Executive summary:

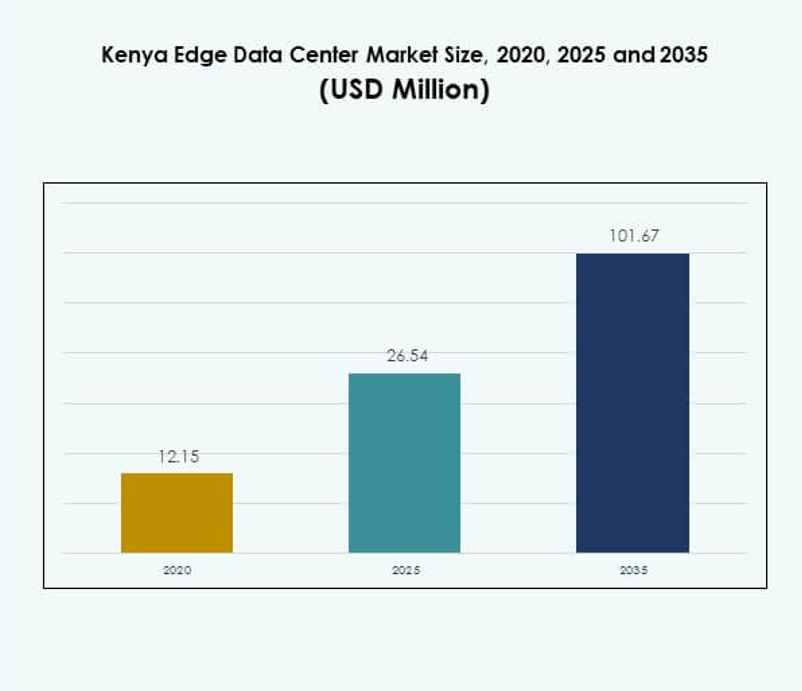

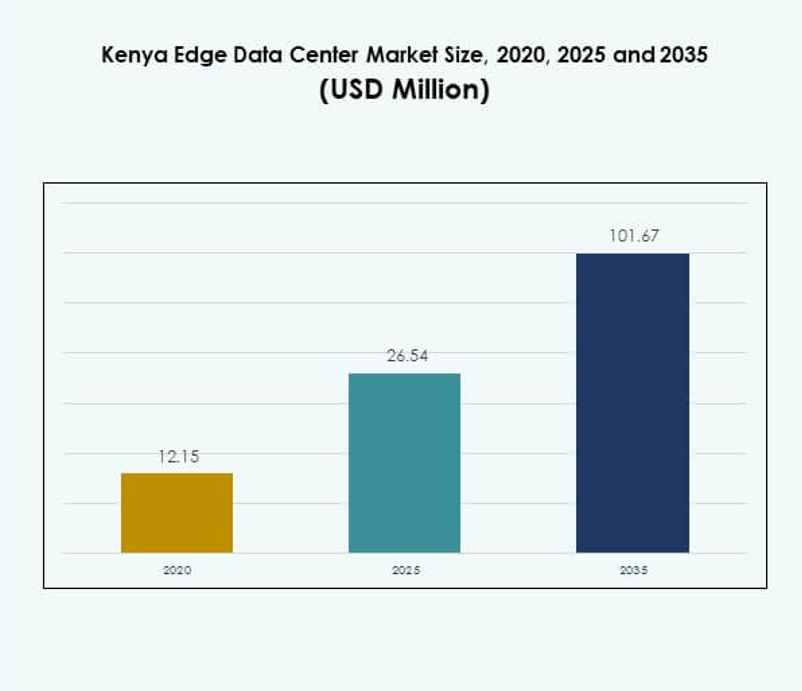

The Kenya Edge Data Center Market size was valued at USD 12.15 million in 2020, increased to USD 26.54 million in 2025, and is anticipated to reach USD 101.67 million by 2035, at a CAGR of 14.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Kenya Edge Data Center Market Size 2025 |

USD 26.54 Million |

| Kenya Edge Data Center Market, CAGR |

14.15% |

| Kenya Edge Data Center Market Size 2035 |

USD 101.67 Million |

Technology adoption, infrastructure modernization, and AI-driven edge innovation are fueling strong market momentum. Enterprises are integrating edge computing to enhance latency-sensitive operations and meet compliance standards. It enables real-time processing, secure connectivity, and high operational efficiency. Investors view this market as strategically significant due to its scalable infrastructure potential, sustainable energy integration, and ability to support enterprise transformation across multiple sectors.

