Executive summary:

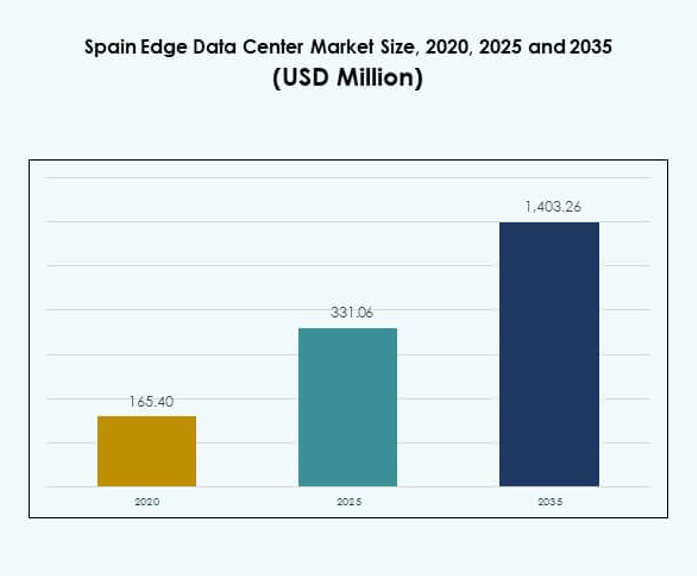

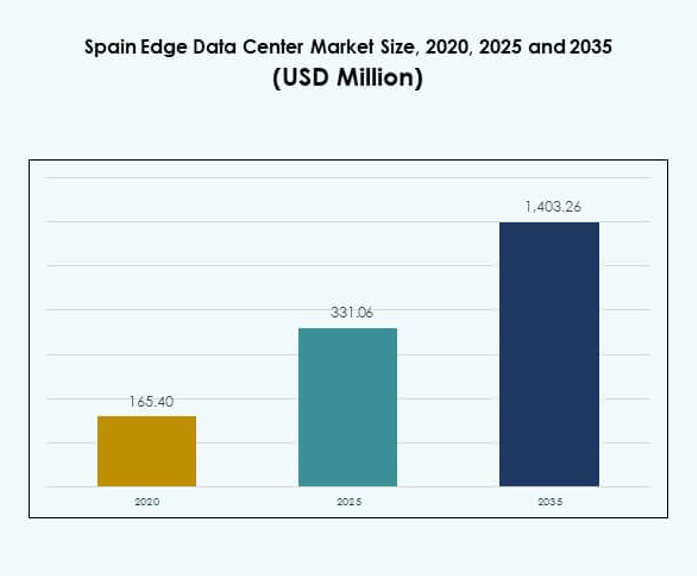

The Spain Edge Data Center Market size was valued at USD 165.40 million in 2020, reached USD 331.06 million in 2025, and is anticipated to reach USD 1,403.26 million by 2035, at a CAGR of 15.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Spain Edge Data Center Market Size 2025 |

USD 331.06 Million |

| Spain Edge Data Center Market, CAGR |

15.41% |

| Spain Edge Data Center Market Size 2035 |

USD 1,403.26 Million |

Growth in the Spain Edge Data Center Market is driven by expanding 5G networks, rapid digital transformation, and strong IoT adoption across industries. Businesses invest in energy-efficient, modular edge facilities to manage real-time data processing. The integration of AI, automation, and cloud connectivity enhances operational agility and resilience. It holds strategic importance for investors seeking opportunities in scalable infrastructure, sustainable operations, and low-latency computing environments across Spain. Northern and Central Spain lead the market due to robust fiber connectivity, strong hyperscaler presence, and government-backed digital initiatives. Southern regions are emerging with renewable-powered data centers supporting industrial and smart city growth. Eastern and Western Spain are witnessing gradual adoption, driven by regional collaboration, improved cross-border connectivity, and expanding enterprise demand for localized computing infrastructure.

