Executive summary:

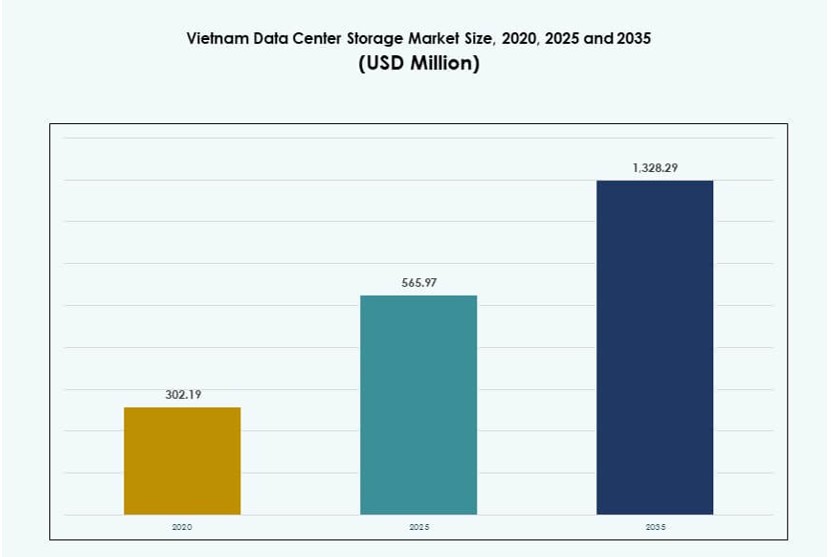

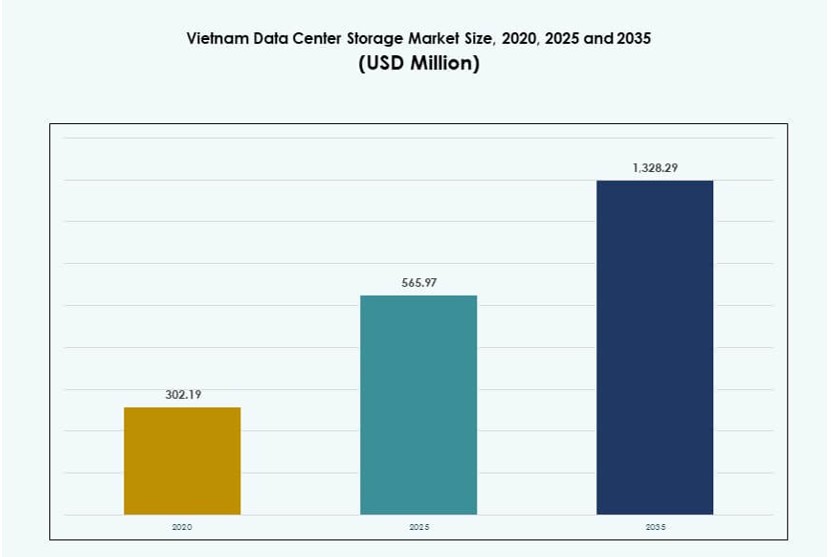

The Vietnam Data Center Storage Market size was valued at USD 302.19 million in 2020 to USD 565.97 million in 2025 and is anticipated to reach USD 1,328.29 million by 2035, at a CAGR of 8.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Vietnam Data Center Storage Market Size 2025 |

USD 565.97 Million |

| Vietnam Data Center Storage Market, CAGR |

8.82% |

| Vietnam Data Center Storage Market Size 2035 |

USD 1,328.29 Million |

Vietnam’s rapid digitalization is fueling demand for reliable, scalable, and high-performance storage infrastructure. The rise of e-commerce, fintech, cloud-native applications, and AI workloads is pushing enterprises to adopt software-defined storage and flash-based systems. Government-led digital transformation initiatives and data localization regulations are expanding local storage footprints. The market holds strategic relevance for telecom providers, colocation operators, and global cloud vendors seeking edge presence in Southeast Asia. It supports real-time analytics, low-latency operations, and secure archiving.

Ho Chi Minh City dominates the storage infrastructure landscape, driven by hyperscale projects, telecom hubs, and enterprise demand. Hanoi is gaining traction with smart city deployments and public-sector digital programs. Binh Duong and Da Nang are emerging as secondary hubs due to improved fiber, land incentives, and industrial expansion. Regional disparity in infrastructure remains, but government incentives continue to attract investment across provinces.

