Executive summary:

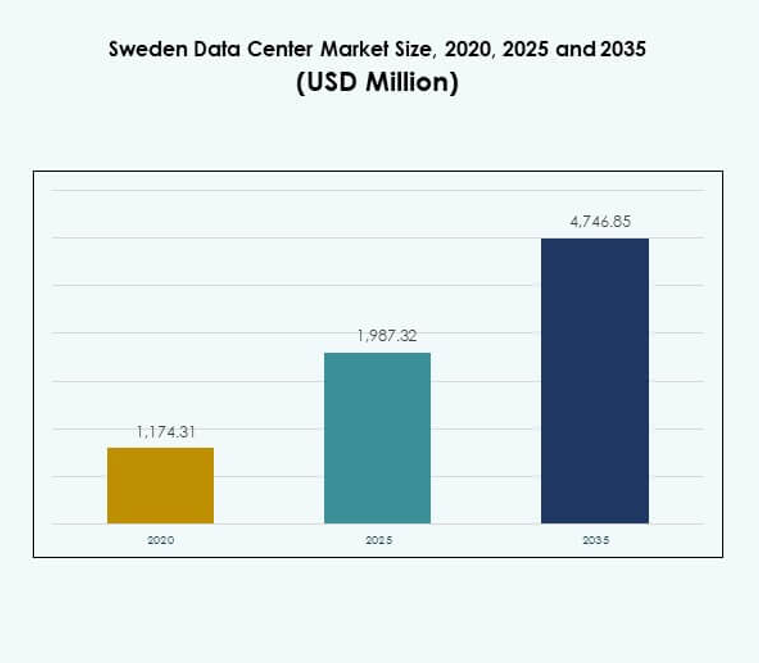

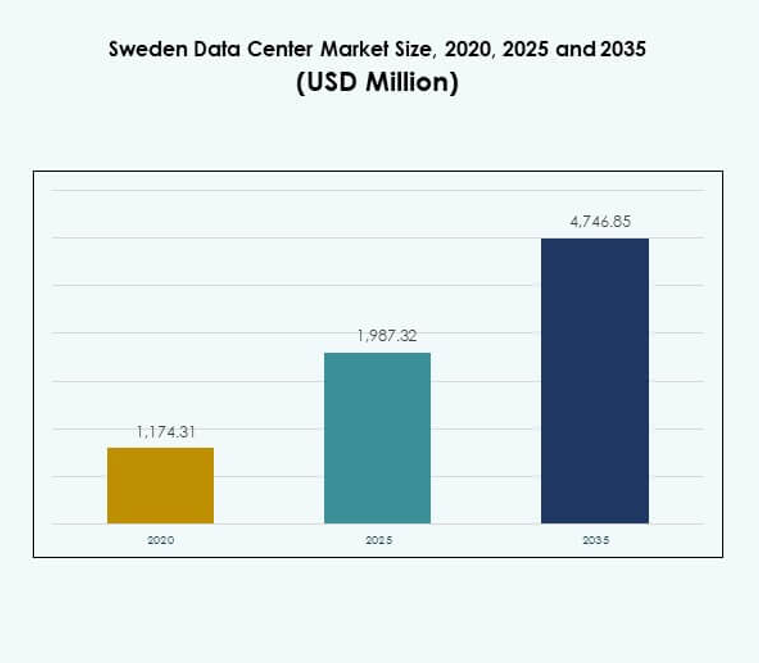

The Sweden Data Center Market size was valued at USD 1,174.31 million in 2020 to USD 1,987.32 million in 2025 and is anticipated to reach USD 4,746.85 million by 2035, at a CAGR of 9.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Sweden Data Center Market Size 2025 |

USD 1,987.32 Million |

| Sweden Data Center Market, CAGR |

9.06% |

| Sweden Data Center Market Size 2035 |

USD 4,746.85 Million |

Growth in the Sweden Data Center Market is fueled by strong adoption of cloud computing, AI-driven applications, and digital transformation initiatives. Enterprises prioritize advanced infrastructure that ensures security, scalability, and operational continuity. Operators focus on energy efficiency and sustainable practices, making Sweden attractive for international investments. It supports strategic objectives for businesses aiming to balance innovation with compliance and resilience. Investors see opportunities in hyperscale, hybrid, and modular facilities that strengthen regional competitiveness.

Regionally, Sweden benefits from its position in Northern Europe, offering robust connectivity across the Nordics and Central Europe. Northern Sweden leads with renewable energy integration and hyperscale expansion, supported by favorable climate conditions for efficiency. Central Sweden emerges as a hub for enterprise and colocation services, while southern regions grow through edge and modular deployments. This balance of leadership and emerging hubs strengthens the national digital infrastructure ecosystem.

Market Drivers

Growing Adoption of Advanced Technologies Across Enterprises and Government Bodies

The Sweden Data Center Market benefits from strong adoption of advanced technologies that reshape business operations. Enterprises and government agencies seek infrastructure supporting artificial intelligence, machine learning, and big data processing. It is driven by organizations shifting workloads to highly secure facilities with scalable computing power. Energy-efficient systems and advanced cooling solutions enhance competitiveness for facility operators. Investors view these technological capabilities as essential for long-term business resilience. The market fosters innovation by integrating digital platforms into core processes. This adoption provides stability for industries undergoing rapid transformation.

- For example, in June 2024, Microsoft announced a SEK 33.7 billion (USD 3.2 billion) investment to expand its AI and cloud infrastructure in Sweden, including the deployment of more than 20,000 GPUs across its data centers in Sandviken, Gävle, and Staffanstorp, marking its largest-ever investment in the country.

Rising Importance of Cloud Services and Hybrid Infrastructure Expansion

Enterprises prioritize cloud migration strategies to streamline data management, scalability, and operational continuity. The Sweden Data Center Market supports hybrid models that blend public and private cloud for flexibility. Companies invest in hybrid strategies to balance cost efficiency and data sovereignty. Cloud-based services accelerate collaboration and improve agility across industries. It enables multinational corporations to expand operations while meeting compliance standards. The demand for scalable cloud platforms creates opportunities for hyperscale and colocation facilities. Businesses rely on these infrastructure models to gain a competitive edge. This shift ensures stable revenue streams for investors.

- For instance, Equinix signed a 15 MW Power Purchase Agreement with Neoen in December 2023 to add new wind capacity to the Swedish grid, reinforcing its commitment to 100% renewable energy for local data centers.

Integration of Renewable Energy to Strengthen Sustainability Commitments

Sustainability remains central for global investors assessing infrastructure markets. The Sweden Data Center Market gains advantage from abundant renewable energy, particularly hydropower and wind. Data centers adopt green energy to lower carbon emissions and enhance cost efficiency. Energy reuse programs, such as waste heat recovery, reflect innovation aligned with national climate policies. It positions Sweden as a leader in environmentally conscious infrastructure investment. International enterprises prefer establishing operations in regions prioritizing low-carbon solutions. Investors recognize sustainability as a driver of long-term cost savings. Renewable integration sets benchmarks for digital infrastructure development across Europe.

Strategic Role of Data Centers in Business Continuity and Economic Growth

Modern businesses depend on uninterrupted digital services for growth and security. The Sweden Data Center Market acts as a backbone for BFSI, healthcare, telecom, and retail sectors. High-capacity facilities reduce downtime risks and safeguard sensitive information. Regional hubs improve connectivity and promote international trade flows. It delivers resilience for enterprises navigating economic volatility and cybersecurity threats. Investors acknowledge the market’s strategic importance for regional and cross-border operations. Digital infrastructure plays a direct role in national competitiveness. This driver ensures consistent growth across industries dependent on digital ecosystems.

Market Trends

Growing Demand for Edge Data Centers Supporting Emerging Applications and IoT Growth

The rise of edge data centers reflects demand for real-time data processing near end users. The Sweden Data Center Market supports IoT-driven applications in healthcare, logistics, and smart cities. Edge facilities enable faster decision-making and reduce latency for critical operations. It provides capacity for connected devices expanding across industries. Telecom providers collaborate with technology firms to build smaller, modular centers closer to customers. Smart grids, autonomous systems, and advanced monitoring tools rely on edge infrastructure. This trend strengthens Sweden’s digital economy by enabling efficient localized processing. Growth accelerates through partnerships across telecom and technology ecosystems.

Increased Adoption of Modular and Prefabricated Data Center Solutions

Modular facilities reduce construction time and enhance scalability for evolving business needs. The Sweden Data Center Market integrates prefabricated solutions to address rising demand efficiently. It ensures rapid deployment for enterprises needing flexible capacity. Modular systems allow operators to adjust power and cooling with precision. Industries such as finance and e-commerce adopt these facilities to manage unpredictable workloads. Standardized components reduce upfront costs and improve energy efficiency. The trend aligns with investor interest in scalable, cost-effective infrastructure. Modular adoption highlights Sweden’s role as a hub for innovative construction practices in the sector.

