Executive summary:

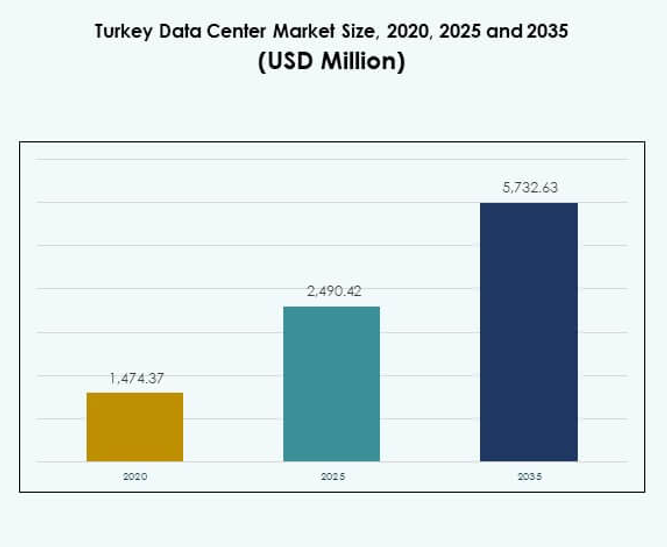

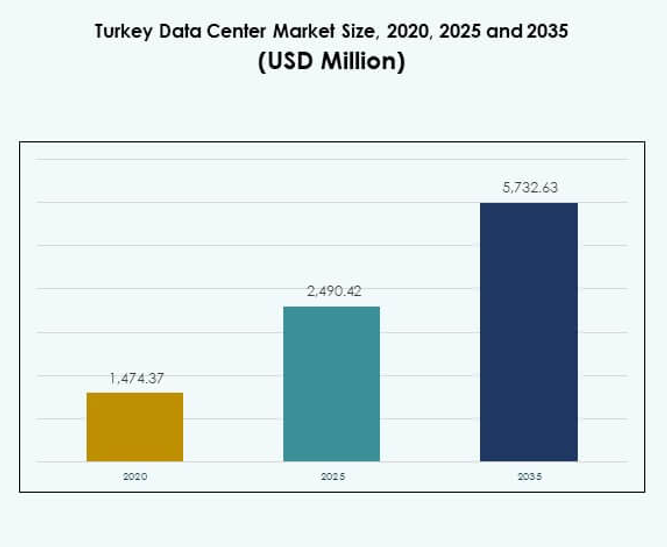

The Turkey Data Center Market size was valued at USD 1,474.37 million in 2020 to USD 2,490.42 million in 2025 and is anticipated to reach USD 5,732.63 million by 2035, at a CAGR of 8.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Turkey Data Center Market Size 2025 |

USD 2,490.42 Million |

| Turkey Data Center Market, CAGR |

8.64% |

| Turkey Data Center Market Size 2035 |

USD 5,732.63 Million |

The market is driven by rising demand for cloud adoption, digital transformation, and hybrid infrastructure solutions. Enterprises are adopting advanced data storage and processing systems to improve agility and security. The rollout of 5G networks and the integration of artificial intelligence in IT operations enhance efficiency and scalability. Strong government support and investor interest strengthen the market’s role as a regional hub for technology and digital services.

Western Turkey leads due to Istanbul’s advanced connectivity and strategic location, attracting hyperscale and colocation investments. Central Turkey is emerging with steady growth fueled by government-driven digital initiatives and industrial expansion. Eastern Turkey holds potential with cross-border trade and connectivity projects, though it remains less developed compared to western and central regions. This regional distribution reflects a balanced pathway for market growth.

Market Drivers

Growing Demand for Digital Transformation Across Enterprises and Government Sectors

The Turkey Data Center Market is driven by the country’s rapid digital transformation agenda, supported by both public and private sector investments. Enterprises seek scalable infrastructure to support cloud adoption, artificial intelligence, and big data applications. Government-backed digital economy programs also accelerate adoption of high-capacity computing solutions. Businesses require secure environments to process and store data locally, creating demand for modern facilities. Investors view the sector as a vital pillar of Turkey’s economic modernization. It continues to strengthen competitiveness in regional technology ecosystems. Digitalization remains a critical engine shaping long-term growth.

Advancement in Connectivity Infrastructure and Expansion of 5G Networks

High-speed connectivity remains essential for data centers, and Turkey’s growing 5G rollout is fueling this demand. Low-latency applications in autonomous systems, financial trading, and media streaming require advanced networks. Telecom operators are aligning infrastructure expansion with new data center developments to handle increasing bandwidth. It creates opportunities for hyperscale facilities to thrive. The Turkey Data Center Market benefits from being at the intersection of Europe and Asia, enhancing its value for global cloud players. Edge facilities also gain traction to support real-time workloads. Strong connectivity improvements ensure continuous growth and technology integration.

- For example, as of 2025, Türk Telekom’s fiber network reached 496,000 km, covering 33.5 million households, with 54% of LTE base stations connected to fiber to strengthen 5G readiness nationwide.

Rising Cloud Service Adoption and Need for Hybrid Infrastructure Solutions

Cloud adoption has expanded across industries, with enterprises pursuing both cost optimization and agility. Demand for hybrid cloud infrastructure is strong, enabling companies to balance security and scalability. Turkey hosts growing demand for both public cloud and private infrastructure integration. Local providers and international hyperscalers invest in facilities to strengthen service availability. The Turkey Data Center Market leverages this hybrid model as a key driver for modernization. It allows industries to combine legacy infrastructure with cloud agility. Increased SaaS adoption and virtualization continue to fuel demand for more resilient centers.

- For example, as of September 2025, Turkcell operates eight core data centers across four key markets in Turkey, totaling 122,000 sqm with 41.5 MW of combined power capacity. This infrastructure delivers advanced digital services and is part of Turkcell’s broader strategy for digital infrastructure expansion.

Strategic Importance of Turkey as a Regional Digital Hub and Investor Destination

Turkey’s strategic position between Europe, the Middle East, and Asia boosts its value for global players. Data traffic flows through the country, making it a logical site for interconnection hubs. Regional demand from multinational companies drives continuous investment in colocation and hyperscale facilities. Strong government support for ICT growth enhances investor confidence. The Turkey Data Center Market is recognized as a regional digital hub with cross-border significance. It attracts technology companies seeking proximity to high-growth markets. Strategic location ensures sustainable demand and makes it a key investment hotspot.

Market Trends

Increasing Deployment of Edge Data Centers to Support Low-Latency Applications

Edge computing emerges as a major trend with the rise of real-time applications. Autonomous vehicles, IoT devices, and industrial automation require processing closer to users. The Turkey Data Center Market is witnessing growth in modular and micro facilities tailored for latency-sensitive workloads. Telecom and cloud providers deploy distributed edge infrastructure in metropolitan areas. It supports faster response times for consumer and industrial use cases. Gaming, AR/VR, and smart city initiatives also accelerate adoption. Edge expansion complements hyperscale growth, making Turkey a hybrid ecosystem for data infrastructure.

Focus on Renewable Energy Integration and Sustainable Facility Designs

Sustainability is becoming central to new investments, driven by global ESG standards and local policies. Operators prioritize renewable energy sourcing and energy-efficient cooling systems. Green building certifications and innovative designs such as liquid cooling gain momentum. The Turkey Data Center Market integrates eco-friendly initiatives to align with investor expectations. It benefits from Turkey’s renewable potential, including solar and wind projects. Companies adopt energy management systems to reduce carbon emissions. Sustainability shifts elevate market reputation and attract global players seeking compliance with environmental targets.

Growing Interest in Artificial Intelligence Integration for Data Center Operations

Artificial intelligence is increasingly used for predictive maintenance, energy optimization, and workload automation. Data centers in Turkey are deploying AI-powered solutions to enhance operational resilience. The Turkey Data Center Market integrates machine learning tools for cooling, power, and security management. It allows facilities to cut costs and maximize uptime. Investors prefer AI-enabled centers due to long-term efficiency advantages. AI-driven automation strengthens reliability of mission-critical applications. This trend ensures improved scalability while reducing human error in management processes.

Expansion of Colocation Facilities to Support SMEs and Global Enterprises

Colocation continues to grow as businesses shift from on-premises infrastructure. SMEs benefit from cost efficiency, while large enterprises leverage advanced connectivity and scalability. The Turkey Data Center Market sees rising investments in colocation, with international operators targeting Istanbul as a regional hub. Demand for interconnection services also grows as digital ecosystems expand. It supports fintech, e-commerce, and content delivery networks. Colocation enables flexible deployment models, making it attractive for industries balancing cost and performance. This expansion trend underlines Turkey’s role as a hub for enterprise digital services.

