Executive summary:

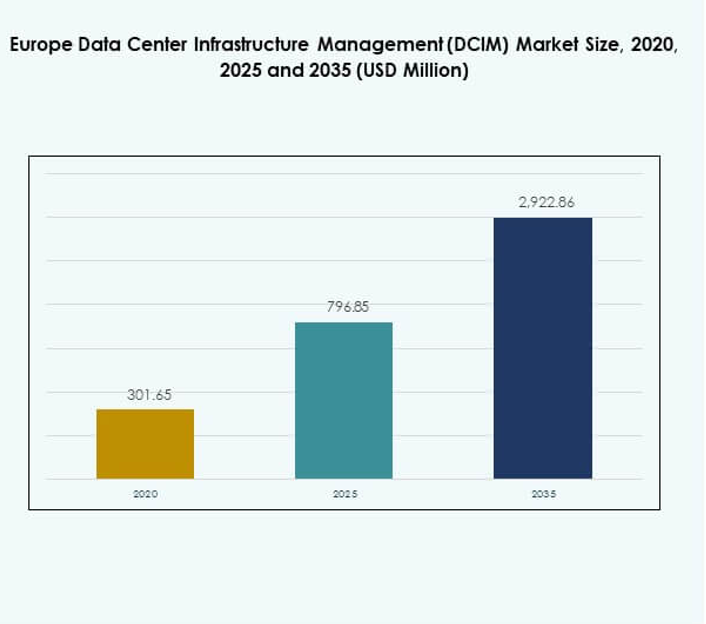

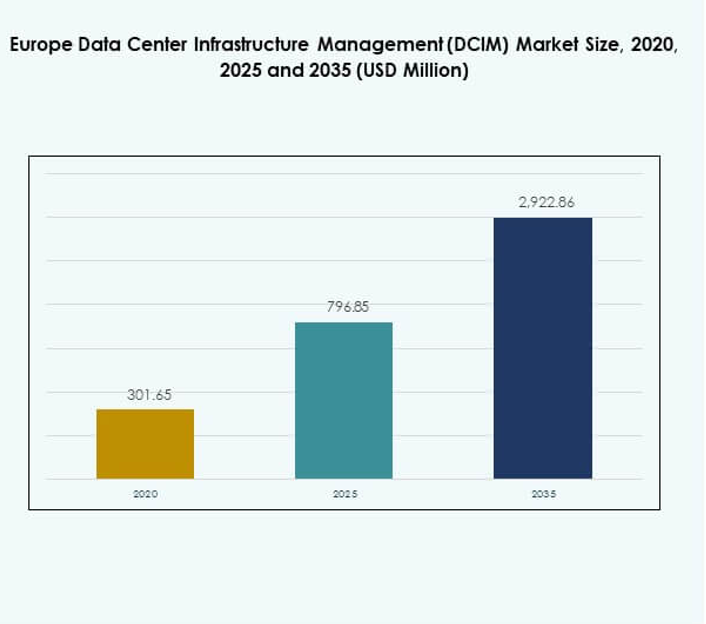

The Europe Data Center Infrastructure Management (DCIM) Market size was valued at USD 301.65 million in 2020 to USD 796.85 million in 2025 and is anticipated to reach USD 2,922.86 million by 2035, at a CAGR of 15.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2025 |

| Forecast Period |

2025-2035 |

| Europe Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 796.85 Million |

| Europe Data Center Infrastructure Management (DCIM) Market, CAGR |

15.66% |

| Europe Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 2,922.86 Million |

The market is driven by rapid cloud adoption, digital transformation, and the integration of AI-enabled analytics into infrastructure management. Enterprises prioritize intelligent platforms to monitor power, cooling, and assets with higher efficiency. Innovation in modular and hybrid IT strategies positions DCIM as essential for resilience and sustainability. Businesses invest in automation and predictive tools to reduce operational costs, while investors see the market’s strategic importance in enabling compliance, efficiency, and long-term digital growth.

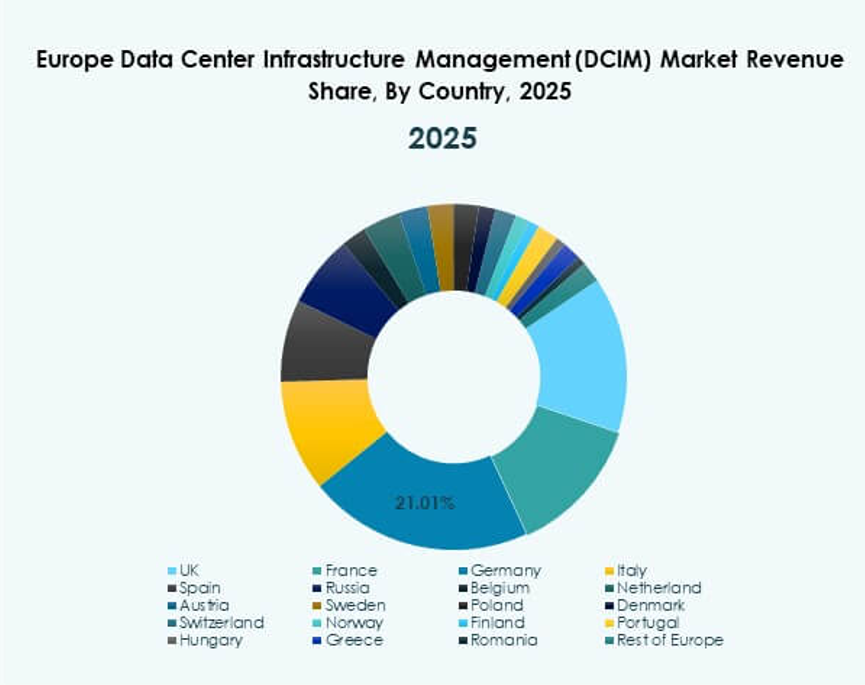

Western Europe leads the market with strong investments in hyperscale and colocation data centers, particularly in the UK, Germany, and the Netherlands. These regions benefit from advanced digital infrastructure, strong sustainability mandates, and government-backed digital initiatives. Eastern Europe emerges as a fast-growing segment due to rising e-commerce, gaming, and digital services adoption. Countries like Poland and Hungary invest in modernization, while Southern Europe sees expansion through retail, cloud, and smart city projects, creating a diverse growth landscape.

Market Drivers

Rising Demand for Intelligent Infrastructure Management Platforms Across Diverse Data Center Environments

The Europe Data Center Infrastructure Management (DCIM) Market is experiencing significant momentum with enterprises adopting intelligent platforms to optimize infrastructure performance. Rapid growth of hyperscale and colocation facilities drives higher requirements for real-time monitoring and predictive maintenance. Businesses demand integrated systems capable of handling power, cooling, and environmental variables with accuracy. Organizations view DCIM as a strategic tool for reducing operational inefficiencies and improving sustainability. It helps data centers manage rising digital workloads across multiple locations. Enterprises invest heavily in platforms that integrate asset tracking and lifecycle management. Strong adoption also reflects regulatory pressure to align with energy efficiency mandates. Investors recognize that advanced DCIM solutions are becoming indispensable to the digital economy.

- For instance, Schneider Electric’s EcoStruxure Asset Advisor was deployed at the University of Rochester Medical Center, enabling predictive, condition-based maintenance through cloud-connected monitoring of electrical assets. This deployment saved nearly $1 million by early problem detection and provided a 20:1 ROI with continuous asset monitoring and analytics.

Adoption of Advanced Analytics and AI to Enhance Operational Decision-Making

Artificial intelligence and advanced analytics are transforming how data centers use DCIM to optimize performance. Predictive models help operators identify risks early, avoid downtime, and maximize resource allocation. Businesses focus on deploying AI-driven modules that track asset health and automate workload distribution. It provides operators with actionable intelligence that supports faster decision-making. Machine learning integration ensures power and cooling systems operate at peak efficiency. Demand for AI in DCIM continues to grow as organizations pursue automation strategies. It enables businesses to scale operations without proportionate increases in cost. The market gains strategic importance for investors seeking long-term value in digital infrastructure.

Shifts Toward Sustainable Operations Driving Energy-Efficient DCIM Deployment

Energy optimization remains a leading driver of investment across Europe, with companies focusing on sustainability targets. The Europe Data Center Infrastructure Management (DCIM) Market benefits from government mandates that encourage carbon reduction and renewable energy integration. Businesses require DCIM tools to monitor power usage effectiveness and reduce unnecessary consumption. Operators implement automated systems that adjust cooling loads to balance performance and energy savings. Demand grows further with enterprises aiming to meet corporate social responsibility goals. Sustainability-linked financing also drives interest in energy-efficient data center operations. Strategic adoption of DCIM creates measurable benefits in compliance and operational transparency. For investors, sustainability-linked technologies represent both compliance readiness and competitive advantage.

- For instance, NTT Global Data Centers Europe achieved 51% renewable energy usage for non-IT loads in FY23 and implemented AI-driven cooling and smart sensors that reduced fan energy use by 50%, saving 2.6 GWh annually in UK data centers—showcasing measurable reductions in power usage effectiveness (PUE) and enhanced sustainability.

