Executive summary:

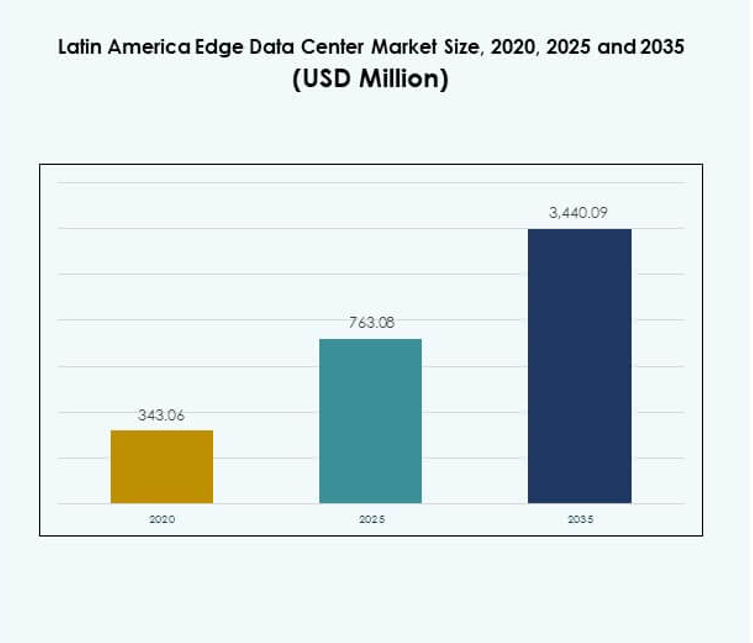

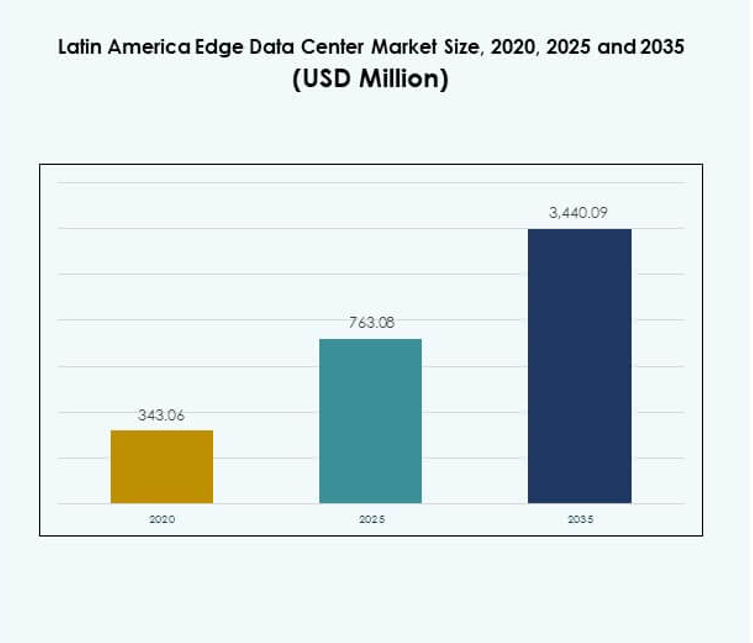

The Latin America Edge Data Center Market size was valued at USD 343.06 million in 2020, increased to USD 763.08 million in 2025, and is anticipated to reach USD 3,440.09 million by 2035, at a CAGR of 16.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Latin America Edge Data Center Market Size 2025 |

USD 763.08 Million |

| Latin America Edge Data Center Market, CAGR |

16.12% |

| Latin America Edge Data Center Market Size 2035 |

USD 3,440.09 Million |

The market is expanding due to strong technology adoption, 5G deployment, and AI-driven infrastructure development. Edge computing plays a critical role in enabling low-latency connectivity, faster processing, and reliable service delivery. Industries such as telecom, BFSI, retail, and healthcare are investing in distributed architectures to support real-time applications. For investors, it represents a fast-scaling infrastructure segment with high strategic importance for regional digital transformation.

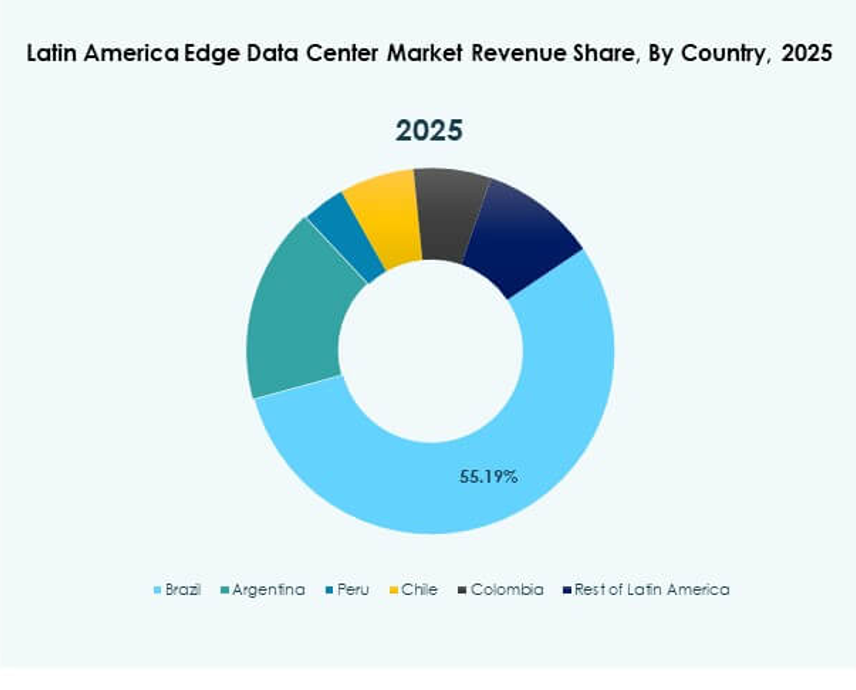

Brazil leads the market, supported by robust connectivity networks and large enterprise demand. Mexico and Chile are emerging markets due to cloud expansion and favorable investment conditions. Colombia and Argentina are gaining traction with targeted infrastructure development and digital ecosystem growth. This regional diversification is strengthening the overall edge computing landscape in Latin America.

Market Drivers

Rising Digital Transformation Initiatives Across Industries

Rapid digital adoption in financial services, telecom, healthcare, and retail is driving massive data processing demands. Edge infrastructure enables faster response time and better user experience in these sectors. It reduces latency, supports real-time analytics, and enhances operational resilience. Companies are modernizing networks to meet application performance goals. Investors view edge capacity as a core requirement for future-proofing enterprise infrastructure. The Latin America Edge Data Center Market is growing as industries push for high-performance systems. Governments are also aligning policies to support data localization. This creates a strong foundation for regional edge growth.

Expansion of 5G Networks and Cloud Computing Ecosystems

5G deployment and maturing cloud ecosystems are unlocking new levels of connectivity. Telecom operators are investing in distributed architectures to support IoT and critical applications. Low latency and high bandwidth enable seamless streaming, smart manufacturing, and connected healthcare. This infrastructure shift accelerates edge deployments across urban and semi-urban areas. It creates opportunities for infrastructure operators to expand services closer to end users. The Latin America Edge Data Center Market benefits from strong integration between cloud and edge. It allows businesses to scale digital services efficiently. This evolution strengthens regional competitiveness.

- For instance, América Móvil, led by CEO Daniel Hajj, allocated $7 billion in capital expenditure for 2024 with the core priority on expanding its 5G networks across Latin America, including major deployments in Mexico, Peru, Colombia, and Brazil, with Telcel’s 5G network already live in 100 Mexican cities by the end of 2022.