Market Drivers

Rapid 5G Expansion and Rising Data Traffic Creating Strong Demand

The deployment of 5G networks across Spain is increasing data generation and driving the need for low-latency processing. Telecom operators are investing in edge facilities near urban and industrial zones to manage growing traffic loads efficiently. The Spain Edge Data Center Market benefits from expanding IoT applications that depend on real-time analytics. Industries such as automotive, healthcare, and retail require localized data handling to enhance operational responsiveness. Enterprises adopt edge infrastructure to reduce dependency on distant cloud centers. The transition toward smart cities fuels investments in distributed data networks. This transformation supports national digitalization strategies. It strengthens Spain’s position as a regional technology hub.

Technological Innovation in Edge Infrastructure and Energy Efficiency

Technology providers focus on modular and prefabricated edge centers, optimizing scalability and quick deployment. The integration of AI-driven monitoring tools enhances power efficiency and workload balancing. The Spain Edge Data Center Market experiences progress through software-defined networking and liquid cooling systems. These advancements lower operational costs and extend equipment life cycles. Data center operators adopt renewable energy to meet sustainability targets. Innovation in automation and predictive maintenance reduces downtime and improves performance reliability. The government supports energy-efficient construction through sustainability policies. It encourages enterprises to invest in modernized infrastructure that aligns with European energy goals.

- For example, in February 2025, Schneider Electric acquired a controlling stake in Motivair, expanding its liquid-cooling portfolio to support AI and high-density data center workloads. The partnership strengthens Schneider Electric’s AI-ready infrastructure solutions, aligning with its collaboration with NVIDIA to accelerate sustainable, high-performance edge and cloud deployments across Europe.

Rising Digital Transformation Across Enterprises and Government Initiatives

Spain’s growing digital economy fuels demand for edge computing solutions across sectors. Public and private organizations invest in edge networks to support digital services, cybersecurity, and AI-based applications. The Spain Edge Data Center Market benefits from EU funding that promotes data sovereignty and infrastructure modernization. Businesses prioritize localized processing to comply with GDPR and ensure faster decision-making. Cloud adoption among SMEs supports hybrid architectures that combine cloud and on-premises operations. The government’s digital Spain 2026 agenda accelerates technology readiness. This transition strengthens regional competitiveness and supports cross-border connectivity. It creates long-term opportunities for investors and technology providers.

Strategic Relevance for Enterprises and Investors in Data Localization

The need for localized computing in Spain reflects both regulatory and commercial priorities. Enterprises adopt edge data centers to handle sensitive information closer to end-users. The Spain Edge Data Center Market holds strategic value for investors seeking stable returns through digital infrastructure. Growing interest from hyperscalers and colocation providers creates favorable investment conditions. Businesses view edge locations as critical to latency-sensitive services such as autonomous systems and digital banking. Strong fiber connectivity enables scalable expansion across cities like Madrid and Barcelona. Policy reforms and tax incentives promote long-term capital inflows. It strengthens Spain’s role within the European digital corridor.

- For example, in August 2025, Equinix announced a €460 million expansion of its Alcobendas (Madrid) data center campus to increase operational capacity and develop AI-ready, 100% renewable-powered data halls. The expansion strengthens Madrid’s role as a key interconnection hub within Europe’s digital corridors, supporting fintech, hyperscale, and enterprise clients with high-speed fiber connectivity and sustainable infrastructure.

Market Trends

Expansion of AI and Machine Learning Applications Across Edge Networks

The growing integration of AI in analytics, video processing, and predictive modeling drives edge adoption. The Spain Edge Data Center Market witnesses new use cases in healthcare diagnostics, manufacturing automation, and logistics optimization. AI systems deployed at the edge reduce latency and improve response times. Cloud providers partner with AI firms to enable decentralized intelligence. The focus shifts toward data-driven services that rely on near-user computing. Continuous innovation in AI hardware enhances edge node efficiency. It creates opportunities for hybrid models that combine cloud and local computing. This advancement strengthens operational autonomy across industries.

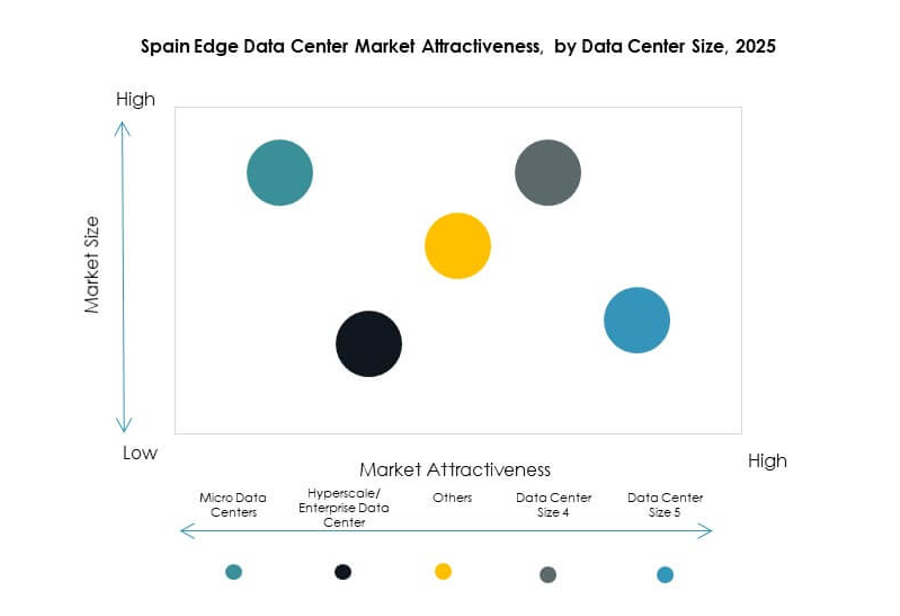

Increased Deployment of Micro Data Centers Supporting Urban Digitization

Urban areas adopt compact, energy-efficient micro data centers to enhance connectivity for smart applications. The Spain Edge Data Center Market gains from increased adoption of these systems by enterprises and municipalities. Compact setups reduce real estate requirements and support scalability in dense regions. Edge micro facilities enable local data aggregation, reducing network congestion. Energy-efficient designs ensure sustainable operations in metropolitan regions. Industrial automation and remote monitoring systems use these centers for real-time insights. The micro model supports smart mobility and digital public services. It becomes integral to Spain’s evolving digital ecosystem.

Shift Toward Sustainable and Renewable-Powered Edge Facilities

Sustainability becomes a defining factor in data center construction and operation across Spain. The Spain Edge Data Center Market focuses on integrating renewable power sources such as wind and solar. Operators implement energy storage systems to stabilize power usage during peak demand. Companies invest in advanced cooling solutions to reduce carbon emissions. Green building certifications gain importance for attracting institutional investors. Supply chain transparency ensures environmental compliance and brand trust. This transition aligns with Spain’s commitment to reducing energy intensity in ICT operations. It builds a competitive advantage through eco-friendly infrastructure.

Strategic Partnerships Between Telecom and Cloud Providers Driving Ecosystem Growth

Telecom companies form partnerships with hyperscalers to extend cloud capabilities to the edge. The Spain Edge Data Center Market benefits from these collaborations aimed at reducing latency for end-users. Integrated networks combine private 5G, edge, and cloud services to support business continuity. Enterprises deploy multi-access edge computing to serve IoT-driven applications. Strategic alliances accelerate rollout across industrial zones and logistics hubs. Co-location and managed service providers expand regional presence through these ventures. The collaboration model ensures cost efficiency and technical interoperability. It establishes Spain as a regional hub for edge connectivity and innovation.

Market Challenges

High Initial Investment and Complex Deployment Processes Limiting Growth

Establishing edge infrastructure requires significant capital investment in equipment, fiber connectivity, and cooling systems. The Spain Edge Data Center Market faces challenges in balancing upfront costs with long-term operational efficiency. Smaller firms struggle to finance advanced facilities with scalable capacity. Complex zoning laws and local permits delay construction timelines in urban areas. High costs of renewable power integration increase project budgets. Limited local expertise in edge-specific engineering slows rollout. Coordination between telecom providers and utilities remains inconsistent. It affects the overall pace of infrastructure deployment and market expansion.

Regulatory Compliance and Data Privacy Concerns Restricting Market Agility

Regulatory frameworks around data sovereignty demand strict adherence to European and national standards. The Spain Edge Data Center Market experiences delays due to evolving GDPR interpretations and cybersecurity obligations. Businesses require localized processing, but cross-border compliance remains complex. Operators must ensure continuous monitoring and certification to meet data protection laws. Interoperability issues between legacy systems and modern architecture create integration gaps. Network security upgrades raise operating costs. Limited standardization across data protocols increases administrative effort. It challenges stakeholders to maintain compliance while pursuing scalability.

Market Opportunities

Expansion of Smart Infrastructure and Industry 4.0 Adoption Across Spain

Spain’s growing industrial automation and smart manufacturing sector generate strong demand for edge solutions. The Spain Edge Data Center Market benefits from integration with robotics, predictive maintenance, and digital twin systems. Emerging technologies require localized computing to enhance productivity and accuracy. Businesses view edge networks as vital for next-generation industrial operations. Government-backed digital transition plans create funding opportunities for private players. It enables widespread deployment of edge-enabled automation and monitoring solutions. This shift attracts global technology investors seeking scalable industrial projects. It supports long-term modernization across Spain’s manufacturing ecosystem.

Emergence of Hyperscale-Edge Synergy Strengthening Cloud Ecosystem

Global cloud leaders invest in distributed edge facilities to enhance regional coverage. The Spain Edge Data Center Market leverages these expansions to attract enterprise workloads. Localized data storage and hybrid infrastructure models deliver operational flexibility. Telecom operators collaborate with hyperscalers to ensure high-performance connectivity. Cross-border interconnectivity drives foreign investment in digital real estate. Businesses gain reduced latency and improved resilience from regionalized operations. It strengthens Spain’s role in Europe’s broader digital infrastructure network. This evolution supports sustained growth for investors and service providers.

Market Segmentation

By Component

Solutions dominate the Spain Edge Data Center Market, accounting for a major revenue share driven by hardware infrastructure, cooling, and power systems. Enterprises prioritize edge-specific servers and networking equipment to reduce latency and improve reliability. Service offerings such as maintenance and consulting continue to expand but contribute a smaller share. Growing demand for scalable and modular systems drives solution upgrades. Cloud-based solutions remain attractive for flexible deployment. Strong vendor competition enhances technological diversity. It ensures continuous innovation in infrastructure optimization.

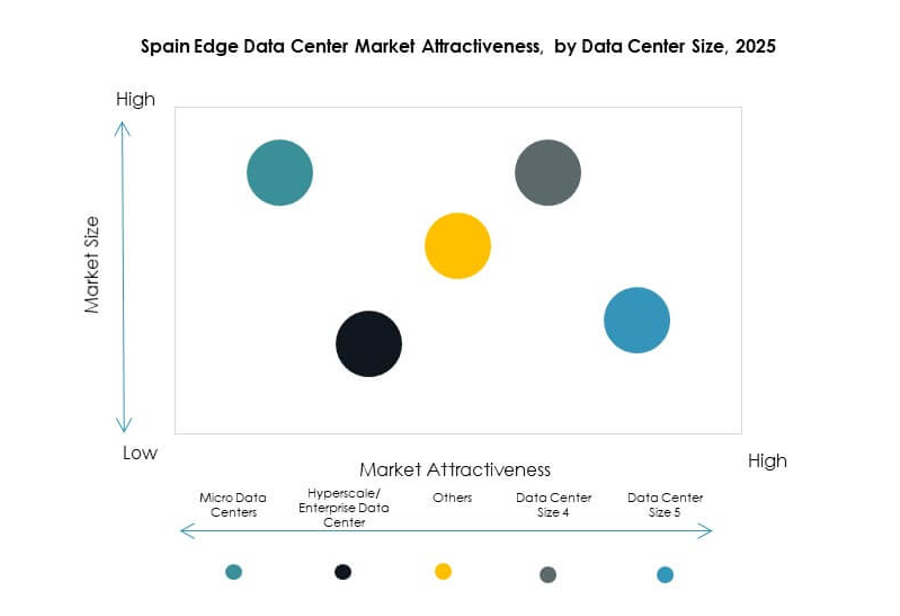

By Data Center Type

Colocation edge data centers hold the largest share in the Spain Edge Data Center Market due to strong enterprise reliance on shared facilities. Managed and cloud edge centers are expanding as companies prefer hybrid service models. Enterprise data centers cater to customized operational needs with higher control. The growing demand for multi-tenant hosting fuels infrastructure upgrades across major cities. Scalability and cost efficiency attract both startups and global firms. High-density rack deployments improve power utilization rates. It strengthens operational flexibility across enterprise networks.

By Deployment Model

Cloud-based deployment leads the Spain Edge Data Center Market, offering scalability and reduced setup time. Hybrid models gain traction as organizations balance private and public workloads. On-premises deployment remains relevant for industries handling sensitive data. Enterprises adopt distributed models to ensure high-speed access and lower network congestion. The hybrid framework supports dynamic resource management for AI and IoT applications. Rapid digital transformation across sectors drives this preference. It supports secure, flexible infrastructure integration across regional data networks.

By Enterprise Size

Large enterprises dominate the Spain Edge Data Center Market, holding a significant share due to high investment capacity and data processing requirements. SMEs show increasing adoption supported by cost-effective modular designs. Scalable services attract mid-sized firms integrating IoT and cloud analytics. Government initiatives support digitalization among small businesses through financial incentives. Enterprise networks prioritize edge computing for operational continuity and agility. Improved hardware affordability supports broader adoption across business sizes. It expands the edge ecosystem beyond large corporations.

By Application / Use Case

Power monitoring leads applications in the Spain Edge Data Center Market, ensuring efficient energy utilization and uptime reliability. Asset management and environmental monitoring also record strong adoption across industrial sectors. BI and analytics platforms rely on edge data to support decision-making in real time. Capacity management tools ensure optimized performance across distributed networks. Businesses use integrated dashboards for system control. Demand for real-time insights drives continuous innovation in software. It enhances the overall operational effectiveness of edge deployments.

By End User Industry

The IT and telecommunications sector leads the Spain Edge Data Center Market with a substantial market share due to strong infrastructure demand. BFSI and retail industries show rapid adoption of edge computing for secure, fast transactions. Healthcare facilities deploy edge solutions for patient monitoring and diagnostics. Energy and utilities sectors benefit from predictive analytics and grid optimization. Aerospace and defense rely on low-latency systems for mission-critical applications. Continuous digital transformation across industries supports long-term market growth. It broadens the operational impact of edge networks nationwide.

Regional Insights

Northern and Central Spain Driving Market Leadership with Strong Connectivity

Northern and Central Spain account for 46% share of the Spain Edge Data Center Market, led by Madrid’s status as a primary connectivity hub. The region benefits from dense fiber networks, strong cloud adoption, and hyperscaler investments. Financial and telecom companies drive consistent demand for edge services. Strategic infrastructure upgrades strengthen data localization and disaster recovery capabilities. The government’s investment incentives further attract new entrants. It positions this subregion as the operational backbone of Spain’s digital infrastructure.

- For example, as of 2025, Madrid ranked among the top 10 cities in the EMEA region for data center infrastructure, with a total capacity of 538 MW across facilities in operation, construction, and planning. This leadership is supported by Madrid’s strategic location, strong digital infrastructure, and access to renewable energy, according to Cushman & Wakefield.

Southern Spain Emerging as a High-Potential Zone for Edge Expansion

Southern Spain holds a 33% market share supported by growing smart city projects and renewable energy availability. Major cities such as Seville and Malaga are witnessing rising deployments of modular edge facilities. The region benefits from industrial growth and strong support for digital inclusion. Colocation providers expand presence near logistics corridors to serve manufacturing clusters. Rising energy-efficient data facilities enhance its competitiveness. It gains importance as a sustainable hub for edge-driven services.

Eastern and Western Spain Gaining Momentum Through Regional Collaboration

Eastern and Western Spain together represent 21% share of the Spain Edge Data Center Market, supported by cross-border connectivity with Portugal and France. Local governments invest in regional data exchange networks to strengthen digital trade. Growth in SMEs accelerates demand for smaller, localized edge systems. Renewable power capacity and favorable real estate availability drive project feasibility. Telecom providers expand connectivity routes through coastal regions. It supports balanced digital infrastructure development across Spain’s less saturated markets.

- For example, in January 2023, Cellnex began six European Commission–funded CEF-2 projects to deploy 34 new telecom sites, including distributed antenna systems in tunnels and edge computing nodes along four cross-border 5G corridors linking Spain with France and Portugal, spanning over 1,400 km, with completion expected by December 2025.

Competitive Insights:

- Telefónica

- Cellnex Telecom

- Iberdrola

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

- Microsoft

- VMware

- Schneider Electric SE

- Rittal GmbH & Co. KG

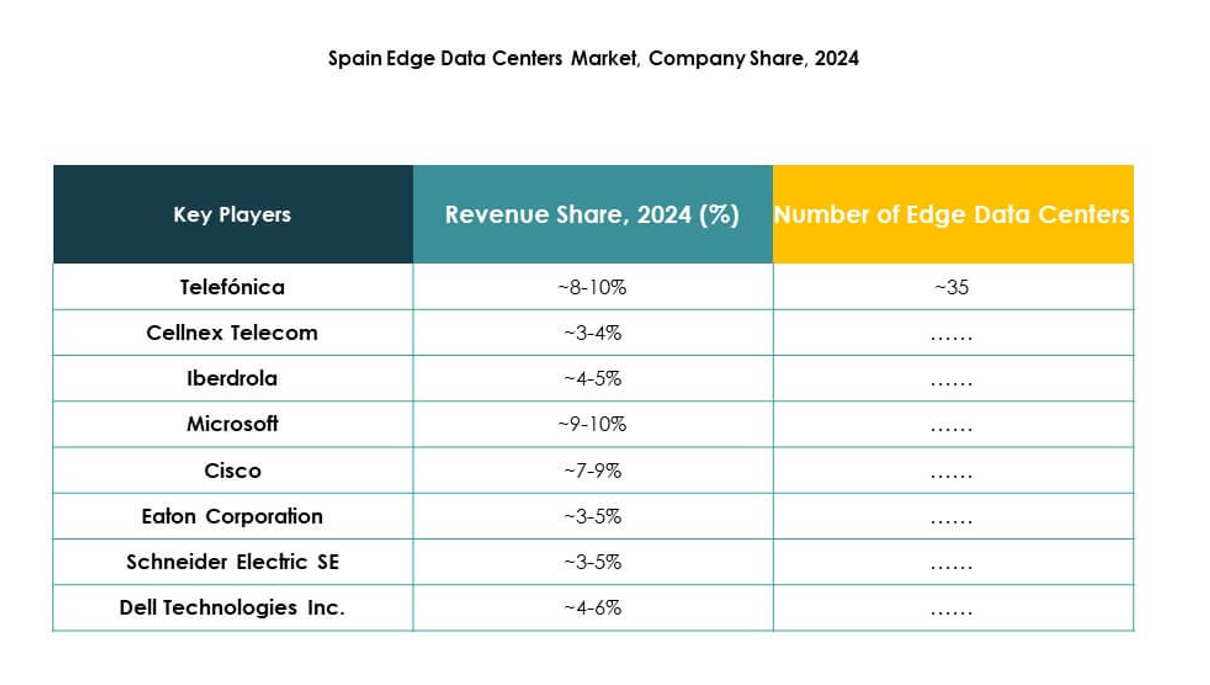

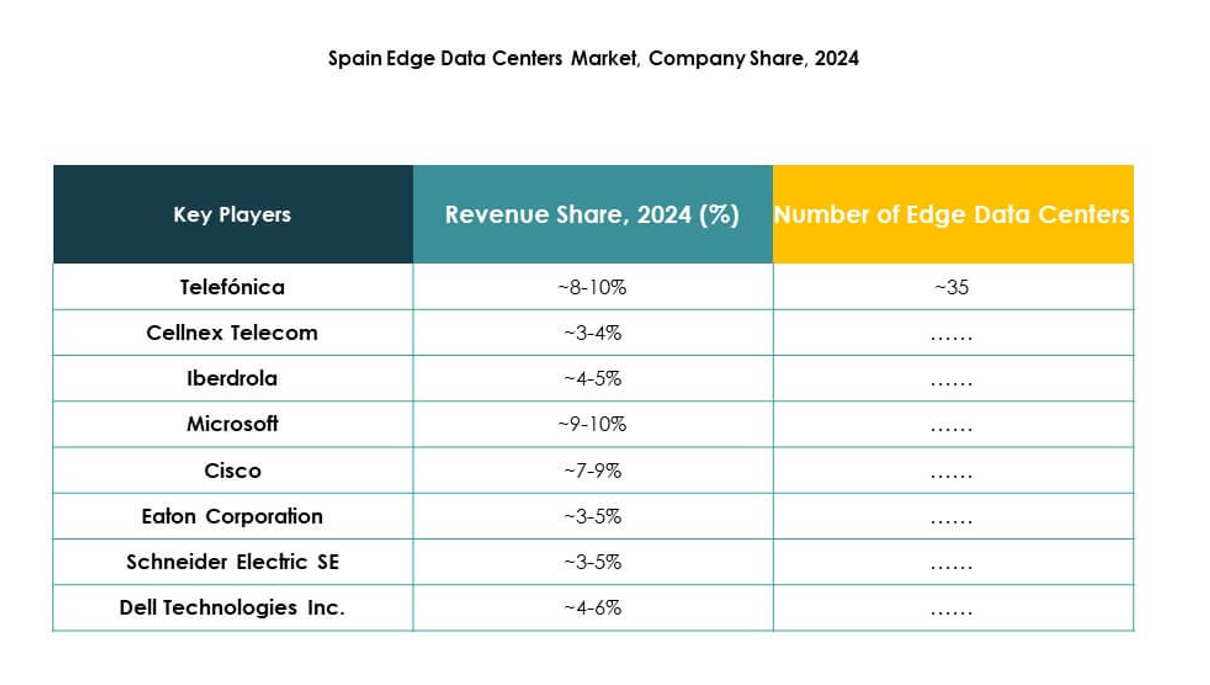

The Spain Edge Data Center Market features strong competition driven by telecom operators, cloud providers, and energy firms. Telefónica and Cellnex Telecom lead with robust network infrastructure and 5G integration. Iberdrola supports green power solutions that enhance sustainability in edge operations. EdgeConneX and Schneider Electric strengthen presence through modular and energy-efficient designs. Dell Technologies and Cisco expand through hardware innovation and hybrid cloud solutions. Microsoft and VMware accelerate ecosystem growth via edge-to-cloud platforms. Eaton and Rittal focus on power reliability and rack management systems. It continues to evolve through partnerships, acquisitions, and investments that reinforce Spain’s position as a strategic digital hub in Europe.

Recent Developments:

- In October 2025, Fujitsu expanded its strategic collaboration with NVIDIA, focusing on integrated AI infrastructure for edge data centers. Additionally, in September 2025, Fujitsu and 1Finity partnered with Arrcus to jointly deliver innovative network solutions across edge and AI infrastructure worldwide, targeting seamless connectivity for data centers.

- In July 2025, Iberdrola entered a landmark joint venture with Echelon Data Centres to develop, build, and operate data centers in Spain. Iberdrola will hold a 20% stake, focusing on supplying land and 24/7 renewable energy. The first facility is planned for Madrid, with a processing capacity of 144 megawatts, targeting operation commencement by 2030.

- In June 2025, Schneider Electric announced a major partnership with NVIDIA to develop AI-ready infrastructure for European data centers, including Spanish edge facilities, as part of broader EU innovation projects. The company continues to serve as a leading supplier of sustainable power and cooling solutions to new AI and cloud-enabled data center infrastructure across Europe.