Executive summary:

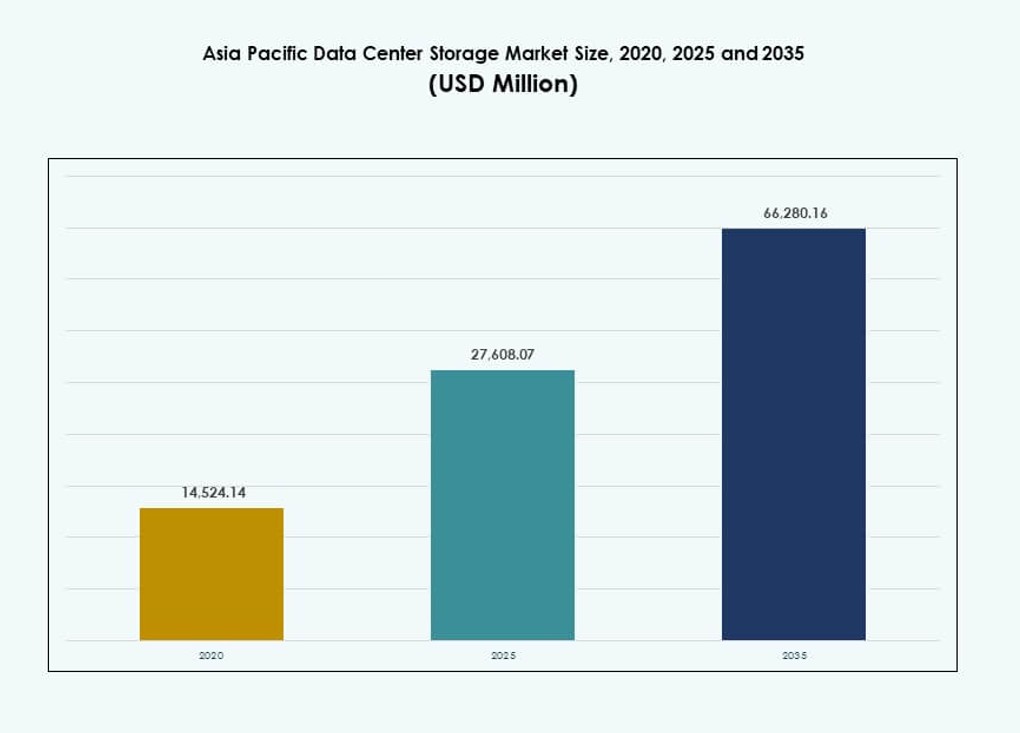

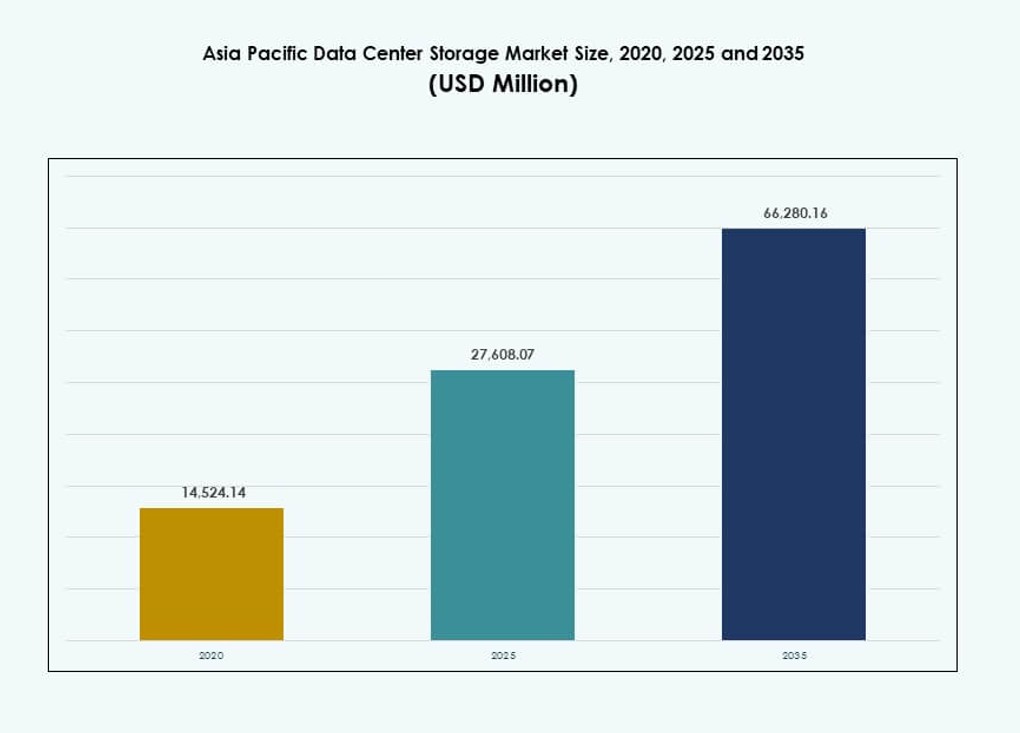

The Asia Pacific Data Center Storage Market size was valued at USD 14,524.14 million in 2020 to USD 27,608.07 million in 2025 and is anticipated to reach USD 66,280.16 million by 2035, at a CAGR of 9.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Asia Pacific Data Center Storage Market Size 2025 |

