Executive summary:

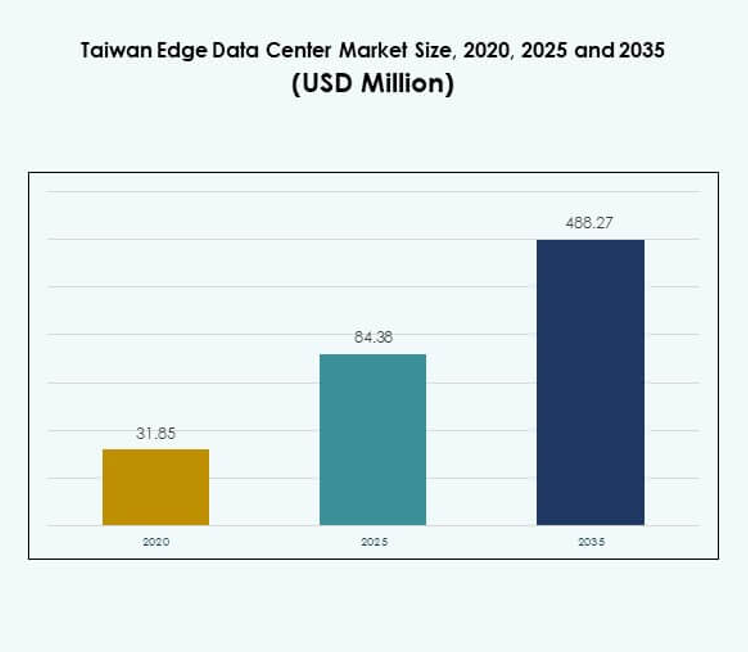

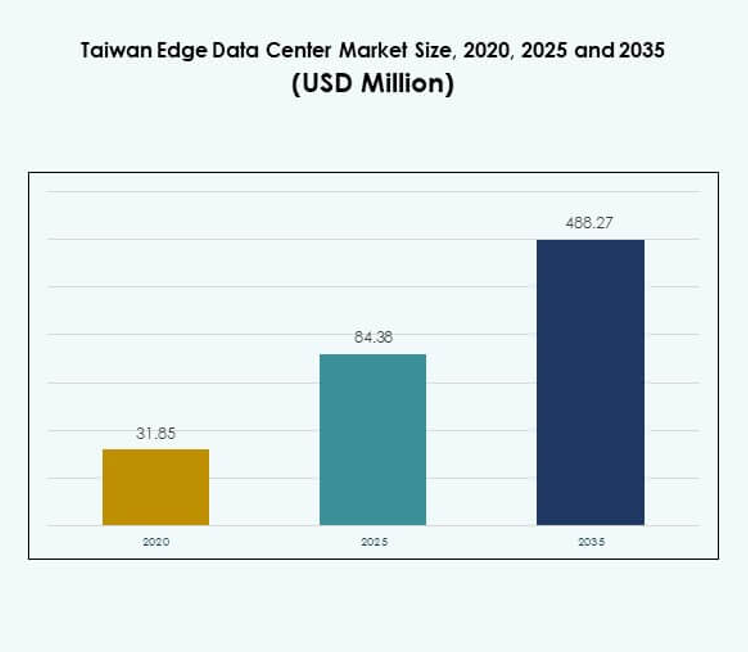

The Taiwan Edge Data Center Market size was valued at USD 31.85 million in 2020 to USD 84.38 million in 2025 and is anticipated to reach USD 488.27 million by 2035, at a CAGR of 19.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Taiwan Edge Data Center Market Size 2025 |

