Executive summary:

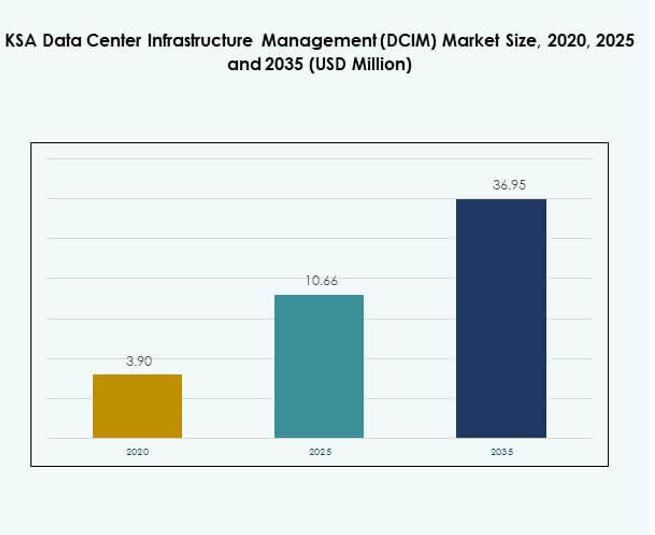

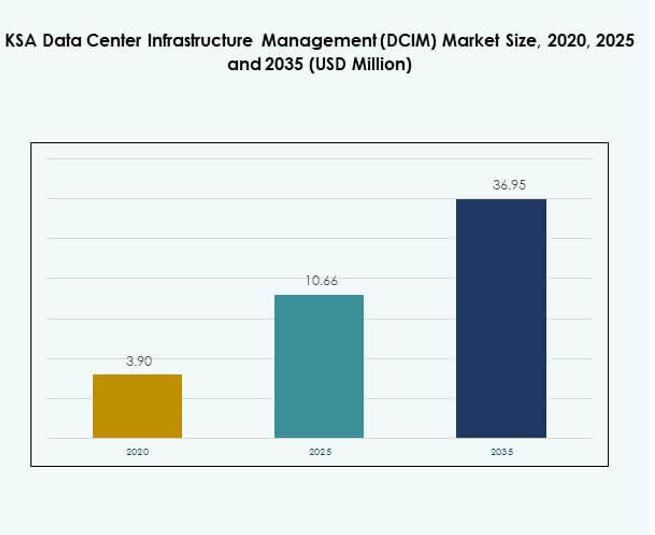

The KSA Data Center Infrastructure Management (DCIM) Market size was valued at USD 3.90 million in 2020, reaching USD 10.66 million in 2025, and is anticipated to reach USD 36.95 million by 2035, at a CAGR of 15.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| KSA Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 10.66 Million |

| KSA Data Center Infrastructure Management (DCIM) Market, CAGR |

15.01% |

| KSA Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 36.95 Million |

Rapid cloud adoption, AI integration, and government-led digital transformation are driving strong growth across the Kingdom. The market benefits from expanding hyperscale data centers, smart city initiatives, and renewable-powered facilities that align with Vision 2030 goals. Businesses and investors view the market as a core enabler of operational efficiency, energy optimization, and sustainable digital infrastructure expansion in the region.

Riyadh leads the market with strong enterprise and government investment in advanced digital infrastructure. Jeddah and Dammam follow as emerging data center hubs, supported by improved connectivity, industrial growth, and cloud adoption. The Kingdom’s strategic location between Europe, Asia, and Africa positions it as a key digital gateway, attracting global and regional investors in DCIM solutions.

Market Drivers

Rapid Digital Transformation and Vision 2030 Alignment

The Saudi government’s Vision 2030 agenda drives large-scale digitalization and cloud migration across sectors. Enterprises are deploying automation tools and centralized monitoring systems to enhance operational resilience. The KSA Data Center Infrastructure Management (DCIM) Market benefits from public-private partnerships focused on smart city development and e-government services. Increased investment in hyperscale data centers reinforces digital infrastructure readiness. Energy efficiency and carbon reduction targets push data center operators to adopt DCIM tools. Investors view this segment as a foundation for long-term digital competitiveness. Strategic focus on sustainability and data sovereignty accelerates modernization. Businesses are reconfiguring operations around these digital initiatives.

Integration of AI and IoT for Data Center Optimization

Artificial intelligence and IoT are redefining asset management and predictive maintenance across Saudi facilities. Operators are deploying AI-based analytics for cooling efficiency, fault prediction, and energy optimization. IoT sensors enhance asset-level visibility and performance tracking across multiple sites. The market integrates real-time monitoring with automated control systems to prevent downtime. It supports dynamic energy distribution in hybrid environments. Organizations in finance, healthcare, and telecom lead adoption due to regulatory and service reliability demands. Increased cloud activity amplifies infrastructure complexity, driving greater reliance on AI-powered DCIM. This integration improves operational transparency and performance stability.

- For instance, at the May 2025 Huawei Global Data Center Facility Summit, Huawei’s modular UPS5000-H achieved 97.5% efficiency for a single unit and 97.3% in parallel systems, with S-ECO mode reaching 99.1% efficiency. These advancements highlight the growing adoption of AI-driven power and cooling systems in Saudi Arabia’s mission-critical data center operations.

Growing Investments in Hyperscale and Edge Data Centers

Rising internet usage, cloud workloads, and AI applications create demand for hyperscale and edge data centers. The market supports these developments by providing scalable energy and capacity management solutions. The KSA Data Center Infrastructure Management (DCIM) Market gains traction through partnerships with global hyperscalers expanding across Riyadh and Jeddah. These facilities require high-density power optimization and advanced thermal monitoring. It helps achieve low PUE metrics essential for sustainability targets. Local data center operators are adopting intelligent automation to manage distributed assets. Increased edge adoption enhances latency-sensitive service delivery. The expansion supports 5G and regional cloud connectivity initiatives.

- For instance, in December 2020, Google Cloud and Saudi Aramco confirmed the launch of a cloud region in Dhahran to provide low-latency hyperscale cloud and AI services. The initiative strengthens data localization and hyperscale capacity across Saudi Arabia, supporting the Kingdom’s expanding digital infrastructure ecosystem.

Government-Led Initiatives and Regulatory Compliance Pressure

Government incentives for digital infrastructure, coupled with cybersecurity compliance, stimulate DCIM deployment. Regulatory bodies emphasize uptime, security, and energy transparency for licensed operators. The market benefits from initiatives fostering data localization and green infrastructure compliance. It enables companies to meet ISO, Uptime Institute, and Saudi Authority for Data standards efficiently. Businesses leverage compliance-driven modernization to attract global cloud partners. Investors recognize DCIM solutions as essential to maintaining regional competitiveness. Public agencies are transitioning toward fully monitored facilities for operational continuity. The increasing alignment between regulation and innovation strengthens long-term adoption across the Kingdom.

Market Trends

Adoption of Renewable-Powered and Energy-Efficient Data Centers

Operators in Saudi Arabia are investing in renewable-powered data centers supported by DCIM for energy optimization. Solar and wind energy integration aligns with the country’s sustainability commitments. The KSA Data Center Infrastructure Management (DCIM) Market supports real-time power balancing across hybrid grids. Smart algorithms manage power flow to reduce dependency on fossil fuels. Enterprises seek efficiency gains through liquid and immersion cooling systems. The trend attracts investments from ESG-focused data operators. Energy dashboards within DCIM platforms track carbon metrics accurately. It enables measurable sustainability compliance for global investors.

Expansion of Cloud-Based and Hybrid Deployment Models

Cloud-based DCIM deployment is expanding rapidly with enterprises seeking scalability and cost reduction. SaaS-driven management platforms allow centralized control of distributed data centers. The KSA Data Center Infrastructure Management (DCIM) Market is shifting toward hybrid deployment for flexibility and faster configuration. It allows seamless integration between on-premises and multi-cloud environments. Service providers are offering subscription-based models tailored for SMEs. Cloud-native monitoring enhances data visualization and operational automation. Hybrid solutions cater to compliance-sensitive sectors balancing data sovereignty and agility. The convergence of IT and operational technology reinforces this transition.

AI-Driven Predictive Maintenance and Automation Growth

AI and automation are emerging as dominant themes in the regional DCIM landscape. Predictive analytics reduce downtime by identifying potential failures early. The KSA Data Center Infrastructure Management (DCIM) Market leverages machine learning for thermal modeling and dynamic capacity planning. Automated fault resolution minimizes manual intervention, improving reliability. AI-enabled systems facilitate workload orchestration in energy-constrained environments. Predictive maintenance tools enhance asset lifespan and reduce unplanned outages. The increasing focus on autonomous operations aligns with the nation’s smart infrastructure goals. It supports continuous optimization of both cost and performance parameters.

Rise of Edge and Modular Data Centers Across Key Cities

Edge and modular data centers are gaining popularity to support growing 5G and IoT demand. Prefabricated modular facilities enable quick deployment near population hubs. The KSA Data Center Infrastructure Management (DCIM) Market supports real-time control of edge nodes through integrated dashboards. It facilitates scalable power and cooling management at micro data centers. Riyadh, Dammam, and Jeddah lead adoption due to expanding enterprise networks. The modular trend complements national goals for low-latency service delivery. It enhances disaster recovery capabilities through distributed site management. Rapid deployment flexibility attracts telecom and AI service providers to regional clusters.

Market Challenges

High Implementation Costs and Integration Complexities

Deployment of DCIM systems involves significant upfront costs for hardware, software, and integration. The KSA Data Center Infrastructure Management (DCIM) Market faces obstacles due to complex legacy environments. Many facilities rely on outdated monitoring tools that resist seamless upgrades. Integrating real-time analytics and automation requires high technical expertise. Limited regional availability of skilled professionals hinders implementation speed. It also impacts post-deployment optimization and maintenance consistency. Smaller enterprises delay adoption due to capital constraints. Vendors must simplify pricing models to improve accessibility across mid-tier operators.

Data Security and Interoperability Limitations

Interoperability across multiple platforms remains a critical challenge for data-driven infrastructure management. The KSA Data Center Infrastructure Management (DCIM) Market experiences concerns about data security and system compatibility. Sensitive industries such as finance and defense face stricter compliance rules. Cloud-based systems increase exposure to cybersecurity risks without strong encryption. It demands localized data storage and advanced identity access controls. Integrating tools from different vendors often causes visibility gaps. Security misconfiguration can disrupt automated processes and cause downtime. Ensuring full alignment between IT and OT environments remains a key technical priority.

Market Opportunities

Growth Potential Through AI, Green Data Centers, and Digital Sovereignty Goals

The KSA Data Center Infrastructure Management (DCIM) Market presents strong opportunities through AI-driven automation and green data center deployment. National digital sovereignty initiatives increase the need for locally managed infrastructure. It creates demand for energy-efficient monitoring solutions supporting carbon reduction goals. AI-based analytics open new service models for predictive energy and asset management. Data-driven policies promote investment in green-certified facilities. Local players gain from collaborations with global hyperscalers entering the Saudi ecosystem. The combination of sustainability and AI adoption creates new business opportunities for DCIM providers.

Expansion Through Strategic Partnerships and Regional Infrastructure Projects

Partnerships between telecom operators, cloud providers, and technology vendors are strengthening ecosystem growth. The KSA Data Center Infrastructure Management (DCIM) Market benefits from regional megaprojects, including NEOM and Red Sea initiatives. These projects demand reliable infrastructure monitoring for large-scale deployments. It promotes DCIM adoption for efficient capacity planning and uptime management. Cross-border digital infrastructure development enhances investment inflows. Vendors offering modular, AI-enabled platforms are well-positioned for government and enterprise contracts. Increased collaboration between public and private sectors expands market reach across the GCC region.

Market Segmentation

By Component

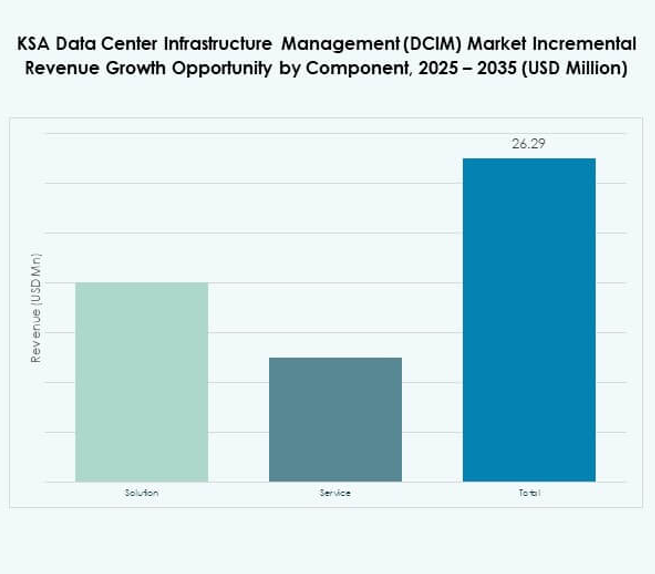

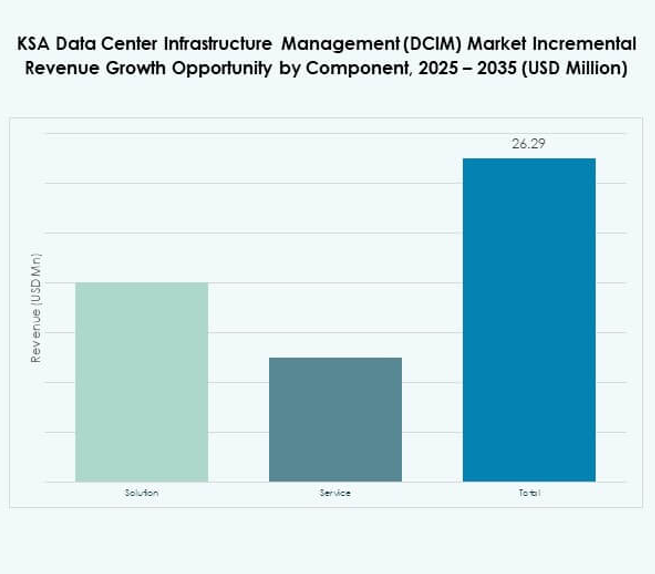

The solution segment dominates the KSA Data Center Infrastructure Management (DCIM) Market due to growing demand for integrated energy, cooling, and asset monitoring platforms. These systems enable unified dashboards and AI-driven analytics for operational control. Service components follow closely, driven by managed support and software integration needs. Vendors offering scalable software suites attract large enterprise customers. Continuous product innovation and modular solution delivery sustain this segment’s leadership.

By Data Center Type

Enterprise data centers hold the largest share in the KSA Data Center Infrastructure Management (DCIM) Market owing to their requirement for strict compliance and uptime. Managed and colocation centers are expanding as businesses outsource infrastructure. Cloud and edge facilities show strong growth, supported by AI workloads and IoT expansion. It helps organizations balance scalability with cost efficiency. Regional operators integrate DCIM to ensure predictable performance across diverse environments.

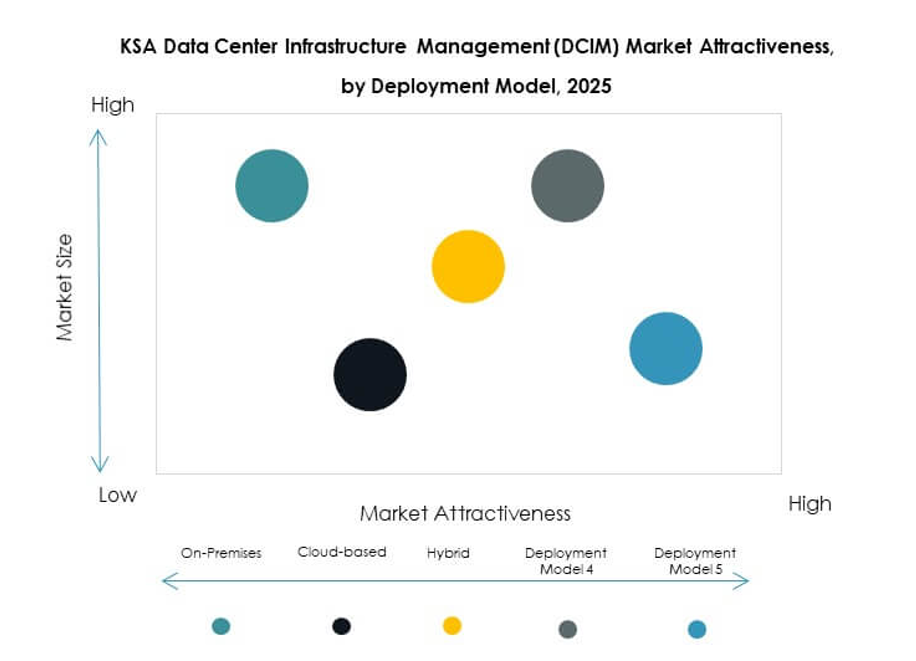

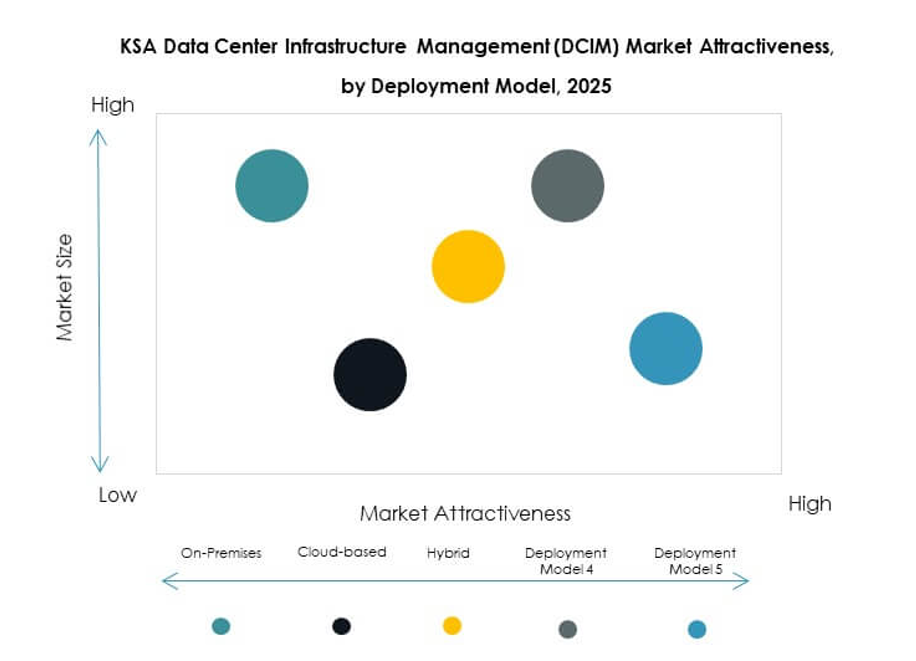

By Deployment Model

Cloud-based DCIM deployment leads due to cost flexibility, remote accessibility, and scalability advantages. The KSA Data Center Infrastructure Management (DCIM) Market also witnesses strong growth in hybrid models, combining cloud control with on-premises security. On-premises systems remain essential for regulated sectors requiring data localization. Vendors offering multi-tenant cloud platforms support adoption across enterprises. The shift toward SaaS-based frameworks reinforces modernization across regional operators.

By Enterprise Size

Large enterprises dominate adoption due to the complexity of their data infrastructure and energy optimization needs. The KSA Data Center Infrastructure Management (DCIM) Market also experiences rising adoption from SMEs leveraging cloud-based platforms. SMEs prefer subscription models to reduce capital expenses. Enhanced user-friendly dashboards encourage broader participation. Growing awareness of energy efficiency benefits accelerates small enterprise investments.

By Application / Use Case

Power monitoring and capacity management lead the application segment due to their direct impact on uptime and cost reduction. The KSA Data Center Infrastructure Management (DCIM) Market benefits from strong adoption of environmental monitoring for sustainable operations. Asset management tools enhance lifecycle efficiency, while BI and analytics support data-driven decision-making. It reflects the growing emphasis on predictive control and operational transparency across facilities.

By End User Industry

IT and telecommunications dominate usage due to their extensive data infrastructure and service reliability needs. The KSA Data Center Infrastructure Management (DCIM) Market also sees notable uptake in BFSI, healthcare, and energy sectors. Retail and e-commerce firms adopt DCIM for 24/7 uptime assurance. Aerospace and defense rely on secure systems aligned with regulatory frameworks. The market expands as diverse industries modernize digital operations.

Regional Insights

Riyadh – The Core of National Digital Infrastructure (38% Share)

Riyadh holds the largest market share in the KSA Data Center Infrastructure Management (DCIM) Market due to its concentration of government and enterprise data centers. The city drives adoption through major digital transformation programs and international hyperscale investments. It benefits from strong regulatory support and advanced network connectivity. AI and cloud projects across ministries and telecoms expand the DCIM footprint. Strategic positioning makes Riyadh a central data hub for the Kingdom. It remains the primary region for DCIM innovation and research partnerships.

- For instance, in 2025, Amazon Web Services (AWS) and Saudi AI firm HUMAIN announced a $5 billion investment to establish an AI Zone in Riyadh, featuring AWS UltraCluster infrastructure and high-performance computing systems. The initiative includes training 100,000 Saudi nationals in cloud and AI skills, supporting Vision 2030 and the planned launch of the AWS Saudi cloud region by 2026 backed by a $5.3 billion data center investment.

Jeddah – Expanding Cloud and Colocation Ecosystem (33% Share)

Jeddah’s proximity to international subsea cable routes supports growth in cloud connectivity and colocation infrastructure. The KSA Data Center Infrastructure Management (DCIM) Market in this region gains traction through rapid deployment of modular and edge facilities. It attracts investments from regional and global service providers. Strong logistics and port connectivity enhance its appeal for enterprise operations. DCIM integration ensures efficiency in multi-tenant facilities. Emerging hyperscale centers continue to position Jeddah as a key western digital gateway.

- For instance, in early 2025, DataVolt signed a $5 billion agreement to develop a 1.5 GW sustainable data center campus in NEOM’s Oxagon, designed to run entirely on renewable energy. The project’s first 300 MW phase is scheduled to become operational by 2028, supporting Saudi Arabia’s goal of building net-zero, high-efficiency digital infrastructure.

Dammam and Eastern Province – Industrial and Energy Data Hub (29% Share)

Dammam and the Eastern Province are evolving into industrial digital hubs due to their energy and manufacturing sectors. The KSA Data Center Infrastructure Management (DCIM) Market grows here with rising demand for monitoring in industrial data centers. It supports energy utilities, petrochemical firms, and logistics operations. The presence of industrial cities accelerates private investment in infrastructure monitoring. The region benefits from ongoing digital expansion under Vision 2030 diversification goals. Its strategic role links industrial modernization with data-driven efficiency across the Gulf.

Competitive Insights:

- STC / Center3

- Mobily

- Quantum Switch Tamasuk

- NourNet

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

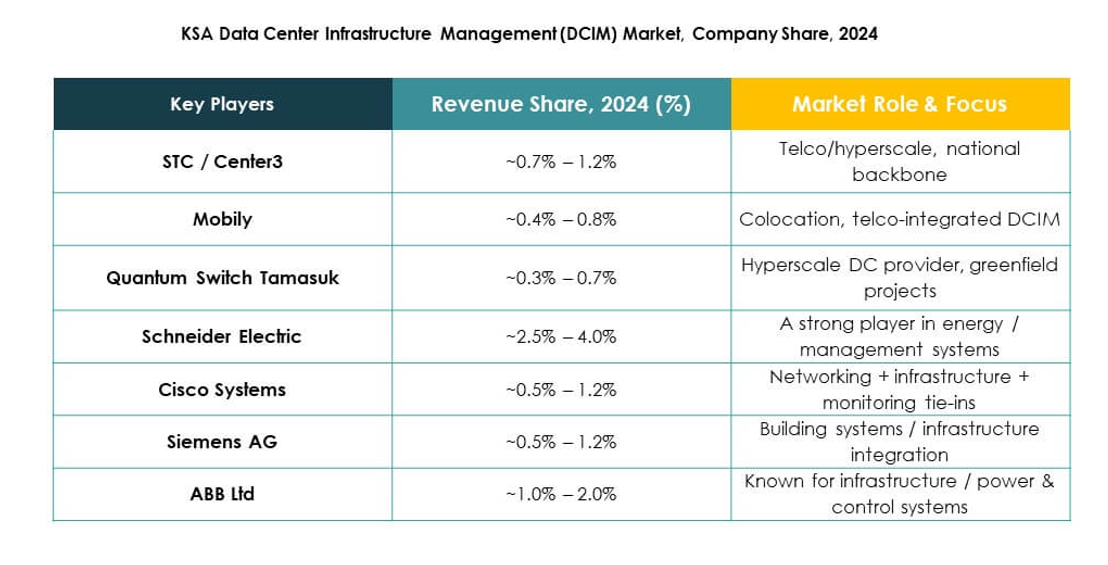

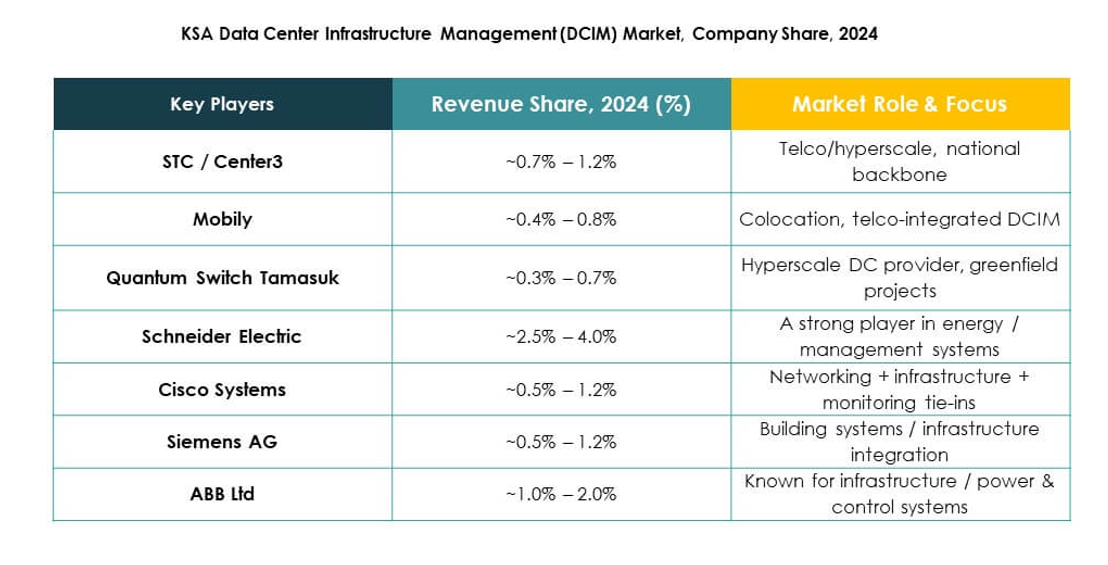

The KSA Data Center Infrastructure Management (DCIM) Market features a mix of domestic telecom operators and global technology providers competing through innovation and infrastructure investments. Local players such as STC/Center3, Mobily, and Quantum Switch Tamasuk focus on hyperscale expansion and digital sovereignty projects. Global leaders including Schneider Electric, Huawei, and ABB dominate with AI-based DCIM platforms and energy-efficient power solutions. Cisco, Eaton, and Siemens strengthen market presence through modular automation and integrated monitoring systems. NourNet enhances its edge through managed services and enterprise-grade cloud connectivity. The market emphasizes smart energy management, predictive analytics, and cloud interoperability, driving competition around operational excellence and sustainability.

Recent Developments:

- In September 2025, Saudi Telecom Company (stc) and Solutions signed a significant agreement worth $62 million to expand data center infrastructure across Saudi Arabia, covering new developments in Khamis Mushait, Dammam, Qassim, and north Riyadh. This 36-month contract also involves upgrading network and 5G capabilities, with financial effects expected to begin in Q1 2026, demonstrating a robust commitment to strengthening the Kingdom’s digital backbone in line with evolving demand in the KSA Data Center Infrastructure Management (DCIM) Market.

- In August 2025, center3 unveiled plans to aggressively scale its data center footprint, announcing an ambitious goal to achieve 1 Gigawatt capacity by 2030. Backed by an additional $10 billion investment plan, this initiative targets AI, cloud, and hyperscaler needs and directly supports Saudi Arabia’s Vision 2030, solidifying center3’s leading role in the region’s digital transformation.

- In February 2025, Mobily, operating as Etihad Etisalat Company, concluded major partnership agreements during LEAP 2025 with both global and regional technology firms spanning digitalization, AI, cybersecurity, and IoT solutions. These collaborations are designed to advance Saudi Arabia’s ICT sector, reinforce digital infrastructure, and foster innovation in line with the country’s vision to be a regional digital hub.