East Africa leads the market, supported by advanced connectivity infrastructure, submarine cable landings, and concentrated private investments. Southern Africa is emerging as a key growth region with expanding fiber coverage and smart city initiatives. West Africa is expanding due to rising fintech activity and cross-border infrastructure projects. These regional dynamics position Kenya as a strategic digital hub driving edge deployments and network expansion across the continent.

Market Drivers

Rising Adoption of Digital Infrastructure and Enterprise-Level Data Localization

Enterprises are rapidly shifting toward decentralized computing to address latency and compliance needs. The Kenya Edge Data Center Market benefits from expanding data localization mandates and growing enterprise cloud strategies. This trend aligns with the government’s push to enhance national digital infrastructure. Businesses are moving critical workloads closer to end users, strengthening network resilience. Enterprises view edge facilities as essential for enabling digital services and applications. These deployments support real-time processing and improved cybersecurity. Investors see long-term revenue potential from the steady rise in demand for localized data. Edge data centers are becoming strategic assets for national digital growth.

Integration of 5G Networks with Edge Infrastructure to Enhance Real-Time Capabilities

5G deployment drives stronger edge infrastructure development across multiple industries. Enterprises leverage this integration to power low-latency services, automation systems, and IoT platforms. It allows faster response times and broader service coverage across regions. Edge locations support bandwidth-intensive use cases in transport, finance, and public services. Telecom operators are accelerating network modernization to enable real-time connectivity. This alignment between 5G and edge solutions creates scalable infrastructure ecosystems. Investors recognize the commercial advantages of integrated infrastructure models. It sets a solid foundation for high-value digital services across industries.

- For instance, Safaricom expanded its 5G network to more than 1,000 sites nationwide, enabling faster connections that enhance the performance of edge applications.

Accelerated Growth of IoT Devices and Industry-Specific Applications

Expanding IoT adoption is transforming data processing and storage requirements. The Kenya Edge Data Center Market supports this growth by providing proximity-based infrastructure. Industrial, retail, and public service applications rely on these capabilities for operational efficiency. Enterprises reduce latency while handling vast IoT-generated data sets at local nodes. This strategy enhances system responsiveness and security. IoT-focused industries prioritize scalability and high availability in edge deployments. Investors identify strong revenue streams from industry-specific use cases. Edge platforms enable the next phase of connected ecosystem development.

- For instance, Kenya Power announced plans to deploy 55,000 smart meters for SME customers to improve energy efficiency and grid reliability. The initiative aims to enhance real-time monitoring and operational control within Kenya’s power distribution network.

Strategic Investment Momentum and Strengthened Private Sector Participation

Private sector participation drives rapid market acceleration. Local and international operators are establishing advanced facilities to address rising digital demand. Investments target scalable modular architectures that can adapt to future network expansion. The Kenya Edge Data Center Market gains importance as investors seek stable infrastructure assets. Businesses benefit from improved connectivity, reduced latency, and service reliability. This investor confidence builds strong foundations for capacity expansion. Strategic capital deployment aligns with national and enterprise digitization goals. It reinforces the market’s role in enabling future digital ecosystems.

