Executive summary:

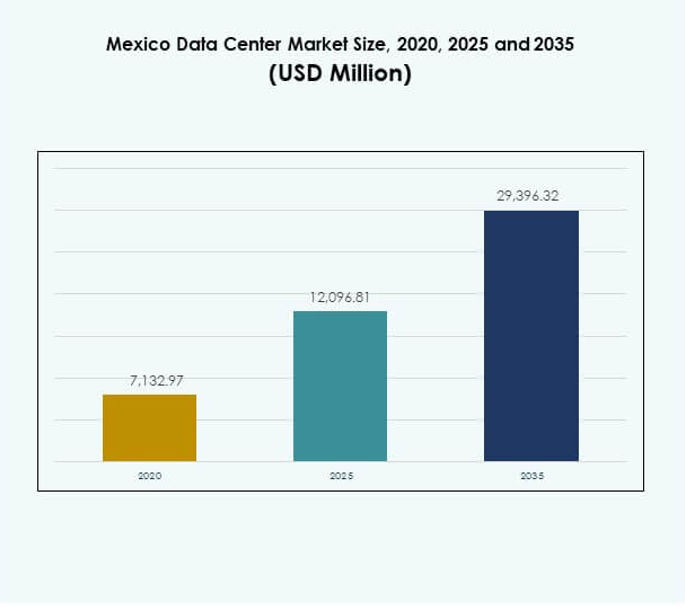

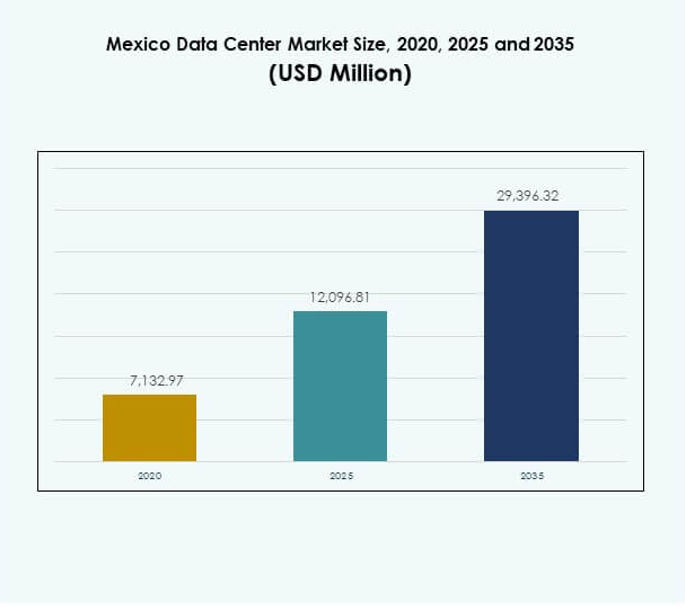

The Mexico Data Center Market size was valued at USD 9,402.08 million in 2020 to USD 16,047.52 million in 2025 and is anticipated to reach USD 41,539.74 million by 2035, at a CAGR of 9.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Mexico Data Center Market Size 2025 |

USD 16,047.52 Million |

| Mexico Data Center Market, CAGR |

9.93% |

| Mexico Data Center Market Size 2035 |

USD 41,539.74 Million |

The market growth is fueled by rapid adoption of advanced technologies, rising cloud deployments, and innovation in hybrid infrastructure models. Enterprises and service providers invest heavily in hyperscale and edge facilities to meet demand for AI, IoT, and big data solutions. The Mexico Data Center Market holds strategic importance as it provides businesses and investors with scalable, secure, and resilient digital infrastructure, positioning the country as a competitive hub in Latin America.

Regionally, Mexico has emerged as a leading destination within Latin America due to strong connectivity with North America and a growing domestic digital ecosystem. Northern Mexico benefits from industrial strength and proximity to U.S. markets, while Central Mexico shows robust expansion through finance, telecom, and enterprise demand. Southern Mexico is steadily emerging, supported by renewable energy projects and rising regional connectivity, creating balanced opportunities for nationwide data center development.

Market Drivers

Rising Adoption of Advanced Digital Infrastructure Across Enterprises and Government Agencies

The Mexico Data Center Market is driven by the need for advanced digital infrastructure among enterprises and government institutions. Organizations invest in modern facilities to support data-intensive applications and high-speed processing. Growing reliance on real-time data and AI-based solutions creates stronger demand for scalable systems. The government supports digitization, fostering infrastructure projects that meet compliance and performance standards. Enterprises prioritize secure storage and faster connectivity. This market continues to evolve with robust investment in digital capacity. It holds significant strategic relevance for investors evaluating long-term growth. Businesses gain operational resilience through strong infrastructure expansion.

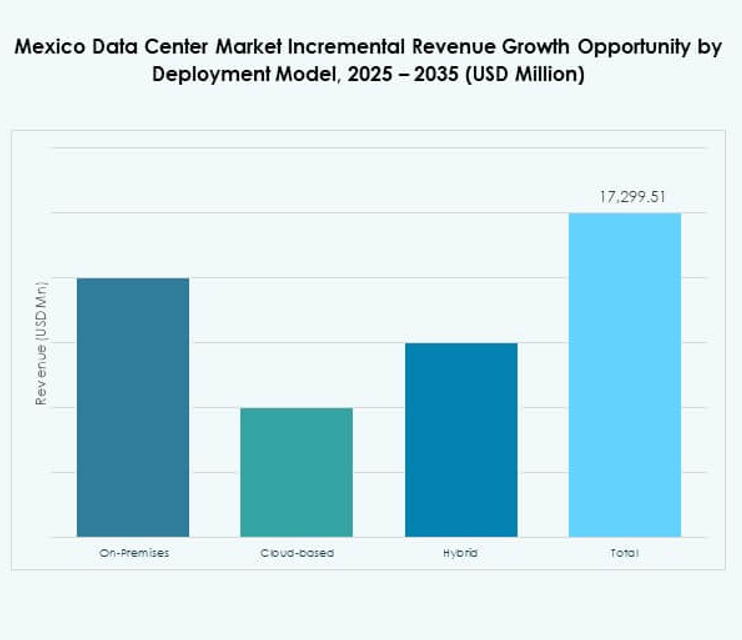

Innovation in Cloud-Based and Hybrid Deployment Models Driving Scalability and Efficiency

Cloud-based and hybrid models transform how enterprises deploy and manage workloads. The Mexico Data Center Market sees a shift toward flexible infrastructure that integrates cloud with on-premises systems. Companies adopt hybrid frameworks to balance performance, compliance, and cost. Investors view this as a sustainable growth driver with high return potential. Innovation enhances agility in scaling infrastructure according to demand. Enterprises achieve cost efficiency and service continuity through modern models. It strengthens business resilience in competitive industries. This momentum attracts both local providers and multinational technology firms.

- For instance, in 2022 Megaport formed a partnership with KIO Networks to enable hybrid cloud connectivity from KIO’s Mexico City and Querétaro data centers. Customers gained direct access to leading clouds Microsoft Azure, Google Cloud, Oracle Cloud, and IBM Cloud via Megaport’s Network as a Service platform.

Growing Demand for Edge and Hyperscale Facilities to Support Next-Generation Applications

The rise of hyperscale and edge facilities underscores Mexico’s role in the regional digital ecosystem. Enterprises expand their networks to meet requirements of IoT, AI, and 5G applications. The Mexico Data Center Market benefits from investments in hyperscale campuses supporting massive workloads. Edge facilities improve latency-sensitive applications across industries like telecom, finance, and retail. Companies recognize the strategic need for localized computing capacity. It enhances end-user experiences while ensuring efficiency in resource utilization. The evolution of hyperscale and edge aligns with global digital growth. Investors see opportunity in the scalability of these models.

Strategic Importance of Digital Transformation for Business Continuity and Global Competitiveness

Digital transformation strengthens Mexico’s position as a key market in Latin America. Enterprises integrate data centers into long-term business strategies for continuity and competitiveness. The Mexico Data Center Market creates a backbone for industries shifting to cloud and AI ecosystems. Multinational firms view Mexico as a regional hub with geographic advantages. It enables reliable connectivity to North America while serving regional needs. Stronger resilience against downtime and cyber risks highlights its strategic value. Investors secure exposure to fast-growing digital industries by supporting local projects. This dynamic ecosystem positions Mexico as an attractive destination for global players.

- For instance, Microsoft inaugurated the Mexico Central Azure cloud region in Querétaro in 2024, built with three independent Availability Zones to ensure business resilience and compliance for regulated industries and public sector organizations.

Market Trends

Integration of Renewable Energy Sources for Sustainable Data Center Operations

Sustainability emerges as a major trend with operators integrating renewable energy in their facilities. The Mexico Data Center Market reflects rising adoption of wind and solar power to reduce carbon footprints. Operators prioritize energy-efficient cooling technologies to meet stricter ESG standards. It enables long-term operational savings and aligns with global climate commitments. Renewable integration attracts eco-conscious enterprises as clients. Providers strengthen brand reputation by committing to green practices. Market differentiation now relies heavily on sustainability initiatives. Investments in renewable-linked projects continue to expand across the industry.

Expansion of Artificial Intelligence and Machine Learning in Data Center Management

Artificial intelligence transforms operational efficiency by optimizing power, cooling, and workload management. The Mexico Data Center Market witnesses wider adoption of AI and ML for predictive monitoring. Automated tools reduce downtime and lower operational costs. It enables real-time insights into system performance and enhances energy distribution. Enterprises benefit from improved service reliability through AI-driven solutions. Providers invest in algorithms that support adaptive infrastructure scaling. AI’s role in security strengthens defense against emerging cyber threats. This adoption trend elevates Mexico’s digital readiness.

Development of Colocation Facilities as Enterprises Prioritize Shared Infrastructure Models

Colocation centers grow rapidly as enterprises favor cost-effective infrastructure sharing. The Mexico Data Center Market benefits from strong demand for colocation across industries. Shared facilities provide advanced power, cooling, and security systems at lower upfront costs. It ensures scalability without major capital investment for enterprises. Providers expand facilities across urban hubs to capture rising demand. Businesses gain flexibility to adapt to fluctuating workloads with colocation. It enhances network connectivity by integrating multiple enterprises in one ecosystem. This trend secures stable revenue streams for operators.

Growth of Modular and Micro Data Centers to Enhance Localized Computing Needs

The adoption of modular and micro facilities strengthens the regional digital framework. The Mexico Data Center Market demonstrates growth in compact solutions supporting local enterprises and SMEs. These centers enable fast deployment and lower operating costs. It supports localized computing for industries demanding real-time data access. Modular designs allow flexibility in scaling operations to match business needs. Providers develop standardized solutions to reduce lead times and costs. Market expansion accelerates in secondary cities with growing digital penetration. Modular facilities represent a resilient and adaptive growth strategy.

Market Challenges

High Energy Consumption and Rising Infrastructure Costs Limiting Operational Efficiency

The Mexico Data Center Market faces challenges related to high energy consumption and infrastructure costs. Operators struggle to balance sustainability with rising electricity demand from large-scale facilities. Cooling requirements create additional pressure on operating expenses. It impacts profitability and slows smaller providers from competing with hyperscale players. Infrastructure investments remain capital intensive, discouraging new entrants. Energy price volatility further complicates financial planning for operators. Managing these costs while ensuring uninterrupted service is a key challenge. Market growth depends on solutions that combine efficiency with long-term reliability.

Cybersecurity Threats and Regulatory Compliance Barriers Affecting Market Stability

Data centers face increasing cybersecurity risks from evolving global threats. The Mexico Data Center Market must address compliance with strict regulations on data protection. Cyberattacks disrupt operations and damage trust in providers. It pushes operators to enhance digital security frameworks and invest in advanced monitoring. The cost of compliance with national and international standards creates operational complexity. Providers must balance client expectations with strict oversight from authorities. These challenges limit flexibility in scaling operations quickly. Long-term success depends on securing data integrity and operational stability.

Market Opportunities

Strategic Expansion of Cloud and Hyperscale Facilities to Strengthen Regional Digital Infrastructure

The Mexico Data Center Market holds strong opportunities through expansion of cloud and hyperscale campuses. Global technology firms continue to invest in large-scale facilities to support digital growth. It enhances Mexico’s role as a regional hub for advanced IT solutions. Growing enterprise demand creates long-term revenue potential for hyperscale and cloud providers. Expansion improves latency and connectivity for critical applications. Investors capitalize on rising demand from telecom, healthcare, and e-commerce industries. Market opportunities lie in building infrastructure that strengthens Mexico’s regional competitiveness.

Rising Demand for Managed Services and AI-Driven Infrastructure Optimization Across Industries

The market benefits from rising demand for managed services that support enterprises lacking in-house capabilities. The Mexico Data Center Market aligns with industries requiring AI-based infrastructure optimization. It creates opportunities for providers offering consulting, integration, and predictive monitoring solutions. Enterprises gain efficiency without large upfront investments. Managed services expand client portfolios by appealing to SMEs and startups. AI-driven management tools open paths for cost control and risk reduction. Investors find growth potential in service-driven models complementing hardware-focused markets.

Market Segmentation

By Component

Hardware dominates the Mexico Data Center Market, led by servers, power, and cooling systems holding the largest share. Enterprises prioritize resilient infrastructure to support rising workloads. Storage and networking further strengthen demand as industries expand digital capacity. Software, including DCIM and monitoring, grows steadily with automation adoption. Services like consulting and managed operations add long-term value. Providers gain recurring revenue through integration and maintenance support. Stronger focus on energy efficiency drives innovations in hardware solutions. Market growth remains hardware-centric with integrated services adding resilience.

By Data Center Type

Hyperscale facilities dominate the Mexico Data Center Market, driven by global cloud providers investing in large campuses. Colocation centers also record strong growth as enterprises prefer shared infrastructure. Enterprise facilities serve large corporations with tailored needs. Edge and modular facilities expand to secondary cities with increasing digital penetration. Mega facilities support regional demand for large-scale processing. Cloud/IDC structures enhance scalability and operational efficiency. Providers balance multiple types to meet diverse client needs. Hyperscale continues leading expansion with sustained investment from global players.

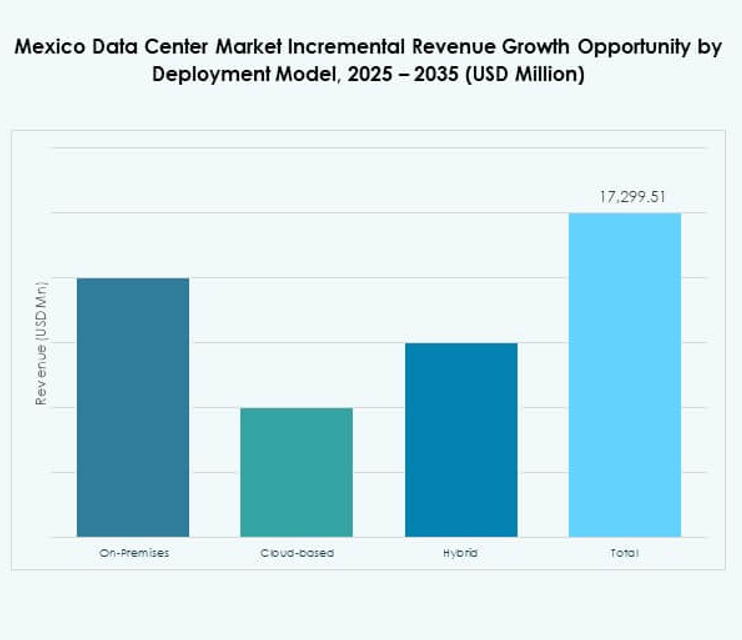

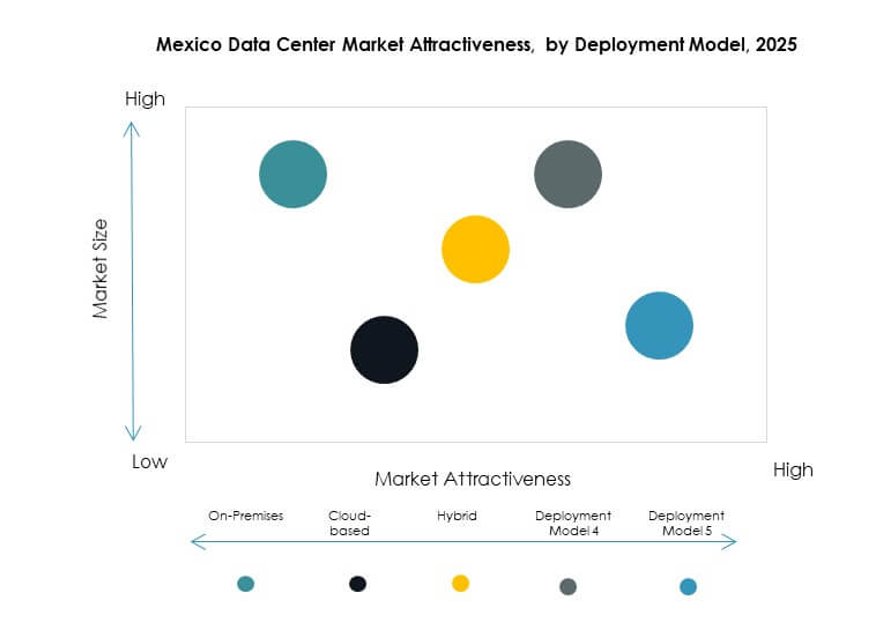

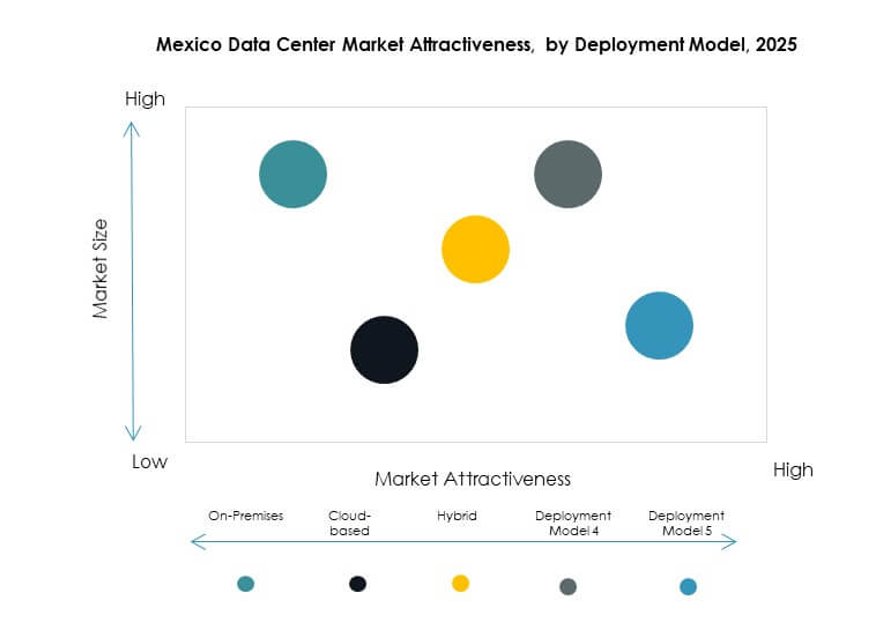

By Deployment Model

Hybrid deployment leads the Mexico Data Center Market as enterprises balance flexibility with control. On-premises models retain importance in industries with strict compliance requirements. Cloud-based deployments expand rapidly across SMEs and tech-driven enterprises. Hybrid frameworks allow integration of legacy systems with scalable cloud solutions. Providers invest in hybrid ecosystems offering security and performance. It enhances resilience by diversifying workloads across environments. Enterprises view hybrid as a path toward gradual transformation. The deployment landscape remains diverse with hybrid gaining long-term dominance.

By Enterprise Size

Large enterprises dominate the Mexico Data Center Market due to high demand for complex digital infrastructure. SMEs increasingly adopt colocation and managed services to reduce costs. Growth in SMEs accelerates adoption of cloud solutions for flexibility. Providers target SMEs with modular and scalable offerings. Large corporations continue driving revenue with higher capital investments. It ensures balanced growth across both segments. Providers leverage dual strategies to serve multinational firms and local businesses. This balance strengthens overall industry resilience and scalability.

By Application / Use Case

IT and telecom dominate the Mexico Data Center Market by enabling connectivity and digital services. BFSI emerges as a strong segment due to reliance on secure storage and real-time processing. Healthcare accelerates demand for data management through digital health initiatives. Retail and e-commerce expand adoption with online growth. Media and entertainment push demand for low-latency solutions. Manufacturing and government also contribute through digital modernization. Providers serve a diverse base across industries. Growth remains strongest in IT, telecom, and BFSI sectors.

By End User Industry

Cloud service providers dominate the Mexico Data Center Market with large-scale investments in hyperscale campuses. Enterprises adopt colocation and hybrid models to meet evolving business needs. Government agencies demand secure infrastructure for digital services and compliance. Colocation providers expand capacity to serve SMEs and startups. Other industries like utilities and education contribute steadily. It ensures a balanced distribution of end users. Strong growth opportunities align with rising cloud adoption. Market leadership remains with cloud service providers driving expansion.

Regional Insights

Northern Mexico as a Leading Subregion with Strong Industrial and Technological Base

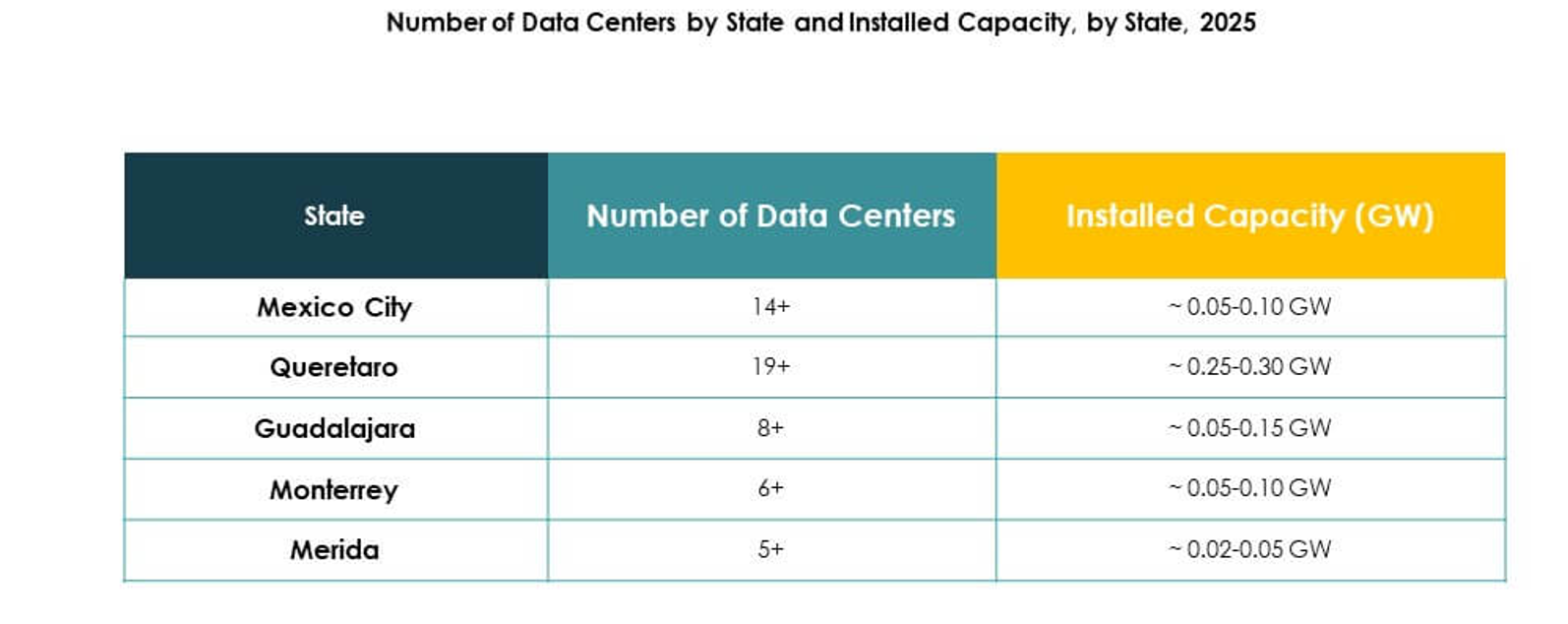

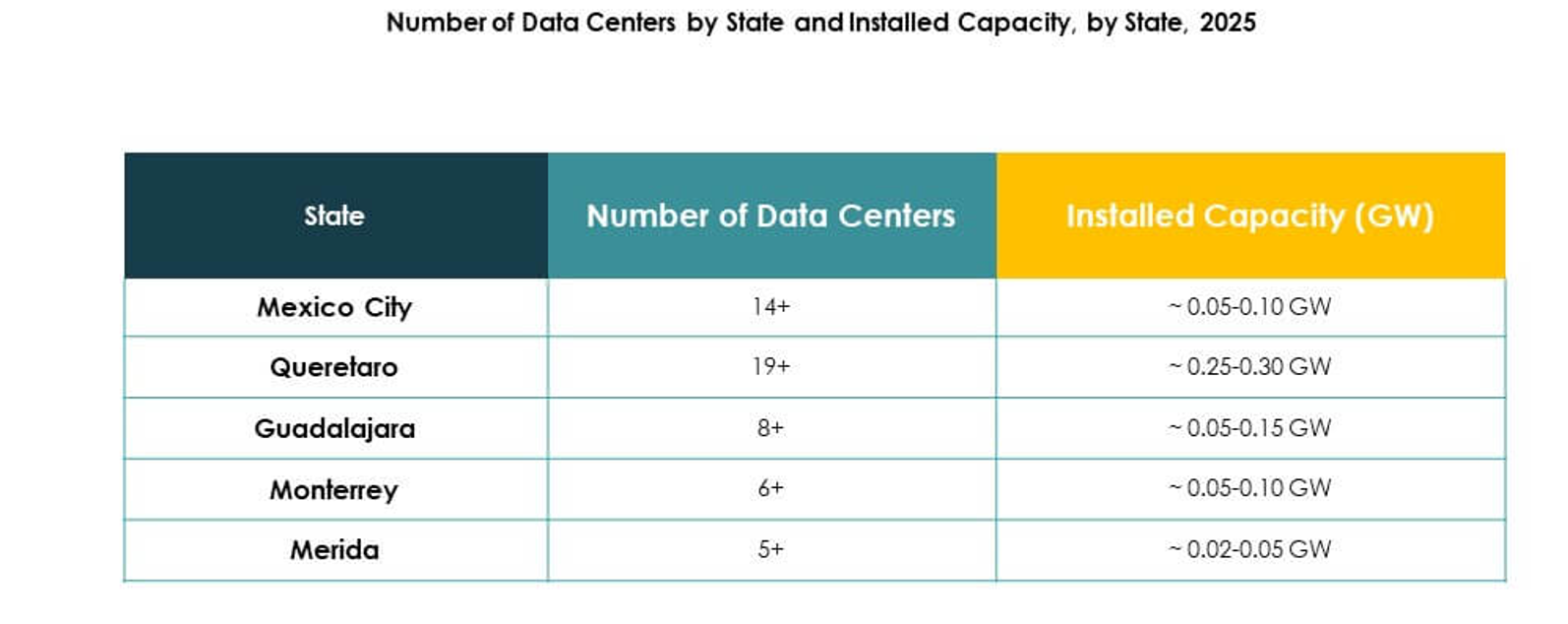

Northern Mexico leads the Mexico Data Center Market with 41% share in 2024. The subregion benefits from proximity to the U.S., advanced industrial hubs, and strong connectivity. It attracts hyperscale providers building cross-border facilities. Enterprises leverage geographic advantages for operational continuity. It strengthens Mexico’s global positioning as a regional hub. Northern states anchor growth through robust infrastructure and foreign investments. The area continues to capture the largest share of future expansions.

Central Mexico Emerging as a High-Growth Subregion with Expanding Urban Infrastructure

Central Mexico holds 36% share, driven by strong urban centers like Mexico City and Querétaro. The Mexico Data Center Market benefits from robust infrastructure and skilled workforce in the region. Growing demand from finance, telecom, and healthcare industries accelerates adoption. It offers geographic advantages for enterprises seeking central connectivity. Providers invest heavily in hyperscale and colocation facilities in this subregion. Central Mexico shows consistent growth with strong industry presence. The subregion establishes itself as a high-growth market for long-term investors.

- For instance, in 2024, KIO Networks announced a US $400 million investment to build its third data center in the El Marqués Industrial Park in Querétaro, which will interconnect with its existing facilities to form a unified campus.

Southern Mexico Expanding with Steady Growth Through Localized Investments and Connectivity Projects

Southern Mexico accounts for 23% share of the Mexico Data Center Market in 2024. The subregion expands steadily with localized investments and digital connectivity projects. It gains momentum through renewable energy projects supporting sustainable facilities. Enterprises explore opportunities for modular centers in emerging cities. It improves digital penetration and creates balanced national growth. Southern Mexico continues building competitive positioning in the market. The subregion strengthens national coverage for enterprises seeking reliable infrastructure.

- For instance, in September 2025, Arelion announced a second fully diverse fiber route from Querétaro to Monterrey, enhancing connectivity and supporting scalable data center growth in Mexico.

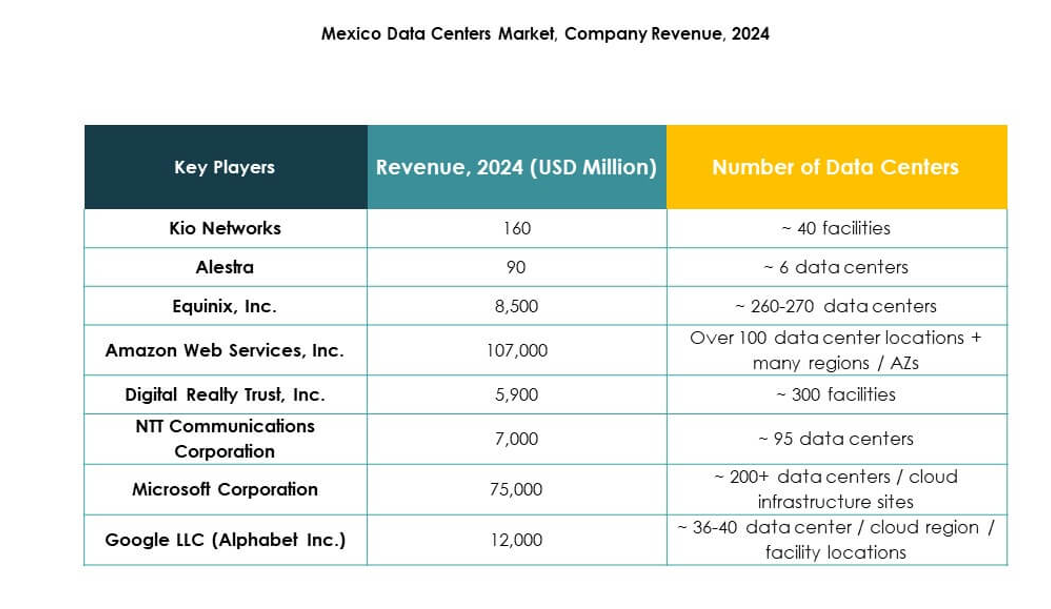

Competitive Insights:

- Kio Networks

- Alestra

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Digital Realty

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

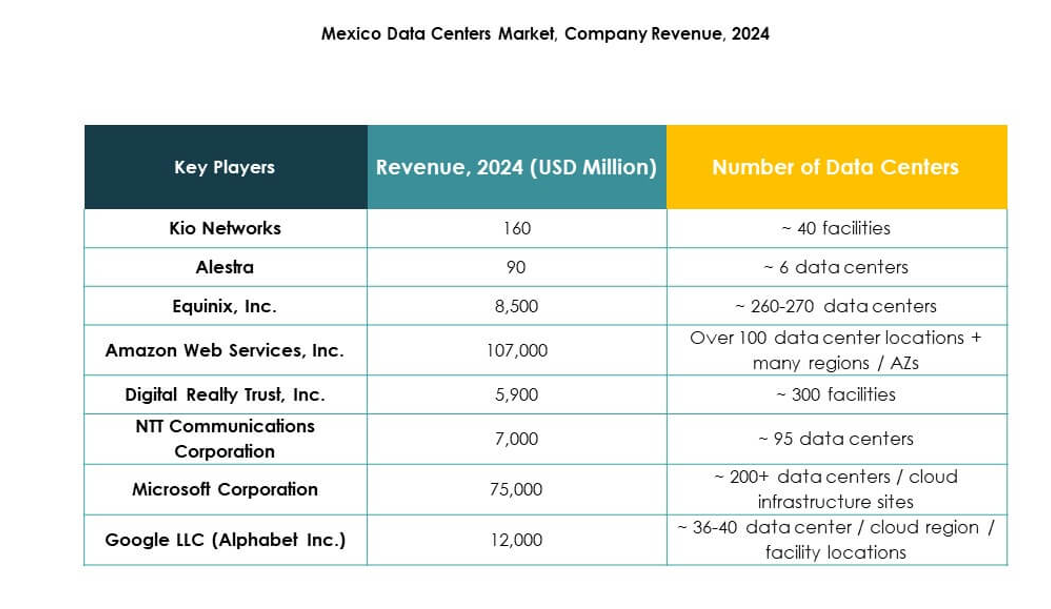

The Mexico Data Center Market features strong competition between local and global players, each pursuing aggressive expansion and innovation strategies. Kio Networks and Alestra maintain a strong local presence by offering reliable colocation and enterprise solutions tailored to Mexican clients. Global leaders such as Equinix, Digital Realty, and NTT Communications strengthen their market footprint with large-scale investments and strategic partnerships. Cloud giants including Microsoft, AWS, and Google drive growth by expanding hyperscale and hybrid deployments to meet rising digital demands. It fosters intense competition across services, pricing, and infrastructure quality. Providers differentiate through energy-efficient facilities, advanced security frameworks, and strong connectivity networks, positioning themselves to capture growing demand from enterprises, SMEs, and cloud service providers.

Recent Developments:

- In September 2025, CloudHQ announced a substantial $4.8 billion investment to build six new data center campuses in the state of Querétaro, Mexico. The announcement was made during a press conference with the company’s chief operating officer, highlighting that these facilities will be designed to fuel cloud computing and AI adoption in the region. The initial phase will have a capability of supporting 200 MW of power, and the entire campus will ultimately reach a critical computing load of 600 MW, with construction supported by collaboration with various government and energy agencies.

- In September 2025, KIO Data Centers announced a landmark strategic alliance with Lonestar Data Holdings, a space-based data storage operator, establishing a hybrid data ecosystem that connects KIO’s terrestrial data centers with Lonestar’s space-based “data embassies.” The partnership aims to redefine data security and sovereignty, positioning KIO as a pioneer in bridging terrestrial and space infrastructure for data protection.

- In August 2025, Mexico Telecom Partners (MTP) initiated the second phase of its Edge data center in Mérida, Mexico. This development highlights the rapid expansion of edge infrastructure to support growing demands for local data processing and connectivity, reinforcing Mexico’s digital infrastructure beyond core hubs like Querétaro.

- In July 2025, Alestra launched the “Alianza Program,” expanding its strategic partnerships with ICT market specialists in Mexico. This initiative allows technology firms and independent professionals to integrate Alestra’s solutions into their service offerings, facilitating collaboration on innovative projects and boosting business growth across the region.