Executive summary:

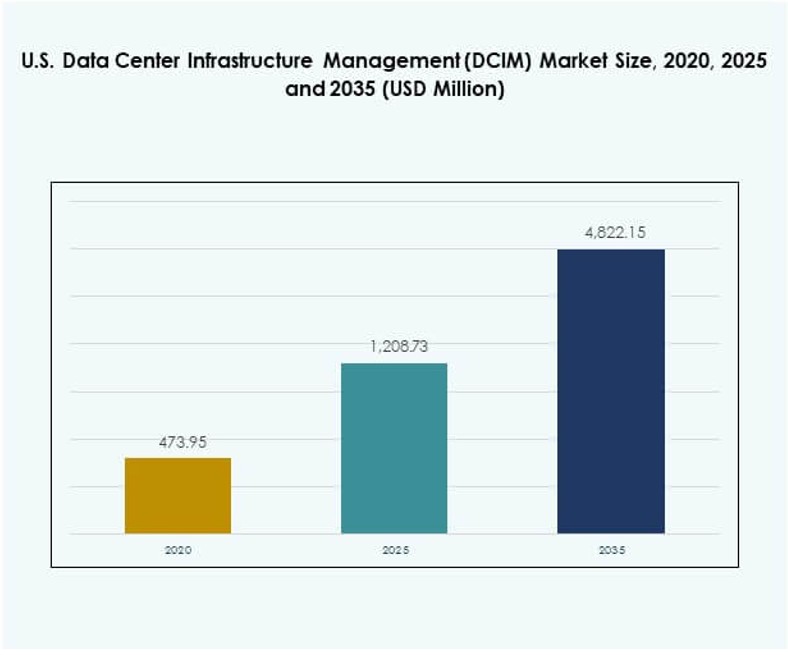

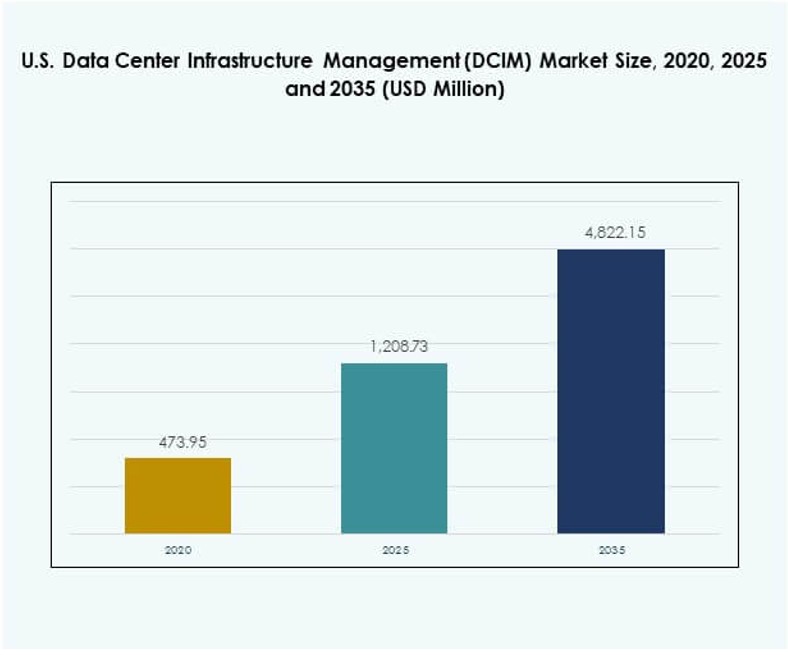

The U.S. Data Center Infrastructure Management (DCIM) Market size was valued at USD 473.95 million in 2020, reached USD 1,208.73 million in 2025, and is anticipated to reach USD 4,822.15 million by 2035, at a CAGR of 16.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| U.S. Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 1,208.73 Million |

| U.S. Data Center Infrastructure Management (DCIM) Market, CAGR |

16.63% |

| U.S. Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 4,822.15 Million |

The market is driven by rapid adoption of artificial intelligence, IoT, and automation in data centers. Companies are focusing on innovation in energy efficiency, predictive analytics, and modular infrastructure to improve performance and reduce costs. It plays a strategic role for businesses and investors by enabling scalable growth, ensuring sustainability, and strengthening resilience across digital ecosystems. The demand for unified monitoring and operational transparency continues to accelerate investments across enterprises.

Regionally, the U.S. leads North America in adoption due to the strong presence of hyperscale facilities and advanced cloud providers. The North-Eastern states dominate with dense data center clusters, while the Western region grows rapidly with cloud and hyperscale demand supported by renewable energy integration. Emerging states in the South and Midwest are attracting investments through tax incentives, reliable power availability, and growing enterprise demand, strengthening the country’s overall digital infrastructure.

Market Drivers

Adoption of Artificial Intelligence and Automation in Data Center Operations

Artificial intelligence and automation are transforming operational efficiency in the U.S. Data Center Infrastructure Management (DCIM) Market. Companies use predictive analytics and machine learning to monitor workloads, optimize power, and manage capacity. Automated fault detection reduces downtime and improves resilience. It helps organizations scale infrastructure while reducing manual interventions. The integration of robotics in monitoring is enhancing real-time responsiveness. AI-based resource allocation supports cloud-native applications. Investors view this automation as critical for long-term cost efficiency. Enterprises gain competitive advantage through reduced energy consumption and smarter workload management.

- For instance, in March 2024, Schneider Electric launched new automated sustainability reporting features in its EcoStruxure IT DCIM platform, allowing U.S. data center operators to automate calculation and tracking of Power Usage Effectiveness (PUE) per site and access real-time performance analytics, securely exporting data to meet regulatory metrics at the click of a button.

Innovation in Energy Efficiency and Sustainable Data Center Design

Innovation in energy efficiency is reshaping the U.S. Data Center Infrastructure Management (DCIM) Market. Operators are deploying liquid cooling, modular power systems, and smart sensors to optimize energy use. It supports sustainability goals by reducing emissions and lowering costs. Companies increasingly prioritize renewable energy integration into DCIM platforms. Intelligent cooling lowers power usage effectiveness (PUE) scores across facilities. Advanced metering systems enhance environmental monitoring and sustainability reporting. Energy-efficient design attracts government incentives and enterprise clients. This innovation secures investor confidence in long-term operational stability.

Strategic Importance of Scalability and Edge Data Center Expansion

Scalability remains a core driver for the U.S. Data Center Infrastructure Management (DCIM) Market. Edge computing growth demands decentralized infrastructure managed through DCIM platforms. It enables organizations to scale rapidly without losing visibility or control. Companies are investing in hybrid and multi-cloud ecosystems. Enterprises demand dynamic scalability to support artificial intelligence and 5G applications. DCIM solutions integrate seamlessly with edge facilities, creating unified infrastructure visibility. This ability drives investor focus on long-term adaptability. Businesses view scalability as a fundamental pillar for digital transformation initiatives.

- For instance, Vertiv reported in its Q2 2025 financial results that its order backlog reached USD 8.5 billion, reflecting double-digit year-over-year growth driven by strong demand for data center and AI infrastructure solutions across the U.S. and global markets.

Shifts in Enterprise IT Strategy and Cloud Integration

Enterprise IT strategies are shifting toward hybrid and multi-cloud adoption, fueling growth in the U.S. Data Center Infrastructure Management (DCIM) Market. It aligns with demand for unified monitoring across dispersed workloads. Companies seek real-time analytics for asset tracking and capacity planning. The shift integrates on-premises infrastructure with public cloud services. Cloud-native applications rely heavily on DCIM platforms for resilience. Businesses invest to achieve operational transparency and service continuity. This alignment strengthens investor confidence. The shift positions DCIM as central to enterprise modernization strategies.

Market Trends

Growing Integration of AI-Driven Predictive Maintenance in DCIM Solutions

AI-driven predictive maintenance is becoming a defining trend in the U.S. Data Center Infrastructure Management (DCIM) Market. It allows operators to anticipate failures before disruptions occur. Companies rely on machine learning to predict component degradation. It enhances uptime by proactively scheduling maintenance. Enterprises reduce costs through optimized equipment lifecycles. Predictive analytics integrates with environmental monitoring to reduce cooling inefficiencies. Cloud service providers adopt it for resilience at scale. Investors recognize this trend as essential for maintaining competitive service delivery.

Rise of Real-Time Visualization and Digital Twin Technologies

Digital twin technology is emerging as a transformative trend in the U.S. Data Center Infrastructure Management (DCIM) Market. Operators replicate infrastructure in a virtual environment for simulation and monitoring. It enables real-time visualization of performance and asset utilization. Companies optimize workflows by running predictive models. It improves disaster recovery readiness with scenario testing. Enterprises reduce errors through enhanced asset mapping. Digital twin adoption aligns with smart infrastructure policies. Investors see this as a catalyst for next-generation operational intelligence.

Adoption of Cybersecurity-Integrated DCIM Platforms to Address Evolving Threats

The rising cyber threat landscape is driving adoption of cybersecurity-integrated platforms in the U.S. Data Center Infrastructure Management (DCIM) Market. Companies seek unified solutions for both operational visibility and security monitoring. It integrates identity access control, anomaly detection, and compliance reporting. Enterprises prioritize secure data transmission across hybrid facilities. Cybersecurity integration reduces risks in interconnected IT environments. Financial and healthcare sectors lead adoption due to strict compliance mandates. This shift secures investor confidence in long-term resilience. Businesses gain enhanced trust from clients through secure DCIM frameworks.

Deployment of DCIM Solutions in Modular and Micro Data Centers

The demand for modular and micro data centers is rising in the U.S. Data Center Infrastructure Management (DCIM) Market. Enterprises expand into decentralized environments closer to end-users. It aligns with the need for low-latency services in 5G and IoT applications. Modular centers require agile DCIM platforms for monitoring. Businesses leverage it for rapid deployment without compromising control. Cloud-native enterprises are driving adoption in urban and remote areas. The trend supports scalable digital infrastructure expansion. Investors are targeting this segment for its high growth potential.

Market Challenges

High Implementation Costs and Complexity in Integration Across Enterprises

Implementation costs remain a challenge for the U.S. Data Center Infrastructure Management (DCIM) Market. Enterprises face financial pressure from upfront investment in software, sensors, and skilled staff. It requires customization for integration with legacy systems. Organizations struggle with workforce readiness and training requirements. Many businesses delay adoption due to uncertain ROI timelines. Small and medium enterprises find costs more prohibitive. Vendors must address flexible pricing to expand accessibility. These challenges affect the overall adoption pace in key industries.

Data Security Concerns and Regulatory Compliance Constraints for Operators

Data security concerns present another significant challenge for the U.S. Data Center Infrastructure Management (DCIM) Market. Companies must comply with strict regulations across healthcare, finance, and government sectors. It involves complex monitoring of data residency and sovereignty. Enterprises face rising costs of compliance audits. Integration of third-party cloud services complicates regulatory alignment. Data breaches damage reputation and slow adoption. Vendors must prioritize advanced encryption and compliance automation. These factors hinder seamless deployment of DCIM platforms across industries.

Market Opportunities

Expansion of Cloud-Native Applications and Hybrid Infrastructure Integration

The rapid expansion of cloud-native applications creates opportunities in the U.S. Data Center Infrastructure Management (DCIM) Market. It supports hybrid environments that require unified monitoring. Enterprises demand advanced capacity management tools. Investors favor platforms that optimize hybrid scalability. DCIM vendors can deliver tailored solutions for complex infrastructures. The opportunity aligns with rising edge computing deployments. Vendors focusing on hybrid integration will gain market share. Enterprises adopting cloud-native strategies strengthen long-term growth for DCIM solutions.

Sustainability-Focused Innovations and Growing Demand for Energy Optimization

Sustainability-focused innovation creates another strong opportunity in the U.S. Data Center Infrastructure Management (DCIM) Market. Enterprises demand tools for power monitoring and emission reduction. It aligns with corporate ESG commitments and green policies. Companies integrating renewable energy benefit from DCIM-enabled efficiency tracking. Vendors offering sustainable optimization attract government and enterprise buyers. Investors focus on platforms delivering measurable environmental impact. This sustainability opportunity strengthens competitive positioning. The market gains momentum through eco-friendly solutions.

Market Segmentation

By Component

Solutions dominate the U.S. Data Center Infrastructure Management (DCIM) Market as enterprises prioritize software platforms for asset, capacity, and power monitoring. Services are growing, supported by managed operations, training, and consulting needs. The demand for integrated platforms drives strong solution adoption. Services gain traction in industries lacking technical expertise. Together, they ensure efficient implementation and sustained growth.

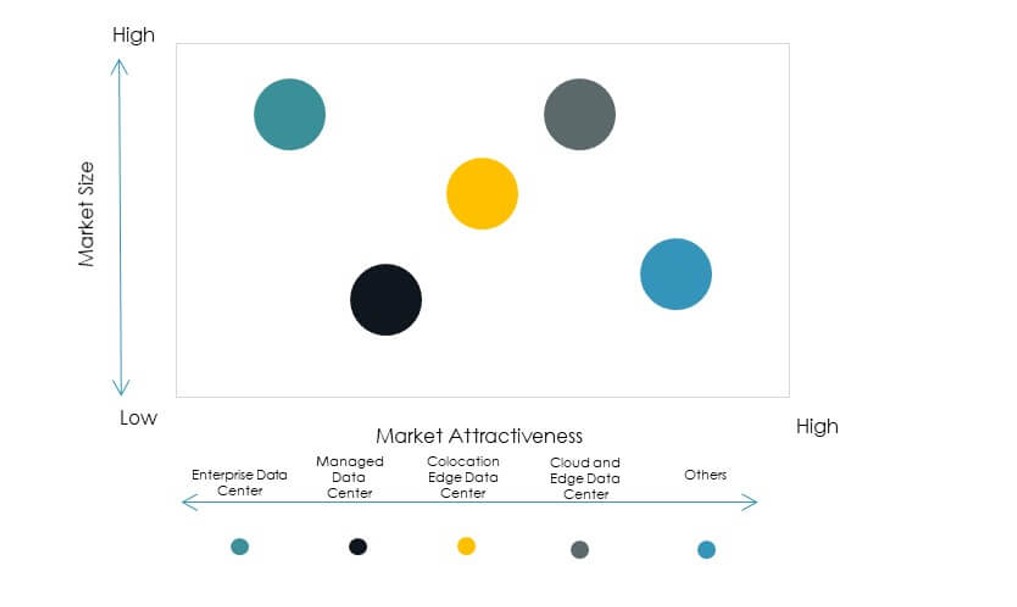

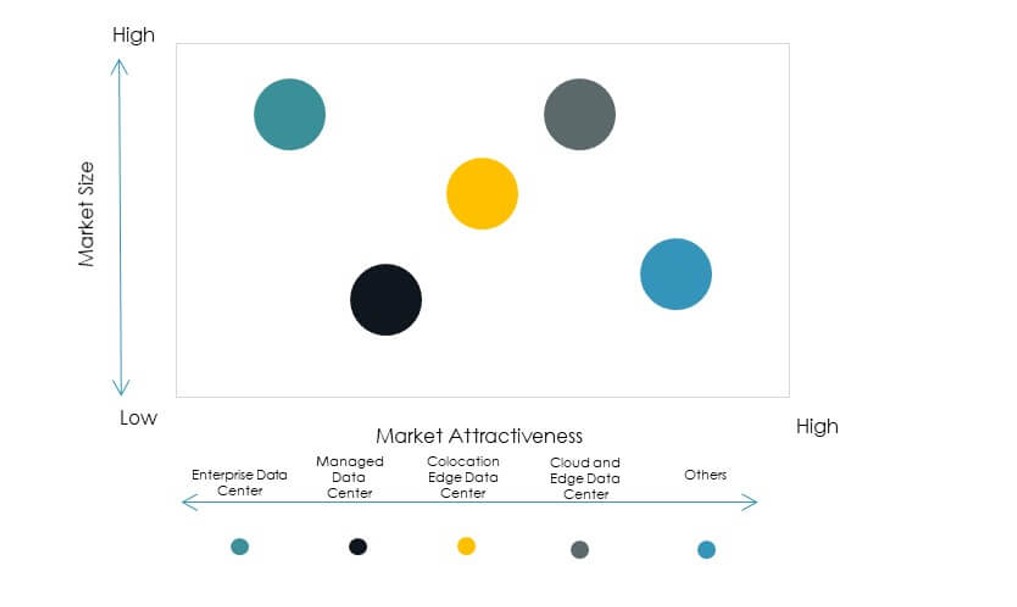

By Data Center Type

Cloud and edge data centers lead the U.S. Data Center Infrastructure Management (DCIM) Market due to increasing cloud adoption and low-latency requirements. Colocation centers also hold significant share as enterprises outsource infrastructure management. Managed data centers attract mid-sized businesses seeking cost efficiency. Enterprise data centers remain relevant for regulated industries. Growth continues as hybrid deployments become more common.

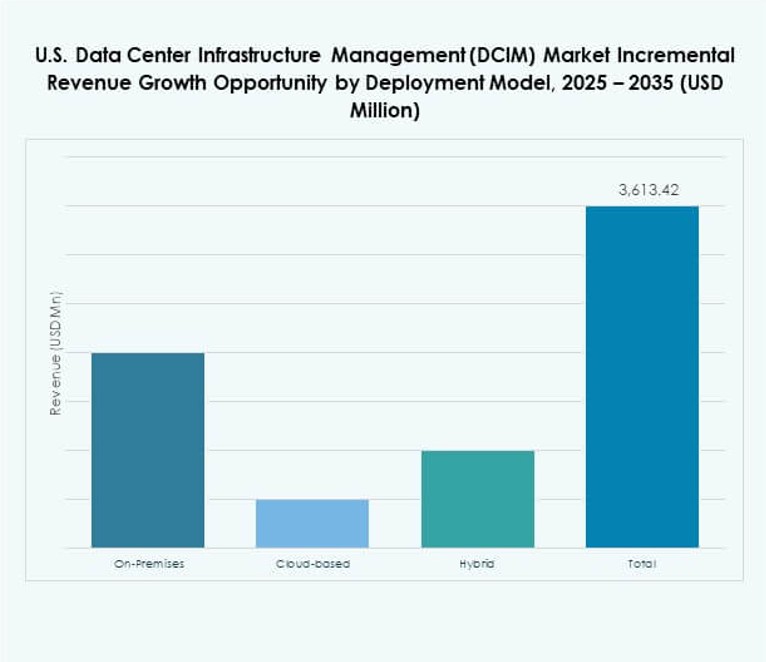

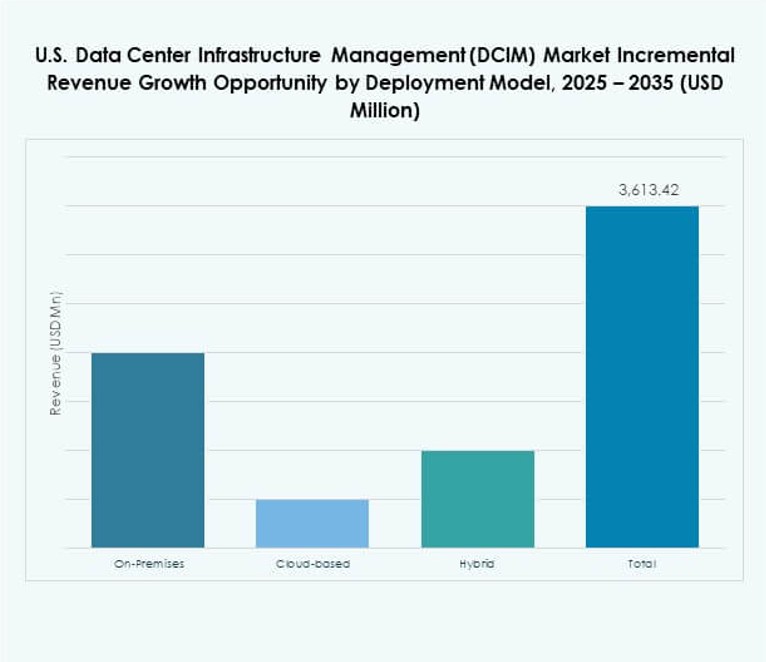

By Deployment Model

Cloud-based deployment is expanding fastest in the U.S. Data Center Infrastructure Management (DCIM) Market, driven by flexibility and scalability. On-premises models retain share in regulated industries needing control. Hybrid deployment combines advantages of both, gaining traction among large enterprises. Enterprises value hybrid for resilience and customization. The segment balance reflects diverse infrastructure needs.

By Enterprise Size

Large enterprises dominate the U.S. Data Center Infrastructure Management (DCIM) Market due to complex infrastructure and global operations. SMEs are emerging adopters, seeking cost-effective DCIM solutions for growth. Cloud-driven services support SME adoption. Large enterprises continue to invest heavily in resilience and compliance. Both segments create balanced growth opportunities.

By Application / Use Case

Power monitoring holds strong share in the U.S. Data Center Infrastructure Management (DCIM) Market, supported by rising energy efficiency requirements. Capacity management and asset tracking drive operational efficiency. Environmental monitoring gains importance for sustainability. BI and analysis are rising as enterprises seek deeper insights. Each application strengthens overall adoption.

By End User Industry

IT and telecommunications dominate the U.S. Data Center Infrastructure Management (DCIM) Market due to high demand for infrastructure visibility. BFSI and healthcare sectors adopt solutions for compliance and security. Retail and e-commerce drive growth through digital expansion. Energy, utilities, and defense sectors invest in resilience and efficiency. The diverse adoption secures market stability.

North-Eastern United States Leading With Strong Share

The North-Eastern region holds a leading 38% share of the U.S. Data Center Infrastructure Management (DCIM) Market. It benefits from high data center density in Virginia, New York, and New Jersey. Enterprises in finance, healthcare, and government drive adoption. It also benefits from strong connectivity infrastructure. Leading technology vendors concentrate operations here. The region secures dominance with established colocation and cloud facilities.

- For instance, the Equinix NY4 data center in Secaucus, New Jersey, is a key interconnection hub for the U.S. financial sector, hosting major exchanges and high-frequency trading platforms. It offers carrier-neutral connectivity and direct access to a wide range of network providers, making it central to low-latency trading and financial services in the Northeast.

Western United States Growing With Cloud and Hyperscale Demand

The Western region accounts for a 34% share in the U.S. Data Center Infrastructure Management (DCIM) Market. California, Oregon, and Washington lead cloud and hyperscale deployments. The presence of major cloud providers fuels expansion. It gains strength from renewable energy integration into facilities. Silicon Valley investments further accelerate adoption. The West emerges as a hub for innovation and sustainability.

- For instance, in July 2025, Avangrid announced a power purchase agreement to supply more than 100 MW from its Leaning Juniper IIB wind project in Gilliam County, Oregon, to Google’s data centers in The Dalles.

Southern and Midwestern United States Emerging With Expansion Opportunities

The Southern and Midwestern regions collectively hold 28% share in the U.S. Data Center Infrastructure Management (DCIM) Market. Texas, Ohio, and Arizona lead growth with favorable tax incentives and power availability. Enterprises expand infrastructure to meet rising digital demand. It attracts investment in modular and edge deployments. Carrier-neutral facilities strengthen competitiveness. These regions emerge as key growth frontiers.

Competitive Insights:

- ABB Ltd.

- Cisco Systems, Inc.

- Device42, Inc.

- Eaton Corporation

- FNT GmbH

- Huawei Technologies Co., Ltd.

- IBM

- Schneider Electric SE

- Siemens AG

- Hewlett Packard Enterprise (HPE)

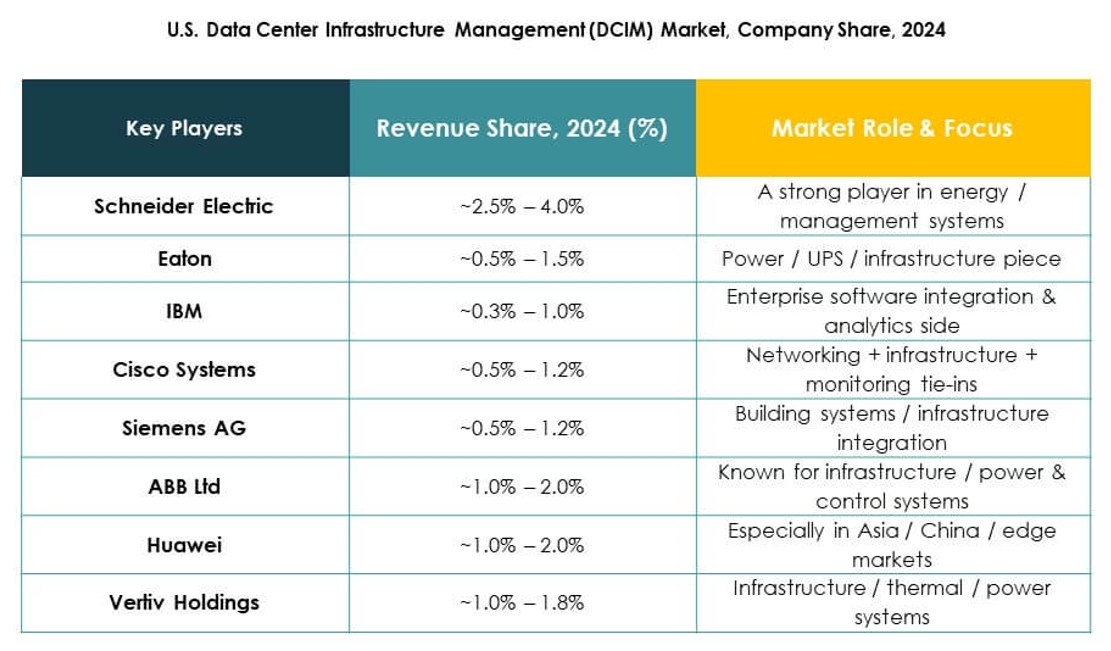

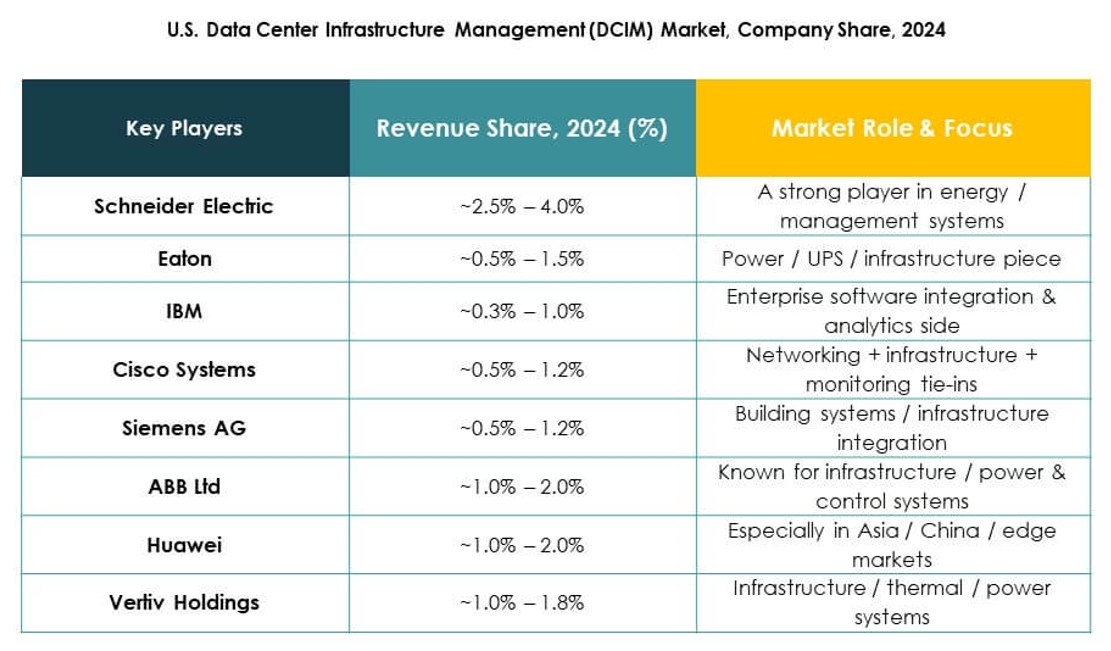

The competitive landscape of the U.S. Data Center Infrastructure Management (DCIM) Market is defined by strong participation from global technology leaders and specialized vendors. It demonstrates high competition driven by product innovation, service differentiation, and strategic alliances. Established players such as Schneider Electric, Vertiv, and ABB focus on energy-efficient platforms and intelligent monitoring systems. Cisco, IBM, and HPE integrate advanced analytics and hybrid cloud capabilities to capture enterprise demand. Device42, Nlyte Software, and Sunbird strengthen presence with niche solutions targeting asset visibility and simplified integration. It continues to expand through mergers, acquisitions, and regional data center growth strategies, ensuring a dynamic and evolving ecosystem that balances scale, innovation, and regulatory compliance.

Recent Developments:

- In July 2025, Nlyte Software revealed a new integration with ServiceNow, aimed at automating compliance and change management processes in U.S. data centers, reducing workforce overhead and improving audit reliability.

- In May 2024, Sunbird Inc. launched “Power IQ 9.0,” the latest version of its DCIM software, featuring advanced environmental monitoring and reporting capabilities targeted at reducing energy consumption and enhancing uptime in U.S. data centers.