Executive summary:

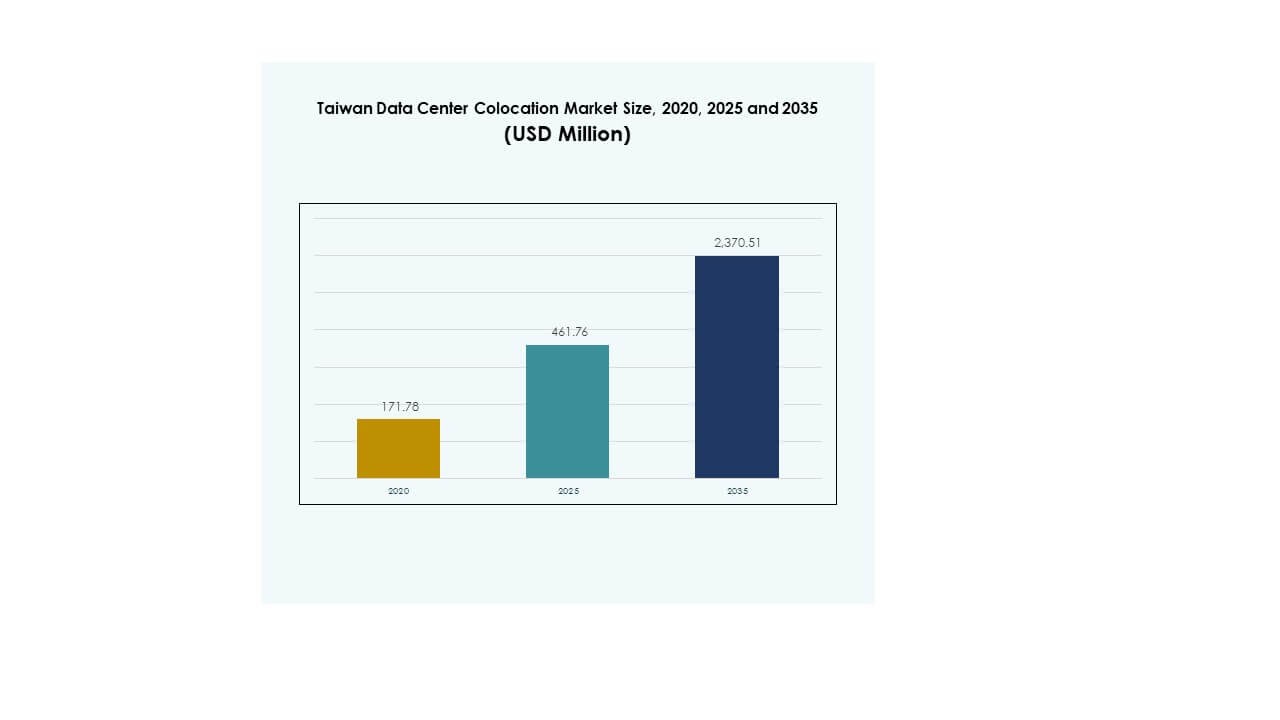

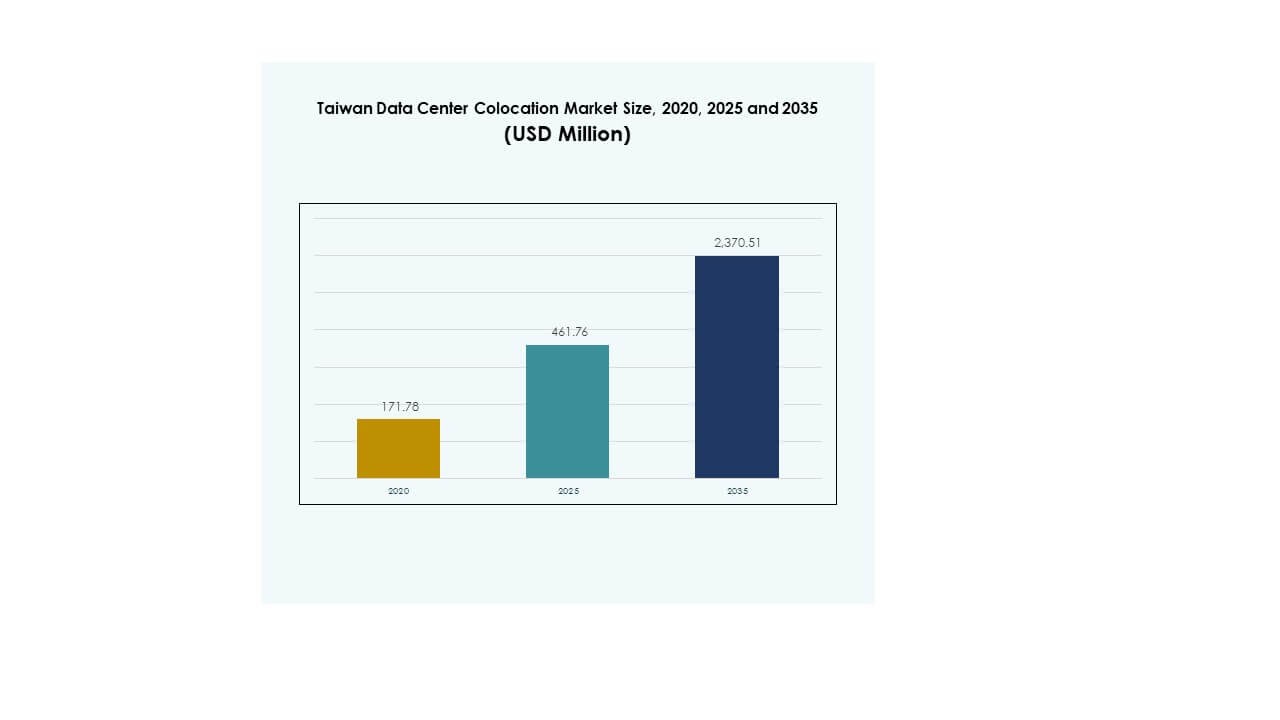

The Taiwan Data Center Colocation Market size was valued at USD 171.78 million in 2020 to USD 461.76 million in 2025 and is anticipated to reach USD 2,370.51 million by 2035, at a CAGR of 17.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Taiwan Data Center Colocation Market Size 2025 |

USD 461.76 Million |

| Taiwan Data Center Colocation Market, CAGR |

17.67% |

| Taiwan Data Center Colocation Market Size 2035 |

USD 2,370.51 Million |

The market is expanding rapidly due to growing AI integration, cloud adoption, and edge computing developments. Enterprises are shifting workloads to colocation facilities to strengthen operational resilience, improve connectivity, and reduce infrastructure costs. Strategic partnerships between hyperscalers and local operators are accelerating innovation. Strong digital transformation momentum and energy-efficient infrastructure make the market a priority for businesses and investors seeking scalable and future-ready assets.

Northern Taiwan leads the market due to its advanced connectivity infrastructure, dense enterprise clusters, and hyperscale deployment activity. Central Taiwan is emerging as a secondary hub, supported by renewable energy growth and industrial development. Southern Taiwan shows strong expansion potential through strategic infrastructure projects and growing enterprise interest, reinforcing the country’s regional digital ecosystem.

Market Drivers

Rising Demand for Scalable and Resilient Digital Infrastructure Across Core Sectors

The Taiwan Data Center Colocation Market benefits from strong demand for scalable and resilient digital infrastructure across banking, retail, telecom, and manufacturing sectors. Enterprises are shifting workloads to colocation facilities to secure reliable power, advanced security, and uninterrupted connectivity. It supports mission-critical workloads and minimizes downtime, enabling firms to maintain operational continuity. Businesses prioritize colocation over on-premises setups to reduce infrastructure costs. The market supports edge computing strategies for faster application performance. Strong data protection and regulatory compliance make it a preferred model for enterprises. Investors view this stability as a foundation for long-term returns. Strategic infrastructure investment continues to grow.

Growing Integration of AI, Cloud, and IoT in Enterprise Applications

Digital transformation accelerates demand for advanced colocation infrastructure capable of supporting AI, IoT, and multi-cloud ecosystems. Enterprises rely on low-latency networks to run applications such as predictive analytics and automation. The Taiwan Data Center Colocation Market plays a central role in supporting these technology-intensive workloads. It provides flexible capacity and carrier-neutral connectivity to meet evolving business needs. Hyperscalers and cloud providers are expanding partnerships with local operators to enable AI-ready deployments. Businesses prefer colocation to avoid heavy upfront investments in infrastructure. Energy-efficient cooling and power systems improve operational sustainability. Strong technology adoption enhances the market’s strategic relevance for investors.

- For instance, Microsoft announced its plan to launch a new Azure cloud region in Taiwan by 2026, expanding its global infrastructure of over 70 datacenter regions. The new region is designed to strengthen cloud capacity and regulatory compliance across Asia.

Expanding Hyperscale Investments and Strong Digital Transformation Momentum

Hyperscale players are expanding infrastructure footprints in Taiwan to meet growing enterprise demand. Strong growth in cloud computing, cybersecurity, and big data drives higher utilization of colocation capacity. The Taiwan Data Center Colocation Market acts as a critical backbone for supporting global data exchange. It allows businesses to scale operations quickly while maintaining cost efficiency. Investment activity reflects confidence in the country’s connectivity ecosystem and strategic location. Telecom operators collaborate with cloud vendors to strengthen cross-border interconnectivity. This alignment accelerates digital transformation in multiple industries. Investor interest continues to rise with growing infrastructure scalability.

- For instance, Google has invested over USD 1.6 billion in its Changhua County data center since 2011, making it a key hub for its Asia-Pacific cloud operations. The facility supports Google’s commitment to clean energy and carbon-free operations in the region.

Favorable Regulatory Environment and Green Energy Integration Strategies

Government-led initiatives are promoting green energy adoption and regulatory clarity in the colocation sector. Energy-efficient facilities with renewable integration improve long-term operational sustainability. The Taiwan Data Center Colocation Market benefits from predictable compliance structures and stable policy frameworks. It enables investors to commit capital with greater confidence. Enterprises adopt green strategies to meet ESG reporting requirements. Infrastructure providers invest in advanced cooling technologies and carbon reduction measures. These efforts enhance the market’s global competitiveness. Regulatory support continues to attract new entrants and expand capacity pipelines.

Market Trends

Rising Shift Toward Edge Data Centers to Improve Network Efficiency

Edge data centers are gaining importance to support latency-sensitive applications in IoT, AI, and 5G networks. Enterprises deploy edge facilities to process data closer to end users, improving response times and reducing network congestion. The Taiwan Data Center Colocation Market aligns with this shift, offering distributed infrastructure capabilities. It helps industries improve user experience and streamline operational processes. Telecom operators are rolling out edge nodes across urban areas. Enterprises view edge integration as a key enabler for real-time workloads. Strong demand for AI-driven analytics supports this trend. Edge deployments also strengthen the country’s digital infrastructure backbone.

Growing Adoption of Modular and Prefabricated Data Center Solutions

Operators are adopting modular and prefabricated designs to expand capacity faster and control costs. These solutions provide flexibility, faster deployment, and energy-efficient operations. The Taiwan Data Center Colocation Market leverages these advancements to meet surging enterprise demands. It allows operators to scale efficiently without extended construction timelines. Prefabrication supports rapid response to new technology requirements. Investors view this as a way to reduce project risks and increase ROI timelines. Demand from cloud, telecom, and enterprise sectors is reinforcing the modular trend. Energy-efficient designs further enhance market resilience.

Increasing Focus on Renewable Energy and Sustainable Operations

Colocation operators are integrating renewable energy sources to lower carbon emissions and optimize power efficiency. This shift aligns with Taiwan’s broader sustainability targets and global ESG standards. The Taiwan Data Center Colocation Market supports energy-efficient innovations such as liquid cooling and smart energy management. It helps operators lower operational costs and meet green compliance norms. Investors prefer sustainable infrastructure portfolios due to long-term cost savings. Enterprises also seek environmentally responsible colocation partners. Renewable integration improves overall operational reliability. Green strategies increase global competitiveness for operators in this market.

Strengthening Interconnectivity Ecosystems and Carrier-Neutral Expansion

Carrier-neutral facilities are expanding across strategic locations to support multi-cloud and hybrid strategies. Enterprises prefer neutral connectivity models to optimize costs and improve interoperability. The Taiwan Data Center Colocation Market plays a key role in enabling interconnectivity between hyperscalers, telecom operators, and enterprises. It improves data traffic efficiency across regional and global networks. Expanding carrier-neutral hubs supports cross-border traffic flows. Investors view this as a strong foundation for long-term growth. Telecom partnerships further strengthen peering and exchange capacity. Interconnectivity remains central to enterprise infrastructure strategies.

Market Challenges

Power Availability Constraints and Growing Pressure on Energy Infrastructure

Power availability remains a key challenge for operators as demand for colocation capacity rises sharply. Taiwan’s existing energy infrastructure faces increased stress from hyperscale and enterprise expansions. The Taiwan Data Center Colocation Market must address growing electricity needs while ensuring operational stability. It requires heavy investment in power generation and grid upgrades to support sustained growth. Limited renewable integration capacity can delay expansion timelines. Power costs also impact operator margins and pricing strategies. Reliability remains critical to attract international clients. Operators continue to explore innovative energy management and efficiency solutions.

Intensifying Market Competition and Rising Cost of Land and Construction

Rising competition among local and global operators creates pricing pressures and increases market entry barriers. Real estate costs for suitable data center locations are increasing across major urban areas. The Taiwan Data Center Colocation Market experiences tightening margins due to high infrastructure costs. It also faces challenges in securing skilled labor for advanced operations. Strong competition drives heavy capital commitments to maintain technical differentiation. Long approval timelines for permits can delay facility launches. Operators must balance cost control with innovation investments. Strategic partnerships and scale efficiencies help sustain competitiveness.

Market Opportunities

Strategic Positioning as a Key Gateway for Asia-Pacific Digital Connectivity

Taiwan’s location offers direct connectivity to major Asian economies, creating strong growth potential for new investments. The Taiwan Data Center Colocation Market benefits from proximity to Japan, South Korea, and Southeast Asia. It enables enterprises to establish regional hubs for data exchange and low-latency connectivity. Government incentives encourage foreign investment in critical infrastructure. Strong subsea cable networks further improve capacity expansion prospects. This position attracts hyperscalers and telecom carriers seeking regional reach. Strategic partnerships continue to strengthen its role as a connectivity hub. Investor interest remains robust across large-scale projects.

Rapid AI and Cloud Adoption Creating High-Value Infrastructure Demand

Enterprises across industries are deploying AI-driven applications and cloud platforms to enhance productivity and resilience. The Taiwan Data Center Colocation Market supports this transition with flexible capacity, connectivity, and carrier-neutral environments. It enables companies to scale without heavy capital expenditure. Demand for GPU-ready infrastructure strengthens hyperscale deployments. Colocation facilities offer ideal environments for high-performance computing workloads. This surge opens new opportunities for operators and investors. Technological advancements continue to drive new investment pipelines. AI integration increases infrastructure utilization rates and long-term returns.

Market Segmentation

By Type

Retail colocation dominates the Taiwan Data Center Colocation Market, driven by rising demand from enterprises seeking cost-effective, secure, and flexible infrastructure. It holds a significant share due to its suitability for multiple workloads. Wholesale colocation follows, supported by hyperscale investments from cloud providers. Hybrid cloud colocation is gaining momentum as businesses adopt multi-cloud strategies. Demand for carrier-neutral facilities supports retail leadership. The segment benefits from enterprise migration from on-premises setups. Retail models offer better flexibility for scaling. Investors prefer retail due to steady recurring revenues.

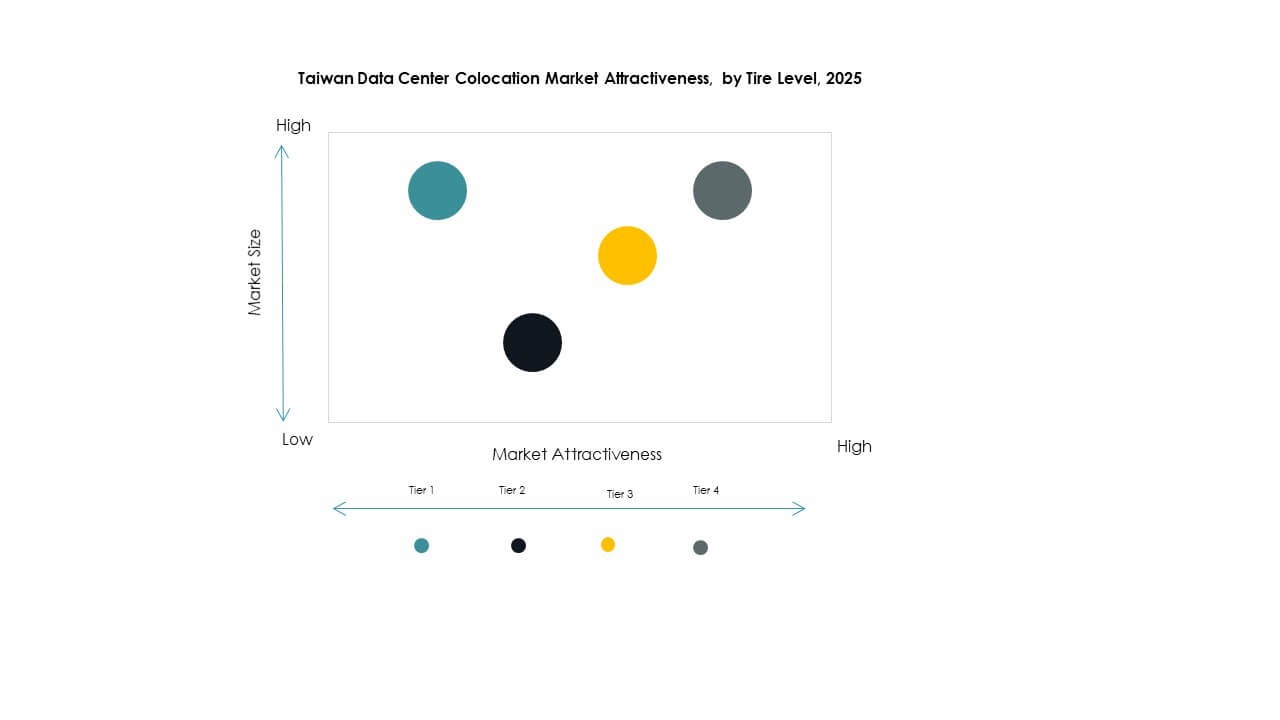

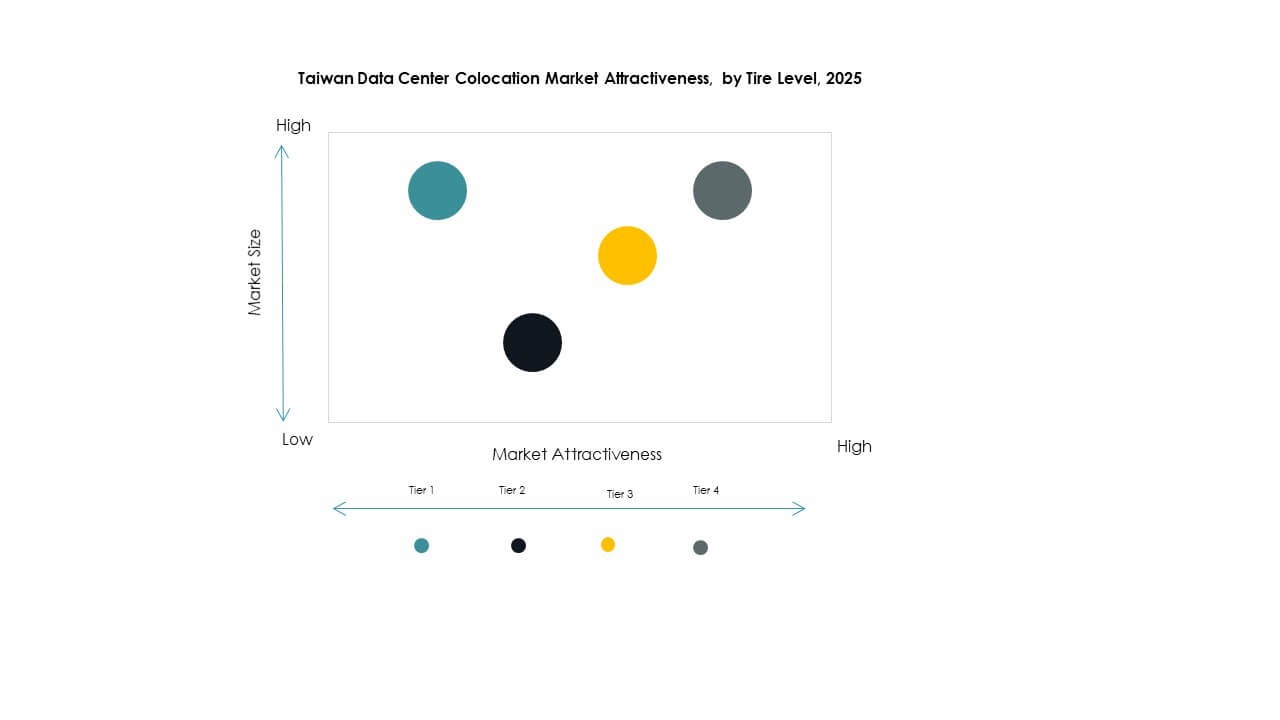

By Tier Level

Tier 3 facilities hold the dominant share of the Taiwan Data Center Colocation Market, supported by strong reliability and efficient power usage. Enterprises prefer Tier 3 for critical workloads requiring high uptime. Tier 4 is growing steadily due to advanced fault tolerance and hyperscale requirements. Tier 1 and Tier 2 attract smaller enterprises with moderate IT needs. Tier 3’s balance between cost and resilience makes it a preferred option. Expanding cloud integration strengthens Tier 3 adoption. Energy efficiency improvements support its expansion. Investor confidence remains strong in this segment.

By Enterprise Size

Large enterprises lead the Taiwan Data Center Colocation Market, driven by strong IT infrastructure needs and global service requirements. SMEs show increasing adoption, supported by flexible pricing models and managed service options. Large organizations prioritize colocation to reduce CAPEX and enhance scalability. SMEs adopt it for improved security and connectivity. Strong digital transformation trends support adoption across both segments. Large firms drive most capacity demand. SME adoption continues to rise in urban areas. This dual demand strengthens overall market depth and revenue streams.

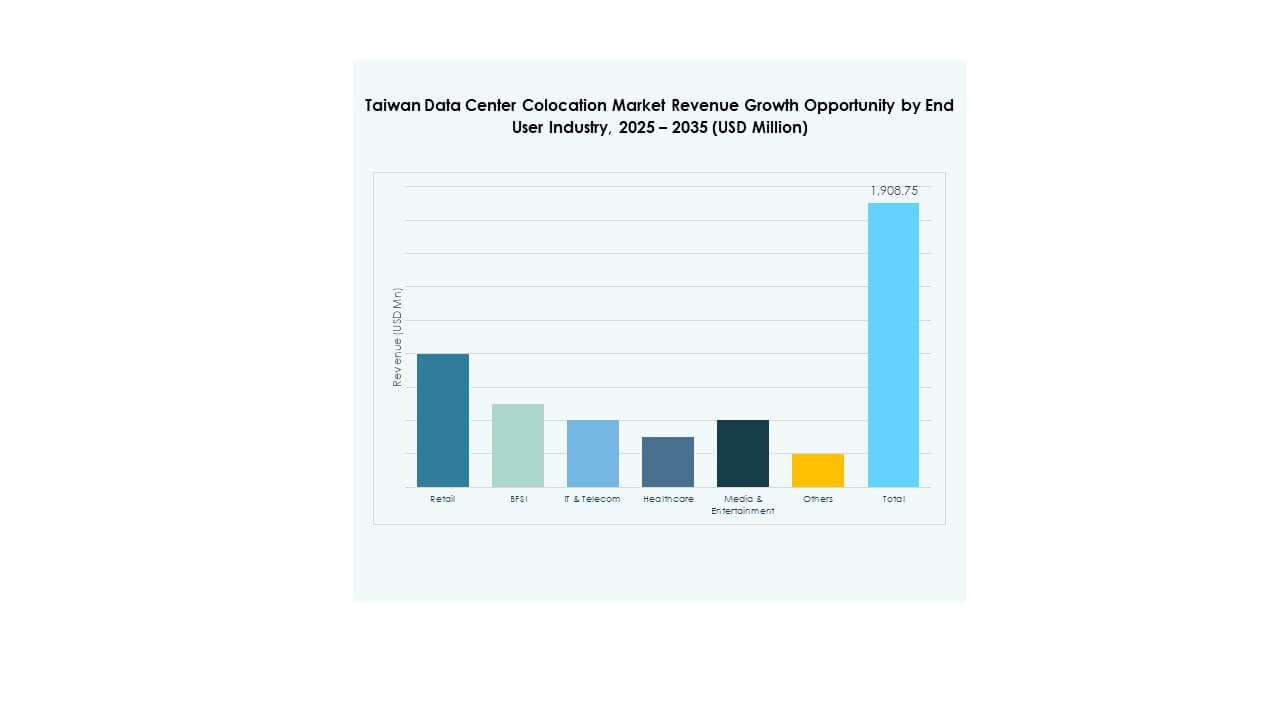

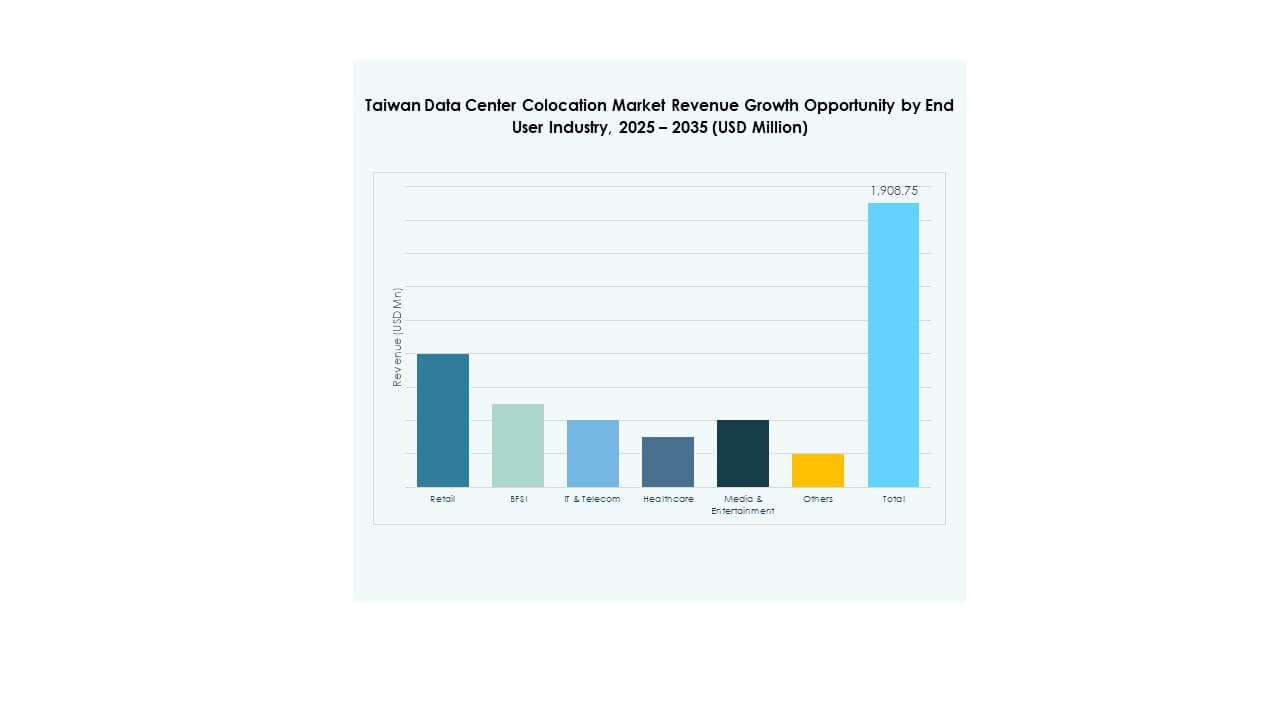

By End User Industry

The IT and Telecom sector dominates the Taiwan Data Center Colocation Market, supported by cloud migration, AI integration, and 5G expansion. BFSI ranks second, driven by security and regulatory needs. Retail, healthcare, and media are growing users of colocation facilities. IT and Telecom’s strong demand ensures stable capacity utilization. Enterprises in BFSI rely on secure facilities to protect sensitive data. Healthcare uses colocation for data management and telemedicine platforms. Media leverages it for content delivery. IT and Telecom continues to anchor market growth.

Regional Insights

Northern Taiwan: Leading Regional Hub with 54% Market Share

Northern Taiwan leads the Taiwan Data Center Colocation Market with a 54% share, supported by strong connectivity, urban infrastructure, and enterprise concentration. Taipei hosts most hyperscale deployments due to its proximity to business districts and government institutions. It benefits from multiple submarine cable landings and robust grid infrastructure. Operators focus on building high-capacity facilities to support enterprise demand. Strong cloud, AI, and fintech growth drives continued investment. Government policies supporting energy-efficient infrastructure further strengthen the region’s leadership position.

Central Taiwan: Rapid Expansion Driven by Industrial and Renewable Integration

Central Taiwan holds 28% of the Taiwan Data Center Colocation Market, supported by growing industrial zones and renewable energy initiatives. The region offers strategic locations with lower real estate costs compared to the north. Operators invest in energy-efficient designs to attract enterprise clients. It is emerging as a secondary hub for edge and hyperscale deployments. Government-backed projects improve grid reliability. Strong industrial presence fuels data demand. Infrastructure upgrades continue to boost competitiveness.

- For instance, Google’s 2025 partnership with Baseload Capital established the country’s first corporate power purchase agreement for geothermal energy, bringing 10 MW of “always-on” clean energy to central Taiwan data centers and setting a new standard for sustainable operations, as verified in the April 2025 Data Centre Magazine feature and Google public statements.

Southern Taiwan: Emerging Growth Cluster with Strategic Development Projects

Southern Taiwan accounts for 18% of the Taiwan Data Center Colocation Market, supported by ongoing infrastructure developments and expanding enterprise activity. The region focuses on industrial diversification and smart city projects. Energy availability improvements enhance colocation feasibility. Operators target this region for cost-competitive expansion. It is gaining traction among mid-sized enterprises seeking flexible deployments. Strategic connectivity enhancements strengthen regional positioning. Investment interest continues to grow in this emerging hub.

- For instance, Chunghwa Telecom won the 2025 Smart City Innovative Application Award at Kaohsiung Smart City Expo for deploying AI, 5G, and IoT analytics in smart governance projects across Kaohsiung.

Competitive Insights:

- Chunghwa Telecom

- Chief Telecom

- Taiwan Fixed Network

- Taifoong Telecom

- Google Cloud

- Taiwan Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Taiwan Data Center Colocation Market features strong competition among domestic telecom operators and global colocation providers. Chunghwa Telecom and Chief Telecom lead through extensive infrastructure networks and carrier-neutral services. Global players like Equinix, Digital Realty Trust, and NTT Ltd. strengthen their presence through hyperscale investments and advanced interconnectivity solutions. It is shaped by partnerships that expand capacity and enhance connectivity for cloud and AI workloads. Google Cloud supports ecosystem growth with hyperscale integration. Domestic firms hold strategic advantages through local regulatory alignment and power access. International providers focus on innovation, sustainability, and scalability. Competitive strategies center on expanding rack capacity, integrating renewable energy, and improving operational resilience to serve enterprise and hyperscale demand.

Recent Developments:

- In July 2025, Chunghwa Telecom received Frost & Sullivan’s prestigious 2025 Taiwan Data Center Services Competitive Strategy Leadership Award for its advancements in AI-ready infrastructure, modernization, and sustainability. The recognition also follows the company’s announcement of a hyperscale data center in northern Taiwan designed to support 12 MW of IT load, aimed at AI and high-performance computing workloads.

- In June 2025, Amazon Web Services (AWS) announced a major investment of over USD 5 billion to establish a multi-zone AWS region in Taiwan, marking the company’s largest digital infrastructure project in the country to date. This initiative represents a significant boost for Taiwan’s data center landscape, emphasizing long-term sustainability through renewable electricity sourcing, standardized campus design, and integration with local technology suppliers.

- In October 2024, Keppel Data Centres unveiled plans for an 80 MW Greenfield colocation campus in Taiwan, optimized for the evolving power and reliability requirements of AI and cloud workloads. Designed with modular scalability and sustainability in mind, the campus aligns with the increasing adoption of advanced computing systems fueled by global and local digital transformation.