Market Dynamics:

Market Drivers

Rapid Digital Transformation Across Key Industries and Growing Need for Scalable Storage Infrastructure

Vietnam’s digital economy is expanding rapidly due to e-commerce, fintech, and public sector digitization. Enterprises in sectors such as banking, retail, and logistics demand scalable, high-availability data infrastructure. The rise in online services accelerates storage upgrades, particularly among telecom and cloud service providers. Data-heavy applications require better IOPS performance and faster retrieval. The Vietnam Data Center Storage Market benefits from increased workload migration to virtualized and containerized environments. Companies adopt hybrid storage solutions to optimize cost and speed. Data-intensive government programs including e-governance boost centralized and secure storage demand. Energy-efficient rack-based systems are replacing legacy setups in high-traffic server farms. Business continuity planning further raises investments in data replication and failover storage.

- For instance, CMC Telecom’s Tan Thuan Data Center in Ho Chi Minh City is Uptime Institute Tier III certified and designed to accommodate around 1,200 racks. It delivers cloud and colocation services to financial, e-commerce, and enterprise clients across Vietnam.

Policy-Led Infrastructure Expansion Encouraging Foreign and Domestic Investment in Storage Platforms

Vietnam’s National Digital Transformation Program supports infrastructure upgrades for both cloud and edge environments. Regulatory frameworks push for domestic data residency, driving demand for local storage solutions. International players enter joint ventures to build large-scale, Tier III+ and IV certified data centers. The Vietnam Data Center Storage Market is witnessing increased investment in redundant and scalable architecture. Cloud providers expand their regional footprints to minimize latency and meet rising enterprise demands. Local telecoms deploy new storage networks linked to 5G rollout schedules. Policy alignment with international data security norms boosts investor confidence. Regional SEZs provide land and power incentives for storage-driven infrastructure. Strategic alliances with equipment manufacturers help speed up supply chain and deployment timelines.

- For instance, Viettel IDC began construction of a hyperscale campus in Ho Chi Minh City with an initial planned power capacity of 140 MW, designed to host large-scale storage and cloud workloads for enterprise and government users.

Accelerated Shift Toward Cloud-Native Applications Fueling Hybrid and Software-Defined Storage

Vietnamese enterprises increasingly adopt cloud-native development, requiring persistent storage across hybrid environments. Software-defined storage (SDS) platforms enable agility, scalability, and integration with container orchestration tools. The Vietnam Data Center Storage Market supports this shift with storage virtualization and platform unification. Vendors offer multi-tier storage combining flash and HDD systems to match workload needs. AI-powered storage management tools automate provisioning and performance tuning. Demand for seamless scaling across public and private clouds supports flexible storage options. Workloads tied to real-time analytics and IoT are driving low-latency storage adoption. Enterprises consolidate backup, disaster recovery, and archiving into unified platforms. The market gains momentum from evolving DevOps and data lifecycle strategies.

Enterprise Resilience Strategy Driving Investments in High-Performance and Energy-Efficient Storage

Business continuity, disaster recovery, and zero-downtime commitments fuel demand for high-availability storage. Enterprises implement tiered storage and data deduplication for performance-cost optimization. The Vietnam Data Center Storage Market supports this trend through modular and scalable systems with active-active failover. Storage vendors offer all-flash systems to meet enterprise latency thresholds. Backup frequency and regulatory mandates lead to increased storage consumption. Facilities prioritize rack-dense SSD systems with low power consumption. Cold storage options grow for archival and compliance workloads. High-speed interconnects improve data transmission across storage nodes. Businesses seek storage architecture that adapts to evolving workload types and user access patterns.

Market Trends

Growing Role of Edge Data Centers in Distributed Storage and Low-Latency Content Delivery

Vietnam’s Tier II and Tier III cities are witnessing new edge data center rollouts to support regional content delivery. These centers integrate compact, high-capacity storage systems to handle local traffic surges. The Vietnam Data Center Storage Market is aligning with distributed cloud architectures that bring compute and storage closer to end-users. Enterprises adopt edge-first deployment models for video streaming, retail analytics, and IoT telemetry. Storage solutions are tailored to manage data bursts and ensure faster local processing. Autonomous data tiering enhances performance across high-use applications. Telecom firms deploy micro-edge units with localized storage clusters. Edge caching improves content delivery across remote and industrial zones. Power-optimized designs reduce the footprint and OPEX of storage at edge sites.

Adoption of AI and Machine Learning Workloads Creating Demand for Parallel Storage Systems

AI models used in language processing, cybersecurity, and predictive analytics demand fast, parallel-access storage. Enterprises adopt NVMe-over-Fabrics and scale-out file systems to meet these throughput needs. The Vietnam Data Center Storage Market is evolving to support training pipelines and real-time inference. Large datasets require burst handling and quick redundancy failover. Multi-protocol access enables seamless integration with AI compute clusters. Vendors deliver modular GPU-ready storage enclosures. Accelerated storage interfaces reduce I/O bottlenecks and improve AI model training times. Real-time surveillance and fraud detection workflows use low-latency SSD arrays. AI-integrated storage controllers automate monitoring and system optimization tasks.

Rising Integration of Cybersecurity Features Within Storage Systems for Zero-Trust Architectures

Storage solutions are embedding zero-trust security frameworks to protect against ransomware and insider threats. Hardware-accelerated encryption, immutable snapshots, and real-time access monitoring are becoming standard. The Vietnam Data Center Storage Market supports enterprises moving toward isolated and protected storage zones. Multi-tenant environments require tenant-specific encryption and auditing capabilities. Governments mandate strict compliance for sensitive datasets stored in commercial and public data centers. Vendors offer policy-driven data retention, user authentication, and write-once-read-many (WORM) features. Cloud-integrated storage supports region-specific security protocols. Backup platforms now include anomaly detection for early breach indicators. Cyber resilience features align with emerging data protection regulations.

Sustainability-Driven Storage Innovations Supporting Energy Efficiency and Long-Term Value

Energy efficiency and lower carbon footprint are key parameters in new storage procurement. Enterprises seek storage with power-down modes, high-capacity drives, and advanced cooling integration. The Vietnam Data Center Storage Market sees rising demand for green-certified hardware and low-emission systems. All-flash arrays with low idle power use are replacing mechanical drives. Data compression and deduplication reduce physical space and cooling needs. Organizations deploy storage tiering strategies to separate hot, warm, and cold data more efficiently. Smart storage platforms manage energy use dynamically based on real-time workloads. Government-backed energy programs encourage green data center design. Sustainable storage is emerging as a competitive advantage in vendor selection.

Market Challenges

Limited Availability of Tier-IV Infrastructure and Uneven Power and Fiber Connectivity in Secondary Zones

Although demand is rising, Vietnam has few fully certified Tier IV data centers with large-scale storage readiness. Power supply inconsistencies in non-urban zones hinder continuous operations of storage-intensive deployments. The Vietnam Data Center Storage Market faces challenges expanding into remote provinces lacking dense fiber networks. Construction permits and environmental clearances delay high-capacity infrastructure. Lower land availability near metro cores forces data center operators to build farther out. Edge data center growth depends on last-mile digital infrastructure, which varies widely. Cooling infrastructure and backup energy for rack-dense storage remain underdeveloped in some zones. Deployment timelines stretch due to complex project coordination. Regional disparities in infrastructure readiness limit even market penetration.

High Import Dependency for Advanced Storage Components and Rising Cost of Skilled Labor

Vietnam relies on imports for high-performance drives, RAID controllers, and NVMe storage systems. Currency fluctuation impacts procurement budgets for international vendors. The Vietnam Data Center Storage Market also struggles with rising labor costs in skilled segments like system integration and storage architecture design. Local talent for enterprise-grade storage deployments is limited. Certification programs for storage security and SDS management are still growing. Enterprises depend on external consultants for architecture design and deployment, increasing setup costs. Storage downtime risk remains high due to limited local maintenance expertise. Tax structures and customs duty affect pricing competitiveness of imported storage units.

Market Opportunities

Expansion of Cloud and Hybrid Storage Platforms Across BFSI, Healthcare, and Retail Enterprises

Demand for hybrid and cloud-based storage is rising from sectors requiring secure yet scalable infrastructure. BFSI firms deploy encrypted storage with disaster recovery to meet compliance. The Vietnam Data Center Storage Market benefits from healthcare digitization initiatives that generate long-term storage demand. Retail chains need real-time customer data and transactional analytics stored efficiently. Cloud-native applications push demand for multi-zone, elastic storage solutions. Vendors gain from offering flexible licensing, consumption-based pricing, and fast-deployment storage platforms.