Market Trends

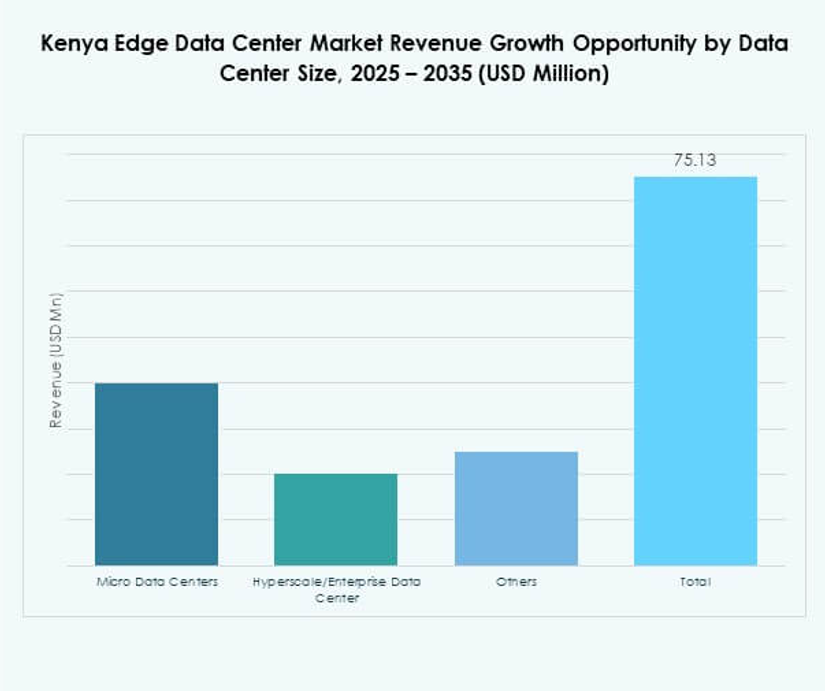

Expansion of Modular and Micro Data Center Architectures to Support Scalability

The demand for modular data centers is increasing, driven by their flexibility and speed of deployment. Enterprises adopt modular units to optimize costs and expand capacity based on demand shifts. It enables quick scaling in urban and remote areas. Micro data centers offer faster provisioning and more efficient power utilization. Operators deploy these units to serve high-traffic zones with low latency. Modular solutions are transforming infrastructure strategies for telecoms, BFSI, and logistics. Businesses view these deployments as essential for cost-effective digital growth. Investors favor these models for their rapid ROI and adaptability.

