Executive summary:

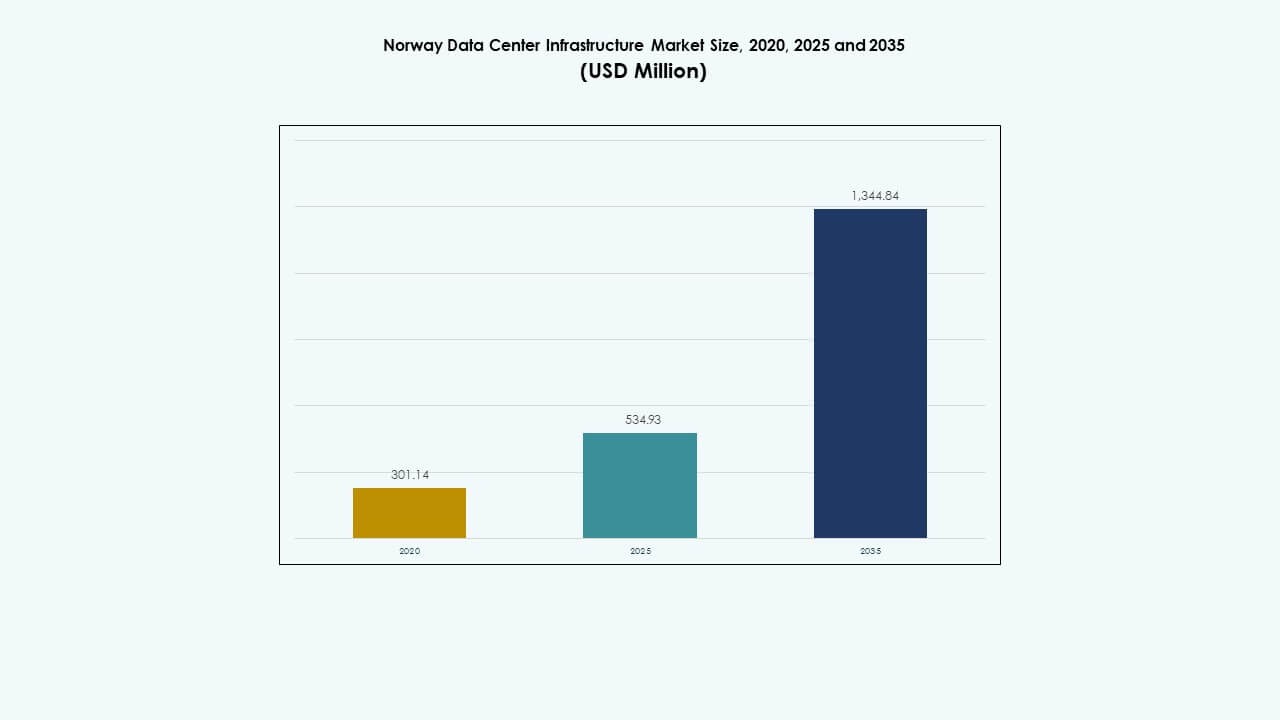

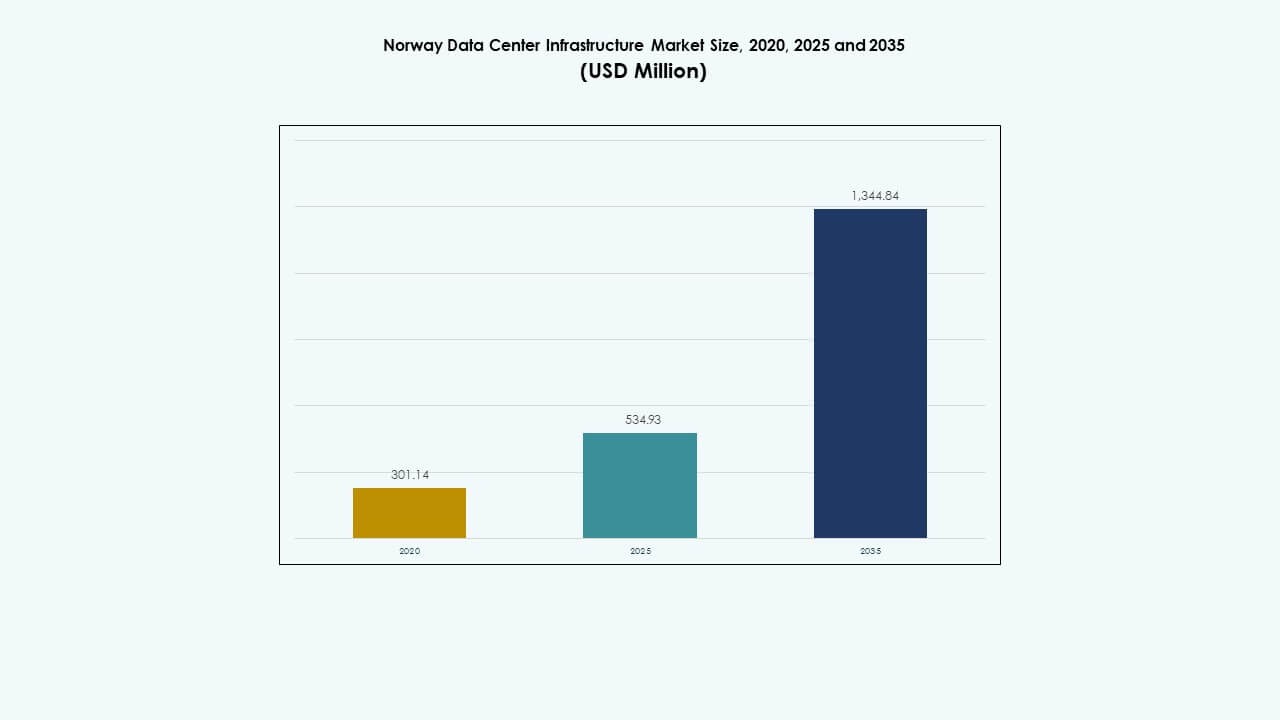

The Norway Data Center Infrastructure Market size was valued at USD 301.14 million in 2020, increased to USD 534.93 million in 2025, and is anticipated to reach USD 1,344.84 million by 2035, at a CAGR of 9.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Norway Data Center Infrastructure Market Size 2025 |

USD 534.93 Million |

| Norway Data Center Infrastructure Market, CAGR |

9.59% |

| Norway Data Center Infrastructure Market Size 2035 |

USD 1,344.84 Million |

Strong expansion in cloud computing, AI integration, and high-performance workloads drives infrastructure investments. Companies adopt modular designs, renewable-powered cooling, and automation to enhance efficiency. Digital transformation across telecom, finance, and public sectors fuels upgrades in power, IT, and mechanical systems. The market holds strategic importance for investors seeking long-term returns from green, scalable, and AI-ready infrastructure.

Eastern Norway leads the market, supported by Oslo’s strong connectivity, stable grid, and hyperscale investments. Western regions like Stavanger and Bergen grow fast through renewable energy projects and proximity to subsea cables. Northern Norway emerges as a secondary hub, offering lower land costs and natural cooling advantages for edge and AI applications.

Market Drivers

Market Drivers

Growing Cloud Adoption and Hyperscale Expansion Driving Infrastructure Investments

The Norway Data Center Infrastructure Market expands through a strong wave of cloud and hyperscale adoption. Global providers like Microsoft, Google, and AWS establish large-scale campuses to meet rising demand. Domestic operators upgrade legacy facilities to support hybrid and multi-cloud models. Investors prioritize regions with renewable power and low operating costs. New colocation builds in Oslo and Stavanger cater to AI and enterprise workloads. It benefits from long-term contracts with financial and energy firms. Norway’s fiber connectivity improves access across Nordic and European networks. Businesses view the country as a secure digital hub.

- For instance, Microsoft signed a $6.2 billion deal in September 2025 with Nscale and Aker for AI compute capacity at a new Kvandal data center starting with 230 MW in 2026.

Shift Toward Sustainable Power and Carbon-Neutral Operations

Green energy access positions Norway as a leader in sustainable data infrastructure. Operators leverage hydro and wind energy for 100% renewable uptime. Cooling systems use natural airflows, reducing energy intensity and emissions. Enterprises align with ESG mandates by hosting workloads in green-certified campuses. Government incentives promote eco-efficient expansions. It attracts hyperscale players seeking climate-positive credentials. Efficiency metrics like low PUE remain industry benchmarks. The focus on sustainability strengthens investor confidence in long-term stability.

Accelerated Digitalization Across Key Industries and Public Sector Modernization

Digital transformation across oil, finance, and public sectors fuels data center growth. Cloud-native platforms support analytics and automation for high-compute tasks. Energy and telecom firms invest in local data storage for regulatory compliance. Government modernization initiatives expand digital services across health and education. AI and IoT workloads require scalable and low-latency infrastructure. It enables faster innovation cycles and secure data control. Managed services gain traction as enterprises outsource infrastructure management. Norway’s focus on digital resilience drives sustained infrastructure spending.

- For instance, Nscale and Aker’s Stargate Norway facility targets 100,000 NVIDIA GPUs by end of 2026 for AI workloads.

Advancements in Modular and High-Density Infrastructure Deployment

The shift toward modular and prefabricated construction reduces deployment time. Builders deliver scalable units that support quick expansion for enterprise and edge setups. Rack densities rise as AI and HPC workloads grow. Automation enhances power and cooling management, improving uptime. It adapts to flexible capacity requirements across verticals. Prefabricated components lower construction risk and capital intensity. Operators integrate predictive maintenance to cut downtime. This modernization accelerates Norway’s role in regional digital transformation.

Market Trends

Rising Integration of AI, Edge, and High-Performance Computing

Artificial intelligence and edge computing reshape infrastructure design in Norway. Data centers adopt GPU-optimized clusters to support AI training and analytics. Edge nodes near urban centers process data locally for faster delivery. Telecom and enterprise operators integrate 5G backbones with data hubs. It strengthens real-time data ecosystems across industries. HPC applications in oil simulation and weather modeling lift compute intensity. Investments focus on energy-efficient AI-ready hardware. The trend boosts Norway’s digital competitiveness in Europe.

Growth of Colocation and Interconnection Ecosystems

Enterprises prefer colocation services for scalability and reduced capital costs. Providers expand carrier-neutral campuses to host cloud on-ramps. Peering and interconnection points improve network efficiency across regions. The Norway Data Center Infrastructure Market supports dense connectivity clusters linking Nordic capitals. It drives collaboration among content delivery, fintech, and IoT firms. Demand for cross-border redundancy lifts interlinked network design. Colocation models attract foreign clients seeking stable energy and compliance. This trend reshapes capacity allocation and pricing structures.

Expansion of Renewable-Powered and Energy-Optimized Facilities

Energy efficiency dominates design priorities for Norwegian data centers. New builds incorporate water-cooling, heat reuse, and AI-based energy control. Recovered heat supports local district heating networks, enhancing sustainability. Operators adopt modular chillers to manage variable loads efficiently. It aligns with Europe’s carbon neutrality agenda. Power purchase agreements secure predictable energy pricing. Facilities gain green certifications to attract environmentally conscious tenants. These initiatives help position Norway as a top eco-digital hub.

Increased Focus on Security, Resilience, and Regulatory Compliance

Rising cybersecurity awareness drives investment in physical and digital safeguards. Data centers enhance surveillance, fire suppression, and access control layers. Government standards enforce strict uptime and disaster recovery requirements. It aligns with GDPR and national data protection frameworks. Operators adopt zero-trust network architectures to prevent breaches. Backup systems ensure operational continuity under grid instability. Multicloud adoption encourages hybrid resiliency planning. This compliance-focused trend improves Norway’s appeal to global clients.

Market Challenges

Market Challenges

High Construction Costs and Complex Permitting Frameworks

The Norway Data Center Infrastructure Market faces challenges in balancing cost and compliance. High construction costs arise from strict building codes and material pricing. Complex environmental approvals delay new projects and expansions. It increases the timeline for hyperscale deployment. Limited availability of skilled contractors raises labor costs. Supply-chain bottlenecks affect imported electrical and mechanical components. Currency fluctuations also impact project economics. These barriers pressure profit margins for new entrants.

Power Grid Limitations and Cooling Constraints in Select Regions

Certain regions face strain on grid capacity due to heavy industrial and renewable load integration. Delayed substation upgrades restrict capacity scaling. It limits hyperscale growth near smaller cities. Cooling challenges emerge during warmer months, testing design efficiency. Infrastructure in remote zones faces logistical complexity. Operators must invest in advanced thermal systems and redundant feeds. These issues slow site selection and capacity expansion. Addressing grid modernization remains vital for sustainable growth.

Market Opportunities

Expansion of AI-Ready and High-Density Infrastructure

Growing adoption of AI, machine learning, and real-time analytics opens large-scale investment potential. The Norway Data Center Infrastructure Market benefits from AI-centric upgrades with GPU clusters and liquid cooling. Enterprises and cloud vendors seek low-latency hubs powered by renewable sources. It creates opportunities for specialized infrastructure providers. Modular and high-density rack solutions gain momentum. The market’s sustainability appeal attracts long-term institutional investors.

Strengthening Position as a Regional Digital Gateway

Norway’s proximity to the UK and continental Europe supports cross-border connectivity. Subsea cable systems such as Havfrue and NO-UK improve latency and bandwidth reliability. It enables Norway to serve as a digital bridge between Nordics and Western Europe. Investors view the region as a low-risk data host. Expanding colocation campuses near Oslo and Bergen strengthen this role. Strategic alliances with telecom carriers further enhance growth potential.

Market Segmentation

Market Segmentation

By Infrastructure Type

Electrical infrastructure dominates due to heavy focus on power stability and redundancy. Uninterrupted supply remains crucial for uptime and compliance with Tier III and IV standards. Mechanical and IT infrastructure segments grow steadily as operators upgrade for energy efficiency. Civil works see modular construction uptake to cut delivery timelines. The Norway Data Center Infrastructure Market gains strength through a balanced mix of electrical reliability and modular efficiency.

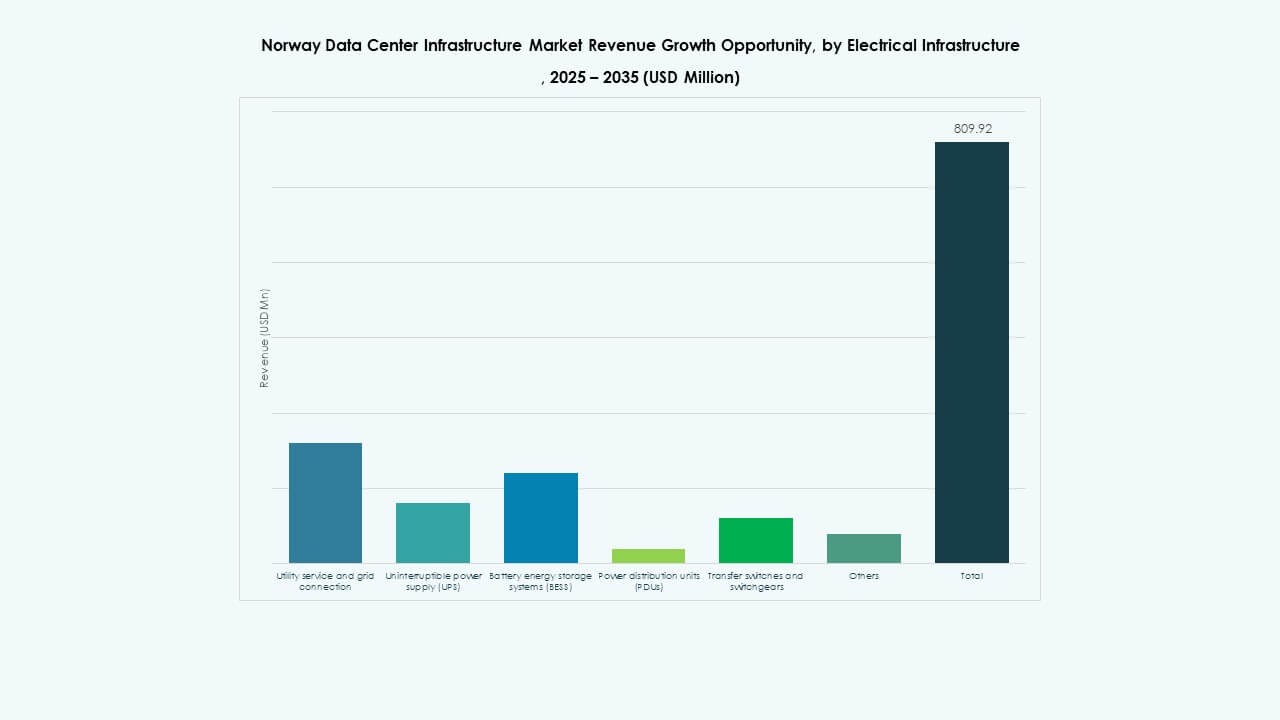

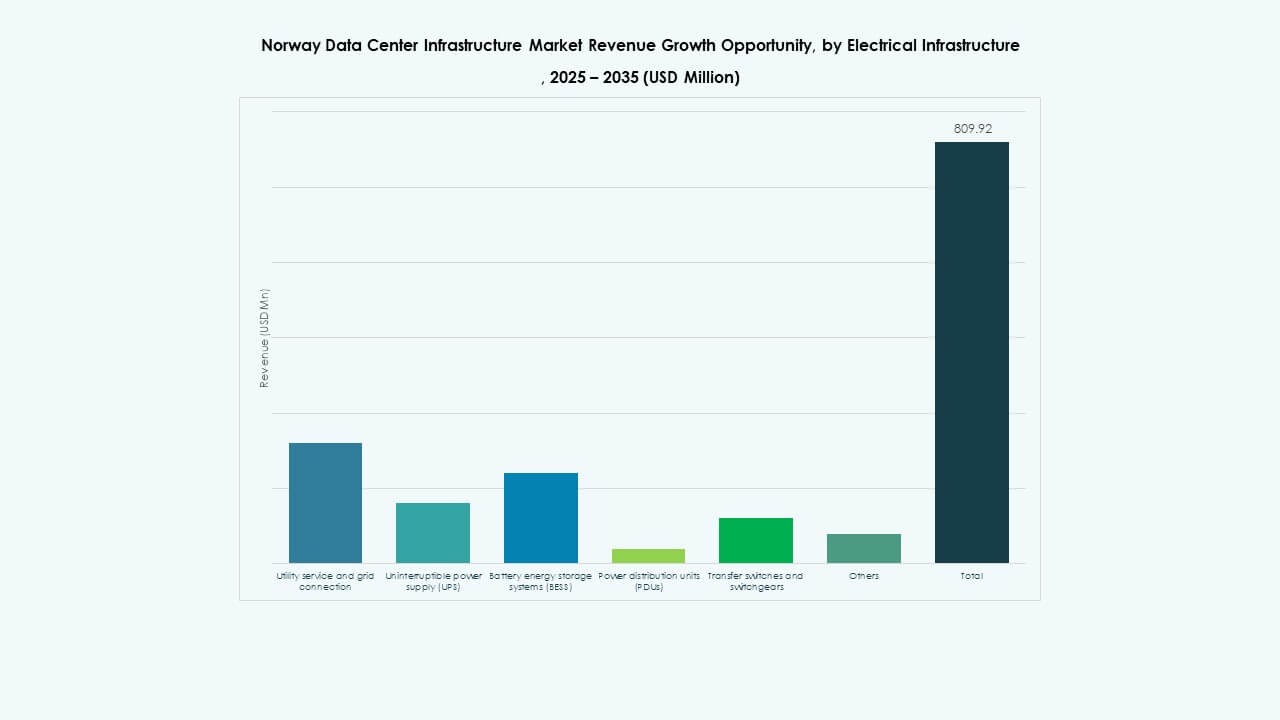

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) systems hold a significant share due to critical load protection. Power Distribution Units (PDUs) and switchgears follow closely for managing high-density power. It benefits from Norway’s low-cost renewable grid integration. Battery Energy Storage Systems (BESS) gain traction to handle fluctuating loads. Utilities invest in smart-grid integration for real-time control. The segment evolves toward hybrid and renewable-powered architectures.

By Mechanical Infrastructure

Cooling units and chillers dominate due to energy-efficient operations and heat reuse systems. Containment systems and water-based chillers reduce PUE in large campuses. Pumps and piping networks support liquid-cooling for AI clusters. It advances with modular systems offering scalability. The segment’s growth reflects Norway’s climatic advantage and sustainability focus. Efficient mechanical designs strengthen uptime reliability across facilities.

By Civil / Structural & Architectural

Superstructures and building envelopes lead due to robust engineering standards. Modular and prefabricated systems gain attention for faster deployment. Raised floors and suspended ceilings enhance flexibility for airflow and cabling. It improves operational adaptability in enterprise and colocation sites. Durable steel frames ensure resilience under Nordic weather. The focus on scalability drives architectural innovation across new projects.

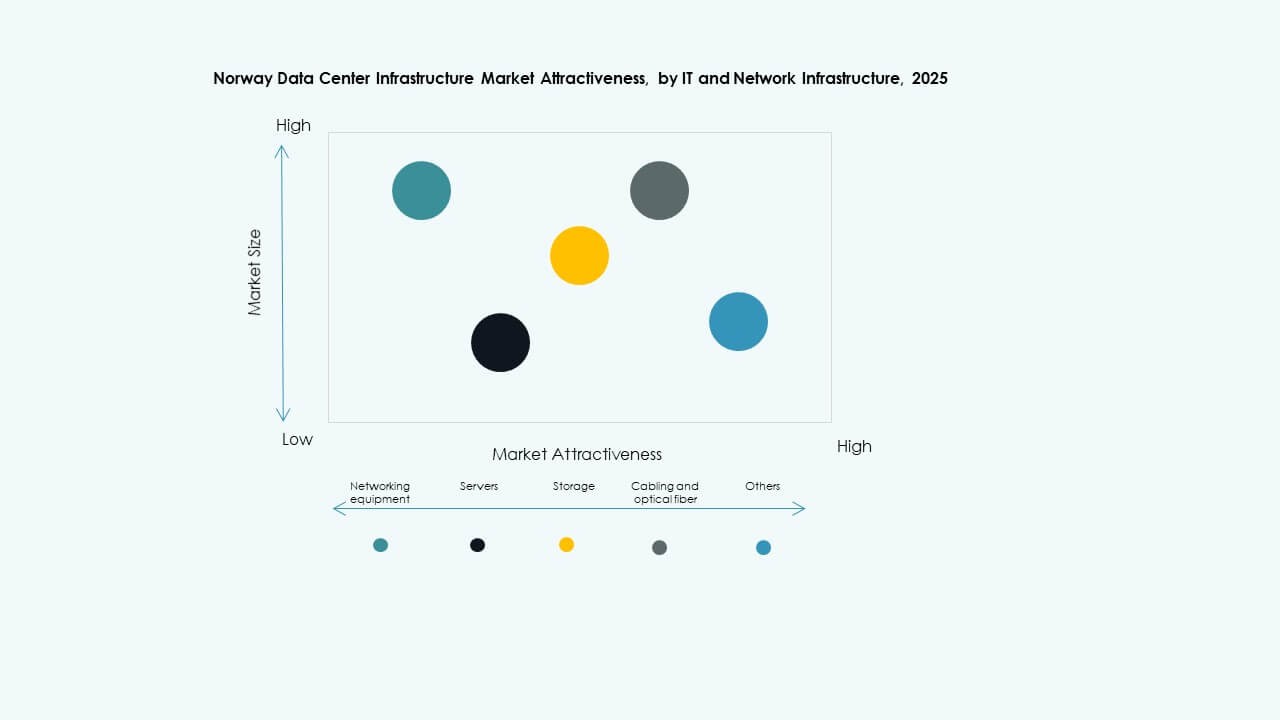

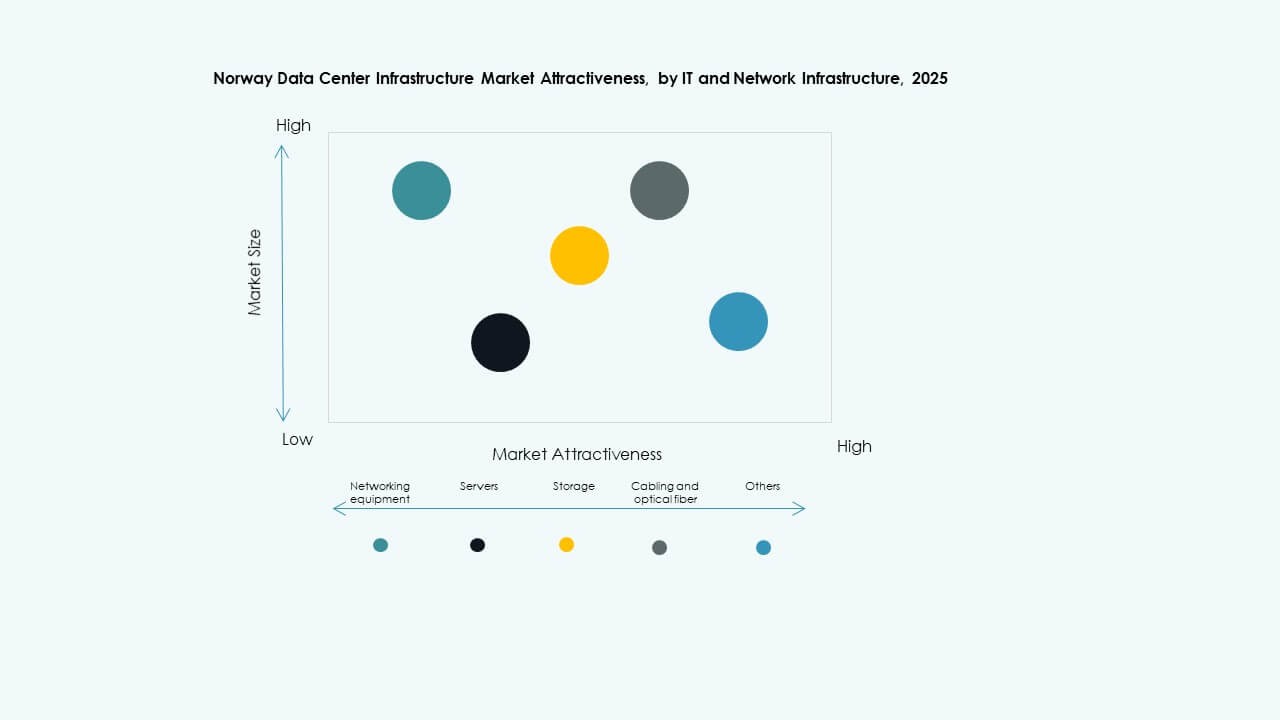

By IT & Network Infrastructure

Servers and networking equipment dominate due to rising AI and cloud workloads. Storage and optical fiber systems follow as key enablers of performance. Racks and enclosures adopt flexible layouts for power-hungry applications. It supports multi-cloud and hybrid IT strategies. Vendors innovate with liquid-cooled servers to enhance efficiency. The segment remains critical to Norway’s role in regional data processing.

By Data Center Type

Hyperscale data centers dominate due to global cloud expansions. Colocation models grow with enterprise outsourcing trends. Edge facilities emerge to support 5G and IoT demand near population hubs. It promotes distributed compute frameworks for latency-sensitive operations. Enterprise and modular designs remain active in public and financial sectors. The shift reflects a hybrid mix of centralized and localized capacity.

