Executive summary:

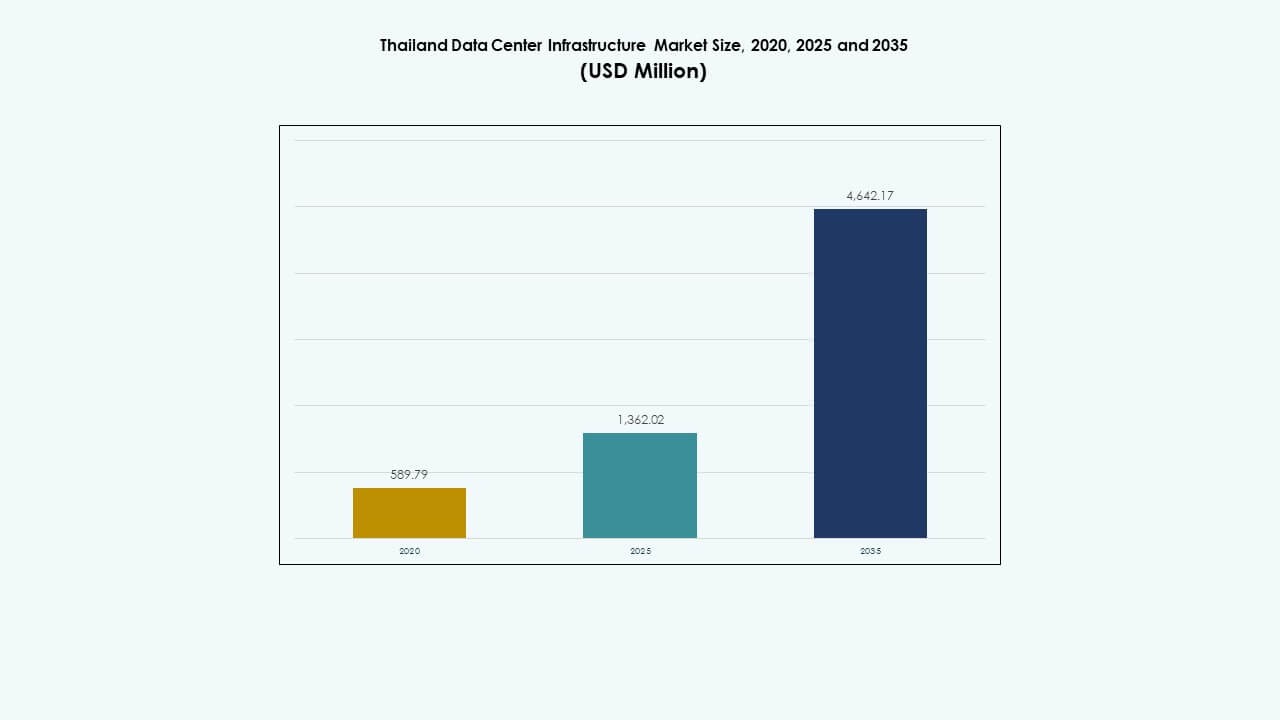

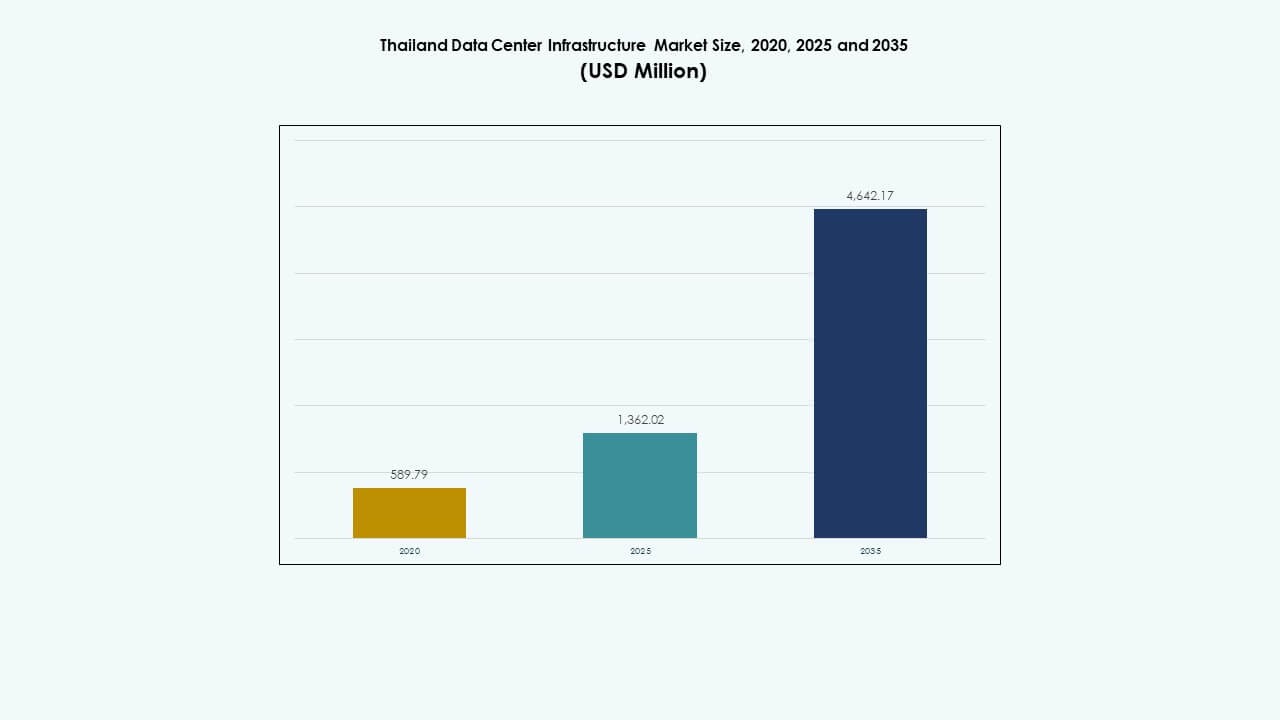

The Thailand Data Center Infrastructure Market size was valued at USD 589.79 million in 2020, grew to USD 1,362.02 million in 2025, and is anticipated to reach USD 4,642.17 million by 2035, growing at a CAGR of 12.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Thailand Data Center Infrastructure Market Size 2025 |

USD 1,362.02 Million |

| Thailand Data Center Infrastructure Market, CAGR |

12.94% |

| Thailand Data Center Infrastructure Market Size 2035 |

USD 4,642.17 Million |

The market is driven by strong momentum in cloud services, AI workloads, and 5G deployment. Operators invest in high-density power, liquid cooling, and smart monitoring systems to meet advanced workload requirements. The hyperscale shift brings new partnerships between global cloud players and local providers. Government-backed digital policies enhance investor confidence, making Thailand a strategic entry point for Southeast Asia’s data economy. For businesses, the infrastructure supports low-latency, regulation-compliant hosting, vital for digital transformation.

Bangkok leads due to its dense network ecosystem and fiber connectivity. It holds the largest number of colocation and enterprise facilities. The Eastern Economic Corridor is emerging fast, driven by industrial cloud demand and favorable land policies. Northern cities like Chiang Mai are gaining traction for edge deployments. Compared to regional peers, Thailand is closing the gap with a balanced mix of hyperscale, colocation, and edge-ready zones.

Market Dynamics:

Market Dynamics:

Cloud Expansion, Digital Government Goals, and Public-Sector Infrastructure Push Driving Growth

Government-led digital transformation and cloud adoption fuel infrastructure investments. Thailand’s Digital Economy Promotion Agency supports long-term cloud policy frameworks. Demand from public services, smart cities, and e-governance creates consistent need for scalable data capacity. Cloud players benefit from land-use exemptions and policy incentives. Cloud localization mandates drive demand for in-country infrastructure. The Thailand Data Center Infrastructure Market benefits from growing reliance on localized cloud hosting. Public sector workloads need high uptime and disaster recovery. National digital policies position data centers as mission-critical assets.

- For instance, AWS launched its Asia Pacific (Thailand) Region in January 2025, providing high-availability cloud services for government workloads with 99.99% uptime guarantees.

5G Commercialization and Edge Computing Architectures Fuel Next-Generation Infrastructure Rollouts

Thailand’s 5G rollout enables distributed computing demand across Tier-2 cities. Telecom providers invest in urban and semi-urban edge nodes to reduce latency. Edge infrastructure requires high-density, low-footprint mechanical and electrical systems. The shift creates demand for modular units with integrated cooling and UPS systems. Data center designs evolve to support 5G base station backhaul and content delivery. Smart factory and IoT services increase edge usage. Edge readiness becomes essential for telecom and enterprise competitiveness. The Thailand Data Center Infrastructure Market aligns with telecom convergence and rapid edge scaling.

AI, IoT, and Machine Learning Accelerate High-Density Rack Design and Power Innovation

High-performance computing and AI workloads need greater rack densities. GPU clusters and deep learning models demand 20–50 kW per rack. Infrastructure shifts from air to liquid and rear-door cooling for thermal efficiency. UPS and BESS systems scale to support runtime and power quality. Thailand’s data center designs adopt advanced electrical and containment systems. AI firms need low-latency and resilient network backbones. Cloud players integrate AI-ready architecture into colocation builds. The Thailand Data Center Infrastructure Market adapts to enterprise digitalization and workload diversity.

Foreign Direct Investment, Cross-Border Cloud Growth, and Strategic ASEAN Connectivity

Thailand attracts global data center firms through liberalized FDI and trade agreements. Proximity to Vietnam, Malaysia, and Singapore enables regional interconnection. SEA-based hyperscalers prefer Thailand’s land cost and redundancy profile. Strategic fiber routes through Thailand support low-latency Asia-Pacific traffic. Thailand’s submarine cable connectivity enhances its regional relevance. Tax incentives and BOI support attract new developers. The Thailand Data Center Infrastructure Market plays a key role in ASEAN’s neutral hosting landscape. Investor interest remains strong across greenfield and brownfield builds.

- For instance, in 2024, Google announced a $1 billion investment to establish its first data center and cloud region in Thailand. The move aims to support local cloud adoption, AI innovation, and strengthen Thailand’s position in the regional digital infrastructure landscape.

Market Trends

Market Trends

Rising Demand for Renewable-Energy-Integrated and ESG-Compliant Data Center Designs

Operators prioritize green power procurement and energy reuse systems. Solar integration and RE100 participation drive long-term infrastructure design shifts. PUE targets fall below 1.4 for large-scale sites. Heat reuse, greywater systems, and green roofs gain traction in new builds. Carbon-neutral operations gain importance among global clients. ESG tracking becomes a key metric for colocation vendor selection. Data center operators set 2030 net-zero goals. The Thailand Data Center Infrastructure Market supports sustainable expansion with grid partnerships and hybrid microgrids.

Deployment of Modular, Prefabricated, and Scalable Infrastructure Builds Across Urban Sites

Modular construction models reduce deployment time and costs. Vendors offer containerized mechanical-electrical systems for remote and urban zones. Prefabricated UPS, chillers, and PODs streamline edge deployments. Builders shift toward scalable room-based architecture over traditional slab-based builds. Infrastructure integrates smart controls for thermal tuning and predictive failure response. Scalability supports phased rollouts and tenant upgrades. Retrofit-ready modules support legacy facility upgrades. The Thailand Data Center Infrastructure Market adopts modular blueprints to reduce capex and improve deployment speed.

Shift Toward Software-Defined, AI-Based Facility Monitoring and Predictive Maintenance

Data centers implement AI-driven monitoring for thermal loads, PDU performance, and capacity planning. Software-defined power and cooling controls automate load balancing. Predictive maintenance reduces unplanned downtime and repair costs. Digital twin models simulate facility changes before implementation. BMS and DCIM platforms adopt AI models for resource optimization. Facilities integrate APIs with asset tracking and incident systems. Smart monitoring improves SLA compliance. The Thailand Data Center Infrastructure Market invests in AI-integrated facility management.

Focus on High-Capacity Interconnectivity Through IX Expansion and Regional Subsea Gateways

Data center facilities partner with Internet Exchange operators and telcos to increase route diversity. Bangkok IX and NIXI expansion improves cross-border latency. International players seek sites with multiple cable landing points. New subsea cable projects link Thailand to India, Singapore, and Japan. Interconnection density impacts hyperscaler leasing preferences. Wholesale providers offer dark fiber and on-demand cross-connects. Content delivery networks co-locate in high-connectivity zones. The Thailand Data Center Infrastructure Market capitalizes on network-centric site development.

Market Challenges

Market Challenges

Limited Availability of Power-Ready Land and Delays in Grid Capacity Approvals

Securing power-provisioned land within Bangkok and EEC zones remains difficult. High-voltage connections require long utility approval cycles. Substation proximity and transformer availability affect site selection. Developers face high costs in sourcing backup diesel or BESS setups. EV growth adds pressure on urban grids. Rural sites lack dual-feed or ring-network grid connectivity. The Thailand Data Center Infrastructure Market faces risk from utility delays and power cost volatility. Investors prioritize projects with pre-secured grid permits.

Shortage of Skilled Technical Workforce and Low Maturity in Construction Management

Thailand lacks sufficient high-skill professionals for data center engineering and operations. EPC firms face design delays due to limited BIM and commissioning expertise. Cooling and UPS design flaws raise rework and warranty risks. Contractors lack familiarity with hyperscale and multi-tenant compliance standards. Market maturity remains lower than Singapore or Japan. Global clients require training and local talent development programs. The Thailand Data Center Infrastructure Market requires workforce upgrades to meet next-gen standards.

Market Opportunities

Colocation and Hyperscale Demand from Global Cloud, Financial, and Gaming Clients

Multinational cloud, fintech, and content players seek regional hosting options. Thailand’s central location supports SEA coverage with low latency. Hyperscale tenants seek power capacity, connectivity, and ESG compliance. Colocation operators expand shell-and-core and turnkey offerings. The Thailand Data Center Infrastructure Market offers capacity leasing and long-term anchor tenant deals.

Rising Edge Deployments and 5G Integration Across Smart Cities and Manufacturing Zones

Urban and industrial clusters drive micro-edge and modular deployment. 5G densification accelerates edge demand near end-user nodes. Developers offer build-to-suit and plug-and-play models. The Thailand Data Center Infrastructure Market gains from latency-sensitive verticals and smart automation hubs.

Market Segmentation

By Infrastructure Type

The Thailand Data Center Infrastructure Market is dominated by electrical infrastructure due to high focus on reliable power delivery. Mechanical infrastructure follows closely, driven by increased rack density. IT and network segments grow with digital service providers scaling operations. Civil and architectural components gain share with modular construction. Infrastructure spending balances across power, cooling, and digital assets.

By Electrical Infrastructure

Uninterruptible power supply (UPS) holds the largest market share due to growing uptime demand. Battery energy storage systems gain traction with sustainability goals. Power distribution units (PDUs) and switchgears are essential in modular data halls. Grid upgrades and clean backup power integration drive utility connections. The Thailand Data Center Infrastructure Market prioritizes high-efficiency and scalable power infrastructure.

By Mechanical Infrastructure

Cooling units lead the segment, driven by high-performance computing and AI workloads. Chillers and containment systems improve PUE across hyperscale builds. Pumps and piping systems support modular mechanical rooms. Rack-level and liquid cooling gain adoption. The Thailand Data Center Infrastructure Market adapts to dense rack loads and tropical temperatures.

By Civil / Structural & Architectural

Superstructure and raised floors dominate this segment. Modular building systems reduce construction time and offer flexibility. Site preparation and foundation works remain critical in new greenfield zones. The Thailand Data Center Infrastructure Market uses advanced building envelopes for thermal insulation and seismic resilience.

By IT & Network Infrastructure

Networking equipment holds the top share due to demand for high-throughput connectivity. Servers and racks grow with cloud and enterprise deployment. Storage and optical fiber systems expand with AI training and content hosting. The Thailand Data Center Infrastructure Market invests heavily in core IT assets.

