Executive summary:

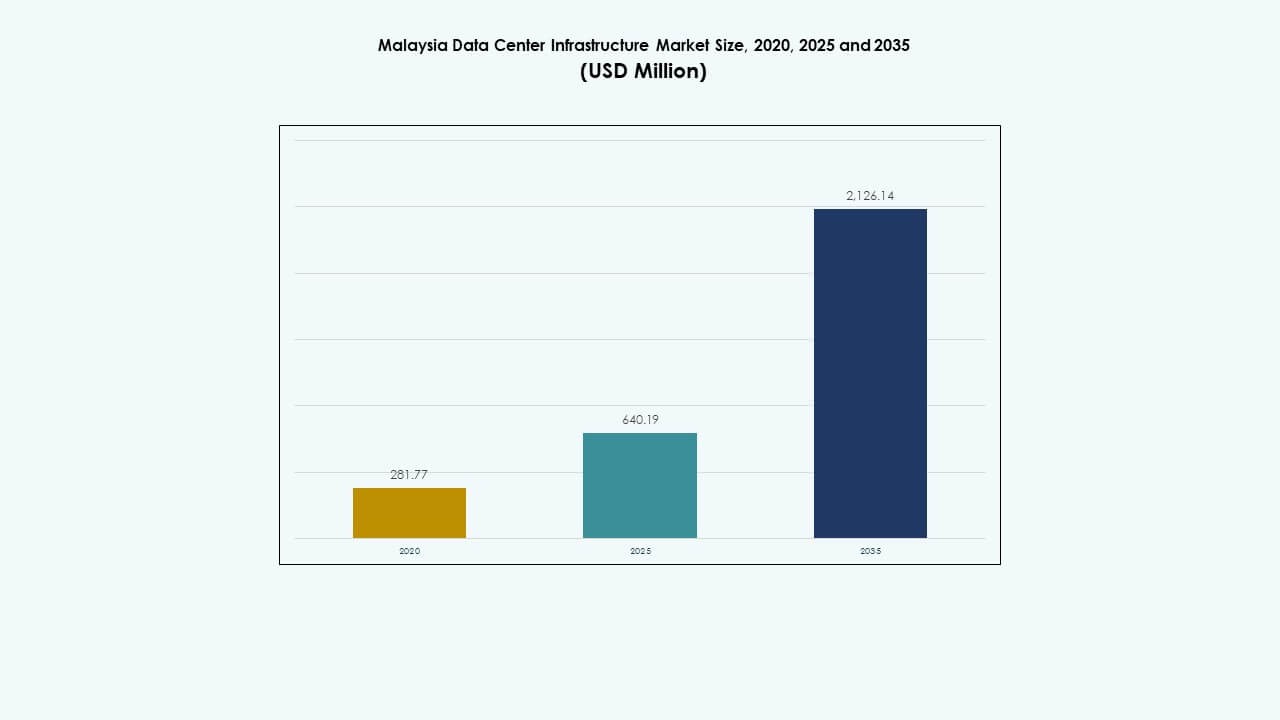

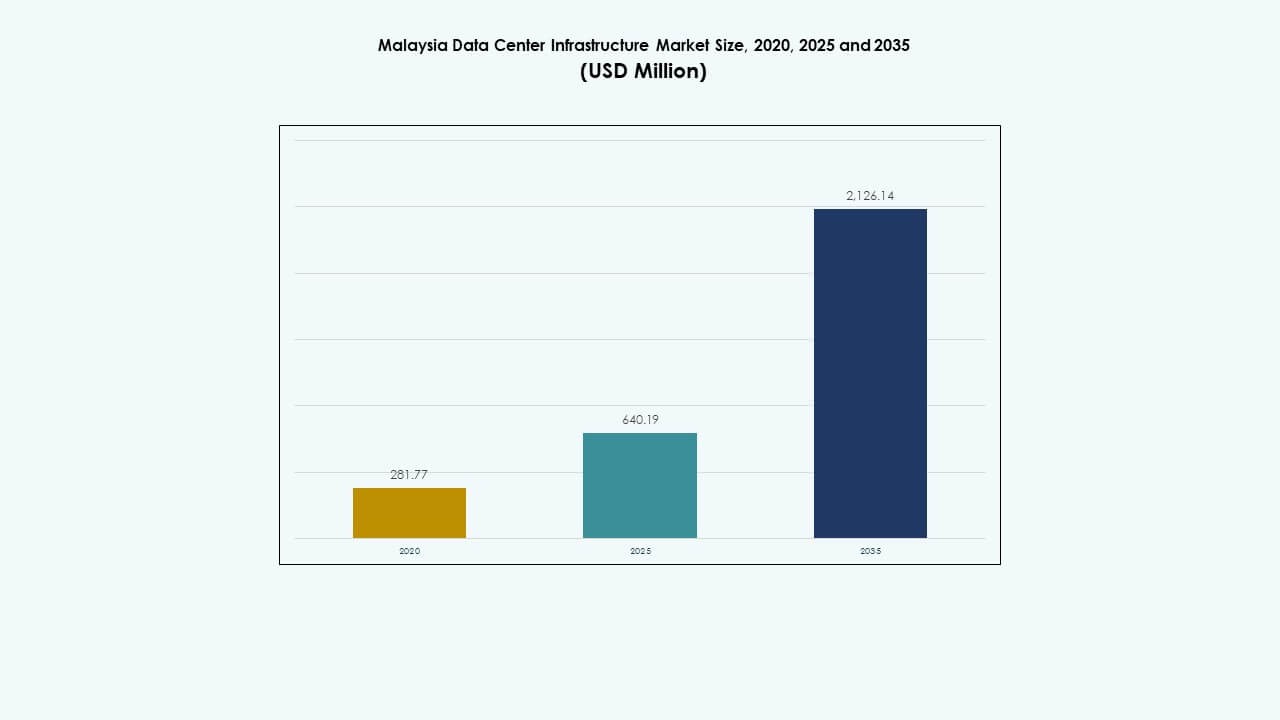

The Malaysia Data Center Infrastructure Market size was valued at USD 281.77 million in 2020 to USD 640.19 million in 2025 and is anticipated to reach USD 2,126.14 million by 2035, at a CAGR of 12.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Malaysia Data Center Infrastructure Market Size 2025 |

USD 640.19 Million |

| Malaysia Data Center Infrastructure Market, CAGR |

12.65% |

| Malaysia Data Center Infrastructure Market Size 2035 |

USD 2,126.14 Million |

The market is fueled by rising cloud adoption, AI-driven workloads, and a shift toward hybrid IT models. Operators invest in modular power, advanced cooling, and high-density IT infrastructure to support digital transformation. Enterprises demand scalable and energy-efficient systems to enable real-time processing, edge computing, and automation. Malaysia’s strategic location, policy support, and robust connectivity attract hyperscalers and regional data center operators. This positions the market as a key hub in Southeast Asia’s digital infrastructure landscape.

Klang Valley leads due to mature network access, enterprise presence, and established colocation zones. Johor is emerging as a regional hotspot, driven by proximity to Singapore, land availability, and new hyperscale projects. Penang and surrounding regions are also gaining traction, supported by industrial growth and increasing demand for distributed edge nodes. These locations support diverse deployment needs across financial, logistics, and cloud segments.

Market Drivers

Market Drivers

Cloud Integration, AI Workloads, and IoT Expansion Accelerate Infrastructure Modernization Across Data Centers

Malaysia’s shift toward digital-first strategies boosts investments in scalable and intelligent data center infrastructure. Cloud adoption from enterprises and public agencies fuels demand for next-gen electrical and mechanical components. AI workloads and IoT deployment require higher processing density and real-time data handling. Companies adopt liquid cooling, containerized designs, and scalable power systems to meet new IT requirements. The Malaysia Data Center Infrastructure Market gains from this wave of innovation and system upgrades. IT infrastructure vendors expand modular rack solutions to support rapid deployment. Global operators prioritize Malaysia for hybrid workloads requiring regional presence. Automation in power, cooling, and security management enhances operational visibility and energy efficiency. Strategic focus on low-latency digital services drives sustained infrastructure refresh cycles.

- For instance, Huawei’s FusionServer 2488H V6 deploys four 3rd Gen Intel Xeon Scalable processors in a 2U space, supporting 48 DDR4 DIMMs for up to 18TB memory capacity with Optane PMem in high-density AI scenarios.

Digital Policy Push and Strategic Location Reinforce Market Attractiveness for Investors and Cloud Providers

Government initiatives like MyDIGITAL and JENDELA continue to strengthen digital infrastructure foundations. Malaysia’s submarine cable links, cross-border fiber routes, and regulatory openness attract cloud majors and colocation operators. Digital hubs in Klang Valley and Johor gain traction due to incentives and land availability. The Malaysia Data Center Infrastructure Market benefits from increasing enterprise confidence in cloud adoption and interconnection growth. Financial institutions, telecom firms, and logistics players lead investments in private and hybrid IT setups. Edge computing readiness and digital sovereignty priorities further encourage local hosting. Multi-cloud architecture growth leads to demand for flexible and scalable network infrastructure. Malaysia’s position as a digital bridge between Singapore, Indonesia, and the wider ASEAN region drives cross-border deployments.

Enterprise Hybrid IT Evolution and Remote Work Models Accelerate Edge Deployments

Large enterprises restructure IT strategies around hybrid and distributed architecture. Remote operations, cloud collaboration tools, and rising cybersecurity needs change data center demand profiles. Edge data centers reduce latency, support real-time analytics, and improve application responsiveness. The Malaysia Data Center Infrastructure Market evolves with more edge nodes and modular edge systems deployed across urban and semi-urban areas. Retail, manufacturing, and logistics firms prefer regionally distributed infrastructure for better service availability. Equipment manufacturers offer containerized solutions with integrated power and cooling to enable quicker deployment. These trends increase investments in scalable, prefabricated components. Enterprises seek high reliability while controlling energy usage, pushing adoption of advanced UPS, PDUs, and rack-level cooling systems.

- For instance, Dell’s PowerEdge XR12 is a rugged 2U edge server supporting NVMe storage, up to 1TB memory, and designed for real-time IoT analytics in harsh environments.

Sustainable Infrastructure and Green Data Center Goals Reshape Equipment Preferences

Energy use, carbon emissions, and cooling efficiency become critical design considerations. Operators shift to high-efficiency chillers, liquid cooling, and intelligent airflow systems. Modular UPS systems, battery energy storage, and renewable integration gain attention across new build projects. The Malaysia Data Center Infrastructure Market attracts investors aligned with ESG goals. Certifications such as LEED and ISO 50001 influence equipment procurement. Smart building controls and predictive maintenance tools help reduce downtime and improve performance. Integration of real-time monitoring software across electrical and mechanical systems improves efficiency tracking. Equipment vendors offer lifecycle energy analytics, enabling optimized operation and maintenance. These drivers reshape future infrastructure buildouts toward energy-optimized and environmentally responsible facilities.

Market Trends

Market Trends

Subsea Cable Growth and Interconnection Services Fuel Network-Centric Infrastructure Expansion

Malaysia’s increasing role as a regional data transit hub drives demand for high-speed interconnection infrastructure. Growth in subsea cables linking to the U.S., China, and Southeast Asia raises bandwidth capacity across key landing stations. The Malaysia Data Center Infrastructure Market benefits from this trend through rising deployment of routers, switches, and optical fiber. Telecom operators expand cross-border connections with Singapore and Indonesia for redundancy. Carriers and hyperscalers co-locate near cable landing stations to lower transmission latency. Multi-tenant data centers invest in optical backbones and dark fiber links to support content providers. Neutral internet exchange points enable better peering and traffic distribution. Network redundancy and ultra-low latency connections become critical differentiators.

Liquid Cooling and Immersion Technologies Gain Momentum for High-Density Computing Needs

AI models, ML algorithms, and advanced simulation workloads require dense computing hardware. Traditional air cooling becomes inefficient for racks drawing 30–50 kW or more. Data center operators explore cold-plate liquid cooling, rear-door heat exchangers, and immersion setups. The Malaysia Data Center Infrastructure Market incorporates such solutions into hyperscale and high-density enterprise zones. Vendors launch modular liquid-cooling kits for GPUs and AI servers. Operators design mechanical systems to support dual-phase immersion tanks with reduced water usage. These technologies improve PUE and extend rack capacity without increasing footprint. Smart controls automate fluid temperature regulation for different rack zones.

Smart Infrastructure Integration Boosts Predictive Maintenance and Resource Optimization

Data centers adopt intelligent control systems across electrical and mechanical domains. Real-time monitoring, sensor fusion, and predictive analytics enable faster fault detection and energy management. The Malaysia Data Center Infrastructure Market sees growth in integrated software platforms tied to UPS, chillers, batteries, and PDUs. Operators implement DCIM and BMS tools with AI-driven optimization features. Infrastructure automation helps reduce human error and manage demand spikes. Asset tracking and thermal imaging enhance equipment maintenance planning. Facility managers receive alerts before potential failures, reducing downtime risk. Smarter infrastructure improves asset lifespan, operational visibility, and environmental compliance.

Colocation Shift Toward Hyperscale Pods with Modular and Prefab Construction

Colocation facilities move away from traditional multi-tenant halls toward hyperscale-ready pods. Operators use prefabricated modules, integrated power blocks, and factory-assembled infrastructure units. This approach shortens build time and ensures consistency. The Malaysia Data Center Infrastructure Market adopts modular EPC delivery for large projects. Developers align pod designs with tenant-specific load, redundancy, and cooling requirements. Site preparation aligns with just-in-time module delivery. Mechanical and civil systems are pre-tested at factory level for faster commissioning. This model appeals to hyperscale firms seeking regional expansion without lengthy construction timelines.

Market Challenges

Market Challenges

Grid Reliability, Power Pricing Volatility, and Delays in Utility Access Impact Scalability

Power availability remains a major constraint in developing large-scale data centers in some regions. Grid constraints, long lead times for substation upgrades, and fluctuating tariffs affect cost predictability. The Malaysia Data Center Infrastructure Market faces challenges in securing multi-MW utility access for hyperscale builds. Developers often face project delays due to transformer procurement or switchgear installation backlogs. Rising energy costs reduce ROI for colocation and enterprise builds. Operators must invest in backup generators, energy storage, and demand response strategies. This increases upfront CAPEX and operational complexity. Regulatory delays in approvals for grid interconnections add uncertainty to expansion plans.

Skilled Workforce Shortages and Supply Chain Disruptions Hinder Infrastructure Deployment

Malaysia lacks a deep pool of skilled technicians for specialized data center infrastructure work. Roles in electrical design, commissioning, thermal engineering, and DCIM implementation remain difficult to fill. The Malaysia Data Center Infrastructure Market sees longer project cycles due to skill gaps. International vendors often need to bring in external consultants, increasing deployment costs. Supply chain bottlenecks for PDUs, chillers, and fiber cabling also delay installation timelines. Geopolitical tensions, port congestion, and raw material shortages impact availability of imported components. Lead times for high-capacity UPS and containment systems have lengthened post-pandemic.

Market Opportunities

AI, Smart Nation Plans, and Localized Cloud Zones Open New Growth Avenues

Malaysia’s AI roadmap, Industry 4.0 programs, and Smart City initiatives create steady demand for advanced data centers. The Malaysia Data Center Infrastructure Market benefits from growing AI model training, edge AI inference, and real-time data applications. New demand arises from connected traffic systems, predictive healthcare, and public safety AI platforms. Domestic cloud zones launched by major hyperscalers offer localization benefits and compliance assurance. Local partners engage in retrofitting and modular builds to support distributed demand nodes.

Renewable Energy Integration, Green Tax Incentives, and ESG Goals Create Sustainability-Focused Investments

Investors target green-certified campuses powered by solar, hydro, or bioenergy sources. The Malaysia Data Center Infrastructure Market aligns with national climate goals through energy-efficient builds and equipment upgrades. Developers receive incentives for green building certification, high PUE standards, and low-carbon materials. Battery storage, DC power distribution, and efficient cooling systems enhance sustainability metrics. ESG-driven capital prioritizes long-term projects with environmental transparency.