USD 27,608.07 Million |

| Asia Pacific Data Center Storage Market, CAGR |

9.06% |

| Asia Pacific Data Center Storage Market Size 2035 |

USD 66,280.16 Million |

Cloud migration, 5G rollout, and enterprise digitalization are reshaping storage demand across the region. Businesses are shifting from legacy systems to agile, hybrid, and software-defined storage models. AI, IoT, and real-time analytics are driving need for scalable, high-performance solutions. Governments are mandating data localization, pushing on-premise and edge storage growth. The market is strategically important for hyperscale, colocation, and enterprise IT investors targeting long-term digital infrastructure expansion.

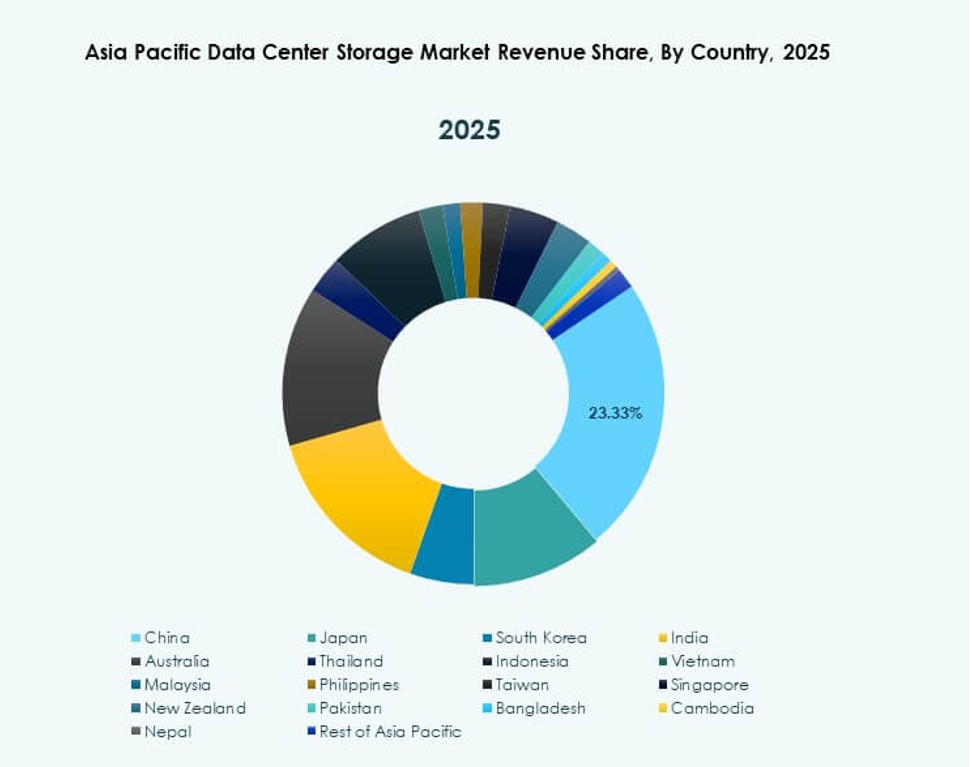

East Asia leads the market due to large-scale hyperscale deployments and advanced cloud ecosystems in China, Japan, and South Korea. Southeast Asia and South Asia are emerging quickly, driven by digital government programs, cloud-first enterprises, and expanding startup ecosystems. Australia shows steady adoption with a focus on sustainability and hybrid models. Regional variation reflects infrastructure readiness, compliance demands, and investment incentives.

Market Dynamics:

Market Drivers

Cloud Migration and Enterprise Digitalization Fuel Demand for Scalable Storage Platforms

Large-scale digital transformation across Asia Pacific drives strong demand for modern storage infrastructure. Enterprises are shifting from legacy storage to scalable, software-defined systems to meet cloud and hybrid workload needs. Storage growth is amplified by government-backed digital programs across India, Indonesia, and Vietnam. In China and Japan, tech firms expand AI and IoT usage, pushing storage throughput and reliability requirements. The Asia Pacific Data Center Storage Market benefits from both enterprise IT and consumer data growth. 5G rollout increases the flow of real-time data from connected devices, prompting stronger edge storage needs. Financial services and e-commerce players drive demand for low-latency and secure storage systems. Businesses seek flexible architectures that support hybrid environments without compromising data compliance. Investors see the region as a strategic hub due to scale, speed, and innovation potential.

- For instance, Alibaba Cloud’s Apsara File Storage NAS Capacity edition supports up to 10 PiB per file system with 99.999999999% (11 9s) data durability across geo-redundant replicas.

