Executive summary:

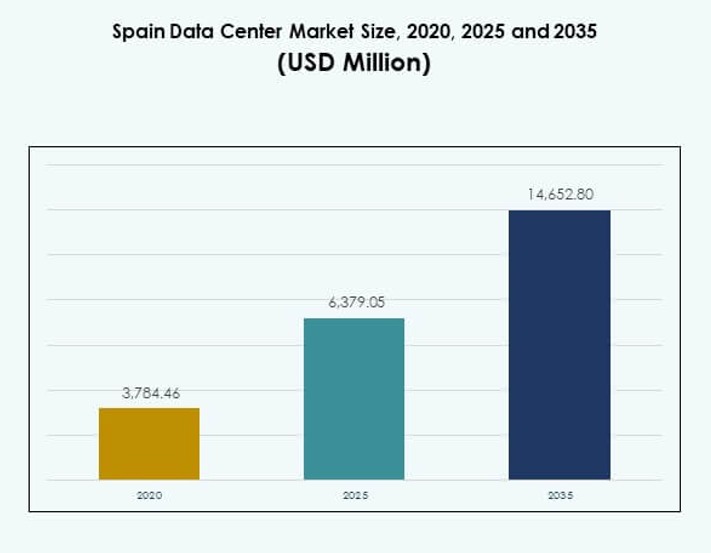

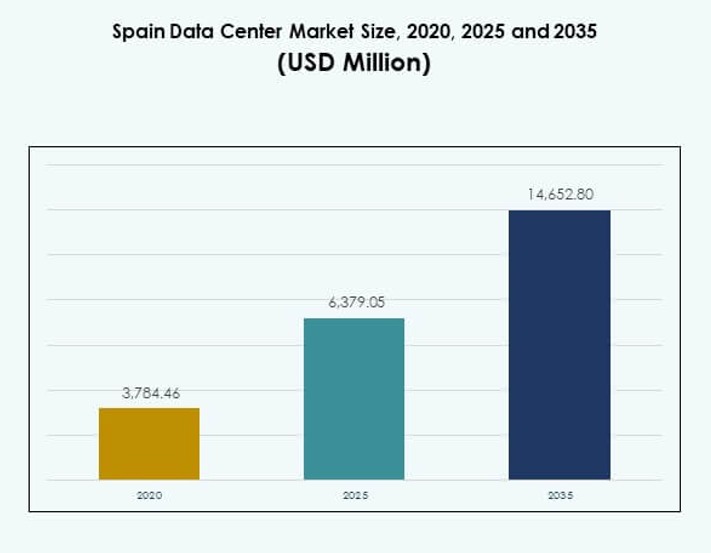

The Spain Data Center Market size was valued at USD 3,784.46 million in 2020 to USD 6,379.05 million in 2025 and is anticipated to reach USD 14,652.80 million by 2035, at a CAGR of 8.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Spain Data Center Market Size 2025 |

USD 6,379.05 Million |

| Spain Data Center Market, CAGR |

8.63% |

| Spain Data Center Market Size 2035 |

USD 14,652.80 Million |

Growth in the market is driven by strong cloud adoption, AI-driven workloads, and rapid deployment of digital services. Enterprises prioritize colocation and hyperscale facilities to enhance scalability, while sustainability initiatives and renewable energy integration shape infrastructure strategies. It has become a strategic hub for investors and businesses seeking reliable connectivity, resilience, and expansion opportunities within Europe’s digital economy. Regionally, Madrid leads as the dominant hub supported by hyperscaler presence and connectivity advantages. Barcelona emerges as a secondary hub with increasing investments in modular and edge facilities. Other regions, including Aragon and Southern Spain, are gaining traction due to renewable energy resources and government support, positioning the country as a balanced ecosystem for digital infrastructure growth.

Market Drivers

Growing Adoption of Advanced Digital Infrastructure and Cloud Integration

The Spain Data Center Market is driven by strong adoption of digital infrastructure and enterprise cloud integration. Businesses across banking, retail, healthcare, and telecom continue to migrate workloads to cloud-ready facilities, supporting faster digital transformation. The market benefits from integration of artificial intelligence, IoT, and 5G technologies that demand scalable and resilient hosting capacity. Enterprises prioritize hybrid cloud models to balance security with flexibility. Demand for private cloud and multicloud strategies strengthens vendor competition. Sustainability initiatives push providers toward renewable energy sourcing. It remains a strategic market for digital-first business operations. Investors see sustained momentum for long-term returns.

Innovation in Energy-Efficient Systems and Renewable Power Use

Growing focus on renewable energy adoption and power efficiency shapes future expansion of the Spain Data Center Market. Operators deploy advanced cooling, modular designs, and energy management systems to meet efficiency standards. Enterprises demand compliance with carbon-neutral targets, encouraging adoption of low-PUE designs. Providers strengthen partnerships with renewable suppliers to ensure sustainable sourcing. Technological upgrades reduce operational costs while enhancing capacity. Businesses see facilities as reliable platforms for critical workloads. It creates opportunities for global investors focused on green infrastructure. Strong alignment with European climate policies reinforces the long-term appeal of Spain’s data infrastructure.

- For instance, in February 2023, Equinix signed five long-term Power Purchase Agreements in Spain totaling 225 MW to supply renewable energy for its data centers in Madrid, Barcelona, and Seville, with projects starting in 2025 and expected to deliver nearly two million MWh annually worldwide.

Strategic Importance of Colocation and Hyperscale Facilities for Enterprises

Colocation and hyperscale facilities act as critical growth drivers in the Spain Data Center Market. Enterprises seek secure interconnection, redundancy, and low latency for applications across sectors. Hyperscalers continue to expand presence to serve AI workloads and global cloud adoption. Colocation providers attract enterprises looking for reduced capital expenditure and flexibility. High demand for scalable hosting supports real estate development and energy sourcing partnerships. Investors recognize colocation hubs in Madrid and Barcelona as strategic assets. Businesses enhance resilience through disaster recovery solutions integrated into these facilities. It strengthens the competitive edge of Spain as a digital hub.

- For instance, in September 2025, Digital Realty confirmed an investment of over €500 million to develop new data centers in Madrid and Barcelona, including the MAD5 facility in Madrid with a planned capacity of 20–24 MW.

Industry Shifts Toward Edge Computing and Artificial Intelligence Workloads

Rapid growth of edge computing and AI-focused workloads defines new directions for the Spain Data Center Market. Enterprises prioritize processing data closer to users for efficiency and real-time insights. Telecom operators expand 5G networks, driving investments in micro and modular data centers. AI adoption requires advanced GPU-ready infrastructure with higher power density. Edge facilities support retail, smart cities, and healthcare applications. Providers redesign facilities for flexibility and automation. It enhances resilience against rising digital demands. Businesses gain improved service delivery across industries. Global investors see Spain as a gateway for emerging workloads and regional AI innovation.

Market Trends

Expansion of Subsea Cable Connectivity Strengthening International Data Exchange

The Spain Data Center Market experiences strong growth from subsea cable projects that link Europe, Africa, and Latin America. New cable landings in Bilbao and Barcelona increase international bandwidth capacity. Providers integrate connectivity hubs into new facilities, reinforcing Spain’s role in global routing. Enterprises gain faster access to international cloud services and cross-border applications. It creates a competitive advantage for Spain within the European data economy. Providers use these connections to attract hyperscalers and multinational enterprises. Growing demand for resilient international connectivity sustains ongoing expansion. Spain’s geographic location strengthens its role as a data exchange hub.

Rising Focus on Modular and Prefabricated Facility Deployment Models

Growing demand for modular and prefabricated infrastructure shapes facility development across the Spain Data Center Market. Enterprises seek faster deployment timelines and lower upfront costs. Providers design prefabricated modules to scale with demand while reducing construction complexity. It enables flexible solutions for edge and colocation deployments. Modular facilities enhance sustainability through efficient cooling and power management. Investors value modular projects for quick market entry. The trend aligns with increased demand for hybrid IT and regional coverage. Providers continue to develop modular strategies to match evolving enterprise workloads.

Integration of Automation and Artificial Intelligence for Operational Efficiency

Automation and artificial intelligence play a growing role in reshaping operations within the Spain Data Center Market. Providers use AI-driven systems for predictive maintenance, energy optimization, and workload balancing. Enterprises demand real-time monitoring tools to ensure uptime and efficiency. Automation enhances resource allocation, reducing human error in large facilities. It strengthens operational resilience across colocation and hyperscale environments. AI tools also support sustainability goals through predictive energy modeling. The market continues shifting toward intelligent and self-optimizing systems. Businesses gain improved service levels while reducing operational risk.

Adoption of Sustainable Cooling Technologies for High-Density Workloads

The Spain Data Center Market integrates advanced cooling technologies to support high-density workloads. Providers deploy liquid cooling, direct-to-chip solutions, and advanced airflow management. It reduces energy consumption and supports AI and HPC applications. Enterprises value efficiency improvements that lower operational costs. New cooling designs align with European climate policies. Providers showcase innovation to differentiate within a competitive landscape. Sustainable cooling supports hyperscalers running GPU-based infrastructures. The trend improves overall efficiency and strengthens Spain’s position in sustainable facility development.

Market Challenges

Rising Energy Costs and Pressure on Sustainability Targets for Operators

The Spain Data Center Market faces challenges from rising energy costs and strict sustainability mandates. Electricity prices fluctuate, raising operational expenses for hyperscalers and colocation providers. Enterprises demand low-cost yet resilient infrastructure, intensifying competitive pressure. Meeting renewable sourcing commitments requires large investments in partnerships with energy providers. Facilities must adapt designs to meet low PUE standards while maintaining scalability. It strains margins and complicates expansion strategies. Investors face risks tied to energy volatility and regulatory shifts. Sustaining profitability requires continuous innovation in energy efficiency and sourcing.

Data Security Concerns and Regulatory Compliance Complexity for Enterprises

The Spain Data Center Market faces challenges linked to increasing data security and compliance demands. Enterprises across BFSI, healthcare, and government require strict adherence to GDPR and local regulations. Providers must invest heavily in cybersecurity infrastructure to prevent data breaches. Rising risks from ransomware and cyberattacks increase operational costs. It complicates adoption for SMEs lacking advanced security resources. Compliance audits extend timelines for deployment and add expenses for providers. Enterprises weigh security risks when choosing between colocation and cloud options. Balancing compliance with scalability remains a critical challenge for stakeholders.

Market Opportunities

Emergence of Spain as a Strategic Hub for Regional and Global Connectivity

The Spain Data Center Market offers opportunities driven by its location linking Europe, Africa, and Latin America. Growing subsea cable investments expand international bandwidth and attract hyperscale providers. Madrid and Barcelona evolve into leading hubs supporting global enterprise demands. It enhances Spain’s status as a gateway for international trade and digital services. Strong investment appeal supports expansion of cloud and colocation facilities. Enterprises benefit from reduced latency in global applications. Investors view Spain as a regional connectivity leader with long-term growth potential.

Growth of Edge and AI Infrastructure Supporting Next-Generation Workloads

The Spain Data Center Market presents opportunities from expanding edge computing and AI infrastructure. Telecom operators integrate micro and modular data centers to serve 5G applications. Enterprises demand GPU-ready hosting for AI and machine learning models. It supports growth in sectors like retail, manufacturing, and healthcare. Providers develop facilities with high-density power and advanced cooling to match workloads. Growth of automation and IoT drives further adoption. Investors see AI-driven workloads as a sustainable growth area. The market continues evolving into a hub for intelligent infrastructure.

Market Segmentation

By Component

The Spain Data Center Market by component is dominated by hardware, holding the largest share due to demand for servers, storage, and power systems. Growth in AI workloads requires GPU-based servers and advanced cooling. Networking and security remain critical as enterprises prioritize resilience and compliance. Software, including DCIM and virtualization tools, supports automation and efficiency. Services such as consulting and managed solutions expand with SMEs seeking expertise. Hardware remains the anchor of expansion, sustaining its dominance across colocation and hyperscale deployments.

By Data Center Type

The Spain Data Center Market by type is led by hyperscale facilities, driven by cloud providers and AI-focused enterprises. Colocation facilities hold a strong share as enterprises prefer flexible capacity. Edge and modular data centers expand rapidly due to 5G rollout and IoT adoption. Enterprise data centers remain relevant for industries requiring private hosting. Cloud internet data centers gain traction with digital-first firms. Mega data centers attract global investment for large-scale workloads. Hyperscale continues to dominate due to its scalability and role in hosting cloud infrastructure.

By Deployment Model

The Spain Data Center Market by deployment model is dominated by cloud-based solutions. Enterprises move workloads to cloud for flexibility, speed, and cost efficiency. Hybrid models gain momentum as firms balance security with scalability. On-premises remains important for sensitive data in regulated industries. Cloud adoption expands with SaaS, PaaS, and IaaS services. SMEs benefit from affordable cloud migration. Hybrid deployment grows faster as enterprises adopt multi-cloud strategies. Cloud-based infrastructure sustains the largest share, shaping vendor strategies and investments.

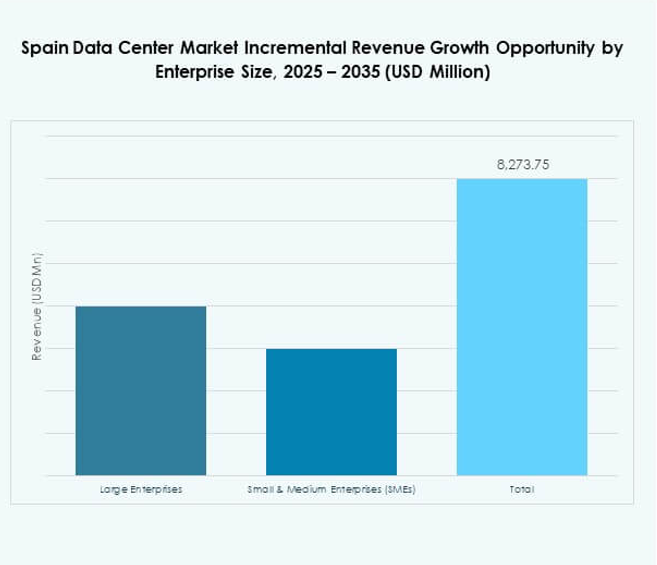

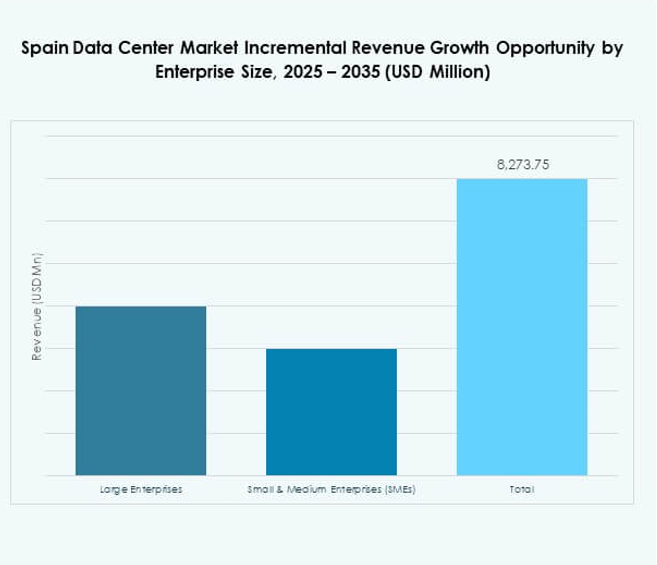

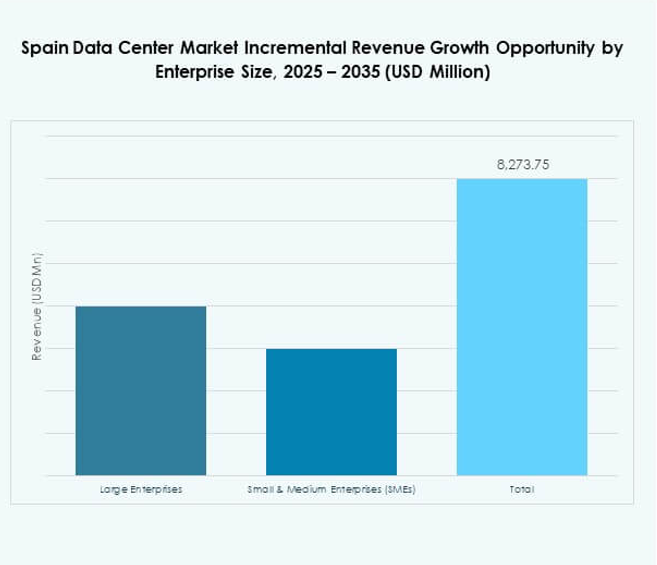

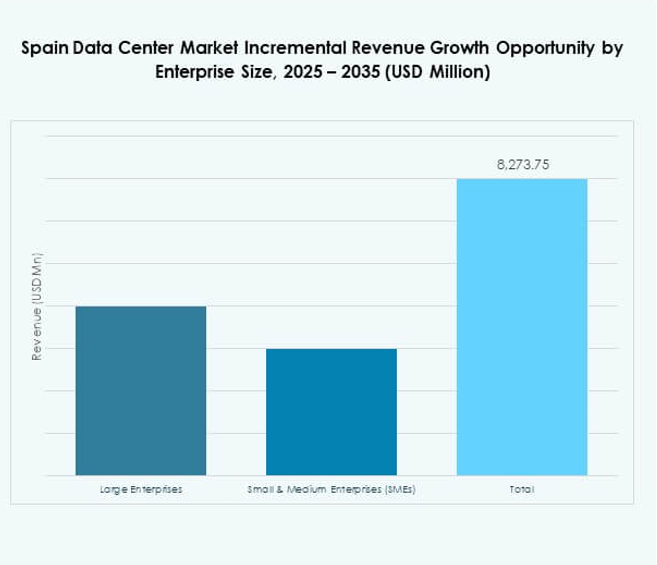

By Enterprise Size

The Spain Data Center Market by enterprise size is dominated by large enterprises with extensive IT demands. They drive hyperscale adoption, cloud strategies, and colocation investments. SMEs represent a growing segment supported by managed services and flexible pricing. Providers develop tailored offerings for smaller firms adopting digital solutions. Large enterprises secure the majority share due to strong capital capabilities. SMEs expand rapidly as digitalization spreads across sectors. It ensures a balanced demand landscape. Large enterprise dominance remains clear across infrastructure adoption.

By Application / Use Case

The Spain Data Center Market by application is led by IT and telecom, securing the largest share through strong demand for hosting, cloud, and 5G services. BFSI follows with requirements for secure data management and compliance. Retail and e-commerce expand with digital platforms and omnichannel strategies. Healthcare leverages data centers for patient records, telemedicine, and AI diagnostics. Media and entertainment drive adoption through streaming and gaming. Manufacturing and energy sectors integrate IoT and automation. Government and defense sustain demand for resilient infrastructure. IT and telecom remain the largest contributor to market demand.

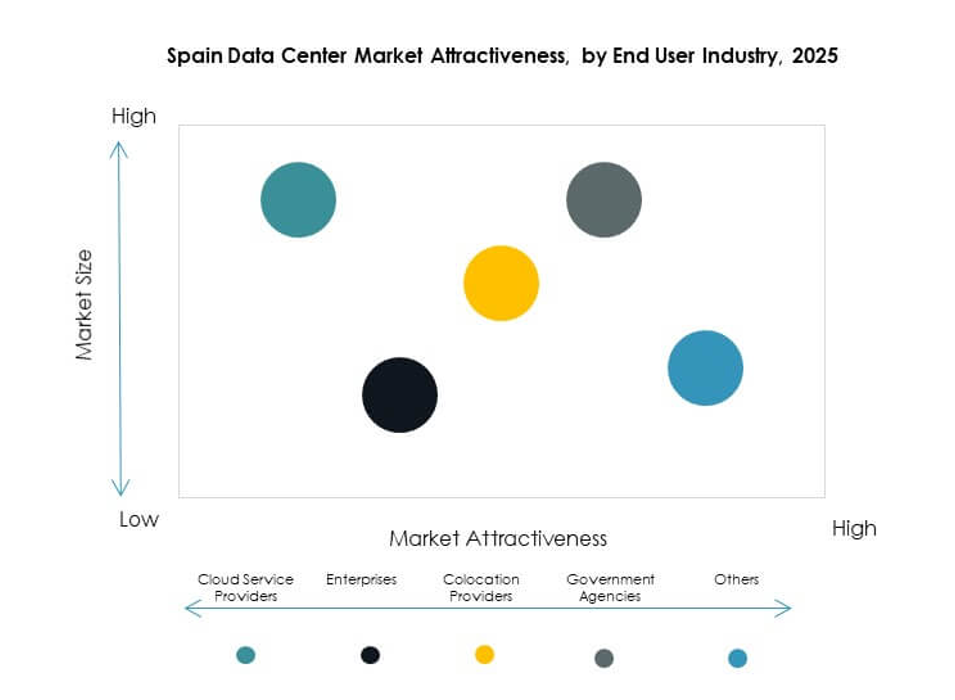

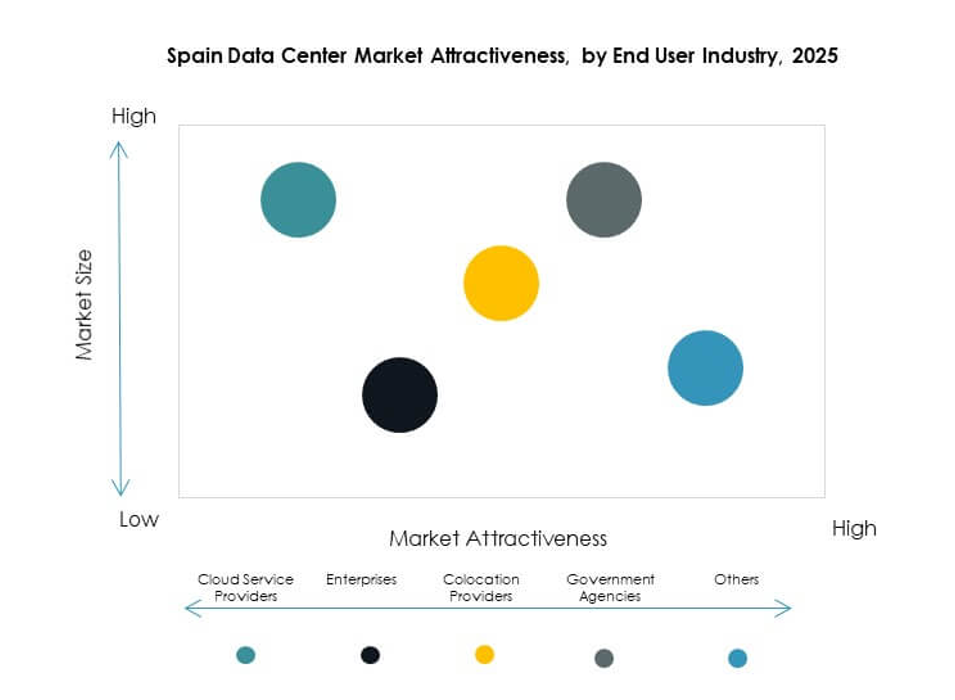

By End User Industry

The Spain Data Center Market by end user industry is dominated by cloud service providers. Hyperscalers invest in large-scale facilities to meet regional demand. Enterprises represent a strong segment seeking flexible colocation and hybrid solutions. Government agencies require secure data hosting for critical applications. Colocation providers play a vital role in offering scalable capacity. It creates a balanced ecosystem where cloud providers lead in share. Enterprise adoption and government needs ensure diverse market participation. Cloud service providers remain the primary growth driver across end user categories.

Regional Insights

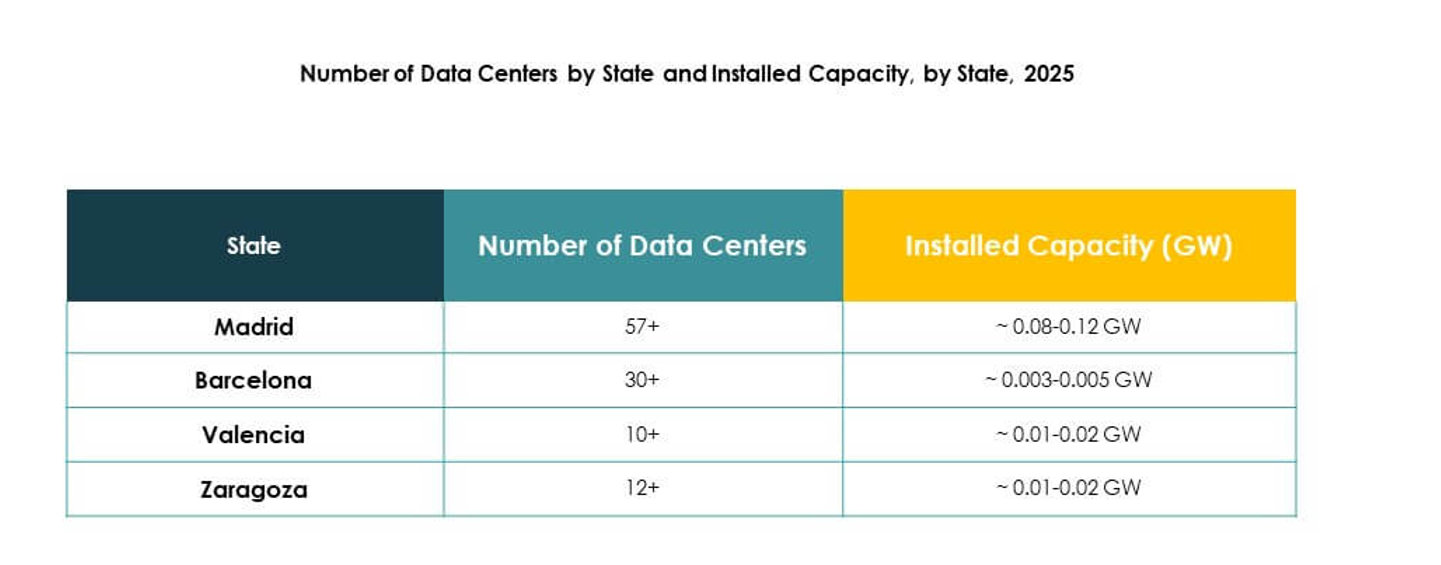

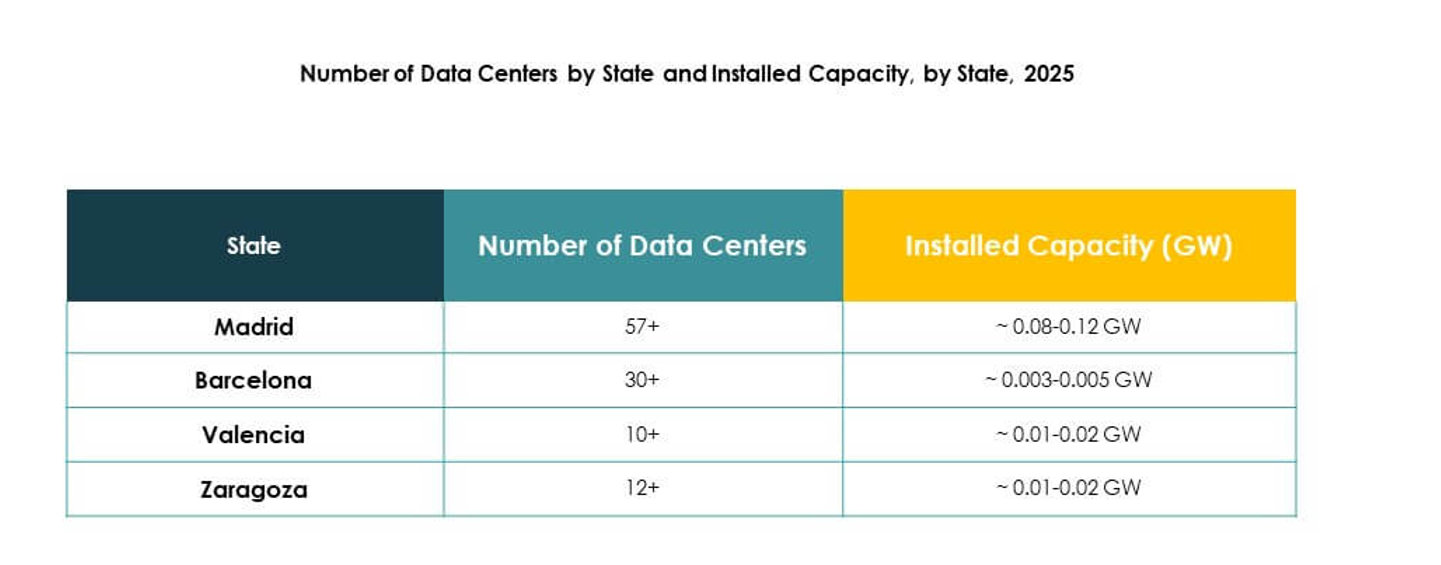

Dominance of Central Spain with Madrid as a Primary Hub

The Spain Data Center Market shows Central Spain leading with 52% share, supported by Madrid’s role as a primary hub. Strong hyperscaler investments, robust connectivity, and renewable sourcing strengthen Madrid’s position. Colocation providers expand capacity to serve BFSI, healthcare, and government workloads. It offers enterprises reliable interconnection and disaster recovery solutions. Madrid continues to attract international investors due to subsea cable connections and skilled workforce availability. Strong policy support enhances its leadership in the national market.

Expansion of Northeastern Spain with Barcelona Driving Innovation

Northeastern Spain holds 28% share in the Spain Data Center Market, with Barcelona emerging as a strong hub. Growth stems from investments in edge and modular facilities to support 5G networks. Enterprises in media, telecom, and retail industries drive demand for advanced infrastructure. It benefits from subsea cables connecting to European and Mediterranean routes. Barcelona supports innovation in sustainable cooling and modular design. Providers see the city as a technology-driven ecosystem for future expansion.

- For instance, in February 2023, Equinix announced the construction of its second Barcelona data center (BA2), designed to serve as a key Mediterranean subsea hub, interconnecting major cables such as 2Africa and Medusa to strengthen connectivity between Europe, Africa, and the Middle East.

Emergence of Southern and Western Spain as Growing Subregions

Southern and Western Spain collectively account for 20% share in the Spain Data Center Market. Growth is driven by renewable energy availability and increasing demand from SMEs. Subsea connections expand capacity for regions near Portugal and Africa. Enterprises adopt colocation services to manage digital workloads cost-effectively. It creates opportunities for regional development outside major hubs. Government support for digital transformation strengthens expansion into underserved areas. Southern and Western Spain emerge as attractive subregions for future infrastructure projects.

- For instance, in March 2025, Templus acquired and relaunched a data center in Seville, featuring a rooftop solar installation and plans to expand capacity to more than 1MW, supporting over 20 telecommunications operators and advancing regional infrastructure sustainability.

Competitive Insights:

- Interxion (Digital Realty)

- Itconic

- Colt Data Center Services

- Nabiax

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC (Alphabet Inc.)

The Spain Data Center Market features a competitive environment shaped by global hyperscalers and established colocation providers. It is defined by strong investments in hyperscale campuses, cloud integration, and energy-efficient infrastructure. Equinix, Interxion, and Nabiax lead colocation, offering interconnection and scalability for enterprise clients. Microsoft, Amazon, and Google drive cloud-based adoption, supported by large-scale hyperscale facilities. NTT and Digital Realty focus on hybrid deployments and renewable energy integration. It encourages partnerships between local and global operators, enhancing service diversity and resilience. The market’s strategic location linking Europe, Africa, and Latin America attracts continuous investments, strengthening Spain’s role as a regional connectivity hub.

Recent Developments:

- In September 2025, Digital Realty announced that it will invest over €500 million to expand its data center infrastructure in Madrid and Barcelona. This move is aimed at strengthening its presence in Spain and supporting the robust growth in demand for digital infrastructure in the country, with new projects and facility upgrades planned across both cities.

- In September 2025, Digital Realty announced the allocation of more than €500 million to fund the construction of two new data centers in Madrid and Barcelona. This investment aims to expand the company’s portfolio in Spain and strengthen its presence in the country’s rapidly growing digital infrastructure sector.

- In August 2025, Equinix unveiled a €460 million investment to expand its Madrid Alcobendas data center campus. The project, recognized as strategic infrastructure by the Madrid regional government, is designed to power AI, IoT, and cloud growth with sustainable operations, and will contribute substantially to job creation and international investment in Spain’s digital economy.

- In August 2025, Blackstone announced a $5 billion expansion of its planned data center project in the Aragon region of Spain. This second phase of investment, following an earlier pledge of €7.5 billion, focuses on building new capacity for data centers—with an emphasis on renewable electricity supply and advanced cooling systems for the new facilities. The plan covers eight data centers, a dedicated electricity substation, and a photovoltaic power plant, aiming to turn Aragon into one of Europe’s major cloud computing hubs.