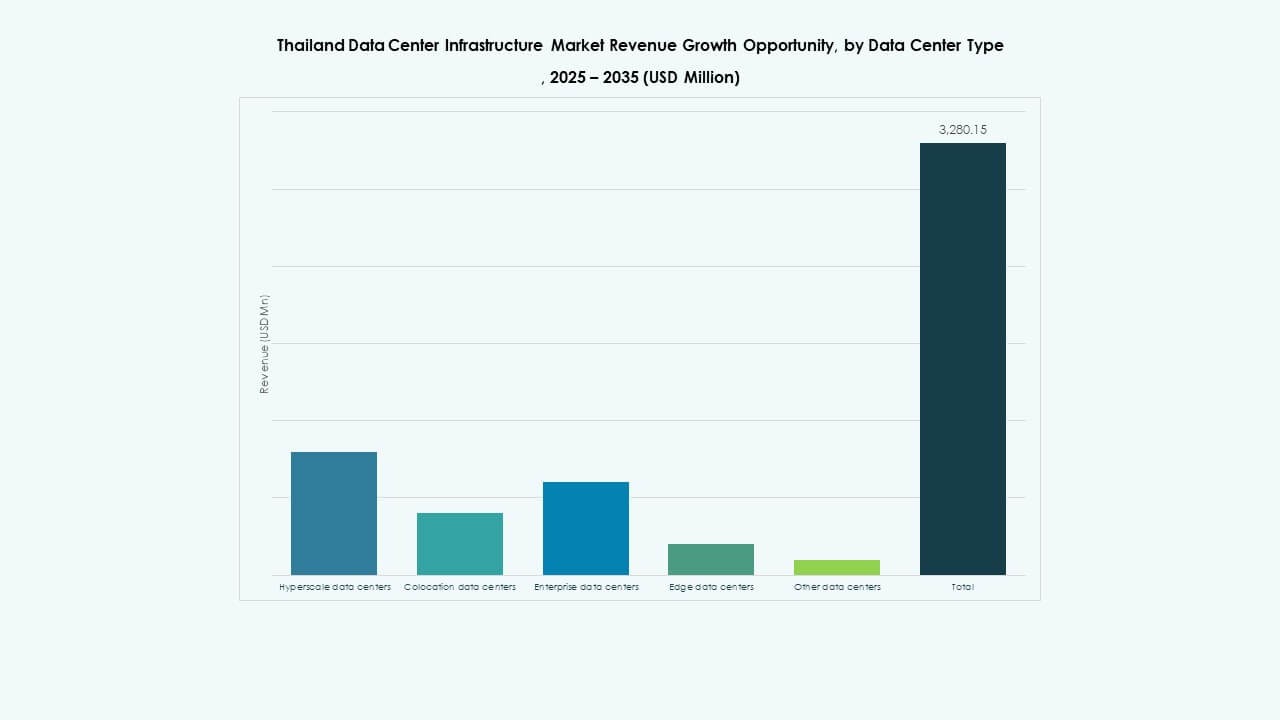

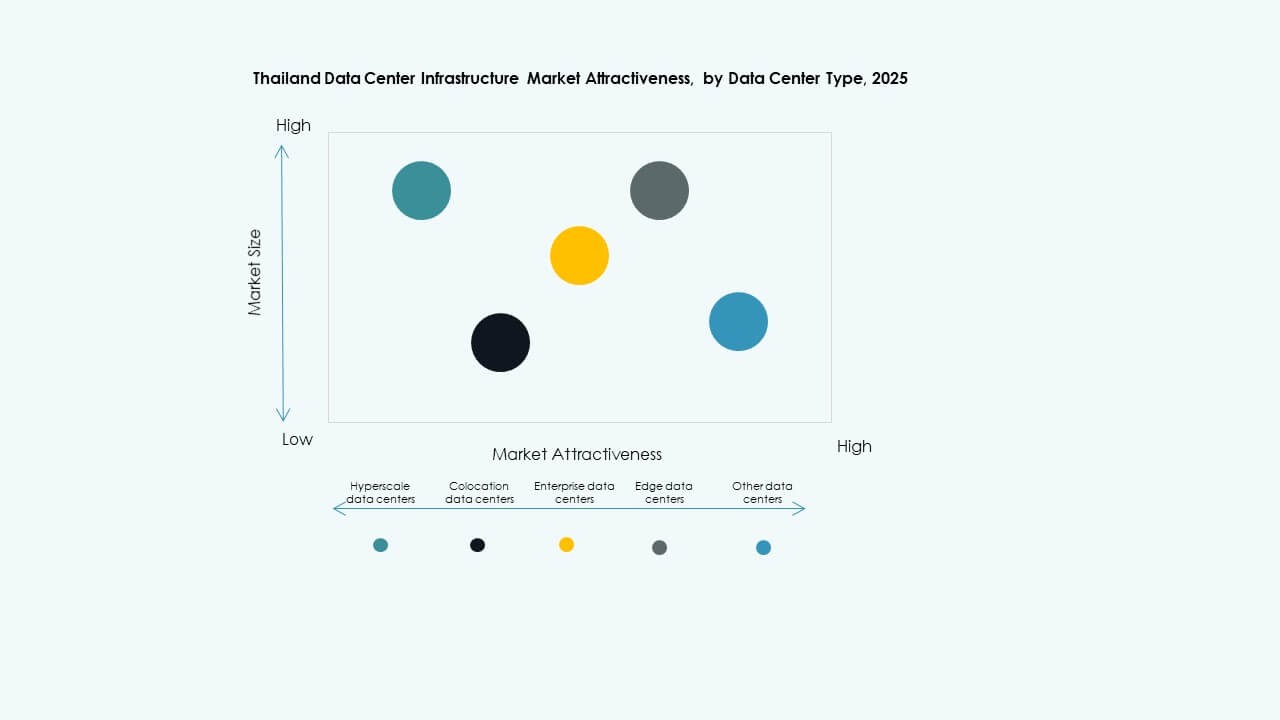

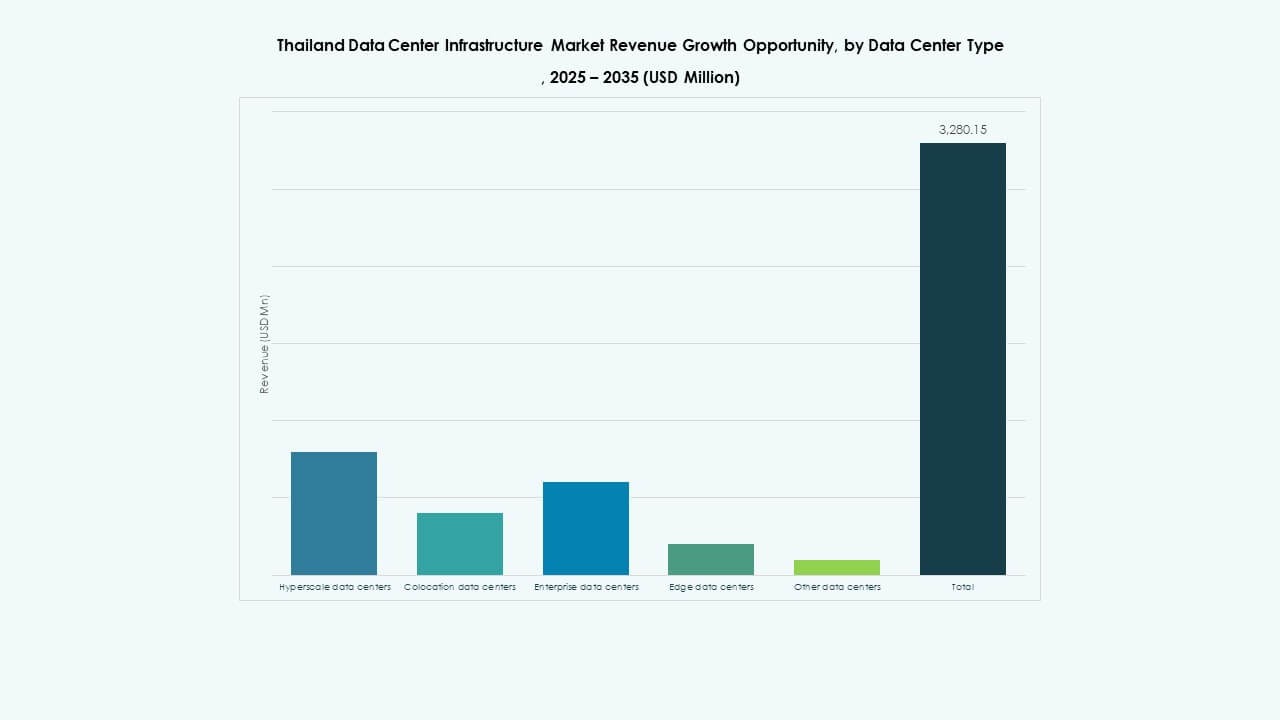

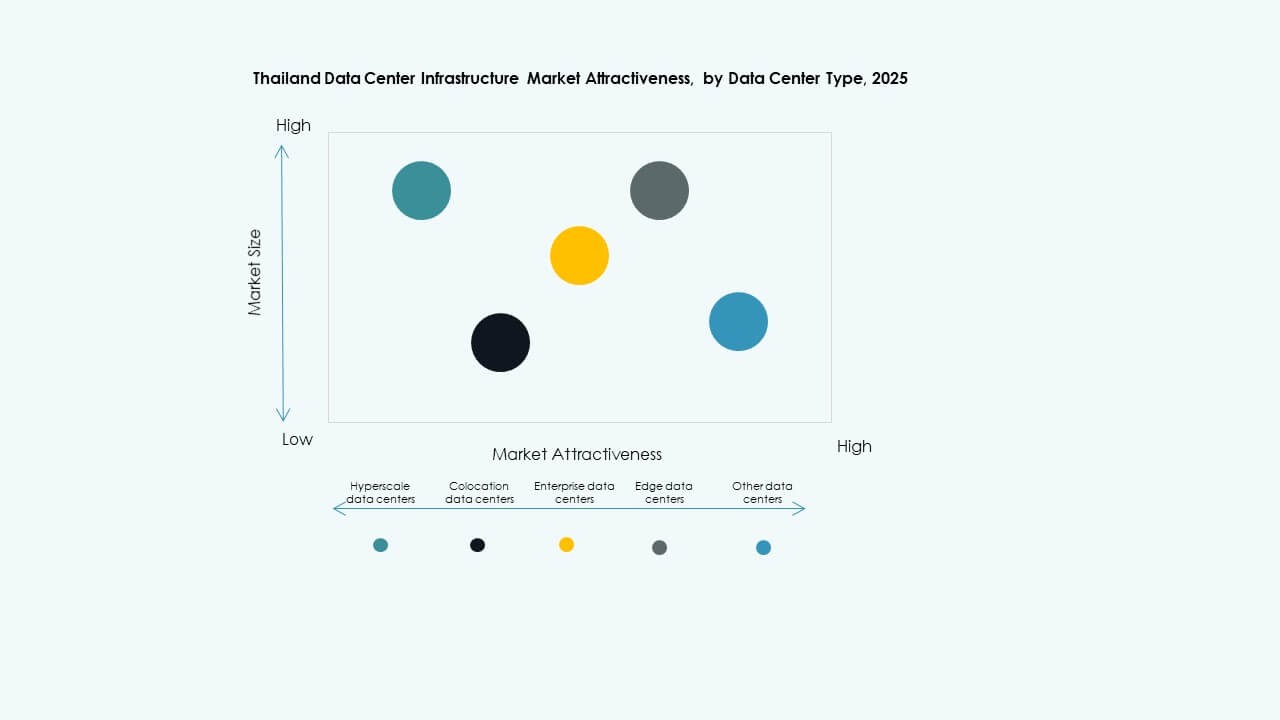

By Data Center Type

Colocation data centers dominate due to enterprise and government demand. Hyperscale centers grow with global cloud player investment. Edge data centers gain traction with 5G and smart cities. Enterprise facilities shrink in share but persist in banking and telecom. The Thailand Data Center Infrastructure Market sees a diverse mix across build types.

By Delivery Model

Design-build or EPC models dominate with large projects by global developers. Retrofit and upgrade models serve urban data halls. Modular factory-built units gain share in edge and telecom rollouts. Turnkey and construction management models support local firms. The Thailand Data Center Infrastructure Market benefits from flexible deployment models.

By Tier Type

Tier 3 holds the largest market share due to balanced uptime and cost. Tier 4 facilities increase for banking and government workloads. Tier 1 and Tier 2 serve small enterprises or rural zones. The Thailand Data Center Infrastructure Market moves toward Tier 3+ architecture for colocation builds.