AI, IoT, and High-Performance Computing Accelerate Adoption of Next-Generation Storage

The market is witnessing rapid integration of AI and machine learning workloads in data centers, requiring low-latency storage systems. High-performance computing clusters are increasing across Japan, South Korea, and Singapore, triggering demand for flash-based and parallel file storage. The Asia Pacific Data Center Storage Market supports new workloads with tiered storage solutions and NVMe-based architecture. Startups and SaaS providers fuel adoption of hybrid and hyperconverged storage to optimize performance and cost. IoT and edge AI applications in sectors like manufacturing and logistics demand real-time data capture, driving need for faster read/write capabilities. Government projects in smart cities and digital public infrastructure increase long-term capacity requirements. The shift to software-defined platforms simplifies integration and management. Interoperability and automation become critical for multi-cloud data orchestration.

- For instance, Alibaba Cloud’s Cloud Parallel File System (CPFS) supports up to 20 PB per file system and delivers aggregate throughput exceeding 1 TB/s for AI training clusters. Single-client throughput typically ranges between 2–4 GB/s, with sub-millisecond latency to support high-concurrency GPU workloads.

Surging Colocation and Hyperscale Investments Build Ground for Storage Infrastructure Growth

Colocation and hyperscale providers dominate infrastructure investments in Australia, Singapore, and India. This drives massive storage deployment to support cloud-native tenants and AI-ready clients. Storage is no longer viewed as a backend element—it becomes central to compute performance. The Asia Pacific Data Center Storage Market scales rapidly through hyperscale builds exceeding 100 MW, often with dedicated storage clusters. Cloud-first strategies across banking, retail, and education shift focus toward hybrid cloud storage platforms. Operators emphasize modular and scalable storage systems to adapt to workload fluctuations. Greenfield builds integrate energy-efficient storage arrays to meet ESG goals. Enterprises in regulated industries adopt storage with built-in compliance and data sovereignty. Scalable deployment models like consumption-based storage improve economics for growing workloads.

Digital Sovereignty, Data Localization, and Industry-Specific Compliance Requirements Expand Storage Complexity

Governments are enforcing stronger data localization laws across India, Indonesia, and China. This compels enterprises to host data locally and expand on-premises and in-country cloud storage. The Asia Pacific Data Center Storage Market reflects increasing storage diversification to meet jurisdictional constraints. Highly regulated sectors such as healthcare and finance require storage solutions that ensure encrypted, traceable, and compliant data workflows. Industry-specific compliance pushes adoption of WORM (Write Once Read Many) storage in legal and archival use cases. Regional CSPs and MSPs offer customized storage tailored to these needs. Multinational firms need geographically distributed and resilient storage architectures to meet service-level expectations. Edge deployments become essential for remote regions with strict data laws. Advanced encryption, identity-based access, and audit-ready solutions define enterprise purchasing decisions.

Market Trends

Shift Toward Flash-Based Storage Drives Performance-Oriented Architecture Deployments

The market is shifting away from traditional spinning drives toward all-flash and hybrid arrays for faster access. Flash storage gains share due to higher input/output operations per second (IOPS) and reduced power consumption. The Asia Pacific Data Center Storage Market sees hyperscale and enterprise buyers preferring NVMe and SSD-based solutions. Performance-sensitive sectors such as gaming, fintech, and scientific research lead the transition. Flash-based storage enables real-time analytics and AI model training with minimal latency. Total cost of ownership decreases with longer lifecycle and lower cooling needs. Innovation in controller design and firmware optimization enhances reliability. Regional OEMs introduce competitive flash offerings with localized support. This shift reflects user need for agility, speed, and scale in a single storage architecture.

Growing Demand for Cloud-Native Backup and Archival Solutions Across Industries

Cloud-native applications require integrated backup, disaster recovery, and archival storage. Enterprises look for seamless tiering between hot, cold, and deep archive storage. The Asia Pacific Data Center Storage Market is seeing demand for object storage and cloud-integrated file systems. Cloud service providers enable policy-based automation for data protection. Media and entertainment firms use archival cloud storage to preserve large-format video with cost efficiency. Financial and health sectors adopt immutable storage for secure backups. Storage vendors promote API-first solutions compatible with Kubernetes and container workloads. Long-term storage expansion aligns with compliance-driven record retention requirements. Scalable cold storage is growing for digital twins, training datasets, and AI logs.

Rise of Software-Defined Storage (SDS) Enables Vendor-Agnostic Flexibility and Cost Control

SDS adoption increases across hybrid and multi-cloud environments due to flexibility and vendor neutrality. Organizations deploy SDS to decouple storage control from hardware, reducing capital expenditure. The Asia Pacific Data Center Storage Market supports this shift with demand for centralized management and analytics. Enterprises use SDS to consolidate workloads from VMs, containers, and bare-metal systems. Policy-driven automation helps streamline operations across global storage clusters. Storage solutions from Red Hat, VMware, and Nutanix see traction among enterprises. Kubernetes-native storage platforms expand SDS into cloud-native application delivery. Cost control, flexibility, and performance scalability define SDS investment decisions. Regional service providers bundle SDS with managed services to capture SME clients.

Edge Storage Solutions Gain Momentum in Remote, Rural, and Suburban Deployment Scenarios

Edge storage sees growth due to data-heavy applications in factories, logistics hubs, and smart infrastructure. The Asia Pacific Data Center Storage Market experiences demand for compact, ruggedized storage for edge data centers. Edge deployments serve real-time processing for sensor data, video analytics, and telemetry. Telecom players support MEC with distributed storage nodes in 5G base stations. Edge storage helps reduce latency and network costs by keeping data closer to source. Industrial automation and smart agriculture drive demand in rural Asia. Government programs in education and e-governance promote localized edge storage. Vendors focus on energy-efficient, tamper-resistant edge devices. Data replication and synchronization tools ensure consistency across core and edge layers.

Market Challenges

High Capital Expenditure and Fragmented Infrastructure Limit Storage Deployment in Developing Regions

Cost remains a major barrier to storage infrastructure rollout in several Southeast Asian markets. Many enterprises struggle to upgrade from legacy storage due to upfront investment and skill gaps. The Asia Pacific Data Center Storage Market reflects this divide, where leading economies adopt cutting-edge storage and others face deployment hurdles. Smaller markets lack power reliability, network bandwidth, and certified IT staff. High import duties and regulatory red tape inflate costs for storage hardware and software. Fragmented procurement models delay decision-making in government and SME sectors. Without proper incentives or financing, storage modernization lags in emerging markets. Cross-border data storage remains complex due to inconsistent regulations. Multilingual support, localized documentation, and region-specific training remain limited from global vendors.

Complex Compliance Environment and Rising Cybersecurity Threats Increase Storage Vulnerability

The region’s compliance landscape is evolving rapidly, with each country enforcing different data handling rules. The Asia Pacific Data Center Storage Market faces pressure to deliver storage solutions aligned with GDPR-like and national privacy frameworks. This introduces complexity for multinational operators managing cross-jurisdictional data. Storage must ensure strong encryption, secure access control, and immutable audit trails. Cyberattacks, ransomware, and unauthorized access attempts are growing in frequency and severity. Enterprises demand storage platforms with built-in threat detection and zero-trust architecture. Government scrutiny of foreign-owned data infrastructure complicates market entry. Data breach penalties and operational risk limit adoption of cloud-based storage in some sectors. Compliance missteps can lead to business disruption or financial loss.

Market Opportunities

Public Cloud Expansion and SaaS Growth Unlock Multi-Tenant Storage Innovation Across Sectors

The rise of public cloud platforms creates opportunities to deliver multi-tenant storage with secure, scalable access. The Asia Pacific Data Center Storage Market leverages this growth to offer object storage, backup-as-a-service, and hybrid storage to startups and mid-sized enterprises. Strong SaaS growth across education, healthcare, and retail supports demand for flexible, pay-as-you-grow storage. Regional hyperscale expansions increase partner ecosystems and edge cache demand.

Sustainability and Green Data Initiatives Promote Demand for Energy-Efficient Storage Infrastructure

Investors and operators prioritize energy savings and carbon reduction, creating room for eco-efficient storage technologies. The Asia Pacific Data Center Storage Market promotes flash storage, liquid cooling, and smart power management. Countries with renewable energy targets push for sustainable colocation and modular storage. Vendors offering low-power storage arrays and recyclable components see higher preference in procurement.

