Executive summary:

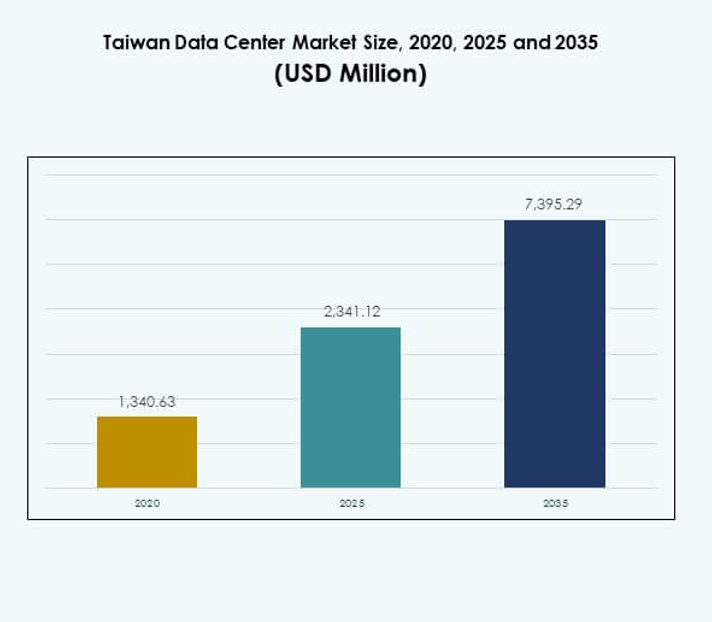

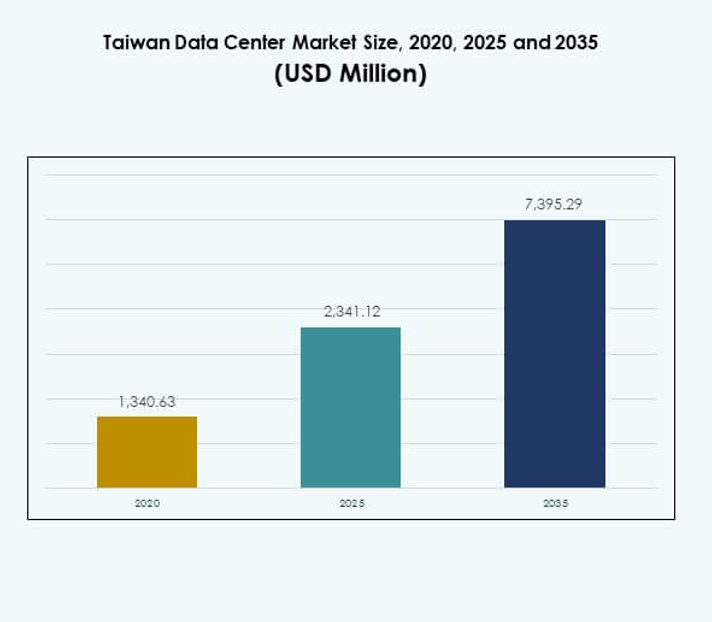

The Taiwan Data Center Market size was valued at USD 1,340.63 million in 2020 to USD 2,341.12 million in 2025 and is anticipated to reach USD 7,395.29 million by 2035, at a CAGR of 12.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Taiwan Data Center Market Size 2025 |

USD 2,341.12 Million |

| Taiwan Data Center Market, CAGR |

12.11% |

| Taiwan Data Center Market Size 2035 |

USD 7,395.29 Million |

The market is driven by rapid cloud adoption, AI integration, and the growing demand for low-latency infrastructure. Enterprises are investing in hybrid and multi-cloud strategies to improve flexibility and security. Taiwan’s strong semiconductor industry supports innovation in hardware and computing power. Government support for digital transformation strengthens infrastructure development. It positions Taiwan as a strategic hub for hyperscale, colocation, and advanced workloads. Businesses and investors see long-term growth potential through reliable and scalable infrastructure. Regionally, northern Taiwan leads with concentrated hyperscale and colocation investments, supported by strong connectivity and ICT clusters. Central Taiwan is emerging with enterprise-driven growth, benefiting from manufacturing expansion and localized data needs. Southern Taiwan gains importance through renewable energy integration and modular deployments. It attracts enterprises seeking sustainable and cost-effective infrastructure. Together, these regions position Taiwan as a balanced digital ecosystem connecting Northeast and Southeast Asia.

Market Drivers

Growing Demand for Advanced Digital Infrastructure Across Industries

The Taiwan Data Center Market is gaining strength due to its role in enabling digital transformation. Enterprises demand robust digital infrastructure to manage increasing data traffic and support critical workloads. Businesses rely on high-performance computing and scalable storage solutions to improve operational efficiency. Government initiatives supporting cloud adoption and smart city programs further accelerate infrastructure expansion. Strong digital adoption across BFSI, telecom, and healthcare increases demand for reliable facilities. Global investors view Taiwan as a strategic digital hub in Asia. It positions the country as a preferred destination for hyperscale expansion. The strong base of semiconductor and ICT industries reinforces data center ecosystem growth.

Accelerated Cloud Adoption and Strong Enterprise Shift Toward Hybrid Models

Enterprises in Taiwan rapidly migrate workloads to cloud platforms while adopting hybrid architectures. Cloud service providers expand their infrastructure footprint to meet enterprise requirements. Demand for hybrid and multi-cloud strategies grows as businesses aim for flexibility and resilience. Global providers see Taiwan as a strategic location to connect with Asia-Pacific markets. It enables companies to manage regional workloads with efficiency and security. Enterprises also demand better connectivity through submarine cables and cross-border networks. Such advancements enhance Taiwan’s importance as a regional data hub. The country benefits from strong international collaboration in cloud and hybrid solutions. Businesses find long-term value in adopting secure and scalable hybrid strategies.

- For instance, in March 2023, Google Cloud launched Dedicated Interconnect services in Taiwan, providing enterprises private connectivity options delivering up to 200 Gbps per connection via dual 100 Gbps connections, supporting hybrid and multi-cloud strategies with secure cross-border networking.

Rising Investments in High-Performance Computing and Emerging Technologies

The market expands with rapid integration of AI, IoT, and 5G-driven applications. Enterprises demand low-latency computing to enable automation, smart manufacturing, and real-time analytics. Investors are focusing on AI-ready infrastructure and GPU-based clusters. Taiwan’s expertise in semiconductors drives innovation in high-performance hardware for data centers. It helps operators reduce costs while ensuring energy efficiency and scalability. Growing demand for edge computing infrastructure boosts adoption of modular facilities. Enterprises rely on new technologies to support advanced workloads. Partnerships between global cloud leaders and local operators expand innovation capacity. Strategic investment in future-ready systems increases Taiwan’s importance as a technology-driven hub.

- For instance, in May 2025, NVIDIA and Foxconn began construction of the Hon Hai Kaohsiung Super Computing Center in Taiwan, featuring 4,608 NVIDIA Blackwell GPUs to deliver over 90 exaflops of AI performance, making it the fastest supercomputer in the country for AI-driven workloads and smart city applications.

Government Support and Strategic Importance for Global Connectivity

Government support for digital transformation fosters innovation-friendly policies and regulatory frameworks. Initiatives encourage foreign direct investments in data infrastructure. Strong demand for regional connectivity drives submarine cable projects and international partnerships. Taiwan’s geographic position enhances its role as a link between Northeast and Southeast Asia. It strengthens cross-border digital services and cloud adoption. The Taiwan Data Center Market supports global companies expanding in Asia. It provides stable investment opportunities through infrastructure resilience and digital security. Businesses recognize the market’s importance in enhancing operational continuity. The government’s focus on cybersecurity and data sovereignty makes Taiwan a trusted digital hub.

Market Trends

Rapid Growth of Edge and Modular Data Centers to Support Low-Latency Needs

The Taiwan Data Center Market is shifting toward edge and modular facilities to support demand for low-latency services. Telecom providers and enterprises invest in micro data centers for IoT and smart city deployments. The rise of autonomous systems, telemedicine, and real-time analytics fuels adoption of edge computing. Modular facilities offer scalability and cost efficiency for enterprises with dynamic requirements. It supports localized data processing to improve speed and reliability. Demand grows in retail, healthcare, and manufacturing industries. Edge deployments create opportunities for rapid service delivery. Taiwan’s infrastructure maturity encourages operators to adopt modular designs with strong resilience.

Sustainability and Energy Efficiency Emerging as Central Investment Themes

Operators prioritize green initiatives to reduce carbon footprints and align with sustainability goals. The market focuses on renewable energy adoption including solar and offshore wind power. Energy-efficient cooling systems and AI-driven power optimization improve operational efficiency. It highlights Taiwan’s role in sustainable infrastructure development. Enterprises demand eco-friendly solutions to meet ESG commitments. Waste heat recovery and power usage effectiveness optimization gain importance. Investments in renewable-backed facilities attract global players focused on sustainability. Market leaders integrate circular energy models to lower operational costs. Taiwan is positioned as a regional leader in sustainable data infrastructure.

Expansion of Colocation Services Driven by Cost Efficiency and Scalability Needs

Colocation providers see rising demand from enterprises aiming to reduce infrastructure costs. The Taiwan Data Center Market benefits from organizations preferring flexible colocation over building proprietary facilities. It enables SMEs and large enterprises to manage workloads effectively. Colocation services attract global players seeking local market entry. Enterprises prefer shared facilities due to scalability, security, and operational resilience. Demand from financial institutions and government agencies enhances colocation adoption. Submarine cable projects support international connectivity for colocation customers. Operators expand multi-tenant facilities to cater to digital-first businesses. Colocation strengthens Taiwan’s role in regional digital connectivity networks.

Advanced AI, Blockchain, and FinTech Driving New Infrastructure Demands

Emerging technologies accelerate demand for high-density computing infrastructure. AI workloads require GPU clusters and liquid cooling systems. The Taiwan Data Center Market integrates blockchain and FinTech solutions requiring strong security frameworks. It creates new infrastructure opportunities for BFSI and digital commerce. Blockchain adoption in supply chains and government services drives computing demand. AI-based predictive analytics reshapes healthcare and retail data needs. It pushes operators to innovate in design and efficiency. Market participants expand partnerships to meet evolving AI and FinTech workloads. Taiwan emerges as a destination for advanced digital technology adoption.

Market Challenges

High Energy Demand and Rising Concerns Over Sustainability Compliance

The Taiwan Data Center Market faces challenges from high energy requirements linked to rapid expansion. Operators confront rising electricity costs while meeting sustainability targets. Balancing efficiency with increasing workloads remains a critical concern. Enterprises expect eco-friendly solutions, but limited renewable capacity creates dependency on fossil fuels. It raises pressure on operators to deploy innovative cooling and power management systems. Strict government regulations on emissions demand compliance, impacting cost structures. Achieving low PUE across large facilities requires substantial capital investments. Sustainability targets are challenging, especially with high-density workloads and rapid AI adoption.

Geopolitical Risks and Data Sovereignty Limitations Affecting International Expansion

Taiwan faces geopolitical risks that may impact foreign investments and cross-border digital services. Regional tensions create uncertainty for global operators considering expansion. The Taiwan Data Center Market must navigate strict compliance rules on data sovereignty. Enterprises need secure environments for sensitive workloads, raising regulatory pressure. It increases costs for compliance frameworks and cybersecurity measures. International investors hesitate due to concerns over long-term stability. Dependence on submarine cables for connectivity creates vulnerability to disruptions. It underscores the importance of resilient infrastructure. Balancing foreign investments with sovereignty laws is a continuing challenge for operators.

Market Opportunities

Rising Role of Taiwan as a Regional Digital Gateway in Asia-Pacific

The Taiwan Data Center Market creates opportunities by positioning itself as a regional hub. Its location strengthens cross-border connectivity across Northeast and Southeast Asia. Enterprises benefit from reliable interconnection and submarine cable projects. It supports global businesses with low-latency services and international cloud adoption. Taiwan’s role as a digital gateway attracts hyperscale investments. It enables businesses to access growing Asian digital markets with resilience. Operators gain long-term advantages by aligning with global network expansions. The market offers strong opportunities for investors seeking scalable and secure infrastructure.

Expansion of AI-Ready and Industry-Specific Infrastructure Solutions

Growing demand for AI workloads and industry-specific applications creates new investment opportunities. The Taiwan Data Center Market integrates GPU clusters and AI-optimized infrastructure. Enterprises in BFSI, healthcare, and manufacturing drive demand for specialized facilities. It allows service providers to target vertical-specific opportunities with tailored solutions. Edge deployments strengthen AI use cases in retail and logistics. Blockchain-driven FinTech services require secure and high-density facilities. Operators see opportunities to innovate with industry-oriented solutions. The market expands scope for investors and technology providers.

Market Segmentation

By Component

Hardware dominates the Taiwan Data Center Market due to strong demand for servers, storage, and cooling systems. High-performance hardware is essential to support AI, 5G, and IoT workloads. Power and cooling solutions attract significant investment to maintain efficiency. Software solutions such as DCIM and automation gain importance for real-time monitoring. Services including managed services and consulting grow steadily with enterprise outsourcing. Hardware maintains the largest share, driven by Taiwan’s semiconductor ecosystem and ICT expertise.

By Data Center Type

Hyperscale data centers lead the Taiwan Data Center Market due to demand from global cloud providers. Colocation facilities follow closely, serving enterprises seeking flexibility and cost savings. Edge and modular centers are expanding with IoT adoption. Enterprise-owned data centers retain importance for sensitive government and defense applications. Cloud/IDC facilities continue rapid growth with digital commerce and FinTech expansion. Mega data centers support large-scale AI workloads. Hyperscale and colocation remain the strongest contributors to overall market growth.

By Deployment Model

Cloud-based deployment dominates the Taiwan Data Center Market with rising enterprise adoption of SaaS and PaaS. Hybrid deployment gains traction as companies seek a balance between flexibility and security. On-premises models retain relevance for regulated sectors such as BFSI and defense. Cloud-based adoption supports scalability and cost efficiency. Hybrid deployments enhance resilience by combining private and public cloud environments. Enterprises rely on hybrid strategies to manage multi-regional operations. Cloud-based and hybrid models will continue driving majority of new investments.

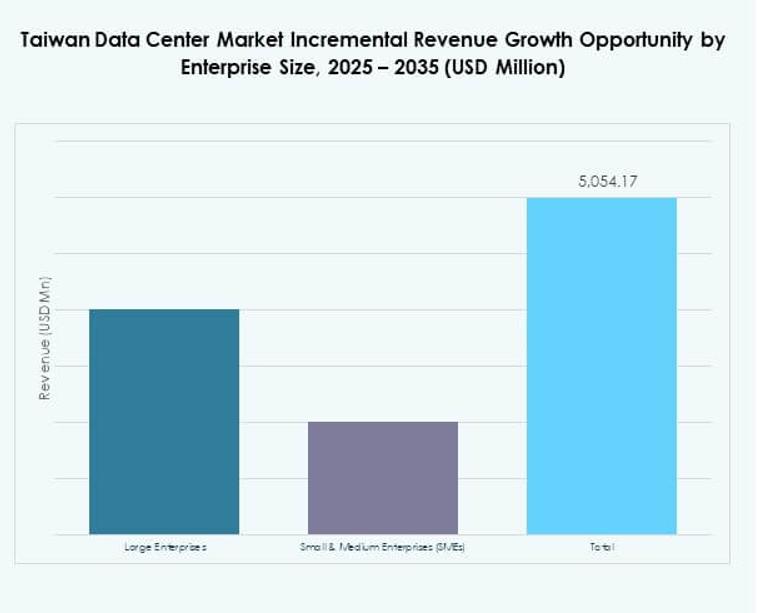

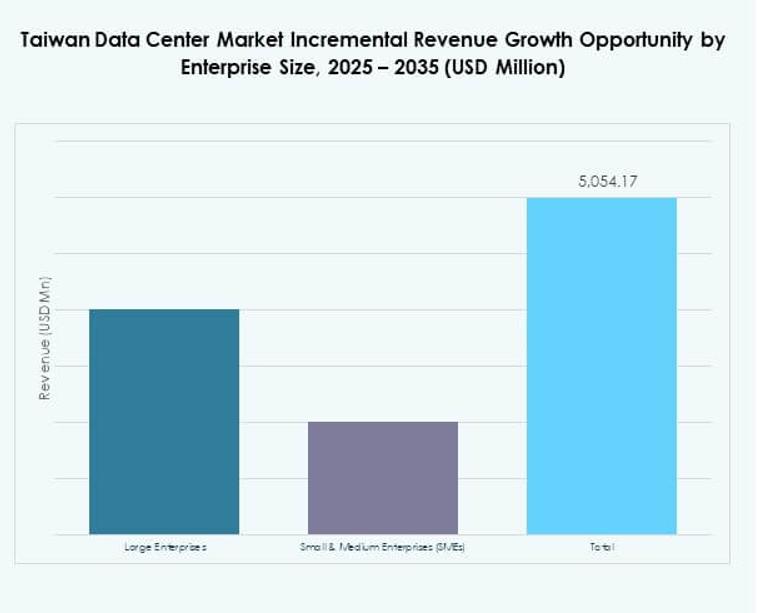

By Enterprise Size

Large enterprises hold the largest share in the Taiwan Data Center Market due to their extensive IT infrastructure needs. BFSI, telecom, and manufacturing sectors lead demand for large-scale deployments. SMEs increasingly adopt colocation and cloud-based solutions for affordability. The SME segment grows rapidly with digital commerce and startup ecosystems. It relies on flexible deployment to remain competitive. Both segments contribute significantly, but large enterprises maintain dominance. Their focus on security, compliance, and resilience strengthens demand for enterprise-grade facilities.

By Application / Use Case

IT and telecom lead the Taiwan Data Center Market with the highest share due to digital transformation and 5G adoption. BFSI follows with demand for secure, high-performance computing to support digital banking. Healthcare expands adoption for telemedicine and patient data management. Media and entertainment drive storage growth due to OTT platforms. Retail and e-commerce rely on scalable data centers for online operations. Manufacturing strengthens smart factory deployment. Education and energy utilities are emerging contributors. IT and telecom maintain leadership across applications.

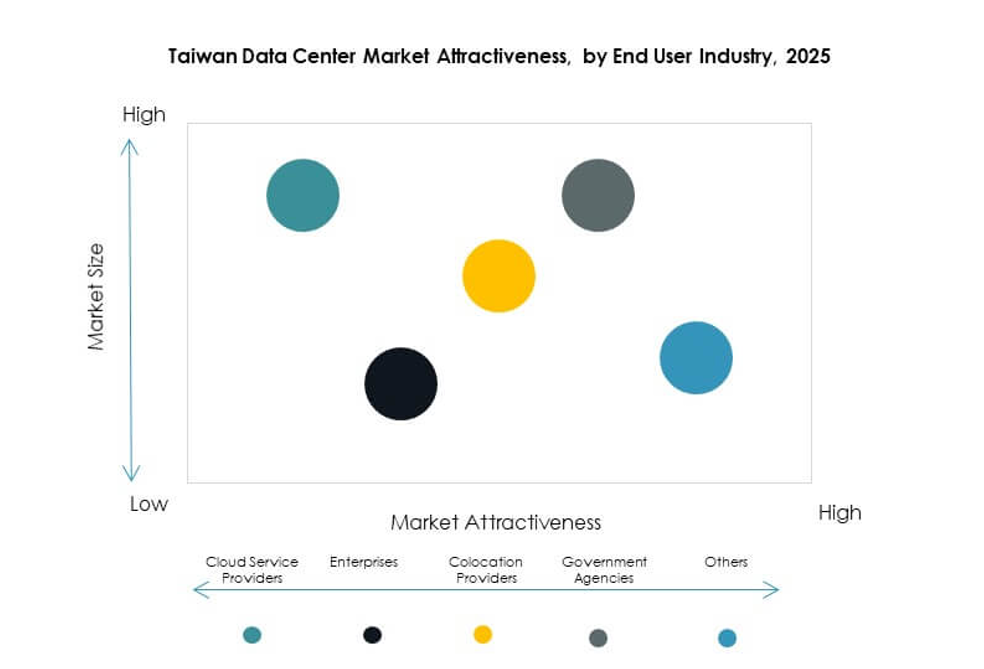

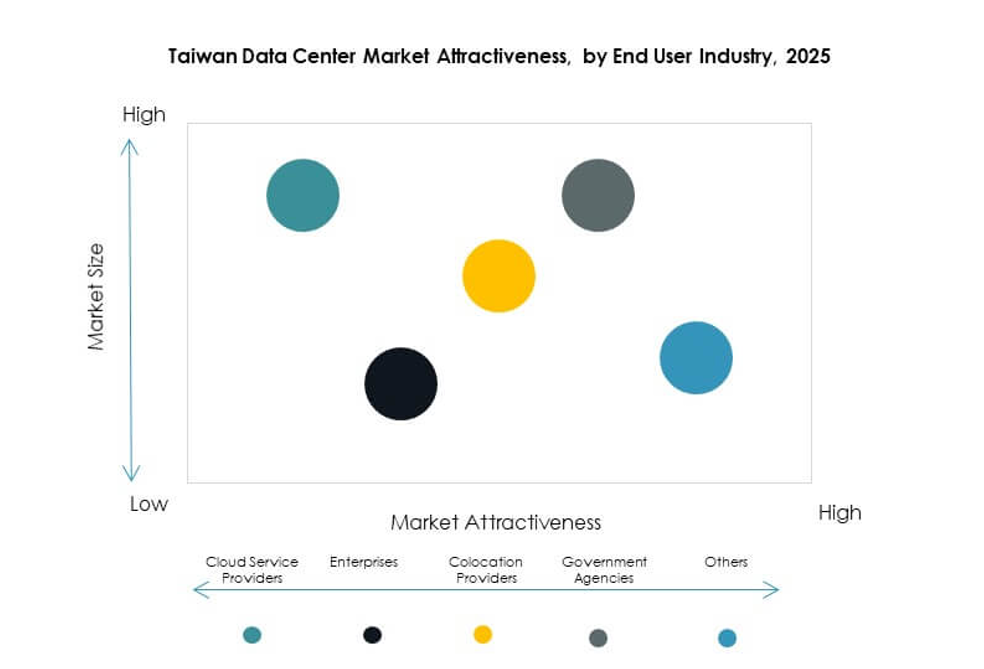

By End User Industry

Cloud service providers dominate the Taiwan Data Center Market with the largest share, driven by global hyperscale players. Enterprises adopt colocation and hybrid models to support critical workloads. Government agencies invest in secure infrastructure to safeguard public data. Colocation providers grow steadily, attracting SMEs and foreign players. Others including energy and education add diversity to end-user demand. Cloud providers continue to invest heavily, reinforcing Taiwan’s position as a regional hub.

Regional Insights

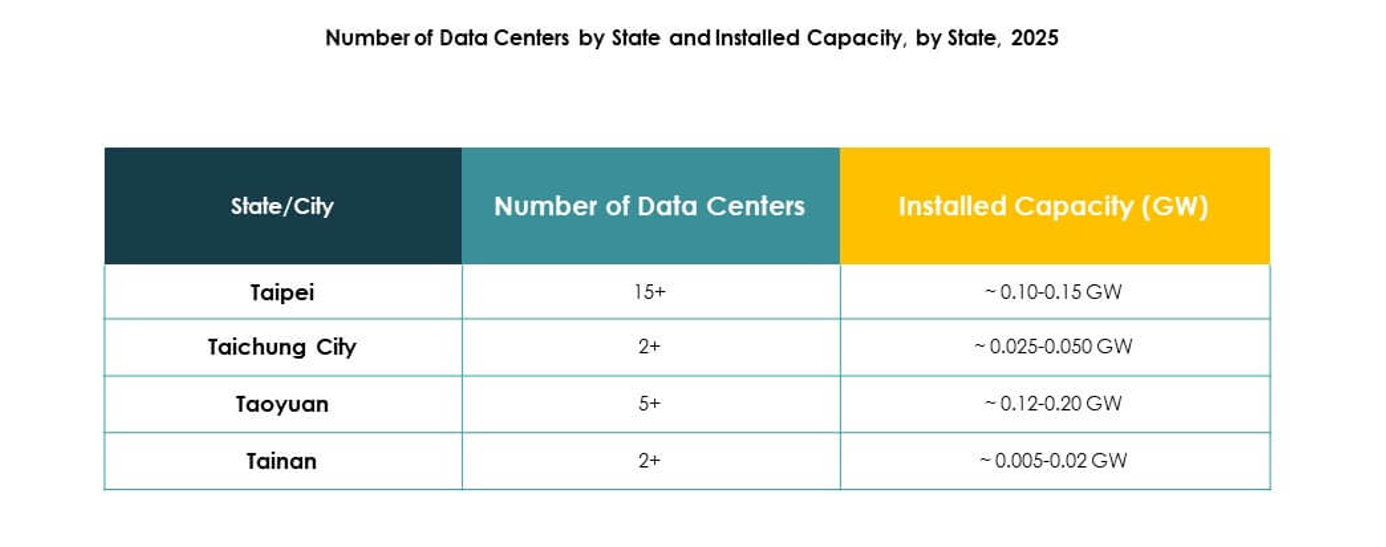

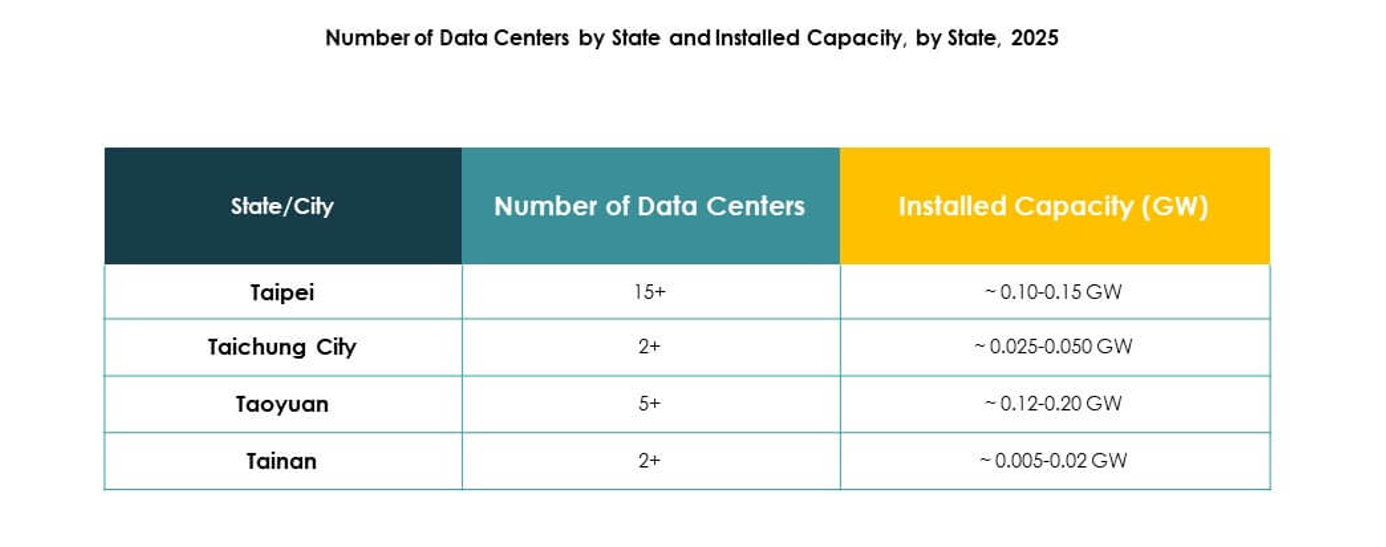

Northern Taiwan Driving Growth With Dominant 58% Market Share

Northern Taiwan leads the Taiwan Data Center Market with a 58% share. Taipei and New Taipei serve as hubs for hyperscale and colocation investments. The region benefits from strong connectivity, submarine cables, and ICT clusters. It supports financial institutions, government operations, and multinational corporations. Northern Taiwan’s dominance comes from high demand for large-scale and hybrid deployments. It remains the preferred location for global operators entering Taiwan. Investors find long-term stability in the region’s infrastructure ecosystem.

- For instance, Chunghwa Telecom joined a multinational consortium in July 2025 for the Asia United Gateway East Submarine Cable System (AUG East), which will deploy an 8,900-kilometer cable and establish two new landing stations in Yilan and Taitung, enhancing Taiwan’s international network redundancy and capacity for hyperscale demands.

Central Taiwan Emerging With 25% Share Driven by Manufacturing and Enterprise Needs

Central Taiwan holds a 25% share of the market, fueled by manufacturing and enterprise sectors. Taichung emerges as a growing hub for colocation and enterprise-owned facilities. It supports smart manufacturing initiatives with localized data processing. The region benefits from industrial expansion requiring scalable IT infrastructure. Enterprises adopt modular and hybrid data centers for resilience. Central Taiwan plays a growing role in serving local and regional needs. It strengthens overall market balance by diversifying capacity across regions.

Southern Taiwan Holding 17% Share and Rising With Renewable Energy Integration

Southern Taiwan contributes 17% of the Taiwan Data Center Market, with strong growth potential. Kaohsiung leads in integrating renewable energy with data center expansion. The region attracts investments due to lower land costs and green energy access. It serves industries requiring high energy efficiency and sustainability compliance. Southern Taiwan is gaining attention for modular and edge deployments. It supports emerging enterprises with localized digital solutions. The region’s renewable advantage positions it as a future growth center.

- For instance, in April 2025, Google signed its first offshore wind power purchase agreement in Asia for its Taiwan data center, committing to 495 MW of offshore wind energy from the Fengmiao I project to support 24/7 carbon-free operations, advancing Taiwan’s renewable sector leadership and positioning Google as a global clean energy pioneer.

Competitive Insights:

- Chunghwa Telecom

- Taiwan Mobile

- FarEasTone Telecom

- Asia-Pacific Telecom

- Cellsite Network Services

- NTT Communications Corporation

- Digital Realty Trust, Inc.

- Microsoft Corporation

- AWS Taiwan

- Google Cloud Taiwan

The competitive landscape of the Taiwan Data Center Market reflects strong collaboration between domestic telecom providers and global cloud operators. Local players such as Chunghwa Telecom, Taiwan Mobile, and FarEasTone dominate the colocation and enterprise segments, supported by nationwide networks and government relationships. Global firms including AWS Taiwan, Microsoft, and Google Cloud expand hyperscale and cloud-based infrastructure to address growing enterprise adoption. NTT Communications and Digital Realty strengthen international connectivity and multi-tenant facilities. It benefits from a balanced mix of domestic resilience and foreign investment, ensuring diversified service offerings. Competitive intensity drives innovation in sustainability, edge deployments, and AI-ready infrastructure. This dynamic environment positions Taiwan as a regional hub where global and local firms compete and collaborate to deliver scalable, secure, and efficient digital services.

Recent Developments:

- In July 2025, Foxconn (Hon Hai Precision Industry) entered a strategic partnership with TECO Electric & Machinery to accelerate AI data center development in Taiwan and abroad. The collaboration aims to deliver modular AI data center infrastructure, combining Foxconn’s AI server strengths with TECO’s expertise in industrial electromechanical systems, and focuses on scalable, green data center solutions to serve markets in Taiwan, the Middle East, and the United States.

- In July 2025, the Taiwan data center market was reported to have added 8,000 new rack spaces and over 60 MW of additional power capacity, driven by heavy investment from global technology companies in cloud computing, artificial intelligence, and semiconductor industries. Taipei leads among key cities in expansion, reflecting the swift development of the nation’s data center ecosystem.

- In May 2025, Foxconn and Nvidia, joined by the Taiwan government, announced a high-profile collaboration to build an AI data center, also described as an “AI factory,” in Taiwan. The first phase will target a power capacity of 100 megawatts, with infrastructure supplied by Foxconn and Nvidia providing thousands of its Blackwell GPUs. The initiative is set to fuel AI innovation for researchers and enterprises and is supported by the Taiwan National Science and Technology Council and TSMC.