Executive summary:

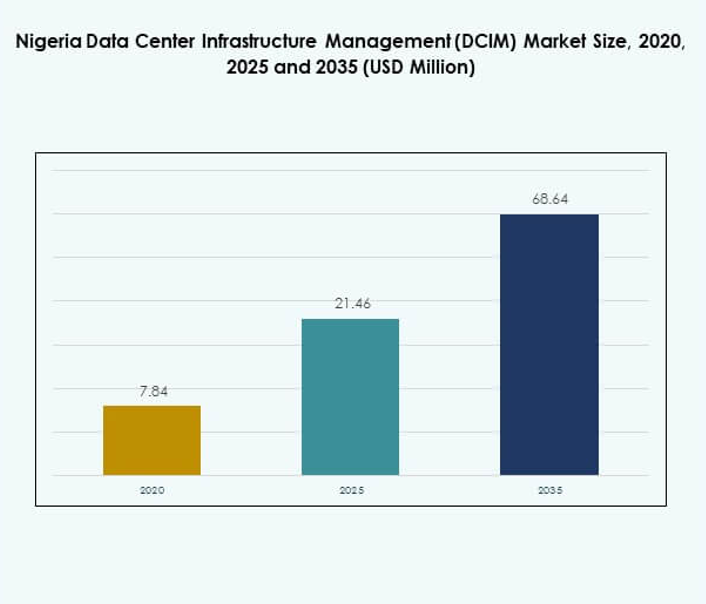

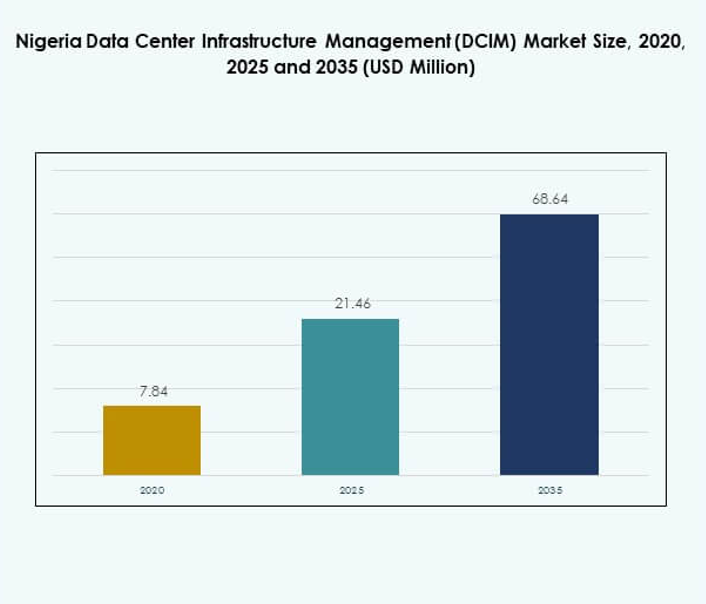

The Nigeria Data Center Infrastructure Management (DCIM) Market size was valued at USD 7.84 million in 2020 to USD 21.46 million in 2025 and is anticipated to reach USD 68.64 million by 2035, at a CAGR of 14.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Nigeria Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 21.46 Million |

| Nigeria Data Center Infrastructure Management (DCIM) Market, CAGR |

68.64% |

| Nigeria Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 14.09 Million |

The market is driven by the rapid expansion of digital infrastructure, cloud computing adoption, and increasing automation across industries. It benefits from growing demand for real-time monitoring, AI-based predictive analytics, and energy-efficient operations. Businesses and investors view DCIM solutions as strategic assets that optimize cost, ensure uptime, and enhance sustainability in data-driven environments. Continuous innovation in intelligent management systems supports scalability and competitiveness across enterprises.

Lagos leads the Nigeria DCIM market due to its established connectivity, robust data center ecosystem, and high enterprise concentration. Abuja is emerging as a secondary hub supported by government-led digital transformation initiatives and smart infrastructure projects. Other regions such as Port Harcourt and Kano are witnessing early-stage investments aimed at improving connectivity and regional data processing capacity.

Market Drivers

Growing Adoption of Cloud Computing and Digital Infrastructure

The Nigeria Data Center Infrastructure Management (DCIM) Market is driven by rapid cloud adoption and growing digitalization across sectors. Businesses are shifting workloads to hybrid and multi-cloud environments to improve scalability and reduce operational costs. It benefits from enterprises integrating DCIM platforms for efficient resource utilization and performance monitoring. Government-led data sovereignty policies further encourage local data storage, strengthening infrastructure demand. Increased reliance on SaaS and IaaS models amplifies the need for real-time visibility. Investments in Tier III and IV data centers are expanding the country’s capacity. These developments enhance operational resilience and data accessibility. Investors view DCIM as vital for Nigeria’s digital economy evolution.

Rising Demand for Energy-Efficient Data Centers and Sustainability Goals

Energy efficiency is a key growth driver shaping market evolution. Data centers are adopting advanced DCIM tools for power optimization and thermal management. It enables real-time power usage monitoring and automation, reducing carbon footprints. Enterprises in Nigeria are increasingly focusing on green certifications and renewable energy integration. Operators deploy AI-based systems for dynamic cooling and predictive maintenance. This shift ensures reliability while cutting operational costs. Energy audits and sustainability metrics are becoming central to data center planning. Investors favor companies with proven energy-saving outcomes. Sustainability-driven strategies are fostering competitive differentiation within Nigeria’s DCIM sector.

- For instance, in August 2025, Airtel Nigeria publicly announced the construction of a 38MW hyperscale data center at Eko Atlantic City in Lagos, which will feature advanced energy-efficient systems targeting a power usage effectiveness (PUE) of under 1.4 and support over 3,000 high-density racks with renewable energy technologies designed to cut operational carbon footprint.

Advancements in Automation, AI, and IoT Integration

Automation and AI integration are transforming DCIM operations in Nigeria. Intelligent sensors and IoT devices collect and analyze performance data across facilities. It allows predictive maintenance, fault detection, and capacity planning. The integration of AI enhances decision-making and reduces downtime risks. Vendors are launching platforms with unified dashboards for multi-site management. Automation reduces human dependency and improves response time to network issues. Nigerian enterprises are investing in machine learning-enabled monitoring tools for efficient operation. These technologies enhance service reliability and infrastructure resilience. Innovation in smart management systems is redefining the region’s data center landscape.

- For instance, in October 2024, Huawei announced the launch of a major new data center in Nigeria, equipped with advanced cloud infrastructure to bolster local digital capabilities and ensure compliance with Nigeria’s data protection regulations, thus providing indigenous businesses with secure, AI-powered data storage and computing resources.

Government Policies and Rising Investments in Digital Transformation

Government initiatives promoting digital transformation are reinforcing the Nigeria DCIM market. Policies supporting broadband expansion and national data center development encourage adoption. It benefits from public-private partnerships fostering infrastructure modernization. Foreign direct investments are driving the construction of hyperscale facilities. These projects create opportunities for advanced DCIM solutions. The digital inclusion strategy accelerates the need for secure and scalable systems. Strategic reforms in ICT strengthen Nigeria’s role as a regional data hub. Businesses and investors recognize the long-term potential of this policy-backed environment. Infrastructure digitization is becoming a central pillar of Nigeria’s economic growth.

Market Trends

Increased Adoption of Edge Data Centers and Distributed Infrastructure

Edge computing adoption is reshaping Nigeria’s data center landscape. The Nigeria Data Center Infrastructure Management (DCIM) Market is witnessing demand for low-latency solutions supporting IoT and 5G applications. Distributed infrastructure enhances connectivity in remote and urban regions. It enables real-time processing near data sources, minimizing transmission delays. Telecom operators and service providers are expanding micro-data centers. These smaller facilities require DCIM integration for power and cooling optimization. Enterprises prefer modular setups for flexible capacity scaling. The trend aligns with Nigeria’s digital ecosystem growth and future-ready network strategy.

Shift Toward Cloud-Based DCIM Solutions for Operational Flexibility

Cloud-based DCIM models are gaining traction among enterprises and colocation providers. It simplifies centralized monitoring across geographically dispersed facilities. The Nigeria Data Center Infrastructure Management (DCIM) Market benefits from rising demand for SaaS-based solutions offering scalability and cost efficiency. Cloud models provide remote accessibility, ensuring continuous supervision of assets. Service providers deploy AI analytics for workload management and incident prediction. This shift enhances business continuity and operational transparency. Vendors are integrating cybersecurity frameworks to secure multi-tenant environments. Cloud-based DCIM systems are becoming the backbone of Nigeria’s smart infrastructure ecosystem.

Integration of Predictive Analytics and Machine Learning for Optimization

Predictive analytics is emerging as a transformative trend in Nigeria’s DCIM space. It enables early detection of performance anomalies through historical data analysis. The Nigeria Data Center Infrastructure Management (DCIM) Market leverages machine learning to improve resource utilization. Operators use advanced algorithms for capacity forecasting and load balancing. It supports automated risk alerts, enhancing reliability and uptime. Predictive maintenance tools reduce downtime and improve operational predictability. Data-driven insights enable strategic decision-making in dynamic environments. Adoption of analytics-driven DCIM tools ensures long-term efficiency and asset optimization.

Growing Focus on Cybersecurity and Compliance Management

Data privacy and regulatory compliance are shaping DCIM implementation strategies. Organizations adopt secure management platforms to align with data protection laws. The Nigeria Data Center Infrastructure Management (DCIM) Market emphasizes compliance frameworks to maintain user trust. Enterprises deploy encrypted protocols and multi-factor authentication within DCIM systems. It reduces vulnerability to cyberattacks and insider threats. Vendors enhance platforms with advanced logging and audit capabilities. Compliance certifications are becoming mandatory for operators serving critical industries. Strengthening cybersecurity readiness is a key trend driving Nigeria’s digital reliability.

Market Challenges

High Energy Costs and Power Supply Instability

Energy challenges remain a critical barrier in the Nigeria Data Center Infrastructure Management (DCIM) Market. Frequent power outages increase dependency on diesel generators, raising operational costs. It affects sustainability goals and limits green initiatives. Energy inefficiencies constrain infrastructure reliability and uptime. Many operators struggle to maintain consistent power quality. The lack of renewable energy integration further elevates maintenance costs. Limited availability of high-quality grid power deters large-scale investments. Businesses are exploring hybrid power models to offset energy volatility. Addressing these issues is essential for stable DCIM performance and investor confidence.

Limited Technical Expertise and High Implementation Costs

A shortage of skilled professionals poses challenges to DCIM deployment and management. Many enterprises face difficulties integrating complex monitoring systems effectively. It leads to underutilization of DCIM capabilities and performance gaps. High initial investment and software licensing costs deter smaller firms. Limited training programs restrict workforce readiness in advanced automation tools. Integration with legacy systems remains a technical hurdle. Vendors are investing in localized training and support partnerships. Expanding technical education will be vital for sustaining Nigeria’s digital infrastructure growth. Bridging this expertise gap will drive broader market adoption.

Market Opportunities

Expansion of Hyperscale and Colocation Facilities in Emerging Cities

The Nigeria Data Center Infrastructure Management (DCIM) Market offers opportunities in hyperscale and colocation expansion. Rising data consumption drives the need for advanced facility management. It enables scalability for cloud providers and enterprise clients. Secondary cities like Abuja and Port Harcourt are attracting new data investments. Strategic deployment of modular DCIM systems ensures cost control and energy efficiency. Telecom operators are collaborating with DCIM vendors to enhance uptime. Growing digital adoption across enterprises strengthens demand for colocation-based infrastructure solutions.

Adoption of Renewable Energy and Smart Infrastructure Technologies

Renewable energy integration is opening new opportunities for sustainable data center operations. The Nigeria Data Center Infrastructure Management (DCIM) Market benefits from the push toward solar and hybrid energy systems. It supports reduced dependency on diesel generators and improves cost efficiency. Green data center initiatives are gaining support from policymakers and investors. Intelligent DCIM systems are enabling automation of energy optimization. Vendors are investing in smart-grid-compatible platforms to meet sustainability targets. These trends create long-term opportunities for technological and environmental innovation.

Market Segmentation

By Component

Solution components hold a dominant share in the Nigeria Data Center Infrastructure Management (DCIM) Market. Enterprises rely on advanced monitoring, analytics, and control systems to enhance efficiency. Service offerings, including consulting and managed solutions, support customized implementation. The growing complexity of multi-tenant facilities drives solution adoption. Vendors providing integrated platforms with modular architecture are gaining traction. This segment benefits from recurring revenue streams through software upgrades and service renewals.

By Data Center Type

Colocation and edge data centers dominate due to increasing demand from enterprises seeking scalable capacity. The Nigeria Data Center Infrastructure Management (DCIM) Market is expanding with new hyperscale and cloud-based deployments. Managed data centers are also growing with digital service providers entering partnerships. Enterprise data centers maintain relevance for mission-critical workloads. Edge facilities support IoT and 5G applications, ensuring faster processing. Continuous upgrades and network resilience strategies fuel this segment’s momentum.

By Deployment Model

Cloud-based deployment models lead due to flexibility and cost advantages. The Nigeria Data Center Infrastructure Management (DCIM) Market is adopting hybrid models for better control and scalability. Cloud systems offer centralized visibility across multiple locations, reducing hardware dependency. On-premises models remain vital for highly regulated sectors like BFSI. Vendors offering hybrid and SaaS-based DCIM solutions experience steady demand. These deployment models support evolving operational and compliance needs efficiently.

By Enterprise Size

Large enterprises dominate due to extensive IT infrastructure and compliance requirements. The Nigeria Data Center Infrastructure Management (DCIM) Market also witnesses rising adoption among SMEs. SMEs implement cloud-based DCIM platforms to optimize resources without heavy capital investment. Large organizations prioritize automation and AI-driven analytics for performance enhancement. Vendors tailor scalable pricing models to attract both enterprise categories. Growing IT modernization efforts across industries strengthen this segmentation.

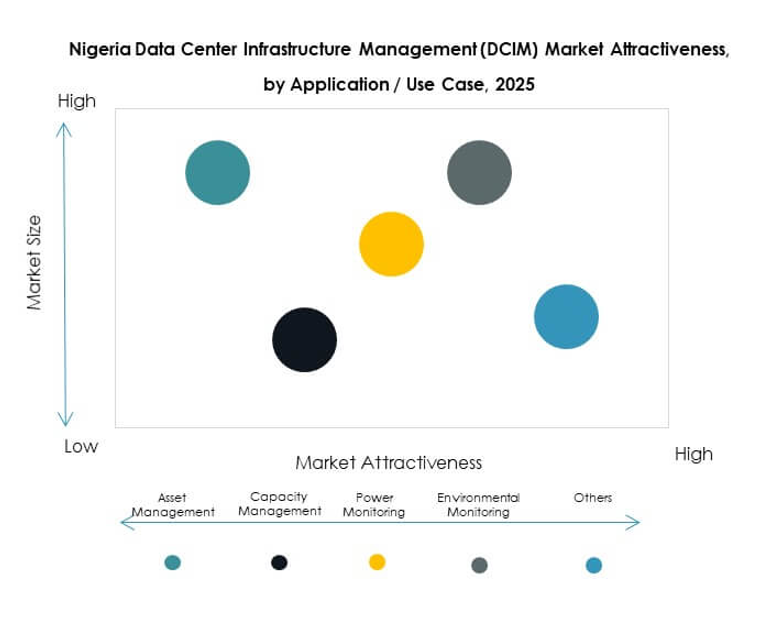

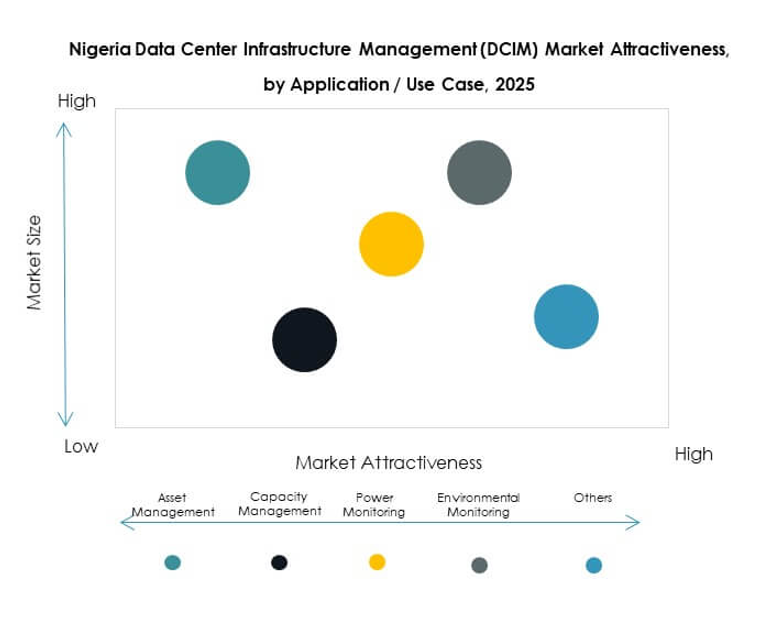

By Application / Use Case

Power and environmental monitoring represent key applications within the Nigeria Data Center Infrastructure Management (DCIM) Market. Asset and capacity management tools enable efficient infrastructure utilization. BI and analytics modules support decision-making and forecasting. Enterprises integrate these tools for predictive maintenance and operational continuity. Comprehensive monitoring enhances sustainability and risk mitigation. This segment gains momentum through demand for real-time performance insights.

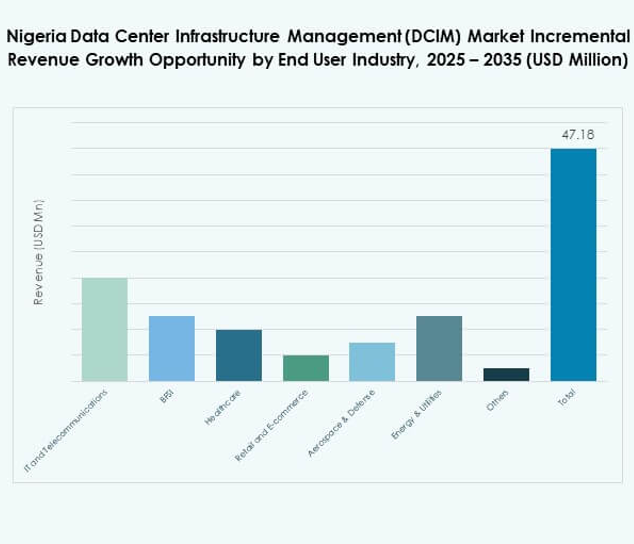

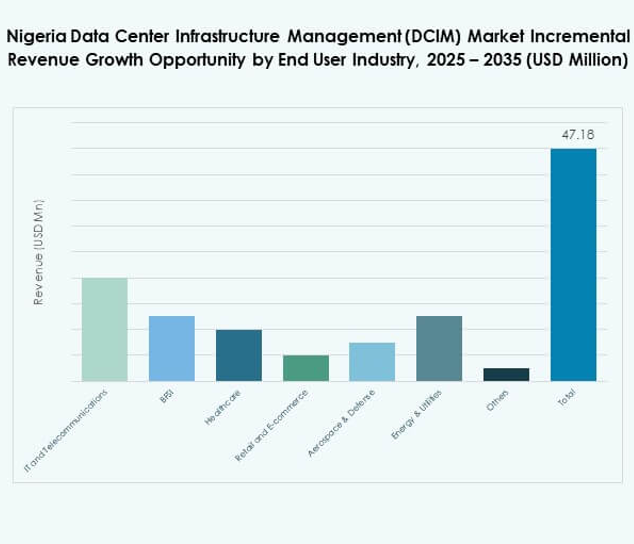

By End User Industry

IT and telecommunications hold the largest share, driven by cloud and connectivity expansion. BFSI and healthcare sectors are rapidly adopting DCIM for data security and compliance. The Nigeria Data Center Infrastructure Management (DCIM) Market also finds traction in retail and e-commerce sectors. Energy, utilities, and defense industries rely on DCIM for continuous uptime. The diversification across industries ensures long-term market resilience and expansion.

Regional Insights

Lagos Region: Nigeria’s Core Digital and Data Infrastructure Hub (Share: 46%)

Lagos leads the Nigeria Data Center Infrastructure Management (DCIM) Market due to its dense concentration of colocation and enterprise facilities. It benefits from reliable connectivity, international subsea cable landings, and strong corporate presence. The region’s economic strength supports continuous infrastructure expansion. Multiple hyperscale data centers are under development, boosting DCIM adoption. Lagos serves as the primary access point for cloud and telecom networks. Investors prioritize the city for its mature ecosystem and growing regional demand.

- For instance, Rack Centre launched its LGS2 data center facility in Lagos in 2025, featuring a 12 MW IT load capacity and 3,240 square meters of white space across six data halls, strengthening Nigeria’s position as a major digital infrastructure hub in West Africa.

Abuja Region: Rising Secondary Market Driven by Government and Enterprise Demand (Share: 33%)

Abuja is emerging as a strategic secondary hub within Nigeria’s DCIM ecosystem. It houses government-led IT modernization initiatives and smart city projects. The Nigeria Data Center Infrastructure Management (DCIM) Market benefits from expanding enterprise operations and data localization efforts. Public-private partnerships are driving new facilities with modern infrastructure. The region’s policy-driven growth supports long-term digital transformation. Infrastructure reliability and stable regulatory policies make Abuja a key expansion zone.

- For instance, Digital Realty’s subsidiary, Medallion Communications, operates a colocation facility in Abuja with a 1MW IT load capacity as of 2024, designed to support high-density enterprise workloads and critical government applications.

Other Regions: Emerging Connectivity and Infrastructure Growth Across the Nation (Share: 21%)

Emerging cities such as Port Harcourt, Kano, and Ibadan are gaining attention for regional expansion. These areas benefit from growing telecom networks and enterprise adoption. The Nigeria Data Center Infrastructure Management (DCIM) Market in these zones focuses on smaller, modular data centers. It ensures service availability in underserved regions. Infrastructure investments are improving network reliability and digital inclusion. The regional diversification strengthens Nigeria’s overall digital competitiveness and data economy potential.

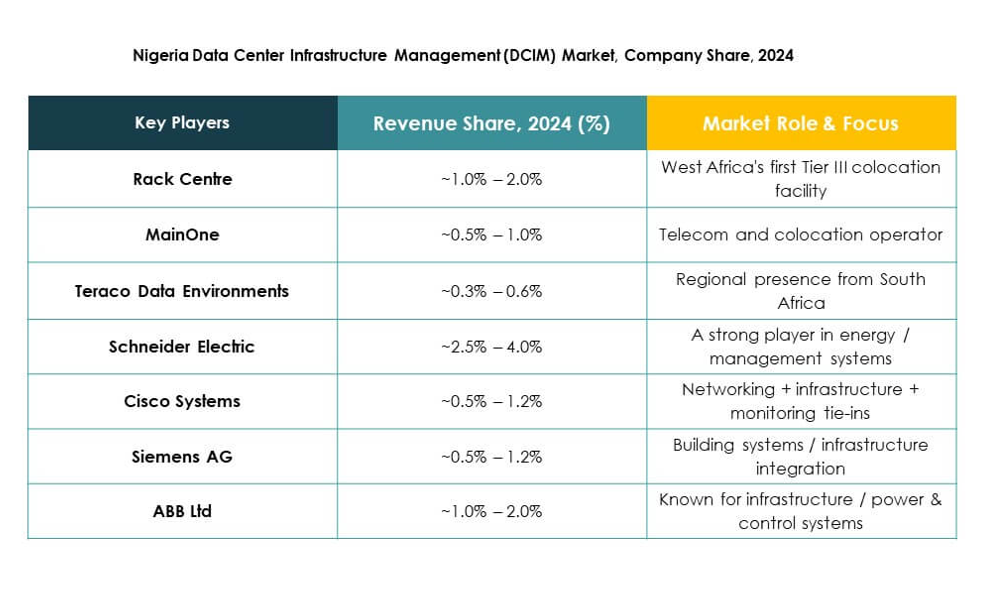

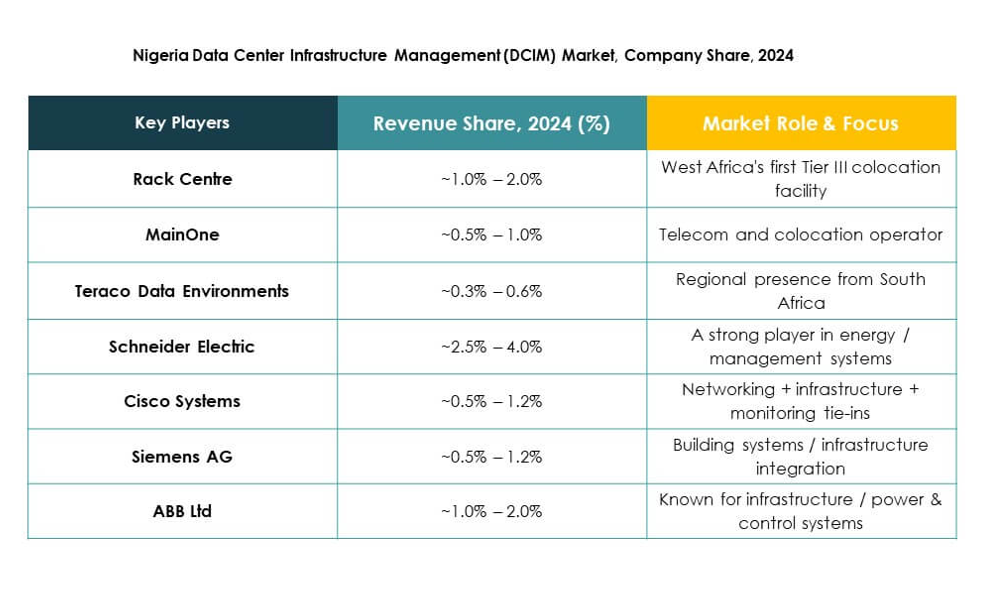

Competitive Insights:

- Rack Centre

- MainOne

- Teraco Data Environments

- Cisco Systems, Inc.

- Equinix

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

The Nigeria Data Center Infrastructure Management (DCIM) Market features strong competition among global technology firms and regional data infrastructure providers. It is shaped by companies focusing on innovation, reliability, and integration of intelligent monitoring systems. Local leaders such as Rack Centre and MainOne strengthen Nigeria’s digital ecosystem through expansion and energy-efficient facilities. Global vendors like Schneider Electric SE, Huawei, and Cisco Systems provide advanced automation, cooling, and AI-based DCIM platforms to enhance operational performance. Teraco Data Environments and Equinix contribute expertise in colocation and interconnection services. Eaton and Siemens drive energy optimization and sustainability solutions. The market’s competitive intensity promotes rapid adoption of next-generation DCIM technologies across enterprise and colocation environments.

Recent Developments:

- In August 2025, Schneider Electric enabled local IT partners in Nigeria to deliver secure, reliable, and sustainable AI solutions through its EcoStruxure platform and AI-ready data center ecosystem, aiming to support rapid growth in advanced data workloads across sectors such as fintech, telecommunications, and manufacturing.

- In July 2025, MTN Nigeria officially launched the first phase of its USD 235 million Dabengwa Sifiso Data Center in Lagos, a Tier III-certified facility and the largest of its kind in West Africa, alongside a new locally priced cloud service targeting enterprise customers.

- In April 2025, Rack Centre launched its LGS2 12MW IT Load Data Centre in Lagos, Nigeria, officially marking a significant milestone in West Africa’s digital infrastructure, and positioning the firm as a major leader in the country’s data center ecosystem with advanced sustainability and energy efficiency capabilities.

- In April 2025, Equinix announced the opening of its LG2.3 data center expansion in Lagos, which aims to provide Nigerian businesses with additional digital infrastructure capacity, colocation, and interconnection solutions to support ongoing digital transformation efforts.

- In March 2025, Open Access Data Centres revealed plans to construct a new data center in Lagos with a projected power capacity of 24 MW, with the first 12 MW phase scheduled for completion by 2026.