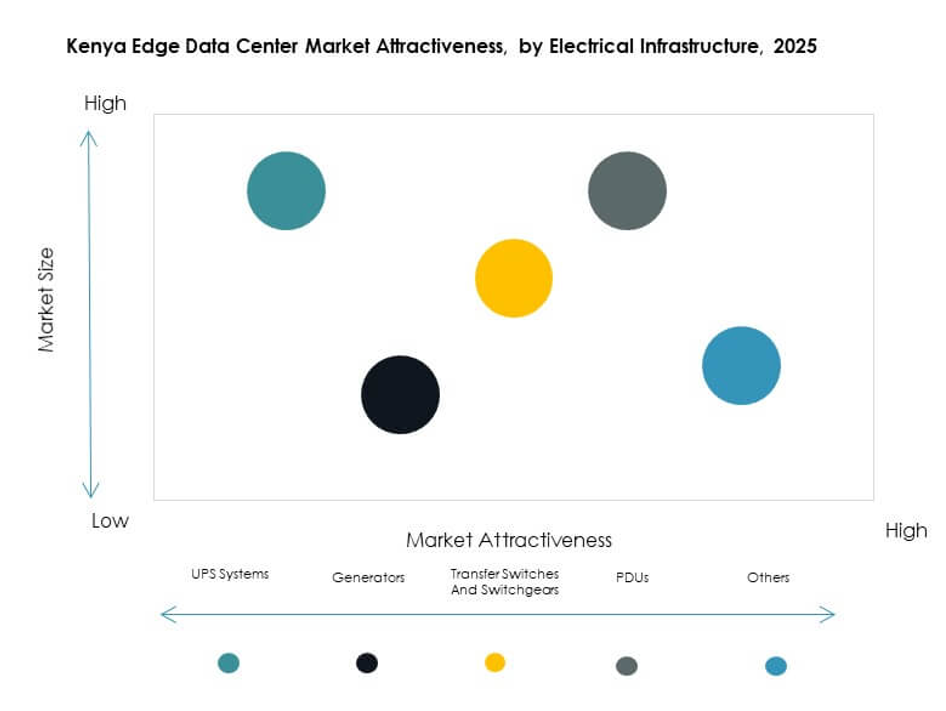

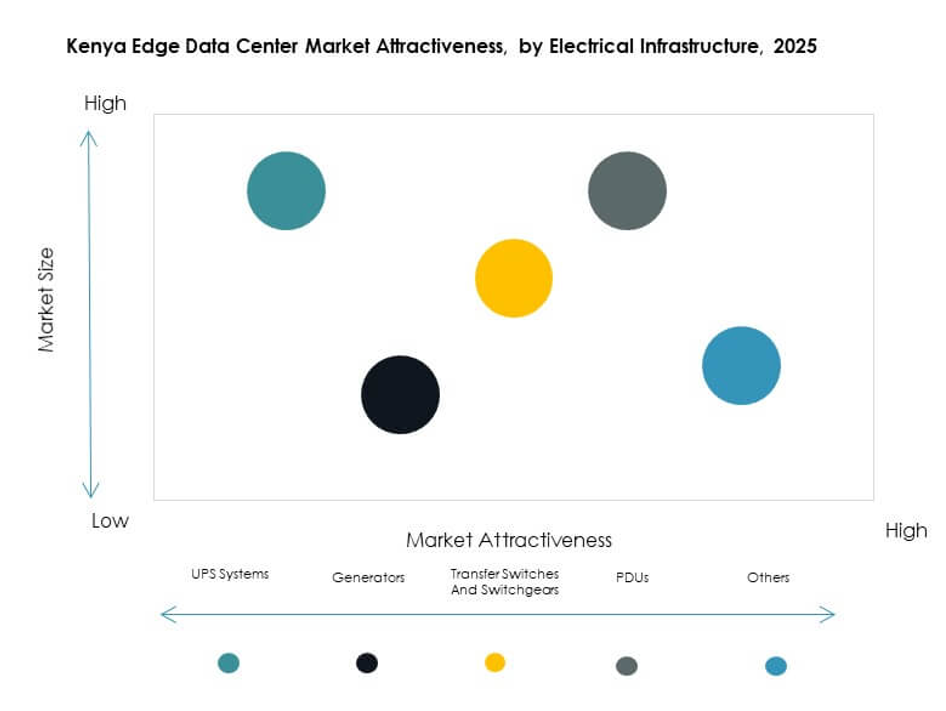

Surge in Green Data Center Designs and Energy-Efficient Operations

Sustainability trends are reshaping infrastructure investments. Operators prioritize energy-efficient designs to meet global environmental standards. The Kenya Edge Data Center Market sees rising interest in green cooling systems, renewable power, and efficient power distribution units. Enterprises adopt energy-optimized infrastructure to reduce operating costs. Regulatory pressure and customer expectations drive this transition toward sustainable models. It encourages operators to invest in innovative cooling and power management technologies. Green strategies strengthen brand reputation and attract climate-focused investors. Sustainable infrastructure is becoming a key differentiator in competitive markets.

Integration of Artificial Intelligence and Automation in Edge Operations

Operators are integrating AI-driven solutions to optimize edge data center performance. Intelligent monitoring systems enhance fault detection, capacity planning, and workload balancing. It improves operational efficiency and lowers maintenance costs. Automated orchestration allows seamless scaling across distributed networks. Enterprises rely on AI to deliver high availability and predictive maintenance. This technological shift improves uptime and operational transparency. Investors see AI integration as a key factor for operational resilience. The trend reflects a larger shift toward self-optimizing infrastructure ecosystems.

Growing Ecosystem of Cloud Service Providers and Strategic Alliances

The edge ecosystem is strengthening through strategic partnerships. Telecom companies, cloud providers, and technology vendors are forming alliances to expand infrastructure reach. The Kenya Edge Data Center Market benefits from joint ventures that accelerate service delivery. It creates an interconnected environment for businesses adopting hybrid models. Alliances drive technological standardization and interoperability. Service providers build scalable platforms to support multiple industries. Investors find these partnerships attractive due to their predictable growth patterns. The collaboration trend is shaping the next generation of edge infrastructure.

Market Challenges

Inadequate Power Infrastructure and Limited Network Reliability

Unstable grid power remains a key barrier for operators. Edge facilities require stable electricity to maintain uptime and service quality. The Kenya Edge Data Center Market faces reliability gaps in rural and semi-urban areas. Power disruptions increase operational costs due to the need for backup generation. Network reliability also impacts data center efficiency and service availability. Businesses face constraints when deploying latency-sensitive workloads in unstable regions. Investors view power infrastructure gaps as risk factors for scalability. Addressing energy reliability remains a top operational priority for stakeholders.

Shortage of Technical Expertise and Limited Policy Standardization

A shortage of skilled workforce limits efficient edge infrastructure operation. Highly specialized expertise is required for AI integration, cybersecurity, and network optimization. The Kenya Edge Data Center Market faces skill gaps that delay project execution. Regulatory frameworks remain fragmented, slowing consistent infrastructure development. Lack of standardized guidelines complicates deployment for international investors. Businesses experience operational complexity due to compliance uncertainty. These challenges reduce deployment speed and raise costs. Addressing skills and regulatory gaps is critical for long-term growth.

Market Opportunities

Rising Demand for Low-Latency Infrastructure in Urban and Industrial Hubs

Urban centers are driving demand for edge-based connectivity solutions. Enterprises seek infrastructure close to end users to enable faster application response. The Kenya Edge Data Center Market offers strong opportunities in transport, finance, and retail. Edge nodes provide competitive advantages through better service quality and reduced latency. Businesses prioritize real-time capabilities to enhance digital experience. Investors are drawn to this stable, growing demand. Expanding edge coverage in key cities strengthens the national digital network. It positions the market for sustained capital inflows.

Growing Interest in Strategic Public-Private Partnerships for Digital Infrastructure

Public-private collaboration creates favorable conditions for expansion. Governments provide regulatory clarity and incentives for digital infrastructure projects. The Kenya Edge Data Center Market benefits from structured investment pipelines. Businesses gain access to better connectivity frameworks and operational support. Investors see reduced risks in shared development models. These partnerships enable large-scale deployment with efficient resource allocation. Edge infrastructure expansion aligns with national digital economy objectives. It supports broader industry transformation goals.

Market Segmentation

By Component

The solution segment holds the dominant market share due to strong demand for scalable hardware and software infrastructure. Enterprises prioritize solutions supporting real-time processing, edge computing, and secure connectivity. The Kenya Edge Data Center Market benefits from expanding investments in modular solutions. Service offerings, while growing, focus on integration and lifecycle management. This mix allows flexible adoption models for both small and large enterprises. Demand for managed and cloud-integrated solutions continues to grow. Investors view solutions as stable, high-margin assets. This segment forms the foundation for edge infrastructure evolution.

