Executive summary:

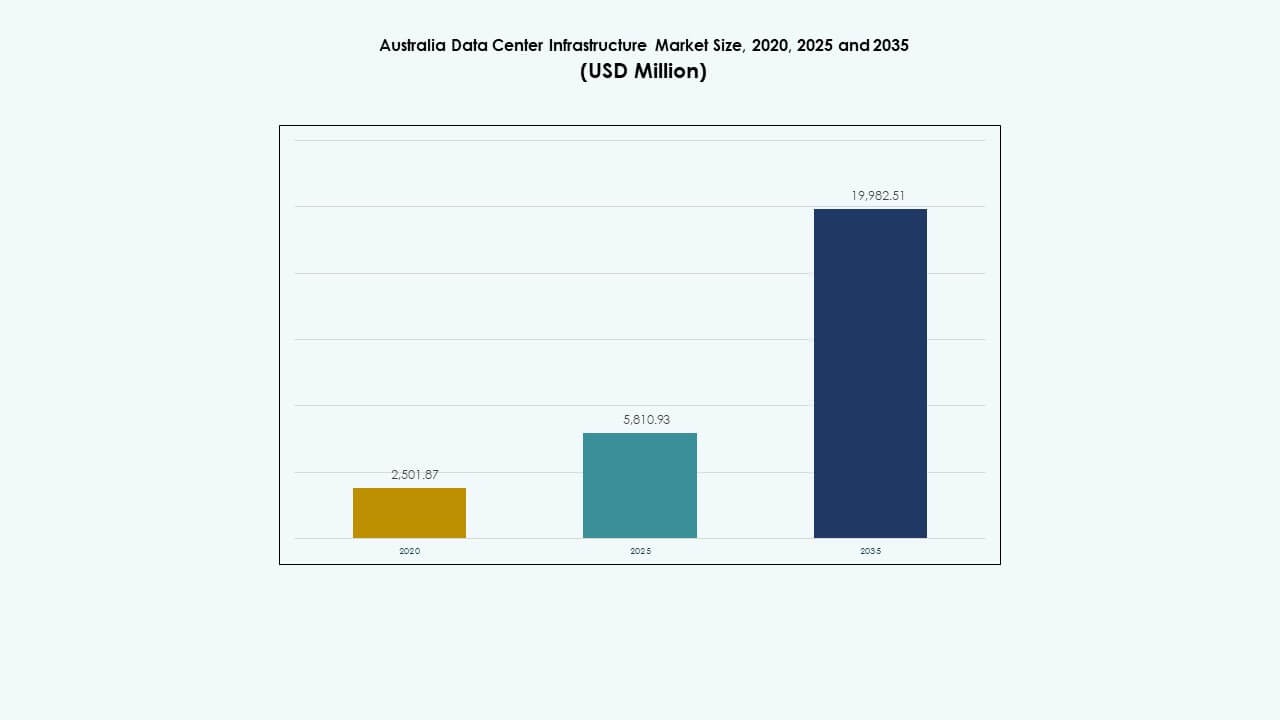

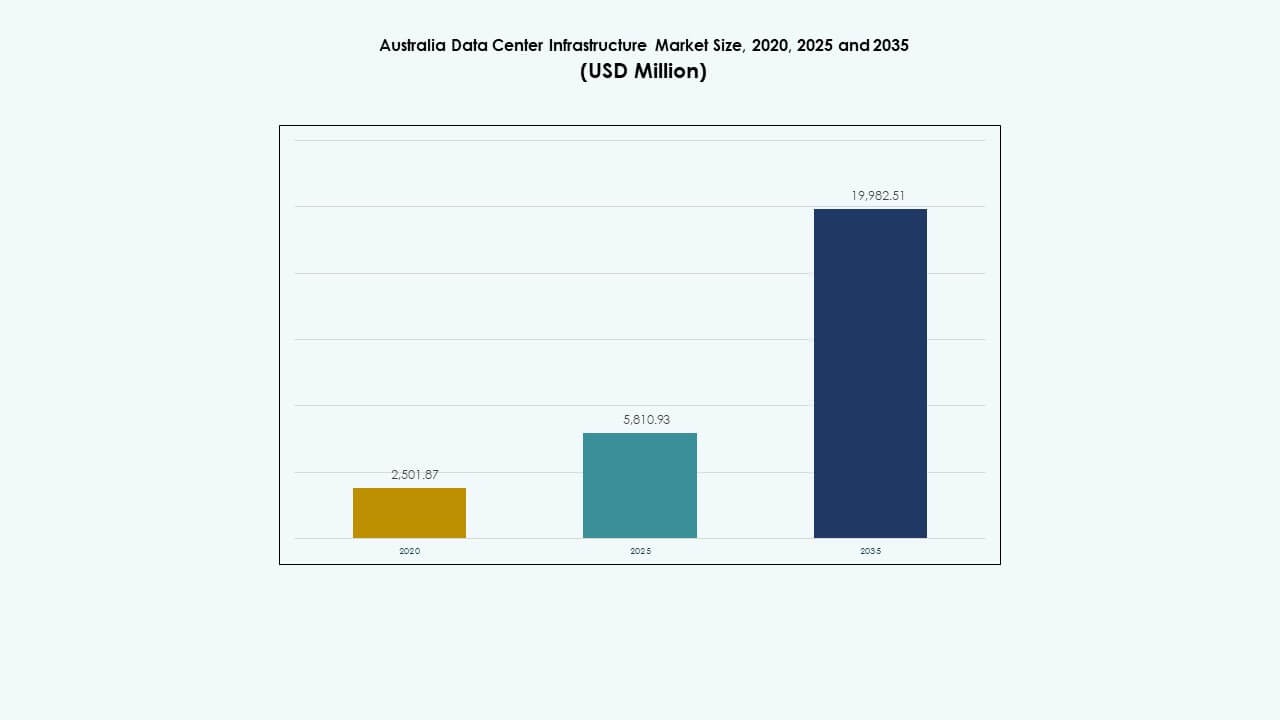

The Australia Data Center Infrastructure Market size was valued at USD 2,501.87 million in 2020 to USD 5,810.93 million in 2025 and is anticipated to reach USD 19,982.51 million by 2035, at a CAGR of 13.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Australia Data Center Infrastructure Market Size 2025 |

USD 5,810.93 Million |

| Australia Data Center Infrastructure Market, CAGR |

13.04% |

| Australia Data Center Infrastructure Market Size 2035 |

USD 19,982.51 Million |

The market is expanding due to rising cloud adoption, AI-driven compute demands, and widespread digitization across sectors. Companies prioritize high-density rack deployment, renewable energy integration, and modular facility builds. Innovation in cooling systems and power redundancy enhances operational resilience. Australia’s strong regulatory framework and cybersecurity focus increase demand for localized, sovereign data hosting. Investors view the market as a stable, high-growth opportunity driven by long-term infrastructure cycles and service consolidation.

New South Wales leads in capacity, driven by Sydney’s concentration of hyperscale and enterprise facilities. Victoria follows, supported by Melbourne’s commercial growth and government tech strategies. Queensland and Western Australia are emerging as strong regional markets due to demand in logistics, mining, and cloud services. Regional expansion reflects efforts to improve connectivity and latency outside metro cores.

Market Drivers

Market Drivers

Expansion of Cloud Adoption and Local Data Hosting Mandates Driving Infrastructure Investments

Cloud service adoption continues to accelerate across Australia, supported by enterprise digitization and regulatory shifts. Local data hosting requirements increase demand for in-country data center capacity. Businesses migrate to cloud platforms to scale services and reduce on-premise costs. Government mandates and cybersecurity frameworks make localized infrastructure a top priority. This creates sustained demand for advanced power, cooling, and IT systems. Major tech players expand regional presence to meet service latency targets. The Australia Data Center Infrastructure Market becomes a key destination for hyperscale deployments. It enables digital resilience and operational agility for public and private sectors.

- For instance, Canberra Data Centres (CDC) secured a AU$91.5 million contract with the Australian Defence Department for data centre services from 2022 to 2025, ensuring compliant local hosting.