Strong Push Toward Real-Time Data Processing and AI Adoption

AI, machine learning, and data analytics adoption drive demand for localized processing capacity. Organizations require near-instant insights to support automation and decision-making. Edge facilities enable faster computing and reduce dependency on distant centralized data centers. Industries use these capabilities to optimize logistics, financial transactions, and security systems. It supports critical use cases in fintech, e-commerce, and autonomous applications. The Latin America Edge Data Center Market gains strategic significance in this transformation. Enterprises prioritize low-latency infrastructure to maintain service quality. This trend accelerates modernization across multiple verticals.

Growing Infrastructure Investments by Private and Public Stakeholders

Public and private investments are reshaping regional infrastructure capacity. Telecom firms, hyperscalers, and governments are building facilities to serve rising digital demand. These investments help address network congestion and ensure reliable service availability. It supports strategic goals like economic competitiveness and regional cloud adoption. Investors focus on scalable and energy-efficient designs to maximize ROI. The Latin America Edge Data Center Market benefits from this capital flow. Infrastructure expansion creates opportunities for equipment vendors, construction partners, and energy providers. This investment momentum strengthens the region’s edge ecosystem.

- For instance, as part of a $735 million acquisition deal completed in 2022, Equinix acquired four data centers from Entel in Santiago, Chile and one in Lima, Peru, directly expanding energy-efficient Latin American edge infrastructure with robust connectivity to hyperscale cloud partners.

Market Trends

Widespread Deployment of Modular and Containerized Data Centers

Modular designs are gaining traction due to flexible and fast deployment models. Containerized units help reduce construction time and operational costs. Businesses deploy these units in remote areas to support emerging demand clusters. Modular facilities offer energy efficiency and easy scalability. It improves deployment economics for telecom and enterprise operators. The Latin America Edge Data Center Market reflects a sharp shift toward agile infrastructure. This trend supports decentralized computing strategies. It also aligns with rapid urban and semi-urban digital expansion plans.

Integration of Renewable Energy Sources in Edge Infrastructure

Sustainability targets are driving integration of solar, wind, and hydro energy sources. Companies design energy-efficient facilities with advanced power management systems. Renewable integration helps reduce operating costs and supports ESG commitments. It builds investor confidence in long-term infrastructure resilience. Edge operators are adopting green certifications to attract enterprise customers. The Latin America Edge Data Center Market aligns with this environmental focus. It positions green infrastructure as a strategic differentiator. This shift increases investment appeal in the region.

Advanced Automation and AI-Based Monitoring Systems

Operators are adopting AI tools to monitor cooling, power, and asset utilization. Predictive maintenance helps reduce downtime and extend equipment life. Automated systems optimize resource use and ensure stable performance during peak loads. This trend supports scalability while maintaining operational efficiency. It enables better service delivery to demanding enterprise clients. The Latin America Edge Data Center Market benefits from smarter infrastructure management. This evolution enhances uptime guarantees. It strengthens customer trust and long-term contracts.

Growing Demand for Distributed Edge Architectures

Decentralized infrastructure is critical to meet next-generation connectivity needs. Distributed edge enables real-time data handling at local nodes. It supports mission-critical applications like autonomous mobility, gaming, and remote healthcare. Operators deploy multiple smaller facilities to reduce traffic load on central hubs. It ensures higher network resilience and better service continuity. The Latin America Edge Data Center Market reflects this distributed model expansion. This trend drives collaboration between telecoms, hyperscalers, and governments. It accelerates the maturity of the regional digital ecosystem.

Market Challenges

High Capital Expenditure and Infrastructure Complexity

Building edge infrastructure requires significant upfront investment in land, equipment, and energy systems. Operators face difficulties securing funding for large-scale rollouts. Infrastructure complexity increases when integrating multiple network layers. It affects deployment speed and cost efficiency. The Latin America Edge Data Center Market encounters financial hurdles that limit scalability. Smaller players struggle to compete with hyperscalers. Limited financing options and high build costs delay project timelines. This creates uneven infrastructure distribution across countries.