Market Segmentation

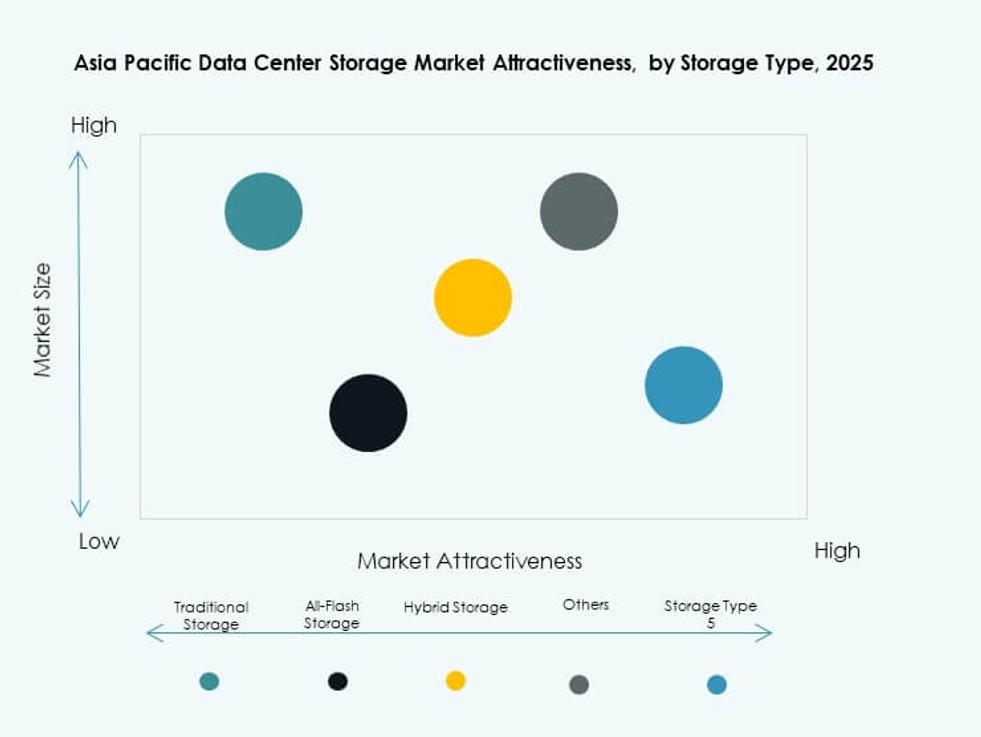

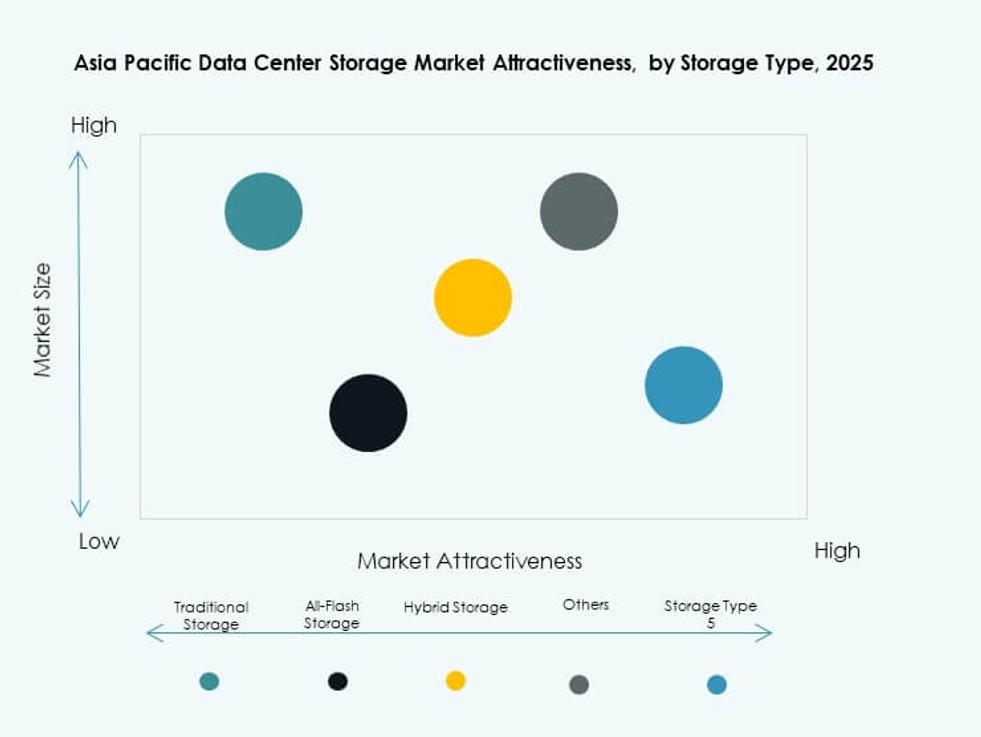

By Storage Type

Traditional storage holds a declining share as enterprises transition to all-flash and hybrid models. All-flash storage leads in performance-sensitive segments such as AI, gaming, and BFSI. Hybrid storage sees broad adoption for balancing cost and speed. The Asia Pacific Data Center Storage Market shows increasing preference for flash arrays due to latency benefits. Others category includes object and archive storage, which see rising adoption in video surveillance and compliance use cases.

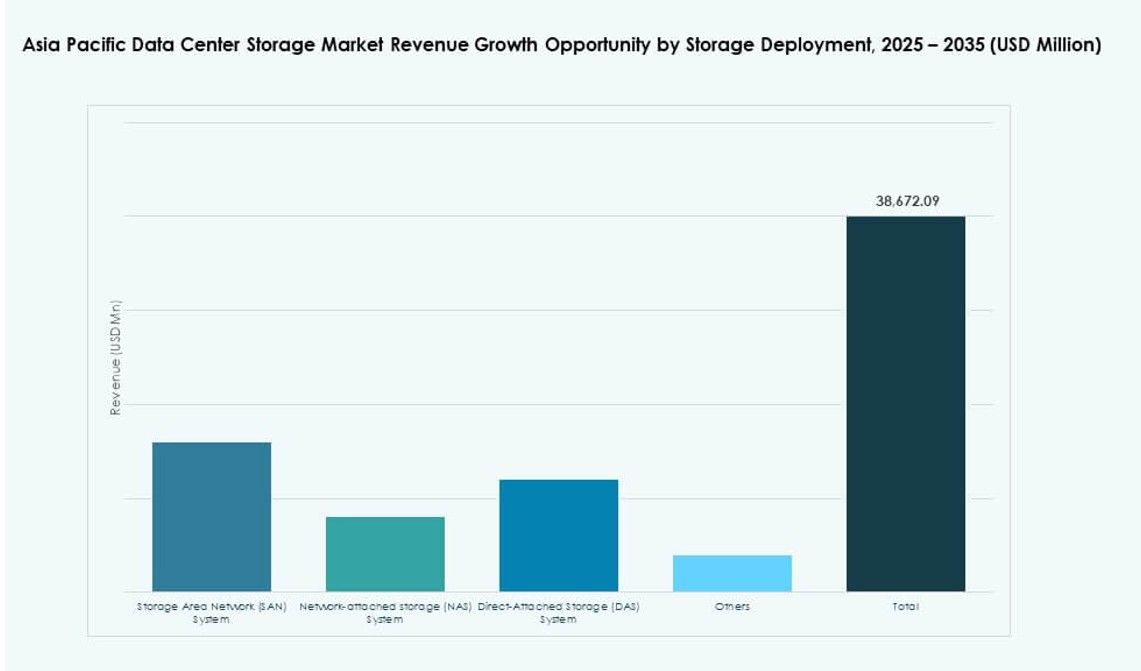

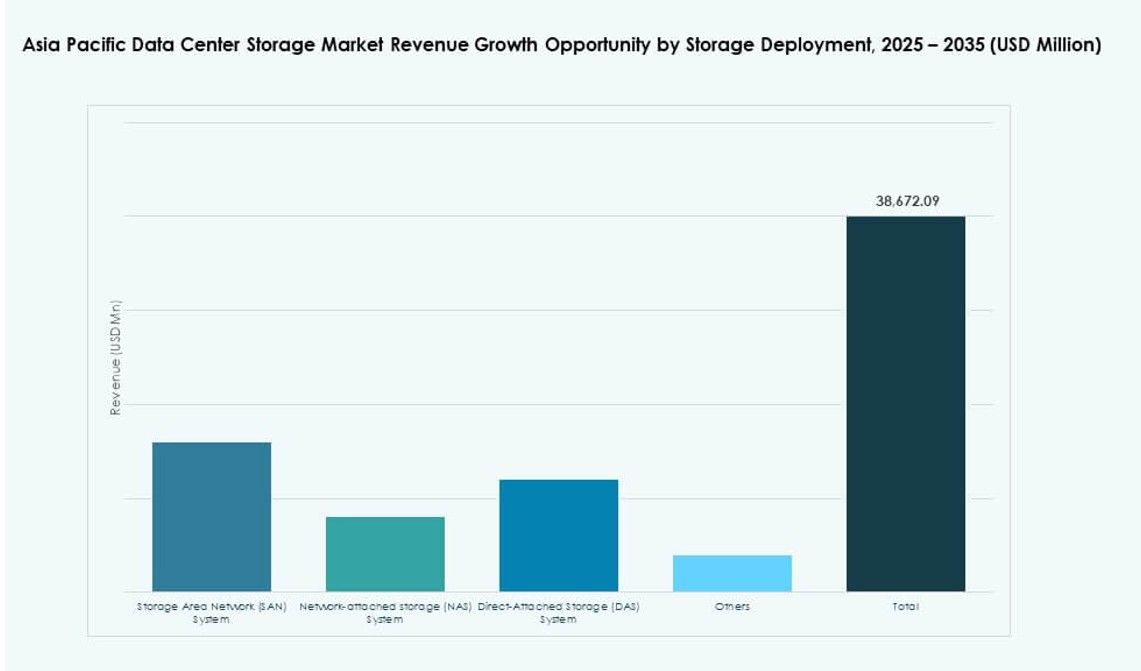

By Storage Deployment

Storage Area Network (SAN) dominates due to high-throughput needs in enterprise and hyperscale data centers. Network-attached Storage (NAS) is popular among SMEs for ease of integration and scalability. Direct-attached Storage (DAS) finds limited use in edge and branch deployments. The Asia Pacific Data Center Storage Market reflects growing NAS deployment in software firms and educational institutions. SAN remains vital for mission-critical applications and large data transfers.

By Component

Hardware contributes a higher market share driven by large-scale infrastructure rollouts across hyperscale and colocation facilities. Software segment grows steadily with adoption of SDS, storage management, and orchestration platforms. The Asia Pacific Data Center Storage Market demonstrates strong investment in both, with software gaining traction due to operational flexibility. AI-powered data classification and tiering software improve cost and performance balance.

By Medium

Solid-State Drives (SSD) lead the segment due to speed, reliability, and shrinking cost per gigabyte. Hard Disk Drives (HDD) remain in use for cold storage and backup solutions where cost per terabyte matters. Tape storage holds a niche for long-term archival in government and media applications. The Asia Pacific Data Center Storage Market sees SSD growth across all verticals due to power efficiency and space savings.

By Deployment Model

Hybrid deployment dominates due to the need for workload portability and cost optimization. On-premises storage retains importance for regulated sectors like BFSI and healthcare. Cloud-based storage grows rapidly in digital-native firms and startups. The Asia Pacific Data Center Storage Market reflects a convergence of these models, with hybrid setups offering data control and operational agility. Workload-specific deployments shape future adoption.

By Application

IT and Telecommunications lead due to massive cloud and data traffic growth. BFSI follows with strong demand for encrypted, compliant, and scalable storage platforms. Healthcare sees rising adoption driven by imaging data, EMRs, and compliance needs. Government applications expand under digital governance initiatives. The Asia Pacific Data Center Storage Market supports diverse use cases through tailored, high-performance storage deployments.

Regional Insights

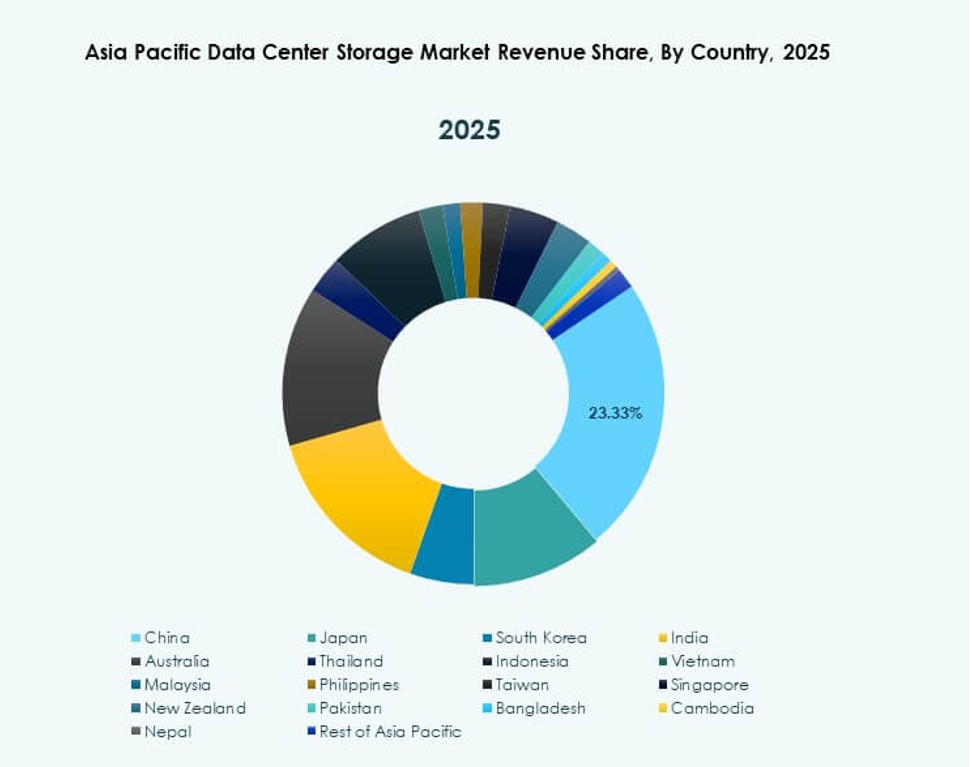

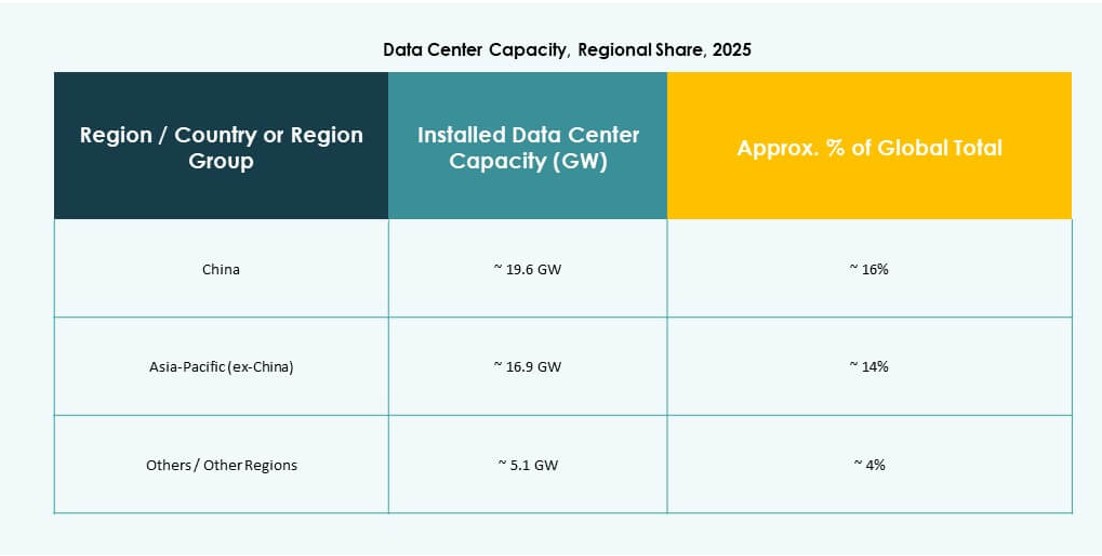

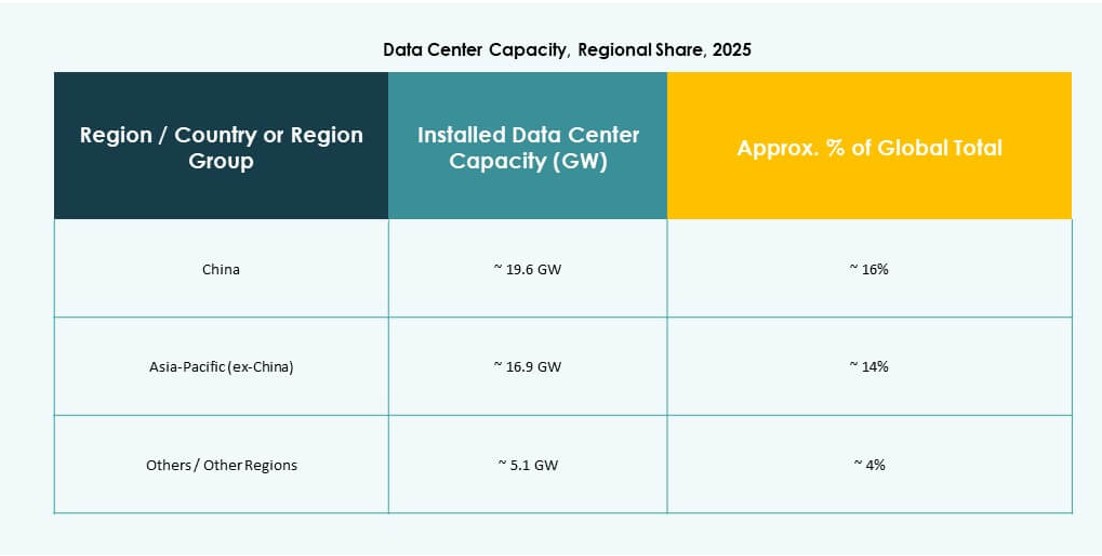

East Asia Holds the Largest Share Driven by Hyperscale, Telecom, and AI Innovation

East Asia dominates the Asia Pacific Data Center Storage Market with a 42% share. China leads the subregion through hyperscale expansions and cloud ecosystem maturity. Japan and South Korea invest in AI data centers and advanced analytics workloads, requiring high-speed flash storage. Telecom providers in these countries drive storage needs for 5G edge deployments. Enterprise digitalization across manufacturing and services supports sustained storage demand. Storage vendors see East Asia as a primary target for premium solutions.

- For instance, China Mobile budgeted CNY 47.5 billion for computing-network infrastructure in 2024, establishing intelligent-computing centers across western regions.

South Asia and Southeast Asia Emerge with Rapid Digital Expansion and Cloud Uptake

South Asia holds around 26% share, led by India’s fast-growing colocation and public cloud segments. Southeast Asia contributes about 21%, with Singapore, Indonesia, and Malaysia as key contributors. Governments promote local data centers and smart city initiatives, increasing storage demand. Rising internet penetration and e-commerce adoption fuel enterprise storage investments. The Asia Pacific Data Center Storage Market finds emerging customers in SME and startup segments across these regions.

- For instance, ST Engineering began construction on a seven-story data center in Singapore in 2024, targeting completion by 2026. The facility supports high-density workloads and incorporates energy-efficient infrastructure as part of Singapore’s broader push for sustainable data center growth.

Oceania Maintains Steady Growth Through Colocation, Cloud, and Regulatory Storage Needs

Oceania accounts for 11% of the Asia Pacific Data Center Storage Market. Australia is the core contributor, with consistent investments in green data centers and public cloud zones. Enterprises adopt hybrid storage to meet compliance and performance goals. New Zealand follows with demand from banking, education, and health sectors. Storage procurement favors modular and energy-efficient deployments. Regional innovation and secure data frameworks make Oceania an attractive market for premium storage vendors.

Competitive Insights:

- Huawei Technologies Co., Ltd.

- Dell Technologies

- Hewlett Packard Enterprise Development LP (HPE)

- Lenovo Group

- NetApp

- Fujitsu Limited

- Cisco Systems, Inc.

- IBM Corporation

- Seagate Technology

- Hitachi Vantara

The Asia Pacific Data Center Storage Market features a mix of global OEMs and regional technology leaders. It is shaped by strong competition across hardware, software-defined platforms, and hybrid storage solutions. Huawei and Dell lead hyperscale deployments, while HPE and NetApp maintain a presence in enterprise and hybrid cloud setups. Lenovo and Fujitsu cater to diversified regional demand across SMEs and public institutions. IBM, Cisco, and Hitachi Vantara focus on integrated offerings and software-defined systems. Seagate drives innovation in high-capacity drives for cold and archival storage. Strategic moves such as NVMe adoption, SDS integration, and ESG-focused storage efficiency continue to influence vendor positioning. Players compete on performance, scale, compliance, and energy efficiency to serve a fragmented but fast-growing market.

Recent Developments:

- In June 2025, Hewlett Packard Enterprise (HPE) and Veeam deepened their partnership integrating backup and recovery solutions to improve data resilience in hybrid and private clouds across Asia Pacific markets

- In April 2025, Lenovo unveiled 21 new ThinkSystem and ThinkAgile AI-optimized storage models designed to accelerate IT modernization and handle data at scale for data center storage demands

- In January 2025, Lenovo Group agreed to acquire Infinidat. This acquisition enhances Lenovo’s high-performance storage offerings, including cyber-resilient solutions, complementing its existing flash, hybrid, HCI, and SDS products for data centers.