Rise of AI, Big Data, and High-Density Computing Demanding Robust Facility Designs

Advanced workloads such as AI training, big data analytics, and GPU-intensive tasks require high-performance infrastructure. Data centers adopt liquid cooling, high-capacity racks, and dense server clusters. This shift drives modernization across both hyperscale and edge facilities. Innovation in thermal management and energy distribution becomes essential. Facility designs now incorporate scalable zones, automation, and environmental controls. These investments ensure operational stability under heavy loads. The Australia Data Center Infrastructure Market sees stronger demand for engineered solutions. It supports future-ready capacity aligned with digital economy needs.

- For instance, Microsoft signed a AU$495 million five-year cloud deal with the Australian Department of Defence, supporting high-density computing for defense applications.

Government Support for Digital Economy and 5G Integration Enhancing Infrastructure Demand

Federal and state-level policies actively promote digital infrastructure expansion. 5G rollout and smart city initiatives create ripple effects across data center design. High-speed networks require distributed nodes and low-latency processing hubs. Government grants and incentives lower barriers to infrastructure projects. Urban development plans integrate tech ecosystems with data facility zones. Partnerships between public agencies and private firms accelerate delivery timelines. The Australia Data Center Infrastructure Market aligns with national goals for innovation and resilience. It becomes central to enabling next-generation connectivity and services.

Growing Emphasis on ESG Compliance and Renewable Integration in Facility Planning

Environmental compliance pressures data center operators to adopt low-impact systems. Renewable energy sourcing and green building certifications become part of design mandates. Operators install solar panels, battery storage, and waste heat recovery units. Water usage efficiency and carbon accounting improve across facilities. Investors demand sustainability disclosures before funding large-scale projects. Energy-as-a-service models gain traction to reduce upfront costs. The Australia Data Center Infrastructure Market prioritizes clean energy integration. It reflects the transition toward low-carbon infrastructure ecosystems.

Market Trends

Market Trends

Rapid Deployment of Modular and Prefabricated Data Center Units Gaining Market Traction

Modular construction enables faster delivery of data center capacity in high-demand regions. Prefabricated systems reduce build time, improve cost certainty, and ensure design consistency. Factory-built modules support incremental expansion for colocation and edge sites. Operators benefit from lower site disruption and better quality control. Disaster recovery zones also adopt prefabricated units for business continuity. Telecom firms scale distributed architecture with modular components. The Australia Data Center Infrastructure Market sees modular builds supporting time-sensitive digital rollouts. It helps operators respond quickly to shifting demand curves.

Rise in Edge Data Center Installations Across Remote and Industrial Zones

Australia’s geographic vastness and industrial distribution drive edge infrastructure demand. Resource-rich states like Western Australia and Queensland need local compute for mining and logistics. Remote health, defense, and telecom sectors deploy edge nodes to minimize latency. Edge sites integrate compact cooling, storage, and networking in smaller footprints. Integration with satellite and terrestrial networks supports connectivity. Private LTE networks further push edge deployments for critical operations. The Australia Data Center Infrastructure Market adapts to dispersed service needs. It enables low-latency processing beyond metro cores.

Integration of AI-Based Operations for Predictive Maintenance and Energy Optimization

AI and machine learning technologies optimize real-time power, cooling, and hardware performance. Predictive analytics detect faults, prevent downtime, and improve uptime SLAs. Digital twins model infrastructure behavior under varying load conditions. Energy efficiency improves through automated adjustments in airflow, temperature, and workload routing. AI-driven insights support better capacity planning and asset lifecycle management. The Australia Data Center Infrastructure Market embraces intelligent infrastructure management. It aligns with operator goals for performance, cost, and reliability.

Strengthening Cybersecurity Infrastructure to Support Critical Workloads and Compliance

Cyber risk is rising across cloud and on-premise deployments. Data center operators invest in advanced network segmentation, zero-trust models, and encryption protocols. Facilities house high-assurance zones for government and financial workloads. Regulatory compliance demands regular audits, access control, and physical security upgrades. Private sector firms deploy SIEM and threat detection platforms. Demand for cyber-resilient infrastructure fuels hardware and software upgrades. The Australia Data Center Infrastructure Market integrates physical and digital protection layers. It ensures service continuity amid rising security threats.

Market Challenges

Market Challenges

High Electricity Costs and Grid Dependency Impacting Operating Margins and Scalability

Australia’s data centers face high power tariffs across several states. Electricity prices account for over 40% of operating costs in some facilities. Grid instability in rural or fast-growing regions complicates site planning. Peak demand periods raise concerns over supply reliability. Operators invest in energy storage and microgrid systems to hedge risks. Transitioning to renewable energy contracts is still cost-intensive for mid-sized players. The Australia Data Center Infrastructure Market must navigate utility cost volatility. It challenges profitability and investment planning.

Land Availability, Approval Delays, and Workforce Shortages Slowing Deployment Timelines

Large-scale data centers require expansive, well-connected sites with zoning approvals. Urban saturation limits space in Sydney and Melbourne, pushing expansion into outer regions. Approval cycles often stretch 12–24 months due to environmental and infrastructure impact reviews. Skilled construction and engineering labor remains in short supply. Cross-state regulations create added compliance burden for multi-location operators. These hurdles delay project completion and raise development risk. The Australia Data Center Infrastructure Market must overcome supply-side bottlenecks. It limits pace of capacity growth.

Market Opportunities

Government-Backed Digital Infrastructure Initiatives Driving Hyperscale and Regional Projects

Public-private partnerships and funding support long-term infrastructure roadmaps. Government agencies prioritize secure, sovereign hosting for sensitive data. National strategies include rural connectivity, edge deployments, and interconnect upgrades. Operators gain access to fast-track permits and subsidy programs. The Australia Data Center Infrastructure Market benefits from long-horizon policy stability. It creates predictable opportunities for both incumbents and new entrants.

AI and High-Performance Workloads Creating Demand for Advanced Infrastructure Solutions

Data-heavy sectors including healthcare, research, and media increase demand for scalable IT environments. AI model training and analytics workloads need high-density racks and liquid cooling. Facility upgrades target performance, sustainability, and compute flexibility. The Australia Data Center Infrastructure Market adapts to host critical workloads efficiently. It enables service providers to unlock high-value customer segments.

Market Segmentation

By Infrastructure Type

Electrical infrastructure holds a dominant share due to high emphasis on power reliability. Mechanical infrastructure also sees robust growth led by cooling system upgrades. Civil, structural, and architectural work drives initial capital spend during new site construction. IT and network infrastructure upgrades align with digital transformation needs. The Australia Data Center Infrastructure Market integrates all four components to ensure facility efficiency and uptime.

By Electrical Infrastructure

Uninterruptible power supplies (UPS) and power distribution units (PDUs) lead demand under this segment. Battery energy storage systems are growing due to renewable integration and power backup needs. Switchgears and transfer switches enable reliable switching during faults or grid instability. Utility grid connections remain essential for primary energy sourcing. The Australia Data Center Infrastructure Market sees ongoing upgrades in power continuity systems.

By Mechanical Infrastructure

Cooling units and chillers dominate mechanical infrastructure spend due to rising rack density. Containment systems and efficient airflow management improve energy usage. Pumps and piping systems form critical backend components. Operators shift toward liquid and hybrid cooling for high-performance setups. The Australia Data Center Infrastructure Market adopts scalable mechanical systems to meet future workloads.

By Civil / Structural & Architectural

Site preparation and superstructure framing take up major capital in greenfield builds. Building envelopes and modular construction enable flexibility and speed. Raised floors and ceilings support structured cabling and airflow. The Australia Data Center Infrastructure Market leverages civil engineering to optimize layouts. It ensures physical robustness, energy efficiency, and maintenance access.