Growing Importance of Hybrid IT Strategies and Multi-Cloud Environments

The adoption of hybrid IT and multi-cloud strategies accelerates demand for advanced DCIM platforms. Organizations across Europe require visibility into complex infrastructures spread across on-premises, cloud, and edge facilities. The Europe Data Center Infrastructure Management (DCIM) Market becomes central to managing interconnected resources seamlessly. It allows enterprises to track utilization, enhance workload placement, and reduce redundancies. Businesses also focus on improving security and governance in distributed environments. This shift drives new requirements for modular and scalable DCIM platforms. Investors identify hybrid-focused solutions as highly strategic, especially for enterprises managing diverse digital ecosystems. The need for integration across traditional and emerging infrastructures ensures sustained market demand.

Market Trends

Integration of IoT and Smart Sensors to Enable Proactive Facility Management

IoT-enabled sensors are becoming essential for improving data center efficiency and resilience. The Europe Data Center Infrastructure Management (DCIM) Market is witnessing rapid adoption of sensor-based monitoring systems. Operators use IoT tools for granular tracking of power, cooling, and environmental parameters. Smart sensors provide real-time alerts, allowing faster corrective measures before disruptions occur. This trend strengthens predictive maintenance strategies while minimizing downtime risks. Businesses find IoT-based solutions scalable and cost-efficient. It creates opportunities to extend monitoring beyond physical infrastructure into remote sites. The reliance on intelligent, connected devices continues to reshape operational practices.

Growing Use of Modular DCIM Platforms for Scalability and Deployment Flexibility

Demand for modular DCIM solutions is increasing as organizations seek faster deployment and adaptability. The Europe Data Center Infrastructure Management (DCIM) Market benefits from enterprises seeking flexible platforms that scale with workloads. Modular architecture supports step-by-step expansion without disrupting existing operations. Businesses adopt these platforms to manage hybrid infrastructures with minimal complexity. Modular systems also align with dynamic requirements in colocation and cloud facilities. It reduces upfront costs by allowing incremental adoption of features. Operators value the ability to integrate specialized modules for power, capacity, or asset management. This trend reflects a strong move toward future-ready infrastructure planning.

Increased Adoption of Cloud-Based DCIM for Remote Accessibility and Control

Cloud-based DCIM platforms are gaining traction for their flexibility and accessibility. Enterprises in the Europe Data Center Infrastructure Management (DCIM) Market deploy cloud solutions to manage distributed infrastructures more effectively. Cloud-based systems enable operators to oversee multiple facilities remotely through centralized dashboards. This accessibility supports rapid growth in edge computing environments. Businesses also value subscription-based models that reduce capital investment pressure. It enhances collaboration across geographically dispersed teams. The scalability of cloud DCIM solutions allows enterprises to expand capacity seamlessly. Growing reliance on cloud-based platforms strengthens their position in enterprise IT strategies.

Shift Toward Integrated Cybersecurity Capabilities within DCIM Frameworks

Cybersecurity integration is becoming a core trend as data centers face rising threats. The Europe Data Center Infrastructure Management (DCIM) Market is evolving to include security features within monitoring platforms. Businesses demand DCIM systems that identify anomalies and provide early warnings of cyber risks. Operators use advanced analytics to secure data flows and infrastructure access. It reduces vulnerabilities in multi-tenant and cloud environments. Integration of threat detection with physical infrastructure management enhances overall resilience. Enterprises benefit from unified visibility across digital and physical assets. The trend positions DCIM as a comprehensive solution for risk mitigation in digital infrastructure.

Market Challenges

Complexity of Integration Across Diverse Infrastructure and Technology Ecosystems

The Europe Data Center Infrastructure Management (DCIM) Market faces challenges with integration across hybrid infrastructures. Operators struggle to unify legacy systems, cloud deployments, and new edge facilities. Diverse vendor ecosystems increase the complexity of interoperability. It slows down implementation timelines and raises overall project costs. Businesses often require extensive customization, creating long adoption cycles. Lack of standardized frameworks adds another barrier to seamless integration. Vendors must invest in interoperability features to ease these issues. The challenge remains significant for enterprises aiming to streamline operations quickly.

High Initial Investment and Skills Gap in Managing Advanced DCIM Platforms

High capital expenditure remains a hurdle for many businesses adopting DCIM. The Europe Data Center Infrastructure Management (DCIM) Market requires advanced solutions that often demand strong financial and technical resources. Smaller enterprises face difficulties in justifying the investment compared to immediate operational needs. It also requires skilled professionals capable of managing analytics-driven systems. Shortage of talent slows the pace of adoption. Training costs increase the total burden on enterprises. Investors remain cautious where return on investment is less certain. This challenge continues to affect market expansion in cost-sensitive segments.

Market Opportunities

Expansion of Edge Computing and AI-Driven Workload Optimization

The Europe Data Center Infrastructure Management (DCIM) Market offers strong opportunities through the rise of edge facilities. Businesses deploy DCIM to manage geographically distributed infrastructure more effectively. It enables AI-based workload optimization, ensuring seamless operation of mission-critical applications. Operators see opportunities in addressing latency-sensitive industries. The growth of connected devices strengthens demand for scalable solutions. Investors view edge integration as a pathway for long-term revenue. Vendors delivering agile platforms can benefit from rapid adoption. Strategic growth in this segment opens new opportunities for both established and emerging players.

Rising Demand for Sustainability-Focused DCIM Solutions Across Enterprises

The Europe Data Center Infrastructure Management (DCIM) Market benefits from growing demand for green technologies. Enterprises require solutions that optimize energy consumption and reduce carbon footprints. It strengthens compliance with strict European regulations and corporate sustainability goals. Businesses view sustainability-focused platforms as a way to build competitive differentiation. Vendors offering renewable integration features attract strong interest. The focus on energy-efficient operations provides measurable financial and environmental gains. Opportunities emerge in sectors with large-scale data center operations. This demand positions sustainability-oriented solutions as high-value market opportunities.

Market Segmentation

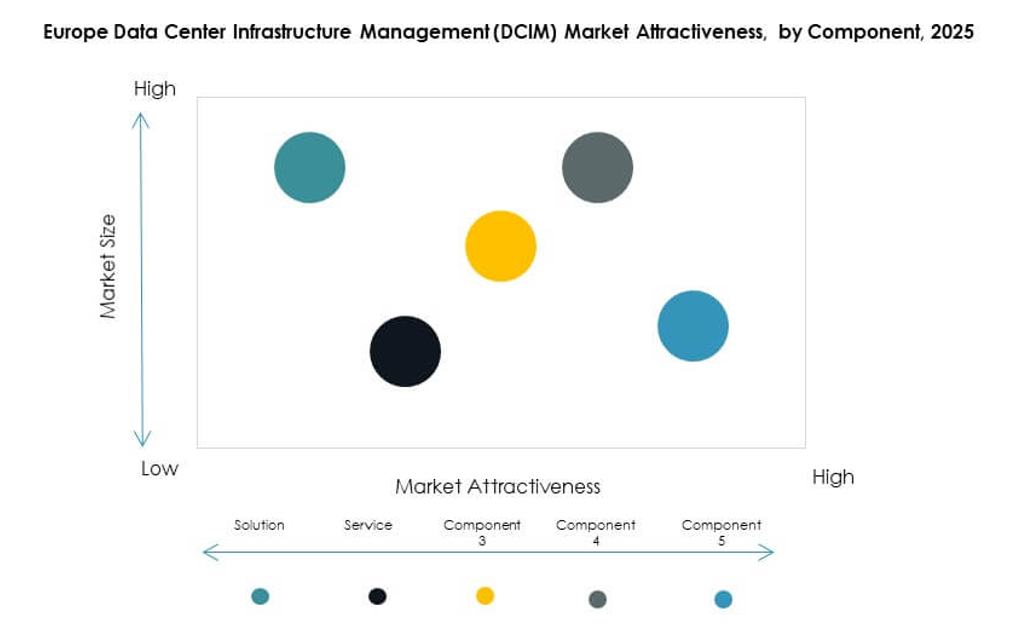

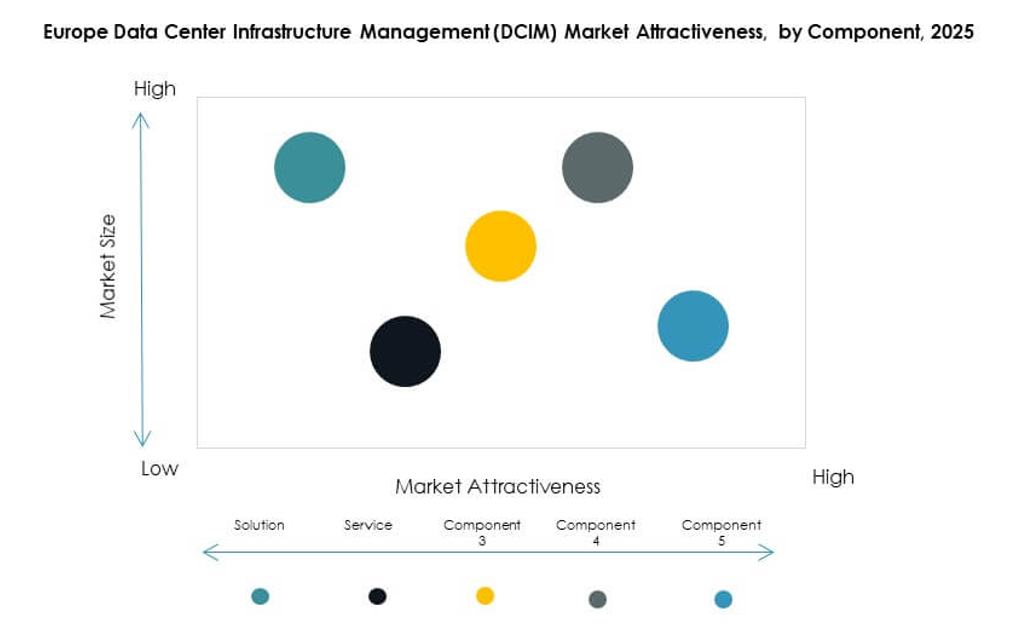

By Component

Solutions dominate the Europe Data Center Infrastructure Management (DCIM) Market, accounting for a major share due to their role in managing power, assets, and capacity with precision. Services also gain momentum as enterprises seek managed and consulting expertise for complex deployments. Solutions remain critical for enterprises adopting analytics-driven infrastructure management. Vendors offering customizable platforms strengthen their positions. Service providers support operational continuity by integrating advanced monitoring frameworks. The balance between solutions and services highlights the ecosystem’s depth and growth potential.

By Data Center Type

Colocation and cloud data centers hold the dominant share within the Europe Data Center Infrastructure Management (DCIM) Market. Enterprises increasingly shift to colocation for cost efficiency, scalability, and global connectivity. Cloud and edge data centers grow rapidly, driven by digital transformation and IoT expansion. Enterprise-owned data centers still play a role but face slower growth. Managed data centers attract mid-sized businesses seeking reliability without high capital costs. Vendors prioritize platforms suited for hybrid environments. Growth in edge adoption fuels broader demand across data center categories.

By Deployment Model

Cloud-based deployment leads the Europe Data Center Infrastructure Management (DCIM) Market, offering scalability, accessibility, and reduced infrastructure costs. Enterprises value subscription-based models that align with operational budgets. On-premises deployment remains critical for industries demanding strict data control, such as BFSI and defense. Hybrid models gain traction, allowing flexibility across distributed assets. Businesses deploy hybrid frameworks to manage security and compliance alongside scalability. Vendors invest in hybrid-ready DCIM platforms to meet evolving requirements. The diversity of deployment models ensures the market serves both large and small enterprises.

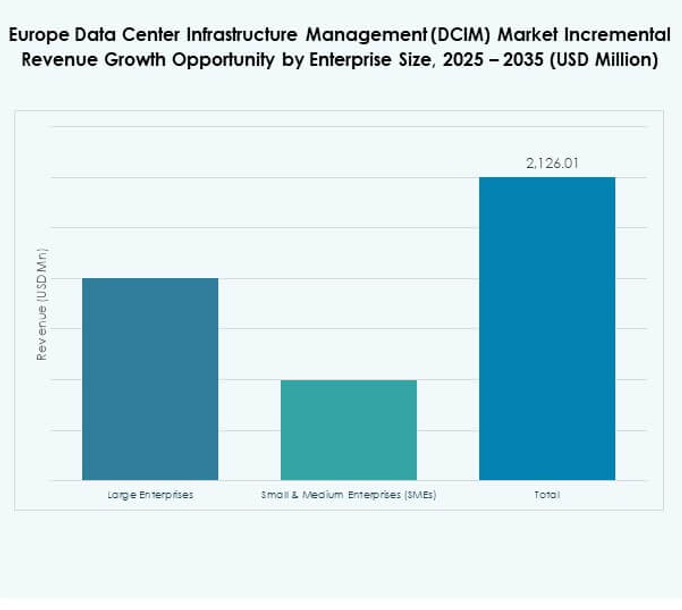

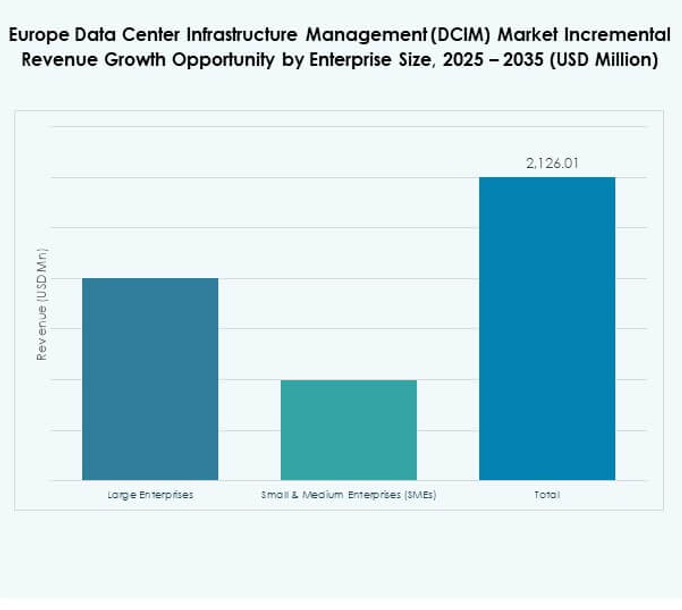

By Enterprise Size

Large enterprises dominate the Europe Data Center Infrastructure Management (DCIM) Market due to extensive infrastructure and strong investment capacity. These organizations prioritize advanced solutions for asset management, power efficiency, and sustainability compliance. Small and medium enterprises (SMEs) also expand adoption, supported by cloud-based and modular offerings. SMEs seek cost-effective and scalable solutions that minimize upfront expenditure. Vendors targeting SMEs with flexible pricing models gain traction. Demand from SMEs highlights the democratization of advanced infrastructure management. Growth in both segments supports overall market expansion.

By Application / Use Case

Capacity management leads applications within the Europe Data Center Infrastructure Management (DCIM) Market, reflecting enterprise demand for optimization. Businesses adopt capacity modules to track resource utilization and prevent inefficiencies. Power monitoring remains critical for energy compliance and operational sustainability. Environmental monitoring grows as enterprises seek to manage cooling loads effectively. Asset management ensures infrastructure reliability and lifecycle planning. Business intelligence and analytics gain importance for strategic decision-making. Vendors offering integrated use cases strengthen adoption rates across enterprise sectors.

By End User Industry

The IT and telecommunications sector dominates the Europe Data Center Infrastructure Management (DCIM) Market, supported by rapid digital expansion and high infrastructure reliance. BFSI follows with strong demand for secure and efficient management platforms. Healthcare sees growth due to rising digital records and compliance needs. Retail and e-commerce invest to enhance online operations. Aerospace and defense rely on strict monitoring capabilities for mission-critical operations. Energy and utilities deploy DCIM to maintain system resilience. Other industries contribute, but technology-driven sectors remain the leading growth engines.

Regional Insights

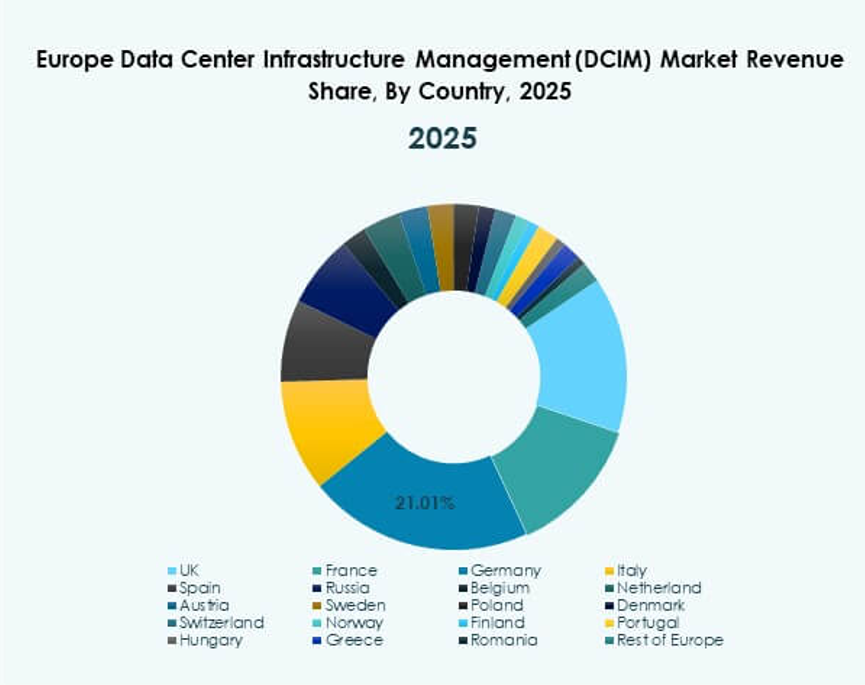

Western Europe: Leading Region with Strong Hyperscale and Colocation Investments

Western Europe dominates the Europe Data Center Infrastructure Management (DCIM) Market with a 44% share, led by the UK, Germany, France, and the Netherlands. Strong digital economies, renewable integration, and advanced IT ecosystems strengthen adoption. Enterprises prioritize modular and AI-enabled DCIM solutions. Governments enforce sustainability mandates, further driving investments. It remains the most mature region with strong presence of hyperscale operators. Investors identify Western Europe as the hub for advanced data infrastructure. The region continues to shape innovation trends for broader markets.

- For example, Equinix announced plans to deploy direct-to-chip liquid cooling across more than 100 data centers in over 45 metros worldwide, supporting AI and other high-density workloads, as confirmed in its official 2023–2024 statements. This initiative strengthens capacity for advanced computing across key global hubs, including Western Europe.

Northern and Southern Europe: Expanding Adoption Driven by Digitalization and Cloud Services

Northern and Southern Europe collectively account for a 32% share in the Europe Data Center Infrastructure Management (DCIM) Market. Countries such as Sweden, Denmark, Spain, and Italy show rising adoption supported by cloud and colocation growth. Enterprises in these regions deploy DCIM to support digital transformation initiatives. It addresses operational efficiency and sustainability challenges effectively. Vendors find strong opportunities in markets with increasing renewable integration. Demand in Southern Europe accelerates as e-commerce and digital services expand. Regional governments promote smart city projects, further supporting demand.

Eastern Europe: Emerging Market with Growing Digital Infrastructure and Government Support

Eastern Europe holds a 24% share of the Europe Data Center Infrastructure Management (DCIM) Market. Countries like Poland, Czech Republic, and Hungary are witnessing strong growth in digital infrastructure. Enterprises invest in DCIM to modernize legacy systems and support hybrid adoption. It offers resilience against rising workloads from e-commerce, gaming, and cloud services. Government-backed digitalization programs stimulate demand across enterprises. Vendors gain opportunities by offering cost-effective, modular platforms. Eastern Europe emerges as a competitive frontier for future market growth.

- For instance, 3S Group opened its third data center in Katowice, Poland in 2023, doubling the company’s local data center footprint and adding a facility of 2,200 sq m, with planned further expansion across the country and direct investment in cloud and fiber backbone, as confirmed by official 3S Group and industry news sources.