USD 84.38 Million |

| Taiwan Edge Data Center Market, CAGR |

19.01% |

| Taiwan Edge Data Center Market Size 2035 |

USD 488.27 Million |

Strong technology adoption and rapid digital transformation are fueling the market expansion. Enterprises across telecom, manufacturing, and IT sectors are deploying edge infrastructure to support AI, IoT, and real-time applications. It plays a key role in enabling ultra-low latency networks and advanced computing capabilities. Innovation in modular and energy-efficient data center solutions further strengthens infrastructure readiness. The market’s strategic value continues to grow for businesses and investors focused on digital resilience and operational agility. North Taiwan leads the regional landscape due to its advanced network backbone, major enterprise clusters, and strategic connectivity. Central Taiwan is emerging as a strong manufacturing hub, driving demand for automation-enabled edge facilities. South Taiwan is steadily expanding with investments in smart infrastructure and logistics networks. This regional distribution creates a balanced ecosystem that supports national connectivity goals and positions Taiwan as a critical digital hub in Asia.

Market Drivers

Rapid Integration of Edge Infrastructure with Advanced Cloud Ecosystems

The growing demand for ultra-low latency solutions drives rapid integration of edge and cloud networks. Businesses rely on advanced connectivity to handle real-time applications in manufacturing, logistics, and telecom. It supports faster processing closer to the end user, improving operational agility and cost efficiency. Enterprises invest in next-generation infrastructure to meet rising data volume. Key developers deploy modular designs to scale operations effectively. Investors view edge infrastructure as a core element of digital transformation. Taiwan Edge Data Center Market strengthens national competitiveness by supporting industry 4.0. Its strategic relevance encourages broader digital ecosystem growth.

Strong Technology Adoption Across Industrial and Commercial Applications

Industrial players actively embrace AI, IoT, and 5G-driven solutions to modernize their processes. Digital infrastructure upgrades allow seamless integration of connected devices. It enhances speed, security, and performance of critical systems. Businesses prioritize real-time data management to meet service-level requirements. Manufacturing, healthcare, and logistics sectors lead adoption. Growing use of smart sensors and edge devices boosts localized processing capabilities. Firms invest in scalable platforms that lower operational risks. Taiwan Edge Data Center Market gains strategic strength from broad-based industry deployment, accelerating ecosystem maturity.

- For instance, Inventec showcased next-generation Edge AI infrastructure at COMPUTEX 2025, held in May in Taipei. The company presented its Artemis II rack solutions (in partnership with NVIDIA), designed for large-scale generative AI training and inference, and diversified edge AI applications for smart factories and healthcare. These deployments highlight Inventec’s leadership in AI-powered edge computing for verticals such as digital health and intelligent retail in Taiwan.

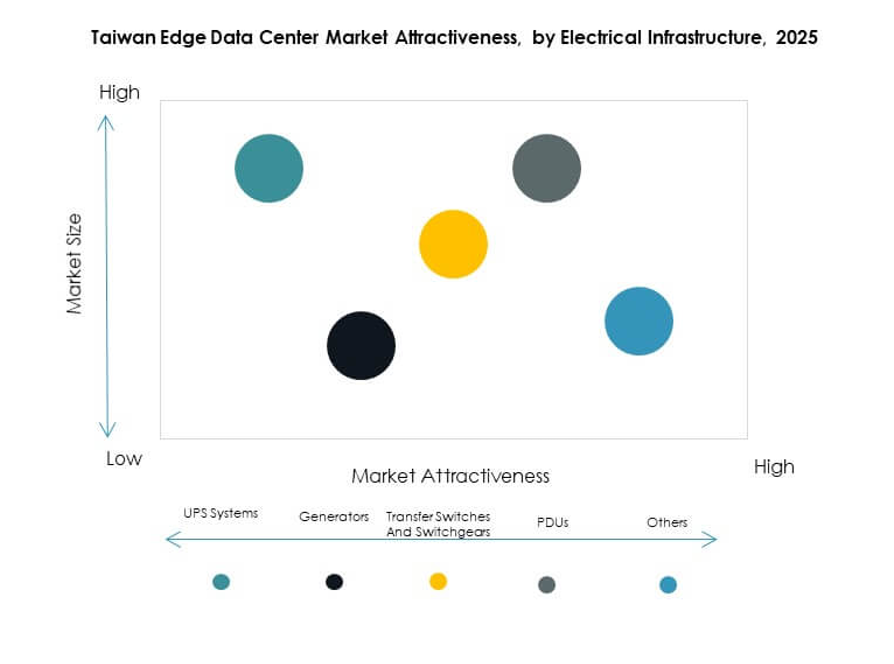

Innovation in Energy-Efficient and Scalable Edge Infrastructure

Data centers are adopting advanced cooling, renewable energy integration, and modular structures to reduce energy costs. Companies focus on green infrastructure to meet ESG goals and regulatory targets. It enhances performance efficiency and aligns operations with sustainability strategies. Edge facilities deliver lower power usage effectiveness, supporting cost savings and compliance. Modular construction enables faster deployments with minimal physical footprint. Enterprises expand deployment strategies to strengthen regional service availability. Innovation attracts strategic investors seeking resilient infrastructure. Taiwan Edge Data Center Market benefits from sustained investments in energy-smart technologies.

- For instance, at Data Centre World Asia in October 2025, Delta Electronics unveiled a 20-foot containerized data center solution featuring a liquid-to-air coolant distribution unit with up to 80 kW of cooling capacity and modular power systems scalable up to 2,400 kW. The showcased technology is built to accelerate AI adoption while reducing operational costs and improving sustainability through high-efficiency liquid cooling and power management innovations.

Strategic Role in Strengthening National and Cross-Border Digital Infrastructure

Edge facilities enhance Taiwan’s position in Asia’s digital supply chain. Global enterprises expand their network presence to ensure low-latency service delivery. It provides stronger data sovereignty and supports critical national infrastructure. Government programs promote high-speed connectivity, creating strong investor confidence. Firms view the market as an operational base for wider regional coverage. Strategic deployments enable smooth integration with 5G and submarine cable systems. Cross-border data flow becomes more efficient. Taiwan Edge Data Center Market supports economic growth through strong digital infrastructure alignment.

Market Trends

Surge in AI-Enabled Edge Applications Across Sectors

Enterprises accelerate AI deployment in edge environments to improve processing speed. AI workloads at the edge lower reliance on centralized facilities. It allows smarter decision-making and faster response times. Industrial automation, smart logistics, and connected healthcare adopt edge AI solutions. Companies invest in flexible hardware and software stacks to support scalability. AI-powered edge nodes boost cost efficiency and network resilience. Firms prioritize security and real-time analytics capabilities. Taiwan Edge Data Center Market reflects this growing shift toward intelligent edge ecosystems.

Shift Toward Hybrid Edge-Cloud Operating Models

Many enterprises adopt hybrid models to balance flexibility and control. Edge computing manages time-sensitive workloads, while cloud handles large-scale data processing. It allows firms to optimize performance and costs. Businesses rely on these models to scale digital operations without infrastructure strain. Telecom and financial services firms lead this transition. Integration of orchestration platforms enhances workload portability. Providers offer customizable solutions to meet sector-specific needs. Taiwan Edge Data Center Market aligns with hybrid architectures that increase service delivery resilience.

Growing Preference for Sustainable and Modular Edge Infrastructure

Edge operators integrate renewable energy sources to meet environmental targets. Modular and containerized deployments help reduce energy usage and land footprint. It accelerates installation timelines and supports flexible scaling. Sustainability-linked financing further boosts project development. Enterprises prefer eco-friendly data centers for compliance and brand image. Compact designs suit urban and remote locations equally. Industry stakeholders view green infrastructure as a growth catalyst. Taiwan Edge Data Center Market expands through sustainable infrastructure innovations.

Expansion of Edge Connectivity Through Telecom and Cloud Partnerships

Telecom operators partner with hyperscalers and cloud firms to build regional edge nodes. Strategic alliances enhance network capacity and coverage. It enables faster access to applications and services across industries. This expansion supports new use cases in retail, gaming, and industrial automation. Infrastructure providers co-develop advanced connectivity frameworks. Strong partnerships accelerate service rollout in underserved areas. Investments ensure stable connectivity and broader reach. Taiwan Edge Data Center Market advances with telecom-cloud collaborations reshaping the edge landscape.

Market Challenges

High Infrastructure Costs and Complexity of Edge Deployment

Edge deployment involves extensive capital expenditure, creating entry barriers for smaller firms. Operators face rising costs for power, connectivity, and advanced cooling systems. It requires skilled resources to maintain service reliability and security. Integration with existing IT environments often demands costly customization. Limited availability of suitable locations adds further complexity. Investors assess long-term ROI carefully before committing large sums. The challenge impacts deployment speed and coverage scope. Taiwan Edge Data Center Market must balance expansion with sustainable capital allocation strategies.

Security Risks, Regulatory Pressures, and Operational Constraints

Edge networks require strong security frameworks to protect distributed endpoints. Regulatory standards on data handling are tightening, increasing compliance demands. It creates operational challenges for multinational firms managing multiple jurisdictions. Infrastructure fragmentation raises vulnerability to cyber threats. Organizations must align with strict data governance frameworks to maintain trust. Power availability and network stability remain critical concerns in dense deployments. Firms face the task of ensuring operational continuity across distributed facilities. Taiwan Edge Data Center Market navigates these issues while supporting rapid digital growth.

Market Opportunities

Rising Investments in 5G and Advanced Connectivity Infrastructure

5G expansion creates opportunities for deploying advanced edge facilities nationwide. It boosts use cases across smart cities, autonomous systems, and manufacturing. Strong connectivity enhances real-time analytics capabilities. It draws global firms seeking competitive network advantages. Telecom and hyperscale alliances accelerate capacity expansion. Public and private investments strengthen ecosystem resilience. Taiwan Edge Data Center Market benefits from improved speed, latency, and coverage alignment.

Emerging Use Cases Across Industrial, Commercial, and Consumer Applications

Industries adopt edge platforms to support mission-critical functions. Smart grids, precision manufacturing, and connected healthcare represent major opportunity zones. It enables localized processing and strong security. Enterprises gain improved decision-making capabilities. Service providers launch tailored solutions to meet these needs. This growth attracts new entrants and investors. Taiwan Edge Data Center Market expands through rising application diversity across multiple sectors.

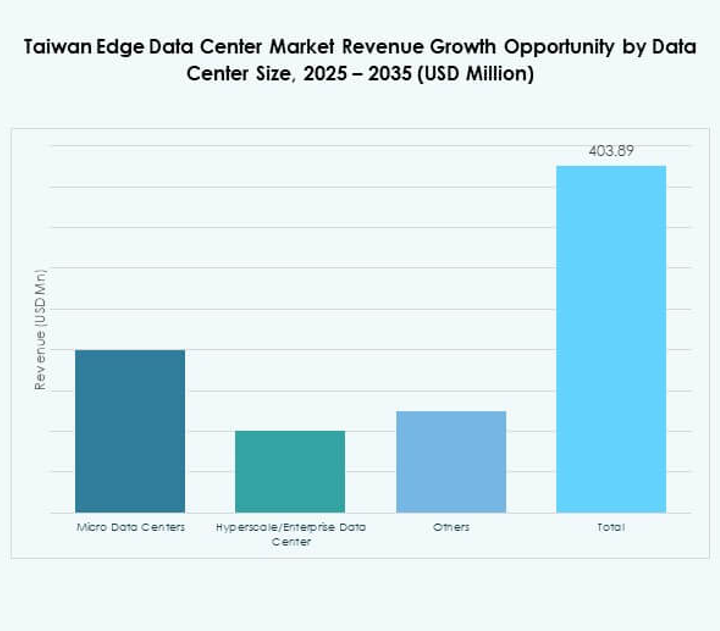

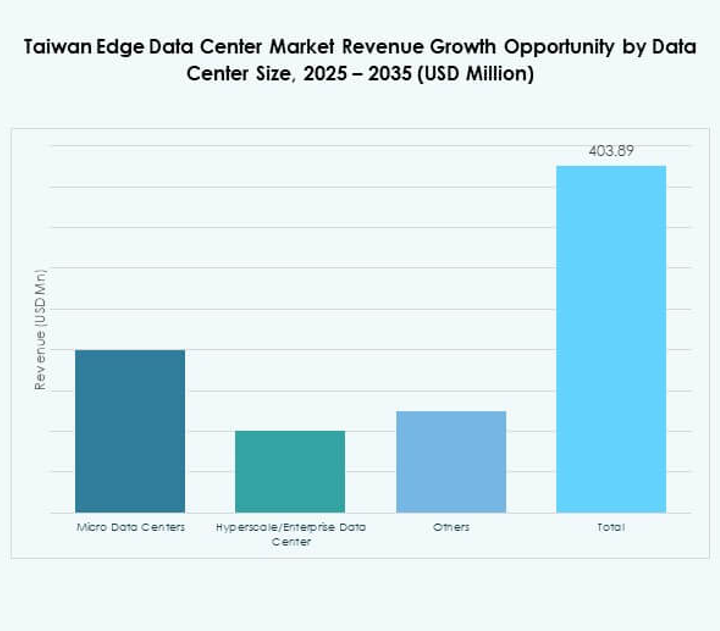

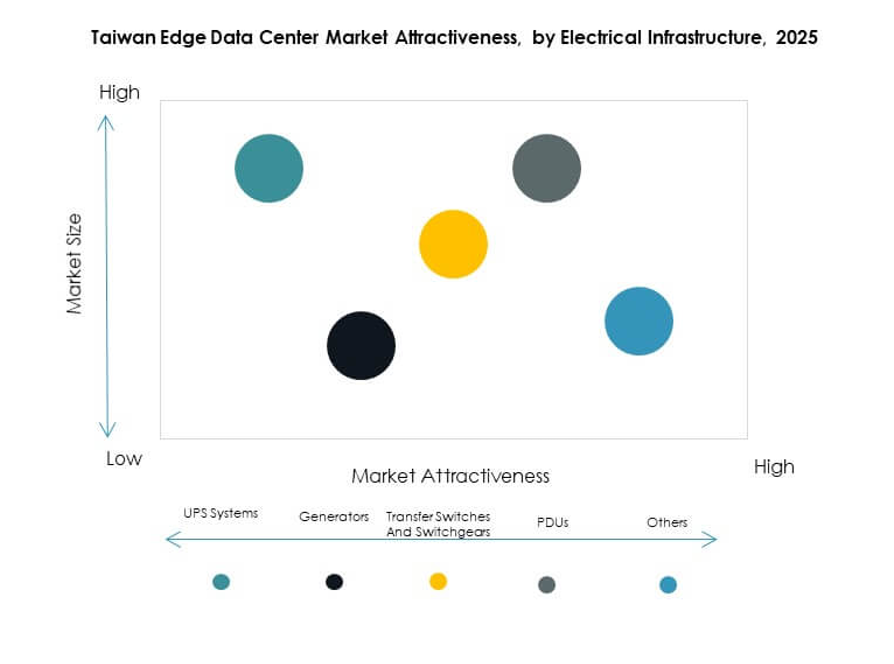

Market Segmentation

By Component

Solution dominates this segment with strong demand for hardware and software integration. Enterprises prioritize advanced servers, storage, and network solutions for faster processing. It ensures seamless connectivity and reliability for mission-critical workloads. Service offerings complement core infrastructure with management, monitoring, and maintenance capabilities. Solution holds the largest market share, supported by rapid adoption across telecom and IT. Taiwan Edge Data Center Market benefits from solution-led deployments that enhance scalability and performance.

By Data Center Type

Colocation Edge Data Center holds the largest market share in this segment. Enterprises prefer colocation facilities for lower upfront costs and faster deployment. It offers flexible infrastructure without compromising performance. Managed and cloud edge models are also growing steadily with hybrid strategies. Service providers expand capacity to support multi-tenant requirements. Businesses focus on security, speed, and availability. Taiwan Edge Data Center Market gains strength from colocation-led investments.

By Deployment Model

Hybrid deployment model leads this segment with strong enterprise adoption. Firms balance workload distribution between edge and centralized environments. It enhances operational flexibility and cost efficiency. On-premises deployments support sensitive data needs, while cloud expands service reach. Hybrid solutions improve redundancy and disaster recovery capabilities. Enterprises adopt them to achieve optimal performance. Taiwan Edge Data Center Market reflects this strong preference for hybrid deployment.

By Enterprise Size

Large Enterprises dominate this segment due to their capacity to invest in infrastructure. They deploy edge solutions to improve operational control and service quality. It enables fast scaling and supports complex applications. SMEs follow with increasing adoption driven by managed service models. Flexible pricing and leasing options encourage participation. Strong enterprise demand accelerates ecosystem maturity. Taiwan Edge Data Center Market sees significant growth from large enterprise investments.

By Application / Use Case

Power Monitoring dominates the use case segment with extensive industrial adoption. It supports reliable and efficient energy management across critical facilities. It ensures real-time visibility and control over power loads. Asset and capacity management also show strong demand for operational optimization. BI and analysis enhance decision-making across sectors. Enterprises adopt these use cases for better resource allocation. Taiwan Edge Data Center Market grows through power monitoring-led deployments.

By End User Industry

IT and Telecommunications lead this segment with the highest market share. Edge infrastructure supports low-latency services and strong connectivity frameworks. It enables telecom operators to extend network coverage efficiently. BFSI, healthcare, and retail sectors also adopt edge solutions rapidly. Energy and defense industries follow with secure deployment needs. Strong telecom demand drives capacity expansion across the region. Taiwan Edge Data Center Market strengthens through telecom-led infrastructure growth.

Regional Insights

North Taiwan – Dominant Share and Core Infrastructure Expansion

North Taiwan accounts for 52% share of the Taiwan Edge Data Center Market, driven by dense urbanization and advanced telecom infrastructure. Taipei’s strategic connectivity and strong enterprise base support fast adoption. It hosts major colocation and hyperscale deployments. Industrial hubs benefit from proximity to 5G backbone networks. The region attracts international investors due to strong connectivity advantages. It remains the core growth driver of edge deployment strategies in the country.

- For instance, Chunghwa Telecom inaugurated its Binjiang Data Center in New Taipei City, which houses 1,400 server racks and is built to TIA-942 Rated 4/Rated 3 specifications. The facility features dual power feed and advanced fire protection systems, positioning it among the most advanced data centers in Taiwan.

Central Taiwan – Emerging Growth Driven by Manufacturing and Industrial Hubs

Central Taiwan holds 29% share and is growing steadily through smart manufacturing expansion. Industrial parks adopt edge infrastructure to support automation and analytics. It attracts enterprises focused on operational efficiency and supply chain optimization. The presence of tech industries encourages edge deployment near production sites. Local governments support infrastructure development through targeted incentives. Taiwan Edge Data Center Market gains strong momentum in this manufacturing-focused subregion.

- For instance, Taiwan Semiconductor Manufacturing Company (TSMC) announced plans to begin construction of its new 1.4-nanometer Fab 25 in Taichung’s Central Taiwan Science Park in Q4 2025, with mass production expected in 2028. This advanced facility will strengthen Central Taiwan’s position as a key hub for next-generation semiconductor manufacturing.

South Taiwan – Rising Investments in Smart Infrastructure

South Taiwan holds 19% share with increasing investments in smart city and logistics projects. The subregion focuses on developing edge capabilities to support industrial and transportation networks. Port infrastructure and energy facilities integrate advanced monitoring and control systems. Strong renewable energy potential enhances green data center deployment. Technology partnerships encourage faster rollout of edge solutions. It shows significant potential for future infrastructure scaling and regional coverage expansion.

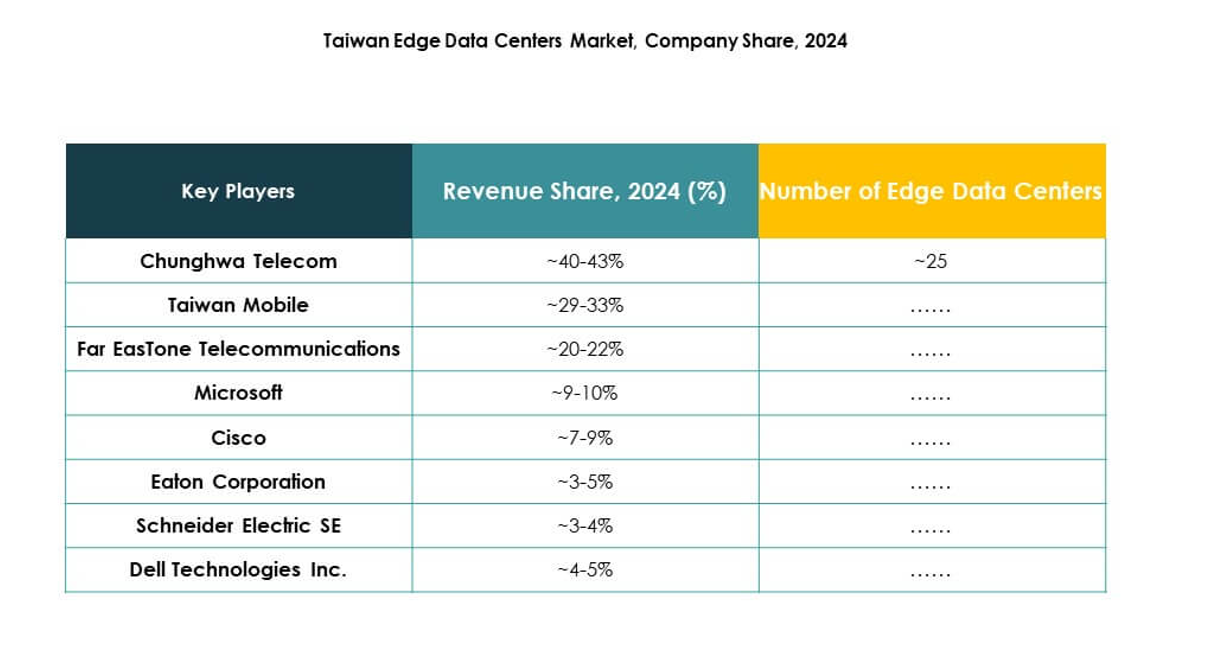

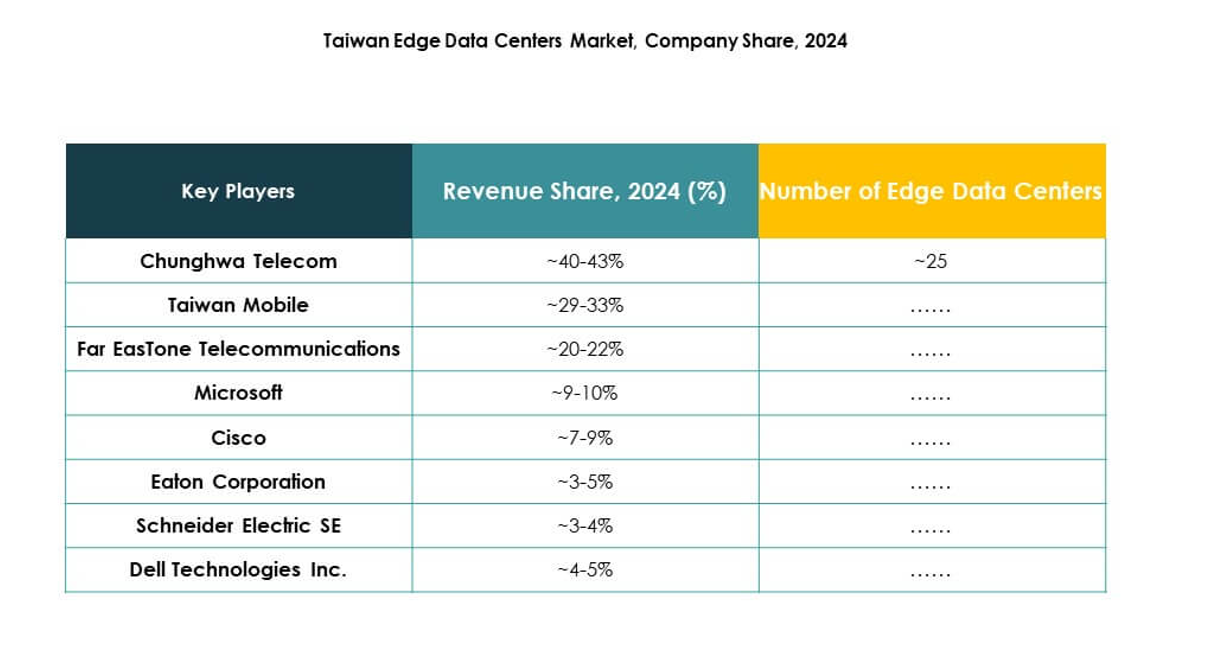

Competitive Insights:

- Chunghwa Telecom

- Taiwan Mobile

- Far EasTone Telecommunications

- Asia Pacific Telecom

- Vibo Telecom

- Fujitsu

- Cisco

- Eaton Corporation

- Dell Technologies Inc.

- Microsoft

- VMware

- Schneider Electric SE

- Rittal GmbH & Co. KG

The competitive landscape of the Taiwan Edge Data Center Market is shaped by telecom operators, global technology firms, and infrastructure solution providers. It features strong investments in 5G backbone networks, edge computing platforms, and modular infrastructure solutions. Telecom leaders hold a decisive advantage through extensive fiber networks and local market access. Global technology firms bring advanced software, automation, and cloud orchestration capabilities. Infrastructure providers strengthen their positions with power systems, enclosures, and energy-efficient designs. Partnerships between telecom operators and hyperscalers accelerate deployment speed and coverage. Competition focuses on technological differentiation, service reliability, and regional expansion strategies.

Recent Developments:

- In October 2025, Fujitsu announced an expanded strategic partnership with NVIDIA to build full-stack AI infrastructure that tightly integrates AI agents and high-performance computing, targeting the advancement of AI-driven industrial transformation. The collaboration aims to accelerate cross-industry, self-evolving digital platforms for data centers and edge computing, marrying Fujitsu’s own CPUs with NVIDIA GPUs.

- In October 2025, Delta Electronics unveiled advanced, energy-efficient solutions at Data Center World Asia. The launch included a 20-foot Containerized Data Center and a Power Train Unit designed explicitly for AI edge applications. These innovations feature state-of-the-art cooling technologies, including a liquid-to-air coolant distribution unit capable of delivering up to 80 kW cooling capacity.

- In October 2025, Edgecore Networks announced the launch of its latest Nexvec™ turnkey AI infrastructure solution at global industry events. This platform integrates open networking switches with GPU-based compute resources, enabling streamlined deployment of AI and machine learning environments.

- In September 2025, Taiwan Mobile expanded its footprint in digital entertainment through a partnership with Nada Holdings to support the launch of multiple new gaming titles and build a robust entertainment ecosystem integrating content creation, digital platforms, and cross-border cooperation across Southeast Asia.

- In April 2025, Chunghwa Telecom signed a landmark agreement with Astranis to launch Taiwan’s first dedicated MicroGEO satellite, expanding resilient communications infrastructure nationwide and bolstering non-terrestrial network capabilities.