Executive summary:

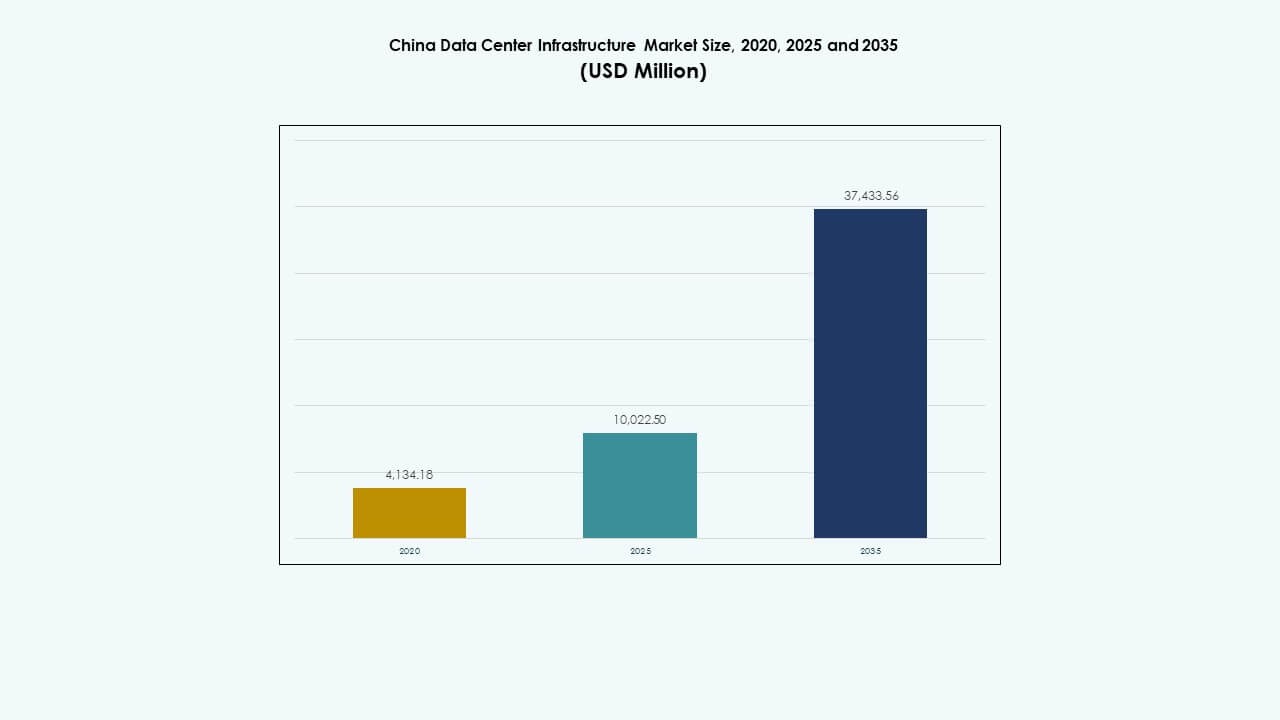

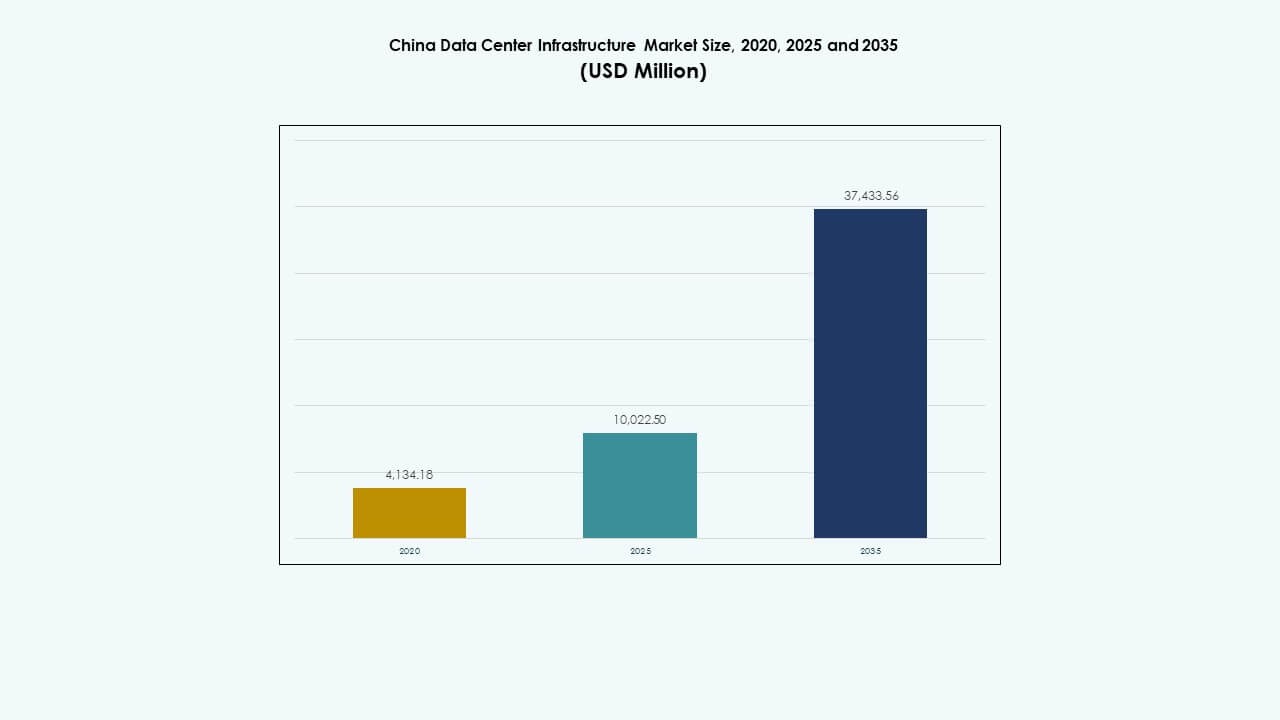

The China Data Center Infrastructure Market size was valued at USD 4,134.18 million in 2020, increased to USD 10,022.50 million in 2025, and is anticipated to reach USD 37,433.56 million by 2035, at a CAGR of 13.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| China Data Center Infrastructure Market Size 2025 |

USD 10,022.50 Million |

| China Data Center Infrastructure Market, CAGR |

13.90% |

| China Data Center Infrastructure Market Size 2035 |

USD 37,433.56 Million |

Growth in the market is fueled by widespread adoption of AI, big data, and cloud platforms across industrial and enterprise sectors. Businesses seek high-density compute, modular systems, and sustainable design to meet evolving performance and environmental needs. Innovation in cooling, power management, and automation is reshaping data center construction and operations. The market holds strategic value for investors seeking to capitalize on China’s digital economy goals and infrastructure modernization plans.

East China leads the market due to dense enterprise clusters, advanced network backbone, and availability of hyperscale facilities. Regions like Shanghai, Hangzhou, and Suzhou host major cloud and colocation players. Meanwhile, Southwest and Northwest China are emerging due to power availability, land incentives, and national policies promoting balanced development. Provinces such as Guizhou and Inner Mongolia attract large-scale builds focused on cost efficiency and green energy integration.

Market Drivers

Market Drivers

Rapid Adoption of Cloud Services and AI-Powered Workloads Drives Infrastructure Growth

The China Data Center Infrastructure Market benefits from strong momentum in cloud computing and artificial intelligence deployment. Major providers like Alibaba Cloud, Tencent Cloud, and Huawei Cloud continue to expand their footprint, requiring robust, scalable infrastructure. AI training workloads demand high-density racks and advanced cooling systems. Enterprise digitalization further increases demand for secure, resilient data center solutions. Edge computing and 5G accelerate data traffic growth, reshaping design needs. The government’s push for national digital sovereignty supports domestic investment. Global and domestic firms view the market as a priority due to its scale and policy stability. This makes the China Data Center Infrastructure Market strategically critical for long-term growth planning.

- For instance, Alibaba Cloud’s datacenter pods house 15,000 GPUs per building with 18 MW power capacity to support AI training.

Policy Support and Industrial Internet Push Enable Investment Momentum

Government programs such as the “New Infrastructure” initiative have driven sustained investment into data center ecosystems. These programs promote cloud, AI, and industrial internet transformation across core verticals. Central and local authorities offer land, tax, and power incentives for building hyperscale facilities. Industries like smart manufacturing, healthcare, and financial services upgrade backend systems. This shift drives demand for integrated electrical and mechanical infrastructure. Real estate developers and EPC firms partner with tech firms to deliver modular campuses. The alignment of digital economy goals with carbon neutrality also creates growth drivers. The China Data Center Infrastructure Market gains strategic importance as it underpins the country’s digital foundation.

Demand for Modular, Scalable, and Energy-Efficient Infrastructure Expands

The need for faster deployment cycles and operational cost control has boosted modular infrastructure adoption. Data center operators implement containerized power and cooling systems for flexible capacity expansion. Liquid cooling and direct-to-chip cooling grow in relevance due to thermal density in AI racks. Smart monitoring tools and automation platforms improve operational visibility. Backup power, BMS, and PDUs are upgraded to match increased load. Green building certifications become critical for hyperscale projects. The China Data Center Infrastructure Market reflects this innovation wave, attracting stakeholders focused on rapid deployment and sustainability. Market dynamics increasingly reward efficient, ready-to-scale systems with low PUE values.

Enterprise Cloud Shift and Private Cloud Resilience Requirements Expand Local Demand

Domestic enterprises shift from legacy systems to private or hybrid cloud platforms to ensure business continuity. This shift strengthens demand for IT and network infrastructure with higher compute capacity and secure connectivity. Finance, telecom, and e-commerce sectors require high availability and low latency architecture. Regional compliance frameworks further encourage localized data storage and disaster recovery setups. Enterprise cloud migration supports demand for Tier III and Tier IV data centers. Managed infrastructure services also grow as SMEs outsource operations. The China Data Center Infrastructure Market enables this strategic shift, offering infrastructure resilience to support digital growth goals.

- For instance, China Telecom deployed a distributed AI cluster with 1,024 GPUs interconnected via 800G networks over 120 km for model training.

Market Trends

Market Trends

Deployment of High-Density, AI-Ready Data Centers to Support Next-Gen Computing

The rise of generative AI and LLM training models has pushed demand for GPU-based clusters. Data centers now require increased rack power densities and advanced cooling. Operators deploy 40kW+ racks with direct-to-chip or immersion systems. Network infrastructure also evolves to 400G/800G to reduce latency. Monitoring platforms leverage AI to optimize workload distribution and energy use. This trend changes data center architecture in major Chinese metros. The China Data Center Infrastructure Market reflects this transition, positioning itself as a hub for AI-ready campuses and innovation.

Increased Role of Renewable Energy and Green Power Trading in Data Center Design

Data center operators adopt renewable energy procurement strategies to meet ESG targets. Green electricity trading platforms gain traction to reduce carbon footprint. Provinces with surplus wind or hydro energy attract hyperscale developments. Some campuses deploy solar panels and energy storage systems for peak shaving. Operators also pursue green certifications like LEED or CECP. Power use effectiveness (PUE) becomes a key metric in design planning. The China Data Center Infrastructure Market now integrates sustainability and low-carbon operations as a central design requirement.

Growing Popularity of Edge Data Centers to Serve Low-Latency, Urban Applications

Smart cities, IoT devices, and autonomous systems require low-latency processing. Operators deploy micro and edge data centers near urban clusters. Telecom players leverage 5G base stations to integrate compact compute facilities. These edge sites reduce data transfer loads and improve responsiveness for urban use cases. The market witnesses demand for compact cooling, smart enclosures, and rugged infrastructure. This shift supports real-time analytics in retail, mobility, and surveillance. The China Data Center Infrastructure Market reflects this decentralization, with edge infrastructure complementing hyperscale growth.

Investment in Data Center Clusters and National Computing Backbone Projects

To manage capacity and redundancy, China is building computing clusters in strategic zones. “Eastern Data, Western Computing” project encourages balanced national distribution. New clusters in Inner Mongolia, Gansu, and Guizhou support overflow from tier-1 cities. These regions offer power access and policy incentives. Operators build large campuses with multi-tenant colocation and government cloud zones. Interconnection hubs and optical fiber expansion improve regional integration. The China Data Center Infrastructure Market gains long-term stability from such policy-backed mega cluster development.

Market Challenges

Market Challenges

Power Availability Constraints and Regional Energy Quotas Impact Expansion Plans

Data center expansion in tier-1 cities faces challenges in securing stable power supply. Some local governments impose energy quotas to meet environmental targets. This affects hyperscale project timelines and capacity additions. High-density computing increases per-site energy demands. Grid upgrades often lag behind demand growth. Renewable energy availability varies across regions, limiting green deployments. These constraints complicate site planning and ROI projections. The China Data Center Infrastructure Market must navigate these energy-related bottlenecks while sustaining growth.

Regulatory Complexity and Zoning Restrictions Delay Project Approvals

Strict zoning rules and land-use permits slow new site development in urban areas. Environmental assessments and impact reviews add months to project cycles. Operators must comply with evolving cybersecurity and data localization rules. Fire safety, construction codes, and emissions tracking involve multiple agencies. This regulatory complexity delays construction starts and inflates project costs. Smaller players struggle to meet compliance benchmarks. The China Data Center Infrastructure Market continues to grow, but faces operational friction from layered regulations.

Market Opportunities

Integration of AI, Cloud, and IoT Creates Demand for Hybrid and Multi-Cloud Infrastructure

Businesses now demand data center infrastructure that supports hybrid workloads across cloud and on-premise platforms. IoT devices and edge nodes generate real-time data needing low-latency processing. The rise of Industry 4.0 and AI-inference workloads boosts high-density compute deployments. This opens new infrastructure opportunities for private cloud builders, telecom integrators, and IT system vendors. The China Data Center Infrastructure Market benefits from serving this multi-cloud transformation across sectors.

Emergence of Modular and Prefabricated Facilities Opens New Deployment Models

Demand for fast, cost-efficient deployment fuels growth in modular data centers. Factory-built systems reduce on-site labor, shorten timelines, and improve build quality. Vendors offer containerized power, cooling, and IT units that scale with demand. This model supports deployment in remote or power-constrained regions. Prefab designs also simplify relocation, upgrades, and phased expansion. The China Data Center Infrastructure Market sees rising modular demand from both hyperscale and edge deployments.

Market Segmentation

By Infrastructure Type

Electrical infrastructure dominates the China Data Center Infrastructure Market due to its critical role in uptime. High-density workloads require advanced UPS systems, switchgear, and PDUs to ensure stable power. Mechanical infrastructure follows, driven by efficient cooling needs in hyperscale facilities. IT and network infrastructure grows with AI and cloud workloads, especially in hyperscale and enterprise segments. Civil and structural infrastructure supports rapid campus expansion and modular builds across provinces.

By Electrical Infrastructure

Uninterruptible power supply (UPS) systems lead the electrical segment due to their role in ensuring power continuity. Battery energy storage and transfer switches follow due to grid instability and backup power needs. Power distribution units and switchgears see steady demand from tier-2 and tier-3 cities. China’s shift to modular and high-efficiency systems accelerates this segment’s growth across enterprise and cloud facilities.

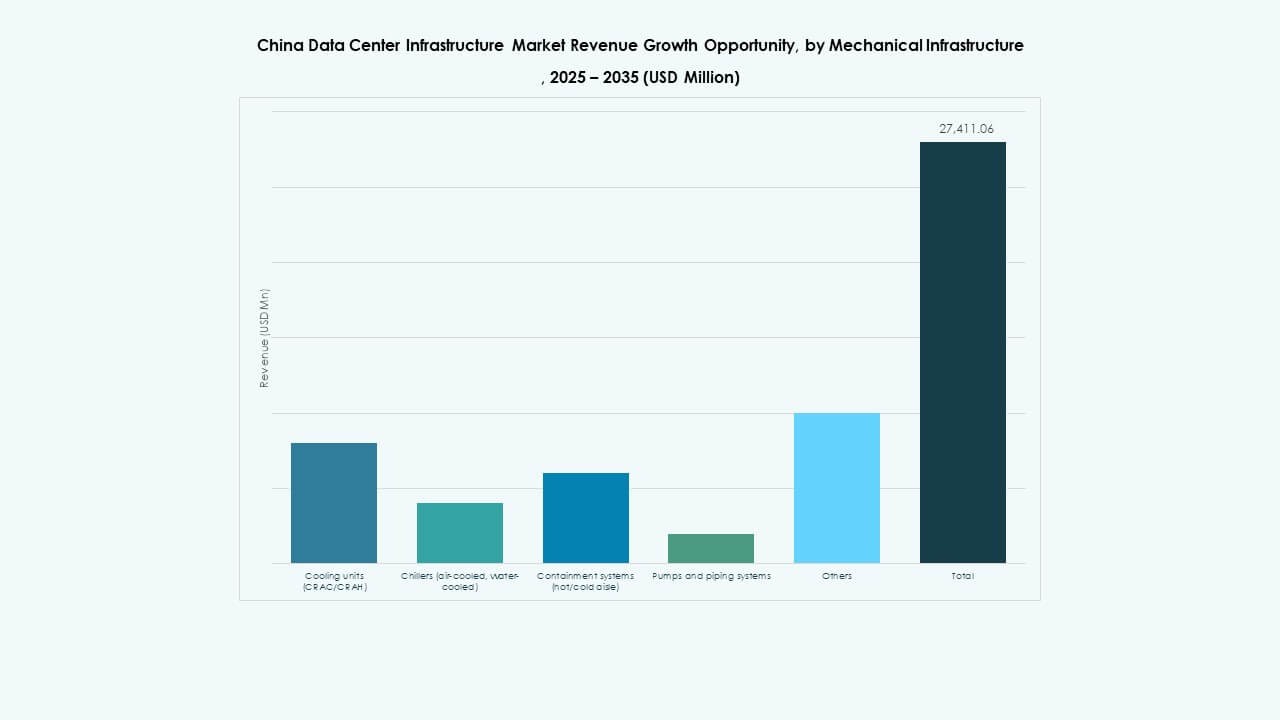

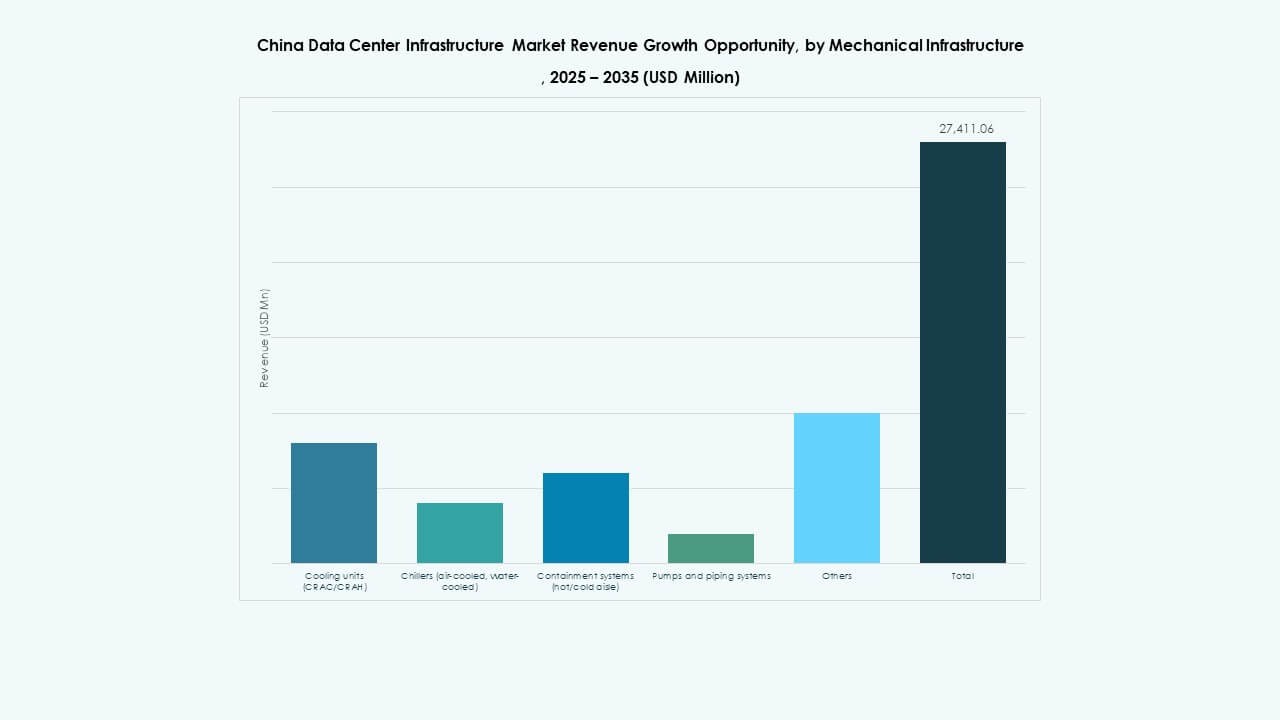

By Mechanical Infrastructure

Cooling units dominate due to their critical function in managing thermal loads from AI and GPU servers. Liquid and hybrid cooling technologies gain traction in high-density racks. Chillers and containment systems follow due to deployment in hyperscale campuses. Pumps and piping systems play a supporting role in chilled water distribution. China’s push for low PUE values fuels growth in energy-efficient cooling architecture.

By Civil / Structural & Architectural

Superstructure and site preparation lead this segment, given the scale of hyperscale projects. Modular building systems gain share due to faster time-to-market and lower labor costs. Raised floors and building envelope technologies evolve to support airflow management and containment. This segment grows steadily as developers prioritize flexible, scalable, and green-certified campuses. Urban land scarcity pushes innovation in compact architectural layouts.

By IT & Network Infrastructure

Servers and networking equipment dominate, driven by AI, cloud, and big data demand. Storage systems grow with enterprise backup and compliance needs. Optical fiber cabling and high-speed interconnects expand with 5G and edge computing. Racks and enclosures evolve to handle rising rack densities. The IT infrastructure layer forms the core of digital transformation across verticals.

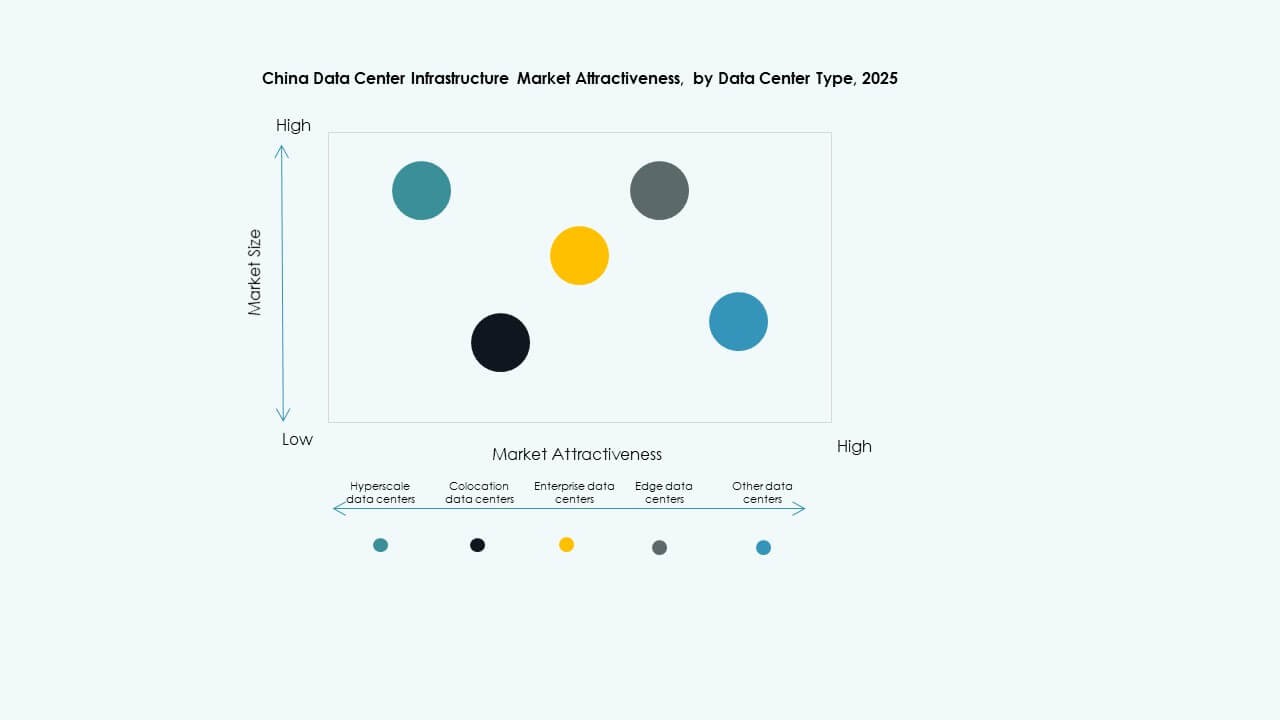

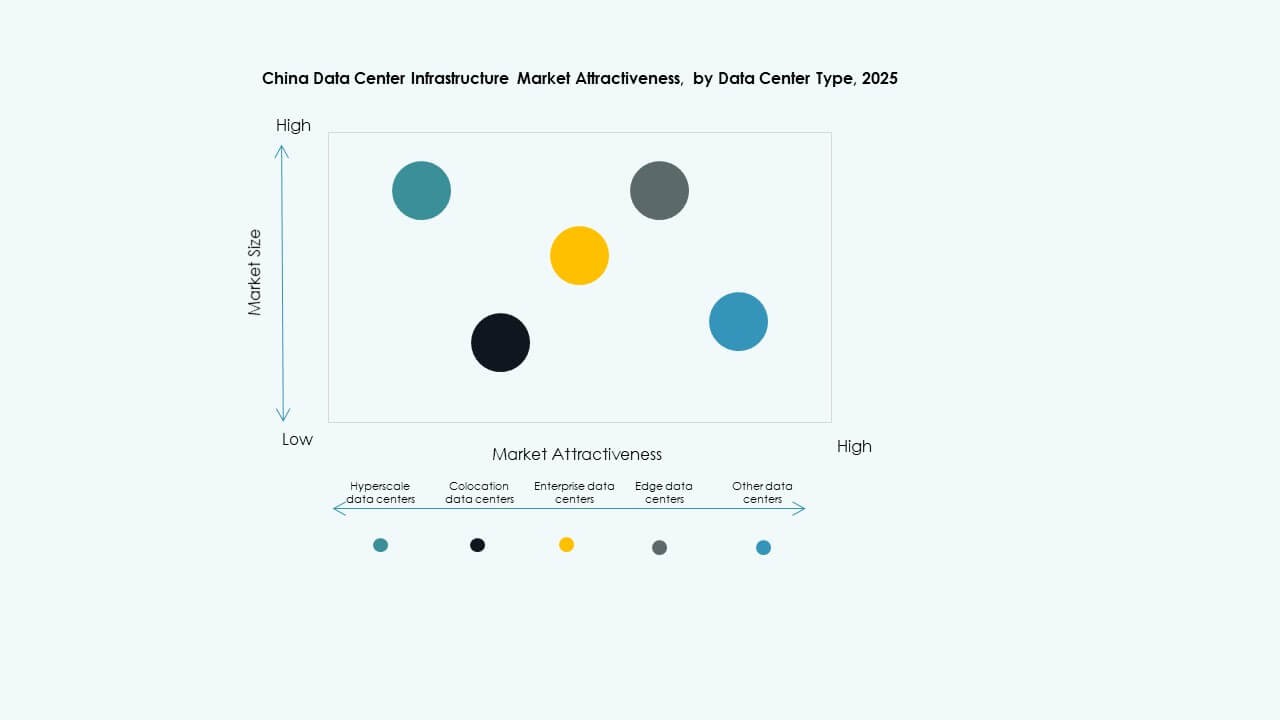

By Data Center Type

Hyperscale data centers hold the largest share, led by tech giants and cloud providers. Colocation facilities follow, supporting internet, banking, and government clients. Enterprise data centers shrink in share but remain vital in regulated sectors. Edge data centers grow rapidly, supporting urban latency-sensitive applications. The China Data Center Infrastructure Market shifts toward a hybrid mix across segments.

By Delivery Model

Turnkey and design-build models dominate due to developer preference for end-to-end execution. Modular factory-built models grow in popularity for their fast deployment advantage. Construction management sees demand in retrofitting legacy sites. Retrofit and upgrade projects rise due to sustainability goals. EPC contractors and tech integrators collaborate closely to deliver complex data center projects.

By Tier Type

Tier 3 facilities dominate due to their balance of uptime and cost-efficiency. Tier 4 data centers grow in critical applications like finance, government, and AI training. Tier 2 sites serve SMEs and secondary cities. Tier 1 facilities phase out due to lower resilience. Demand shifts toward high-availability configurations meeting SLAs and compliance benchmarks.

Regional Insights

East China Remains the Core Hub for Hyperscale and Colocation Data Centers

East China accounts for nearly 40% of the total market share. Cities like Shanghai, Suzhou, and Hangzhou serve as central hubs for hyperscale data center operations. These regions offer dense fiber connectivity, skilled labor, and strong enterprise IT demand. Colocation providers benefit from the presence of fintech, ecommerce, and digital service players. Land and power constraints push operators toward nearby tier-2 cities. The China Data Center Infrastructure Market continues to rely on East China as its operational backbone.

- For instance, Alibaba Cloud unveiled Cube DC 5.0 modular architecture in Shanghai, supporting up to 200 kW server rack density.

North China Gains Importance Through Government and Telecom-Led Cloud Expansion

North China holds around 25% of the market share, led by Beijing and Tianjin. The region hosts government cloud platforms and state-owned telecom data centers. Demand grows from public-sector digitization, security services, and state-owned banks. Policy incentives support growth in suburban zones. Proximity to regulators ensures strong compliance. North China remains vital for regulatory-sensitive workloads within the China Data Center Infrastructure Market.

- For instance, China Telecom’s Beijing facility provides capacity for over 13,000 racks with 1.1 TB internet bandwidth. Demand grows from public-sector digitization, security services, and state-owned banks.

Southwest and Northwest Regions Emerge as Future Hyperscale Clusters

Southwest and Northwest China together contribute over 20% of the market. Guizhou, Inner Mongolia, and Gansu attract investment due to abundant land and green power. These regions offer favorable cooling climates and grid capacity for large-scale builds. National projects like “Eastern Data, Western Computing” direct excess workloads to these zones. Operators build campuses with long-term scalability. This decentralization supports network resilience across the China Data Center Infrastructure Market.

Competitive Insights:

Competitive Insights:

- ABB

- Acer Inc.

- Cisco Systems, Inc.

- Cummins

- Dell Inc.

- Equinix, Inc.

- Fujitsu

- Delta Electronics

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IBM

- INSPUR Co., Ltd.

- KIO

- Lenovo

- Oracle

- Schneider Electric

- Vertiv Group Corp.

The China Data Center Infrastructure Market features intense competition among global and domestic players. Huawei, INSPUR, and Lenovo lead in integrated infrastructure and AI-ready deployments. Schneider Electric, Vertiv, and Delta Electronics dominate the power and cooling systems segment with energy-efficient solutions. Global tech firms like Cisco, Dell, and IBM focus on networking, servers, and edge infrastructure. Equinix strengthens colocation capacity through strategic data center expansions. ABB and Cummins remain essential in electrical systems, including UPS and power distribution. Local partnerships, modular builds, and sustainability benchmarks define recent competitive strategies. It continues to attract innovation-driven investment, especially in liquid cooling, high-density racks, and carbon-neutral design. Players with strong ecosystem integration and fast deployment capabilities gain a lasting edge.

Recent Developments:

- In September 2025, Alibaba Cloud revealed plans to open new data centers in Brazil, France, and the Netherlands and expand into Mexico, Japan, South Korea, Malaysia, and Dubai to grow its AI and cloud infrastructure worldwide.

- In September 2025, China Unicom showcased a large‑scale data center project in Xining, Qinghai province that uses domestically produced AI chips from Alibaba’s T‑Head unit and other Chinese developers, reinforcing China’s push for self‑reliance in critical tech infrastructure.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Competitive Insights:

Competitive Insights: