Executive summary:

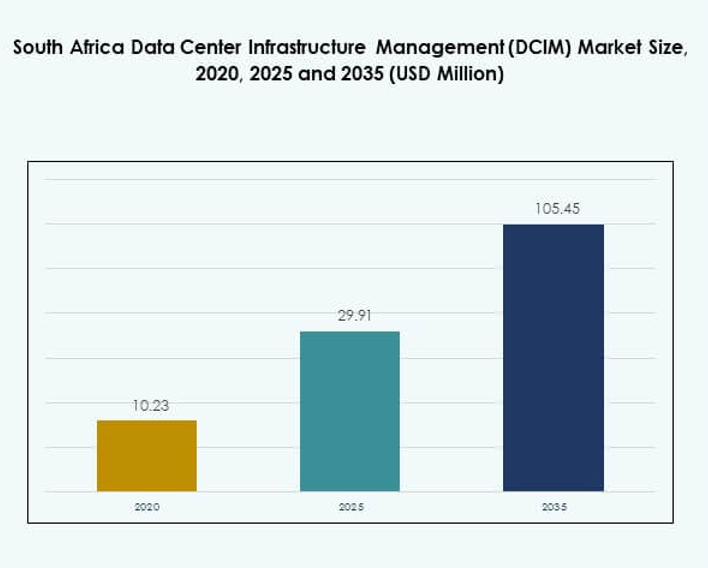

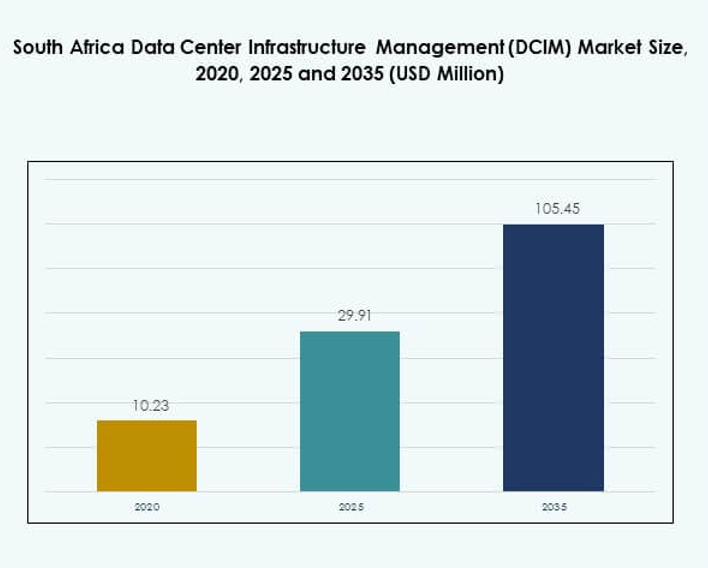

The South Africa Data Center Infrastructure Management (DCIM) Market size was valued at USD 10.23 million in 2020 to USD 29.91 million in 2025 and is anticipated to reach USD 105.45 million by 2035, at a CAGR of 15.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| South Africa Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 29.91 Million |

| South Africa Data Center Infrastructure Management (DCIM) Market, CAGR |

15.19% |

| South Africa Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 105.45 Million |

The market growth is driven by expanding digital infrastructure, rising adoption of cloud-based services, and increasing investment in automation and AI-driven monitoring systems. Organizations are integrating smart technologies to improve energy efficiency and operational visibility. These advancements strengthen competitiveness and attract investor confidence in sustainable, high-performance data infrastructure. The market is strategically important for businesses seeking to optimize infrastructure costs and enhance service reliability across sectors.

Gauteng remains the leading region with dense data center clusters in Johannesburg and strong enterprise demand. The Western Cape is emerging rapidly, supported by renewable energy integration and subsea cable connectivity. KwaZulu-Natal and Eastern Cape show growing investment potential, driven by industrial expansion and improved connectivity networks. These regional developments establish South Africa as a primary hub for digital transformation and infrastructure innovation across Sub-Saharan Africa.

Market Drivers

Growing Demand for Intelligent Infrastructure and Energy Efficiency

The South Africa Data Center Infrastructure Management (DCIM) Market is driven by the growing demand for intelligent, automated, and energy-efficient data centers. Enterprises are integrating AI and IoT technologies to enable predictive maintenance and enhance operational control. Real-time monitoring systems are becoming critical for optimizing energy use and reducing downtime. Sustainability goals are also influencing the adoption of renewable-powered infrastructure. Businesses prefer DCIM platforms that deliver measurable energy savings and lower operating costs. Vendors are focusing on solutions that integrate power, cooling, and asset management. The drive for efficiency strengthens long-term infrastructure resilience and aligns with national sustainability targets.

- For instance, in July 2024, Schneider Electric announced an evolution of its EcoStruxure IT DCIM platform, incorporating model-based automated sustainability metric reporting, enabling data centers to leverage AI for energy consumption analysis and achieving measurable reductions in cooling energy use and operational costs

Accelerating Digital Transformation and Cloud Integration

Rapid cloud adoption and digital transformation are reshaping the South African IT landscape. Organizations are migrating workloads to hybrid and multi-cloud environments that demand scalable infrastructure management. The DCIM market benefits from enterprises investing in tools to ensure visibility across complex data environments. Edge computing growth adds demand for remote monitoring and management capabilities. Cloud-native DCIM solutions provide flexibility and faster deployment for expanding operations. Businesses view it as essential for managing interconnected facilities securely. The integration of automation ensures consistent service delivery across distributed data centers. This trend is transforming operational strategies for local and global enterprises.

Rising Investment in AI and Automation for Operational Excellence

AI-driven analytics and automation have become central to data center modernization. The market is witnessing investments in machine learning-enabled platforms that predict equipment failure and optimize asset performance. Automated DCIM systems reduce human intervention and improve accuracy in capacity planning. These advancements allow enterprises to achieve better reliability and reduce downtime incidents. Real-time data insights also improve power and cooling efficiency. The adoption of automation supports compliance with energy regulations and corporate sustainability goals. Enterprises see these innovations as critical to improving infrastructure resilience. It drives both performance optimization and competitive differentiation.

- For example, in July 2024, Vertiv announced a strategic partnership with Redington to enhance the distribution of its critical digital infrastructure, power, and cooling solutions across Africa. The collaboration aims to support the region’s growing demand for advanced data center technologies and strengthen Vertiv’s presence in emerging African markets.

Strategic Role in Enabling Digital Economy and Investor Confidence

The DCIM market plays a key role in supporting South Africa’s expanding digital economy. Growing adoption among telecom, BFSI, and healthcare sectors enhances the country’s IT ecosystem. Investors are increasingly targeting data center assets due to rising digital service consumption. Government-led initiatives in digital transformation and connectivity are fostering private partnerships. Businesses view DCIM solutions as essential for optimizing ROI on infrastructure investments. Local players are collaborating with global providers to enhance energy management and automation capabilities. The market’s strategic importance extends to regional competitiveness in Africa. It acts as a foundation for sustainable and technology-driven growth.

Market Trends

Adoption of AI-Driven and Cloud-Based DCIM Platforms

AI-driven DCIM systems are gaining momentum in the South Africa Data Center Infrastructure Management (DCIM) Market. Cloud-based DCIM platforms are becoming preferred due to their scalability and cost-effectiveness. They enable remote visibility and predictive analysis of assets across multiple sites. AI algorithms help operators detect faults early and recommend corrective measures. Hybrid models are being adopted for balancing data privacy with scalability. Enterprises use AI-based tools for intelligent power and capacity management. Vendors are launching platforms that unify monitoring and reporting across edge and core facilities. The trend supports continuous optimization and operational reliability.

Sustainability and Green Data Center Initiatives

Sustainability is influencing design and operation strategies across South African data centers. Operators are integrating renewable energy and efficient cooling to reduce carbon footprints. The DCIM market benefits from increased focus on energy transparency and compliance tracking. Data centers are optimizing Power Usage Effectiveness (PUE) through automation tools. Organizations prioritize eco-friendly construction and modular expansion capabilities. Vendors provide sustainability dashboards for measuring and reporting environmental metrics. The push toward green operations aligns with global ESG commitments. It strengthens the long-term competitiveness of South African data infrastructure.

Integration of Edge and Hyperscale Data Center Operations

Edge and hyperscale data centers are reshaping infrastructure management practices. The DCIM market is evolving to manage distributed environments with minimal latency. Businesses require real-time monitoring to synchronize operations between edge and core sites. Hyperscale operators deploy modular DCIM solutions to handle high-density workloads. Edge facilities demand lightweight platforms with automated fault recovery. This convergence improves performance and supports data localization requirements. Vendors design interoperable tools that connect hybrid and edge ecosystems. It promotes efficiency and agility across decentralized infrastructure models.

Rise in AI-Enabled Security and Compliance Monitoring

Data protection and compliance are top priorities for South African enterprises. The DCIM market is witnessing a surge in AI-enabled cybersecurity integration. Intelligent tools monitor anomalies, access patterns, and policy violations in real time. These systems enhance transparency across physical and digital assets. Compliance reporting capabilities are becoming vital for regulated industries. Businesses invest in secure platforms that align with global data standards. Integrated monitoring reduces risks of breaches and ensures system integrity. It strengthens enterprise trust in critical infrastructure management platforms.

Market Challenges

Infrastructure Complexity and Limited Technical Expertise

The South Africa Data Center Infrastructure Management (DCIM) Market faces challenges linked to managing complex hybrid environments. Many enterprises struggle with integrating legacy systems into modern DCIM frameworks. Lack of skilled professionals limits adoption speed and optimization capabilities. Operational teams require continuous training to handle automation tools effectively. High customization costs also create barriers for small and medium enterprises. Vendors must simplify deployment processes to accelerate adoption. Interoperability issues between old and new systems further delay implementation. The skill and technology gaps collectively hinder full-scale modernization efforts.

High Energy Costs and Regulatory Constraints on Sustainability

South Africa’s high electricity costs pose financial challenges for data center operators. Energy shortages and inconsistent power supply affect operational stability. The DCIM market must adapt to stricter environmental compliance regulations. Many operators need to balance sustainability targets with profitability. Infrastructure modernization demands substantial capital investment, slowing adoption. Limited availability of renewable energy sources adds operational risk. Organizations also face delays in achieving power-efficient infrastructure certifications. It emphasizes the need for government and industry collaboration to ensure reliable power and greener operations.

Market Opportunities

Rising Hyperscale and Colocation Investments Across South Africa

The South Africa Data Center Infrastructure Management (DCIM) Market is positioned for expansion through hyperscale and colocation developments. Global and regional operators are investing heavily in scalable facilities. These projects demand advanced DCIM systems to manage power, cooling, and security. The rise in AI and cloud workloads increases the need for automation platforms. Colocation providers seek integrated monitoring tools to ensure uptime and transparency. Growing foreign investment enhances infrastructure modernization and competitiveness. It creates opportunities for vendors offering modular, adaptive, and data-driven DCIM solutions. The market outlook remains strong due to sustained digital expansion.

Emerging Edge Computing and Renewable Integration Potential

Edge computing and renewable energy projects are generating new market opportunities. Local industries are adopting edge facilities to support 5G and IoT applications. DCIM solutions play a key role in optimizing distributed edge environments. Renewable integration allows sustainable power management with real-time analytics. Vendors are partnering with utilities to improve energy efficiency and resilience. The growing policy focus on decarbonization strengthens adoption incentives. It enables future-ready, low-emission digital infrastructure across the country. The shift toward distributed networks and clean energy enhances long-term growth potential.

Market Segmentation

By Component

The solution segment dominates the South Africa Data Center Infrastructure Management (DCIM) Market, driven by demand for real-time monitoring and asset management platforms. Advanced software modules help operators manage complex workloads with improved efficiency. The service segment grows steadily as organizations seek implementation and consulting support. Managed services ensure system reliability, cybersecurity compliance, and performance optimization. Integration with AI tools also supports proactive maintenance.

By Data Center Type

Enterprise data centers hold the leading share, supported by modernization projects in the telecom and banking sectors. Managed and colocation centers are witnessing rapid adoption due to scalable and cost-effective DCIM integration. Cloud and edge data centers are emerging segments with growing investments from hyperscale players. Their need for energy-efficient systems drives advanced monitoring tools. It highlights a shift toward hybrid and interconnected architectures.

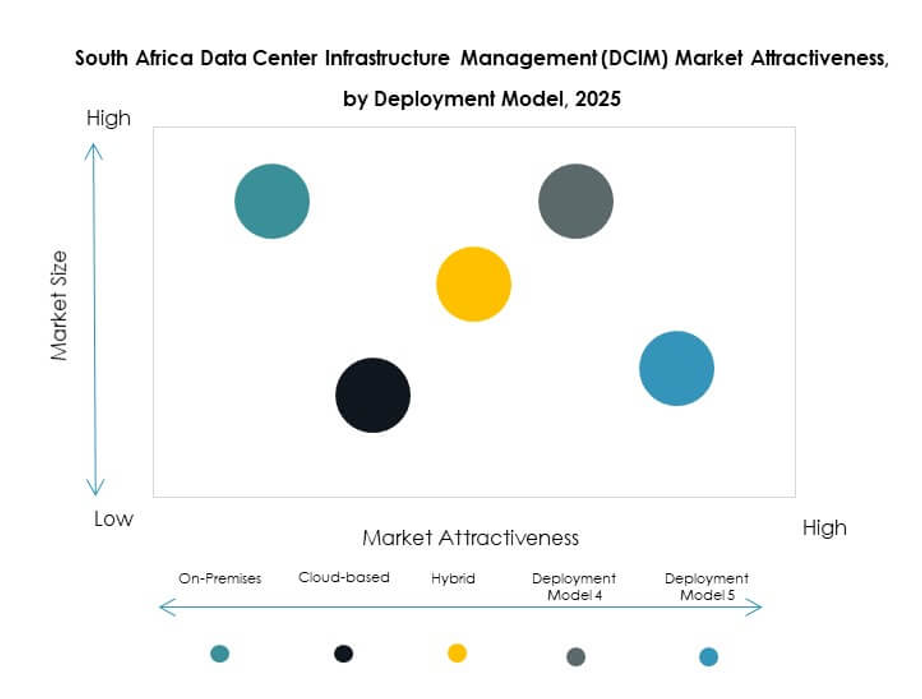

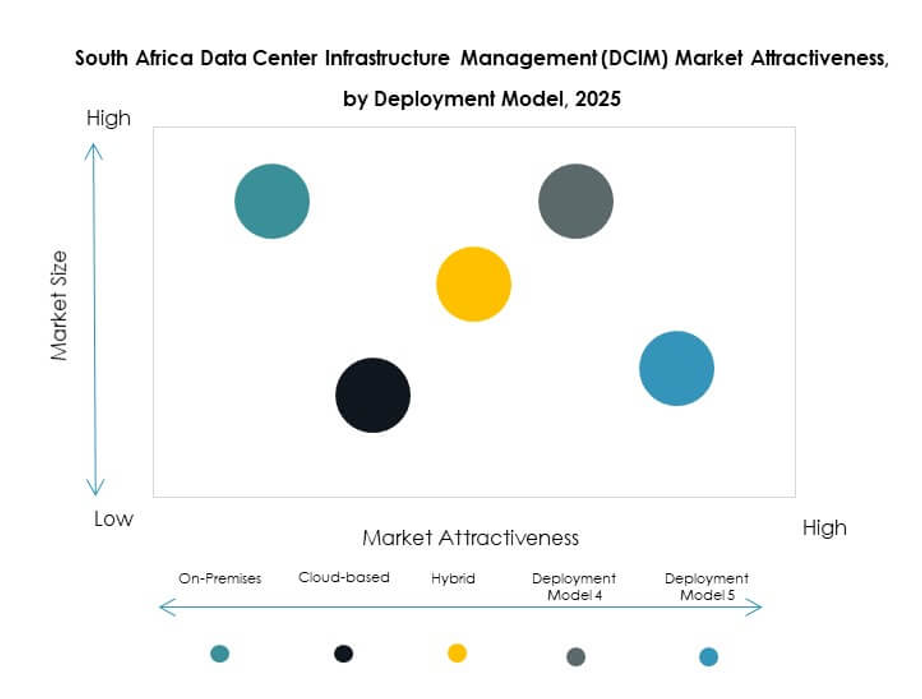

By Deployment Model

The on-premises segment leads the market due to strict data governance and security compliance. Cloud-based deployment is gaining pace owing to scalability and cost advantages. Hybrid models attract large enterprises seeking flexibility across multiple environments. Cloud-native DCIM solutions enable quick scalability and centralized management. It allows integration with public and private cloud ecosystems, improving agility and efficiency.

By Enterprise Size

Large enterprises dominate due to their extensive infrastructure and compliance needs. They prefer advanced DCIM platforms that support global operations and real-time analytics. Small and medium enterprises (SMEs) show growing adoption through cloud-based DCIM systems. Cost-effective subscription models make advanced management tools accessible. It supports digital transformation initiatives across smaller business segments.

By Application / Use Case

Power monitoring and capacity management hold the largest share due to rising energy optimization needs. Asset management and environmental monitoring are expanding rapidly through AI-enabled automation. Business intelligence and analytics functions add value by improving decision-making. Enterprises are leveraging integrated dashboards for predictive and preventive insights. It ensures operational efficiency and sustainability alignment.

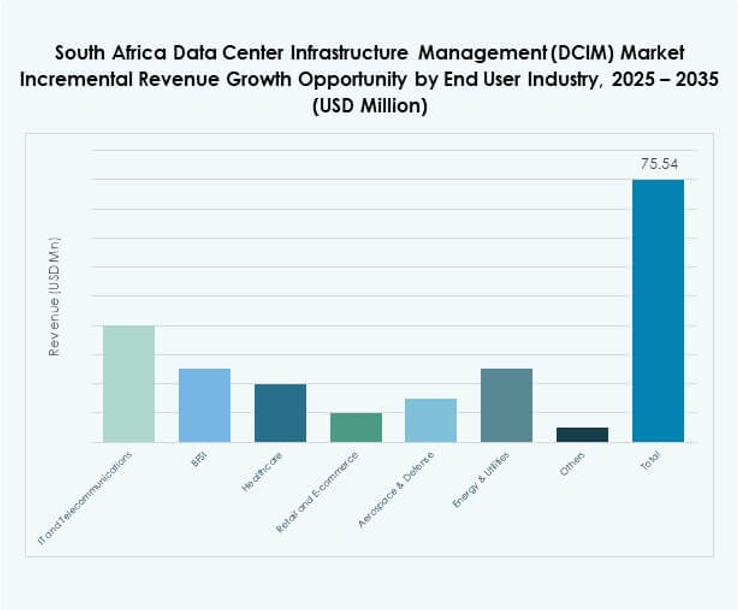

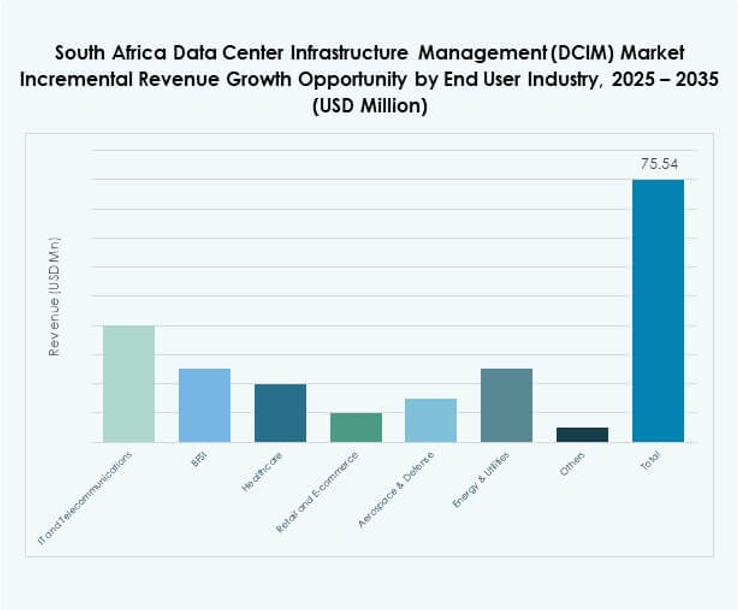

By End User Industry

IT and telecommunications lead the market with continuous infrastructure expansion. BFSI and healthcare sectors are accelerating DCIM adoption to ensure uptime and compliance. Retail, defense, and energy sectors invest in automation for improved asset visibility. E-commerce and logistics rely on hybrid systems for performance tracking. It underlines cross-industry reliance on intelligent DCIM solutions.

Regional Insights

Gauteng – The Core Hub with 48% Market Share

Gauteng holds the dominant share in the South Africa Data Center Infrastructure Management (DCIM) Market, hosting Johannesburg’s major colocation and hyperscale facilities. The province attracts heavy investment due to robust connectivity, strong enterprise presence, and power infrastructure. Leading operators like Teraco and Vantage expand regional capacity with AI-enabled systems. DCIM adoption is high due to strict performance monitoring standards. It serves as the country’s digital and financial hub, driving continuous modernization.

- For example, in August 2025, Teraco announced the completion of its JB4 hyperscale data center expansion in Ekurhuleni, increasing total IT capacity to 50 MW and establishing it as Africa’s largest standalone data center. The new phase features six data halls with liquid-to-liquid cooling, AI-enabled environmental controls, and a closed-loop system designed for zero water usage, setting new benchmarks for efficiency and sustainability in the region.

Western Cape – Growing Data Center Cluster with 32% Market Share

The Western Cape region, led by Cape Town, is emerging as a major digital hub. Expanding subsea cable connectivity enhances its importance in cloud and edge operations. Renewable integration initiatives make it attractive for sustainable infrastructure development. Data center operators are adopting modular DCIM systems to manage scalability. It strengthens the region’s role in supporting global cloud service expansion. Investments in innovation parks further accelerate its digital infrastructure growth.

KwaZulu-Natal and Other Provinces – Emerging Growth Regions with 20% Share

KwaZulu-Natal, Eastern Cape, and Free State represent emerging areas of opportunity. These regions attract infrastructure investments due to new fiber routes and industrial expansion. Colocation providers are exploring mid-sized facilities to serve local enterprises. DCIM adoption is increasing for power management and remote monitoring. Government support for connectivity projects improves digital access. It positions secondary provinces as the next frontier in data infrastructure development.

- For instance, in March 2025, Yangtze Optics Africa completed a new 14,000 sqm optical fiber manufacturing facility in Durban’s Dube Trade Port, making it the largest fiber plant in Africa and enabling local data centers to use advanced DCIM power and network solutions with direct supply of high-capacity cables.

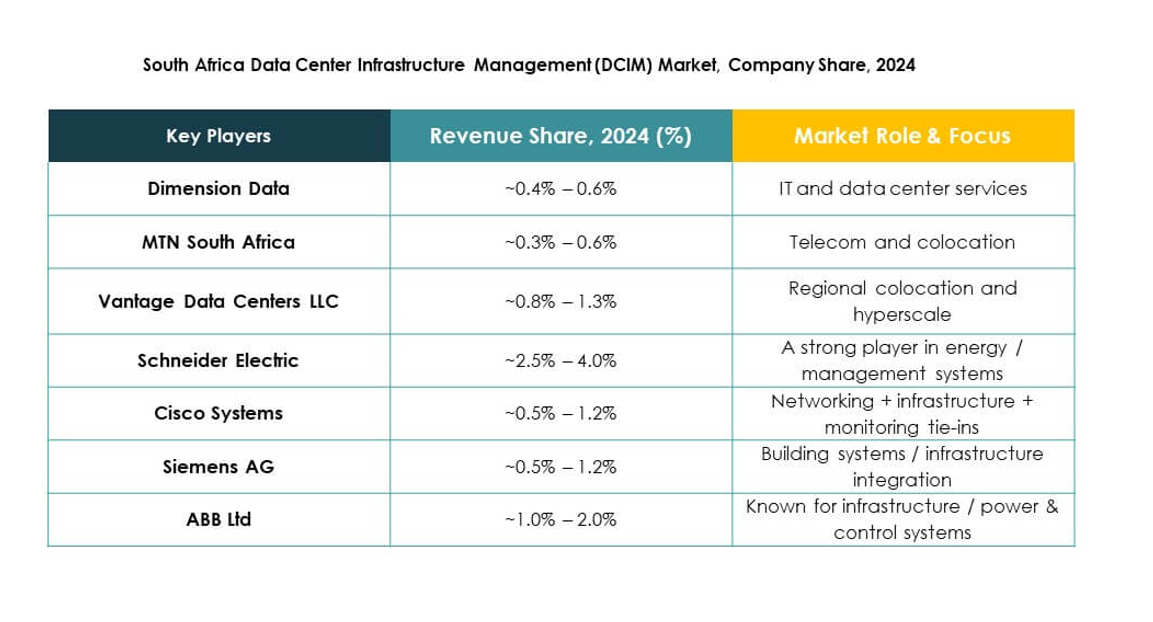

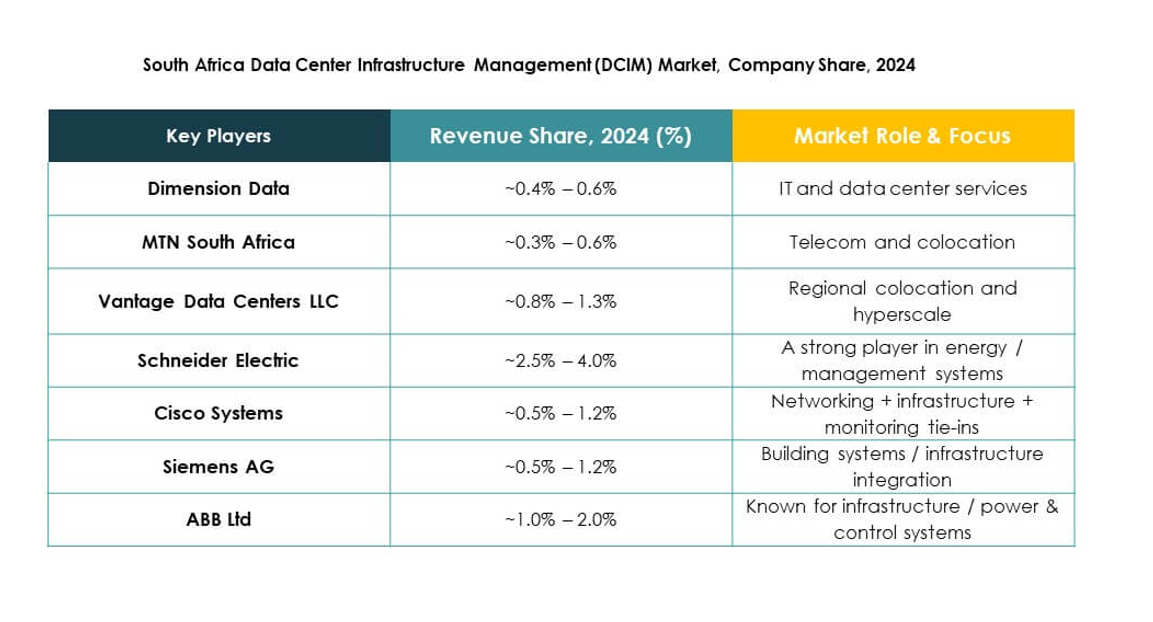

Competitive Insights:

- Teraco Data Environments

- Vantage Data Centers LLC

- Dimension Data

- MTN South Africa

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

The South Africa Data Center Infrastructure Management (DCIM) Market is characterized by a strong mix of global technology providers and regional infrastructure leaders. Teraco and Vantage Data Centers are expanding hyperscale capacity through sustainable and energy-efficient designs. Schneider Electric, Siemens, and Eaton lead in integrated DCIM platforms that enhance power, cooling, and asset management. Huawei and Cisco focus on automation, network optimization, and AI-driven monitoring solutions. MTN South Africa and Dimension Data invest in localized infrastructure modernization to support cloud and enterprise clients. The market shows increasing collaboration between telecom operators and technology vendors, driving innovation, operational efficiency, and green infrastructure adoption.

Recent Developments:

- In August 2025, Teraco Data Environments announced the completion of a significant expansion of its JB4 hyperscale data centre in Johannesburg, integrating new sustainability designs to set industry leading standards in energy efficiency and operational scale in South Africa’s data center market.

- In February 2025, Teraco entered a wind power purchase agreement (PPA) with NOA, a local energy aggregator, to supply renewable wind energy to all Teraco data centres, significantly boosting its commitment to sustainable operations and reducing dependence on the national grid.