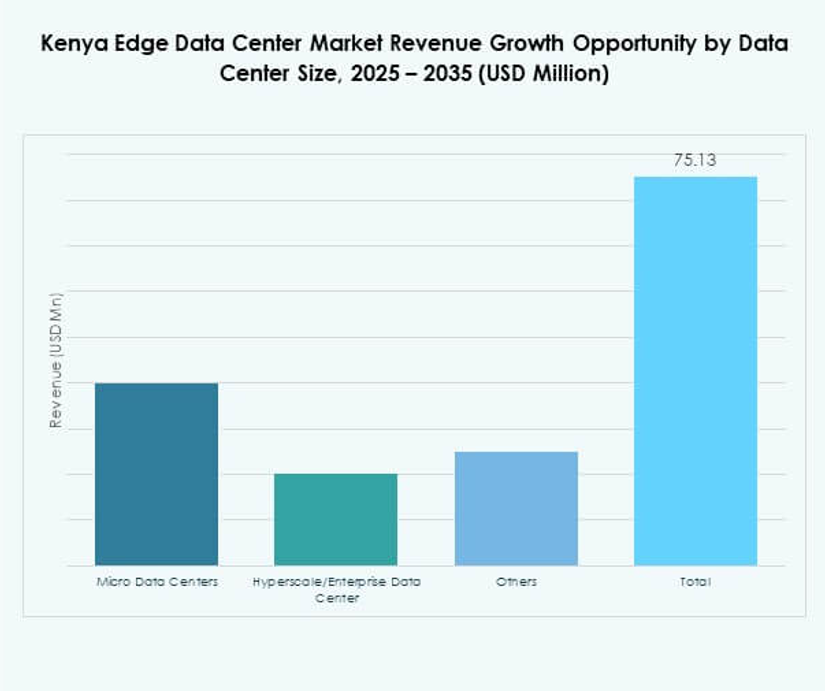

By Data Center Type

Colocation edge data centers lead the segment, capturing the highest market share. Enterprises prefer shared infrastructure to reduce costs and scale faster. The Kenya Edge Data Center Market gains traction as demand rises from telecoms, BFSI, and logistics sectors. Managed and cloud-edge facilities follow closely, supporting dynamic workloads. Enterprise facilities remain relevant for specialized applications. Colocation centers offer flexible capacity, improved efficiency, and strong security frameworks. Their multi-tenant design makes them attractive for investors. This segment drives widespread infrastructure adoption.

By Deployment Model

The cloud-based deployment model dominates due to its flexibility and ease of scaling. Enterprises rely on cloud-integrated edge platforms to handle distributed workloads. The Kenya Edge Data Center Market sees strong traction from hybrid models as well. On-premises setups serve regulated industries with strict data control needs. Cloud deployment supports rapid service delivery and remote access. Investors prefer cloud models for lower capital costs and recurring revenue streams. This structure enables dynamic capacity allocation. The model aligns well with evolving enterprise strategies.

By Enterprise Size

Large enterprises hold the majority market share due to extensive infrastructure investments. These organizations deploy edge solutions to improve operational speed and data control. The Kenya Edge Data Center Market shows increasing adoption by SMEs seeking affordable edge capacity. Cloud and colocation models enable smaller businesses to access advanced infrastructure. Large firms integrate edge systems with existing IT ecosystems. Investors favor enterprise-focused strategies for stable demand. This segment drives innovation in scalable edge solutions. Its growth shapes future market structure.

By Application / Use Case

Power monitoring leads this segment, supported by rising energy optimization requirements. Edge facilities rely on advanced monitoring to ensure efficient power use and system uptime. The Kenya Edge Data Center Market gains strength from growing asset management and BI applications. Environmental monitoring also expands as sustainability priorities increase. Capacity management solutions enhance operational control for critical infrastructure. These applications improve reliability and efficiency. Investors find strong potential in energy and analytics-driven use cases. This segment reflects practical adoption priorities.

By End User Industry

IT and telecommunications dominate the segment, driven by rising data traffic and 5G expansion. Enterprises in this sector deploy edge nodes to enhance connectivity and application delivery. The Kenya Edge Data Center Market also attracts BFSI and retail industries seeking digital resilience. Healthcare and energy sectors follow with targeted deployments. Telecom infrastructure supports widespread edge expansion across the country. Investors focus on telecom-led projects for predictable returns. This segment anchors overall market momentum. Its leadership drives technological standardization.

Regional Insights

Nairobi and Central Kenya — Leading Subregion with Strong Infrastructure and Investment Base (42% Share)

Nairobi and Central Kenya hold 42% of the market share in the Kenya Edge Data Center Market, supported by advanced fiber networks, strong hyperscale presence, and concentrated investment activity. Nairobi serves as the core hub for edge and cloud deployments due to its strategic connectivity and business ecosystem. Submarine cable links and terrestrial fiber routes enable low-latency data transfer and reliable service delivery. Telecom operators and global cloud providers focus expansion efforts in this subregion to meet rising enterprise demand. Government support for data localization policies further strengthens its position as a digital hub.

- For instance, iXAfrica’s NBOX1 hyperscale campus in Nairobi offers 22.5 MW of IT capacity, multiple fiber entry points, and advanced cooling systems to support AI-ready and cloud workloads.

Southern Kenya — Emerging Subregion with Expanding Edge Network Footprint (33% Share)

Southern Kenya accounts for 33% of the market share, driven by rapid expansion of edge infrastructure in industrial and logistics corridors. Smart city projects and industrial parks are fueling data demand in this region. Edge deployments are concentrated around major infrastructure developments, including transport and manufacturing zones. The subregion benefits from growing fiber backbone connectivity and planned data center investments. Enterprises adopt hybrid infrastructure strategies to enhance operational efficiency and reduce latency.