Regional Insights

Regional Insights

Bangkok Metropolitan Region – Core Market with Over 65% Market Share

Bangkok leads due to dense enterprise zones, fiber networks, and global IX access. The region hosts the highest number of colocation and hyperscale facilities. Demand comes from financial services, cloud providers, and telecom carriers. Grid availability and land access remain competitive. The Thailand Data Center Infrastructure Market centralizes in Bangkok due to established infrastructure.

- For instance, NextGen Data Center and Cloud Services, a subsidiary of Dubai-based DAMAC Digital, received approval for an 84 MW hyperscale data center at Navanakorn Industrial Estate in Pathum Thani. The region hosts a high concentration of colocation and hyperscale facilities, reinforcing its role as a core infrastructure zone in the Thailand Data Center Infrastructure Market.

Eastern Economic Corridor (EEC) – Emerging Zone with 20% Share and Hyperscale Growth

The EEC attracts hyperscale builds near Chonburi, Rayong, and Chachoengsao. Land availability, industrial policies, and energy access drive expansion. Global players secure sites near ports and industrial hubs. The EEC region gains from low-cost energy and BOI tax incentives. It evolves as a major secondary market in the Thailand Data Center Infrastructure Market.

- For instance, Vistas Technology, a subsidiary of China’s ZData Technologies, secured approval for an 80 MW data center facility at Amata City Chonburi Industrial Estate in Chonburi. Land availability, industrial policies, and reliable energy access continue to drive infrastructure expansion in this key region of the Thailand Data Center Infrastructure Market.

Northern and Northeastern Thailand – Early-Stage Regions with Combined 15% Share

Chiang Mai and Khon Kaen emerge for edge and enterprise hosting. Lower land costs and smart city development drive potential. Telecom firms pilot micro-edge zones near regional 5G clusters. Power constraints limit large-scale builds. The Thailand Data Center Infrastructure Market expands cautiously into these subregions for localized access.

Competitive Insights:

- True IDC

- CAT Telecom

- Telehouse

- Delta Electronics

- Huawei Technologies Co., Ltd.

- Schneider Electric

- Vertiv Group Corp.

- ABB

- Equinix, Inc.

- Dell Inc.

The Thailand Data Center Infrastructure Market features a competitive mix of local operators, global equipment vendors, and multinational colocation providers. True IDC and CAT Telecom lead the local segment with strong network assets and government ties. Global OEMs such as Schneider Electric, Huawei, and Vertiv supply power and cooling systems to both hyperscale and enterprise clients. Delta Electronics and ABB provide automation and modular solutions for energy and mechanical integration. Equinix and Telehouse target regional interconnection hubs with neutral data center offerings. The market favors companies that offer scalable, energy-efficient, and modular designs. It remains dynamic, with infrastructure players forming alliances with cloud providers and telecom firms. Companies that align infrastructure with ESG goals and edge-readiness gain competitive advantage. Expansion success depends on local execution, interconnection density, and differentiated build-to-suit capabilities.

Recent Developments:

- In October 2025, CP Group, True, and True IDC also announced a strategic collaboration with Microsoft under which True IDC will act as a key data center partner supporting Microsoft’s planned cloud and AI region in Thailand, aimed at delivering low‑latency, reliable cloud services that meet data residency and regulatory requirements in the country.

- In May 2025, CP Group, through True IDC, officially launched what it describes as Thailand’s first AI hyperscale data center, positioning the facility as core digital infrastructure to support AI workloads, cloud services, and the broader digital economy while strengthening Thailand’s role as a regional data hub.

- In December 2024, Telehouse Thailand entered a strategic partnership with satellite and space technology firm mu Space to optimize network performance and provide low‑latency, resilient data center interconnection services in Thailand, including extending Telehouse’s data center capacity to mu Space’s customer base and enhancing satellite‑backed connectivity for data center workloads in the country.

- In May 2024, Evolution DC Thailand Company Limited, a joint venture between Central Pattana and Evolution Data Centres, entered into a partnership with International Gateway Company Limited (IGC) to integrate IGC’s advanced fiber and network services into the Evolution DC Thailand facility, enhancing connectivity and strengthening the country’s core digital infrastructure.

Market Dynamics:

Market Dynamics: Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights