Executive summary:

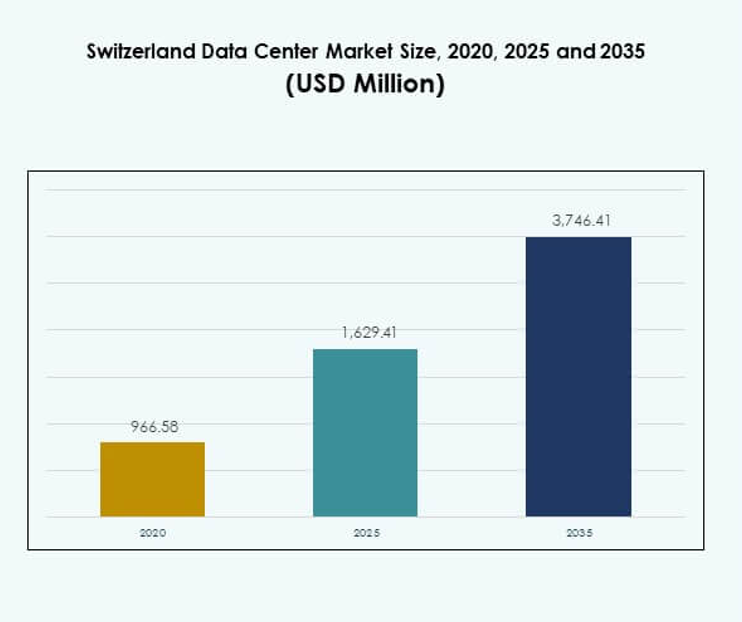

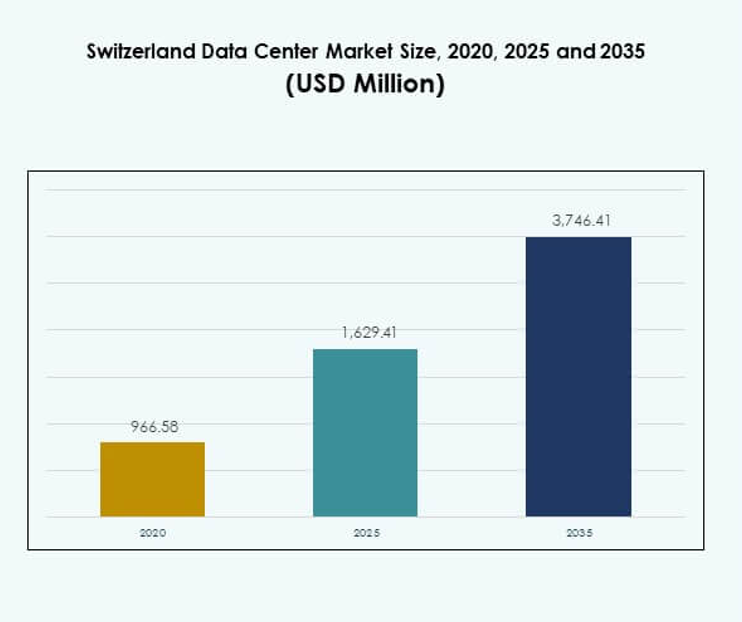

The Switzerland Data Center Market size was valued at USD 966.58 million in 2020 to USD 1,629.41 million in 2025 and is anticipated to reach USD 3,746.41 million by 2035, at a CAGR of 8.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Switzerland Data Center Market Size 2025 |

USD 1,629.41 Million |

| Switzerland Data Center Market, CAGR |

8.64% |

| Switzerland Data Center Market Size 2035 |

USD 3,746.41 Million |

Market growth is driven by rapid adoption of cloud platforms, advanced automation tools, and sustainability-focused infrastructure. Enterprises demand scalable, secure, and energy-efficient solutions to support AI, IoT, and digital transformation initiatives. The market demonstrates strategic importance for businesses and investors due to Switzerland’s regulatory stability, renewable energy integration, and position as a trusted European hub for secure digital operations. Western Switzerland leads due to its concentration of international hubs in Geneva and Lausanne, supported by strong financial and government demand. Northern and Central regions, including Zurich and Bern, expand with hyperscale and colocation facilities serving enterprises and global clients. Eastern and Southern areas emerge as growth corridors, benefiting from modular developments and improved cross-border connectivity.

Market Drivers

Growing Importance of Digital Infrastructure for Enterprise Transformation

The Switzerland Data Center Market benefits from the rising demand for digital infrastructure that supports enterprise transformation across industries. Businesses are deploying advanced IT systems to manage cloud adoption, AI workloads, and IoT applications. This growth highlights the need for secure, scalable, and energy-efficient data centers. Enterprises view Switzerland as a trusted hub due to political stability and strong data protection laws. Companies see digital infrastructure as critical for competitiveness. Investors recognize that infrastructure growth underpins innovation. It strengthens Switzerland’s role as a strategic digital gateway in Europe.

- For instance, in June 2025, Microsoft announced a $400 million investment to expand its data centers in Zürich and Geneva, strengthening cloud and AI infrastructure while supporting over 50,000 customers. The expansion ensures all data remains within Switzerland’s borders, reinforcing compliance and security for regulated sectors.

Accelerating Shift Toward Cloud and Hybrid Models

Enterprises are migrating workloads to cloud and hybrid models to enhance scalability and cost efficiency. The Switzerland Data Center Market gains momentum from strong adoption of multi-cloud strategies among financial institutions and global enterprises. Colocation and hyperscale providers expand capacity to meet increasing demand for flexible infrastructure. Cloud-native applications require low latency and robust security frameworks, which local facilities deliver. Enterprises prefer hybrid approaches to balance compliance with agility. Demand for integration with global cloud platforms accelerates growth. It positions Switzerland as a key node for global cloud traffic management.

- For instance, in March 2025, NorthC Group opened a new data center in Winterthur with 1,100 square meters of operational space and 1.8 MW of IT capacity, delivering hybrid solutions, direct cloud connectivity, and operating entirely on renewable energy.

Adoption of Energy-Efficient Technologies and Sustainability Goals

Sustainability is central to investment in new facilities, driven by environmental goals and regulatory compliance. Operators deploy renewable energy sources, liquid cooling, and AI-powered efficiency tools to reduce carbon footprint. The Switzerland Data Center Market aligns with European Union climate targets and Switzerland’s strong sustainability policies. Data centers increasingly supply heat to nearby communities, optimizing energy use. Green certifications attract global enterprises seeking eco-friendly solutions. Investors see energy-efficient infrastructure as a differentiator in the competitive landscape. It creates long-term operational advantages and stronger appeal for multinational clients.

Integration of Advanced Automation and AI-Driven Management

Automation and AI technologies improve efficiency and optimize workload distribution across facilities. Operators use predictive analytics for capacity planning, real-time monitoring, and risk reduction. The Switzerland Data Center Market gains strength from rising deployment of DCIM software, orchestration, and machine learning tools. These innovations reduce downtime and lower operational costs. Businesses rely on AI to forecast demand patterns and allocate resources efficiently. Investors identify automation as a driver of resilience and value creation. It ensures operators deliver consistent performance across expanding infrastructure networks.

Market Trends

Expansion of Hyperscale Facilities to Support High-Density Applications

The Switzerland Data Center Market observes significant growth in hyperscale development to handle AI and large-scale cloud workloads. Providers invest in high-density racks and advanced power management systems. Demand for hyperscale capacity reflects rising enterprise digitalization and global SaaS adoption. Facilities emphasize modular expansion to adapt quickly to shifting demand. Companies invest in next-generation cooling methods to support dense workloads. Hyperscale operators attract foreign investments through scalable designs. It reinforces Switzerland’s reputation as a preferred destination for mission-critical global infrastructure.

Colocation Growth Driven by International Enterprises and Regulatory Assurance

Colocation continues to expand as international firms prioritize secure and compliant infrastructure in Switzerland. The Switzerland Data Center Market benefits from strong demand in financial services, biotech, and telecom. Providers offer flexible space and connectivity solutions that suit global clients. Switzerland’s legal environment assures data sovereignty and compliance with strict privacy rules. Colocation hubs also support cross-border traffic between Germany, France, and Italy. This expansion attracts clients seeking stability and advanced infrastructure. It strengthens Switzerland’s appeal as a trusted regional colocation hub.

Rising Edge Deployments and Micro Modular Data Centers

Edge and modular facilities are gaining traction to support real-time applications and localized workloads. The Switzerland Data Center Market adapts to 5G expansion and smart city initiatives that demand ultra-low latency. Enterprises deploy micro data centers closer to customers to enhance performance. Modular designs allow faster deployment in underserved regions. Telecom operators and industrial firms drive this demand to support IoT and automation. Edge growth creates opportunities for regional players to compete with larger providers. It highlights the shift toward distributed computing models in Switzerland.

Focus on Security Integration and Advanced Compliance Frameworks

Security remains a dominant trend, with rising emphasis on integrated cyber and physical protection. The Switzerland Data Center Market adapts to regulatory frameworks that require high compliance standards for sensitive data. Facilities invest in biometric access, AI-powered intrusion detection, and continuous threat monitoring. Enterprises prioritize operators that align with ISO and GDPR requirements. Security innovations strengthen customer confidence in hosted workloads. Providers expand investment in cyber resilience to defend against sophisticated attacks. It makes Switzerland a leader in secure and compliant data center operations.

Market Challenges

High Energy Costs and Limited Land Availability for Expansion

The Switzerland Data Center Market faces constraints from high electricity prices and limited real estate availability. Operators must secure access to renewable energy while managing operational costs. Rising power demand creates pressure on grid capacity in urban regions. Land scarcity restricts new construction near major cities. Providers adopt vertical builds and modular expansions to overcome spatial challenges. Enterprises often face higher service costs compared to neighboring countries. Investors weigh these cost factors before entering the market. It creates competitive pressure between local and international providers.

Complex Regulatory Environment and Talent Shortages in Advanced Roles

Operators must navigate a complex framework of national and EU regulations covering energy use, data protection, and environmental standards. The Switzerland Data Center Market requires high compliance investments that strain smaller firms. Multinational companies can absorb regulatory costs more effectively, strengthening their position. Talent shortages in AI, cloud architecture, and cybersecurity further add to challenges. Providers compete fiercely for skilled engineers to manage critical systems. This shortage raises labor costs and impacts project timelines. It limits capacity to scale rapidly in high-demand sectors.

Market Opportunities

Rising Investments in AI, Quantum Computing, and High-Performance Infrastructure

Opportunities arise from expanding demand for AI training clusters, quantum computing infrastructure, and HPC systems. The Switzerland Data Center Market provides an ideal environment due to robust energy access and stable regulations. Global enterprises seek facilities that support next-generation workloads. Investors identify strong potential in hosting AI data clusters requiring liquid cooling and specialized hardware. Demand for high-speed interconnections strengthens growth prospects. It positions Switzerland as an innovation hub for advanced computing infrastructure.

Strategic Growth from Cross-Border Connectivity and Cloud Ecosystem Expansion

Cross-border connectivity offers strong opportunities for operators seeking to expand their footprint across Europe. The Switzerland Data Center Market benefits from its central location and direct links to major hubs in Germany, France, and Italy. Cloud ecosystems integrate with international providers, strengthening Switzerland’s role as a global digital gateway. Enterprises seek neutral colocation hubs that interconnect regional markets. Investments in submarine cable extensions and fiber upgrades fuel growth potential. It supports Switzerland’s position in future European digital infrastructure strategies.

Market Segmentation

By Component

Hardware dominates the Switzerland Data Center Market, with strong demand for servers, networking equipment, and cooling systems. Providers invest heavily in high-density racks and advanced power distribution units to handle AI workloads. Software such as DCIM and automation tools gain adoption to optimize efficiency. Services, including integration and managed services, support enterprises migrating to hybrid models. Hardware maintains a leading share due to continuous upgrades. It remains the backbone of Switzerland’s expanding digital infrastructure.

By Data Center Type

Colocation and hyperscale data centers hold the largest share of the Switzerland Data Center Market. Colocation benefits from international enterprises seeking secure facilities, while hyperscale investments serve growing global workloads. Edge and modular centers gain traction to support localized applications and 5G. Enterprise facilities maintain relevance for compliance-driven sectors. Mega data centers expand in strategic hubs near Zurich and Geneva. Cloud and IDC facilities integrate global providers. It demonstrates a diversified mix of data center models.

By Deployment Model

Hybrid deployment dominates the Switzerland Data Center Market, as enterprises balance on-premises control with cloud scalability. Large corporations adopt hybrid models to maintain compliance while accessing cloud agility. Cloud-based models grow strongly due to SaaS and remote work needs. On-premises remains vital for industries with strict regulatory requirements. Hybrid offers flexibility and resilience, appealing to multinational enterprises. Service providers expand hybrid integration capabilities to capture demand. It strengthens Switzerland’s position in advanced IT adoption.

By Enterprise Size

Large enterprises lead the Switzerland Data Center Market with strong investments in high-performance computing and global connectivity. SMEs increasingly adopt cloud-based models due to lower upfront costs and scalability benefits. Hybrid solutions support SME growth across e-commerce, healthcare, and fintech. Enterprises of all sizes leverage colocation for compliance and resilience. Large enterprises drive demand for hyperscale facilities. SMEs push adoption of flexible service-based models. It ensures broad-based growth across enterprise segments.

By Application / Use Case

BFSI dominates the Switzerland Data Center Market due to high data volumes and compliance needs. IT and telecom drive growth through cloud ecosystems and 5G rollouts. Healthcare and retail adopt data centers for digital health services and omnichannel commerce. Media and entertainment expand with streaming and gaming demand. Manufacturing integrates IoT-driven data management. Government and defense prioritize security and sovereignty. Education and utilities also expand adoption. It ensures a balanced demand across multiple industries.

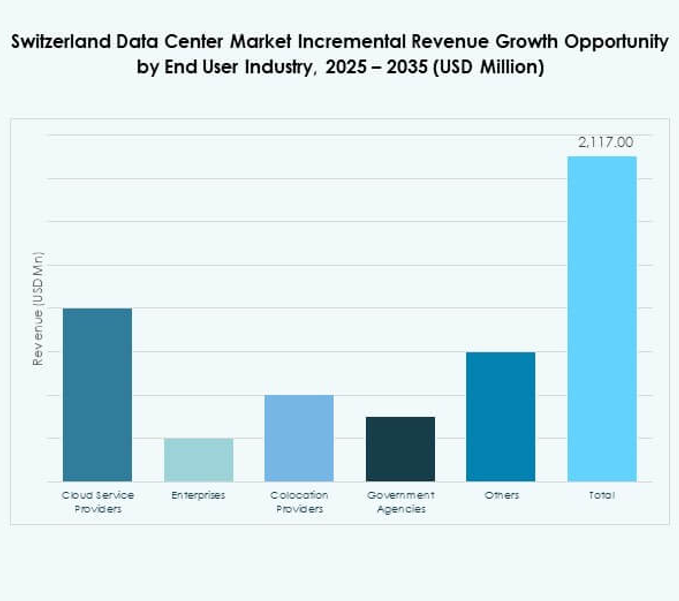

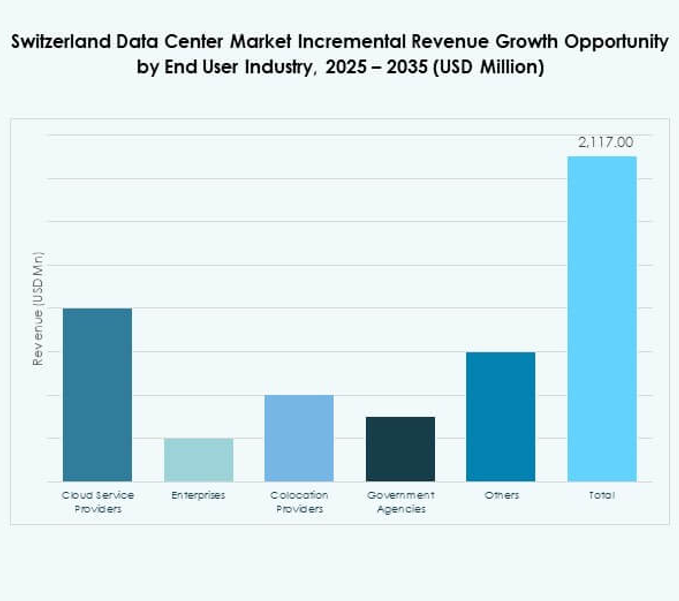

By End User Industry

Cloud service providers dominate the Switzerland Data Center Market with large-scale investments in hyperscale infrastructure. Colocation providers expand to meet international enterprise demand. Enterprises leverage hybrid models for operational flexibility. Government agencies prioritize compliance and sovereignty through secure facilities. Other end users, including research institutions and utilities, increase reliance on data-driven models. End-user diversity ensures strong resilience against sector-specific slowdowns. It creates a broad ecosystem of stakeholders fueling Switzerland’s data infrastructure growth.

Regional Insights

Western Switzerland Leads with Strongest Market Share and Infrastructure Density

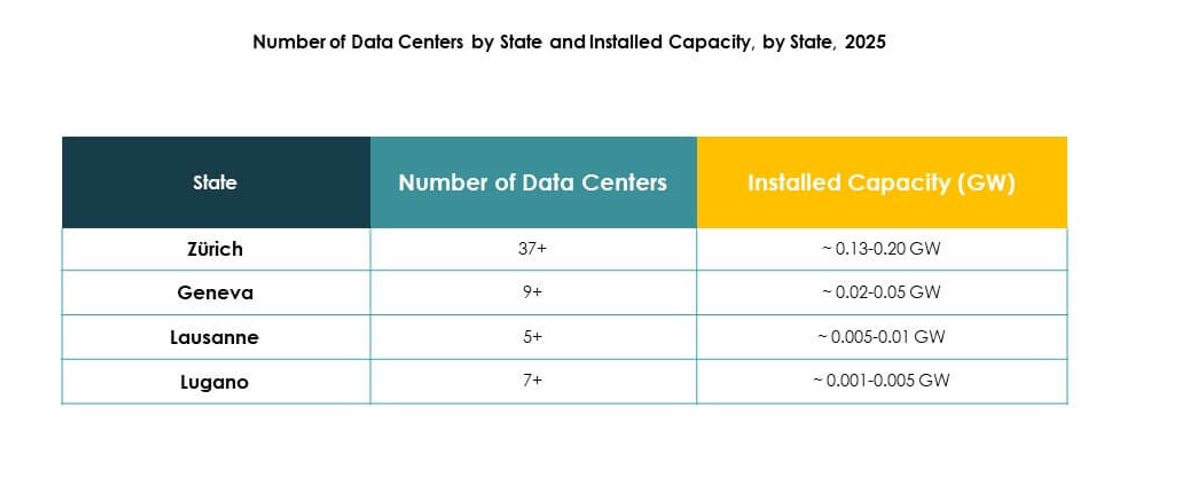

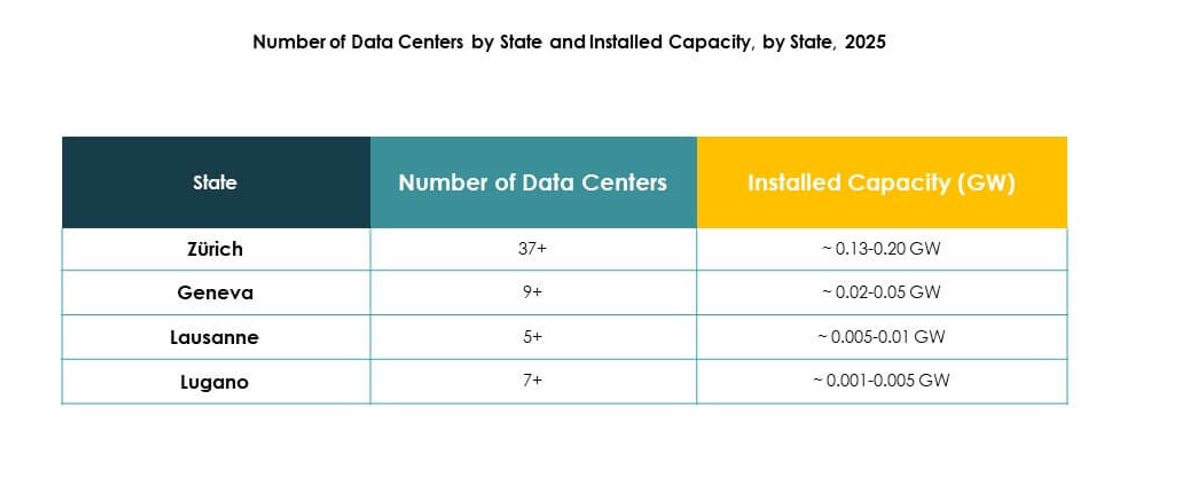

Western Switzerland accounts for 42% share of the Switzerland Data Center Market, led by hubs in Geneva and Lausanne. It benefits from proximity to France and Italy, enabling cross-border connectivity. Strong demand from financial services and government sectors supports growth. Energy availability and advanced fiber networks reinforce its role. Enterprises select this subregion for compliance and resilience. It positions Western Switzerland as the leading digital infrastructure zone.

Northern and Central Switzerland Expand Capacity with Urban Growth and Enterprise Hubs

Northern and Central regions hold 36% share of the Switzerland Data Center Market, anchored by Zurich and Bern. These cities host large enterprise headquarters and financial institutions. Demand grows for hyperscale and colocation facilities serving global workloads. Strong talent pools support innovation and technology adoption. Connectivity with Germany enhances regional integration. It highlights Northern and Central Switzerland as emerging centers for scalable infrastructure.

- For instance, in January 2023, Green Datacenter launched its Dielsdorf campus near Zurich, spanning 46,000 square meters and designed to host up to 80,000 servers, with the M facility featuring advanced energy efficiency measures and heat recovery systems.

Eastern and Southern Switzerland Emerge as Growth Hubs for Edge and Niche Markets

Eastern and Southern Switzerland together account for 22% share of the Switzerland Data Center Market. Growth is driven by modular facilities, edge deployments, and specialized applications. Proximity to Austria and Italy strengthens regional connectivity. Local governments support new investments through incentives and green energy programs. Operators expand capacity in smaller cities to serve SMEs and distributed workloads. It highlights these subregions as important growth corridors for future expansion.

- For instance, in May 2022, Safe Host expanded its operations by integrating four Swiss data centers totaling over 20,000 square meters and 45 MW of IT capacity, following its acquisition by IPI Partners and rebranding as STACK EMEA.

Competitive Insights:

- Green Datacenter

- Interxion Switzerland

- Equinix Switzerland

- Safe Host

- Swisscom Data Centers

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC (Alphabet Inc.)

The Switzerland Data Center Market features strong competition between domestic providers and global hyperscale leaders. Local firms such as Green Datacenter, Interxion, and Safe Host expand capacity to address demand from enterprises seeking secure and compliant infrastructure. Swisscom Data Centers leverage strong ties with government and regulated industries, while international operators like Equinix and Digital Realty strengthen cross-border connectivity. Global tech giants, including Microsoft, AWS, and Google, invest heavily in cloud-linked infrastructure, reinforcing Switzerland’s position as a trusted digital hub. Competition focuses on sustainability, renewable energy adoption, and advanced security standards. It drives continuous innovation in colocation, hybrid, and hyperscale offerings, ensuring that operators maintain reliability, efficiency, and compliance to attract both regional and multinational clients.

Recent Developments:

- In September 2025, Green Datacenter announced the expansion of its presence into Germany by establishing Green Datacenter Germany GmbH, signaling a new milestone in the company’s European growth strategy. The subsidiary, led by Heiko Siats, aims to provide highly energy-efficient data center solutions near Frankfurt, responding to rising demand from enterprises and cloud providers across Europe.

- In July 2025, IFM Global Infrastructure Fund (IFM GIF), advised by IFM Investors, agreed to acquire 100 percent of Green Group AG, marking a significant acquisition in the Swiss data center segment and positioning Green Datacenter for further expansion and investment in sustainable, innovative data center infrastructure.

- In June 2025, Microsoft unveiled a major $400 million investment to expand its existing data centers in Zürich and Geneva. This initiative is focused on boosting AI-ready infrastructure capacity and supporting the digital transformation needs of over 50,000 customers across healthcare, finance, and government sectors.