Executive summary:

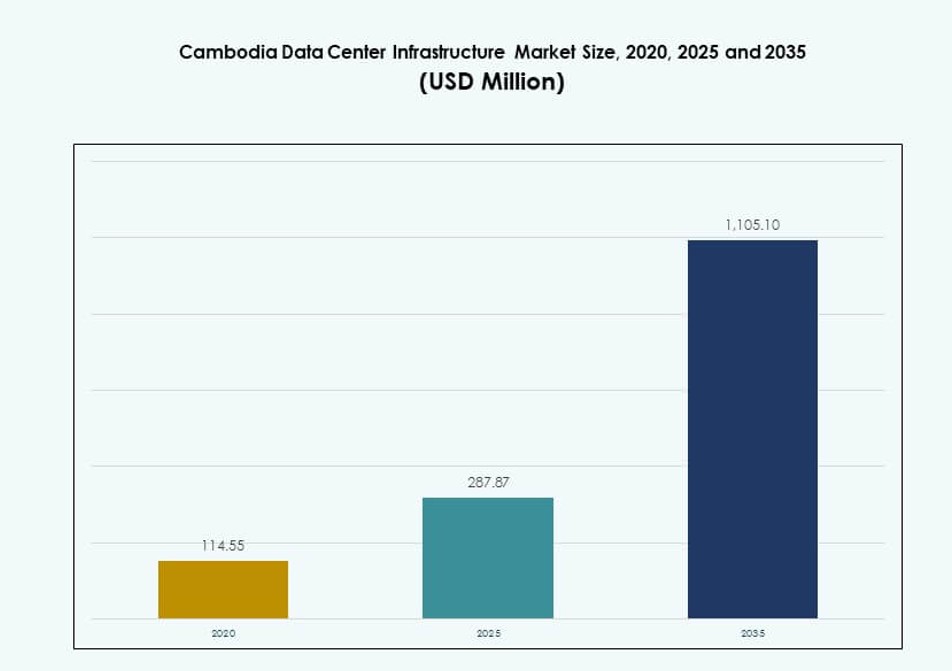

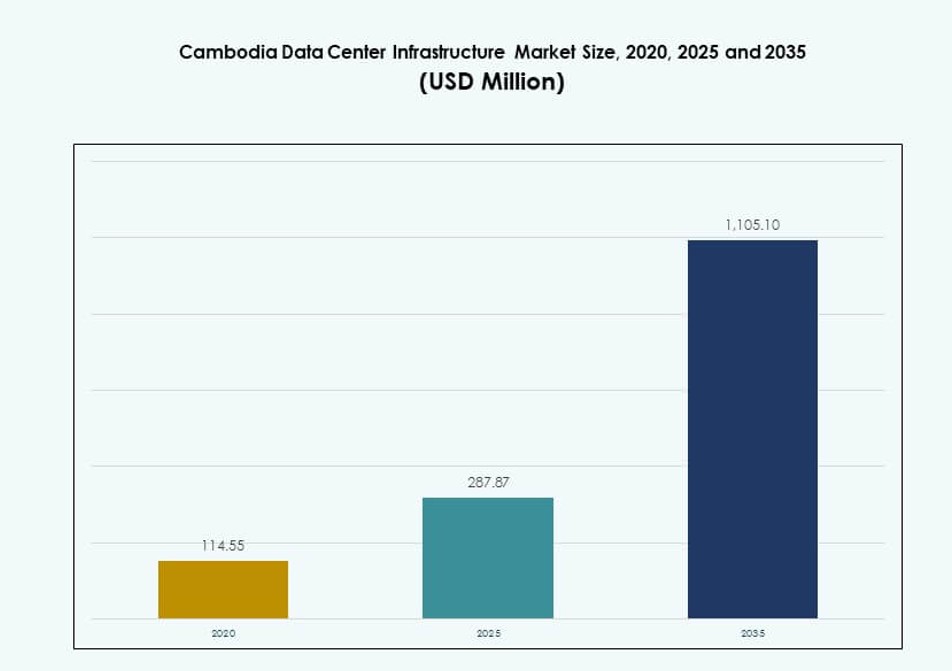

The Cambodia Data Center Infrastructure Market size was valued at USD 114.55 million in 2020 to USD 287.87 million in 2025 and is anticipated to reach USD 1,105.10 million by 2035, at a CAGR of 14.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Cambodia Data Center Infrastructure Market Size 2025 |

USD 287.87 Million |

| Cambodia Data Center Infrastructure Market, CAGR |

14.27% |

| Cambodia Data Center Infrastructure Market Size 2035 |

USD 1,105.10 Million |

The market is expanding due to rising adoption of digital platforms in banking, telecom, and public services. Enterprises are shifting to cloud and edge computing to improve agility and uptime. Innovation in cooling, power systems, and modular builds supports energy-efficient deployments. The demand for certified and scalable infrastructure is growing with Cambodia’s transition to a digital-first economy. These trends position the market as a key investment avenue for regional players and global infrastructure firms.

Phnom Penh leads market growth with strong enterprise demand and government infrastructure push. Sihanoukville and border economic zones are emerging hubs due to submarine cable access and industrial expansion. Siem Reap and Battambang also see rising deployment as digital connectivity improves in tourism and SME clusters. Each zone plays a distinct role in Cambodia’s evolving data infrastructure ecosystem.

Market Dynamics:

Market Drivers

Surge in Digital Transformation Across Telecom, BFSI, and E-Commerce Sectors Boosting Infrastructure Demand

The Cambodia Data Center Infrastructure Market is being driven by rising digitization across telecom, banking, and e-commerce. Enterprises are expanding digital platforms, which increases demand for local data hosting and low-latency services. Financial institutions shift to digital banking, requiring secure and scalable infrastructure. Telecom providers upgrade networks with cloud-native systems and fiber deployment. E-commerce growth demands high-availability storage and real-time analytics. This environment fuels investments in rack systems, backup solutions, and hybrid servers. Government e-services and smart-city planning accelerate infrastructure rollout. The strategic move toward paperless, mobile-first services boosts demand for IT modernization.

Rising Cloud Computing Adoption Creating the Need for Scalable and Modular Infrastructure Investments

Cloud adoption is rising rapidly among enterprises and public institutions. Organizations seek flexible infrastructure for SaaS, PaaS, and IaaS delivery models. This shift drives modular builds, allowing scalable rack deployments and load balancing. Companies adopt virtualization to optimize server space and improve energy efficiency. Data-driven decision-making through AI and ML also supports on-premise-to-cloud transitions. Multitenant facilities gain preference due to cost efficiency and managed services. Regional expansion of cloud providers also encourages local ecosystem growth. The Cambodia Data Center Infrastructure Market benefits from this shift in architecture toward agile, cloud-ready facilities.

Government-Led Regulatory Support and Digital Economy Plans Creating a Favorable Investment Climate

Government strategies supporting ICT infrastructure development play a key role in market acceleration. National programs focused on digital economy growth encourage private-public partnerships. Regulatory frameworks ensure cybersecurity standards, data protection, and disaster recovery mandates. These policies create clear pathways for investment in Tier III and IV facilities. The government supports green infrastructure through incentives and sustainable design guidelines. Licenses for foreign direct investment in telecom and cloud services are being streamlined. Demand for compliant and certified data centers increases among financial and e-governance bodies. The Cambodia Data Center Infrastructure Market leverages this regulatory push for structured growth.

- For instance, in 2023, the Cambodian government invested $100 million to boost national digital infrastructure. This initiative supported data center expansion and accelerated the country’s digital transformation efforts.

Strategic Location in ASEAN Enabling Cross-Border Connectivity and Regional Data Traffic Optimization

Cambodia’s geographical proximity to Thailand, Vietnam, and Laos enhances its position in regional data routing. Companies view the country as a backup and overflow hub for surrounding nations. Submarine cable projects and inland fiber corridors support high-speed connectivity. Businesses leverage Cambodia’s infrastructure for latency-sensitive operations across Southeast Asia. The local government promotes digital trade facilitation through IT infrastructure. Regional telcos and hyperscalers eye Cambodia as a cost-efficient edge location. Its status as an emerging transit point supports regional cloud and AI deployments. The Cambodia Data Center Infrastructure Market gains strategic importance in ASEAN’s digital value chain.

- For instance, the Cambodia-Hong Kong submarine cable link enhances regional data exchange, positioning the country as an edge hub for telcos and hyperscalers

Market Trends

Shift Toward Edge Data Centers to Meet Low-Latency Requirements of Rural and Remote Operations

The market is witnessing a shift toward edge data center deployments, especially in non-urban zones. Companies operating in logistics, agri-tech, and rural banking need faster access to computing resources. Edge models help minimize latency and bandwidth strain across distant locations. Telcos deploy micro data centers to handle 5G network loads. Remote education and telemedicine services demand data locality and faster response times. Enterprises prefer modular containerized units that allow quicker installation. This trend supports real-time applications and enhances regional access to IT infrastructure. The Cambodia Data Center Infrastructure Market sees edge growth as a strategic move for national coverage.

Adoption of Liquid Cooling and Green Infrastructure Designs to Improve Energy Efficiency and PUE

New data center builds focus on sustainable design with improved energy efficiency. Operators adopt liquid cooling technologies to reduce heat and power loads in dense computing environments. Systems like in-row cooling, rear-door heat exchangers, and chilled-water loops replace traditional CRAC units. Facilities aim for lower power usage effectiveness (PUE) through efficient airflow and zoning. The push for green certifications encourages the use of solar-integrated UPS systems. Battery Energy Storage Systems (BESS) gain ground for grid support and backup. The Cambodia Data Center Infrastructure Market integrates eco-friendly infrastructure to meet ESG goals and operational savings.

Rising Preference for Modular and Prefabricated Construction Approaches to Speed Up Deployment Cycles

The need for rapid capacity expansion pushes demand for modular and prefabricated systems. Builders deploy offsite-manufactured components for quick on-ground assembly. These systems offer scalability, lower lead times, and better quality control. Tier III and IV designs use pre-engineered modules for server halls, cooling corridors, and electrical bays. EPC and turnkey contractors deliver projects faster through standardized building kits. Smaller operators use modular setups to pilot services before large-scale investment. The Cambodia Data Center Infrastructure Market embraces this trend to reduce project risks and construction delays.

Growth in AI-Driven Infrastructure Management and Monitoring Solutions for Real-Time Operations

Operators implement AI and automation for infrastructure management and incident detection. Predictive maintenance, cooling optimization, and load balancing are handled by AI algorithms. Real-time monitoring of UPS, BESS, and PDUs improves operational uptime. Smart sensors track thermal changes and airflow to prevent downtime. Data-driven insights support capacity planning and energy conservation. DCIM platforms evolve to integrate advanced analytics dashboards. The Cambodia Data Center Infrastructure Market evolves with intelligent systems to enhance performance, reduce costs, and support uptime.

Market Challenges

Limited Power Reliability and Grid Constraints Hindering High-Density Data Center Operations and Growth

Cambodia’s inconsistent power supply challenges high-density infrastructure deployment. Frequent outages and voltage fluctuations increase operational risks and costs. Operators must over-invest in backup power through generators, UPS systems, and BESS. Grid expansion projects are delayed in non-urban areas, affecting rural deployment plans. Power availability limits rack density and load allocation strategies. Data centers face difficulty meeting Tier III and IV uptime guarantees. These issues slow investment by global cloud providers and colocation firms. The Cambodia Data Center Infrastructure Market must overcome grid reliability barriers to sustain growth.

Skilled Workforce Shortage and Limited Local Vendor Ecosystem Slowing Complex Project Execution

The market suffers from a shortage of skilled professionals in MEP design, automation, and server maintenance. Operators depend on foreign experts for Tier certification, IT support, and project commissioning. The local vendor base lacks specialization in high-end components like liquid cooling and high-density racks. This leads to extended procurement cycles and higher installation costs. Training programs are limited and technical education is underfunded. International firms entering Cambodia must build capacity through partnerships or in-house upskilling. The Cambodia Data Center Infrastructure Market requires stronger workforce development and vendor ecosystems to meet global standards.

Market Opportunities

Strong Demand from BFSI and Telecom Sectors Driving Need for Certified and Scalable Facilities

Banking and telecom firms increasingly require Tier III+ certified facilities for secure operations. Regulatory compliance and business continuity needs fuel colocation and private build-outs. Rapid digital onboarding and 5G rollout expand the demand for edge and core infrastructure. This drives investments in PDUs, UPS, and energy-efficient rack designs. The Cambodia Data Center Infrastructure Market provides an opportunity for certified facility developers to scale alongside these sectors.

Foreign Direct Investment and Regional Connectivity Projects Creating Strategic Entry Points for Global Players

Rising foreign interest in Cambodia’s digital economy opens doors for infrastructure partnerships. Submarine cable links and ASEAN connectivity plans improve the business case for regional data hubs. International EPC firms and cloud providers explore joint ventures with local telcos. These factors position the Cambodia Data Center Infrastructure Market as a cost-effective and strategically located hub in Southeast Asia.

Market Segmentation

By Infrastructure Type

The Cambodia Data Center Infrastructure Market is dominated by electrical infrastructure, which holds the largest share due to its critical role in power stability and uptime. Mechanical infrastructure follows closely, driven by cooling needs in high-density environments. IT & network infrastructure sees strong adoption as enterprises demand scalable storage and servers. Civil and structural components are important for modular builds. Others include security and environmental control systems that support efficient operations across facility types.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) systems lead this segment due to power reliability concerns in Cambodia. Battery Energy Storage Systems (BESS) are rising in use for energy backup and grid stabilization. Power Distribution Units (PDUs) ensure reliable power flow to dense server racks. Transfer switches and grid connectivity solutions are vital for Tier III/IV certification. Utility services vary by region and impact deployment cost. The Cambodia Data Center Infrastructure Market places emphasis on high-reliability electrical systems to meet demand.

By Mechanical Infrastructure

Cooling units like CRAC/CRAH remain essential in Cambodian data centers, especially in tropical zones. Chillers, both air- and water-cooled, support high-capacity server halls. Containment systems such as cold and hot aisles optimize airflow. Pumps and piping systems ensure cooling fluid circulation. Operators move toward energy-efficient cooling to manage PUE. Mechanical reliability determines data center performance and capacity planning. The segment grows with increasing heat loads and power density.

By Civil / Structural & Architectural

Raised floors, suspended ceilings, and modular superstructures dominate the civil infrastructure segment. Modular or prefabricated systems see faster adoption due to ease of expansion. Superstructures made from steel or concrete provide structural stability and security. Building envelope materials reduce thermal loss and increase energy efficiency. Site preparation remains key in flood-prone areas. The Cambodia Data Center Infrastructure Market embraces smart building methods to reduce lead times and improve resilience.

By IT & Network Infrastructure

Servers and storage solutions account for major spending in this segment, driven by data volume growth. Networking equipment is essential for connecting internal and external systems. Racks and enclosures are evolving to support high-density setups and airflow management. Cabling and fiber optics support high-speed connectivity across zones. This segment grows due to enterprise cloud shifts and content demand. The Cambodia Data Center Infrastructure Market benefits from growing enterprise digitization and regulatory compliance needs.

By Data Center Type

Enterprise and colocation data centers hold significant share, supporting local businesses and institutions. Edge data centers grow rapidly, supporting remote area digitization and 5G. Hyperscale adoption is in early stages but gaining interest from regional players. Modular and small-scale designs fit the country’s energy and real estate landscape. The Cambodia Data Center Infrastructure Market favors scalable and cost-effective formats that align with evolving digital demands.

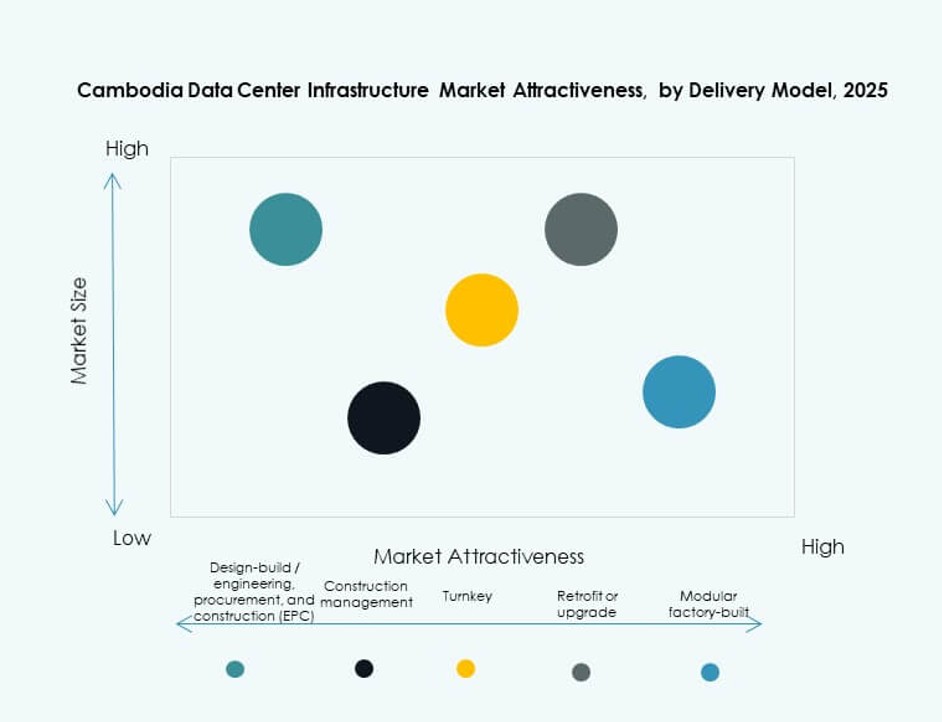

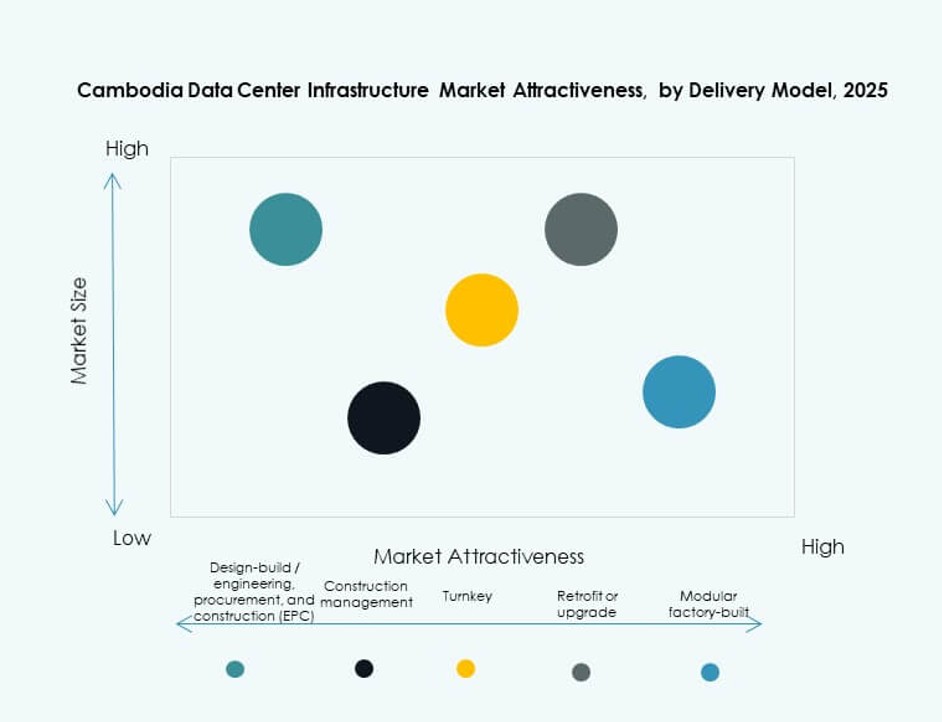

By Delivery Model

Turnkey and design-build models dominate the market due to the need for end-to-end expertise. Retrofit and upgrade projects are also rising as older facilities modernize infrastructure. Modular factory-built solutions support quick deployment in rural and tier-2 zones. EPC contractors handle most complex builds due to limited in-country capabilities. The Cambodia Data Center Infrastructure Market relies on streamlined delivery models for timely execution and risk mitigation.

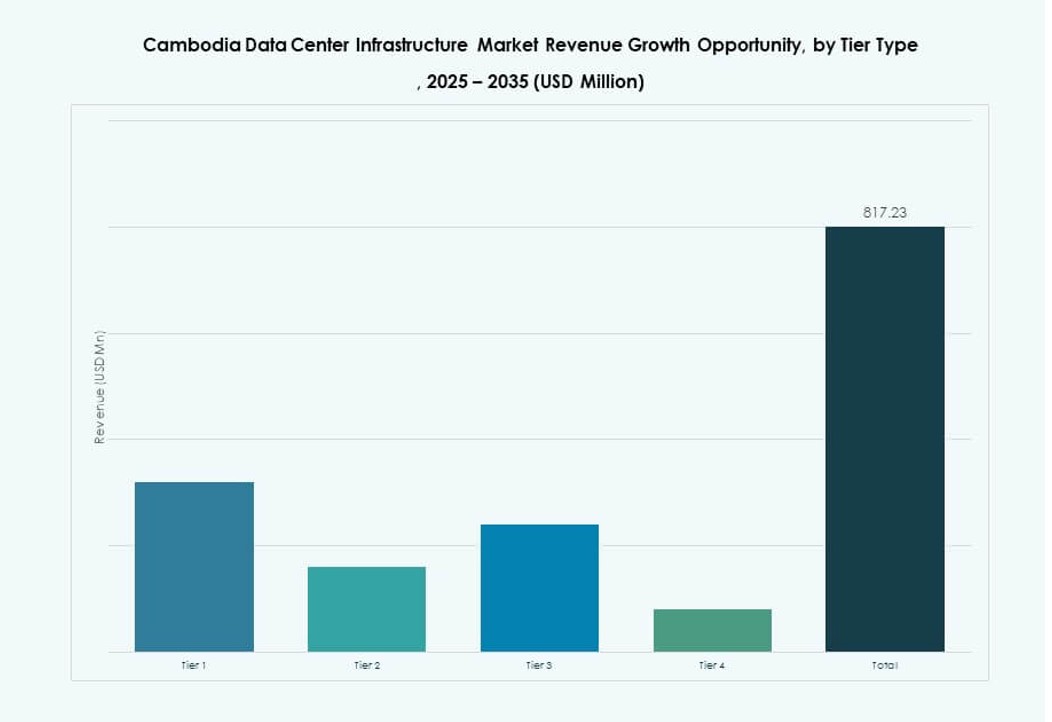

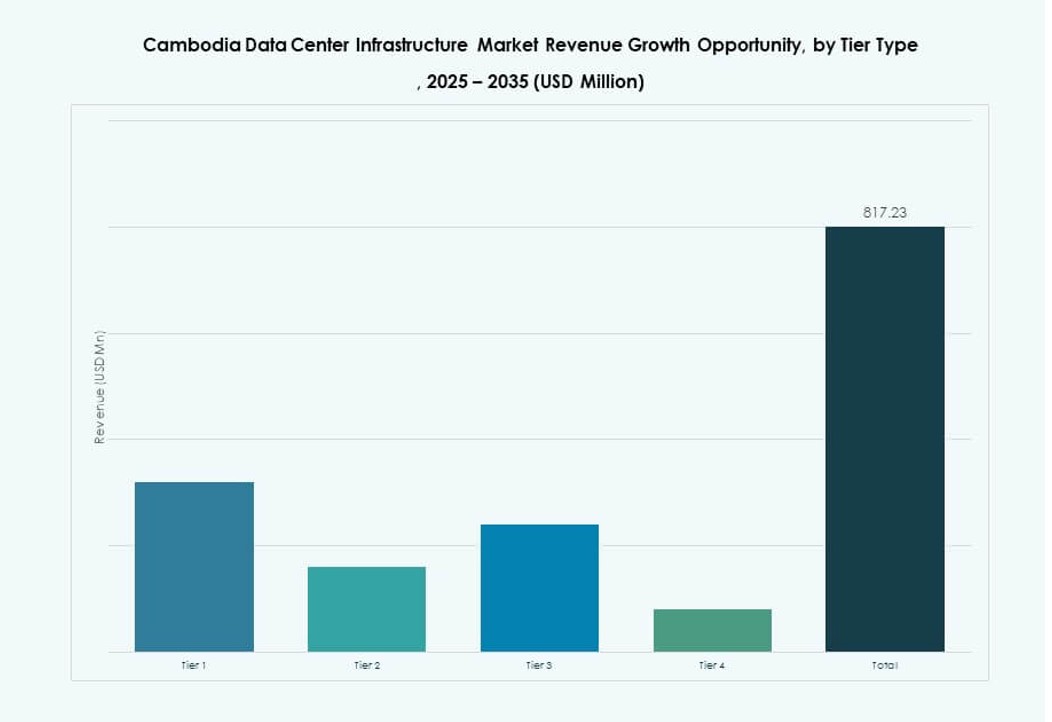

By Tier Type

Tier III infrastructure is most preferred due to its balance of reliability and cost-efficiency. Some financial and government clients demand Tier IV certification for critical workloads. Tier I and II remain relevant for edge or backup deployments. Certification levels drive procurement for UPS, PDUs, cooling systems, and BMS. The Cambodia Data Center Infrastructure Market moves toward higher tiers to meet uptime guarantees and service-level agreements.

Regional Insights:

Phnom Penh Metropolitan Zone – Leading with Over 55% Market Share Driven by Enterprise and Government Demand

The Phnom Penh subregion holds the largest share of over 55% in the Cambodia Data Center Infrastructure Market. It acts as the country’s core commercial and administrative hub, driving demand for enterprise and government IT systems. Major banks, telecom operators, and state institutions operate data centers or rent colocation space in the city. The high concentration of network providers and grid access enables Tier III infrastructure development. Real estate availability for multi-story data centers further boosts deployment. Phnom Penh also leads in early adoption of modular and prefabricated infrastructure to support faster rollout.

- For instance, ByteDC launched a 3MW data center facility in Phnom Penh in May 2023, enhancing national data storage capacity.

Siem Reap and Battambang Corridor – Emerging Zone with Around 20% Share Focused on Tourism and SME Digitization

Siem Reap and Battambang together account for roughly 20% of the Cambodia Data Center Infrastructure Market. These regions grow steadily due to their strong tourism industry and rising digital engagement among SMEs. Local ISPs and small-scale data firms expand edge services for hotels, travel platforms, and mobile apps. Demand for scalable and low-maintenance solutions drives modular builds and micro data centers. Power infrastructure remains under development, so adoption focuses on low-density designs. This corridor builds relevance as a regional edge hub supporting digital inclusion and sectoral diversification.

- For example, Daun Penh Data Center (DPDC) provides over 750 server units with redundant systems and precision air-conditioning for superior uptime.

Sihanoukville and Border Economic Zones – Strategic Coastal Belt Holding 25% Share Through FDI and Connectivity Links

The coastal and border regions, including Sihanoukville, hold about 25% share of the Cambodia Data Center Infrastructure Market. These zones gain momentum from foreign direct investment and cross-border data traffic. Proximity to international submarine cables and port infrastructure attracts interest from regional cloud and CDN providers. Sihanoukville’s special economic zone supports demand from manufacturing, logistics, and fintech operations. These regions adopt both colocation and private facilities, with increasing deployment of high-efficiency UPS and BESS systems. The market here serves as a gateway to ASEAN data flows and strengthens Cambodia’s digital infrastructure export capacity.

Competitive Insights:

- Equinix, Inc.

- Schneider Electric

- Vertiv Group Corp.

- ABB

- Delta Electronics

- Cisco Systems, Inc.

- Dell Inc.

- IBM

- Lenovo

The Cambodia Data Center Infrastructure Market shows moderate concentration with global vendors leading core systems. Large players supply electrical, cooling, and IT stacks through integrated portfolios. These firms leverage strong partner networks to reach local operators. Competition focuses on reliability, efficiency, and faster deployment cycles. Turnkey and EPC capabilities create clear differentiation for complex builds. Vendors push modular designs to shorten project timelines and control costs. Power and cooling specialists gain share through energy-efficient solutions. IT vendors compete on scalability and security features. Strategic alliances with telecom firms expand market access. Price discipline and local service depth shape winning bids.

Recent Developments:

- In August 2025, Viettel IDC launched Vcloudia, its cloud platform tailored for Cambodia, marking a key entry into the data center and cloud computing market. and involves a partnership with Qualcomm to deliver AI platforms and solutions for Cambodian businesses.

- In July 24, 2025, Schneider Electric launched the PrismaSeT Switchboard in Phnom Penh, Cambodia, marking a key advancement in local electrical infrastructure for data centers and sustainable industrialization. This initiative includes technology transfer to ATS Cambodia for local manufacturing, enhancing workforce skills and supporting greener infrastructure development.