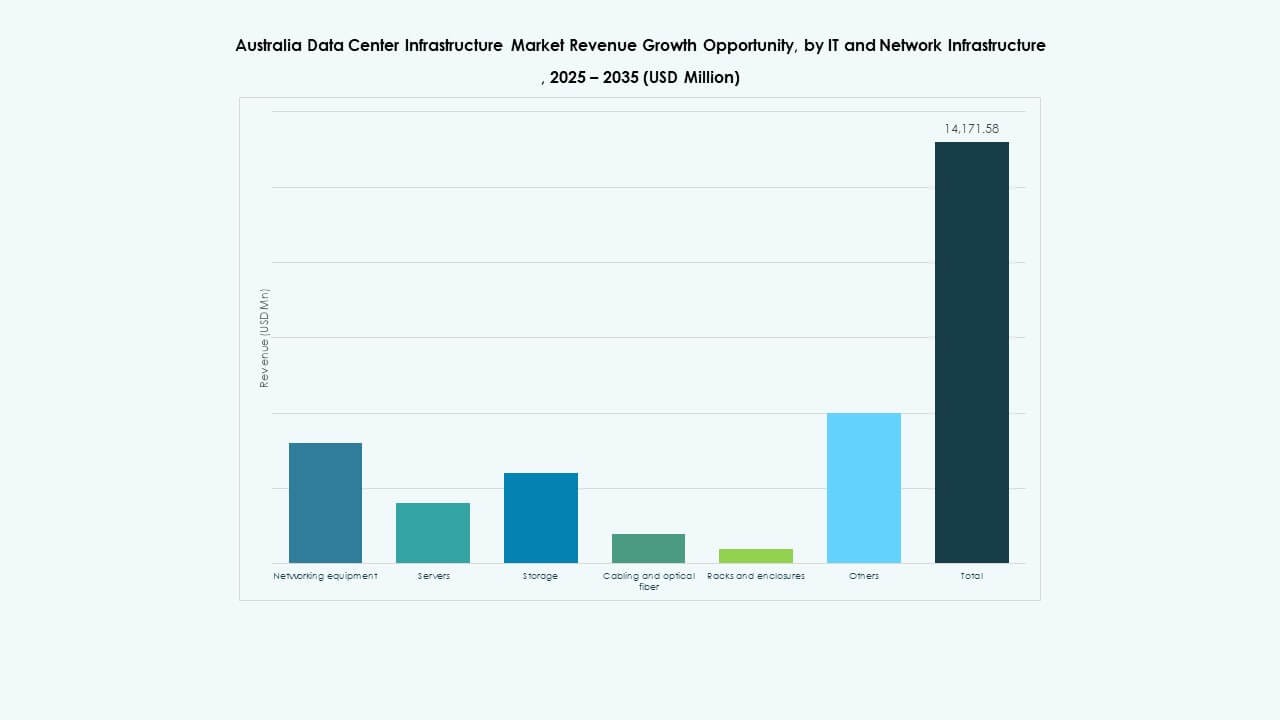

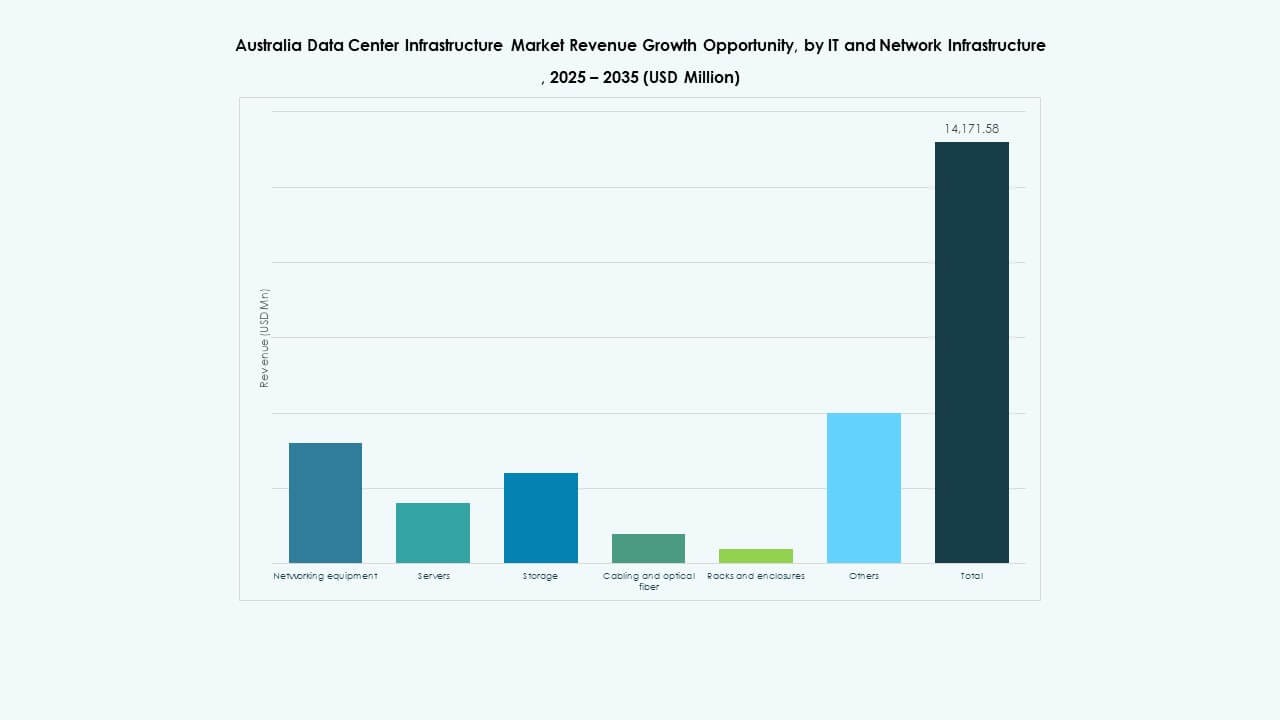

By IT & Network Infrastructure

Networking equipment, servers, and storage dominate IT investments. Cabling and fiber backbone upgrades improve latency and transfer speeds. Rack systems evolve for higher load support and improved access. The Australia Data Center Infrastructure Market reflects rising demand for compute and interconnect. It supports cloud, enterprise, and telco customers with advanced IT infrastructure.

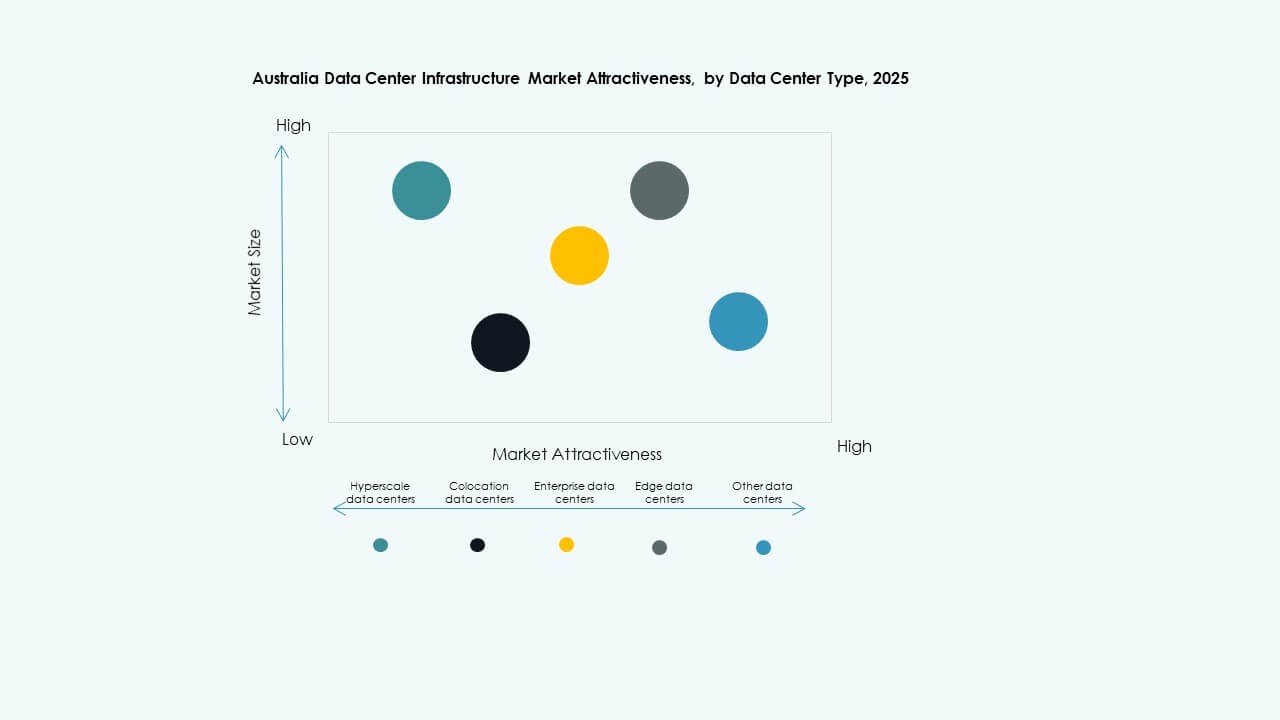

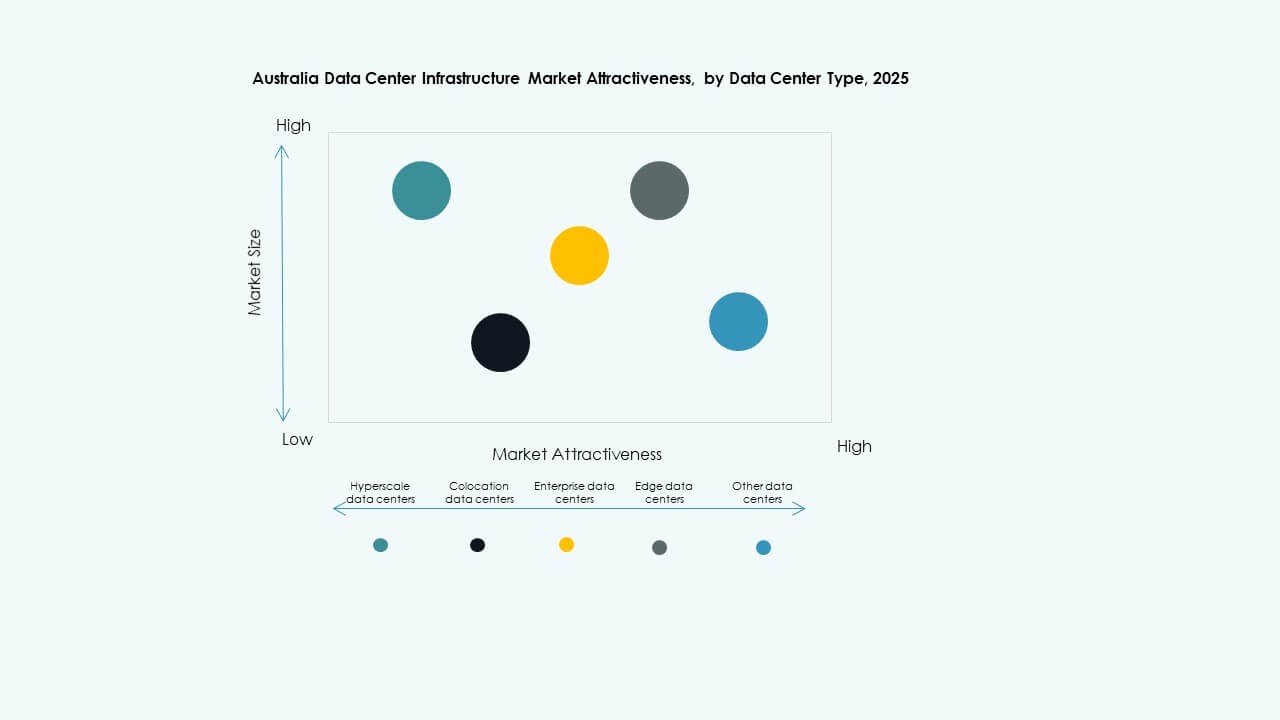

By Data Center Type

Hyperscale data centers hold the largest share due to tech giants’ expansion. Colocation facilities grow with demand from mid-sized enterprises. Edge data centers are emerging across non-metro areas to support 5G and IoT. The Australia Data Center Infrastructure Market shows increasing diversification by type. It reflects evolving customer demands and service proximity needs.

By Delivery Model

Design-build or EPC dominates new builds with integrated project execution. Retrofit and modular factory-built models are gaining traction for edge and legacy upgrades. Construction management sees use in multi-phase expansions. Turnkey delivery ensures faster rollout with single-vendor control. The Australia Data Center Infrastructure Market aligns delivery with scale, speed, and site complexity.

By Tier Type

Tier 3 data centers hold the majority share with balanced redundancy and efficiency. Tier 4 is gaining momentum for mission-critical services in financial and government sectors. Tier 1 and Tier 2 serve edge and smaller enterprises with lower availability needs. The Australia Data Center Infrastructure Market supports multi-tier development. It caters to varied uptime and risk profiles across users.

Regional Insights

Regional Insights

New South Wales Leads with 38% Share Driven by Sydney’s Hyperscale Growth

Sydney remains the primary data center hub in Australia due to strong subsea cable access and enterprise presence. It houses the majority of hyperscale and cloud deployments. High network redundancy and electricity access attract multinational operators. The state’s policy support and commercial demand strengthen its market lead. The Australia Data Center Infrastructure Market concentrates most capacity around Sydney and Western Sydney zones.

- For instance, in 2024, NEXTDC acquired a 258,000 sqm site in Eastern Creek, Sydney, with planned capacity of up to 550 MW. The site is positioned near major power and fiber infrastructure to support hyperscale data center development.

Victoria Holds 27% Share Supported by Government Projects and Commercial Uptake in Melbourne

Melbourne continues to attract investment with its tech-forward ecosystem and urban planning. Government workloads and enterprise demand drive colocation and hyperscale builds. Victoria supports sustainability and digital infrastructure goals through active public programs. Proximity to national backbone routes enables interconnection at scale. Its share reflects a growing preference for dual-region deployments across eastern Australia.

- For instance, the Victorian government launched a Sustainable Data Centre Action Plan with AUD 5.5 million in funding to promote energy‑efficient infrastructure. This funding supports government workloads and expands colocation and hyperscale data center developments statewide.

Queensland, Western Australia, and ACT Emerging with Combined 21% Share

Queensland and WA see expansion due to edge deployments, mining digitization, and industrial cloud services. Brisbane, Perth, and regional cities offer untapped demand for latency-sensitive workloads. The ACT gains traction from defense and federal digital transformation plans. These regions attract mid-sized operators seeking land, power, and lower competition. The Australia Data Center Infrastructure Market gains depth across secondary regions.

Competitive Insights:

- Schneider Electric

- Vertiv Group Corp.

- Huawei Technologies Co., Ltd.

- Delta Electronics

- ABB

- Cisco Systems, Inc.

- Dell Inc.

- Fujitsu

- IBM

- Cummins

The Australia Data Center Infrastructure Market remains competitive, led by global and regional technology firms with strong portfolios in power, cooling, and IT systems. Schneider Electric and Vertiv dominate electrical and mechanical infrastructure supply, offering modular and energy-efficient systems. Huawei and Cisco focus on advanced network solutions, while Dell and Fujitsu support compute and storage demand across enterprise and cloud deployments. Cummins and ABB supply backup power and grid integration technologies. Local customization, energy efficiency, and support capabilities influence buyer preference. Companies expand partnerships with hyperscale operators and construction firms to gain market access. The Australia Data Center Infrastructure Market continues to attract innovation-driven players seeking long-term projects across hyperscale, colocation, and edge deployments. It encourages product localization and lifecycle service offerings to maintain competitive positioning.

Recent Developments:

- In December 2025, Australia’s data center infrastructure market, OpenAI signed a key partnership. OpenAI entered an MoU with Australian firm NEXTDC to develop local AI infrastructure, leading to a $7 billion next-generation data center at NEXTDC’s S7 site in Eastern Creek, Sydney.

- In December 2025, Australian Data Centres (ADC) finalized the acquisition of a data center campus in Fyshwick from Verizon. The deal secured existing capacity and adjacent land for a new sovereign and scalable facility supporting government and enterprise needs.

- In June 2025, Amazon announced a major investment commitment. Amazon plans to invest A$20 billion (about $12.97 billion) from 2025 to 2029 to expand, operate, and maintain its data center infrastructure, focusing on new server capacity for generative AI workloads and including three new solar energy facilities in Victoria and Queensland.

- In March 2025, Partners Group announced the acquisition of Australian data center firm GreenSquareDC with an investment of up to AU$1.2 billion. The transaction will build GreenSquareDC into a next‑generation platform across major cities, expanding sustainable data center services and capacity under long‑term contracts.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights