Executive summary:

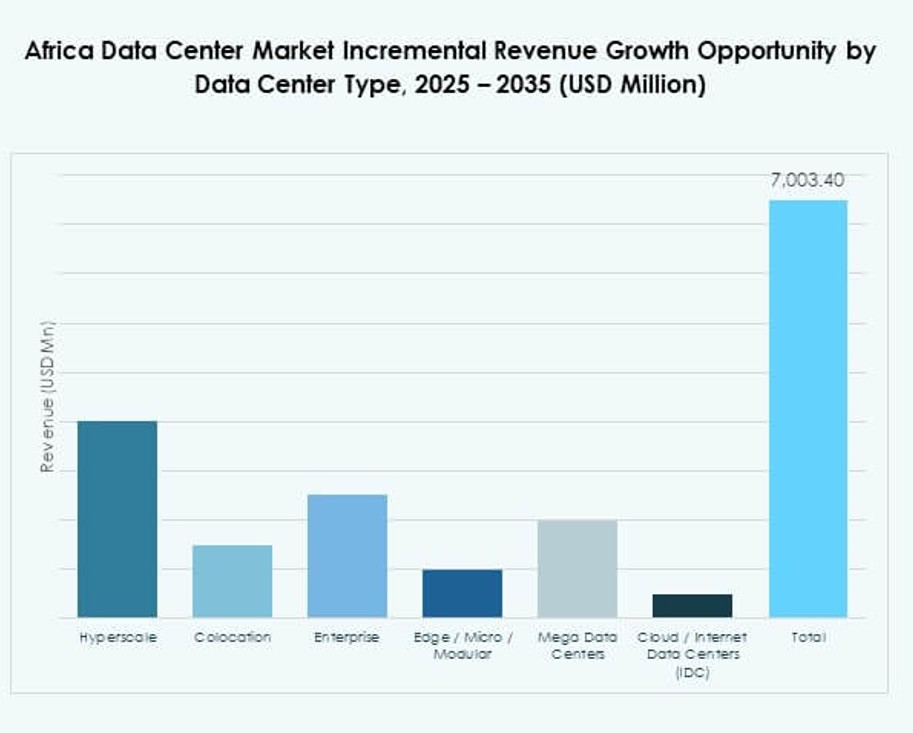

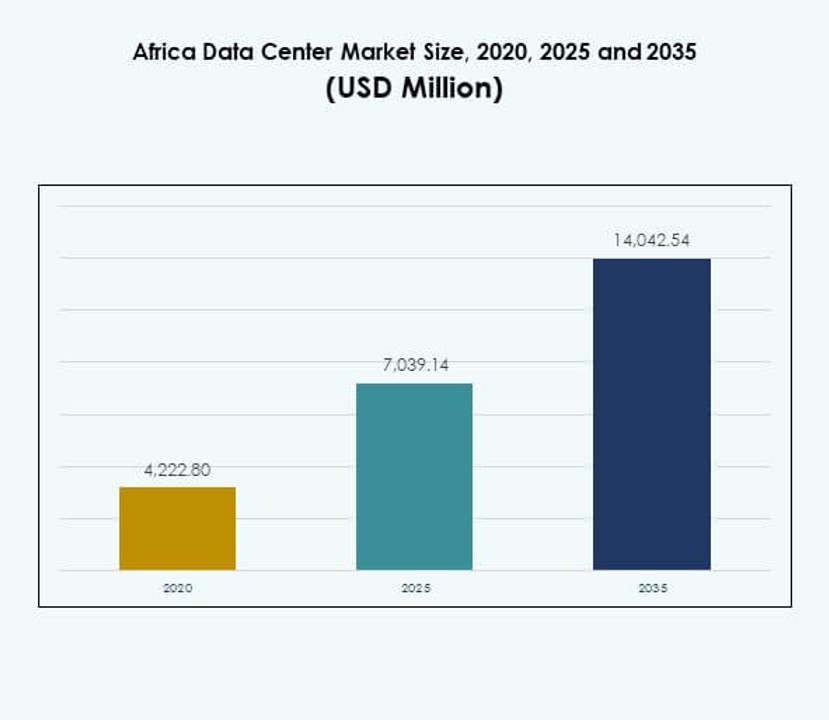

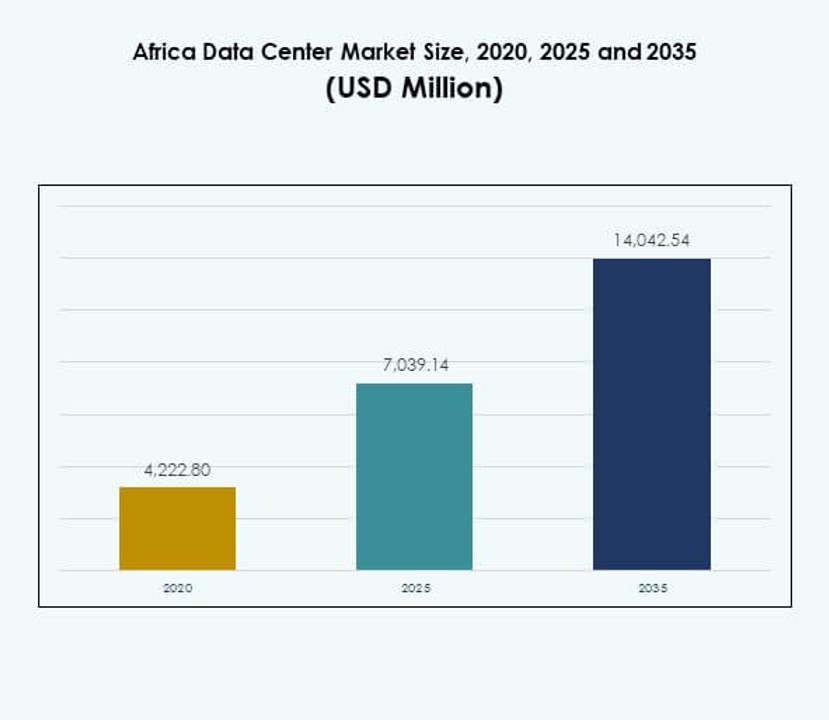

The Africa Data Center Market size was valued at USD 4,222.80 million in 2020 to USD 7,039.14 million in 2025 and is anticipated to reach USD 14,042.54 million by 2035, at a CAGR of 7.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Africa Data Center Market Size 2025 |

USD 7,039.14 Million |

| Africa Data Center Market, CAGR |

7.08% |

| Africa Data Center Market Size 2035 |

USD 14,042.54 Million |

Growth is supported by rising adoption of cloud computing, AI, IoT, and big data applications that require scalable and low-latency infrastructure. Businesses are modernizing operations with hybrid and colocation models, while governments push digital economy strategies to strengthen resilience. The market holds strategic importance for investors and enterprises seeking long-term opportunities in an environment with untapped demand for secure and reliable hosting solutions.

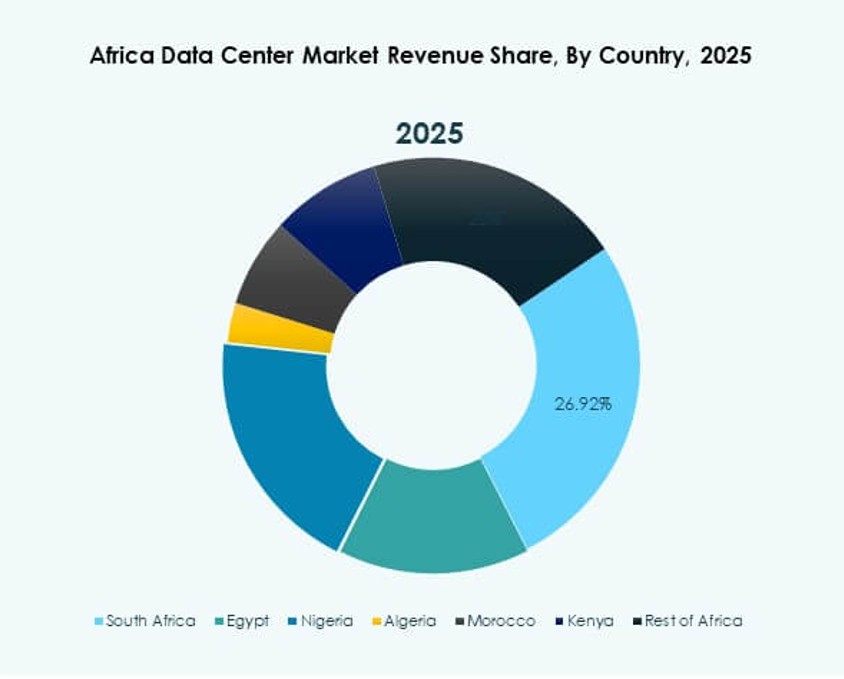

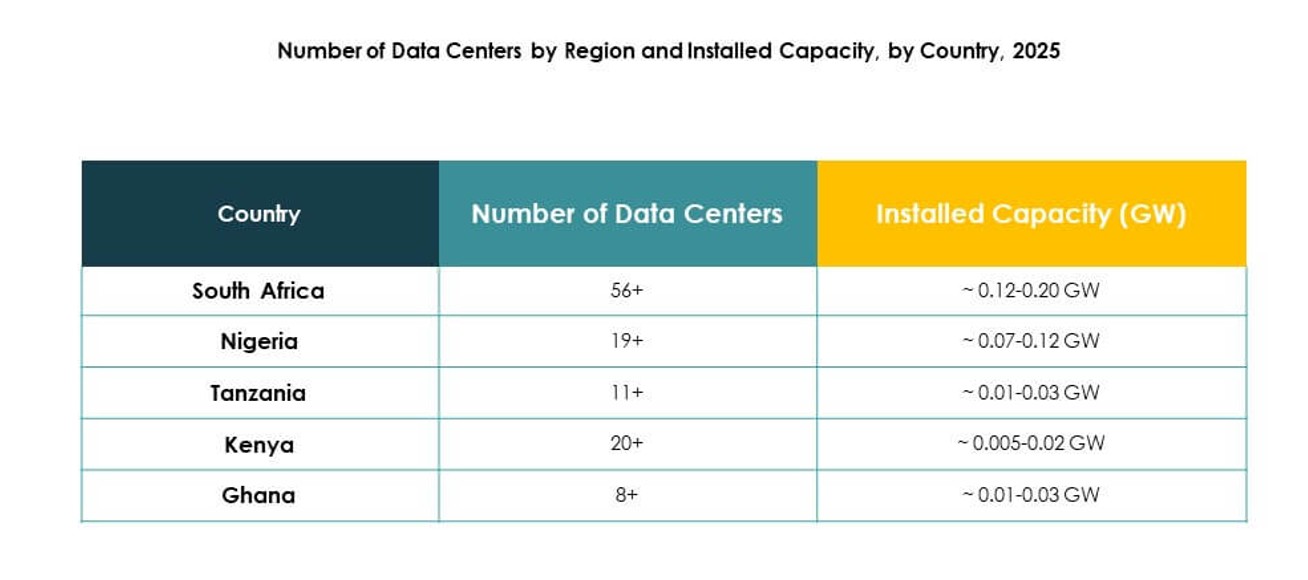

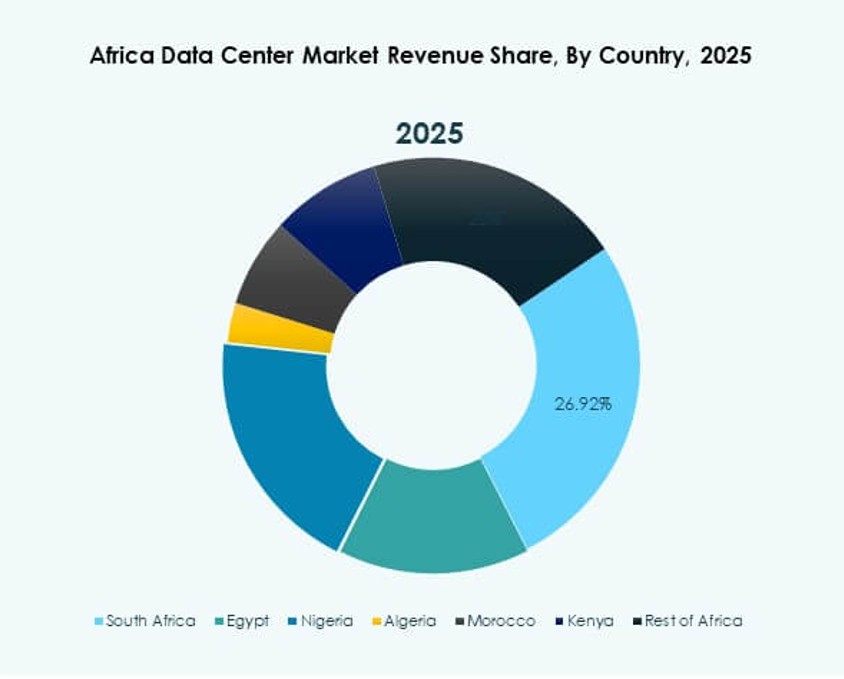

Southern Africa leads due to its advanced infrastructure and hyperscale presence, with South Africa serving as the primary hub. Eastern Africa is emerging with strong policy support and improved connectivity in Kenya and Ethiopia. West Africa, led by Nigeria, is expanding through fintech growth and broadband adoption, while North Africa gains traction through Egypt and Morocco’s strategic positions linking Europe, the Middle East, and Africa.

Market Drivers

Market Drivers

Growing Cloud Adoption and Digital Transformation Accelerating the Demand for Reliable Infrastructure

The Africa Data Center Market benefits from rapid adoption of cloud services across sectors. Enterprises seek reliable infrastructure to host critical workloads and scale operations. Government policies support digital transformation in banking, telecom, and healthcare. Investors recognize the opportunity for long-term growth in the region. It fuels investment in secure hosting and enterprise-grade computing capacity. Cloud-native platforms enable businesses to remain competitive and agile. Enterprises prefer scalable and hybrid deployment models for flexibility. Demand for robust digital ecosystems drives regional and global participation.

Technology Innovations in AI, IoT, and Big Data Driving Infrastructure Modernization

The Africa Data Center Market expands through demand for advanced technologies like AI and IoT. Big data analytics requires low-latency and scalable storage systems. Businesses deploy smart applications that depend on high-performing facilities. It creates opportunities for modernization of legacy infrastructure. Providers invest in liquid cooling, automation, and virtualization platforms. Advanced power efficiency systems reduce operational costs while ensuring sustainability. Global cloud players increase their footprint through hyperscale and colocation expansions. Innovation drives the appeal of Africa as a digital growth hub.

- For instance, in June 2025, Teraco expanded its Isando Campus in Johannesburg with the JB5 facility, adding 12 data halls and bringing the campus’s total critical IT power load to 70MW, supported by a closed-loop chilled water system and 100% free air cooling that enables zero water usage for operations.

Strategic Importance for Multinationals and Local Enterprises in High-Growth Sectors

The Africa Data Center Market holds strong strategic relevance for multinational and local firms. Telecom, fintech, and e-commerce sectors rely on low-latency services. Expansion of online banking and payment systems demands secure facilities. It positions the region as an attractive investment hub. Enterprises seek compliance with global standards for data security. Multinationals view Africa as a gateway for connecting international markets. Energy-efficient operations align with sustainable business strategies. Cloud adoption supports resilience in supply chains and public services.

- For instance, in mid-2023, Africa Data Centres (ADC), part of Cassava Technologies, expanded its Nairobi facility with an additional 1MW of IT capacity, maintaining ISO 27001 and PCI DSS certifications while interconnecting hundreds of telecom, fintech, and digital enterprises.

Government Initiatives and Infrastructure Expansion Creating Strong Market Potential

The Africa Data Center Market grows with government-led digital economy initiatives. National strategies encourage broadband expansion and local cloud storage. Enterprises benefit from improved energy supply in key markets. It strengthens the foundation for large-scale deployment of hyperscale centers. Public-private partnerships accelerate facility construction and connectivity projects. Global providers collaborate with local firms to expand reach. Smart city programs and e-governance drive further capacity needs. Policy support attracts foreign capital and diversifies regional infrastructure.

Market Trends

Rise of Modular and Edge Deployments Supporting Remote Connectivity and Low Latency Needs

The Africa Data Center Market witnesses growth in modular and edge deployments. Remote regions require localized infrastructure for reliable digital services. Modular facilities provide cost-effective scalability for expanding enterprises. It ensures reduced latency for applications in telecom and fintech. Energy efficiency of edge centers appeals to operators in emerging cities. Flexible deployment models encourage adoption by small enterprises. Cloud service providers integrate edge to meet decentralized demand. The trend boosts capacity while serving underpenetrated regions.

Sustainable Infrastructure and Renewable Energy Adoption Becoming Central to Facility Design

The Africa Data Center Market shifts focus toward sustainable power solutions. Providers integrate solar, wind, and hybrid sources into operations. It reduces dependence on unstable national grids and improves resilience. Investors prioritize facilities adopting green certifications and eco-friendly cooling. Renewable energy lowers long-term costs and enhances environmental responsibility. Companies aim to meet corporate sustainability targets through green deployments. Governments encourage clean energy adoption in infrastructure projects. The trend accelerates Africa’s role in sustainable digital infrastructure.

Growth of Regional Internet Exchanges Strengthening Data Sovereignty and Connectivity

The Africa Data Center Market evolves with increased presence of internet exchanges. Regional hubs enhance data sovereignty and reduce reliance on foreign routing. It improves latency for enterprises and supports local content delivery. Telecom operators collaborate with global firms to build neutral exchange platforms. Growing demand for video streaming, gaming, and e-commerce benefits from this shift. Data localization policies reinforce the importance of regional hosting. Enterprises find improved security with local routing options. Enhanced interconnection supports Africa’s digital economy expansion.

Expansion of AI-Driven Automation Enhancing Efficiency in Facility Operations

The Africa Data Center Market integrates AI-driven automation across systems. Intelligent monitoring optimizes energy consumption and improves uptime. It reduces manual errors and enhances predictive maintenance capabilities. Providers deploy machine learning for dynamic cooling and power allocation. Automation improves scalability for hyperscale and colocation operators. Data-driven insights ensure reliable performance under high traffic. Investors support facilities adopting automation for long-term efficiency. The trend solidifies Africa’s position as a modern technology hub.

Market Challenges

High Energy Costs and Limited Power Reliability Impacting Operational Efficiency of Facilities

The Africa Data Center Market faces challenges from limited power availability. National grids remain unstable in many countries. It increases operational costs due to reliance on backup power. Renewable solutions require high capital and long lead times. Enterprises demand uninterrupted uptime despite infrastructure gaps. Providers face hurdles aligning with global efficiency standards. Limited investment in transmission networks slows regional expansion. Operators manage risks by diversifying energy supply models.

Regulatory Complexities and Talent Gaps Limiting Scalability Across the Region

The Africa Data Center Market encounters regulatory hurdles across diverse jurisdictions. Policies differ across countries, complicating compliance. It slows expansion for global providers seeking uniform operations. Talent shortages in advanced IT and facility management add pressure. Enterprises face difficulties finding skilled professionals locally. Regulatory delays restrict infrastructure investments. Complex licensing requirements hinder smaller players. Addressing talent development and standardization becomes critical for growth.

Market Opportunities

Rising Digital Services and E-Commerce Ecosystems Unlocking Investment Prospects Across Industries

The Africa Data Center Market presents strong opportunities with growing e-commerce adoption. Retail and fintech ecosystems require secure and scalable hosting platforms. It fuels investments in colocation and cloud-based deployments. Enterprises adopt digital-first strategies for consumer engagement. Healthcare and education sectors demand reliable hosting for digital platforms. Emerging businesses find opportunities in hybrid cloud adoption. Local service providers gain traction by offering tailored solutions.

Expansion of Hyperscale Facilities and Global Partnerships Strengthening Regional Positioning

The Africa Data Center Market attracts hyperscale investments from global cloud providers. Strategic partnerships enhance capacity across multiple nations. It creates opportunities for colocation operators and SMEs. Enterprises benefit from advanced infrastructure at competitive costs. Governments encourage investment through favorable policies and tax benefits. Regional connectivity improves with cross-border collaborations. Growing demand for AI and 5G boosts hyperscale relevance.

Market Segmentation

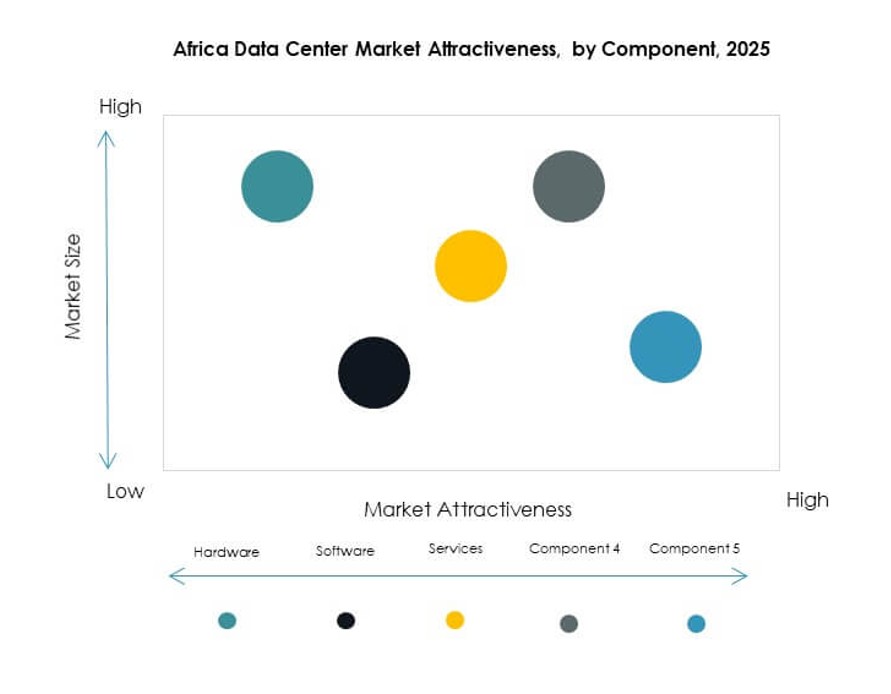

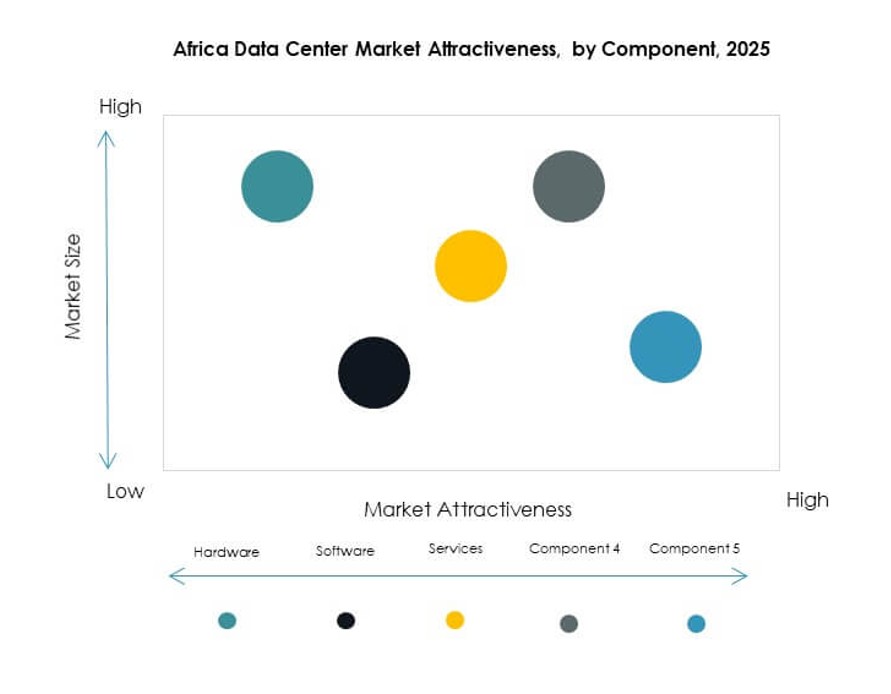

By Component

The Africa Data Center Market is dominated by hardware, particularly servers and storage systems, holding the largest share due to enterprise demand for computing capacity. Cooling and power solutions remain critical in high-density deployments. Software segments, including virtualization and orchestration tools, are growing as enterprises adopt automation. Services such as consulting and managed offerings gain traction among SMEs seeking cost efficiency.

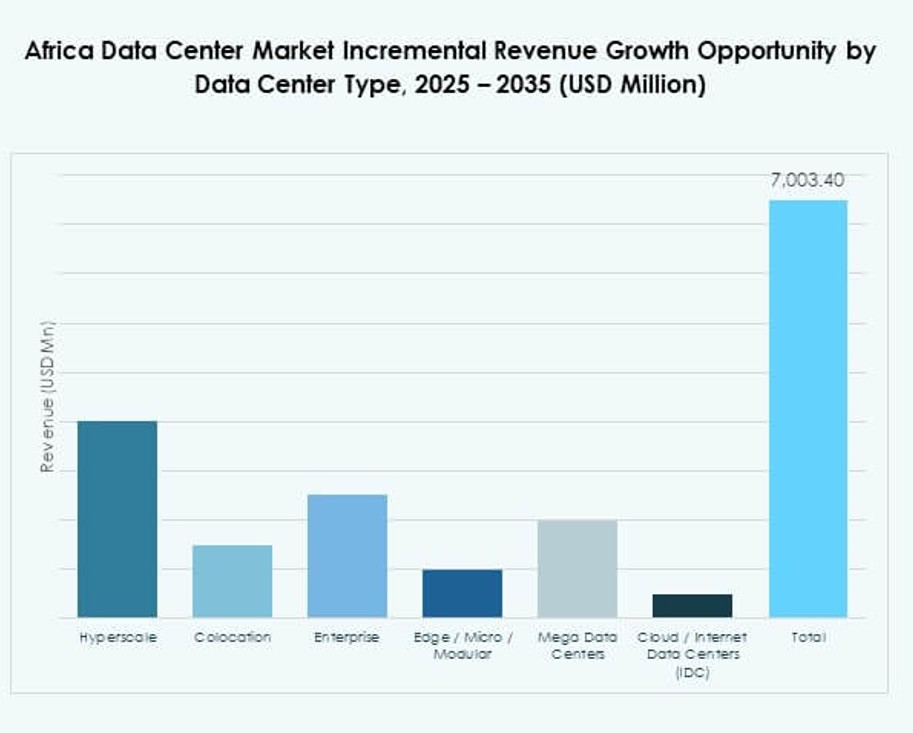

By Data Center Type

The Africa Data Center Market sees hyperscale centers leading due to investments from global providers. Colocation facilities grow steadily as enterprises outsource hosting for scalability. Edge and modular deployments expand to underserved areas. Enterprise facilities continue to support specific in-house needs. Cloud and IDC models gain momentum through digital-first strategies. Mega centers remain limited but attract high-value international investment.

By Deployment Model

The Africa Data Center Market shows hybrid deployment as the leading model, favored by enterprises seeking flexibility. Cloud-based solutions attract SMEs due to cost efficiency and scalability. On-premises hosting retains relevance for government and financial sectors demanding control. Hybrid adoption reflects the shift toward balancing security with operational agility.

By Enterprise Size

The Africa Data Center Market is driven by large enterprises, dominating with higher adoption of advanced infrastructure. SMEs are catching up with strong reliance on cloud services. It highlights opportunities for localized providers offering affordable hybrid solutions. The gap between enterprise segments narrows as digital adoption grows.

By Application / Use Case

The Africa Data Center Market shows IT and telecom as the leading application, supported by broadband expansion. BFSI relies on secure hosting for online banking and payments. Healthcare, retail, and e-commerce sectors grow with digital platforms. Government and defense adopt local hosting to ensure data security. Media, manufacturing, and education contribute to diversified demand across industries.

By End User Industry

The Africa Data Center Market is led by cloud service providers, reflecting hyperscale and global investments. Enterprises increasingly adopt colocation services for agility. Government agencies invest in secure hosting to support e-governance. Colocation providers strengthen regional interconnectivity. Other industries benefit from reliable and secure hosting options.

Regional Insights

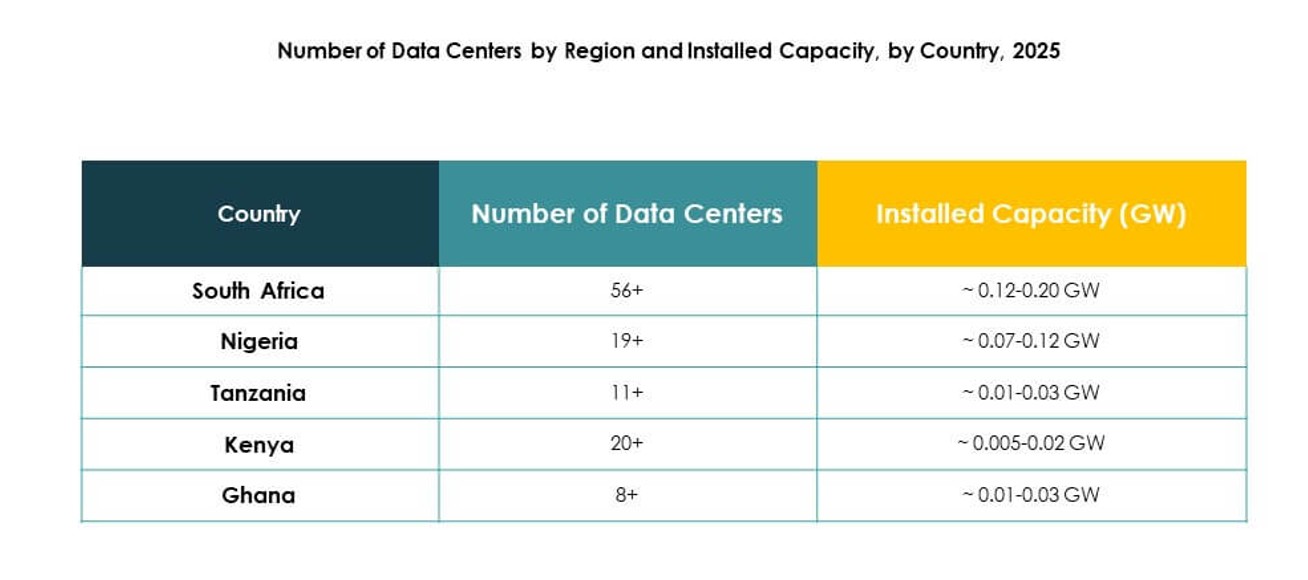

Southern Africa Leading with Established Infrastructure and High Market Share of 42%

The Africa Data Center Market in Southern Africa dominates due to mature IT ecosystems and strong telecom networks. South Africa drives adoption with hyperscale deployments and international investments. It benefits from reliable power supply in key urban areas. Global providers view it as the main entry point into Africa. Enterprises in financial services and e-commerce sectors strengthen demand. Strategic positioning enhances Southern Africa’s long-term leadership.

- For instance, in August 2025, Teraco completed a 30MW expansion at its JB4 Bredell Campus in Johannesburg, bringing the facility’s total critical IT load to 50MW across six new data halls, making it the largest standalone data center on the African continent.

Eastern Africa Emerging as a Growth Hub with 28% Market Share Supported by Digital Policies

The Africa Data Center Market in Eastern Africa expands rapidly with Kenya and Ethiopia at the forefront. Governments promote national cloud strategies and digital-first policies. It benefits from submarine cable investments improving regional connectivity. Enterprises in fintech and e-health increase reliance on colocation. Growth opportunities attract local and foreign investors. Eastern Africa is positioned as a rising digital hub for regional markets.

- For instance, in May 2025, Safaricom partnered with iXAfrica to launch the NBOX1 hyperscale data center in Nairobi, Kenya, with its first phase delivering 4.5MW of IT capacity and 780 racks across three halls, while future phases plan to expand capacity through NBOX1.2 and NBOX2 developments.

Northern and Western Africa Expanding Presence with Combined 30% Share Supported by Strategic Initiatives

The Africa Data Center Market in Northern and Western Africa shows growing potential. Nigeria and Ghana drive expansion in West Africa through fintech and broadband growth. Egypt and Morocco lead North Africa with strategic geographic positions connecting Europe and the Middle East. It supports international hosting demand and data localization policies. Investments in renewable energy strengthen long-term sustainability. These regions are gaining traction with diverse industries adopting digital infrastructure.

Competitive Insights:

- Digital Realty (Teraco)

- Equinix Africa

- Rack Centre

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Africa Data Center Market is shaped by strong competition between global hyperscale providers and regional specialists. Digital Realty (Teraco) and Equinix Africa dominate with large-scale facilities and advanced interconnection services. Rack Centre strengthens regional presence through colocation offerings and local expertise. Global cloud leaders Microsoft, AWS, and Google expand their footprint with investments in availability zones, hybrid cloud services, and AI-ready infrastructure. NTT Communications builds strategic partnerships to deliver enterprise-focused solutions. It reflects a competitive mix where global firms drive hyperscale growth while regional operators secure market share through tailored solutions and compliance with local requirements. Sustainability commitments, renewable energy integration, and modular designs emerge as key differentiators across providers, ensuring long-term competitiveness and alignment with government digital transformation goals.

Recent Developments:

- In September 2025, TecEx announced a strategic partnership with IXAfrica Data Centres aimed at accelerating digital growth in East Africa. This collaboration is set to leverage TecEx’s global IT procurement expertise and IXAfrica’s data center operations in Nairobi, facilitating broader access for businesses seeking digital infrastructure services tailored for the African market.

- In September 2025, MTN, a leading South African telecom operator, revealed it is in advanced discussions with both American and European companies to jointly develop AI-dedicated data centers in Africa. MTN intends to finalize partnership agreements by year-end and directly finance a portion of these investments.

- In August 2025, Digital Realty announced the launch of its third Lagos data center, LKK2, in Nigeria. The newly opened facility features nearly 2MW of IT capacity and expands the company’s West African footprint, supporting the growing demand for scalable, high-performance infrastructure across Nigeria and the broader region.

Market Drivers

Market Drivers