Regulatory Uncertainty and Limited Skilled Workforce Availability

Inconsistent regulatory frameworks increase operational risks for investors. Different countries have varying data sovereignty and licensing rules. Lack of clear policy alignment creates uncertainty for long-term commitments. The Latin America Edge Data Center Market also faces a shortage of skilled technical professionals. Operators struggle to manage advanced equipment and automation systems. Workforce limitations affect service quality and deployment capabilities. This challenge slows innovation pace and weakens regional competitiveness. It also impacts the ability to meet rising enterprise demand.

Market Opportunities

Expansion Potential in Underserved and Tier-2 Cities

Edge deployments in non-metropolitan areas present significant growth opportunities. Expanding infrastructure beyond major cities enhances connectivity coverage. It supports industries requiring fast access to computing resources. Governments are focusing on digital inclusion programs that encourage this expansion. The Latin America Edge Data Center Market benefits from growing interest in regional diversification. It creates new revenue streams for service providers. This also attracts partnerships with telecom and content delivery networks.

Strategic Collaborations Driving Ecosystem Development

Partnerships between hyperscalers, telecom operators, and governments enable rapid scaling. Joint investments reduce infrastructure costs and accelerate deployment timelines. It strengthens service availability in key markets. The Latin America Edge Data Center Market attracts both domestic and international investors. Collaborative models increase resource efficiency and network reach. This approach supports sustainable, long-term market growth. It also enhances the competitiveness of local operators.

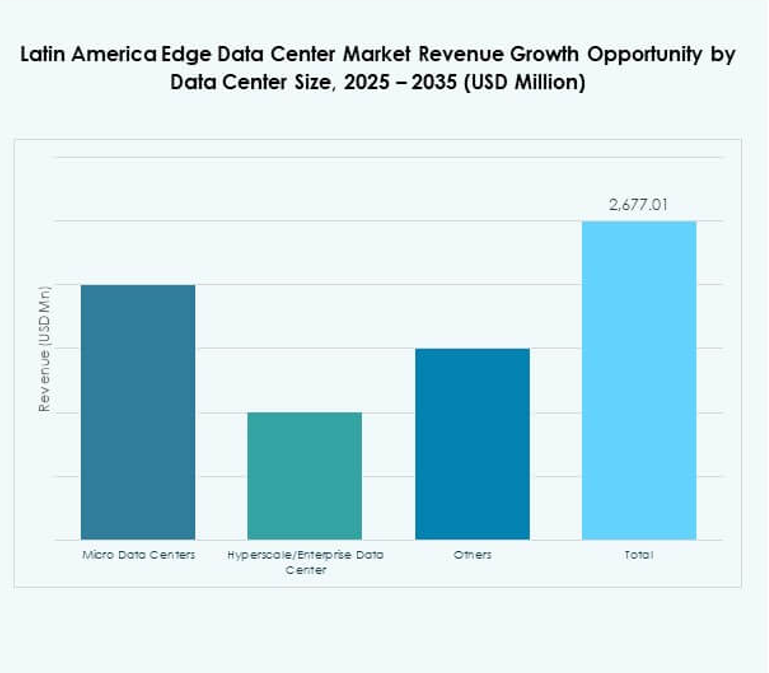

Market Segmentation

By Component

Solution holds the dominant share, driven by growing demand for software-defined infrastructure and scalable systems. It enables operators to manage distributed networks efficiently. Strong focus on cloud integration boosts this segment’s growth. Service offerings such as maintenance and managed operations complement infrastructure expansion. The Latin America Edge Data Center Market benefits from increased adoption of smart control platforms. Businesses prioritize reliable solutions to reduce operational risks. This strengthens solution vendors’ market position across the region.

By Data Center Type

Colocation edge data centers lead the market due to cost efficiency and flexibility. Businesses use shared facilities to reduce capital expenditure while maintaining performance standards. These facilities support quick deployment for multiple enterprises. The Latin America Edge Data Center Market reflects rising adoption among telecom operators and fintech firms. Cloud and edge data centers also show rapid growth with strong enterprise demand. This dual momentum creates a balanced infrastructure ecosystem. It enables more inclusive network coverage.

By Deployment Model

Hybrid deployment dominates due to its ability to combine flexibility and control. Enterprises prefer hybrid models to balance on-premises security with cloud scalability. It ensures efficient workload distribution across different environments. Cloud-based models follow closely, driven by digital service expansion. The Latin America Edge Data Center Market leverages hybrid infrastructure to support critical industries. It helps businesses optimize costs and performance. This segment continues to attract large-scale investments.

By Enterprise Size

Large enterprises hold the largest share due to their focus on advanced computing and network resilience. These firms deploy edge solutions to improve customer experience and operational efficiency. SMEs are adopting cost-effective solutions to modernize infrastructure. The Latin America Edge Data Center Market benefits from the growing SME participation. It creates diverse demand across multiple verticals. This trend supports both large-scale and mid-tier infrastructure expansion.

By Application / Use Case

Power monitoring dominates due to the critical need for energy efficiency and operational reliability. Asset management and capacity management are gaining traction with rising enterprise complexity. Environmental monitoring supports compliance with sustainability regulations. BI and analytics use cases are expanding with demand for real-time insights. The Latin America Edge Data Center Market integrates these applications to enhance service performance. It strengthens overall infrastructure management capabilities.

By End User Industry

IT and telecommunications lead the market with the highest share due to 5G deployment and IoT expansion. BFSI follows with growing digital transactions and fintech adoption. Retail and healthcare sectors show strong demand for low-latency solutions. Aerospace, defense, and energy industries support niche deployments for critical operations. The Latin America Edge Data Center Market benefits from diverse industry participation. It creates stable growth momentum for the regional market.

Regional Insights

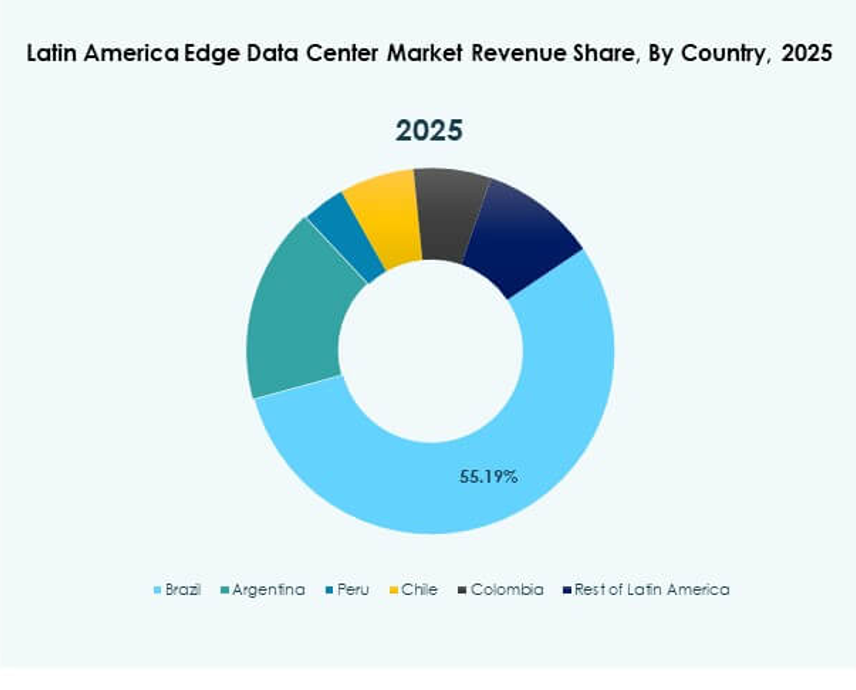

Brazil and Mexico Holding the Largest Regional Share

Brazil accounts for 41% of the regional market share, supported by large-scale 5G rollouts and hyperscale investments. Mexico follows with 27%, driven by rising cloud demand and infrastructure modernization. These countries attract major global players through favorable investment policies. The Latin America Edge Data Center Market benefits from strong backbone connectivity in these regions. It strengthens their position as regional digital hubs. High urbanization and strong enterprise presence drive sustained demand.

- For example, Brazil’s strong 5G rollout is exemplified by Vivo (Telefônica Brasil), which, as of May 2025, has deployed 17,184 5G cell sites covering 63.2% of the population and serving over 19 million 5G users, making it the largest in Brazil by subscriptions.

Chile and Colombia Emerging as Competitive Edge Hubs

Chile holds a 16% market share, supported by renewable energy capacity and stable policies. Colombia represents 9% with rising data center investments and telecom upgrades. Both countries are investing in digital infrastructure to diversify economic activity. The Latin America Edge Data Center Market reflects growing competition among regional players. Their focus on sustainability and fiber connectivity enhances their market positioning. These regions attract both domestic and foreign capital.

- For example, Ascenty inaugurated its third data center in Quilicura, Santiago in 2025, featuring 16 MW capacity and over 1,000 racks, operating at carbon-neutral standards using 100% renewable energy, underpinning sustainability focus in edge infrastructure.

Argentina and Rest of Latin America Showing Steady Growth

Argentina accounts for 7% of the market share, supported by enterprise cloud migration and government digital projects. Other Latin American countries share the remaining 6%, driven by early-stage deployments. Their growth is steady due to ongoing telecom and energy investments. The Latin America Edge Data Center Market sees gradual infrastructure expansion in these areas. It supports rural connectivity and emerging enterprise clusters. This growth pattern indicates long-term development potential across the region.

Competitive Insights:

- Hewlett Packard Enterprise

- Huawei Technologies

- NVIDIA Corporation

- Eaton Corporation

- Dell Technologies Inc.

- Compass Datacenters

- Fujitsu

- American Tower

- Cisco

- SixSq

- Microsoft

- VMware

- Schneider Electric SE

- Rittal GmbH & Co. KG

The competitive landscape in the Latin America Edge Data Center Market is defined by a mix of global technology leaders and specialized infrastructure providers. It is driven by advanced hardware solutions, cloud integration platforms, and strong ecosystem partnerships. Companies invest heavily in energy-efficient designs, modular architectures, and AI-based management tools to gain an edge. Strategic alliances between telecom operators, cloud providers, and data center developers accelerate network expansion. Major firms prioritize scalable deployments and green certifications to strengthen their market positions. Smaller providers focus on targeted regional coverage and niche service models. Product differentiation, innovation, and expansion strategies shape the intensity of competition across the region.

Recent Developments:

- In October 2025, IHS Towers and TIM Brazil signed a major partnership agreement to develop up to 3,000 new cell tower sites throughout Brazil. This initiative is focused on expanding infrastructure for edge computing across key Brazilian cities, supporting telecom, smart city, and next-gen digital services by broadening low-latency data access.

- In September 2025, HostDime, a global hyper-edge data center company, teamed up with Internexa to launch a Point of Presence (PoP) at HostDime’s Bogotá, Colombia data center. This collaboration aims to reinforce HostDime’s commitment to constructing advanced edge data centers in emerging Latin American markets, boosting connectivity and capacity for regional business processing and cloud services.

- In June 2025, Hewlett Packard Enterprise (HPE) showcased several significant innovations at HPE Discover 2025, including new AI Factory solutions developed in partnership with NVIDIA. These solutions span the entire AI lifecycle with integrated hardware, software, and services designed for enterprise AI adoption.

- Dell Technologies in May 2025 unveiled new AI infrastructure solutions supporting everything from edge inferencing to massive enterprise AI workloads. These include on-premises deployment architectures integrating Dell servers with AI platforms like Cohere North and collaborations with Mistral AI.