterprises. Government-backed digitalization programs support new construction. Colocation operators explore rural and coastal areas for edge deployments. These regions leverage lower operational costs and green power incentives. Their growing relevance diversifies Spain’s overall infrastructure ecosystem.

- For instance, Iberdrola and Echelon’s joint venture targets over €2 billion for data centers like Madrid Sur campus (144 MW capacity, 160,000 m², 230 MW grid connection, 1 TWh annual renewable power, on-site solar plant).

Competitive Insights:

- Equinix, Inc.

- Digital Realty

- Schneider Electric SE

- ABB Ltd.

- Vertiv Group Corp.

- Dell Inc.

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Fujitsu

- Lenovo

The Spain Data Center Infrastructure Market faces competition from global infrastructure and service providers that blend power, cooling, and IT-hardware capabilities. Equinix and Digital Realty dominate colocation and hyperscale segments by leveraging large facility networks and interconnection services, making them go-to choices for enterprises needing scalable capacity. Schneider Electric, ABB, and Vertiv lead in electrical and mechanical infrastructure, delivering UPS, energy management, and cooling solutions that meet rigorous uptime and efficiency standards. Dell, Huawei, Cisco, Fujitsu, and Lenovo supply server, networking, and storage hardware — enabling full turnkey data-center builds. Businesses and investors prefer vendors with integrated offerings of facility infrastructure and IT stack. This multi-layer competition drives innovation and keeps pricing and service quality competitive.

Recent Developments:

- In November 2025, ACS and BlackRock launched a €2 billion joint venture to develop data center infrastructure in Spain, focusing on building large-scale facilities supporting the region’s growing digital needs. This partnership is expected to significantly enhance Spain’s data center capacity and infrastructure investment landscape.

- In September 2025, EdgeMode Inc. announced the acquisition of a portfolio of hyperscale data center development assets in Spain through a joint venture with Blackberry AIF. This acquisition positions EdgeMode as a leading developer of renewable-powered hyperscale data centers in Europe, targeting a capacity of 1.5 GW for sustainable AI infrastructure.

- In July 2025, Iberdrola and Echelon Data Centres formed a strategic joint venture to develop and operate data centers in Spain. Iberdrola holds a 20% stake, providing land connected to the electricity grid and supplying 24/7 electricity to the centers, while Echelon manages permits, design, marketing, and operations.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights