Executive summary:

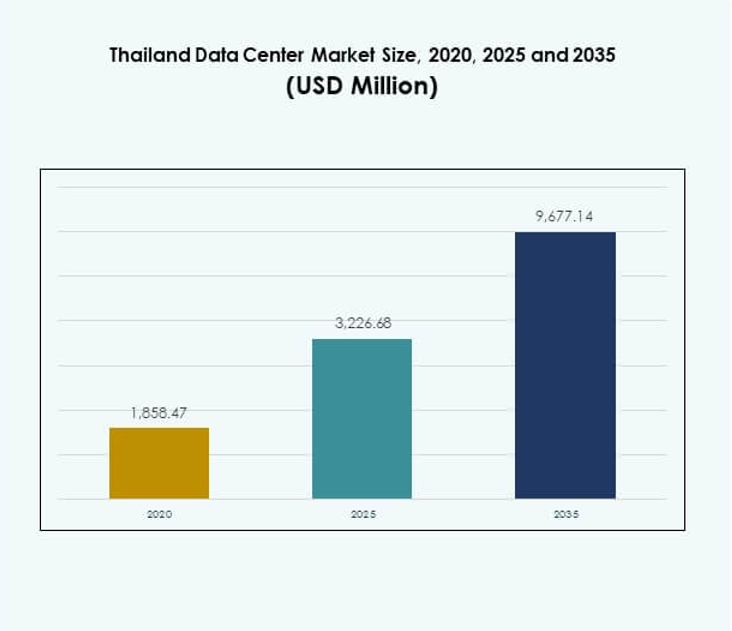

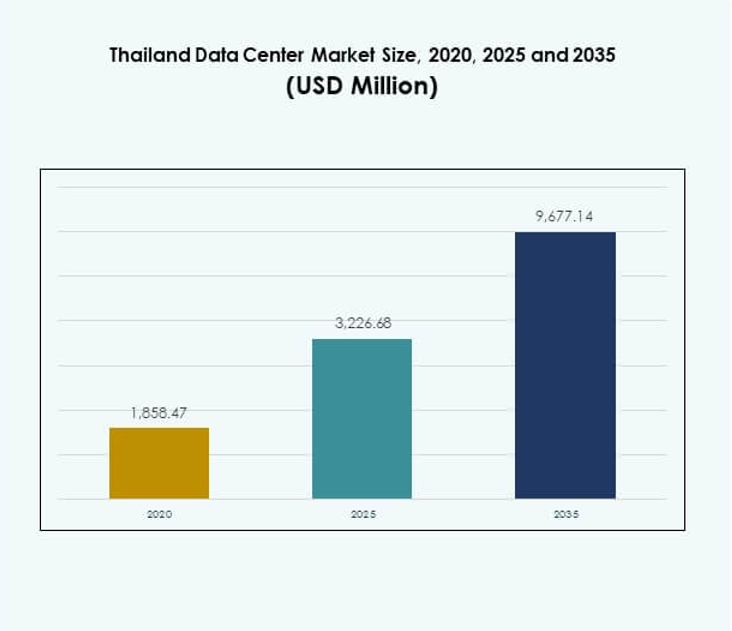

The Thailand Data Center Market size was valued at USD 1,858.47 million in 2020 to USD 3,226.68 million in 2025 and is anticipated to reach USD 9,677.14 million by 2035, at a CAGR of 11.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Thailand Data Center Market Size 2025 |

USD 3,226.68 Million |

| Thailand Data Center Market, CAGR |

11.53% |

| Thailand Data Center Market Size 2035 |

USD 9,677.14 Million |

The market is fueled by rapid adoption of cloud computing, AI, IoT, and 5G technologies, creating demand for advanced colocation and hyperscale facilities. Enterprises increasingly rely on hybrid models to manage sensitive data while optimizing scalability and efficiency. Government-backed digital policies, coupled with rising investment in smart city development, reinforce infrastructure expansion. This positions the market as a critical hub for businesses and investors seeking long-term digital growth in Southeast Asia. Bangkok dominates as the leading region with the highest concentration of hyperscale and colocation facilities, supported by strong enterprise demand and reliable connectivity. The Eastern Economic Corridor is emerging as a strategic growth zone due to industrial expansion and favorable government incentives. Northern and provincial regions develop steadily with edge and modular deployments, serving local enterprises, healthcare, and education sectors. This regional distribution highlights Thailand’s balanced approach toward nationwide digital infrastructure development.

Market Drivers

Rising Digital Transformation and Cloud Migration Driving Infrastructure Growth

The Thailand Data Center Market benefits from rapid digital transformation across industries. Enterprises migrate critical workloads to cloud platforms to improve scalability and flexibility. Increased adoption of SaaS, IaaS, and PaaS services accelerates demand for modern facilities. Global and domestic cloud providers expand footprints to support enterprise cloud adoption. It creates opportunities for colocation, hyperscale, and hybrid models. Government initiatives promoting digital-first strategies further support the ecosystem. Cloud migration enhances operational efficiency while meeting evolving customer demands. Investors see this growth as a signal of long-term stability.

Growing Data Traffic from IoT, 5G, and AI Adoption Across Sectors

The Thailand Data Center Market experiences surging data traffic from IoT devices, 5G networks, and AI-driven applications. Enterprises deploy edge computing solutions to process real-time data efficiently. Rising adoption of smart city initiatives generates large-scale data handling needs. Telecom operators expand 5G infrastructure, fueling demand for high-density server capacity. AI-powered analytics requires specialized infrastructure optimized for machine learning workloads. It drives investment in energy-efficient hardware and cooling systems. Cloud-native platforms support AI adoption at enterprise and national levels. The integration of digital ecosystems highlights the strategic role of data centers.

- For instance, True IDC announced an investment of over 10 billion baht to expand its East Bangna and North Muangthong data centers, adding 41 MW of capacity and integrating high-density and liquid cooling technologies to support AI and 5G applications.

Enterprise Innovation and Hybrid IT Strategies Enhancing Market Competitiveness

Businesses in Thailand increasingly adopt hybrid IT models to balance cloud flexibility with on-premises control. The Thailand Data Center Market grows as enterprises require secure environments for sensitive workloads. Hybrid strategies enable cost optimization and operational agility. Industry players integrate orchestration and automation tools to streamline workflows. Digital innovation in sectors like BFSI, healthcare, and retail drives secure data hosting needs. It strengthens demand for modular and scalable designs. Enterprises prioritize solutions supporting multi-cloud integration. Hybrid IT adoption positions Thailand as a competitive hub for regional service delivery.

- For instance, in 2025, NTT Data invested USD 90 million to construct its Bangkok 3 Data Centre (BKK3) in Chonburi, delivering up to 12MW IT capacity and tailored hybrid cloud services to support banking, retail, and healthcare companies migrating sensitive workloads into secure, modular environments.

Government Regulations, Compliance, and Security Demands Shaping Investments

Strict compliance requirements encourage enterprises to host data locally within regulated facilities. The Thailand Data Center Market aligns with cybersecurity frameworks and privacy rules to meet client trust standards. BFSI and government agencies prioritize certified facilities with high-security measures. Compliance fosters investments in ISO-certified and Tier-rated centers. Rising cyber threats highlight the importance of managed security services. It creates opportunities for providers offering advanced protection. Global firms view regulatory clarity as an enabler of market entry. Security-driven investments ensure sustained demand for compliant infrastructure.

Market Trends

Emergence of Green Data Centers with Focus on Energy Efficiency and Sustainability

Sustainability becomes a critical trend in the Thailand Data Center Market. Operators deploy renewable energy, advanced cooling, and energy reuse programs. Facilities integrate liquid cooling and AI-driven systems to reduce energy waste. Green data centers align with corporate ESG commitments and government climate targets. Investors prioritize projects demonstrating carbon reduction and energy efficiency. It strengthens Thailand’s position in sustainable infrastructure development. Green-certified projects also enhance customer loyalty and brand reputation. The trend reflects a shift toward environmentally responsible operations.

Rapid Expansion of Colocation and Hyperscale Facilities to Support Enterprise Growth

Colocation and hyperscale facilities dominate new investments in the Thailand Data Center Market. Global cloud providers and telecom operators lead capacity expansions. Enterprises favor colocation models for flexibility, lower costs, and scalability. Hyperscale campuses support large-scale AI, IoT, and big data workloads. Rising enterprise cloud adoption drives demand for hyperscale-grade infrastructure. It promotes collaboration between local developers and global players. Colocation growth supports SMEs seeking reliable hosting environments. These facility types gain strong momentum in Thailand’s evolving market landscape.

Integration of Advanced Monitoring and Automation for Operational Efficiency

Automation and AI-based monitoring systems shape the Thailand Data Center Market. Operators adopt DCIM, orchestration, and predictive maintenance platforms. Automated tools reduce downtime and optimize capacity management. Facilities enhance efficiency by applying machine learning for workload balancing. Automation ensures seamless multi-cloud operations with minimal manual intervention. It increases reliability and customer trust in service providers. Enterprises favor data centers that deliver predictive insights for IT optimization. Automation adoption positions Thailand as a modern digital infrastructure hub.

Rise of Edge and Modular Deployments to Enable Localized Processing

Edge and modular facilities expand in the Thailand Data Center Market to meet latency-sensitive demands. Telecom and enterprise operators deploy edge nodes closer to users. Smart cities and IoT ecosystems rely on local processing capacity. Modular designs allow faster deployment with lower upfront costs. It helps service providers respond quickly to regional demand shifts. Edge deployments support 5G-enabled services across key urban hubs. Modular systems enhance scalability without disrupting existing operations. This trend broadens the infrastructure landscape in Thailand.

Market Challenges

High Energy Consumption, Infrastructure Costs, and Environmental Concerns

The Thailand Data Center Market faces challenges from high energy consumption and infrastructure costs. Operators struggle to balance capacity expansion with sustainability targets. Power availability and grid stability remain concerns in high-density regions. Energy-intensive cooling systems increase operational expenses. It pressures providers to invest in alternative solutions like liquid cooling and renewable power. Rising electricity tariffs add financial strain on facility management. Building hyperscale campuses requires heavy upfront investments. Environmental concerns also place stricter regulations on carbon-intensive operations.

Talent Shortages, Cybersecurity Threats, and Complex Compliance Landscape

The Thailand Data Center Market contends with skilled workforce shortages and complex compliance demands. Limited availability of IT professionals delays digital transformation projects. Organizations face increasing risks from cyberattacks targeting sensitive workloads. Meeting international compliance and local regulatory requirements creates cost and operational challenges. It drives demand for specialized managed services. Enterprises seek facilities offering multi-layered security and regulatory alignment. Talent shortages slow adoption of advanced automation and AI-based infrastructure. These factors pose barriers to sustainable long-term growth.

Market Opportunities

Rising Foreign Investments and Regional Positioning as a Digital Hub

The Thailand Data Center Market benefits from rising foreign direct investments. Global hyperscale and colocation providers expand capacity in strategic locations. Thailand’s position as a regional digital hub attracts multinational enterprises. Cross-border connectivity with Southeast Asia strengthens its appeal. It encourages partnerships between telecom providers and global operators. Investors focus on growth opportunities in high-density urban regions. Strong economic policies support long-term commitments. These opportunities highlight Thailand’s role in regional digital infrastructure development.

Adoption of AI, 5G, and Industry 4.0 to Drive Demand for Next-Gen Facilities

The Thailand Data Center Market gains opportunities from AI, 5G, and Industry 4.0 adoption. Enterprises deploy new technologies that demand advanced computing capacity. Smart manufacturing, autonomous systems, and healthcare solutions drive localized processing needs. It promotes development of edge, modular, and high-density facilities. AI integration accelerates demand for specialized hardware and efficient cooling systems. 5G rollouts expand regional connectivity for enterprises. Industry 4.0 initiatives encourage private sector and government collaboration. These trends create significant growth potential for the market.

Market Segmentation

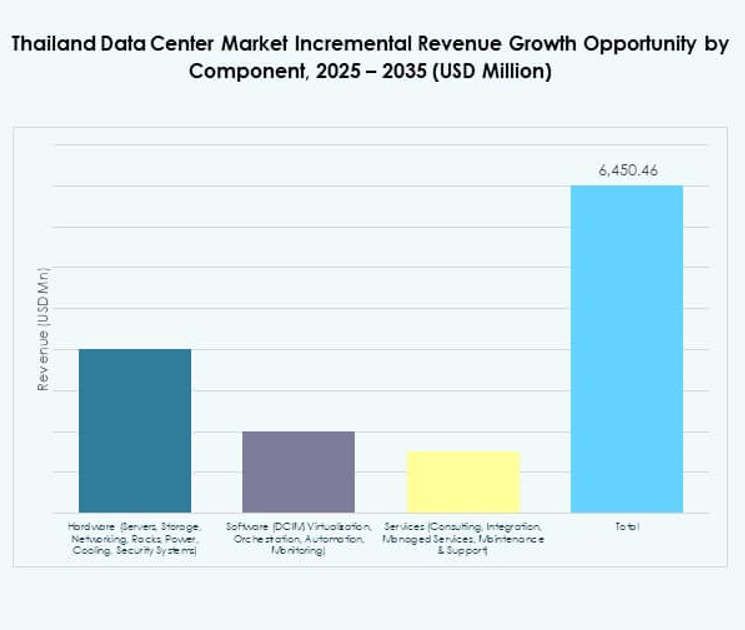

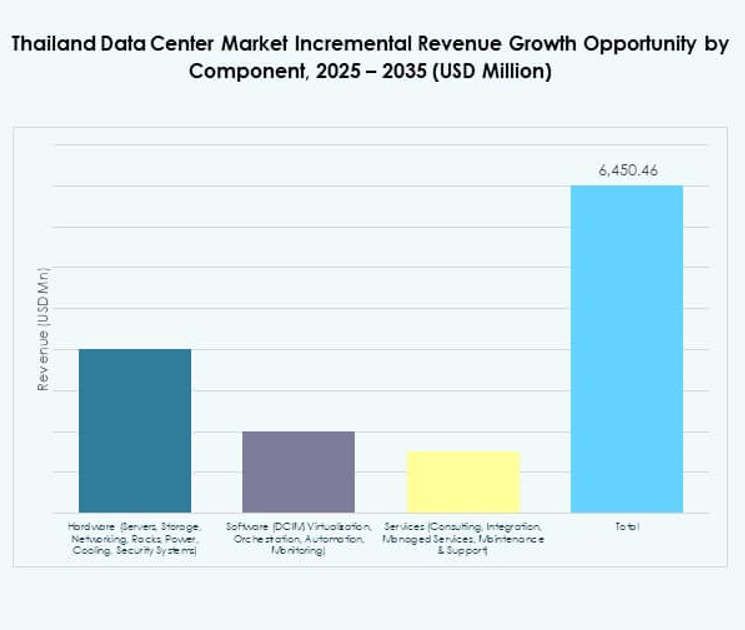

By Component

Hardware dominates the Thailand Data Center Market with strong demand for servers, storage, and cooling systems. High-density applications require advanced racks and power systems to ensure operational stability. Cooling and security systems see increased adoption for hyperscale facilities. Software segments like DCIM and automation grow steadily, enhancing monitoring and orchestration capabilities. Services including managed hosting and integration are also gaining traction. The hardware segment remains dominant due to its critical role in capacity expansion and efficiency.

By Data Center Type

Hyperscale and colocation facilities lead the Thailand Data Center Market. Hyperscale centers attract global cloud providers due to their scalability. Colocation facilities appeal to enterprises and SMEs with lower capital expenditure. Enterprise data centers remain relevant for critical workload hosting. Edge and modular deployments gain adoption to meet latency needs. Cloud and internet data centers grow as SaaS and digital services expand. Mega centers are limited but contribute significantly to capacity. Hyperscale and colocation dominate with growing market share.

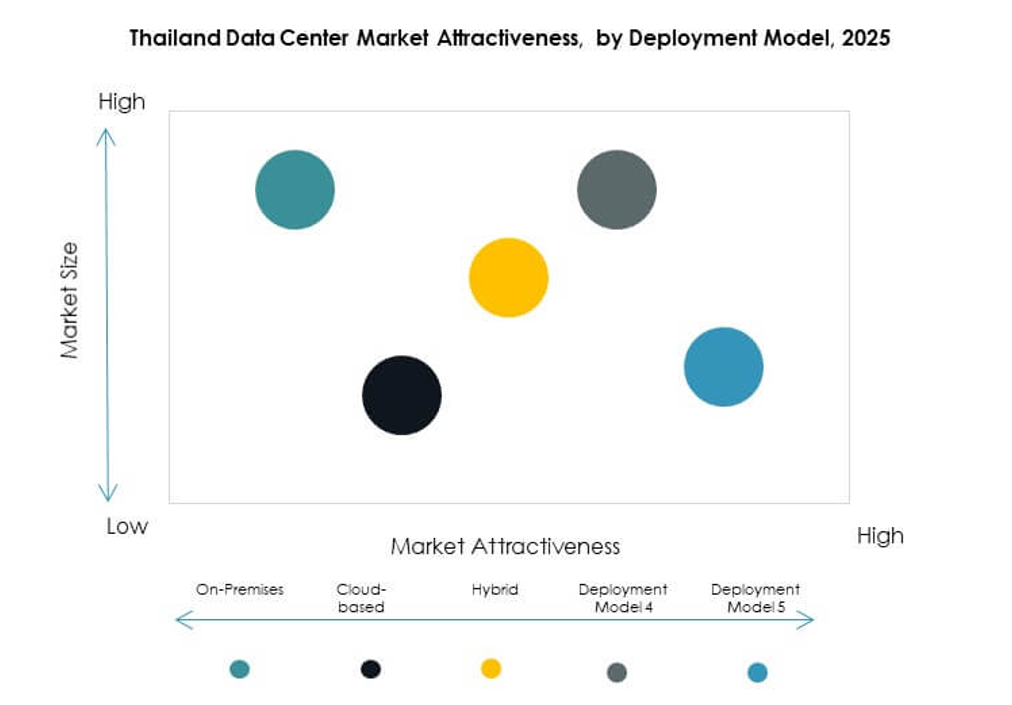

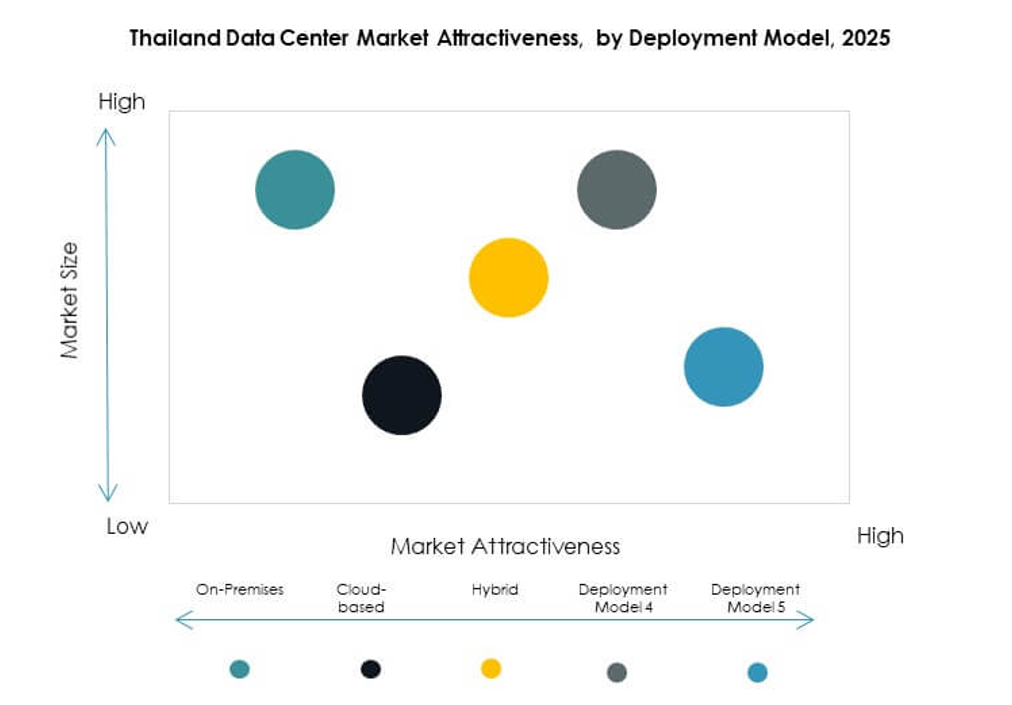

By Deployment Model

Hybrid models dominate the Thailand Data Center Market, offering enterprises flexibility and control. Cloud-based deployments gain traction as businesses embrace SaaS and IaaS solutions. On-premises models remain relevant in industries requiring high security. Hybrid adoption rises as organizations balance regulatory compliance with scalability. Enterprises seek hybrid models to optimize operational costs. Cloud-native applications encourage broader cloud-based deployments. Hybrid solutions also support multi-cloud strategies for businesses. Hybrid remains the most influential model in driving long-term growth.

By Enterprise Size

Large enterprises lead demand in the Thailand Data Center Market. These organizations require hyperscale and colocation facilities for mission-critical operations. SMEs increasingly adopt colocation and cloud-based services to reduce costs. Large firms invest heavily in hybrid and on-premises strategies for data sovereignty. SMEs rely on managed services to address skills gaps. It ensures inclusive growth across different business sizes. Large enterprises dominate market share due to their higher resource allocation. SMEs drive innovation in niche applications.

By Application / Use Case

IT & telecom leads the Thailand Data Center Market due to massive connectivity demand. BFSI drives growth with strict compliance requirements and secure hosting needs. Healthcare adopts modern data centers for digital health records and telemedicine platforms. Retail and e-commerce rely on data hosting for omnichannel services. Media and entertainment benefit from streaming demand and cloud-based content delivery. Manufacturing adopts Industry 4.0 solutions, fueling growth in localized data handling. Education and utilities also contribute steadily. IT & telecom dominates overall share.

By End User Industry

Cloud service providers dominate the Thailand Data Center Market, driving hyperscale capacity expansion. Enterprises remain key users of colocation and hybrid models. Colocation providers enable SMEs and mid-sized firms to access scalable infrastructure. Government agencies drive secure hosting requirements and local compliance adoption. Other industries, including education and utilities, create specialized demand. Cloud providers lead due to their regional service delivery commitments. Enterprises and government maintain strong shares. This balance highlights a diversified user base.

Regional Insights

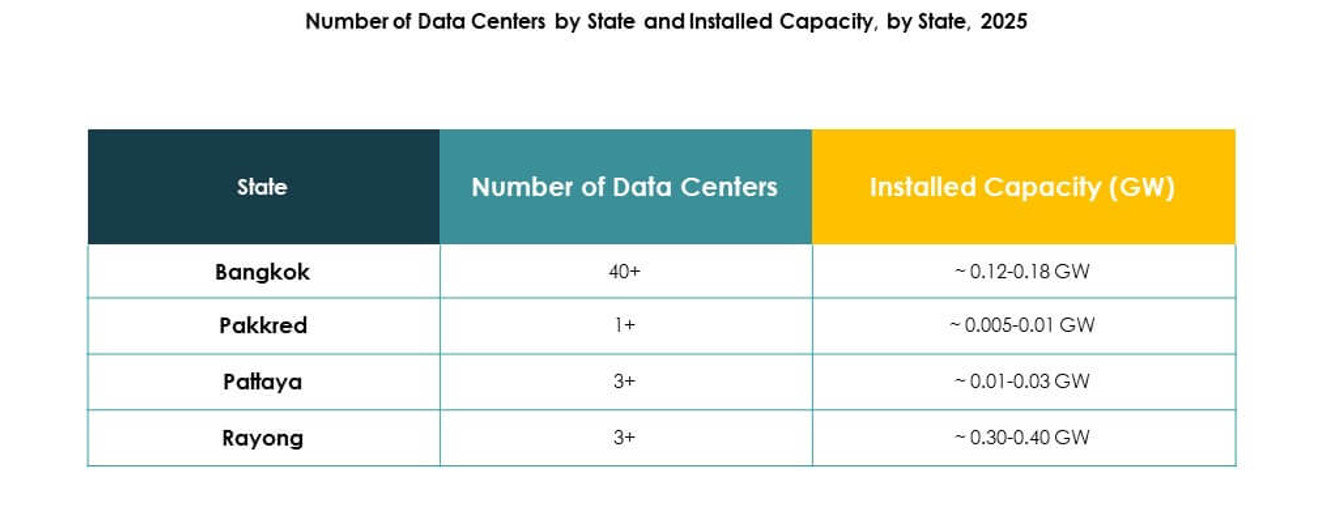

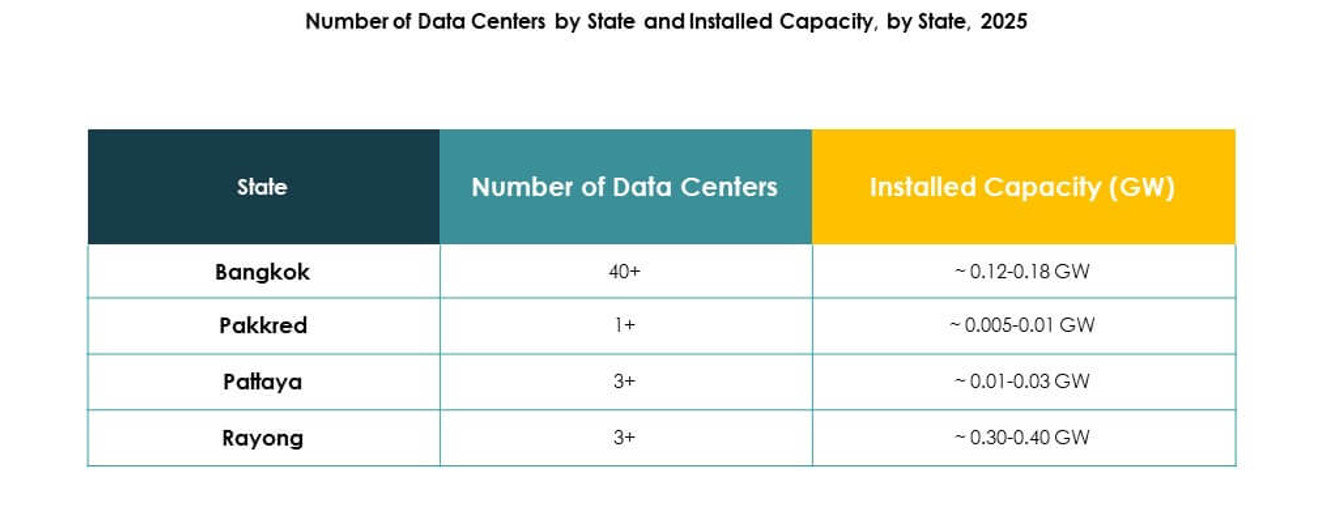

Bangkok Metropolitan Region Leading with Strongest Market Share

The Bangkok Metropolitan Region holds 48% share of the Thailand Data Center Market. It serves as the nation’s commercial and technological hub. The region hosts hyperscale and colocation facilities from global and local players. Demand comes from BFSI, telecom, and digital commerce sectors. High connectivity and reliable infrastructure attract multinational investments. It remains the core center for Thailand’s digital transformation. Growth is supported by enterprise and government-backed initiatives.

- For instance, Bangkok surpassed 2.5 GW of IT capacity by mid-2025, ranking as Southeast Asia’s second-largest data center hub after Johor, supported by major investments such as AWS committing USD 5 billion in Thailand and Google’s USD 1 billion project in Chonburi.

Eastern Economic Corridor Emerging as a Strategic Growth Zone

The Eastern Economic Corridor (EEC) accounts for 32% share of the Thailand Data Center Market. It benefits from government incentives and industrial development projects. The corridor supports logistics, manufacturing, and smart city initiatives. Connectivity to regional subsea cables enhances global integration. Investors favor EEC for scalable hyperscale and modular facilities. It strengthens Thailand’s role in regional trade and innovation. The area grows as a critical secondary hub outside Bangkok.

- For instance, Digital Edge and B.Grimm Power broke ground in September 2025 on a 100 MW AI-ready data center campus in Chonburi, EEC, with a targeted Ready-for-Service date in Q4 2026 and plans to power it via B.Grimm’s renewable energy portfolio.

Northern and Other Provinces Developing with Smaller but Steady Shares

Northern and other provinces collectively represent 20% share of the Thailand Data Center Market. Growth is steady, driven by edge and modular deployments. Local demand arises from healthcare, education, and public sector projects. Limited infrastructure availability creates challenges for hyperscale adoption. It provides opportunities for smaller modular setups. Government support encourages regional digital inclusion. These areas will play a supportive role in balancing nationwide capacity.

Competitive Insights:

- True IDC

- SUPERNAP Thailand

- AIS Data Centers

- Digital Realm Thailand

- CAT Telecom Data Centers

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Thailand Data Center Market is highly competitive with strong participation from domestic and global players. Local firms such as True IDC, AIS Data Centers, and SUPERNAP Thailand focus on colocation, managed services, and enterprise hosting solutions, strengthening domestic digital infrastructure. Global technology leaders including Microsoft, AWS, and Google expand cloud regions and hyperscale investments to capture rising enterprise demand. It creates a balance between local specialization and international scale, driving innovation and capacity growth. NTT Communications and CAT Telecom Data Centers contribute by integrating telecom-led services and expanding regional connectivity. Competition is shaped by sustainability goals, advanced cooling technologies, and hybrid cloud integration. It positions Thailand as a hub where global expertise and local adaptability meet to accelerate the digital economy.

Recent Developments:

- In June 2025, Advanced Info Service (AIS) announced the launch of Thailand’s first locally owned and operated hyperscale cloud service using Oracle Alloy, housed in AIS data centers. This strategic launch enables government and private enterprises in Thailand to access more than 100 Oracle cloud services and marks a significant step in advancing domestic digital transformation and AI innovation.

- In March 2025, China Mobile the state-owned telecommunications giant completed the acquisition of SUPERNAP Thailand, a premier designer and operator of data centers offering cloud and hybrid solutions. Financial terms were not disclosed, but this move strengthens China Mobile’s position in Southeast Asia’s high-growth data center sphere.