Market Segmentation

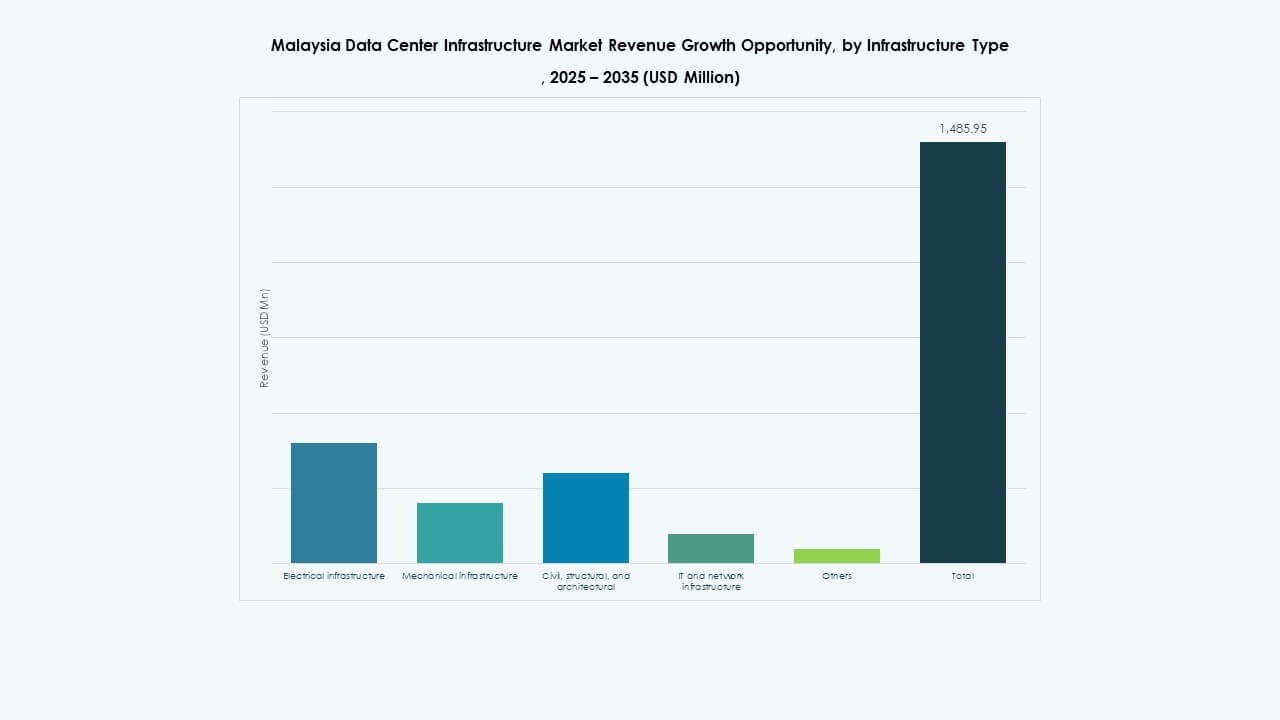

By Infrastructure Type

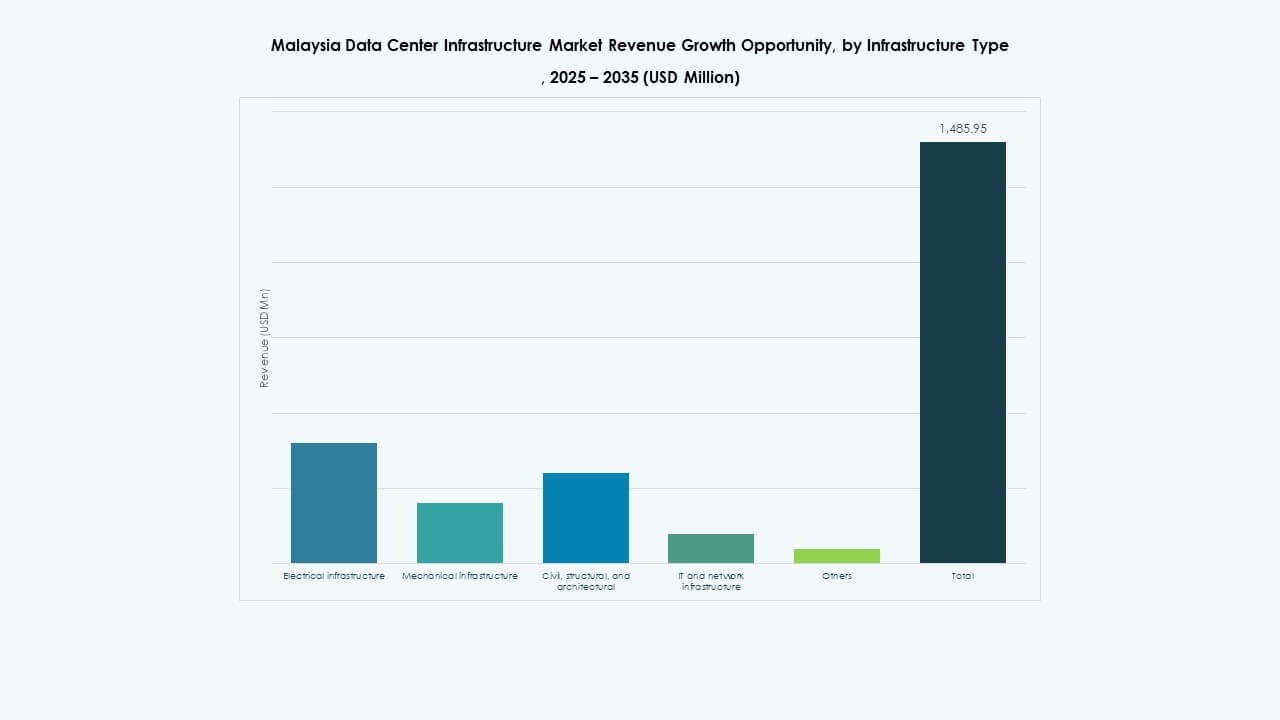

The Malaysia Data Center Infrastructure Market is led by electrical and mechanical infrastructure, which together account for the majority of CAPEX. Electrical systems like UPS and PDUs are critical due to the need for uninterrupted operations and redundancy. Mechanical systems such as chillers and cooling units support increasing rack densities. IT and network infrastructure follows closely, driven by cloud migration and edge deployments. Civil and architectural elements are evolving with modular builds and seismic-compliant superstructures.

