Executive summary:

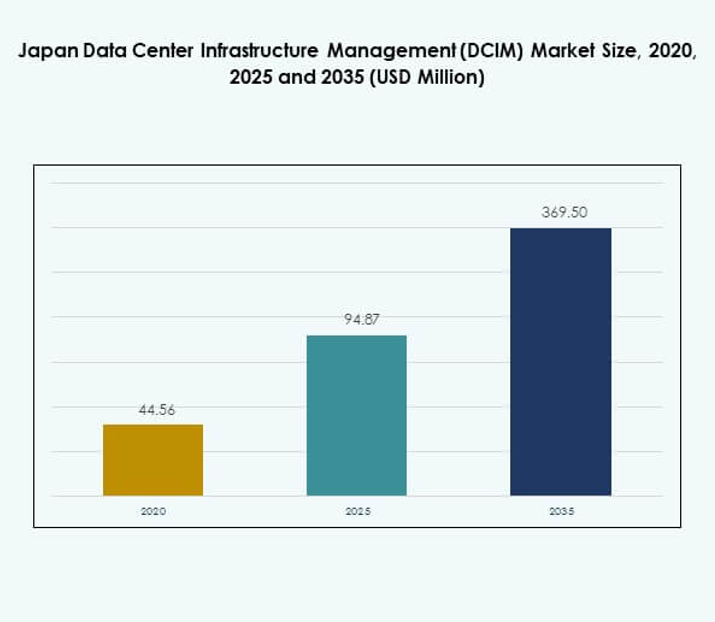

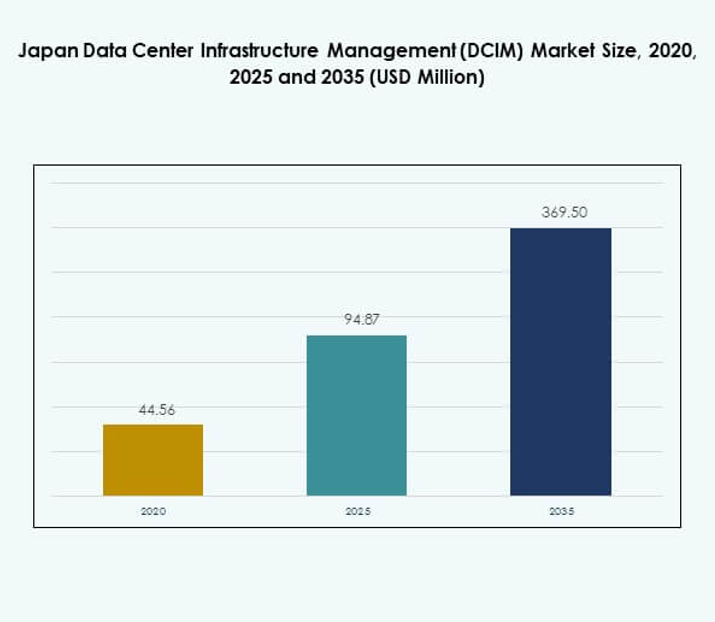

The Japan Data Center Infrastructure Management (DCIM) Market size was valued at USD 44.56 million in 2020 to USD 94.87 million in 2025 and is anticipated to reach USD 369.50 million by 2035, at a CAGR of 16.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Japan Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 94.87 Million |

| Japan Data Center Infrastructure Management (DCIM) Market, CAGR |

16.33% |

| Japan Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 369.50 Million |

The Japan DCIM market is driven by rapid technology adoption, innovation in automation, and the shift toward hybrid infrastructures. Enterprises are deploying AI-enabled monitoring, predictive analytics, and IoT-integrated systems to improve efficiency and reliability. It holds strategic importance for businesses and investors as data centers become central to digital transformation, cloud expansion, and 5G adoption. Operators prioritize sustainability, compliance, and resilience, making DCIM solutions critical for long-term competitiveness.

Regionally, Tokyo leads the market due to the concentration of hyperscale facilities and strong demand from finance and cloud providers. Osaka is emerging as a secondary hub, supported by industrial activity and new investments in high-performance computing. Northern and regional areas are expanding with renewable energy-driven projects and edge deployments. This balanced distribution strengthens Japan’s position as a leader in advanced digital infrastructure within Asia-Pacific.

Market Drivers

Adoption of Advanced Monitoring Technologies for Energy Efficiency and Performance Optimization

The Japan Data Center Infrastructure Management (DCIM) Market is driven by rapid adoption of advanced monitoring technologies to optimize energy usage and improve operational efficiency. Enterprises are prioritizing automation tools that provide real-time insights into power consumption, cooling efficiency, and asset utilization. Rising electricity costs and sustainability mandates are accelerating demand for AI-enabled DCIM platforms. Businesses are seeking to achieve measurable reductions in energy waste through predictive analytics and machine learning. The market has become a focal point for investors targeting eco-friendly digital infrastructure. Data-driven optimization creates measurable savings for operators, enhancing profitability and competitiveness. IT leaders consider integration of advanced DCIM systems a priority to sustain high uptime in hyperscale environments. Strong government initiatives toward carbon neutrality reinforce the importance of efficiency-focused innovation in Japan’s data center sector.

- For instance, NTT DOCOMO BUSINESS’ Tokyo data centers achieved a power usage effectiveness (PUE) of under 1.2, with top facilities reaching below 1.1. These benchmarks, reported in NTT’s official environmental disclosures, position the facilities among the most energy-efficient data centers globally.

Innovation in Hybrid and Cloud-Based Infrastructure Management Solutions

Innovation in hybrid and cloud-based DCIM platforms is fueling new opportunities for enterprises seeking flexibility and scalability. Businesses are shifting from legacy on-premises solutions to cloud-enabled systems that streamline management across distributed facilities. The Japan Data Center Infrastructure Management (DCIM) Market benefits from this transformation by integrating analytics, automation, and multi-site monitoring. These solutions enable operators to handle rapid workload shifts without service disruption. Growing complexity in multi-cloud deployments is also driving demand for hybrid DCIM models. Investors view this trend as strategically significant because it strengthens resilience and reduces dependency on single infrastructures. Technology vendors are innovating with AI-driven fault detection and predictive maintenance features. Cloud-based tools improve business continuity by ensuring seamless visibility across data environments.

- For instance, Fujitsu successfully conducted private 5G network field trials at its Yokohama Data Center from December 2022 to March 2023, enabling automated equipment inspection and remote monitoring through AI and robotics with 4K video analysis, as officially recognized by Japan’s Ministry of Internal Affairs and Communications for advancing operational resilience and digital transformation in data centers.

Growing Demand for Security, Compliance, and Regulatory Alignment

The Japan Data Center Infrastructure Management (DCIM) Market is shaped by increasing demand for compliance-focused solutions that meet strict data security standards. Businesses require DCIM platforms capable of integrating with cybersecurity systems and providing regulatory reporting. Growing threats of cyberattacks on financial and healthcare institutions amplify the role of integrated monitoring and alerting. Investors recognize the market’s strategic importance in safeguarding mission-critical operations. Enhanced security features such as automated incident response and forensic tracking are becoming core differentiators. Regulatory frameworks in Japan emphasize risk management, driving adoption of advanced solutions. Vendors are focusing on aligning platforms with ISO and government certifications. This emphasis on compliance and trust strengthens investor confidence in long-term industry stability.

Strategic Importance of Scalable Data Center Management for Digital Transformation

Digital transformation across industries is creating demand for scalable infrastructure management that supports high data traffic and rapid innovation. The Japan Data Center Infrastructure Management (DCIM) Market holds strategic importance for enterprises investing in 5G, AI, and IoT. Organizations see DCIM as essential for balancing performance, resilience, and cost-efficiency. Rising digital service consumption requires data centers to operate at maximum capacity without failures. Strategic investments by telecom and BFSI firms highlight the role of scalable management in enabling competitive advantage. Enterprises view it as a critical enabler of business continuity and customer trust. Government-backed smart city projects also boost the relevance of modern DCIM systems. The market positions itself as a foundation for Japan’s future digital economy.

Market Trends

Integration of Artificial Intelligence and Predictive Analytics in Operations

The Japan Data Center Infrastructure Management (DCIM) Market is witnessing rising integration of artificial intelligence and predictive analytics for operational efficiency. AI models optimize cooling, forecast capacity needs, and minimize downtime. Predictive analytics allows operators to prevent failures before they occur. Enterprises are leveraging these insights to reduce costs and extend equipment life. The trend is reshaping operational models in hyperscale and colocation facilities. It supports faster decision-making and better resource allocation. Vendors emphasize AI-driven innovations as differentiators in competitive bidding. This integration reflects a broader shift toward automation-driven intelligence in digital infrastructure.

Expansion of Edge Data Centers Driving Localized Infrastructure Needs

Edge computing is a growing trend reshaping infrastructure needs, pushing enterprises to manage distributed environments. The Japan Data Center Infrastructure Management (DCIM) Market benefits from this trend by enabling visibility across smaller, localized facilities. Telecom providers are deploying edge sites to meet latency-sensitive applications like IoT and AR/VR. These distributed centers require compact DCIM solutions for asset monitoring and fault management. The demand is particularly strong in urban areas supporting 5G rollouts. Cloud providers are also investing in edge expansion to enhance service availability. This localized infrastructure growth expands opportunities for lightweight, scalable DCIM systems. Businesses recognize it as essential for next-generation service delivery.

Adoption of Renewable Energy Integration and Sustainable Practices

Sustainability has become a defining trend, influencing operators to adopt renewable energy sources and green management solutions. The Japan Data Center Infrastructure Management (DCIM) Market integrates tools to monitor renewable utilization, carbon emissions, and resource efficiency. Enterprises are pursuing RE100 commitments and requiring DCIM platforms capable of detailed energy reporting. Vendors are developing energy-aware algorithms that balance performance with sustainability. Green-focused operations appeal to global investors and customers demanding accountability. Local operators are also adopting advanced cooling technologies aligned with environmental goals. This trend reflects the shift from cost-driven models toward sustainability-driven strategies. It underscores Japan’s commitment to responsible digital infrastructure.

Growing Use of Digital Twins for Infrastructure Planning and Optimization

Digital twin technology is emerging as a transformative trend in infrastructure management. The Japan Data Center Infrastructure Management (DCIM) Market leverages digital replicas to simulate operations and optimize future capacity. Operators use these tools to identify bottlenecks, improve efficiency, and reduce risks. Real-time digital models enhance transparency in asset management. Enterprises apply digital twins in capacity planning for cloud and edge deployments. This approach accelerates decision-making and reduces capital waste. Vendors highlight digital twins as an advanced value proposition for complex environments. The trend aligns with Japan’s emphasis on innovation-driven modernization across the digital sector.

Market Challenges

High Cost of Deployment and Integration Complexity

The Japan Data Center Infrastructure Management (DCIM) Market faces significant challenges due to high initial deployment costs and integration complexities. Enterprises often struggle to justify expenses for advanced platforms when legacy systems still function. Smaller firms find financial barriers particularly restrictive, limiting market penetration. Integration with existing IT, power, and cooling systems requires specialized expertise, delaying adoption. Many operators face difficulties aligning vendor solutions with multi-vendor infrastructures. This complexity reduces efficiency gains and discourages investment. Businesses view cost and complexity as critical restraints when evaluating solutions. The market must address these issues to expand adoption beyond large-scale operators.

Shortage of Skilled Professionals and Rising Cybersecurity Risks

A shortage of skilled professionals in infrastructure management creates challenges for widespread adoption. The Japan Data Center Infrastructure Management (DCIM) Market requires specialists capable of handling AI-driven, hybrid, and cloud-based systems. Training gaps limit the pace at which companies can modernize operations. Rising cybersecurity threats also challenge operators relying on interconnected platforms. Hackers target real-time monitoring systems to disrupt operations and access sensitive data. Businesses remain cautious about fully embracing DCIM without advanced security guarantees. Vendors face pressure to embed stronger protections and provide workforce training support. These twin challenges of skills and security restrain the market’s momentum.