Market Challenges

Energy Supply Limitations and Rising Operational Costs Affecting Market Expansion

Energy reliability remains a pressing concern for operators establishing large-scale facilities. Turkey faces challenges in balancing rising electricity demand with sustainable supply. The Turkey Data Center Market is impacted by fluctuations in energy prices, leading to higher operational expenses. Power redundancy and alternative energy adoption increase capital costs. It becomes difficult for small and medium providers to compete with hyperscalers. Rising costs also affect pricing structures, influencing competitiveness. Energy availability continues to pose a constraint for capacity expansion strategies in the country.

Regulatory Barriers, Data Sovereignty Concerns, and Infrastructure Gaps Slowing Growth

Complex regulations around data storage and transfer pose hurdles for international players. Enterprises demand compliance with local data residency requirements, raising infrastructure costs. The Turkey Data Center Market also faces challenges from uneven regional infrastructure, with concentration in Istanbul. Rural areas lack advanced connectivity, limiting distributed deployment. Investors hesitate in regions with uncertain policies or limited skilled workforce. It raises entry barriers for new operators. Ensuring regulatory clarity and workforce training is critical to overcoming these challenges.

Market Opportunities

Rising Investments in Hyperscale and Hybrid Infrastructure from Global Technology Leaders

Turkey attracts multinational cloud and technology companies seeking regional footholds. The Turkey Data Center Market benefits from investments in hyperscale facilities designed to handle large-scale workloads. It provides opportunities for hybrid infrastructure services, supporting both enterprise and consumer markets. Demand for AI, IoT, and big data applications strengthens investor confidence. Strategic alliances with telecom operators create further prospects. Growing demand for interconnection hubs enhances Turkey’s role as a key market for expansion.

Expanding Role of Turkey as a Digital Gateway Between Europe and Asia

Turkey’s unique geographic position offers an unmatched advantage for cross-border connectivity. The Turkey Data Center Market leverages its location to serve both developed and emerging regions. It enables data traffic to flow efficiently between Europe, Middle East, and Central Asia. It attracts international companies seeking to reduce latency and improve service reach. Investments in submarine cable networks and fiber projects enhance this opportunity. Turkey’s gateway role positions it as a long-term growth hub.

Market Segmentation

By Component

Hardware dominates the Turkey Data Center Market with the largest share, driven by servers, storage, and cooling systems. Demand for high-density racks and power systems supports scalability. Software adoption, particularly in DCIM and virtualization, grows steadily as enterprises pursue automation. Services such as consulting and managed services complement infrastructure adoption. Increasing reliance on hybrid environments sustains growth across all components, with hardware maintaining its leadership in overall market share.

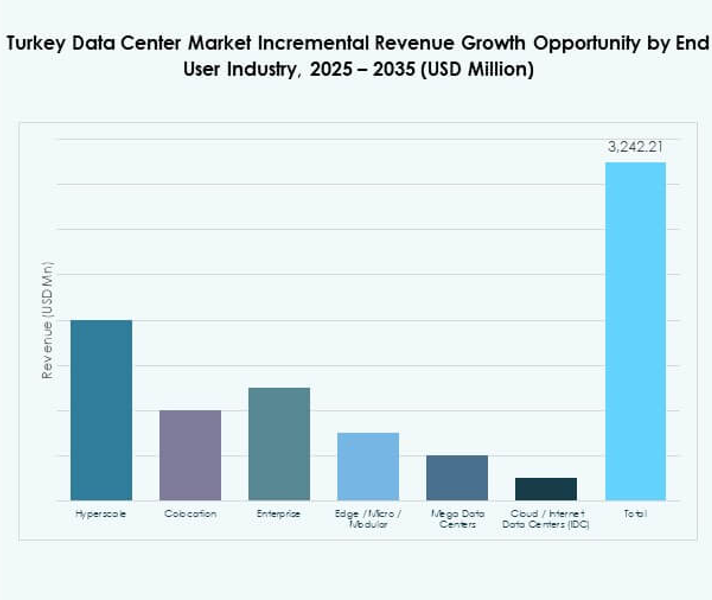

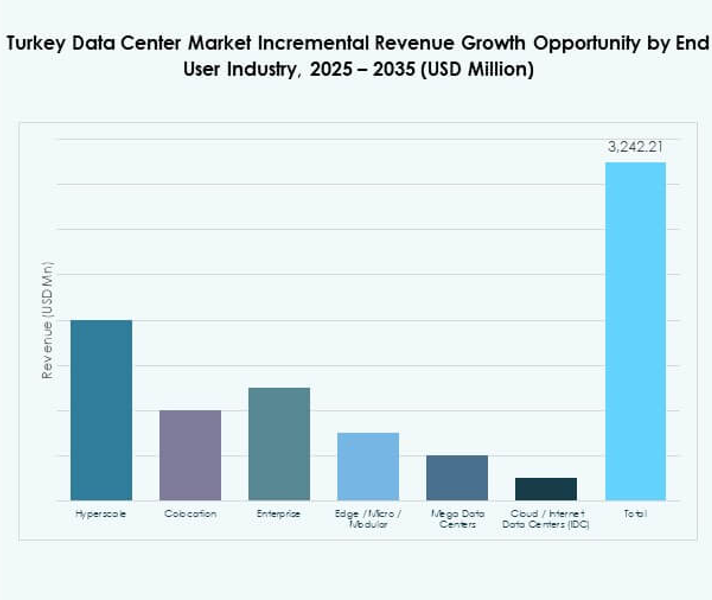

By Data Center Type

Hyperscale data centers hold the leading share due to rising demand from global cloud providers. Colocation facilities expand quickly, serving SMEs and multinational enterprises with cost-effective solutions. Enterprise centers remain relevant for sectors needing control over infrastructure. Edge and modular data centers gain momentum to support real-time applications. The Turkey Data Center Market witnesses balanced growth across types, though hyperscale and colocation lead expansion.

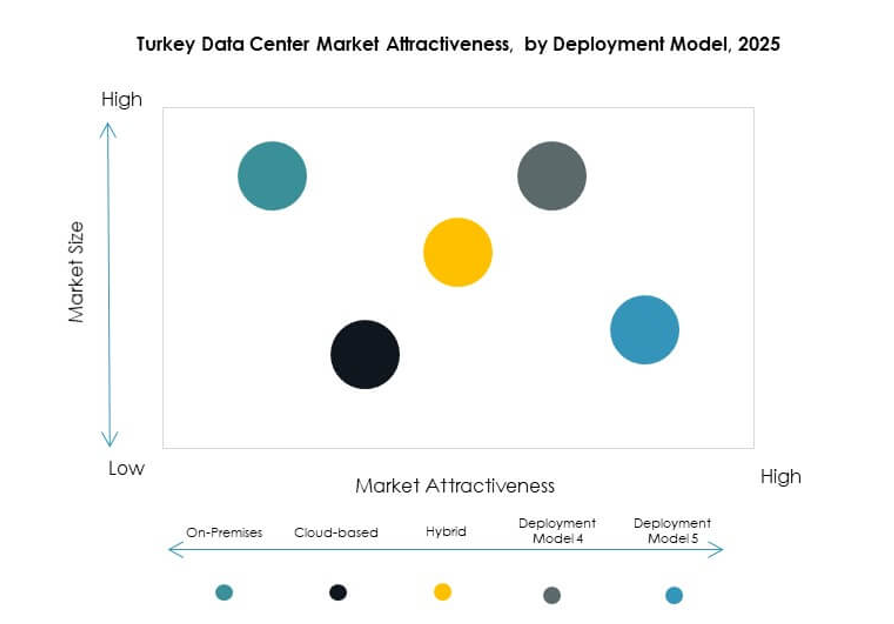

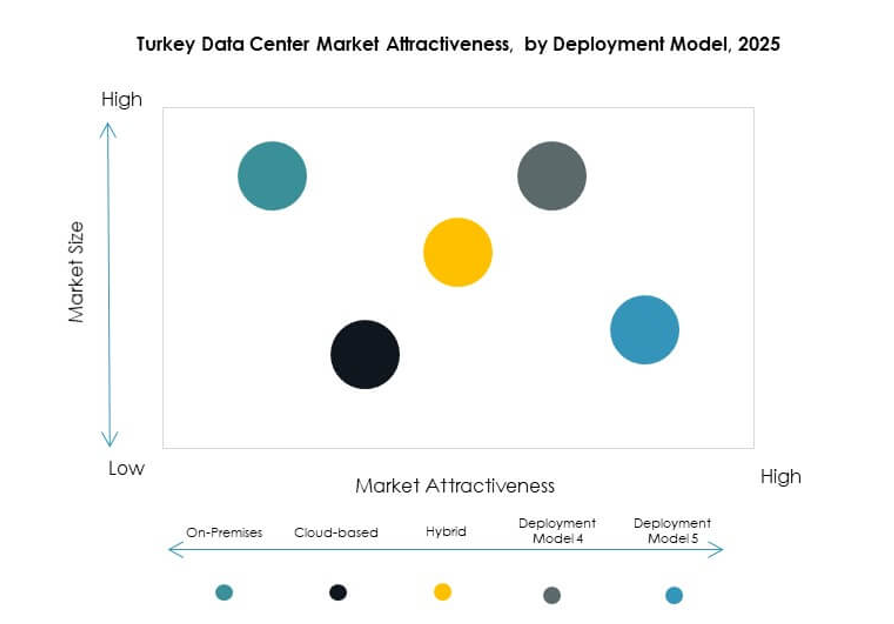

By Deployment Model

Cloud-based deployment leads the market, fueled by SaaS adoption and enterprise digitalization. Hybrid models follow closely, offering flexibility and security benefits. On-premises deployments remain significant for government and financial institutions requiring full control. The Turkey Data Center Market reflects a strong shift toward hybrid and cloud-based adoption. Enterprises favor cloud integration while retaining critical operations in-house, ensuring a balanced deployment landscape.

By Enterprise Size

Large enterprises dominate the market with higher adoption of hyperscale and hybrid infrastructure. SMEs increasingly adopt colocation and cloud services due to cost efficiency. The Turkey Data Center Market sees SMEs driving demand for scalable solutions. Digital startups and e-commerce players rely on flexible capacity expansion. Large enterprises, however, continue to command the largest revenue share due to heavy infrastructure spending.

By Application / Use Case

IT & Telecom leads the market share, driven by digital networks and consumer demand for high data capacity. BFSI and government sectors follow, requiring secure and compliant storage. Healthcare and retail also show strong adoption due to digital services growth. The Turkey Data Center Market benefits from media and entertainment expansion, fueled by streaming. Manufacturing and education sectors contribute steadily to overall market demand.

By End User Industry

Cloud service providers lead the segment, supported by global hyperscale investments. Enterprises adopt hybrid and colocation services for flexibility. Colocation providers serve growing SME demand. Government agencies expand infrastructure for e-governance initiatives. The Turkey Data Center Market remains diverse across end-user industries, with cloud service providers dominating due to rapid digital adoption.

Regional Insights

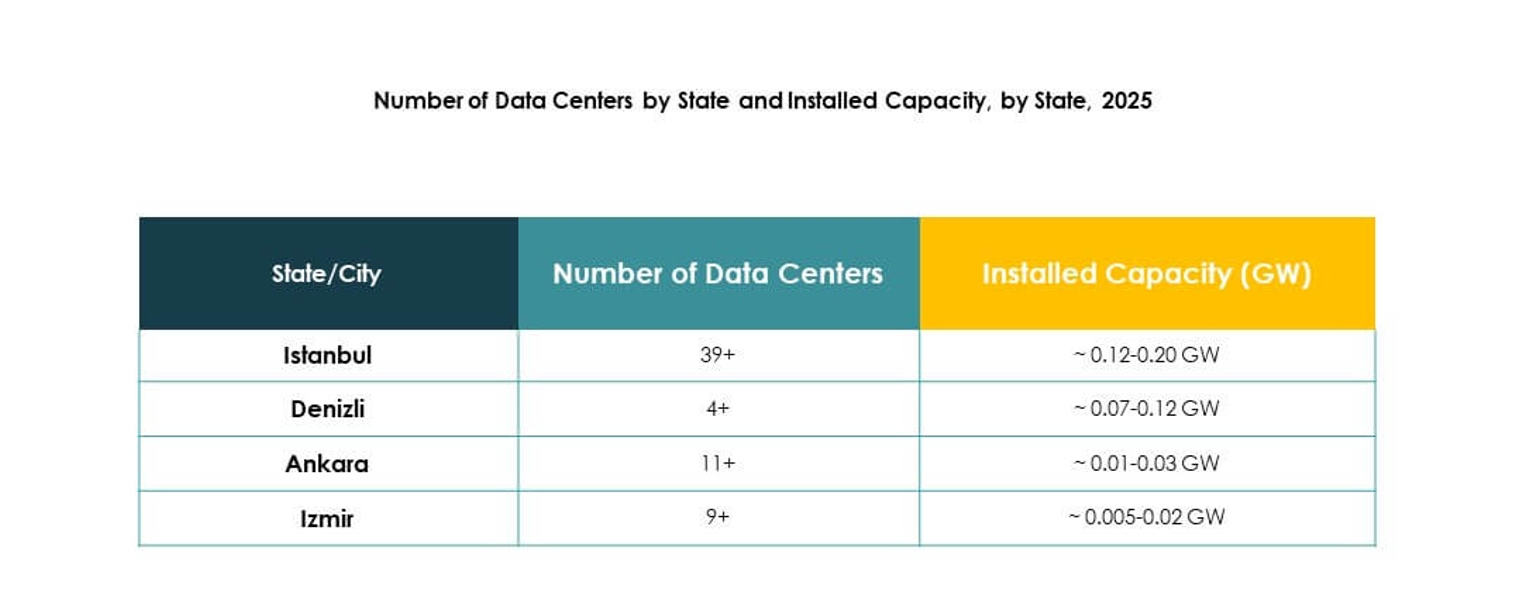

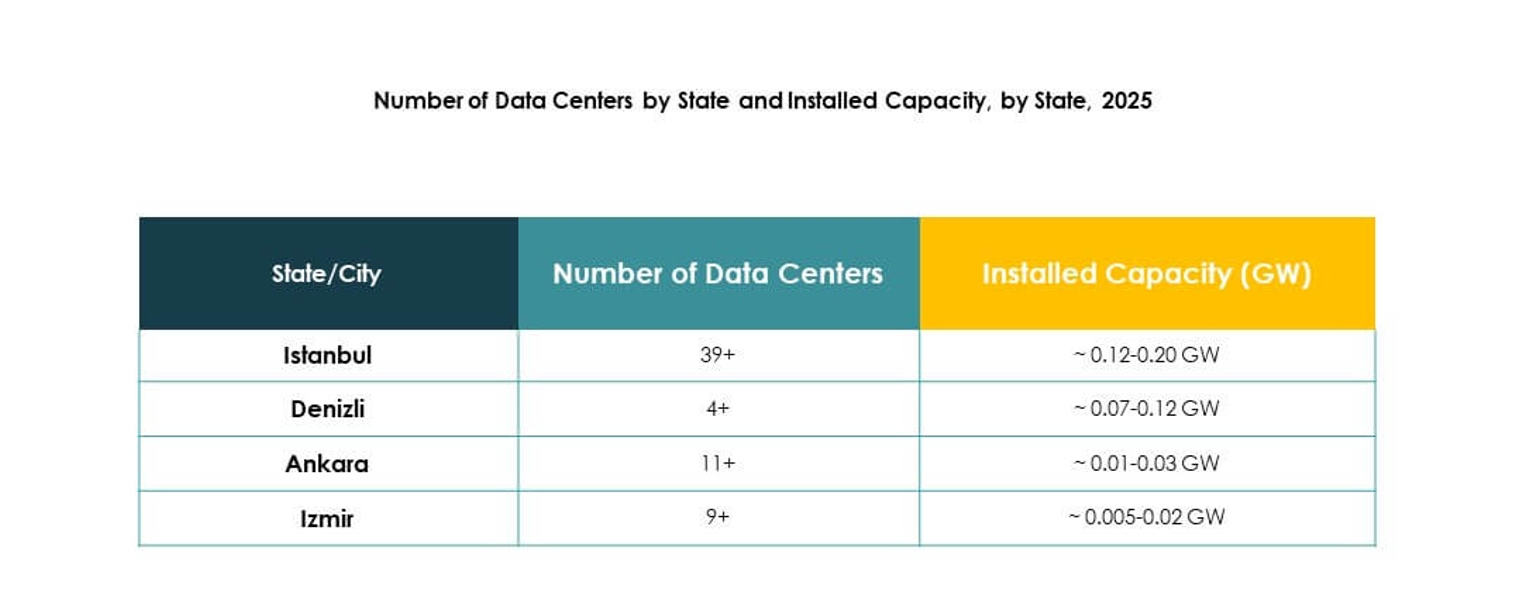

Western Turkey and Istanbul as the Leading Regional Hub with 52% Market Share

Western Turkey dominates the Turkey Data Center Market with 52% share, led by Istanbul. The city’s strategic location and advanced connectivity attract hyperscale and colocation investments. Strong presence of global cloud players ensures continuous expansion. It benefits from submarine cable landings and strong fiber infrastructure. Demand from multinational enterprises keeps growth steady. Istanbul continues to serve as the country’s digital and financial hub.

- For example, in October 2024, Equinix opened its second IBX data center, IL4, in Istanbul, Türkiye, with capacity for 1,125 cabinets and 3,044 m² of colocation space, designed to support high-density deployments with liquid cooling.

Central Turkey Emerging with 28% Share Driven by Growing Industrial and Government Adoption

Central Turkey accounts for 28% market share, supported by industrial growth and government programs. Ankara drives demand with its role as an administrative hub. Government initiatives for digital services create opportunities for colocation and enterprise facilities. The Turkey Data Center Market benefits from increasing enterprise adoption in healthcare, education, and defense. Central Turkey is emerging as a secondary hub, offering growth potential for investors. Infrastructure improvements support ongoing development.

- For example, in August 2024, Turkcell’s Ankara Data Center expanded with Modules 3 and 7 achieving Uptime Institute’s Tier III certification, creating 11,800 m² of dedicated white space and supporting mission-critical services for Turkish government and private enterprises. The site also received LEED Gold certification, confirming its sustainability and operational excellence

Eastern Turkey as a Developing Region with 20% Market Share Supported by Connectivity Projects

Eastern Turkey holds 20% share, supported by ongoing connectivity and industrial development. Data center presence remains limited but new projects improve coverage. The Turkey Data Center Market gains traction from cross-border trade with neighboring countries. Local operators explore edge deployments to serve smaller cities. Energy projects in the region provide opportunities for sustainable operations. Eastern Turkey’s growth potential makes it an attractive area for future expansion.

Competitive Insights:

- Turkcell

- Vodafone Turkey

- Türk Telekom

- Superonline

- TurkNet

- Oracle Cloud Turkey

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Turkey Data Center Market is highly competitive with strong participation from both domestic telecom providers and global hyperscalers. Local leaders such as Turkcell, Vodafone Turkey, and Türk Telekom dominate through extensive infrastructure, colocation services, and nationwide connectivity. Superonline and TurkNet enhance competition with cost-effective broadband and enterprise solutions. Global technology leaders, including Microsoft, AWS, and Google, invest in hyperscale capacity to capture cloud-driven demand. Oracle Cloud Turkey and NTT Communications extend international expertise and enterprise solutions, strengthening service diversity. It fosters a competitive ecosystem where domestic firms focus on localized services while international players scale innovation. The balance of local dominance and global expansion positions Turkey as a dynamic regional hub.

Recent Developments:

- In May 2025, Turkcell announced the securing of €100 million in murabaha financing through a strategic agreement with Emirates NBD Bank, aimed at accelerating Turkcell Group’s data center investments via its subsidiary TDC Veri Hizmetleri (TDC), thereby advancing their digital infrastructure initiatives in Turkey’s data center market.

- In May 2025, Trendyol, one of Turkey’s leading e-commerce platforms, partnered with UAE’s Castle Investments to launch a new data center in Ankara. The agreement was signed last week and will see the development of a $500 million Ankara Data Center project with an initial 10MW capacity, which is set to increase to 48MW as the project reaches completion next year. The facility aims to elevate digital infrastructure and will serve Trendyol’s expanding customer base, with additional capacity being offered to other clients.

- In May 2025, Turkcell secured a €100 million financing agreement to accelerate its data center investments and expand digital infrastructure across Turkey. This initiative supports the country’s robust growth in colocation facilities and aims to meet increasing demand for enterprise-level connectivity and services.

- In February 2024, Vodafone Turkey entered a joint venture partnership with UAE-based Edgnex, the data center arm of DAMAC, to build a new $100 million data center facility in Izmir, Turkey, which is projected to go live in Q1 2025 and represents Vodafone Turkey’s sixth data center in the country.