By Electrical Infrastructure

Uninterruptible power supply (UPS) and battery energy storage systems dominate this segment. These systems are vital to ensure uptime and reduce grid dependence. Power distribution units and switchgear follow due to expansion of Tier III and Tier IV facilities. The Malaysia Data Center Infrastructure Market sees rising interest in lithium-ion batteries over traditional lead-acid. Utility connection challenges lead many developers to rely on modular power blocks and onsite substations for fast deployment.

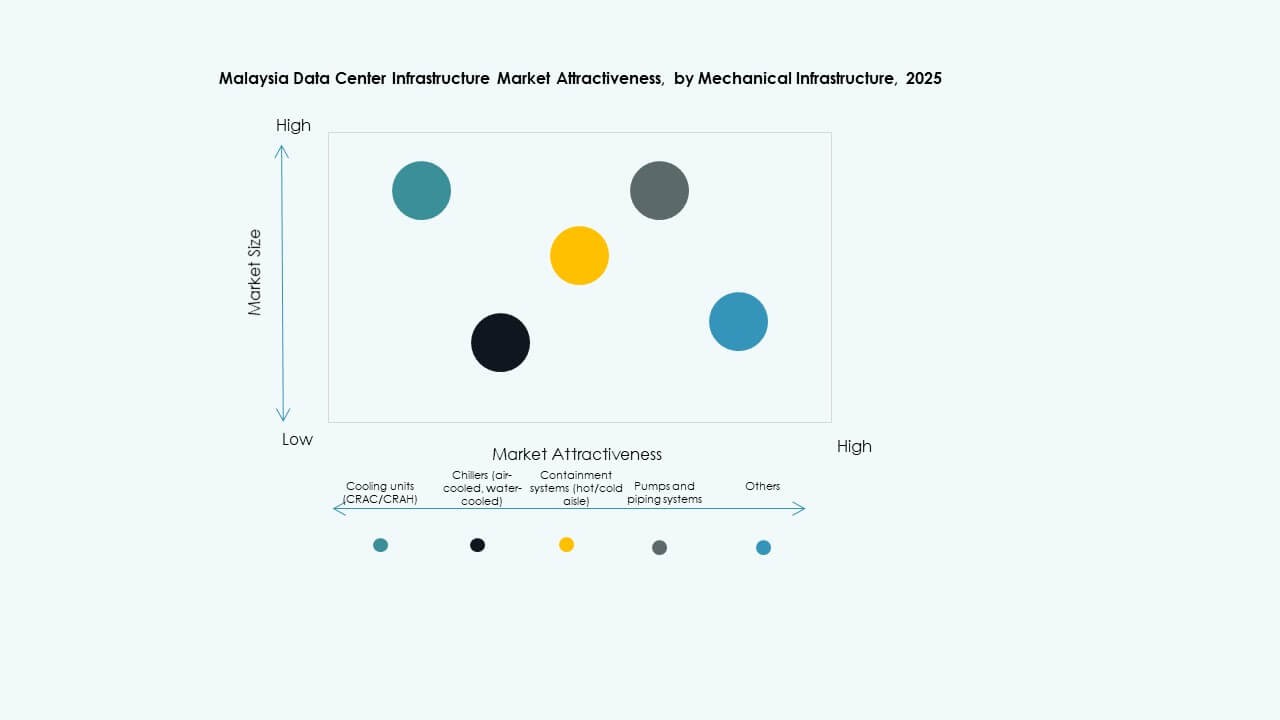

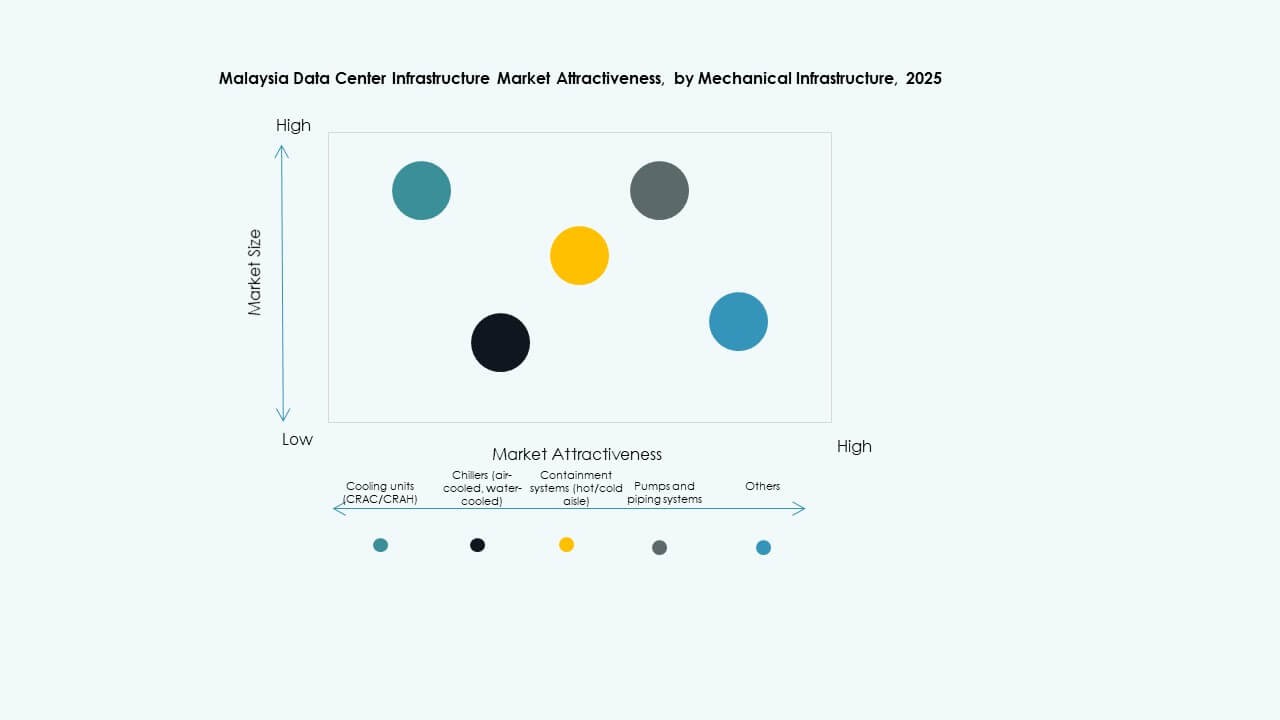

By Mechanical Infrastructure

Chillers and containment systems lead mechanical infrastructure spending due to increasing heat loads from AI and HPC. Operators implement aisle containment to improve airflow management and cooling efficiency. Pumps and piping systems see rising demand in liquid cooling environments. Cooling units are evolving toward variable-speed and inverter-driven designs to reduce energy waste. The Malaysia Data Center Infrastructure Market supports this shift by prioritizing energy efficiency and uptime in both hyperscale and enterprise builds.

By Civil / Structural & Architectural

Superstructure and building envelope components represent the highest share of construction costs. Developers use raised floors and modular wall systems to allow flexibility in equipment layout. Site preparation gains importance due to land-use optimization and environmental compliance. The Malaysia Data Center Infrastructure Market sees interest in prefab modular systems for quicker buildouts. Seismic resilience and weather-proof designs add long-term value. Local contractors increasingly adopt international standards to meet investor expectations.

By IT & Network Infrastructure

Networking equipment and cabling lead this segment, driven by interconnectivity and peering demand. Storage and servers are often deployed by tenants, but colocation operators still invest in base systems for managed services. Racks and enclosures must support dense loads and advanced airflow designs. The Malaysia Data Center Infrastructure Market gains traction with vendors offering pre-integrated IT stacks. Optical fiber adoption supports higher bandwidth and low-latency requirements across hyperscale and enterprise tenants.

By Data Center Type

Hyperscale and colocation data centers dominate the landscape, together holding the largest share. Hyperscale growth comes from global cloud firms, while local enterprises and government workloads support colocation. Edge data centers gain traction for latency-sensitive applications in logistics and retail. Enterprise and other niche data centers contribute a smaller share. The Malaysia Data Center Infrastructure Market favors Tier III or IV colocation builds with rapid expansion capacity.

By Delivery Model

Design-build or EPC remains the most preferred model for large greenfield projects. Turnkey delivery is favored by international hyperscalers to minimize coordination risks. Retrofit projects are common in metro areas with legacy infrastructure. Modular factory-built models are gaining interest for edge and remote deployments. Construction management is used in multi-phase or tenant-specific rollouts. The Malaysia Data Center Infrastructure Market supports flexible delivery methods based on speed, complexity, and scalability.

By Tier Type

Tier III dominates due to balance between cost and resilience, covering most enterprise and hyperscale needs. Tier IV facilities are gaining in regulated sectors like finance and government. Tier I and II are limited to edge deployments and backup facilities. The Malaysia Data Center Infrastructure Market shows a steady shift toward Tier III+ with N+1 redundancy and energy-efficient configurations. Tier certification remains a key value proposition for new facility announcements.

Regional Insights

Klang Valley Remains the Core Hub with Over 60% Market Share

Klang Valley, including Cyberjaya and Kuala Lumpur, dominates the Malaysia Data Center Infrastructure Market with over 60% share. Its strong fiber network, proximity to financial districts, and mature real estate options make it ideal for hyperscale and enterprise deployments. Government support, such as MSC Malaysia incentives, continues to attract local and global players. The region houses multiple carrier-neutral facilities, cloud zones, and campus-style data centers. Continuous power availability and access to technical talent add further strength.

- For instance, Equinix’s KL1 facility in Cyberjaya provides 900 cabinets across 2,630 square meters of colocation space upon full build-out.

Johor Emerges with 25% Market Share Driven by Cross-Border Demand from Singapore

Johor is rapidly becoming Malaysia’s secondary data center region, capturing nearly 25% of the market. Its proximity to Singapore allows hyperscalers and operators to serve spillover demand. Land availability, competitive electricity rates, and state-level incentives make Johor attractive for expansion. Mega campus projects with over 100 MW capacity are under development in Sedenak and Nusajaya. The Iskandar region aligns with Malaysia’s Southern Digital Gateway strategy, drawing long-term cloud investments.

- For instance, Equinix acquired 14,300 square meters of land near KL1 in Cyberjaya for RM23 million to expand capacity serving regional demand.

Penang and Emerging Regions Account for 15% Market Share Due to Industrial Demand and Connectivity Projects

Penang and other emerging areas contribute the remaining 15% of the market. Penang benefits from its electronics manufacturing base and deep-sea port. Subsea cable landings and industrial estates support edge deployments and high-performance workloads. Other regions like Sarawak and Sabah see pilot data centers focusing on public cloud and edge. These locations support distributed deployments, disaster recovery, and green data center initiatives using hydro energy.

Competitive Insights:

Competitive Insights:

- AIMS Data Centre

- EdgeConneX

- Yondr Group

- Equinix, Inc.

- Huawei Technologies Co., Ltd.

- Schneider Electric

- Vertiv Group Corp.

- Dell Inc.

- Cisco Systems, Inc.

- Delta Electronics

The Malaysia Data Center Infrastructure Market features strong competition among global data center operators and specialized equipment providers. AIMS Data Centre and EdgeConneX drive local growth through colocation capacity and carrier-neutral facilities. Equinix and Yondr expand hyperscale footprints to meet cloud and enterprise demand. Infrastructure vendors like Schneider Electric, Vertiv, and Huawei offer complete solutions across power, cooling, and monitoring systems. Dell and Cisco focus on scalable IT and network infrastructure for hybrid workloads. Players compete on energy efficiency, speed of deployment, and modular design flexibility. Strong government support and digital investment zones attract new entrants. Market leaders form strategic partnerships with telcos, utilities, and cloud firms to secure long-term contracts and power availability. It remains attractive for firms targeting ASEAN’s digital expansion and edge computing growth.

Recent Developments:

- In December 2025, GIBO announced a strategic collaboration with E Total Technology Sdn Bhd to accelerate AI infrastructure development and enhance high-performance computing capabilities in Malaysia

- In November 2025, Yondr Group completed the sale of its 300 MW hyperscale data center campus in Johor to Vantage Data Centers as part of a $1.6 billion APAC investment.

- In October 2024, Bridge Data Centres, through a joint venture with Mah Sing, planned to develop new data centers outside Kuala Lumpur, marking a key expansion in Malaysia’s data center infrastructure via strategic partnership

- In August 2024, Vantage Data Centers announced the start of construction on its KUL2 campus in Cyberjaya, an AI-ready facility with 256 MW power capacity, representing a significant new infrastructure launch.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Competitive Insights:

Competitive Insights: