Executive summary:

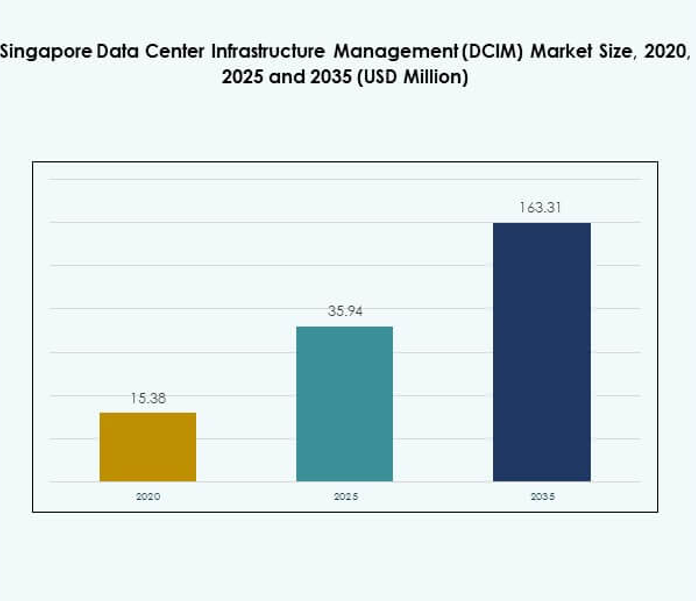

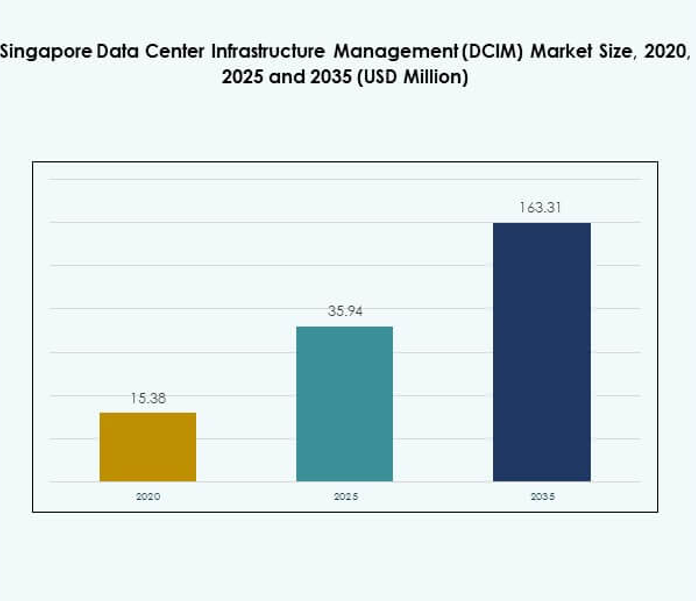

The Singapore Data Center Infrastructure Management (DCIM) Market size was valued at USD 15.38 million in 2020, growing to USD 35.94 million in 2025, and is anticipated to reach USD 163.31 million by 2035, at a CAGR of 18.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Singapore Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 35.94 Million |

| Singapore Data Center Infrastructure Management (DCIM) Market , CAGR |

18.12% |

| Singapore Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 163.31 Million |

The market is being driven by strong adoption of cloud-based platforms, AI-powered analytics, and IoT-enabled monitoring. Organizations are prioritizing operational efficiency, sustainability, and predictive maintenance to meet rising digital demands. Increasing investment in hyperscale and colocation facilities has elevated the need for scalable DCIM systems. Innovation in automation and power optimization continues to transform the market. For businesses and investors, it represents a strategic opportunity to capitalize on Singapore’s role as a regional digital hub.

Geographically, the Central Region leads the market with its concentration of hyperscale facilities, financial institutions, and advanced telecom infrastructure. The East Region is expanding rapidly with new industrial hubs and manufacturing-driven adoption of hybrid models. The West and North Regions are emerging as secondary hubs, attracting modular and edge deployments to support SMEs and localized demand. Together, these subregions shape a balanced digital ecosystem, positioning Singapore as a leader in efficient, future-ready infrastructure.

Market Drivers

Rising Demand for Intelligent Infrastructure and Cloud-Enabled DCIM Solutions

The Singapore Data Center Infrastructure Management (DCIM) Market is being driven by growing demand for intelligent infrastructure solutions that enhance visibility and control over data center assets. Businesses are deploying advanced DCIM tools to manage capacity, energy consumption, and real-time monitoring of workloads. The strong adoption of cloud services across banking, telecom, and government is creating higher demand for scalable DCIM platforms. Technology integration with IoT sensors and AI analytics strengthens predictive maintenance and operational reliability. The market benefits from government-backed digital infrastructure investments that increase demand for automation. Enterprises rely on DCIM to reduce downtime and optimize resources in high-density computing environments. Investors view this market as strategically important due to its potential to strengthen Singapore’s global data hub position. It continues to grow as organizations modernize operations for performance and compliance requirements.

Growing Role of Artificial Intelligence, Machine Learning, and Automation in Operations

DCIM platforms are adopting artificial intelligence and machine learning to provide predictive insights, automate workload balancing, and prevent system inefficiencies. AI-powered automation ensures real-time fault detection and proactive energy management across large-scale facilities. In the Singapore Data Center Infrastructure Management (DCIM) Market, AI integration is especially critical to support high-performance computing and data-intensive workloads. The trend is helping operators reduce operational costs while increasing system uptime. Businesses in Singapore are embracing these capabilities to ensure scalability for emerging AI and 5G deployments. Automated systems improve the ability to manage multiple colocation and cloud facilities efficiently. With increasing complexity, investors prioritize firms that deliver AI-driven DCIM platforms to ensure long-term value. This driver highlights the central role of automation in shaping data center competitiveness.

- For instance, Huawei introduced its latest distributed cooling architecture at the Global Smart Green Data Center Summit in July 2023, designed to incorporate AI-driven optimization and enable independent operation of cooling units. The solution demonstrated PUE levels as low as 1.15 and water usage effectiveness of 0.6 L/kWh in APAC deployments.

Shift Toward Sustainability and Renewable Energy Adoption in Data Centers

Singapore’s data centers face rising pressure to reduce carbon footprints and energy intensity. Operators are leveraging DCIM systems to track energy efficiency, optimize cooling performance, and integrate renewable energy sources into operations. The Singapore Data Center Infrastructure Management (DCIM) Market benefits from regulatory mandates focused on green data centers and energy reporting standards. Sustainable innovations such as liquid cooling and modular capacity planning strengthen adoption. Enterprises adopt DCIM to comply with sustainability targets while improving cost management. Investors are aligning with ESG-focused strategies, recognizing DCIM as a critical enabler of sustainability goals. Businesses across industries view this as a competitive differentiator, strengthening demand for advanced monitoring tools. The shift enhances Singapore’s reputation as a sustainable digital hub in the Asia-Pacific region.

- For instance, Huawei’s iCooling@AI technology has demonstrated significant PUE reductions in data centers through AI-driven cooling optimization and predictive adjustments. Pilot deployments in the Asia-Pacific region reported measurable energy efficiency gains, highlighting its role in supporting sustainability and energy-saving goals.

Increased Focus on Cybersecurity and Regulatory Compliance in Data Center Management

The rise of cyber threats and regulatory requirements makes cybersecurity a vital driver in DCIM adoption. Operators deploy DCIM platforms to integrate security monitoring with compliance standards, including data protection frameworks. The Singapore Data Center Infrastructure Management (DCIM) Market gains momentum from strict government policies on digital trust and information security. Businesses invest in DCIM to safeguard sensitive information across BFSI, telecom, and healthcare industries. Real-time threat detection and compliance management enhance confidence among stakeholders and investors. Secure systems strengthen customer trust and position Singapore as a reliable digital hub. The demand for integrated DCIM solutions that combine infrastructure management with compliance oversight is rising. This driver ensures DCIM remains central to both operational performance and digital security in the market.

Market Trends

Market Trends

Integration of Edge Computing and Colocation Facilities to Meet Low-Latency Needs

The adoption of edge computing is creating a trend toward smaller, distributed colocation data centers in Singapore. The Singapore Data Center Infrastructure Management (DCIM) Market benefits from the demand for low-latency solutions that support IoT and 5G applications. Edge facilities require advanced DCIM tools to monitor distributed workloads and ensure efficiency across multiple sites. Businesses use DCIM to maintain seamless connectivity between cloud and edge environments. Operators focus on offering edge-ready DCIM platforms that provide visibility across complex architectures. This trend reflects the market’s role in enabling the digital ecosystem. Investors recognize edge integration as a growth multiplier for data-driven enterprises. The ability to manage edge efficiently is becoming a key differentiator for service providers.

Emergence of Hybrid and Multi-Cloud Environments Driving Flexible DCIM Adoption

Organizations are adopting hybrid and multi-cloud strategies to balance workloads, ensure compliance, and achieve cost efficiency. This creates a trend where DCIM platforms must manage diverse infrastructure environments. The Singapore Data Center Infrastructure Management (DCIM) Market is witnessing a shift toward hybrid solutions that integrate on-premises and cloud-based resources. Operators focus on providing flexible deployment options to meet dynamic enterprise needs. Businesses demand interoperability features to ensure seamless transitions between cloud providers. Investors highlight hybrid adoption as a long-term trend shaping operational models. The flexibility offered by DCIM in managing hybrid environments enhances resilience. It positions Singapore as a leader in secure, agile digital infrastructure.

Expansion of AI-Powered Analytics and Predictive Maintenance Capabilities

Operators are increasingly deploying AI-powered analytics to strengthen predictive maintenance and reduce downtime risks. In the Singapore Data Center Infrastructure Management (DCIM) Market, predictive systems are becoming a dominant trend as workloads intensify. Businesses rely on advanced monitoring tools to identify anomalies and optimize asset performance. Predictive capabilities reduce operational costs while extending equipment lifecycle. Investors are supporting providers that integrate machine learning to enable real-time insights. Enterprises view predictive maintenance as essential for operational resilience and cost efficiency. The trend reflects the broader shift toward data-driven decision-making in infrastructure management. It establishes DCIM as a central element of future-ready operations.

Adoption of Modular Data Centers and Scalable Infrastructure Solutions

Scalability is a defining trend as enterprises adopt modular data center designs supported by DCIM systems. The Singapore Data Center Infrastructure Management (DCIM) Market benefits from demand for scalable infrastructure that meets evolving business requirements. Modular solutions supported by DCIM enable operators to add capacity efficiently while controlling costs. Businesses adopt these systems to accelerate deployment and enhance agility. Investors favor modular projects due to faster return on investment and sustainability benefits. The trend positions DCIM as a critical enabler of modular expansion across Singapore’s digital economy. Enterprises consider scalability vital to meet unpredictable computing demand. It highlights the growing focus on agility and flexibility in data center strategies.

Market Challenges

High Energy Consumption and Infrastructure Sustainability Pressures Across Data Centers

The Singapore Data Center Infrastructure Management (DCIM) Market faces challenges in managing energy efficiency while meeting increasing computing demands. High-density data centers consume vast amounts of electricity, straining sustainability efforts. Operators struggle to balance performance with environmental targets, despite DCIM solutions enabling optimization. Regulatory scrutiny on carbon footprints places additional pressure on enterprises. The reliance on traditional cooling methods further increases operational costs. Businesses find it difficult to implement sustainable practices without significant investment. Investors highlight sustainability as both a risk and opportunity factor. It is a persistent challenge that requires innovation in energy-efficient infrastructure.

Complex Integration Across Diverse IT Environments and Cybersecurity Risks

Enterprises encounter challenges in integrating DCIM platforms with legacy systems, hybrid clouds, and multi-vendor architectures. The Singapore Data Center Infrastructure Management (DCIM) Market reflects this complexity, with operators needing seamless interoperability. The challenge extends to cybersecurity risks, as expanded networks increase vulnerability. Businesses require continuous upgrades to stay ahead of threats, adding to costs. Integration complexity delays deployment and reduces ROI in some cases. SMEs face particular barriers in adopting advanced DCIM due to budget and technical constraints. Cybersecurity threats further intensify concerns around data protection in regulated industries. It remains a key challenge that impacts adoption across segments.

Market Opportunities

Growing Potential in AI-Enabled DCIM Platforms and Predictive Monitoring Tools

The Singapore Data Center Infrastructure Management (DCIM) Market offers opportunities in AI-enabled platforms that strengthen predictive monitoring and energy optimization. Businesses are adopting advanced analytics to reduce downtime and enhance operational efficiency. Investors view AI-focused DCIM providers as high-growth targets in Singapore’s digital economy. The opportunity lies in offering integrated solutions that address both performance and sustainability goals. Enterprises increasingly demand automation tools that improve decision-making and resource utilization. Providers that deliver scalable AI-driven solutions will capture significant market growth. It remains an area of strong competitive differentiation. The rise of AI workloads makes predictive capabilities essential.

Expansion into Edge Data Centers and Green Infrastructure Solutions

Operators can leverage opportunities in edge computing and sustainable infrastructure investments across Singapore. The Singapore Data Center Infrastructure Management (DCIM) Market benefits from rising adoption of green technologies and modular facilities. Businesses look for DCIM solutions that enable energy tracking and compliance reporting. Investors are focusing on projects that combine low-latency performance with environmental responsibility. The opportunity includes building edge-ready, energy-efficient platforms for distributed workloads. Enterprises see green DCIM adoption as both a compliance requirement and cost advantage. Providers that address sustainability while enabling agility will lead. This opportunity strengthens the market’s global competitiveness.

Market Segmentation

By Component

The solution segment dominated the Singapore Data Center Infrastructure Management (DCIM) Market in 2025, holding the largest share due to its role in asset monitoring, capacity planning, and real-time control systems. Solutions such as AI-driven analytics, energy optimization, and predictive maintenance strengthen enterprise efficiency and reliability. Service offerings are expanding with managed DCIM support and integration services, but they remain secondary compared to solutions. Growth in services is driven by SMEs adopting outsourced expertise. The increasing demand for automation and compliance monitoring reinforces solutions as the primary growth engine.

By Data Center Type

Enterprise data centers led the Singapore Data Center Infrastructure Management (DCIM) Market in 2025, supported by financial institutions and telecom operators investing in large-scale infrastructure. Managed data centers are expanding rapidly as organizations shift toward outsourcing operations. Colocation and cloud data centers are emerging growth drivers, powered by hyperscale deployments and AI workloads. Edge facilities are gaining importance for latency-sensitive applications but remain smaller in share. The market highlights enterprise facilities as dominant due to their scale and security requirements, while hybrid colocation and cloud models continue to capture strong momentum.

By Deployment Model

On-premises deployment accounted for the largest share of the Singapore Data Center Infrastructure Management (DCIM) Market in 2025, primarily driven by enterprises requiring direct control and compliance adherence. Cloud-based DCIM is growing significantly, favored by SMEs and organizations seeking scalability and reduced infrastructure costs. Hybrid models are gaining traction as businesses balance flexibility with security needs. On-premises remains dominant due to mission-critical industries such as BFSI and healthcare, where strict regulations and performance oversight drive adoption. The shift toward hybrid adoption positions the market for accelerated innovation and digital resilience.

By Enterprise Size

Large enterprises dominated the Singapore Data Center Infrastructure Management (DCIM) Market in 2025, securing the largest share through significant investment in hyperscale facilities and advanced monitoring solutions. These enterprises rely heavily on DCIM for compliance, efficiency, and asset optimization across complex operations. SMEs contribute smaller shares but are expanding adoption rapidly, enabled by cloud-based and managed DCIM offerings. The trend highlights how SMEs adopt cost-effective solutions to enhance competitiveness. Large enterprises will continue to hold dominance, but SMEs represent a strong growth avenue due to their increasing reliance on digital infrastructure.

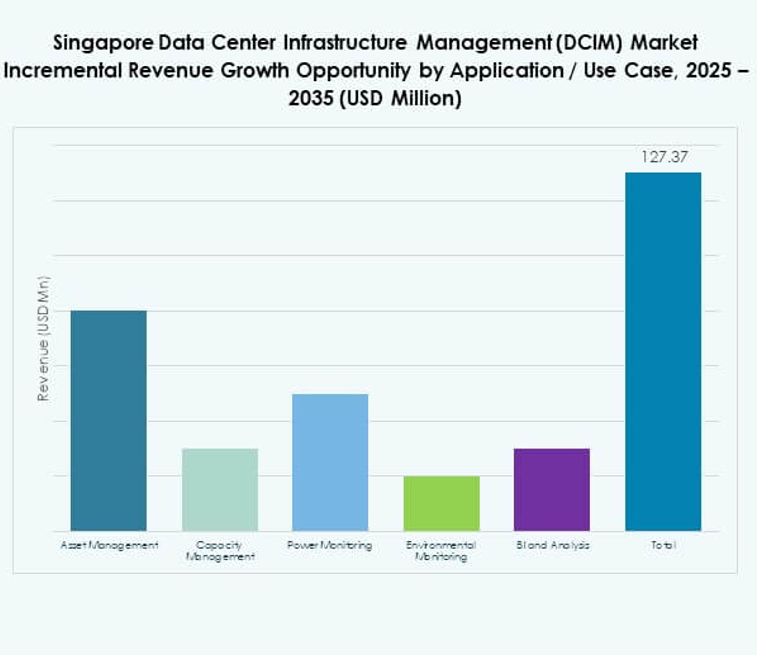

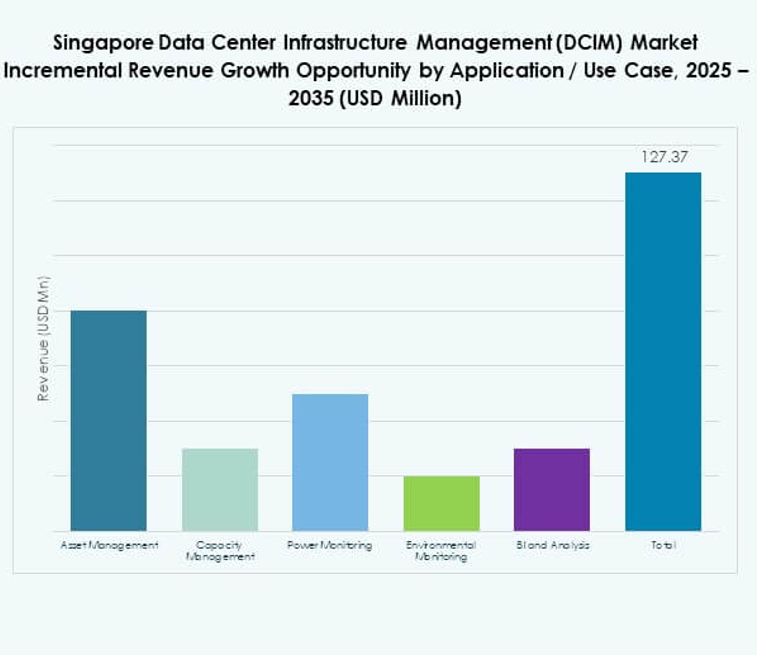

By Application / Use Case

Power monitoring held the largest share in the Singapore Data Center Infrastructure Management (DCIM) Market in 2025, reflecting the critical need for energy optimization in high-density environments. Asset management and capacity management follow, helping enterprises improve utilization and reduce downtime risks. Environmental monitoring is gaining traction due to sustainability goals and regulatory oversight. Business intelligence and analytics are expanding with AI-driven tools that strengthen decision-making. Power efficiency remains the leading driver of DCIM adoption, while advanced analytics enhance the value proposition for enterprises seeking competitive advantage.

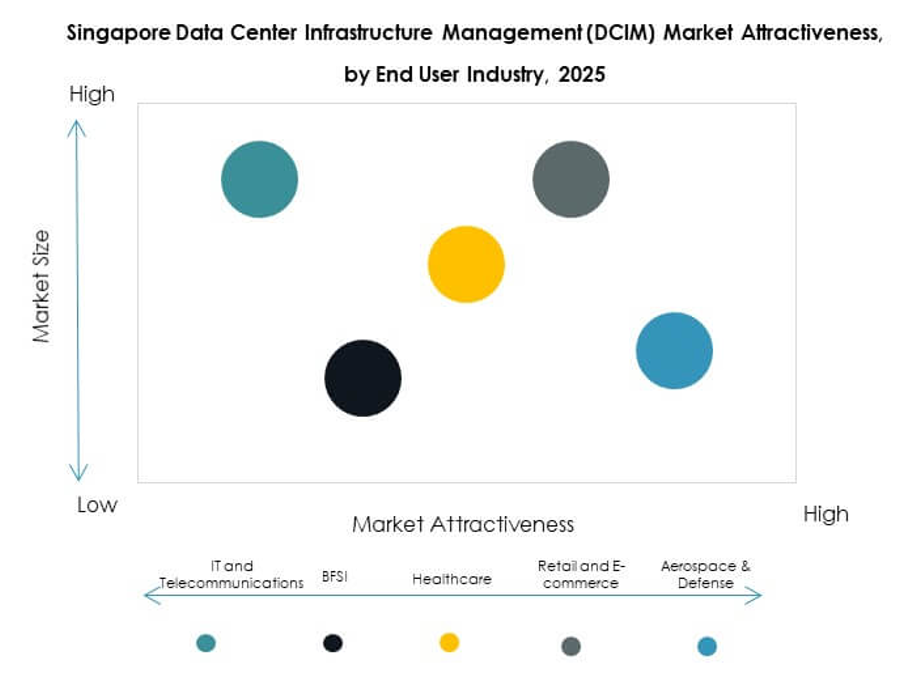

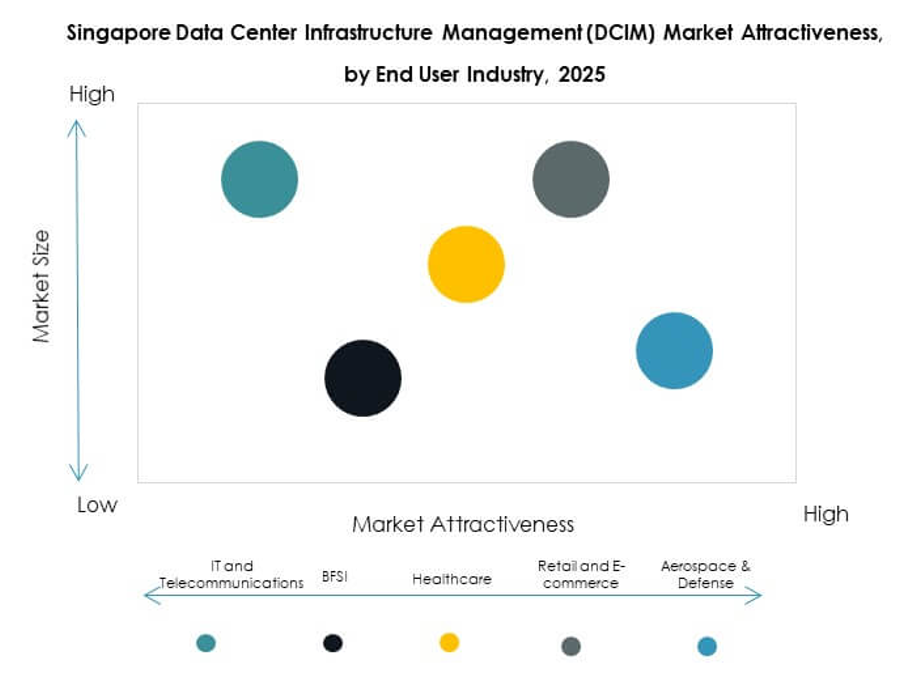

By End User Industry

The IT and telecommunications sector held the largest share of the Singapore Data Center Infrastructure Management (DCIM) Market in 2025, supported by hyperscale expansion and strong network infrastructure requirements. BFSI represents another dominant sector, driven by data-intensive workloads and regulatory compliance. Healthcare adoption is rising due to digitization and the growing need for secure, efficient infrastructure. Retail and e-commerce are expanding with cloud-driven models, while aerospace, defense, and energy sectors adopt DCIM for mission-critical operations. IT and telecom remain the strongest verticals, while healthcare and e-commerce demonstrate significant growth opportunities.

Regional Insights

Central Region

The Central Region accounted for the largest share of the Singapore Data Center Infrastructure Management (DCIM) Market in 2025, holding nearly 48% of the total market. It dominates due to high data center concentration, financial services activity, and government-driven digital projects. Enterprises across BFSI and telecom leverage DCIM platforms here to maintain resilience and compliance. The Central Region benefits from superior connectivity, regulatory alignment, and access to advanced infrastructure. It continues to attract significant investment in hyperscale and colocation facilities. The region will remain the leading hub for innovation and enterprise-scale deployments.

- For instance, Equinix was named a Leader in the 2025 IDC MarketScape for Worldwide Datacenter Colocation Services, credited for its AI-ready infrastructure, sophisticated cooling technologies, and broad interconnection services across approximately 75 metros. Its Equinix Fabric Cloud Router enables software-defined multicloud routing and has been used to move multi-petabyte volumes in some customer deployments.

East Region

The East Region captured 32% of the Singapore Data Center Infrastructure Management (DCIM) Market in 2025, making it a fast-emerging area. It is supported by the development of new industrial hubs and strong adoption among manufacturing and logistics industries. Enterprises in this region adopt cloud and hybrid DCIM models to improve operational flexibility. The East Region benefits from strong infrastructure expansion and energy-efficient data center projects. It is increasingly becoming a strategic location for global operators entering the Singapore market. Investments here are expected to accelerate in the forecast period.

West and North Regions

The West and North Regions together accounted for 20% of the Singapore Data Center Infrastructure Management (DCIM) Market in 2025. These subregions are developing as secondary hubs to reduce pressure on central data infrastructure. Operators are investing in modular and edge facilities in these regions to meet localized demand. Industries such as healthcare, retail, and SMEs are driving adoption here due to lower costs and easier scalability. It plays an important role in diversifying Singapore’s digital infrastructure footprint. Growth in these areas will be supported by sustainability initiatives and distributed IT strategies.

- For instance, NTT operates Tier III and Tier IV certified data centers in Singapore, equipped with ISO 27001-compliant security protocols and designed with modular infrastructure to support scalable enterprise, financial, and healthcare workloads.

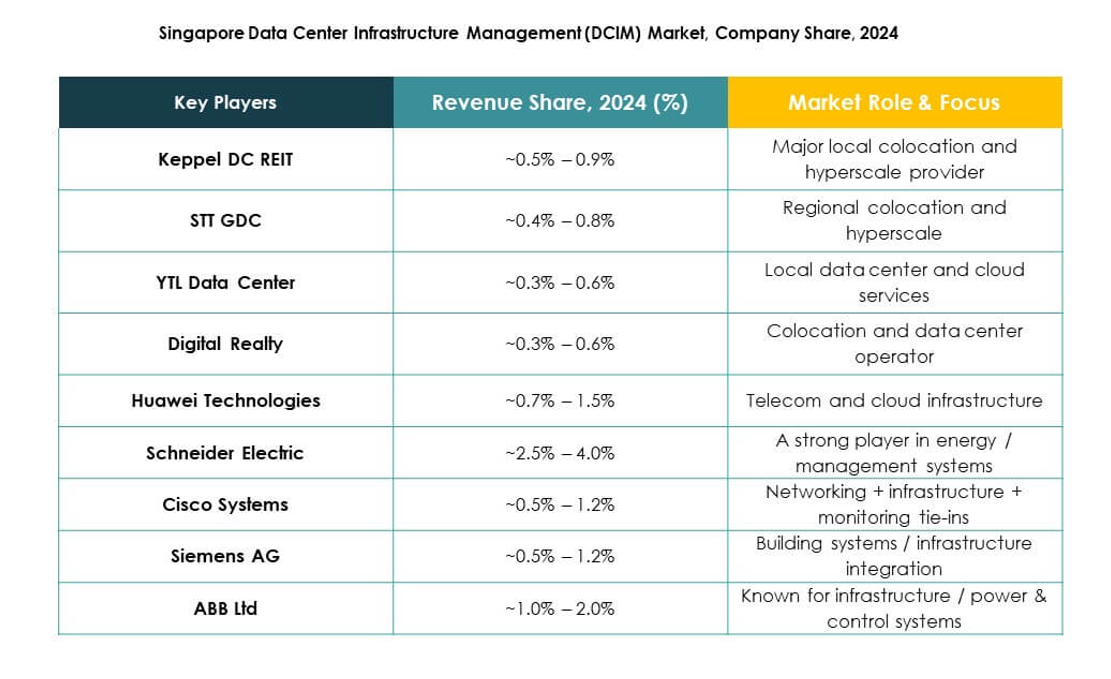

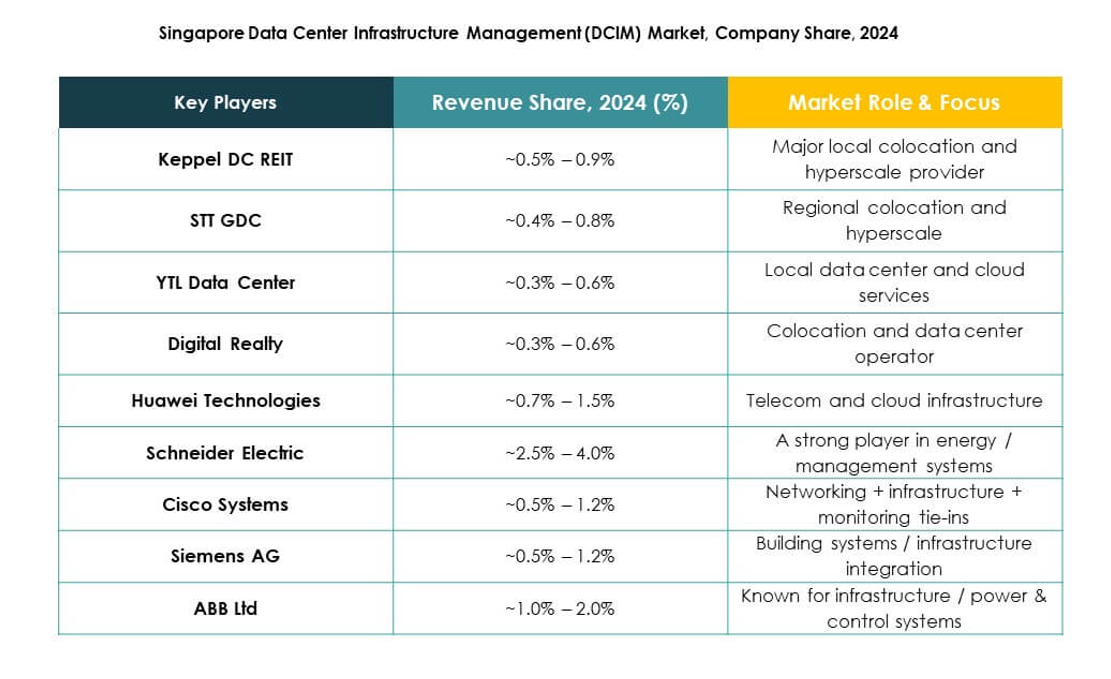

Competitive Insights:

- Keppel DC REIT

- STT GDC

- YTL Data Center

- Digital Realty

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd

- Schneider Electric SE

- Siemens AG

- Others

The Singapore Data Center Infrastructure Management (DCIM) Market is characterized by strong competition between regional data center operators and global technology providers. Local leaders such as Keppel DC REIT and STT GDC focus on expanding colocation and hyperscale capacity, supported by sustainability-driven strategies. Global firms like Schneider Electric, Huawei, and Siemens strengthen their position through advanced DCIM solutions that integrate energy optimization, AI-driven monitoring, and modular scalability. Cisco and Eaton emphasize network resilience and power management, while ABB expands in automation and digital control systems. Digital Realty and YTL Data Center reinforce regional dominance with strategic expansions in Singapore’s digital hub. It remains a dynamic landscape where innovation, sustainability alignment, and strategic partnerships define competitive differentiation and long-term growth.

Recent Developments:

- In September 2025, Keppel DC REIT announced the launch of a fully underwritten non-renounceable preferential offering to raise approximately S$404.5 million, with proceeds partially allocated to finance an asset enhancement initiative (AEI) for Keppel DC Singapore 8, a 30-year land lease extension for Keppel DC Singapore 1, as well as other uses like debt repayment and acquisition funding.

- In August 2025, Digital Realty formed a partnership with Vultr to deliver global AI infrastructure, aiming to provide businesses—including those in Singapore—access to scalable AI and cloud solutions. Around the same period, Digital Realty also expanded its alliance with Oracle, enabling accelerated adoption of hybrid IT and AI via Oracle Solution Centers at the Singapore campus and other major locations, underlining their focus on supporting modern data center workloads

- In July 2025, KKR, a leading global investment firm, entered advanced talks to acquire ST Telemedia Global Data Centres (STT GDC) in a deal valued at over $5 billion. This acquisition targets the rapidly growing Asian data center market and positions both entities as strategic players in AI-driven digital infrastructure. With STT GDC operating more than 95 data centers across 11 regions, including significant presence in Singapore, this move is expected to drive capacity expansion and accelerate AI and hyperscaler-focused growth in the region.

- In July 2025, OpenMetal significantly expanded its footprint in Asia by launching a new data center in Singapore at the Digital Realty SIN10 facility. This center introduces OpenMetal’s full suite of products, including Hosted Private Cloud powered by OpenStack, Bare Metal Servers, Enterprise Storage Clusters, and a future roadmap for GPU Servers and Clusters. The facility offers high connectivity, redundant power and cooling, and advanced security measures, marking a strategic move to support business growth and digital transformation across the region.

- In June 2025, Eaton and Siemens Energy formed a notable partnership to deliver integrated, grid-independent power blocks for new data centers, aiming to shorten construction times for facilities by up to two years. This collaboration targets increased efficiency and rapid deployment in Singapore’s growing DCIM landscape.

Market Trends

Market Trends