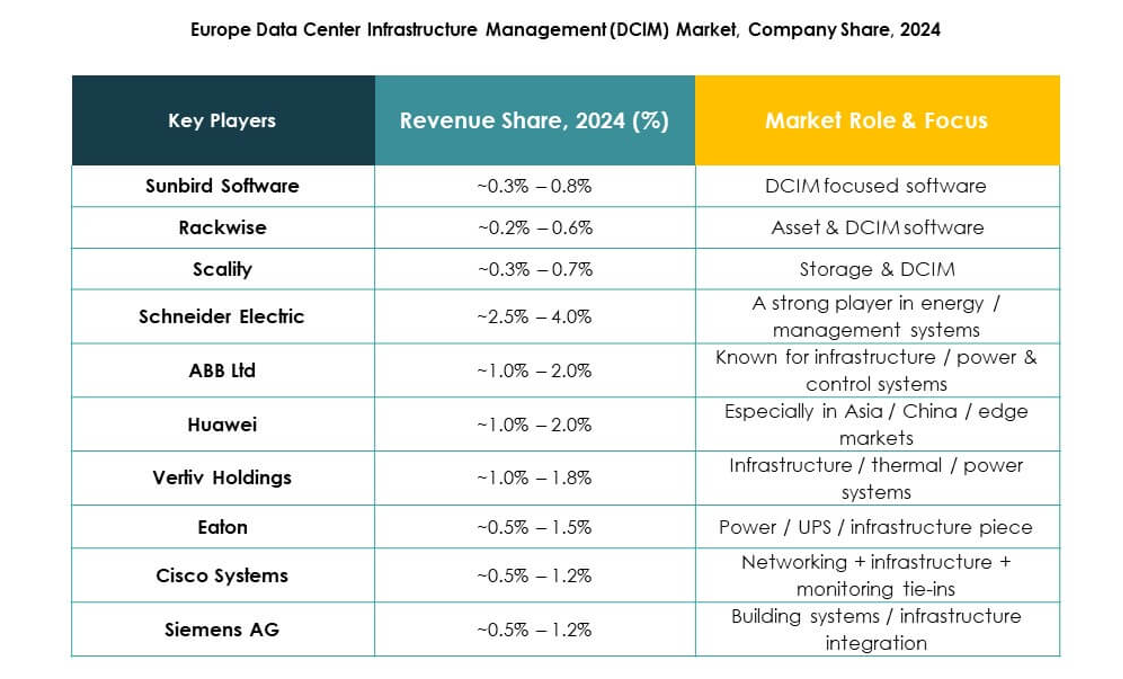

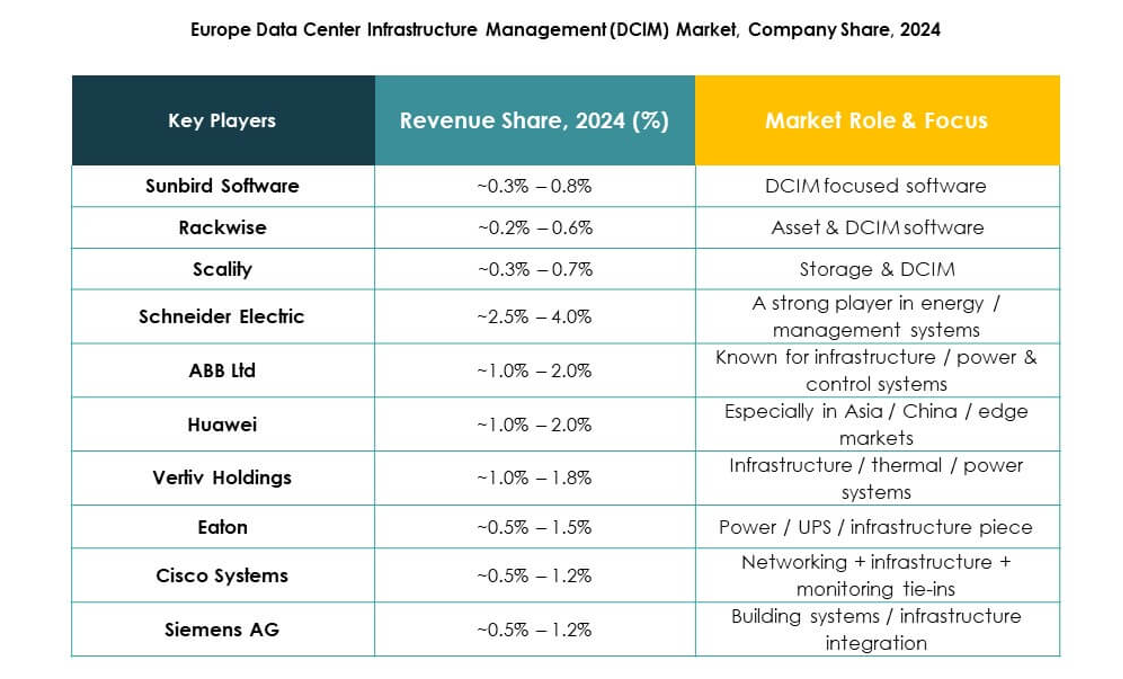

Competitive Insights:

- Sunbird Software

- Rackwise

- Netcall

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- IBM

- Schneider Electric SE

- Siemens AG

- HPE (Hewlett Packard Enterprise)

- Vertiv Holdings

The competitive landscape of the Europe Data Center Infrastructure Management (DCIM) Market is shaped by global technology leaders and specialized software vendors. It reflects intense rivalry as companies focus on innovation, sustainability integration, and modular platforms. Schneider Electric, Siemens, and ABB drive adoption through advanced energy-efficient solutions. Cisco, Huawei, and IBM emphasize hybrid and cloud-ready architectures, while HPE and Vertiv strengthen positions with scalable infrastructure offerings. Sunbird Software and Rackwise capture niche opportunities through specialized DCIM tools. Vendors compete through acquisitions, partnerships, and regional expansion strategies, seeking to align with regulatory requirements and enterprise sustainability goals. The competitive environment continues to push advancements in automation, analytics, and cybersecurity, establishing DCIM as a core enabler of digital infrastructure transformation across Europe.

Recent Developments:

- In September 2025, Cisco launched its Sovereign Critical Infrastructure portfolio, enabling customers in Europe to control and manage digital infrastructure on-premises to meet stringent local compliance and sovereignty standards, with hardware and software available immediately through European partners.

- In September 2025, Huawei launched the Xinghe AI Fabric 2.0 solution for Europe during the Huawei Network Summit in Munich. This AI-driven upgrade is designed to deliver “always-on” data center networking with full compute utilization, empowering European enterprises’ digital transformation initiatives.

- In August 2025, Schneider Electric signed a long-term framework agreement with E.ON to supply SF₆-free medium-voltage switchgear equipment across Europe, enabling faster and greener compliance with upcoming EU F-Gas regulations. This partnership aims to deploy AirSeT technologies throughout E.ON’s European grid—marking a major step toward sustainable and digital energy infrastructure.

- In June 2025, ABB acquired a minority stake in Spanish company HESStec, renowned for its hybridized energy storage systems. This strategic partnership bolsters ABB’s capabilities in grid-forming energy storage and optimization software, amplifying their influence in Europe’s energy storage and DCIM markets.