Incentivized Data Center Investments Driving Advanced Storage Adoption in Emerging Provinces

Government-backed land and tax incentives are pushing data center development in provinces like Binh Duong and Da Nang. These sites offer low-latency zones for storage operations due to improved power and fiber connectivity. The Vietnam Data Center Storage Market gains from this infrastructure push, especially for hybrid and edge deployments. Companies setting up data centers here adopt energy-efficient, high-density storage to maximize ROI. Local regulations encourage data residency and security compliance, further boosting localized storage deployment.

Market Segmentation

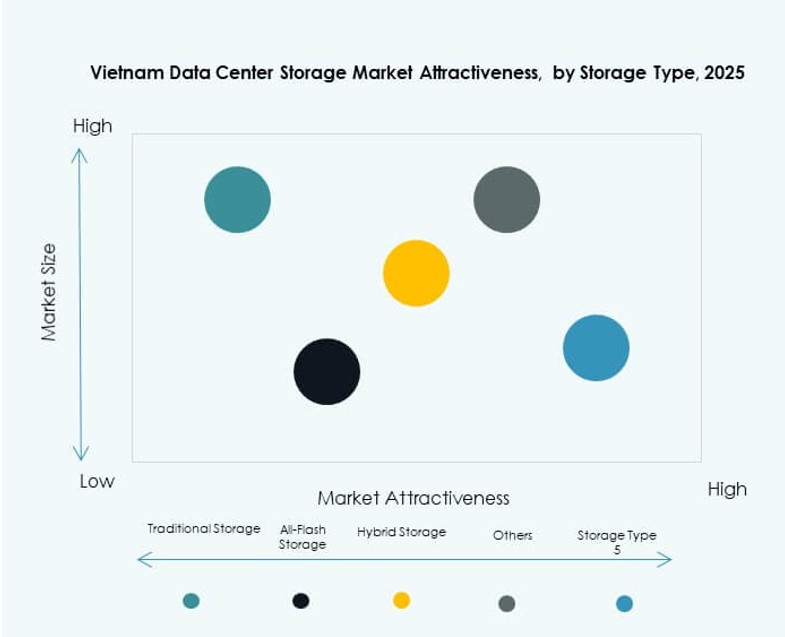

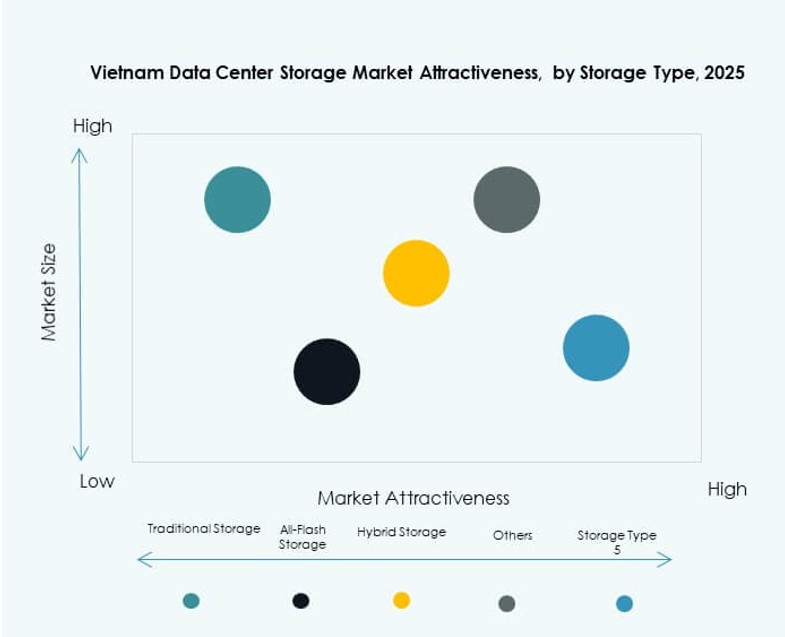

By Storage Type

Traditional storage systems still hold relevance for legacy applications but are gradually losing share to more efficient formats. All-flash storage leads the segment with increasing adoption across banking and digital service providers due to performance and power efficiency. The Vietnam Data Center Storage Market sees hybrid storage growing steadily, offering a balance between cost and performance. Other storage types such as object-based and archival solutions are gaining relevance for backup and compliance tasks.

By Storage Deployment

Network-attached Storage (NAS) dominates due to its file-level access simplicity for enterprise environments. Storage Area Network (SAN) systems also maintain strong presence among data-intensive applications such as financial services and analytics. The Vietnam Data Center Storage Market shows rising uptake in Direct-attached Storage (DAS) for edge locations and small data centers. Other formats like object storage are emerging in AI and big data workloads due to better scalability.

By Component

Hardware remains the dominant component, accounting for a large share of total market deployment. Rack servers, drives, enclosures, and interconnects form the foundation of most investments. The Vietnam Data Center Storage Market is seeing rising demand for software components such as SDS platforms, storage management tools, and encryption layers. The shift to software-defined architectures is pushing software growth ahead of traditional hardware expansion.

By Medium

Solid-State Drives (SSD) lead the segment due to performance and energy savings, especially in cloud and AI workloads. Hard Disk Drives (HDD) still maintain strong use in backup, archival, and large-scale cold storage environments. The Vietnam Data Center Storage Market also includes tape storage in long-term government and compliance-related data centers. SSD growth is driven by the decline in per-gigabyte costs and need for faster boot and query times.

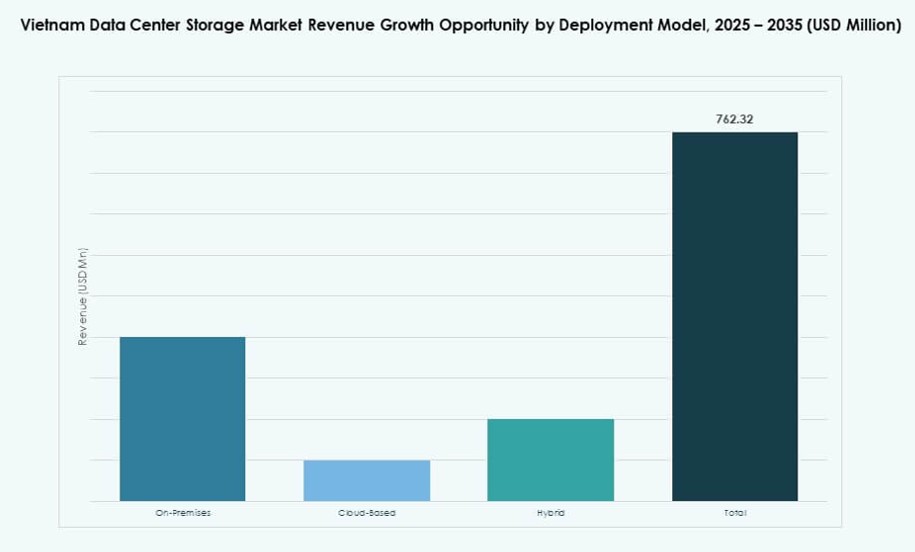

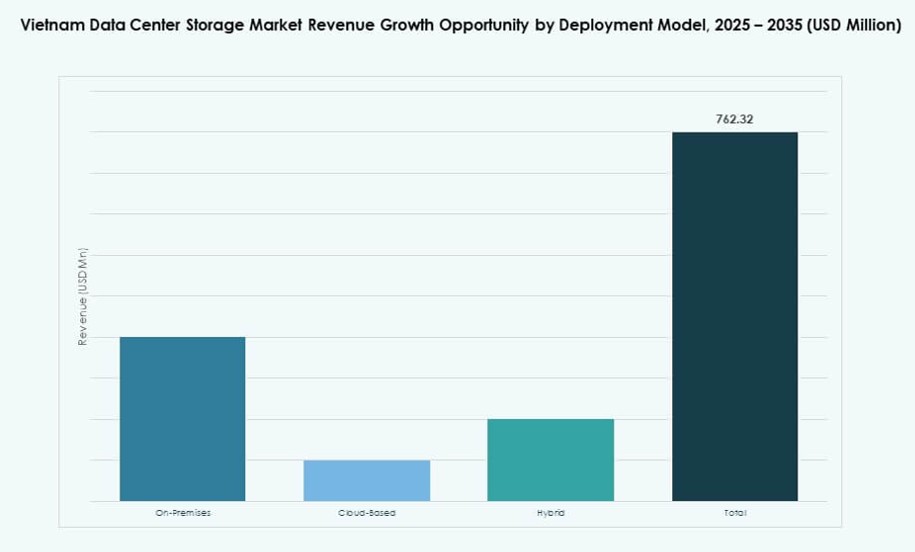

By Deployment Model

On-premises deployment remains relevant among financial institutions and government agencies seeking data control. Cloud-based storage is expanding fast, led by SaaS and IaaS providers. The Vietnam Data Center Storage Market supports hybrid models for enterprises that balance latency, security, and flexibility. Hybrid deployments allow seamless integration between public cloud and private data centers. Vendors offer storage-as-a-service models to match hybrid demand.

By Application

IT and Telecommunications dominate demand with cloud-native applications, media content, and subscriber data needs. BFSI follows with secure and compliant data storage structures. The Vietnam Data Center Storage Market is expanding across healthcare, driven by e-medical records and telehealth services. Government initiatives on digital records and smart governance also require large-capacity and secured storage. Other applications include retail analytics, logistics, and education platforms requiring scalable and low-latency storage solutions.

Regional Insights

Southern Vietnam: Ho Chi Minh City and Surrounding Areas Holding Over 55% Market Share

Southern Vietnam leads the market due to dense corporate presence and well-established telecom infrastructure. Ho Chi Minh City remains the center of IT activity and demand for high-performance storage. Most hyperscale and colocation facilities are concentrated here due to stable power and land availability. The Vietnam Data Center Storage Market benefits from global cloud players anchoring their services in the south. Nearby provinces like Binh Duong and Dong Nai support storage growth with new industrial data parks. Strong local government backing accelerates public-private partnerships.

Northern Vietnam: Hanoi and Technology Parks Account for Nearly 30% of Market Share

Northern Vietnam is rising fast with Hanoi serving as a digital governance and public sector hub. Smart city projects and AI labs increase storage needs for real-time analytics. Tech parks and universities drive localized data processing and storage innovation. The Vietnam Data Center Storage Market sees steady growth here through public sector storage deployments and cloud adoption by domestic enterprises. Investments in Tier III-certified facilities are expanding. Proximity to China and trade zones supports cross-border digital services.

- For instance, VNPT IDC Hoa Lac in Hanoi’s Hoa Lac High Tech Park spans about 23,000 square meters and accommodates up to 2,000 racks, with Tier III certifications and average connectivity of 2 Gbps per rack for domestic traffic and 0.5 Gbps per rack for international traffic, making it Vietnam’s largest and most advanced data center.

Central and Coastal Vietnam: Emerging Growth Belt with 15% Market Share and Rising Investments

Cities like Da Nang, Hue, and Nha Trang are emerging with new data center investments supported by government incentives. These areas offer geographical resilience, low seismic risk, and growing power infrastructure. The Vietnam Data Center Storage Market is gaining from edge deployments in coastal cities to serve tourism, logistics, and offshore business zones. Enhanced submarine cable landing stations increase bandwidth access. Developers prefer these zones for lower land costs and proximity to ASEAN markets. Data center providers target these regions for future-ready storage builds.

- For instance, Da Nang International Data Centre JSC is developing a data center in Da Nang Hi‑Tech Park with a planned capacity of about 1,000 racks, positioned to become the city’s largest facility and support cloud, AI, and cybersecurity workloads for central Vietnam.

Competitive Insights:

- Viettel IDC

- FPT Telecom

- CMC Telecom

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- NetApp

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Hitachi Vantara

The Vietnam Data Center Storage Market is moderately consolidated, with a mix of domestic telecom-led providers and global technology vendors. Viettel IDC, FPT Telecom, and CMC Telecom anchor local infrastructure, offering cloud and storage services customized for Vietnam’s regulatory and language environment. Global firms such as Dell, HPE, and NetApp lead in enterprise-grade storage systems, including all-flash arrays and SDS platforms. Huawei and IBM offer vertical-specific solutions for BFSI and public sector clients. The market favors companies with energy-efficient hardware, multi-cloud integration, and local support capabilities. It remains dynamic with active partnerships, service expansion, and adoption of AI-based storage optimization tools.

Recent Developments:

- In December 2025, HCLTech announced an agreement to acquire HPE’s Telco Solutions Business for up to USD 160 million, a move expected to strengthen HCLTech’s engineering and AI-led network capabilities while allowing HPE to focus more tightly on core hybrid cloud and infrastructure offerings used in telecom and data center environments worldwide, including Asia.

- In August 2025, CMC Telecom had been approved to develop a hyperscale data center in Ho Chi Minh City, with an initial capacity of about 30 MW expandable to 120 MW, which will materially increase the available colocation and storage capacity in the market.

- In April 2025, Viettel IDC began construction of a new hyperscale data center in Ho Chi Minh City with an initial planned power capacity of 140 MW, positioning the company to expand colocation and storage services significantly as demand for cloud and AI infrastructure grows in Vietnam.