- For instance, Airtel Nxtra’s Tatu City facility broke ground in September 2025 with a planned IT load of 44 MW, integrating high-density racks and redundant fiber paths.

Western Kenya — Developing Subregion with Strategic Growth Potential (25% Share)

Western Kenya holds a 25% market share, supported by expanding fiber connectivity, government incentives, and growing enterprise adoption. Businesses in agriculture, fintech, and retail are adopting edge solutions to improve latency-sensitive applications. The subregion is strategically linked to Nairobi’s core hubs, ensuring reliable data flow and network stability. Infrastructure expansion focuses on underserved areas to extend national coverage. Telecom operators and technology providers target this subregion for future deployments to meet rising service demands.

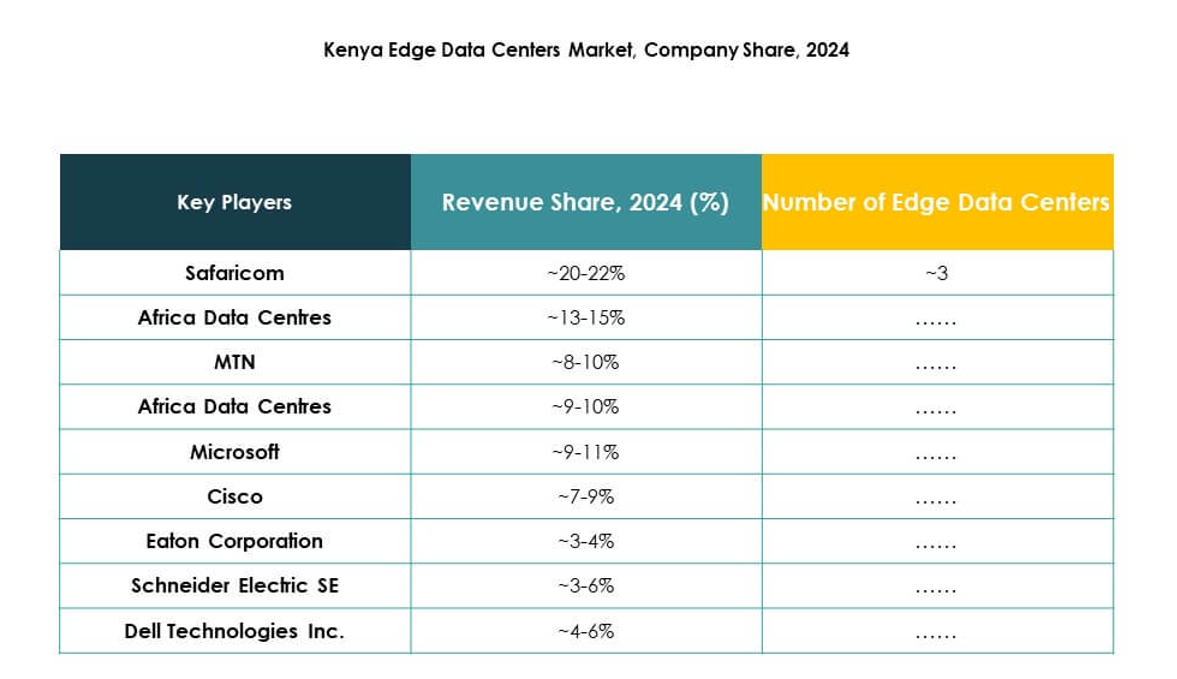

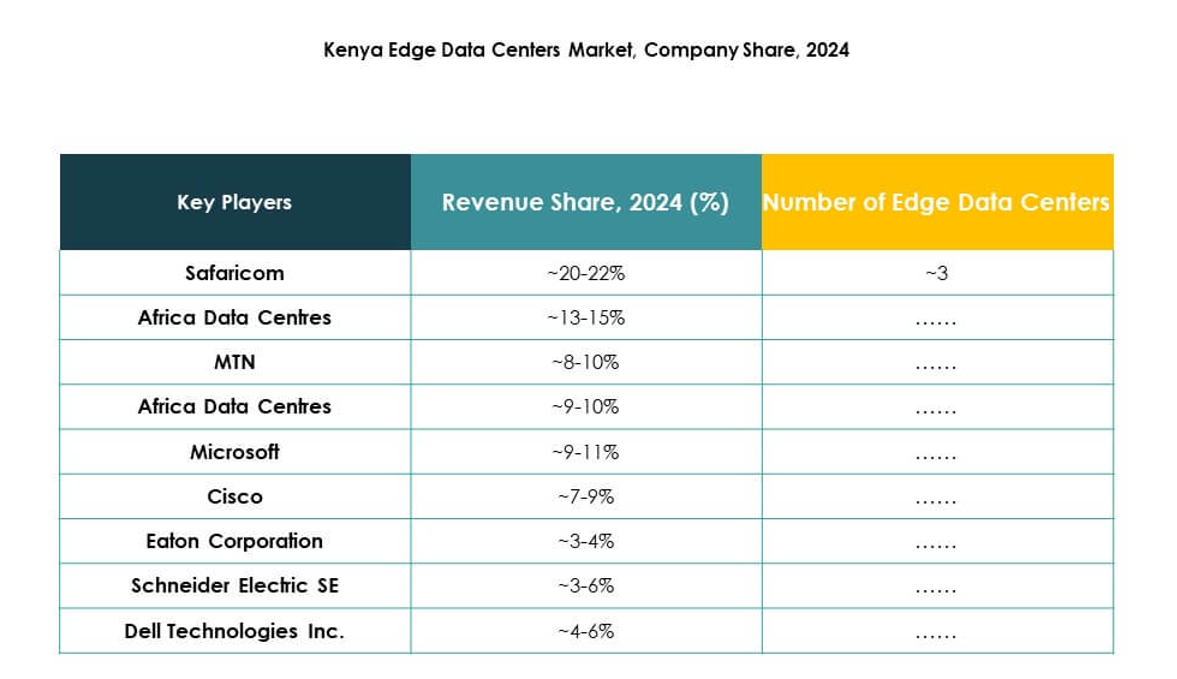

Competitive Insights:

- Safaricom

- Africa Data Centres

- MTN

- iColo Ltd.

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

- Microsoft

- VMWare

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Others

The Kenya Edge Data Center Market features strong competition between telecom operators, cloud service providers, and infrastructure manufacturers. It is shaped by investments in modular designs, energy-efficient technologies, and edge-to-core connectivity solutions. Leading companies expand capacity to support rising data traffic and enterprise digital transformation. Local operators such as Safaricom and iColo strengthen their footprint through targeted deployments and partnerships. Global firms like Microsoft, Schneider Electric, and Cisco focus on technology integration and service expansion. Competition centers on operational efficiency, network reach, and service reliability. Strategic alliances help companies secure early mover advantages and stable customer bases. Innovation in power and cooling infrastructure enhances competitiveness and positions firms for long-term growth.

Recent Developments:

- In September 2025, Airtel Africa, through its data center subsidiary Nxtra by Airtel, began the construction of a 44 MW edge data centerin Tatu City, Kenya, marking one of the largest data infrastructure projects in East Africa. Announced on October 8, 2025, this facility will include high-density GPU-ready racks, redundant fiber paths, and advanced physical and network security systems.

- In September 2025, Distributed Power Africa (DPA)and iXAfrica Data Centres announced a renewable energy partnership to power iXAfrica’s expanding Nairobi facility, which will ultimately provide 22.5 MW of total IT capacity. The collaboration combines iXAfrica’s hyperscale data infrastructure with DPA’s sustainable power systems to ensure efficient, low-carbon operations, reinforcing the shift toward green data centers in East Africa.

- In May 2025, Safaricom entered a strategic partnership with Kenya’s iXAfrica Data Centres to deliver East Africa’s first AI-ready data center solutions, leveraging the new NBOX1 hyperscale facility in Nairobi to serve enterprise and cloud solutions clients. The collaboration features high-density computing infrastructure purpose-built for AI workloads, a joint go-to-market strategy, and integrated services that boost innovation and support data sovereignty and compliance within Kenya.