By Delivery Model

Design-Build/EPC remains the leading model for large-scale facilities. Turnkey and modular factory-built systems gain adoption for quick deployment. Retrofit projects rise as operators modernize legacy sites. It supports rapid response to AI and storage needs. Construction management models cater to long-term investors seeking cost control. The segment underscores flexible delivery across project scales.

By Tier Type

Tier III facilities dominate with high availability and balanced efficiency. Tier IV sites gain interest among hyperscale and government clients for full redundancy. Tier I and II centers cater to smaller enterprises with budget constraints. It showcases Norway’s maturity in designing fault-tolerant infrastructure. The shift toward Tier III+ certifications reflects rising service reliability expectations.

Regional Insights

Regional Insights

Eastern Norway (Oslo and Surrounding Areas)

Eastern Norway holds about 52% of the total market share. Oslo acts as the primary hub for hyperscale and colocation facilities. Strong fiber connectivity and access to renewable power support expansion. Government data initiatives concentrate around the capital. It drives demand for cloud and AI-ready infrastructure. Financial and telecom companies dominate tenant portfolios, ensuring steady utilization.

- For instance, Bulk Infrastructure expanded its Oslo Internet Exchange (OS-IX) data center in 2025 by adding three new data halls, doubling IT capacity to around 14MW with rack densities from 3-4 kW to 40-50 kW per rack. This made OS-IX the largest data center in the Oslo metropolitan area, supporting AI, HPC, and cloud workloads with highly scalable infrastructure.

Western Norway (Bergen, Stavanger, and Coastal Zones)

Western Norway captures around 31% share driven by industrial and energy-sector data demand. Coastal sites near Stavanger leverage abundant renewable power and natural cooling. The region attracts offshore and energy analytics workloads. It also benefits from subsea cable proximity, improving latency for European clients. Green industrial clusters push sustainable data operations. Strong investments enhance long-term competitiveness.

- For instance, Equinor, headquartered in Stavanger, has invested in data centers using local hydropower and natural cooling to support offshore energy analytics. These facilities leverage nearby subsea cables to reduce latency and maintain PUE values near 1.1, aligning with regional sustainability goals documented in energy sector reports.

Northern and Central Norway (Trondheim and Emerging Zones)

Northern and Central regions account for nearly 17% of the market. Cooler climates and low-cost land attract new builds for edge and AI workloads. Trondheim emerges as a research-driven innovation hub. It leverages academic partnerships for digital infrastructure testing. It benefits from national grid expansion projects improving power reliability. Continued rural digitalization drives steady growth in this subregion.

Competitive Insights:

- Dell Inc.

- Equinix, Inc.

- Digital Realty

- Schneider Electric

- Vertiv Group Corp.

- ABB

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- IBM

- Fujitsu

The Norway Data Center Infrastructure Market features a competitive environment shaped by global technology leaders and regional operators. It benefits from strong partnerships between infrastructure providers and hyperscale clients. Vendors focus on modular design, renewable power integration, and automation to enhance energy efficiency and uptime. Schneider Electric and Vertiv dominate power and cooling segments, while Equinix and Digital Realty lead in colocation and interconnection capacity. Cisco and Huawei strengthen network integration through advanced switching platforms. IBM and Dell expand hybrid infrastructure portfolios aligned with enterprise digitalization. Continuous innovation, sustainability goals, and service differentiation define the evolving market structure.

Recent Developments:

- In June 2025, GreenScale acquired Tonstad DataPark, a 420,000 square meter site in Sirdal, West Agder County, Norway, with 300MW grid capacity approved by Glitre Nett and Statnett, planning a €2.5 billion investment for a four-building AI-ready campus, with the first phase operational by 2027.

- In March 2025, CoreWeave partnered with Bulk Infrastructure to deploy a large-scale NVIDIA GB200 NVL72 AI cluster at the N01 Datacenter Campus in Vennesla, Norway, enhancing compute capacity with 100% renewable energy and targeting operations by summer 2025.

Market Drivers

Market Drivers Market Challenges

Market Challenges Market Segmentation

Market Segmentation Regional Insights

Regional Insights