Executive summary:

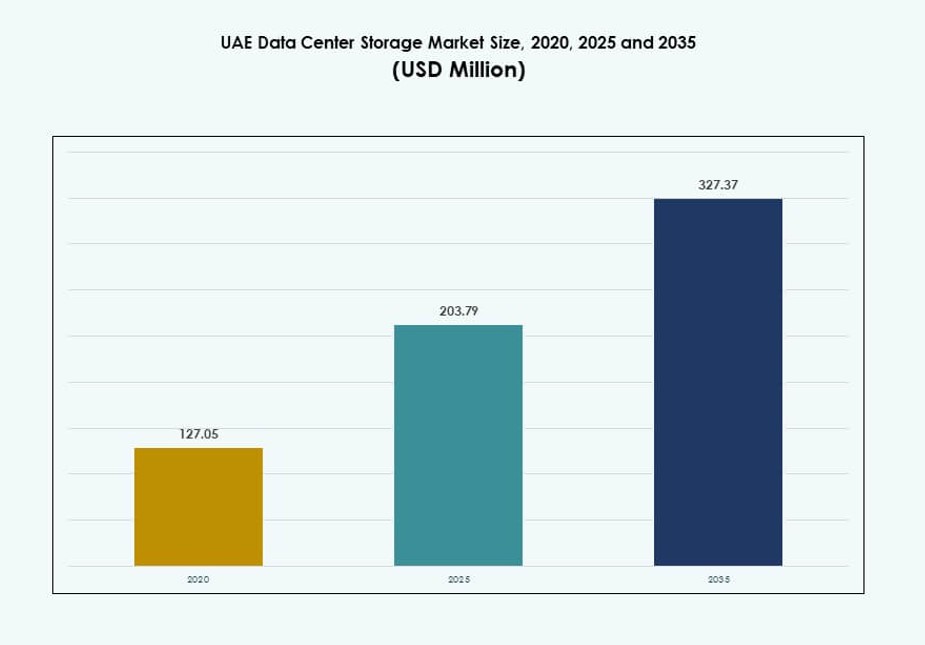

The UAE Data Center Storage Market size was valued at USD 127.05 million in 2020, reaching USD 203.79 million in 2025, and is anticipated to reach USD 327.37 million by 2035, at a CAGR of 4.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| UAE Data Center Storage Market Size 2025 |

USD 203.79 Million |

| UAE Data Center Storage Market, CAGR |

4.71% |

| UAE Data Center Storage Market Size 2035 |

USD 327.37 Million |

Rapid AI adoption, sovereign cloud expansion, and regulatory compliance are key drivers shaping demand. Government digital transformation projects, especially in smart cities, increase the need for scalable and secure data infrastructure. Enterprises prioritize all-flash storage, NVMe arrays, and software-defined platforms to enable analytics, automation, and real-time workloads. Public-private collaborations and national cloud strategies are pushing both hyperscale and edge deployments. The UAE Data Center Storage Market serves as a digital foundation for regulated sectors, creating strong demand for hybrid and high-performance solutions across industries.

Dubai leads storage adoption, holding over 50% of the market share due to its advanced infrastructure, submarine cable access, and hyperscaler zones. Abu Dhabi follows with around 35% share, driven by government workloads, AI use cases, and data localization efforts. Sharjah and other northern emirates contribute the remaining 15%, supporting edge facilities, disaster recovery, and modular capacity build-outs. This geographic mix helps the UAE Data Center Storage Market achieve resilience, national coverage, and capacity diversification.

Market Dynamics:

Market Drivers

Rise of Cloud Zones and Enterprise Digital Workloads Accelerating Local Storage Infrastructure Growth

The rapid increase in cloud regions from hyperscale players is driving demand for high-performance storage in the UAE. Multinationals and regional firms are shifting workloads to public and hybrid clouds, creating steady infrastructure investments. Enterprises in BFSI, logistics, and retail require fast, scalable storage systems to handle transactional and customer-facing operations. The government’s focus on digital transformation and smart services requires robust backend storage. Projects under Dubai 10X and Abu Dhabi’s digital government efforts are driving sovereign cloud storage needs. It makes the UAE Data Center Storage Market a strategic enabler for service uptime, latency control, and regulatory compliance. Technology adoption is shifting toward NVMe, scale-out NAS, and object-based storage to support real-time analytics. Flash-first infrastructure is becoming common across mission-critical and cloud-native workloads. The integration of AI-ready compute stacks is reshaping storage performance expectations.

AI Integration and Real-Time Data Processing Requirements Fuel Need for Low-Latency Storage Solutions

AI applications in the UAE—ranging from surveillance to language modeling—depend on dense, low-latency storage systems. Organizations across government, energy, and telecom sectors are building AI pipelines requiring sub-millisecond storage response. With large training datasets and high-throughput compute nodes, storage systems must scale linearly and manage mixed workloads. Use of GPUs and data lakes has redefined performance benchmarks for storage layers. NVMe-based storage arrays and software-defined storage (SDS) platforms are gaining preference for these applications. The UAE Data Center Storage Market is critical for enabling high-frequency AI model training and inferencing. Government investments in national AI programs are directly tied to backend infrastructure reliability. Private sector leaders are adopting all-flash systems to power analytics and computer vision at scale. Enterprises seek storage platforms that can balance capacity growth with low access times.

- For instance, e& (Etisalat) partnered with Dell Technologies in 2024 to advance AI initiatives using PowerStore platforms, which support AI inferencing with latencies under 1 ms across telecom-scale datasets processed through NVMe architecture.

Regulatory Compliance and Data Sovereignty Laws Supporting Demand for Onshore Storage Facilities

UAE’s emphasis on data localization has prompted financial institutions and healthcare providers to store data onshore. Central Bank and ADGM regulations enforce strict control over customer data location and access. Data classification standards and sector-specific compliance rules encourage investments in sovereign storage infrastructure. Public cloud players now operate in-country regions to support compliant workloads. The UAE Data Center Storage Market benefits from this regulatory clarity and state-backed infrastructure. Enterprises require storage that aligns with ISO 27001, PCI DSS, and HIPAA benchmarks. On-premises and hybrid models are evolving to meet compliance without sacrificing performance. Storage providers offer tiered storage services to support secure archiving and backup. The market plays a foundational role in enabling sovereign digital services across sectors.

High Enterprise Adoption of Hybrid IT Strategies Driving Demand for Interoperable Storage Platforms

Enterprise customers in the UAE are embracing hybrid IT strategies, balancing cloud agility with on-premises control. Organizations in telecom, oil & gas, and real estate require elastic storage that spans edge and core environments. It makes interoperability and unified management critical purchase criteria. The UAE Data Center Storage Market is evolving to offer flexible storage platforms with cross-environment visibility. Vendors are bundling storage with orchestration tools, tiering software, and AI-based optimization. Edge storage deployments are growing due to smart city projects and IoT-based infrastructure rollouts. Organizations need to move and process data closer to the source, then archive or analyze centrally. Interoperability with containerized environments and multi-cloud setups drives storage design. The focus remains on seamless scalability, real-time sync, and centralized policy control.

- For instance, ADNOC deployed Pure Storage FlashArray systems in recent hybrid setups, delivering up to 15 GB/s throughput for processing data from thousands of IoT sensors in oilfield operations across edge and core environments.

Market Trends

Emergence of Liquid Cooling and Storage Densification to Support High-Throughput AI Workloads

New workloads tied to generative AI and video analytics are pushing thermal and performance limits of legacy setups. Data centers in UAE are shifting toward dense rack configurations with higher IOPS and throughput needs. Liquid-cooled storage nodes and disaggregated architecture are entering pilot stages in hyperscale and telecom setups. It marks a shift from traditional air-cooled infrastructure toward advanced thermal solutions. The UAE Data Center Storage Market is aligned with this transition to meet the demands of AI inferencing and HPC. Vendors now offer high-density NVMe enclosures and storage accelerators to support fast pipelines. Storage management software must now address thermal telemetry and system-wide optimization. Heat-aware workload scheduling is becoming a standard feature across enterprise storage stacks.

Growth of Data Center-as-a-Service (DCaaS) Driving Subscription-Based Storage Delivery Models

Enterprises and startups prefer operational flexibility over upfront infrastructure costs. This has triggered a growing interest in DCaaS and storage-as-a-service models across UAE markets. It allows businesses to scale workloads dynamically while aligning cost with usage. Cloud-native firms especially benefit from this OPEX-based approach with API-driven provisioning. The UAE Data Center Storage Market supports this shift with vendor ecosystems offering managed storage bundles. Major service providers now integrate billing, encryption, and compliance under unified DCaaS portfolios. This trend is reshaping vendor-client relationships, emphasizing long-term contracts over hardware-only sales. Businesses demand SLAs tied to storage uptime, throughput, and failover performance. Service-centric delivery is becoming a competitive differentiator for regional players.

Rise in Immutable and Air-Gapped Storage Solutions for Cyber Resilience and Backup Compliance

Growing cybersecurity threats and ransomware attacks have forced enterprises to revisit backup and restore strategies. Immutable storage volumes, snapshot retention, and air-gapped architectures are seeing increased traction in the UAE. Government organizations and BFSI firms require tamper-proof data copies for audit and legal recovery. The UAE Data Center Storage Market reflects this by adding compliance-focused layers to standard offerings. Vendors are packaging WORM-enabled drives and S3-compatible object storage with native replication. Air-gapping is increasingly deployed using isolated DR sites and tape vaults. Backup policies now involve anomaly detection and ransomware rollback at the storage level. It raises the baseline of security expectations across all deployments.

AI-Driven Storage Analytics and Predictive Monitoring Becoming Integral to Operations and SLA Delivery

Data center operators are turning to AI-powered tools to monitor, predict, and auto-correct storage operations. These systems track IOPS, latency spikes, throughput bottlenecks, and disk failure patterns. Predictive storage analytics allows preventive maintenance, improving service uptime and SLA adherence. UAE-based colocation and managed service providers use these tools to maintain performance at scale. The UAE Data Center Storage Market includes storage stacks embedded with telemetry collectors and ML algorithms. Enterprises gain better insight into usage trends and storage tier optimization. Automated alerts and dynamic provisioning are reducing response times and downtime. These trends reflect the growing role of intelligence in backend storage management.

Market Challenges

High Capital Investment and ROI Uncertainty in Scaling Flash-Based Storage for Emerging Workloads

Flash-based storage, especially NVMe and all-flash arrays, delivers low latency and high throughput but comes at a high cost. Many UAE enterprises struggle with upfront capital required to build petabyte-scale flash infrastructure. Without clear ROI visibility, mid-sized firms hesitate to migrate from legacy HDD setups. The UAE Data Center Storage Market must address this by introducing financing models or tiered solutions. Cost-performance optimization is still a gap, particularly for AI and real-time analytics workloads. Storage vendors face pressure to balance innovation with affordability. In-house data centers need modular designs that allow partial upgrades without full stack refresh. Price sensitivity in mid-market segments creates demand for hybrid configurations with smart caching. The challenge is managing growth without burdening CAPEX cycles.

Complexity of Managing Multi-Cloud and Edge Deployments with Unified Storage Architecture

Organizations with hybrid or multi-cloud strategies face difficulty in managing unified data access, sync, and backup policies. Interoperability between cloud platforms, edge deployments, and central infrastructure remains limited. Each vendor often has proprietary systems, making integration expensive and complex. The UAE Data Center Storage Market must evolve with standardized APIs and cross-cloud orchestration tools. Businesses need full-stack visibility to prevent data silos across applications and zones. It becomes difficult to maintain consistent compliance and security across disjointed storage layers. Performance optimization is further challenged by varied latency, bandwidth, and access patterns. This complexity slows IT responsiveness and raises operational overhead. Addressing it requires collaborative ecosystems and interoperable frameworks.

Market Opportunities

Expansion of AI and Video Surveillance Workloads Unlocking Demand for High-Speed Tiered Storage

AI surveillance, smart city analytics, and real-time streaming are generating high-frequency data volumes. Government and commercial deployments now require multi-tier storage with deep archive and instant recall. The UAE Data Center Storage Market is seeing strong opportunity in serving AI-ready video workloads across smart transport, security, and retail. Demand exists for scalable object storage and flash-based edge caches supporting instant query.

National Digital Economy Vision Creating Momentum for Regional and Edge Data Hubs

The UAE’s strategic vision to become a digital economy leader creates strong incentives for local edge hubs. Industrial zones, logistics corridors, and urban centers will require localized storage for latency-sensitive applications. It gives storage providers an opportunity to embed services into smart infrastructure. It also boosts need for interoperable hybrid cloud storage aligned with national data policies.

Market Segmentation

By Storage Type

All-flash storage leads in performance-sensitive deployments across BFSI, government, and hyperscale cloud zones. Hybrid storage follows closely, offering balance between speed and cost-efficiency for mid-range workloads. Traditional storage remains relevant in backup, archival, and cold storage use cases. Others include object storage systems with S3 compatibility. The UAE Data Center Storage Market continues to shift toward flash-first strategies in active workload zones.

