Executive summary:

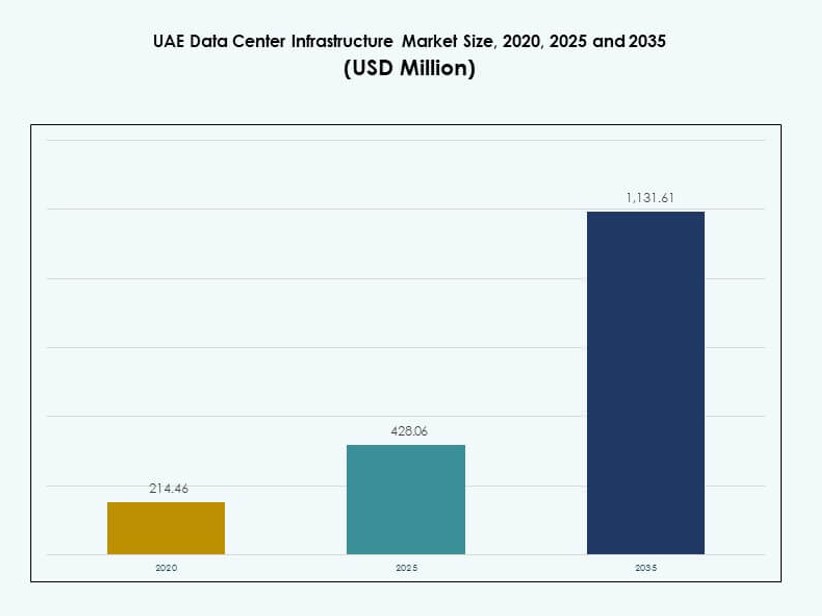

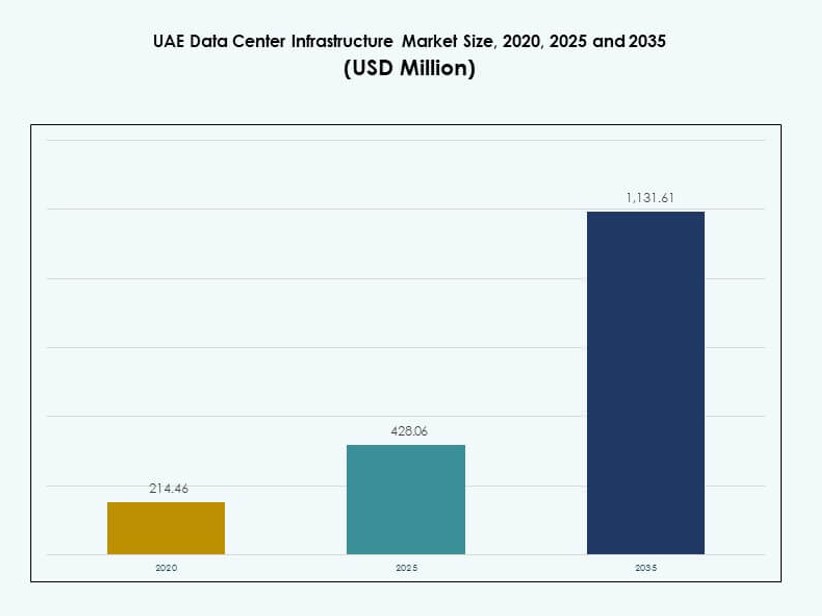

The UAE Data Center Infrastructure Market size was valued at USD 214.46 million in 2020 to USD 428.06 million in 2025 and is anticipated to reach USD 1,131.61 million by 2035, at a CAGR of 10.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| UAE Data Center Infrastructure Market Size 2025 |

USD 428.06 Million |

| UAE Data Center Infrastructure Market, CAGR |

10.13% |

| UAE Data Center Infrastructure Market Size 2035 |

USD 1,131.61 Million |

The UAE Data Center Infrastructure Market is driven by rapid cloud adoption, AI workload growth, and strong digital transformation across enterprises. Businesses invest in scalable, high-density infrastructure to support data localization and low-latency services. Innovation in modular design, advanced cooling, and energy-efficient power systems supports reliability goals. The market holds strategic value for investors due to stable regulations, long-term capacity demand, and the UAE’s role as a regional digital hub.

Within the Middle East, the UAE leads due to strong connectivity, advanced telecom networks, and supportive government policies. Dubai and Abu Dhabi dominate activity because of enterprise concentration and hyperscale investments. Emerging growth appears in northern emirates such as Sharjah and Ajman, driven by lower land costs and modular deployments. Regional leadership is reinforced by early technology adoption and strong public-private collaboration.

Market Dynamics:

Market Drivers

Rising Digitalization and Accelerated Enterprise Cloud Migration Across UAE’s Core Sectors

Government and private sectors are transitioning to cloud-first strategies, fueling robust data infrastructure demand. The expansion of public and hybrid cloud ecosystems is accelerating infrastructure upgrades. The UAE Data Center Infrastructure Market benefits from wide-scale digitization across finance, healthcare, and logistics sectors. Enterprises prioritize private cloud deployments to comply with national data residency laws. Investment in high-density power and scalable cooling systems continues to rise. Multinational cloud providers view the UAE as a regional anchor for MENA cloud operations. Strong fiber optics and submarine cable landing stations enhance the market’s value proposition. The country’s 5G rollout drives demand for edge computing architecture. Government push for smart cities amplifies infrastructure modernization across digital nodes.

- For instance, du signed a AED 2 billion agreement with Microsoft for a hyperscale data center to support cloud migration, announced during Dubai AI Week.

Increased Hyperscale and Colocation Investments Backed by Regulatory and Economic Reforms

Abu Dhabi and Dubai are witnessing hyperscale data center launches backed by foreign direct investment. Colocation providers expand capacity to serve digital-native firms and cloud service vendors. Government initiatives simplify data center licensing and zoning rules, encouraging global players to invest. The UAE Data Center Infrastructure Market continues to benefit from free zones and tax incentives tailored for digital infrastructure growth. Greenfield projects in dedicated tech parks support fast-track builds for hyperscale requirements. Companies invest in scalable racks, efficient PDUs, and BESS systems to future-proof facilities. Multicloud and hybrid IT strategies among enterprises increase colocation uptake. State-backed funds support domestic tech champions investing in edge facilities. National energy transition goals align with low-PUE design mandates, driving infrastructure upgrades.

Strategic Importance of Data Centers in Strengthening UAE’s Role as a Digital Business Hub

The UAE’s strategic location, between East and West, enhances its potential as a regional interconnection hub. Cross-border data flows, trade digitalization, and fintech growth rely on a secure and scalable data infrastructure. The UAE Data Center Infrastructure Market plays a central role in supporting sovereign cloud, cybersecurity, and e-government platforms. Investors see strong return prospects in high-yield colocation and modular deployments. Real estate players increasingly allocate assets for DC infrastructure due to long-term leasing demand. Businesses prioritize digital infrastructure proximity to reduce latency and support faster workloads. High-profile events like Expo 2020 elevated the urgency for infrastructure readiness. Government prioritizes digital economy acceleration through data-localized service architecture. Strategic partnerships with cloud majors expand market breadth and operational depth.

- For instance, Equinix opened its DX3 data center in Dubai Production City, designed to support up to 1,800 cabinets. The facility expands Equinix’s interconnection capacity in the MENA region and is the company’s largest IBX in the Middle East.

Strong Government Support for Sustainability and Energy Efficiency in Data Center Design

The UAE’s Net Zero by 2050 plan is driving aggressive adoption of sustainable data center technologies. Operators focus on using air- and liquid-cooled solutions with high thermal efficiency. The UAE Data Center Infrastructure Market aligns with LEED and Estidama frameworks to lower energy consumption. Investment in solar-powered campuses and green backup systems accelerates. Government supports low-carbon tech innovation zones that attract ESG-focused infrastructure builders. Facilities integrate smart BMS and DCIM software to monitor and optimize power consumption. Modular and prefabricated designs reduce waste and speed construction. Developers use recycled materials and sustainable superstructures in civil and structural works. The push for digital sustainability enhances investor appeal and ESG score alignment.

Market Trends

AI, Machine Learning, and HPC Workloads Driving Customization in Infrastructure Design

Advanced workloads require high-density computing, low-latency networking, and robust power delivery. The UAE Data Center Infrastructure Market witnesses rising demand for GPU-based racks and AI-optimized configurations. Enterprises prioritize HPC clusters for real-time analytics and video processing. Facilities shift from traditional x86-based setups to mixed-architecture environments. High-throughput networking and optical interconnects gain traction. Customization of cooling and rack layouts ensures peak performance. Infrastructure procurement is moving towards workload-specific modularity. Data centers adapt to meet growing requirements of generative AI and LLM training workloads. AI workload expansion promotes co-development between hyperscalers and infrastructure OEMs.

Edge Computing Expansion Accelerated by 5G Rollout and IoT Ecosystem Growth

Low-latency applications like autonomous mobility, smart retail, and connected healthcare require localized processing. The UAE Data Center Infrastructure Market sees a rise in micro data centers and modular edge nodes across city zones. Telecom players and hyperscalers collaborate on distributed infrastructure rollouts. Facilities with ruggedized form factors and outdoor-ready cooling systems become more common. Edge racks support rapid deployment and integration with core networks. Demand for containerized data centers grows in oil fields, ports, and logistics hubs. Latency-sensitive workloads drive rack-level energy density improvements. Networking equipment evolves to support rapid failover and dynamic routing. Public-private initiatives push edge coverage in underserved zones.

Growth of Prefabricated Modular Data Centers and Hybrid Construction Models

Prefabricated modules reduce deployment time and increase scalability. The UAE Data Center Infrastructure Market incorporates containerized power and mechanical blocks for quick expansion. Demand grows for factory-built, pre-tested units that meet strict design tolerances. EPC players offer hybrid builds combining traditional and modular frameworks. Modules reduce risk exposure during harsh weather or supply delays. Prefab cooling systems help operators maintain tight energy budgets. Repeatable designs support faster procurement cycles and reduce onsite errors. Adoption accelerates in retrofit scenarios where speed and site constraints limit traditional builds. Real estate developers partner with modular vendors for rapid tenant onboarding.

Rise of Software-Defined Infrastructure and Smart Automation Integration

Infrastructure management is shifting from hardware-centric to software-defined operations. The UAE Data Center Infrastructure Market integrates DCIM and AI-driven orchestration for predictive maintenance and load optimization. Facilities use automation to regulate airflow, humidity, and energy consumption in real time. Software-defined storage and power systems help reduce over-provisioning. Dynamic resource allocation improves uptime and service levels. DC operators deploy digital twins to simulate infrastructure performance under stress. Remote management platforms improve responsiveness across edge and hyperscale sites. Smart sensors and telemetry data enhance operational intelligence. Automation supports compliance reporting and SLA adherence for colocation clients.

Market Challenges

High Energy Costs, Cooling Demands, and Land Scarcity in Prime Urban Zones

Cooling accounts for a large portion of operational expenses, especially in desert environments. The UAE Data Center Infrastructure Market faces high CapEx in thermal management systems. Operators must design to withstand extreme temperatures and low humidity levels. Real estate costs in Dubai and Abu Dhabi limit hyperscale expansion in core zones. Sites need backup grids, efficient chillers, and secure perimeters, increasing development costs. Energy procurement contracts often lack long-term price predictability. High-density deployments push rack power to 20kW+ levels, requiring advanced containment. Cooling redundancy adds to power draw and equipment costs. Data center rooftops must accommodate large mechanical loads and solar arrays, increasing structural complexity.

Talent Shortages, Regulatory Compliance, and Interconnection Limitations

The UAE faces limited availability of skilled data center design, operations, and cybersecurity professionals. The UAE Data Center Infrastructure Market requires constant upskilling and specialized certifications. Operators navigate evolving data sovereignty, carbon reporting, and disaster recovery mandates. Compliance frameworks differ across emirates, causing regulatory friction. Interconnection between cloud providers and carriers remains fragmented in Tier 2 zones. Smaller players lack access to neutral IXPs and carrier hotels. Legacy infrastructure and retrofit challenges delay modernization efforts. Demand outpaces training program capacity, creating operational risk for new builds.

Market Opportunities

Surging Demand for Greenfield Hyperscale and Edge Builds Across Free Zones and Industrial Parks

The UAE Data Center Infrastructure Market offers long-term growth for investors targeting greenfield hyperscale projects. Industrial parks in Dubai South, Abu Dhabi KIZAD, and Sharjah Hamriyah offer land and utility incentives. Growth in AI, gaming, and media streaming will drive new workload deployments at scale. Developers can leverage modular construction to reduce delivery timelines and attract global tenants. Edge deployments in logistics and smart cities create expansion potential in secondary zones.

Strategic Partnerships and Local Manufacturing of Core Infrastructure Components

Partnerships with local EPCs and power equipment manufacturers reduce dependency on imports. The UAE Data Center Infrastructure Market benefits from rising domestic capability in UPS, switchgear, and containment systems. Local sourcing shortens lead times and improves cost control. Public-private R&D in energy storage and smart cooling creates competitive edge. Localization supports national job creation and meets UAE’s In-Country Value (ICV) targets.

Market Segmentation

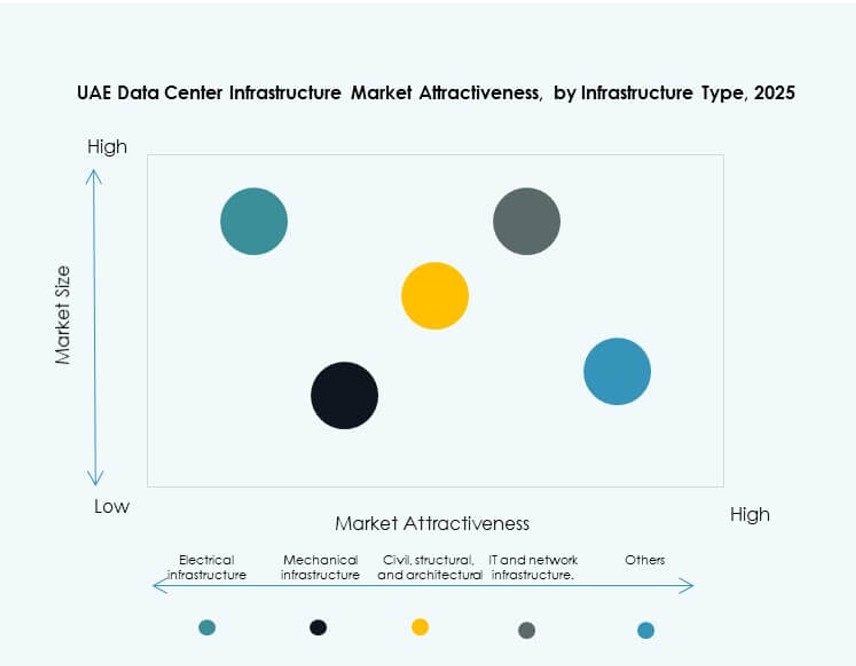

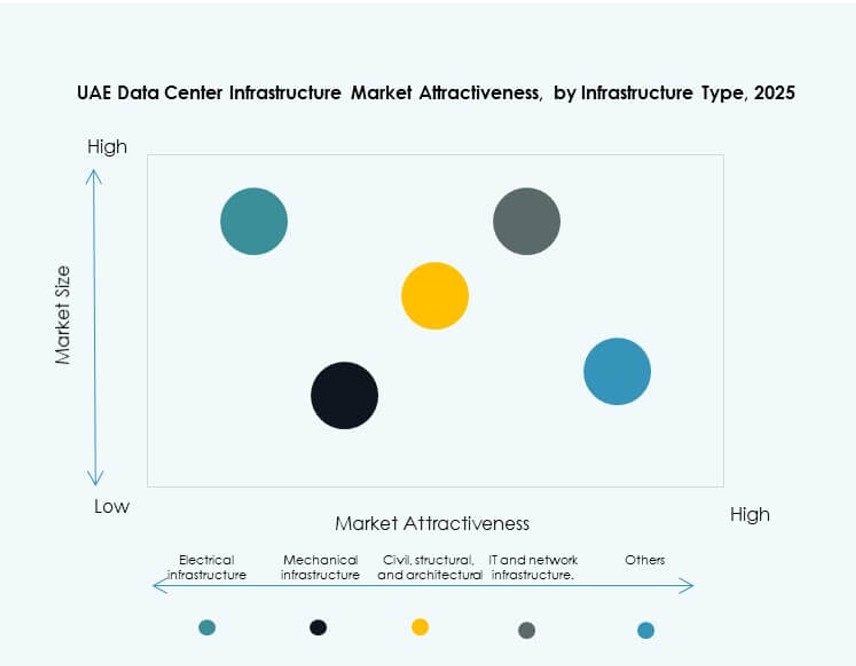

By Infrastructure Type

The UAE Data Center Infrastructure Market is led by electrical infrastructure, accounting for the largest share due to high power density and uptime needs. Mechanical infrastructure follows with strong demand for precision cooling systems. Civil/structural and IT/network infrastructure segments grow steadily as modularity and rack integration advance. Structural upgrades remain critical in new builds and Tier upgrades. The “Others” category includes supporting systems like DCIM platforms and physical security elements.

By Electrical Infrastructure

Uninterruptible power supply (UPS) dominates electrical infrastructure due to the UAE’s high availability and redundancy standards. Power distribution units (PDUs) and battery energy storage systems (BESS) gain traction in Tier III/IV setups. Transfer switches and switchgears see stable growth in mission-critical facilities. Utility service integration becomes smoother with better grid infrastructure. Demand rises for intelligent PDUs to manage high-density racks and dynamic loads.

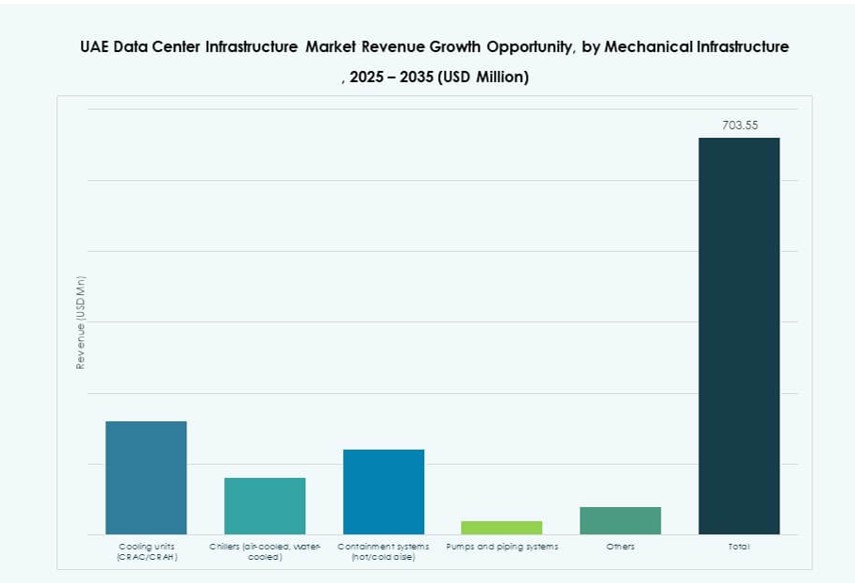

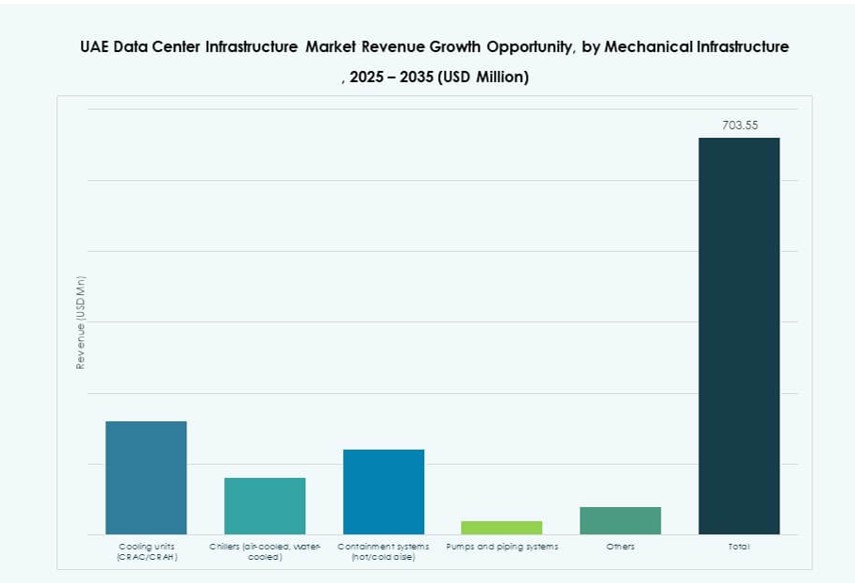

By Mechanical Infrastructure

Cooling units (CRAC/CRAH) hold the largest share due to extreme climate conditions. Chillers, particularly air-cooled units, are widely adopted in hyperscale and colocation facilities. Containment systems gain momentum for hot/cold aisle efficiency. Pumps and piping systems evolve to support liquid cooling integration. Modular cooling technologies help meet sustainability goals and reduce OPEX.

By Civil / Structural & Architectural

Modular and prefabricated systems are leading this segment, enabling fast deployment. Superstructure components using concrete-steel hybrids offer structural resilience. Raised floors and suspended ceilings remain common in enterprise and colocation setups. Site preparation and foundation investments rise with hyperscale demand. High-quality building envelopes support thermal insulation and operational sustainability.

By IT & Network Infrastructure

Server and networking equipment drive the IT infrastructure segment. Racks and enclosures are in demand due to rising density and airflow optimization. Storage solutions shift to hybrid models for better performance. Cabling and optical fiber installations scale with bandwidth growth. Equipment vendors integrate power-efficient designs with remote monitoring features.

By Data Center Type

Hyperscale data centers dominate the UAE Data Center Infrastructure Market, driven by investments from cloud majors. Colocation facilities expand rapidly, serving SMEs and fintech sectors. Edge data centers grow in line with smart city deployments. Enterprise data centers maintain relevance in regulated industries. Other data centers include government and defense-operated facilities.

By Delivery Model

Design-build/EPC models lead in large-scale deployments due to end-to-end execution. Modular factory-built models grow quickly, especially in edge environments. Turnkey and construction management models support private sector builds. Retrofit/upgrade delivery gains traction as legacy sites modernize operations. Project timelines influence the choice of delivery model.

By Tier Type

Tier III data centers dominate due to balanced cost-efficiency and uptime. Tier IV facilities grow in mission-critical segments like banking and defense. Tier I and II see less adoption as enterprises seek higher resilience. Many new builds target Tier III readiness with Tier IV capabilities. Certification and SLA compliance guide tier selection.

Regional Insights

Dominance of Dubai Due to Digital Ecosystem Density and Free Zone Incentives

Dubai leads the UAE Data Center Infrastructure Market with over 45% share. The city houses major colocation hubs, telecom infrastructure, and hyperscale campuses. Dubai Internet City and Dubai Silicon Oasis offer incentives for digital service providers. Strong connectivity through submarine cables and international IXPs enhances its edge. The emirate’s early adoption of 5G and smart city applications drives edge infrastructure rollout. Multinationals prefer Dubai for regional hosting due to business-friendly regulation.

- For instance, du’s Data Center in Dubai Silicon Oasis spans 9,000 m² with a 6.0 MW ultimate IT load, Uptime Institute Tier III certification, and indirect evaporative cooling.

Abu Dhabi Expands Role Through Sovereign Cloud, AI Investment, and Utility Access

Abu Dhabi holds around 30% market share, with rising focus on government cloud, defense data centers, and AI clusters. The city benefits from stable energy supply, greenfield land availability, and growing EPC capabilities. KIZAD and Masdar offer strategic zones for infrastructure investment. State-owned entities back hyperscale partnerships with global providers. The capital’s Vision 2030 digital goals prioritize data sovereignty and cyber resilience.

- For instance, Khazna Data Centers’ KIZAD campus in Abu Dhabi includes six facilities each with 6 MW capacity, totaling 36 MW and 8,200 m² whitespace, carrier-neutral with Tier 3 certification.

Sharjah and Northern Emirates Emerging with Industrial Growth and Edge Facility Potential

Sharjah and the northern emirates collectively hold about 25% of the UAE Data Center Infrastructure Market. Hamriyah Free Zone and SAIF Zone promote affordable infrastructure development. These regions attract logistics, healthcare, and manufacturing-driven edge deployments. Lower land and power costs enable modular builds for SMEs. Government support for digital inclusion increases demand outside core metro zones. Emerging cities offer untapped opportunities for regional colocation providers.

Competitive Insights:

- Khazna Data Centers

- Moro Hub

- Gulf Data Hub

- Equinix, Inc.

- G42 / Core42

- Schneider Electric

- Vertiv Group Corp.

- Cisco Systems, Inc.

- Dell Inc.

- ABB

The UAE Data Center Infrastructure Market is shaped by a combination of local operators, government-backed entities, and global infrastructure providers. Khazna and Moro Hub dominate with large-scale builds and strategic partnerships, while Gulf Data Hub supports regional colocation growth. Equinix drives interconnection leadership through its Dubai-based carrier-neutral facilities. Infrastructure vendors like Schneider Electric and Vertiv enable advanced cooling, power, and automation systems. Global IT giants such as Cisco, Dell, and ABB provide mission-critical hardware across network, server, and power domains. The market favors players that offer end-to-end solutions aligned with energy efficiency, modularity, and uptime. It maintains strong momentum due to consistent enterprise digitization, hyperscale demand, and favorable regulatory alignment for investment. Strategic alliances between EPCs, OEMs, and tech providers continue to define future project pipelines.

Recent Developments:

- In December 2025, ABB partnered with Nvidia to target growth in Gulf data center infrastructure, focusing on the UAE and Saudi Arabia amid rising electricity demand. This collaboration aims to develop next-generation infrastructure,

- In May 2025, Cisco joined the Stargate UAE Initiative through a strategic MoU with G42, OpenAI, Oracle, NVIDIA, and SoftBank Group to build a 1 GW AI data center in Abu Dhabi, starting with 200 MW in 2026. The partnership, powers AI innovation and infrastructure development.