Executive summary:

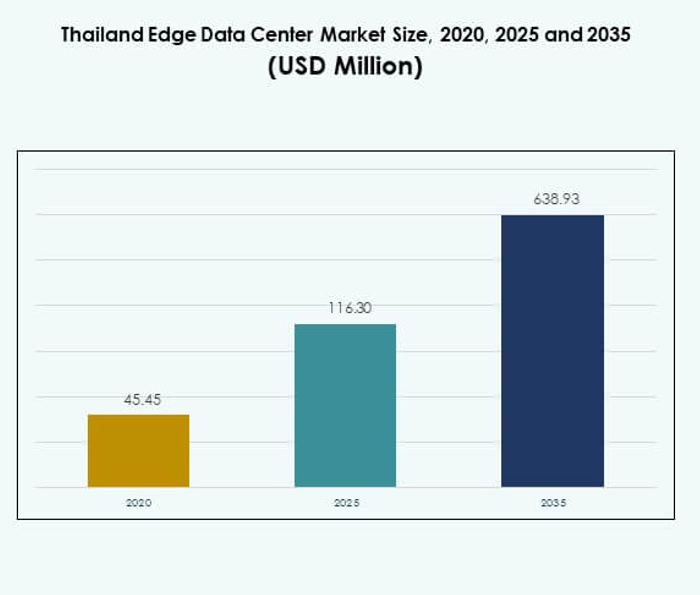

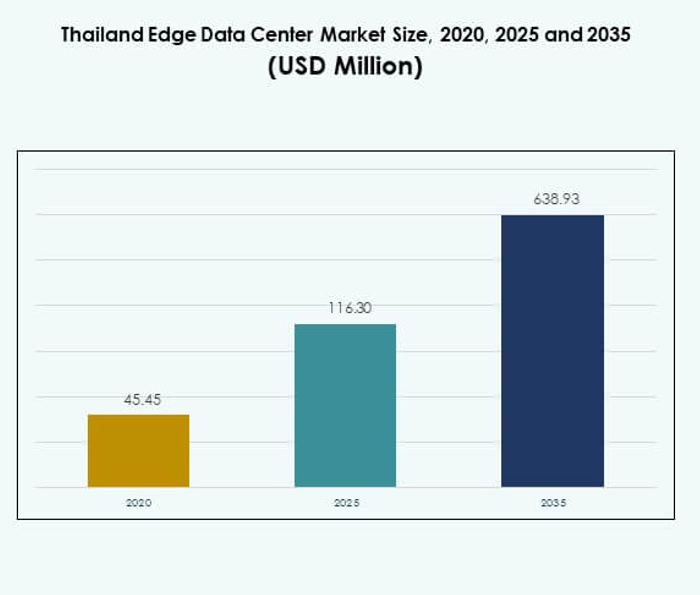

The Thailand Edge Data Center Market size was valued at USD 45.45 million in 2020, increasing to USD 116.30 million in 2025, and is anticipated to reach USD 638.93 million by 2035, at a CAGR of 18.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Thailand Edge Data Center Market Size 2025 |

USD 116.30 Million |

| Thailand Edge Data Center Market, CAGR |

18.40% |

| Thailand Edge Data Center Market Size 2035 |

USD 116.30 Million |

Rapid 5G deployment, cloud adoption, and digital transformation are driving Thailand’s edge data center growth. Businesses across telecom, BFSI, and manufacturing sectors are investing in low-latency infrastructure to improve efficiency and enable AI-driven operations. The market holds strategic importance for investors seeking long-term returns from digital infrastructure and for enterprises pursuing scalable and sustainable computing systems to support real-time data applications. Bangkok leads the national market with strong connectivity, robust fiber networks, and enterprise concentration. The Eastern Economic Corridor is emerging as a major growth region driven by industrial automation and smart manufacturing projects. Secondary cities such as Chiang Mai and Hat Yai are gaining importance as edge locations, supporting regional data distribution and improving digital accessibility across the country.

Market Drivers

Rapid Digital Transformation and 5G Infrastructure Expansion Driving Edge Demand

Thailand’s ongoing 5G rollout is fueling demand for high-performance edge infrastructure to support latency-sensitive services. Telecom operators like AIS and True Corporation are investing in micro data centers to strengthen network performance and ensure low-latency connectivity for smart devices. The Thailand Edge Data Center Market benefits from increasing IoT integration across sectors such as healthcare, retail, and logistics. It supports applications like real-time analytics and connected manufacturing. Government programs under Thailand 4.0 emphasize digital ecosystems, expanding demand for localized computing. Businesses rely on edge capabilities to minimize downtime and improve operational efficiency. Investors are drawn by long-term digital infrastructure growth supported by policy incentives.

- For instance, in October 2024, AIS and Huawei launched the RAN Intelligence Pioneers Program, a collaboration focused on deploying Autonomous Network Level 4 (AN L4) technologies in Thailand’s 5G network, accelerating intelligent network automation and enabling real-time AI-driven wireless services for hundreds of thousands of users in metro areas.

Rising Cloud and AI Adoption Enhancing Edge Integration Across Sectors

Cloud service providers and hyperscale players are integrating edge data centers to enable efficient hybrid operations. It allows enterprises to process critical workloads closer to end users, reducing latency and cost. The Thailand Edge Data Center Market gains from the adoption of AI-driven analytics and automation tools in industries like finance and energy. Companies focus on leveraging real-time data for faster decision-making. Demand for scalable edge infrastructure continues to increase with growing digital workloads. Strategic alliances between telecom and cloud firms enhance ecosystem maturity. These partnerships are key to expanding AI capabilities in regional markets. Such collaborations also attract global investors seeking sustainable technology ventures.

Growing Industrial Automation and Smart Manufacturing Accelerating Edge Adoption

Industrial automation and Industry 4.0 initiatives are creating new use cases for edge computing. Smart factories depend on near real-time processing for predictive maintenance and robotic operations. The Thailand Edge Data Center Market supports these transitions by offering secure, localized data storage. Manufacturing clusters in the Eastern Economic Corridor rely heavily on edge-enabled systems for high-precision control. It enhances productivity and energy efficiency in industrial zones. Companies invest in automation infrastructure to remain globally competitive. Edge technology integration reduces network congestion in high-volume data environments. This trend strengthens Thailand’s industrial digital transformation roadmap and boosts investor confidence in its infrastructure.

- For instance, in June 2025, WHA Industrial Development signed a land sale agreement with Haoyang Data Center 1 (Thailand) Limited to build a hyperscale data center with 300MW IT load in WHA Eastern Seaboard Industrial Estate 4. This smart eco-industrial estate will integrate renewable energy and high-speed telecommunications infrastructure to serve smart factories and manufacturing operations in the EEC, with operational readiness planned for 2026.

Government Support and Strategic Investments Strengthening Digital Ecosystem Growth

Government-led initiatives and incentives are pivotal in accelerating Thailand’s digital infrastructure development. The Digital Economy and Society Ministry promotes smart city frameworks and digital service expansion. It creates favorable conditions for private sector investment in edge computing and connectivity. The Thailand Edge Data Center Market benefits from public-private collaborations focused on cloud integration and cross-border data exchange. Local infrastructure projects also enhance data sovereignty and security. The country’s proactive stance on ICT development attracts multinational corporations to set up regional nodes. Strategic investments in green energy for data centers align with sustainability goals. This regulatory clarity and policy support foster a robust investment environment.

Market Trends

Shift Toward Modular and Prefabricated Edge Data Center Designs

Thailand’s data infrastructure sector is transitioning toward modular and prefabricated designs for faster deployment and scalability. Modular systems provide flexibility to meet localized demand growth across urban and industrial zones. The Thailand Edge Data Center Market benefits from these innovations that reduce setup time and operating costs. It supports enterprises managing dynamic workloads and distributed computing needs. Telecom operators prefer modular edge sites for quick network expansion. These facilities improve fault tolerance and service reliability. The trend also reflects a growing focus on cost optimization and sustainability in infrastructure investments.

Integration of Renewable Energy and Sustainable Cooling Technologies

Data center operators are adopting green energy solutions to cut carbon emissions and operational costs. Renewable integration through solar and hydro power is gaining traction across Thailand’s data ecosystem. The Thailand Edge Data Center Market leverages liquid cooling, free-air systems, and AI-based energy optimization. It aligns with environmental targets under Thailand’s National Energy Plan. Operators use heat reuse systems and advanced cooling loops to reduce power usage effectiveness. This trend enhances sustainability credentials, appealing to ESG-focused investors. The transition also improves long-term operational resilience and power reliability.

Expansion of Local Connectivity Hubs and Carrier-Neutral Facilities

Carrier-neutral data centers are becoming vital for Thailand’s digital expansion strategy. They allow enterprises and cloud providers to access multiple network partners seamlessly. The Thailand Edge Data Center Market benefits from increased investments in interconnection platforms and regional peering points. It supports content delivery, OTT services, and cross-border trade. Bangkok remains a leading hub, while secondary cities are emerging as connectivity zones. This shift diversifies network traffic and improves data flow efficiency. Enterprises gain better service options, driving competition and market maturity.

Rise of Edge-to-Cloud Integration for Real-Time Data Analytics

Edge-to-cloud integration is becoming a core trend for enabling smart applications. Enterprises use hybrid frameworks to process critical data at the edge while retaining scalability in the cloud. The Thailand Edge Data Center Market experiences demand from sectors like automotive, BFSI, and healthcare for near-instant analytics. It supports applications including autonomous vehicles and telemedicine. The fusion of edge and cloud systems enhances business continuity and performance. Vendors invest in orchestration platforms to simplify workload distribution. This approach supports Thailand’s long-term digital transformation vision and strengthens competitive positioning.

Market Challenges

High Infrastructure and Energy Costs Affecting Edge Scalability

Establishing edge data centers in Thailand demands heavy investment in infrastructure, power, and connectivity. Many operators face difficulties managing operational expenses amid rising electricity tariffs. The Thailand Edge Data Center Market must address cost optimization to remain attractive for small enterprises. It requires improved energy management systems to enhance ROI. High cooling expenses and limited renewable integration increase cost pressures. Rural deployments face challenges from unreliable grid networks. Investors seek financial stability before large-scale expansions. These economic barriers limit the pace of regional data center rollout.

Skill Shortage and Regulatory Complexity Slowing Industry Maturity

Thailand faces a growing shortage of skilled data center engineers and technicians. The workforce gap affects maintenance, cybersecurity, and advanced IT management. The Thailand Edge Data Center Market is influenced by evolving data protection laws and compliance frameworks. It needs consistent standards to support international cloud interoperability. Complex approval processes slow project implementation and discourage smaller investors. Policy fragmentation between local and national agencies creates further delays. It limits the speed of digital infrastructure integration across new industrial corridors. Bridging this talent and regulatory gap is critical for sustainable market growth.

Market Opportunities

Emergence of Smart Cities and IoT Ecosystems Creating Strong Market Prospects

Smart city projects and IoT adoption present new growth avenues for localized computing infrastructure. The Thailand Edge Data Center Market supports intelligent traffic systems, public safety, and smart grids. It enables real-time data processing for citizen services and automation. These initiatives create opportunities for tech firms and investors aiming to expand in Southeast Asia. Private partnerships with local governments help speed up smart infrastructure deployments. Edge facilities enhance service delivery for connected urban ecosystems. The long-term potential lies in urban digital resilience and economic inclusivity.

Rising Interest from Global Cloud and Colocation Players Enhancing Market Expansion

International cloud providers view Thailand as a strategic location to extend their Southeast Asian presence. The Thailand Edge Data Center Market attracts investment from colocation operators focused on cross-border cloud services. It benefits from data localization regulations encouraging local infrastructure development. Global players like AWS, Google, and Microsoft explore partnerships with Thai telecoms to expand reach. Increased collaboration stimulates competition and improves technology transfer. This international participation fosters innovation, workforce upskilling, and higher service reliability. The ecosystem thus gains both financial and technological depth.

Market Segmentation

By Component

The solution segment holds the dominant share in the Thailand Edge Data Center Market due to increasing demand for scalable storage and computing systems. It enables enterprises to manage real-time workloads effectively. Service offerings, including maintenance and consulting, complement these deployments. It allows organizations to enhance efficiency through optimized configurations. Service providers are investing in automation and remote monitoring to boost uptime. Businesses favor integrated hardware-software systems for better scalability. The demand for end-to-end solutions ensures long-term market dominance of this segment.

By Data Center Type

Colocation edge data centers lead the Thailand Edge Data Center Market owing to high adoption by telecom and cloud operators. These facilities provide shared infrastructure, reducing capital expenditure for enterprises. It supports digital transformation in industries seeking cost-effective scaling. Managed and cloud edge facilities follow closely, driven by remote operation trends. Enterprises prefer colocation models for flexibility and access to network-neutral connections. This approach ensures performance reliability and rapid deployment. The model continues to gain traction among SMEs and global cloud players.

By Deployment Model

Hybrid deployment models dominate the Thailand Edge Data Center Market due to their balance of control and flexibility. Businesses manage sensitive workloads on-premises while leveraging cloud scalability for analytics. It supports rapid data access with reduced latency. Hybrid setups appeal to industries like BFSI and healthcare needing security and performance. On-premises models remain relevant for mission-critical tasks. Cloud-based frameworks gain popularity in startups for cost efficiency. The hybrid approach’s adaptability ensures widespread enterprise adoption across diverse use cases.

By Enterprise Size

Large enterprises hold a leading share in the Thailand Edge Data Center Market, driven by growing automation and data management needs. They invest in advanced infrastructure to support AI and big data workloads. It ensures faster processing and efficient service delivery. SMEs are catching up due to government digital incentives and lower-cost edge solutions. Cloud-driven models enable affordable entry for smaller players. Increasing e-commerce activity also fuels SME participation. The expansion of digital payment ecosystems further strengthens adoption.

By Application / Use Case

Power monitoring represents the dominant application segment in the Thailand Edge Data Center Market. It enables operators to optimize energy use and improve sustainability metrics. It ensures reliable uptime through real-time insights into power performance. Environmental monitoring follows due to the growing focus on data center efficiency. Capacity management tools aid scalability across enterprises managing fluctuating data loads. Asset management and analytics improve predictive maintenance and cost control. These capabilities boost operational transparency and overall resilience.

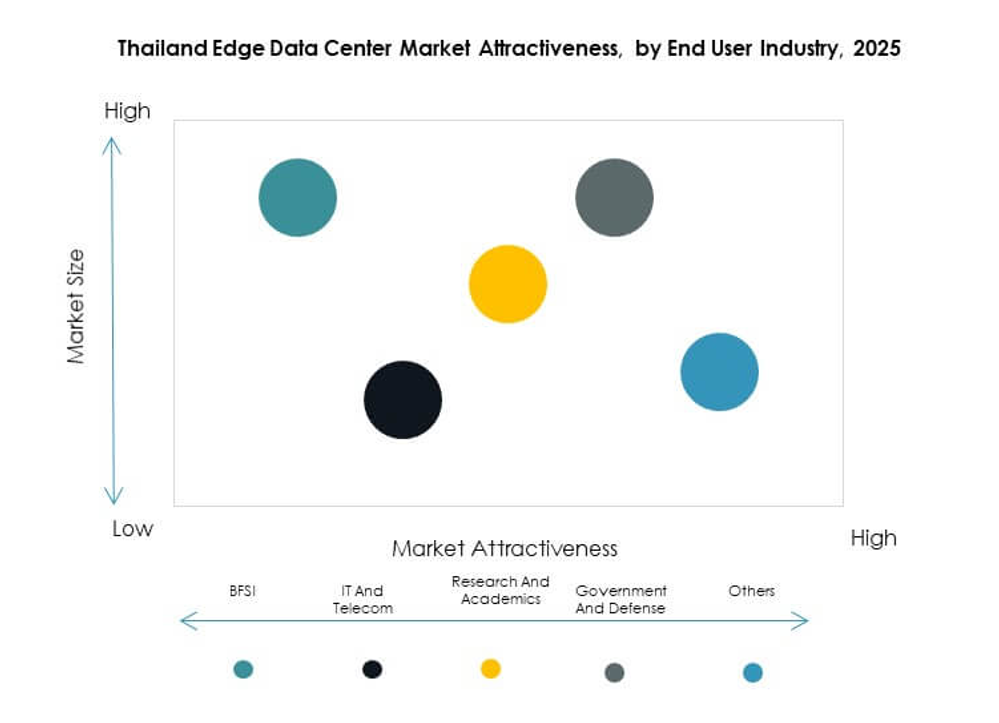

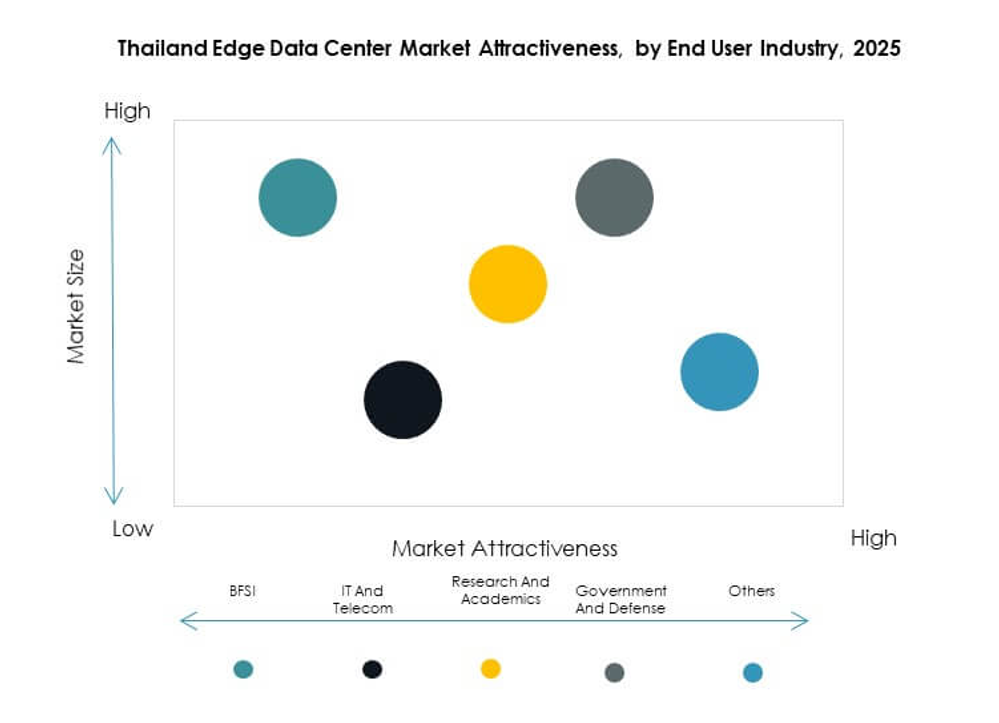

By End User Industry

The IT and telecommunications segment dominates the Thailand Edge Data Center Market, driven by heavy investments from telecom carriers and cloud providers. It plays a central role in network optimization and data delivery. BFSI and retail sectors follow with growing digital service adoption. Healthcare and energy industries use edge infrastructure for real-time monitoring and diagnostics. Aerospace and defense sectors rely on localized data storage for secure communication. Each vertical strengthens the country’s digital modernization strategy.

Regional Insights

Bangkok Metropolitan Region Holding the Largest Market Share at 54%

Bangkok dominates the Thailand Edge Data Center Market due to strong network infrastructure, fiber connectivity, and enterprise concentration. It serves as a regional interconnection hub for major telecoms and cloud providers. The city’s dense commercial and technology landscape supports demand for low-latency computing. It attracts continuous investments from both domestic and international players. High energy availability and reliable connectivity make Bangkok ideal for hyperscale and edge deployments. The concentration of IT enterprises ensures sustainable growth and service innovation.

- For instance, Amazon Web Services (AWS) announced the general availability of its AWS Asia Pacific (Bangkok) Region in January 2025. This region went live with three Availability Zones, making it the first AWS infrastructure region in Thailand. The investment enables businesses, government agencies, and startups in Bangkok to access cloud services locally, supporting low-latency applications and stringent data residency requirements.

Eastern Economic Corridor (EEC) Emerging as a High-Growth Subregion with 32% Share

The EEC, including provinces such as Chonburi, Rayong, and Chachoengsao, is witnessing strong digital infrastructure expansion. It supports industrial automation, logistics, and manufacturing modernization. The Thailand Edge Data Center Market in this subregion benefits from government-backed smart industry projects. It provides near-factory data processing and IoT integration. Edge facilities here enable predictive maintenance and process optimization. Proximity to seaports and industrial estates makes EEC a strategic hub. Investors view it as Thailand’s primary industrial technology corridor.

Northern and Southern Regions Showing Growing Momentum with 14% Share Combined

Emerging cities like Chiang Mai and Hat Yai are gaining importance for regional data distribution and network coverage. The Thailand Edge Data Center Market is expanding across these zones to enhance local service accessibility. It helps balance traffic loads from central Thailand while improving national connectivity. Educational institutions and tech startups fuel localized data requirements. Government programs encourage infrastructure development beyond Bangkok. Improved power reliability and renewable energy adoption strengthen these regional ecosystems. Together, these areas shape Thailand’s broader digital inclusion strategy.

- For instance, in June 2025, Thailand’s National Telecom (NT) and renewable energy provider BCPG partnered to renovate and expand data centers in Chiang Mai (offering 25 racks) and Hat Yai (offering 40 racks), aiming to relaunch upgraded, energy-efficient sites by June 2026. These northern and southern locations are being redeveloped with a focus on clean energy and sustainable digital infrastructure, supporting regional digital inclusion and improved service reliability.

Competitive Insights:

- AIS (Advanced Info Service Public Company Limited)

- True Corporation Public Company Limited

- Total Access Communication (DTAC)

- Equinix Inc.

- Digital Realty Trust, Inc.

- EdgeConneX Inc.

- Fujitsu Limited

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Schneider Electric SE

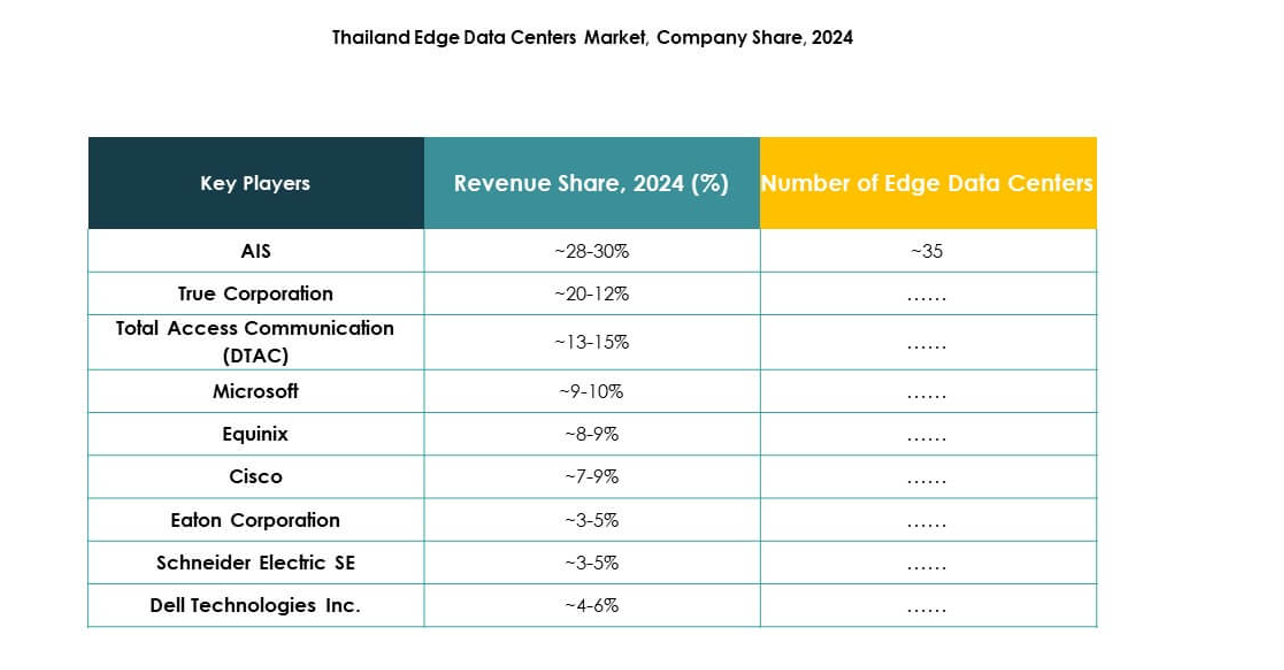

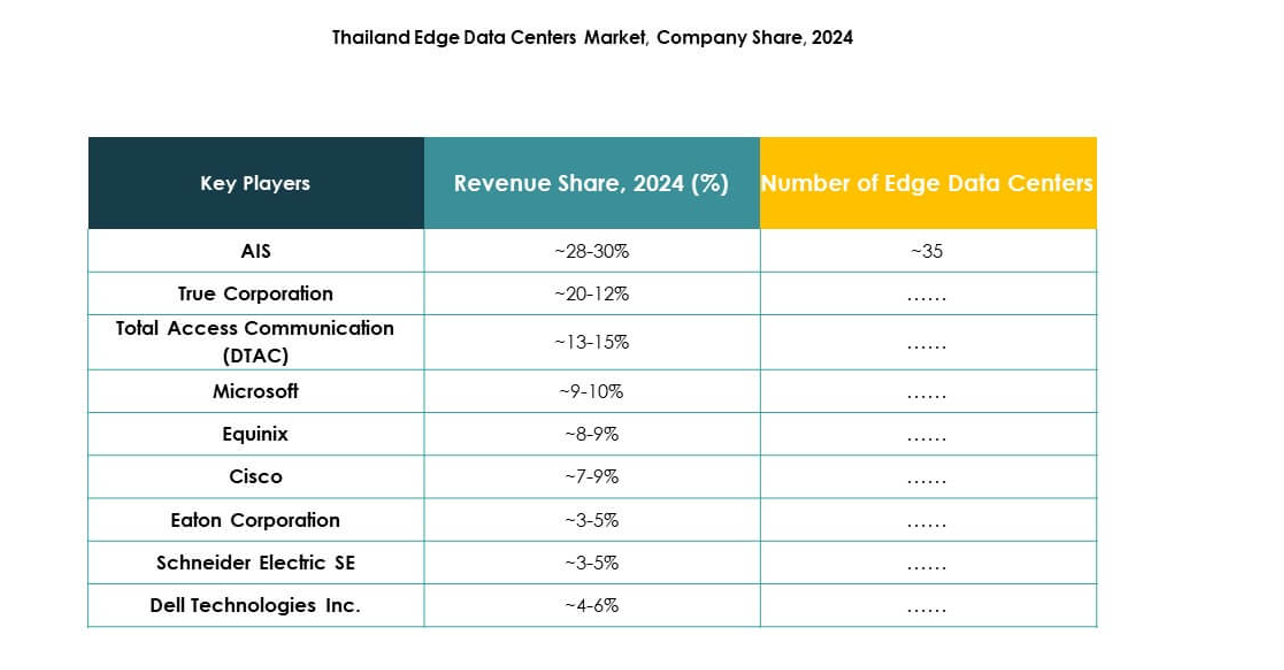

The Thailand Edge Data Center Market features a competitive environment led by telecom operators, global colocation firms, and technology providers. It reflects growing collaboration between telecom leaders like AIS, True Corporation, and DTAC with global data infrastructure companies such as Equinix and Digital Realty. These alliances enhance network density and regional interconnectivity. Technology vendors including Schneider Electric, Cisco, and Dell focus on energy-efficient and modular data center designs to support low-latency applications. EdgeConneX and Fujitsu expand regional presence through scalable, prefabricated models. Continuous innovation in automation, AI management, and sustainability defines competition intensity and shapes Thailand’s evolving digital infrastructure landscape.

Recent Developments:

- In September 2025, Digital Edge Singapore and B.Grimm Power marked a significant milestone by officially breaking ground on a new joint 100MW AI-ready data center campus in Chonburi, within Thailand’s Eastern Economic Corridor (EEC). This initiative is part of a larger $1 billion investment plan, and the campus, which targets a Ready-for-Service launch in Q4 2026, aims to deliver advanced hyperscale and cloud infrastructure, integrating high-density colocation and renewable energy solutions that directly support AI and enterprise workloads for global tech clients.

- In June 2025, Thailand’s National Telecom (NT) and local energy firm BCPG announced a partnership to jointly develop and launch an innovative, sustainable edge data center. Their facility is designed to leverage next-generation renewable energy while enhancing Thailand’s digital infrastructure, and highlights the growing collaboration between telecom and energy sectors in addressing edge computing demands.