Enhanced Focus on Cybersecurity and Data Sovereignty Across Key Industries

Data protection remains a priority across finance, healthcare, and government. The Sweden Data Center Market responds with advanced security frameworks and localized storage policies. It supports compliance with European data protection regulations. Enterprises prefer centers ensuring sovereign control over sensitive information. Cybersecurity enhancements include AI-driven monitoring and multi-layer encryption. Operators invest in infrastructure that ensures resilience against rising cyberattacks. Businesses value security guarantees as part of investment decisions. This trend strengthens investor confidence in Sweden’s infrastructure reliability. It drives consistent growth across sectors managing high-value digital assets.

Growing Integration of Artificial Intelligence in Data Center Operations

Artificial intelligence transforms efficiency, predictive maintenance, and resource optimization across data centers. The Sweden Data Center Market integrates AI to monitor cooling, energy use, and hardware performance. AI algorithms reduce power wastage by predicting workloads and adjusting systems automatically. It helps operators cut costs while meeting sustainability goals. Automation minimizes downtime risks and ensures faster recovery from system disruptions. Businesses prefer facilities deploying AI-driven solutions for reliability. Investors view AI integration as proof of long-term operational excellence. This trend reinforces Sweden’s competitive position in advanced infrastructure development across Europe.

Market Challenges

High Energy Consumption and Rising Pressure to Maintain Sustainability Commitments

Energy use remains one of the largest challenges for operators. The Sweden Data Center Market faces scrutiny over rising electricity demands despite renewable availability. Facilities consume significant power for cooling, computing, and operational continuity. It creates tension between growth and sustainability objectives. Stricter environmental standards add complexity to operational planning. Operators must balance efficiency with rising regulatory compliance. Energy-intensive operations challenge profitability when electricity prices fluctuate. This constraint affects strategic expansion decisions across the country.

Infrastructure Complexity and Skills Gap Affecting Long-Term Growth Potential

The complexity of managing advanced digital infrastructure creates operational risks. The Sweden Data Center Market requires highly skilled professionals for cybersecurity, automation, and systems management. It struggles with talent shortages that delay adoption of advanced solutions. Rapid technological evolution increases the learning curve for existing staff. Operators must invest in training programs and partnerships to bridge gaps. Integration of AI and modular systems adds another layer of complexity. Investors consider workforce limitations when assessing growth potential. This challenge underscores the need for comprehensive workforce strategies.

Market Opportunities

Expansion of Hyperscale and Cloud Infrastructure to Support Global Enterprises

The Sweden Data Center Market presents opportunities for hyperscale facilities that serve multinational corporations. Enterprises demand scalable platforms to support cloud-based services and global operations. It benefits from Sweden’s renewable energy supply and political stability. Hyperscale centers create strong returns through long-term contracts with global cloud providers. Colocation providers also expand capacity to meet international demand. Investors see high-value prospects in these infrastructure expansions. Strategic partnerships enhance Sweden’s positioning as a Nordic hub. Growth opportunities stem from increasing reliance on cloud-driven ecosystems.

Growing Investments in Edge and Modular Infrastructure Across Key Sectors

Demand for edge and modular facilities creates a strong opportunity for diversification. The Sweden Data Center Market aligns with healthcare, retail, and smart city projects. It leverages modular scalability to deliver cost-effective infrastructure quickly. Telecom providers expand edge deployments to strengthen 5G coverage. It fosters innovation by enabling localized applications with low latency. These facilities improve efficiency for SMEs and public agencies. Investors benefit from reduced construction risks and faster deployment cycles. The opportunity enhances Sweden’s role in shaping digital transformation across industries.

Market Segmentation

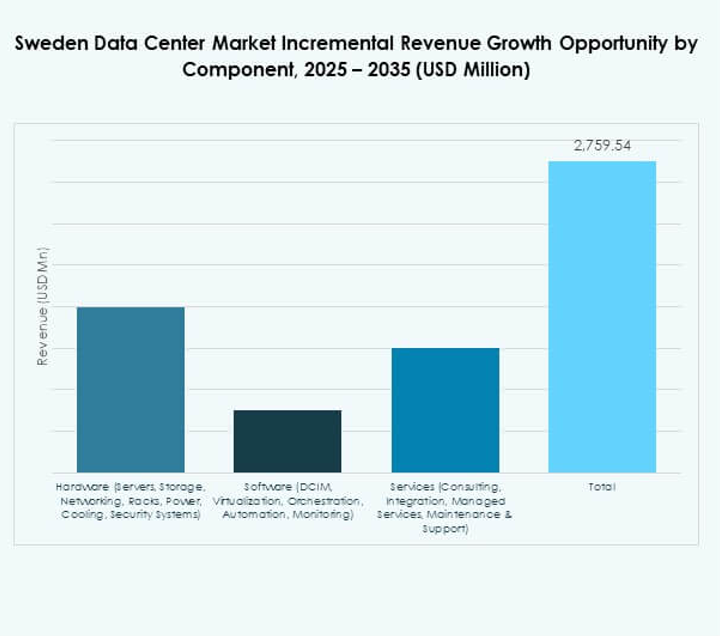

By Component

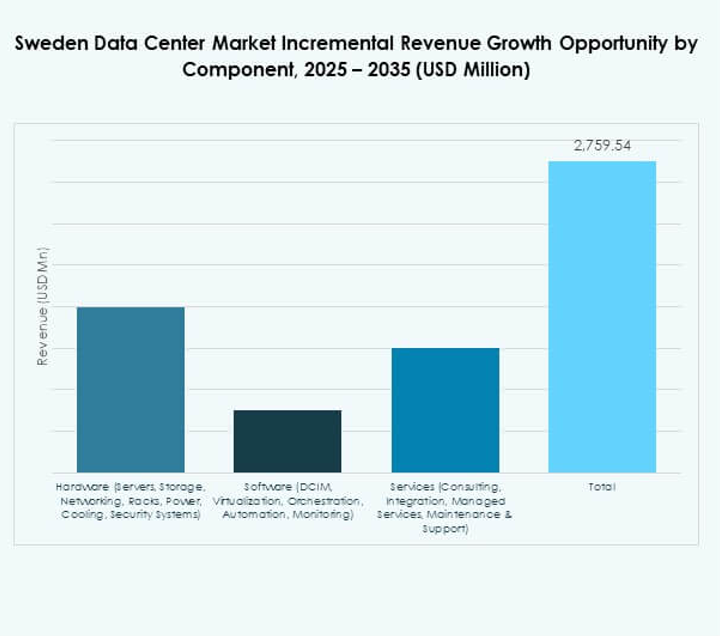

Hardware dominates the Sweden Data Center Market with significant share driven by servers, racks, and cooling systems. Enterprises prioritize robust computing hardware to support cloud adoption and AI workloads. Networking and security systems expand as cyber risks increase. Storage demand grows with big data, video streaming, and enterprise applications. Software adoption, including DCIM and orchestration tools, complements hardware by improving efficiency. Services such as consulting and integration help optimize deployment. Managed services and support also show consistent growth. Together, hardware leads while services and software reinforce operational efficiency.

By Data Center Type

Hyperscale data centers hold the dominant share in the Sweden Data Center Market. Global cloud providers expand capacity to meet enterprise demand. Colocation facilities grow steadily by offering flexible solutions for SMEs. Enterprise data centers remain vital for organizations prioritizing data sovereignty. Edge and modular centers expand due to IoT, 5G, and smart city applications. Mega centers drive investment through large-scale infrastructure projects. Cloud and Internet Data Centers support e-commerce and content delivery. Hyperscale maintains the strongest momentum while modular and edge gain traction.

By Deployment Model

Cloud-based deployment drives growth within the Sweden Data Center Market. Enterprises embrace cloud models to ensure scalability and cost optimization. On-premises centers remain essential for sectors with sensitive data needs. Hybrid deployments gain importance by balancing flexibility and control. It provides organizations with the ability to optimize workload distribution. Hybrid also strengthens resilience by combining private and public resources. SMEs adopt cloud-first approaches due to affordability. Large enterprises pursue hybrid strategies to ensure compliance and operational security. Cloud and hybrid models shape future adoption trends.

By Enterprise Size

Large enterprises dominate the Sweden Data Center Market due to scale and resource needs. BFSI, telecom, and healthcare sectors rely on large infrastructure investments. It ensures resilience for global operations and critical services. SMEs demonstrate growing adoption of colocation and cloud solutions. Lower upfront costs make cloud appealing for smaller firms. SMEs use modular facilities to support innovation and expansion. Demand from SMEs highlights opportunities for colocation providers. Large enterprises continue to lead but SMEs drive future diversification.

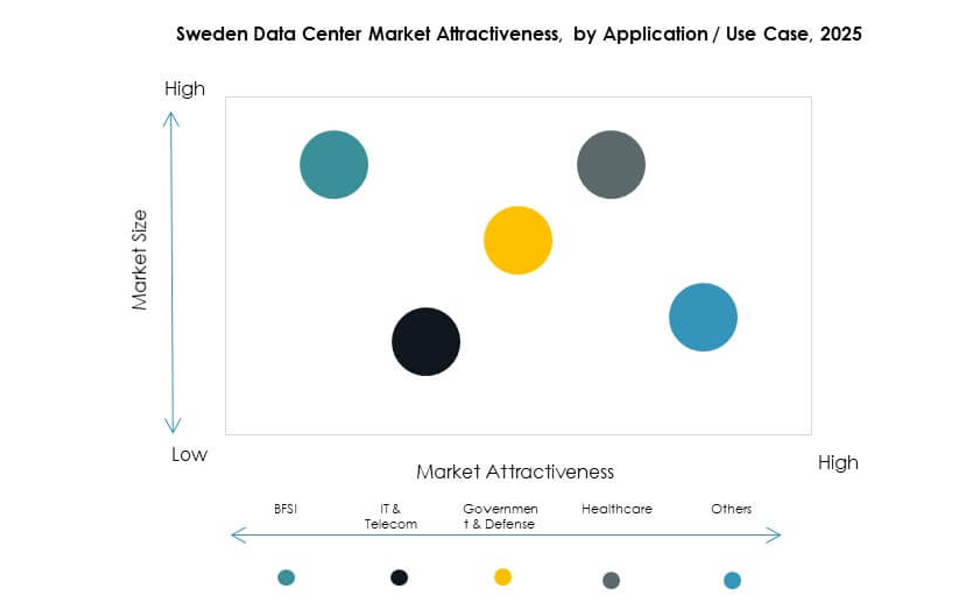

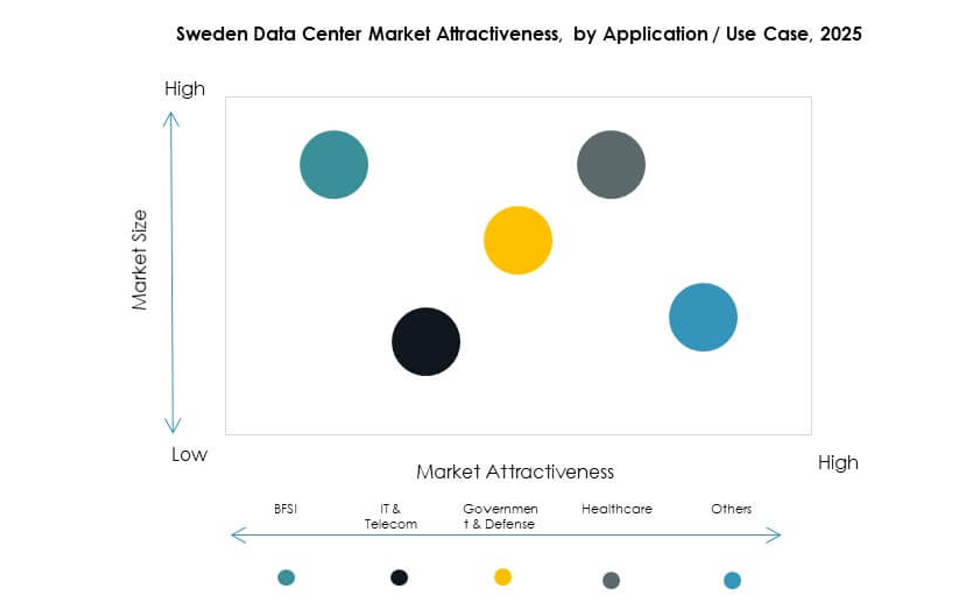

By Application / Use Case

The BFSI sector holds a leading share in the Sweden Data Center Market. It requires secure, compliant infrastructure for sensitive financial data. IT and telecom drive demand with large-scale cloud and 5G adoption. Government and defense depend on localized centers for data sovereignty. Healthcare needs expand with telemedicine and digital health records. Retail and e-commerce rely on fast processing and delivery systems. Media and entertainment grow due to streaming and gaming services. Manufacturing leverages automation requiring reliable infrastructure. Education and utilities also add steady contributions.

By End User Industry

Cloud service providers dominate the Sweden Data Center Market with strong investments in hyperscale facilities. Enterprises remain important users needing hybrid and private solutions. Colocation providers grow as SMEs seek scalable, affordable options. Government agencies adopt facilities to ensure compliance and sovereignty. Other sectors such as education and utilities expand steadily. Cloud providers maintain dominance due to long-term global expansion. Enterprises strengthen hybrid adoption for security and efficiency. Colocation builds strong regional partnerships across industries.

Regional Insights

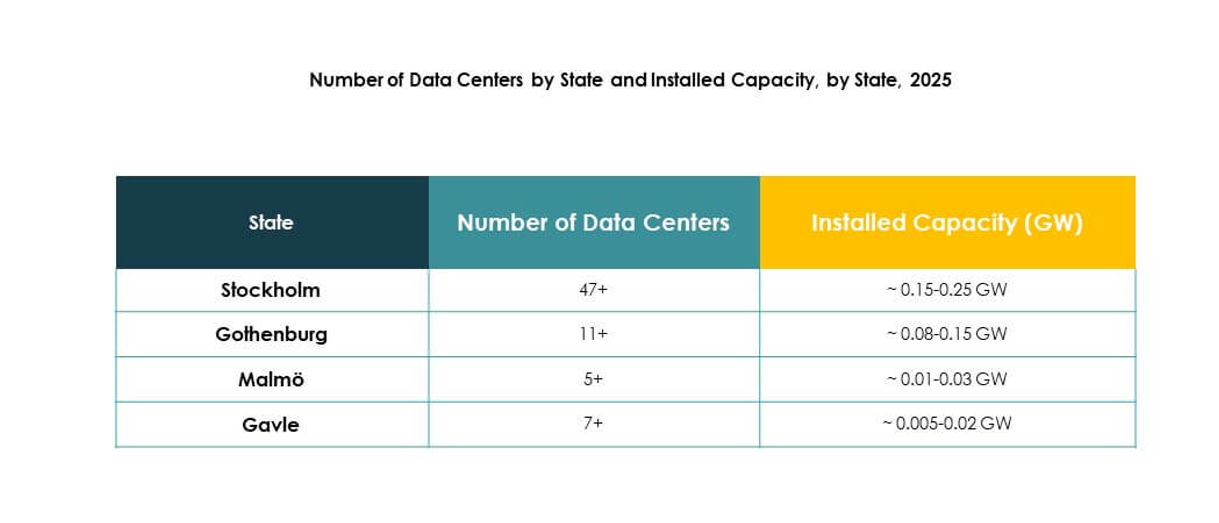

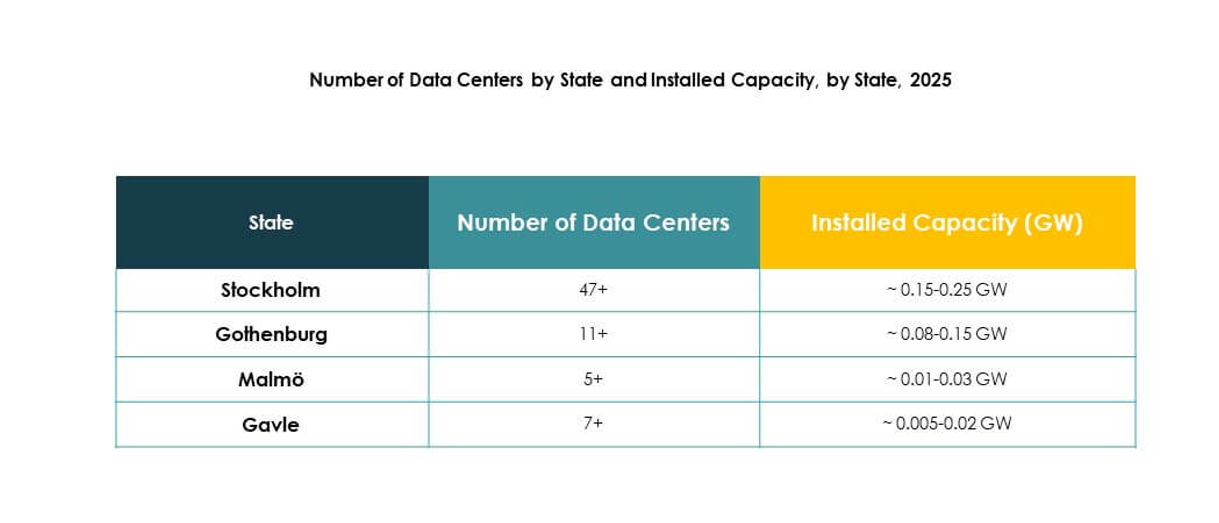

Northern Region Leading with Renewable Energy and Strong Hyperscale Development

Northern Sweden leads the Sweden Data Center Market with 38% share supported by hydropower and wind. It benefits from cold climate reducing cooling costs and boosting efficiency. Hyperscale projects concentrate here due to abundant energy and land availability. It strengthens Sweden’s position as a sustainability leader in Europe. Northern hubs also support international connectivity across Nordic countries. The region attracts investors seeking long-term energy stability. Growth continues through expansion of large-scale data center projects.

- For example, in August 2025, Lyten announced the acquisition of Northvolt’s Swedish assets, which include 16 GWh of operational battery capacity and 15 GWh under construction, making it a leading redevelopment in Northern Sweden’s energy infrastructure.

Central Region Strengthened by Enterprise Demand and Colocation Growth

Central Sweden holds 34% share of the Sweden Data Center Market with strong enterprise presence. The area supports industries in telecom, manufacturing, and finance requiring secure infrastructure. It also fosters colocation growth for SMEs and startups. Connectivity across major cities ensures reliable services for regional operations. It balances demand between enterprise and hybrid models. Businesses prefer central hubs for proximity to headquarters and client bases. The region remains a vital part of Sweden’s infrastructure ecosystem.

- For instance, in June 2025, Conapto expanded its Stockholm facilities with a partnership delivering scalable AI infrastructure, powered by 100% renewable energy and advanced heat reuse systems, ensuring grid efficiency and supporting enterprise workloads.

Southern Region Emerging with Edge and Modular Infrastructure Development

Southern Sweden accounts for 28% share of the Sweden Data Center Market with growing edge deployments. The region benefits from advanced urban networks supporting smart cities and retail hubs. Edge centers reduce latency for customer-facing applications. Modular projects expand to provide cost-efficient capacity quickly. It positions southern hubs as innovation zones for digital infrastructure. Partnerships between telecom and municipalities drive rapid growth. The region emerges as an important complement to northern and central dominance.

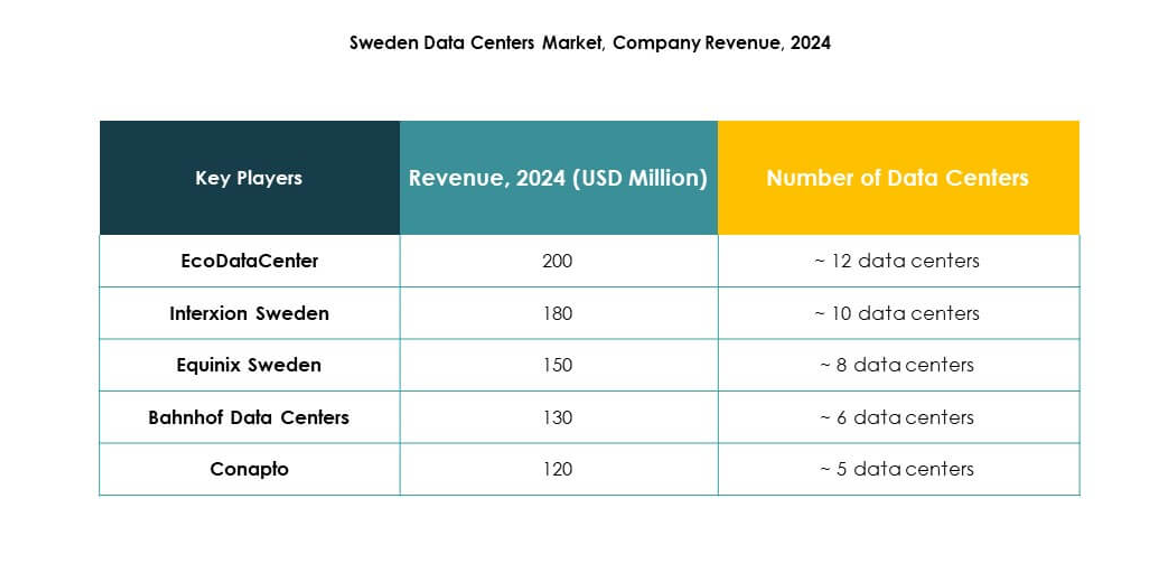

Competitive Insights:

- EcoDataCenter

- Interxion Sweden

- Equinix Sweden

- eww ITandTel

- Bahnhof Data Centers

- Conapto

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

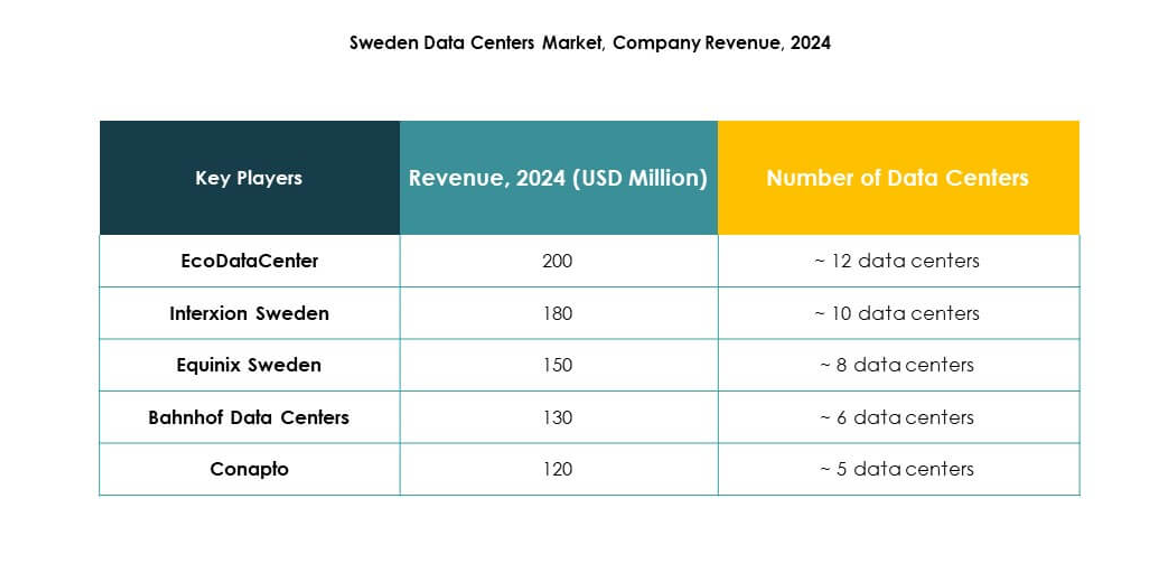

The Sweden Data Center Market reflects a competitive environment shaped by global hyperscale providers and regional specialists. It is driven by a blend of sustainability-focused operators and multinational technology leaders. EcoDataCenter, Bahnhof, and Conapto emphasize renewable power, waste heat recovery, and green certifications to attract environmentally conscious clients. Interxion and Equinix maintain strong colocation portfolios supported by robust connectivity across Europe. Hyperscale leaders such as Microsoft, AWS, and Google expand capacity to serve cloud-first enterprises and public sector organizations. Regional player eww ITandTel enhances diversity by offering localized services tailored to SMEs. The market rewards innovation in efficiency, scalability, and compliance, with competitors investing in modular infrastructure, AI-based monitoring, and renewable integration to differentiate and secure long-term growth.

Recent Developments:

- In September 2025, EcoDataCenter announced it had secured €600 million in debt financing from Deutsche Bank to accelerate the construction of two large-scale AI-focused data centers in the Borlänge and Falun regions of Sweden, supporting surging demand for high-performance computing infrastructure.

- In August 2025, Equinix partnered with Groq to enable low-latency AI infrastructure at Nordic data centers, expanding AI and machine learning capabilities for European enterprises operating through the platform. In December 2023, Equinix signed a new Power Purchase Agreement with Neoen to add 15MW of wind capacity to the Swedish grid, reinforcing its sustainability commitments for local data centers.

- In June 2025, Conapto announced a strategic partnership with Vertical Data to deliver scalable, secure, and climate-friendly AI infrastructure using its Stockholm data centers, which are powered by 100% renewable energy and offer advanced heat reuse and grid support features.

- In May 2025, Bahnhof acquired the historic Bunkerberget site in Gothenburg a Cold War-era industrial bunker to develop a new subterranean data center, increasing secure colocation capacity and supporting the city’s evolution into a major digital gateway for Europe.