By Storage Deployment

Storage Area Network (SAN) systems dominate core enterprise workloads, offering high-speed block-level access. NAS systems are popular for content-heavy and backup-focused deployments in media and education. DAS remains niche, used in edge and single-tenant architectures. Other forms such as cloud-native SDS are gaining traction. The UAE Data Center Storage Market reflects growing demand for centralized SAN with cloud-extendable architecture.

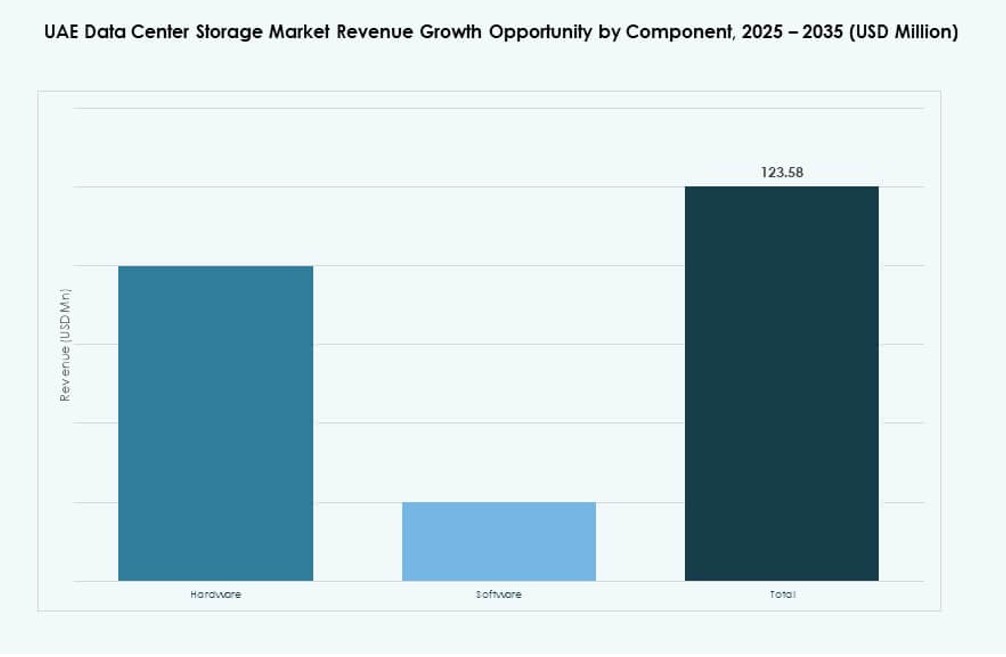

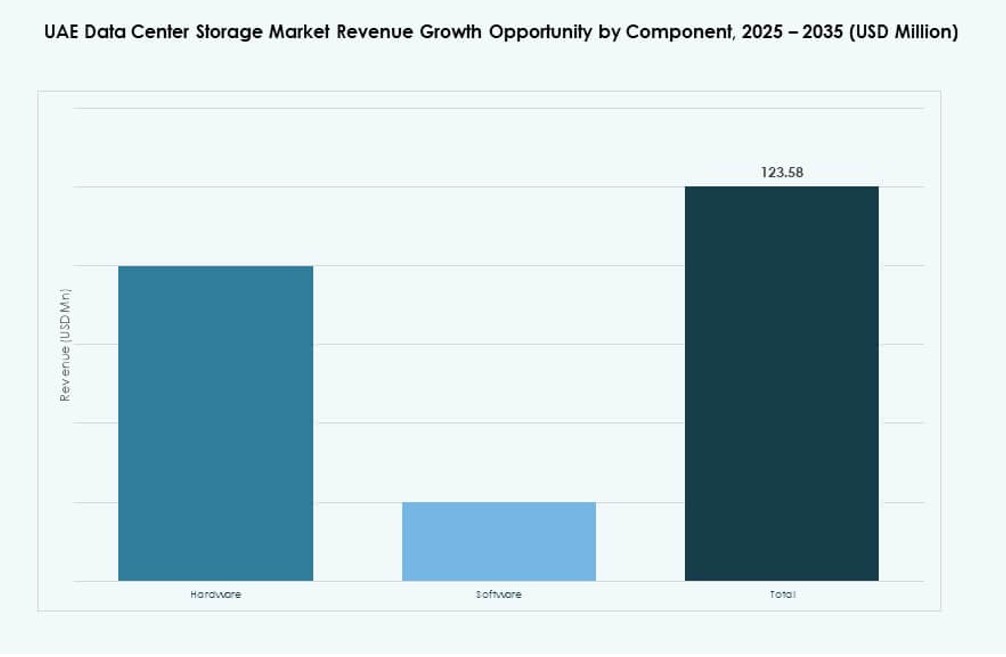

By Component

Hardware holds the majority share due to strong demand for high-capacity drives, NVMe arrays, and controllers. Software is gaining pace through SDS platforms, automation tools, and AI-driven monitoring stacks. Storage software plays a critical role in tiering, deduplication, and orchestration. It supports scaling and cost efficiency across hybrid models. The UAE Data Center Storage Market sees balanced growth across both components.

By Medium

Solid-state drives (SSD) dominate active storage layers for high-performance applications in BFSI and AI. HDDs retain relevance in backup and low-cost archival tiers. Tape storage, though less common, is still used in air-gapped and regulatory archives. SSD adoption is expected to rise due to lower latency and power efficiency. The UAE Data Center Storage Market aligns with global trends favoring SSD-first deployment.

By Deployment Model

Cloud-based storage sees high traction from startups, SaaS providers, and digital-first businesses. On-premises storage remains important for regulated sectors and latency-sensitive operations. Hybrid storage models are emerging as the most strategic option, blending control and agility. These models offer disaster recovery and scalability benefits. The UAE Data Center Storage Market reflects strong hybrid model growth due to cloud maturity and data policies.

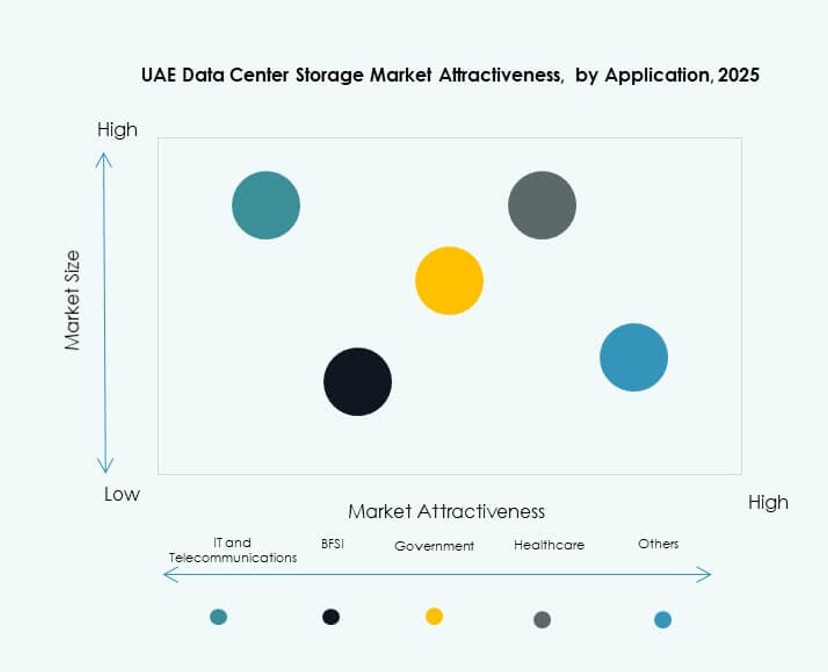

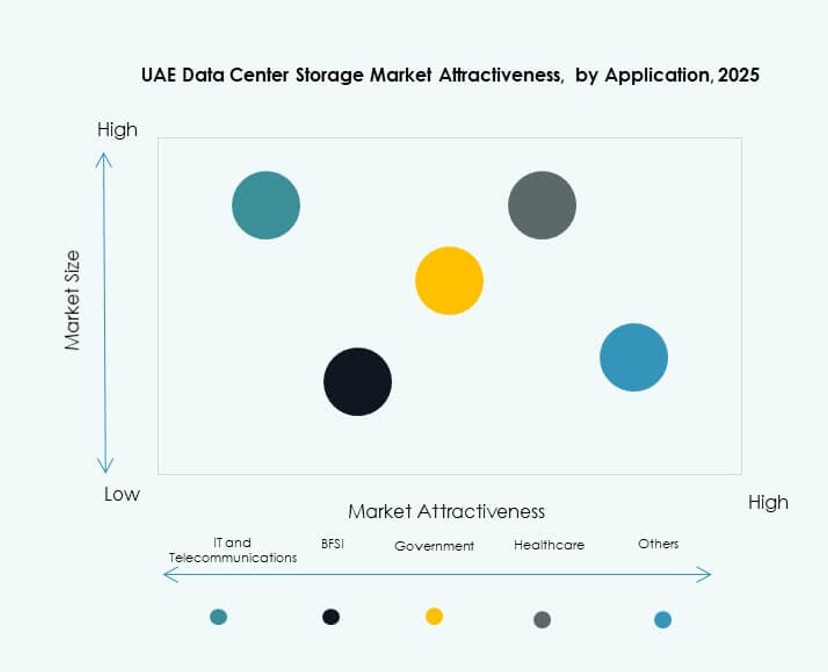

By Application

IT and telecom sectors lead storage consumption due to digitization, streaming, and 5G workloads. BFSI follows with growing need for secure, compliant, and resilient storage. Government is a key buyer, especially for national cloud, AI, and smart city projects. Healthcare storage is expanding with imaging, diagnostics, and EHR workloads. The UAE Data Center Storage Market supports diverse vertical needs with specialized platforms.

Regional Insights

Dubai Commands Over 50% Market Share Driven by Hyperscale Zones and Interconnection Strength

Dubai holds more than 50% share of the UAE Data Center Storage Market. The city leads in hyperscale, fintech, and content streaming demand, driving premium storage capacity. Major cloud players, telcos, and enterprise hubs operate from Dubai Internet City and other free zones. Its submarine cable landing stations enhance latency-sensitive storage performance. Strong regulatory frameworks and data security infrastructure also attract storage investments. Dubai serves as the epicenter for multi-tenant and sovereign cloud deployments.

- For instance, Equinix DX1 in Dubai Production City offers 3,801 sq.m. of whitespace with up to 6 kW power density per cabinet for hyperscale interconnectivity.

Abu Dhabi Holds Around 35% Share Anchored by Government and AI-Driven Storage Needs

Abu Dhabi accounts for approximately 35% of the UAE Data Center Storage Market. Government-backed smart city projects, national cloud initiatives, and AI use cases create consistent demand. The city supports sovereign hosting for public sector, education, and healthcare workloads. Its investments in research clusters and energy data platforms push storage requirements. Data localization mandates strengthen its position in regulated storage services. Abu Dhabi offers high resilience and regulatory compliance across deployments.

- For instance, Khazna Data Centers has achieved Uptime Institute Tier III certification for multiple UAE facilities, including its Apollo 5 and Apollo 6 data centers in Abu Dhabi. These sites feature N+1 redundancy and are designed to support high-availability enterprise and edge deployments.

Northern Emirates Contribute 15% Share with Growing Role in Edge and Secondary Storage Sites

Sharjah, Ras Al Khaimah, and Fujairah jointly hold about 15% market share. These emirates are becoming important for edge hosting, disaster recovery, and industry-specific data needs. Storage providers deploy Tier II and Tier III facilities to support smart manufacturing, logistics, and education. Their proximity to new urban corridors and industrial zones drives growth. The region sees demand for compact, modular, and cloud-managed storage units. The UAE Data Center Storage Market is expanding here to support regional digital inclusion.

Competitive Insights:

- Khazna Data Centers

- Equinix UAE

- Gulf Data Hub

- Moro Hub

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Cisco Systems, Inc.

- NetApp

- IBM Corporation

- Huawei Technologies Co., Ltd.

The UAE Data Center Storage Market is shaped by a mix of domestic colocation providers and global OEMs. Khazna, Moro Hub, and Gulf Data Hub lead localized infrastructure deployments, offering sovereign cloud and high-density storage. Global vendors like Dell, HPE, Cisco, and Huawei supply advanced storage platforms that integrate NVMe, SDS, and hybrid architectures. These players focus on performance, compliance, and flexibility to support AI, BFSI, and government workloads. Equinix UAE supports cross-border interconnection and disaster recovery storage. NetApp, IBM, and Cisco enable multicloud and software-defined environments. The market remains competitive with bundled services, infrastructure SLAs, and regional partnerships. It continues to evolve through M&A, hyperscaler collaborations, and demand for energy-efficient storage models.

Recent Developments:

- In November 2025, Khazna Data Centers secured a $2.62 billion financing facility in partnership with Abu Dhabi Commercial Bank and First Abu Dhabi Bank to fund expansions including new facilities in Abu Dhabi, Dubai, and the region’s first AI-enabled data center.

- In November 2025, Microsoft and G42 announced a 200 MW data center capacity expansion through Khazna Data Centers (G42 subsidiary), enhancing Azure’s sovereign cloud for AI workloads and increasing storage infrastructure, with initial capacity online by end-2026.

- In January 2025, Gulf Data Hub formed a strategic partnership with KKR committing over $5 billion in investments to scale data center capacity amid rising hyperscale and AI demand in the Gulf.