Market Opportunities

Expansion of Cloud and Hybrid Models in Enterprise Environments

The Japan Data Center Infrastructure Management (DCIM) Market offers opportunities through the expansion of cloud and hybrid models. Enterprises are accelerating cloud migration and requiring DCIM platforms to manage distributed assets seamlessly. Hybrid models support both legacy and cloud infrastructure, appealing to businesses in transition. Vendors can tap into this demand by offering modular solutions with scalability. Investors find value in supporting providers with strong hybrid portfolios. It creates room for growth in industries prioritizing resilience and flexibility. The shift positions DCIM solutions as critical enablers of enterprise digital strategy.

Rising Demand from Edge Deployments and Sustainability Initiatives

Emerging demand for edge deployments provides opportunities for compact and scalable DCIM solutions. The Japan Data Center Infrastructure Management (DCIM) Market benefits from telecom, healthcare, and manufacturing investments in localized centers. Sustainability-focused projects present growth opportunities for vendors with energy-efficient innovations. Enterprises seek DCIM platforms capable of integrating renewable energy monitoring and carbon tracking. This convergence of edge computing and sustainability broadens the market’s long-term scope. Investors prioritize companies positioned in both areas of growth. Vendors focusing on innovation in edge and green integration can gain significant competitive advantage.

Market Segmentation

By Component

The Japan Data Center Infrastructure Management (DCIM) Market is segmented into solutions and services, with solutions dominating due to high adoption of monitoring and optimization platforms. Services, including consulting and managed support, are growing steadily as enterprises demand customization. Solutions hold the largest share as businesses prioritize automation and efficiency tools. Vendors offering integrated packages attract strong enterprise interest. The segment’s dominance reflects the strategic shift toward operational transparency and energy optimization.

By Data Center Type

Enterprise data centers hold a strong share, but cloud and edge data centers lead growth in the Japan Data Center Infrastructure Management (DCIM) Market. Rising adoption of hybrid and multi-cloud strategies drives demand for flexible DCIM platforms. Colocation facilities also gain traction as enterprises outsource infrastructure. Managed data centers expand in response to limited in-house capabilities. The trend highlights Japan’s rapid transformation toward distributed computing models. Cloud and edge dominance is reinforced by high demand for real-time services.

By Deployment Model

The Japan Data Center Infrastructure Management (DCIM) Market sees hybrid deployment models leading adoption, supported by their ability to balance flexibility and control. Cloud-based platforms are expanding rapidly as businesses migrate workloads. On-premises solutions maintain relevance in sensitive sectors like defense and healthcare. Hybrid remains dominant as it ensures scalability and integration across legacy and modern systems. Enterprises value hybrid deployment for its adaptability in fast-changing environments. The market’s momentum reflects strong investment in versatile architectures.

By Enterprise Size

Large enterprises dominate the Japan Data Center Infrastructure Management (DCIM) Market due to their extensive infrastructure and need for advanced solutions. These organizations demand high-level automation, predictive analytics, and compliance-focused features. Small and medium enterprises (SMEs) are adopting cloud-based DCIM platforms to reduce costs. Vendors offering affordable modular solutions are targeting this growing SME base. Large enterprise dominance reflects their leadership in digital transformation. Market expansion among SMEs signals rising democratization of advanced management tools.

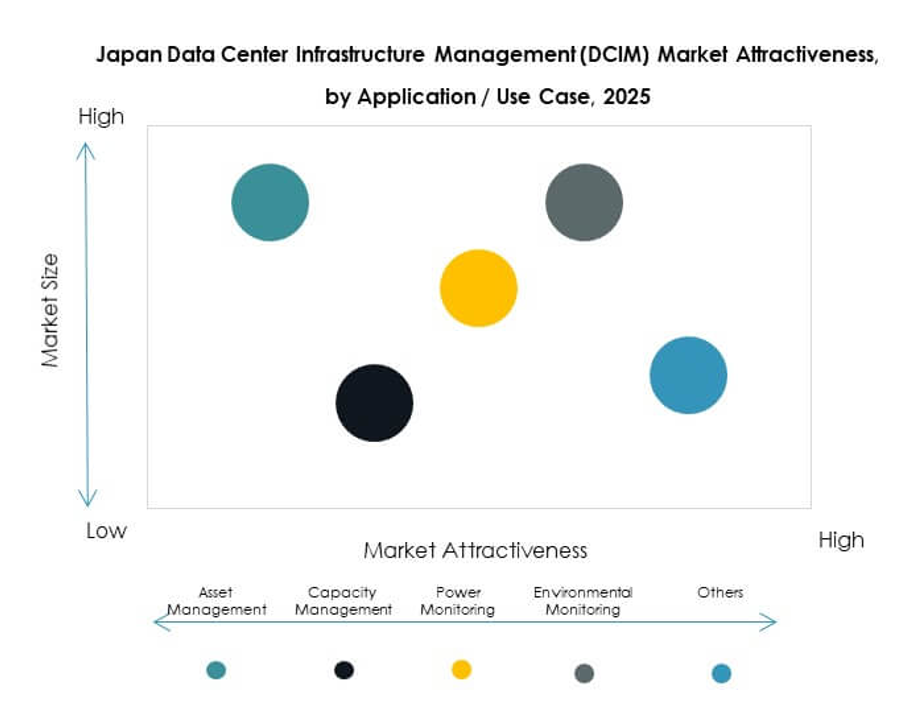

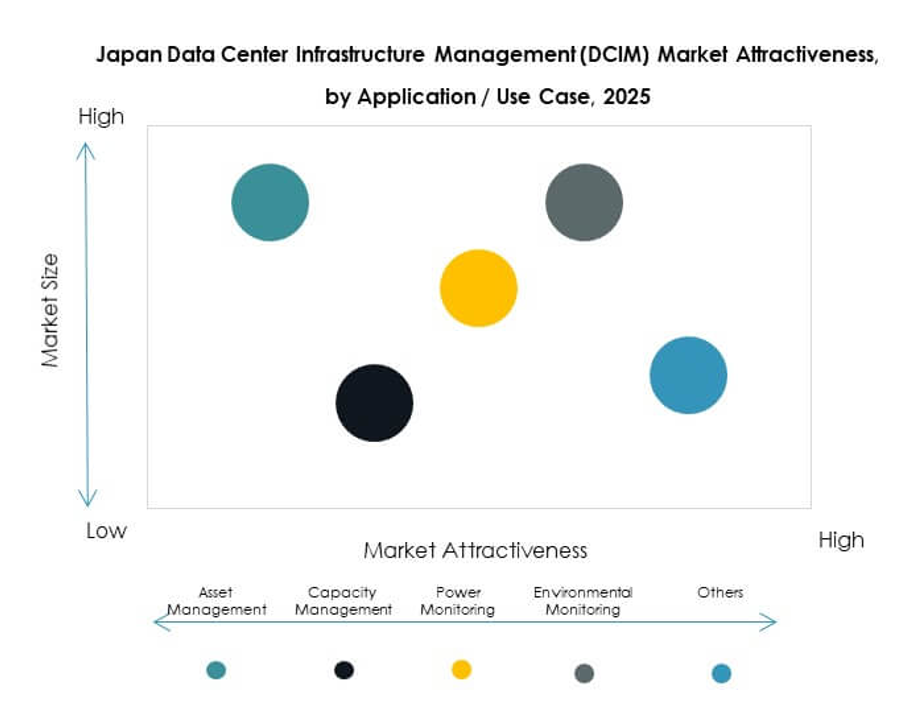

By Application / Use Case

Power monitoring and capacity management hold leading shares in the Japan Data Center Infrastructure Management (DCIM) Market. These applications are vital to reducing operational costs and preventing downtime. Asset management and environmental monitoring are gaining momentum as enterprises prioritize sustainability. Business intelligence and analysis expand as organizations demand deeper insights into performance. The diversity of use cases reflects growing expectations for comprehensive solutions. Vendors with multi-functional platforms are favored in competitive bidding.

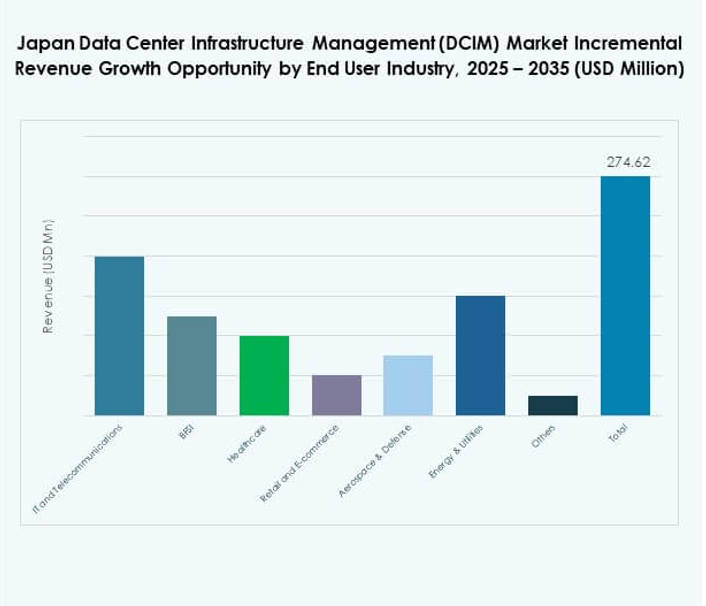

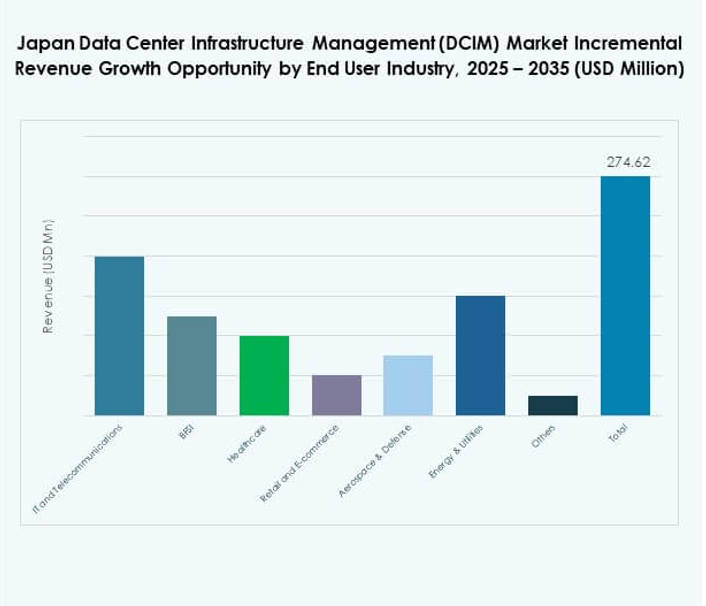

By End User Industry

The IT and telecommunications sector dominates the Japan Data Center Infrastructure Management (DCIM) Market due to strong investment in cloud and 5G infrastructure. BFSI follows with demand for compliance-focused solutions. Healthcare, retail, and energy sectors are growing as digital transformation accelerates. Aerospace and defense maintain steady adoption due to secure infrastructure needs. The IT and telecom sector’s dominance underscores its leadership in shaping Japan’s digital economy. Expanding adoption across diverse industries widens long-term growth potential.

Regional Insights

Tokyo Metropolitan Region Leading with High Market Share

The Tokyo Metropolitan Region leads the Japan Data Center Infrastructure Management (DCIM) Market with 42% share, supported by hyperscale facilities and strong demand from financial services. It acts as the central hub for global cloud providers expanding in Japan. High-density data centers and government-backed initiatives fuel investment. Operators in this subregion focus on sustainability and advanced automation. Enterprises view Tokyo as the anchor for nationwide digital transformation. It remains the most mature and competitive regional market.

- For example, Equinix expanded its Tokyo data center footprint by opening TY15 in December 2024, providing initial capacity and connectivity improvements. All Equinix data centers hold certifications, including ISO 27001 for security and ISO 14001 for environmental management. The expansion aligns with Japan’s digitization and sustainability goals.

Osaka Emerging as a Strong Secondary Hub

Osaka holds 33% share in the Japan Data Center Infrastructure Management (DCIM) Market, driven by its manufacturing base and rising connectivity needs. The city attracts hyperscale and colocation investments to diversify capacity beyond Tokyo. Operators emphasize hybrid deployments to manage growing industrial workloads. Strategic location and energy availability make Osaka attractive for global investors. It is becoming a strong secondary hub balancing demand between central and western Japan. Edge deployments also contribute to Osaka’s rising role in the ecosystem.

Regional Expansion Across Northern and Other Urban Areas

Northern Japan and other urban regions hold 25% share in the Japan Data Center Infrastructure Management (DCIM) Market. These areas are emerging due to government projects, renewable energy adoption, and disaster-resilient infrastructure. Operators in these regions emphasize localized edge deployments. Enterprises value expansion into smaller hubs to reduce reliance on Tokyo and Osaka. Renewable energy projects in Hokkaido strengthen its role in sustainable operations. Regional expansion reflects Japan’s balanced approach to diversifying infrastructure capacity nationwide.

- For instance, SoftBank and IDC Frontier broke ground in April 2025 on the Hokkaido Tomakomai AI Data Center, a 700,000 square meter campus with a planned initial capacity of 50 MW, using local renewable energy sources; the facility is scheduled to commence operations in 2026, marking Japan’s largest new data center infrastructure built to date in a northern urban region.

Competitive Insights:

- Fujitsu

- NEC

- IIJ (Internet Initiative Japan)

- GMO GlobalSign

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- IBM

- Schneider Electric SE

- Siemens AG

- HPE (Hewlett Packard Enterprise)

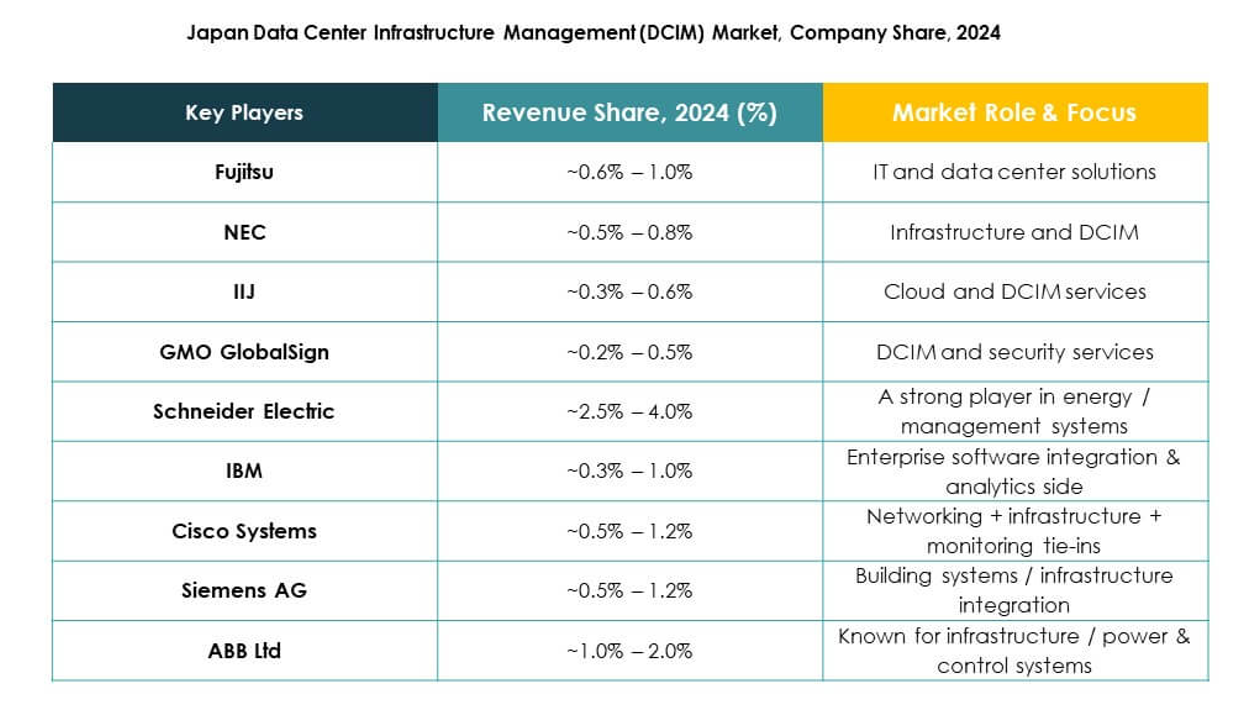

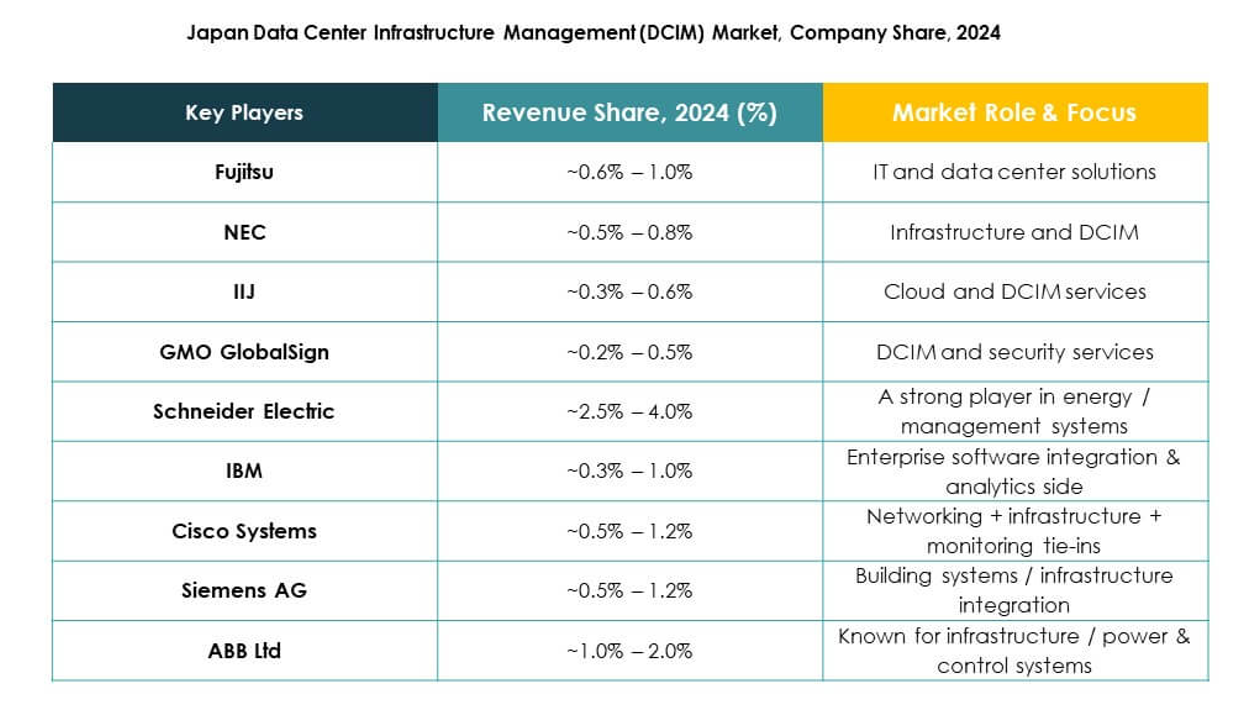

- Delta Electronics

The Japan Data Center Infrastructure Management (DCIM) Market is highly competitive, with both global leaders and domestic firms shaping its direction. Fujitsu and NEC hold strong local positions by integrating DCIM into cloud and enterprise solutions. IIJ and GMO GlobalSign leverage expertise in internet infrastructure and security services to expand relevance. Global players such as Schneider Electric, Huawei, and Cisco provide energy optimization, automation, and networking solutions tailored to Japan’s needs. IBM, Siemens, and HPE drive innovation with AI-powered platforms and hybrid models. ABB, Eaton, and Delta Electronics strengthen portfolios with power management and sustainability-focused tools. It reflects a balanced environment where domestic champions and international leaders compete through technology differentiation, service depth, and regulatory alignment.

Recent Developments:

- In July 2025, Internet Initiative Japan (IIJ) announced a marketing and implementation partnership with Ditto, which will expand Ditto’s mobile database and offline sync technology in Japan. This collaboration addresses data management challenges in environments with intermittent connectivity, supporting resilience in critical business applications.

- In June 2025, KDDI partnered with Hewlett Packard Enterprise (HPE) to launch a new artificial intelligence-focused data center in Osaka, with operations set to begin in fiscal year 2025. The facility will incorporate NVIDIA Blackwell chips, highlighting the emphasis on AI workloads and enhanced high-performance computing capabilities in the Japan DCIM market.